Blank Dot Hs 7 PDF Template

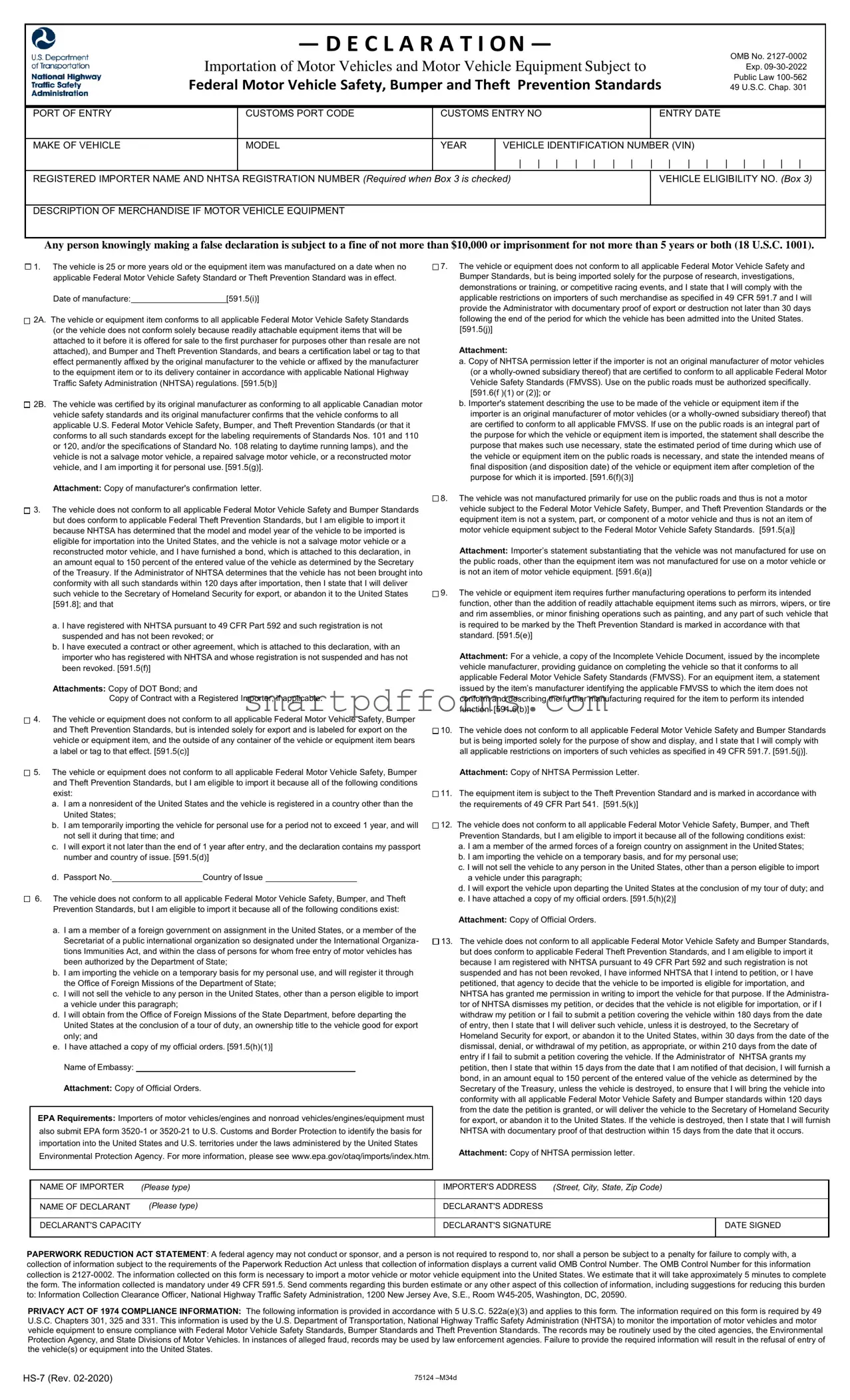

The Dot HS 7 form plays a crucial role in the importation process of motor vehicles and motor vehicle equipment into the United States, ensuring compliance with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards as set by public law and the United States Code. This document outlines various conditions under which a vehicle or equipment may be imported, such as vehicles over 25 years old, those conforming to safety and bumper standards with necessary certification, or vehicles intended for personal use that meet specific criteria. Additionally, it addresses scenarios for temporary importation for nonresidents, members of foreign governments, and military personnel, as well as vehicles imported for research, training, or competitive racing. Importation solely for show and display purposes is also covered under certain restrictions. The form, mandated by the National Highway Traffic Safety Administration (NHTSA) and subject to the Paperwork Reduction Act, requires detailed documentation including, but not limited to, eligibility verification, bonds, contracts with registered importers, and, in some cases, manufacturer confirmation letters. Focusing on keeping the U.S. roads safe, the HS-7 form ensures that vehicles entering the country meet the stringent standards enacted for safety and environmental protection.

Preview - Dot Hs 7 Form

|

|

— D E C L A R A T I ON — |

|

OMB No. |

|||

|

Importation of Motor Vehicles and Motor Vehicle Equipment Subject to |

|

|

Exp. |

|||

|

Federal Motor Vehicle Safety, Bumper and Theft Prevention Standards |

Public Law |

|||||

|

49 U.S.C. Chap. 301 |

||||||

|

|

|

|

|

|

|

|

PORT OF ENTRY |

|

CUSTOMS PORT CODE |

CUSTOMS ENTRY NO |

ENTRY DATE |

|

|

|

|

|

|

|

|

|

|

|

MAKE OF VEHICLE |

|

MODEL |

YEAR |

VEHICLE IDENTIFICATION NUMBER (VIN) |

|

|

|

|

|

|

|

| | | | | | | |

| | | | |

| | | | | |

|

REGISTERED IMPORTER NAME AND NHTSA REGISTRATION NUMBER (Required when Box 3 is checked) |

VEHICLE ELIGIBILITY NO. (Box 3) |

||||||

|

|

|

|

|

|

|

|

DESCRIPTION OF MERCHANDISE IF MOTOR VEHICLE EQUIPMENT

Any person knowingly making a false declaration is subject to a fine of not more than $10,000 or imprisonment for not more th an 5 years or both (18 U.S.C. 1001).

1. The vehicle is 25 or more years old or the equipment item was manufactured on a date when no applicable Federal Motor Vehicle Safety Standard or Theft Prevention Standard was in effect.

1. The vehicle is 25 or more years old or the equipment item was manufactured on a date when no applicable Federal Motor Vehicle Safety Standard or Theft Prevention Standard was in effect.

Date of manufacture: |

|

[591.5(i)] |

2A. The vehicle or equipment item conforms to all applicable Federal Motor Vehicle Safety Standards (or the vehicle does not conform solely because readily attachable equipment items that will be attached to it before it is offered for sale to the first purchaser for purposes other than resale are not attached), and Bumper and Theft Prevention Standards, and bears a certification label or tag to that effect permanently affixed by the original manufacturer to the vehicle or affixed by the manufacturer to the equipment item or to its delivery container in accordance with applicable National Highway Traffic Safety Administration (NHTSA) regulations. [591.5(b)]

2A. The vehicle or equipment item conforms to all applicable Federal Motor Vehicle Safety Standards (or the vehicle does not conform solely because readily attachable equipment items that will be attached to it before it is offered for sale to the first purchaser for purposes other than resale are not attached), and Bumper and Theft Prevention Standards, and bears a certification label or tag to that effect permanently affixed by the original manufacturer to the vehicle or affixed by the manufacturer to the equipment item or to its delivery container in accordance with applicable National Highway Traffic Safety Administration (NHTSA) regulations. [591.5(b)]

2B. The vehicle was certified by its original manufacturer as conforming to all applicable Canadian motor vehicle safety standards and its original manufacturer confirms that the vehicle conforms to all applicable U.S. Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards (or that it conforms to all such standards except for the labeling requirements of Standards Nos. 101 and 110 or 120, and/or the specifications of Standard No. 108 relating to daytime running lamps), and the vehicle is not a salvage motor vehicle, a repaired salvage motor vehicle, or a reconstructed motor vehicle, and I am importing it for personal use. [591.5(g)].

2B. The vehicle was certified by its original manufacturer as conforming to all applicable Canadian motor vehicle safety standards and its original manufacturer confirms that the vehicle conforms to all applicable U.S. Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards (or that it conforms to all such standards except for the labeling requirements of Standards Nos. 101 and 110 or 120, and/or the specifications of Standard No. 108 relating to daytime running lamps), and the vehicle is not a salvage motor vehicle, a repaired salvage motor vehicle, or a reconstructed motor vehicle, and I am importing it for personal use. [591.5(g)].

Attachment: Copy of manufacturer's confirmation letter.

3. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards but does conform to applicable Federal Theft Prevention Standards, but I am eligible to import it because NHTSA has determined that the model and model year of the vehicle to be imported is eligible for importation into the United States, and the vehicle is not a salvage motor vehicle or a reconstructed motor vehicle, and I have furnished a bond, which is attached to this declaration, in an amount equal to 150 percent of the entered value of the vehicle as determined by the Secretary of the Treasury. If the Administrator of NHTSA determines that the vehicle has not been brought into conformity with all such standards within 120 days after importation, then I state that I will deliver such vehicle to the Secretary of Homeland Security for export, or abandon it to the United States [591.8]; and that

3. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards but does conform to applicable Federal Theft Prevention Standards, but I am eligible to import it because NHTSA has determined that the model and model year of the vehicle to be imported is eligible for importation into the United States, and the vehicle is not a salvage motor vehicle or a reconstructed motor vehicle, and I have furnished a bond, which is attached to this declaration, in an amount equal to 150 percent of the entered value of the vehicle as determined by the Secretary of the Treasury. If the Administrator of NHTSA determines that the vehicle has not been brought into conformity with all such standards within 120 days after importation, then I state that I will deliver such vehicle to the Secretary of Homeland Security for export, or abandon it to the United States [591.8]; and that

a. I have registered with NHTSA pursuant to 49 CFR Part 592 and such registration is not suspended and has not been revoked; or

b. I have executed a contract or other agreement, which is attached to this declaration, with an importer who has registered with NHTSA and whose registration is not suspended and has not been revoked. [591.5(f)]

Attachments: Copy of DOT Bond; and

Copy of Contract with a Registered Importer, if applicable.

4. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety, Bumper and Theft Prevention Standards, but is intended solely for export and is labeled for export on the vehicle or equipment item, and the outside of any container of the vehicle or equipment item bears a label or tag to that effect. [591.5(c)]

4. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety, Bumper and Theft Prevention Standards, but is intended solely for export and is labeled for export on the vehicle or equipment item, and the outside of any container of the vehicle or equipment item bears a label or tag to that effect. [591.5(c)]

5. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety, Bumper and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist:

5. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety, Bumper and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist:

a.I am a nonresident of the United States and the vehicle is registered in a country other than the United States;

b.I am temporarily importing the vehicle for personal use for a period not to exceed 1 year, and will not sell it during that time; and

c.I will export it not later than the end of 1 year after entry, and the declaration contains my passport number and country of issue. [591.5(d)]

d. Passport No. |

|

Country of Issue |

6. The vehicle does not conform to all applicable Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist:

6. The vehicle does not conform to all applicable Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist:

a.I am a member of a foreign government on assignment in the United States, or a member of the Secretariat of a public international organization so designated under the International Organiza- tions Immunities Act, and within the class of persons for whom free entry of motor vehicles has been authorized by the Department of State;

b.I am importing the vehicle on a temporary basis for my personal use, and will register it through the Office of Foreign Missions of the Department of State;

c.I will not sell the vehicle to any person in the United States, other than a person eligible to import a vehicle under this paragraph;

d.I will obtain from the Office of Foreign Missions of the State Department, before departing the United States at the conclusion of a tour of duty, an ownership title to the vehicle good for export only; and

e.I have attached a copy of my official orders. [591.5(h)(1)] Name of Embassy:

Attachment: Copy of Official Orders.

EPA Requirements: Importers of motor vehicles/engines and nonroad vehicles/engines/equipment must

also submit EPA form

importation into the United States and U.S. territories under the laws administered by the United States

Environmental Protection Agency. For more information, please see www.epa.gov/otaq/imports/index.htm.

7. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards, but is being imported solely for the purpose of research, investigations, demonstrations or training, or competitive racing events, and I state that I will comply with the applicable restrictions on importers of such merchandise as specified in 49 CFR 591.7 and I will provide the Administrator with documentary proof of export or destruction not later than 30 days following the end of the period for which the vehicle has been admitted into the United States. [591.5(j)]

7. The vehicle or equipment does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards, but is being imported solely for the purpose of research, investigations, demonstrations or training, or competitive racing events, and I state that I will comply with the applicable restrictions on importers of such merchandise as specified in 49 CFR 591.7 and I will provide the Administrator with documentary proof of export or destruction not later than 30 days following the end of the period for which the vehicle has been admitted into the United States. [591.5(j)]

Attachment:

a. Copy of NHTSA permission letter if the importer is not an original manufacturer of motor vehicles (or a

[591.6(f )(1) or (2)]; or

b. Importer's statement describing the use to be made of the vehicle or equipment item if the importer is an original manufacturer of motor vehicles (or a

8. The vehicle was not manufactured primarily for use on the public roads and thus is not a motor vehicle subject to the Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards or the equipment item is not a system, part, or component of a motor vehicle and thus is not an item of motor vehicle equipment subject to the Federal Motor Vehicle Safety Standards. [591.5(a)]

8. The vehicle was not manufactured primarily for use on the public roads and thus is not a motor vehicle subject to the Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards or the equipment item is not a system, part, or component of a motor vehicle and thus is not an item of motor vehicle equipment subject to the Federal Motor Vehicle Safety Standards. [591.5(a)]

Attachment: Importer’s statement substantiating that the vehicle was not manufactured for use on the public roads, other than the equipment item was not manufactured for use on a motor vehicle or is not an item of motor vehicle equipment. [591.6(a)]

9. The vehicle or equipment item requires further manufacturing operations to perform its intended function, other than the addition of readily attachable equipment items such as mirrors, wipers, or tire and rim assemblies, or minor finishing operations such as painting, and any part of such vehicle that is required to be marked by the Theft Prevention Standard is marked in accordance with that standard. [591.5(e)]

9. The vehicle or equipment item requires further manufacturing operations to perform its intended function, other than the addition of readily attachable equipment items such as mirrors, wipers, or tire and rim assemblies, or minor finishing operations such as painting, and any part of such vehicle that is required to be marked by the Theft Prevention Standard is marked in accordance with that standard. [591.5(e)]

Attachment: For a vehicle, a copy of the Incomplete Vehicle Document, issued by the incomplete vehicle manufacturer, providing guidance on completing the vehicle so that it conforms to all

applicable Federal Motor Vehicle Safety Standards (FMVSS). For an equipment item, a statement issued by the item’s manufacturer identifying the applicable FMVSS to which the item does not

conform and describing the further manufacturing required for the item to perform its intended function. [591.6(b)]

10. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards but is being imported solely for the purpose of show and display, and I state that I will comply with all applicable restrictions on importers of such vehicles as specified in 49 CFR 591.7. [591.5(j)].

10. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards but is being imported solely for the purpose of show and display, and I state that I will comply with all applicable restrictions on importers of such vehicles as specified in 49 CFR 591.7. [591.5(j)].

Attachment: Copy of NHTSA Permission Letter.

11. The equipment item is subject to the Theft Prevention Standard and is marked in accordance with the requirements of 49 CFR Part 541. [591.5(k)]

11. The equipment item is subject to the Theft Prevention Standard and is marked in accordance with the requirements of 49 CFR Part 541. [591.5(k)]

12. The vehicle does not conform to all applicable Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist: a. I am a member of the armed forces of a foreign country on assignment in the United States; b. I am importing the vehicle on a temporary basis, and for my personal use;

12. The vehicle does not conform to all applicable Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards, but I am eligible to import it because all of the following conditions exist: a. I am a member of the armed forces of a foreign country on assignment in the United States; b. I am importing the vehicle on a temporary basis, and for my personal use;

c. I will not sell the vehicle to any person in the United States, other than a person eligible to import a vehicle under this paragraph;

d. I will export the vehicle upon departing the United States at the conclusion of my tour of duty; and e. I have attached a copy of my official orders. [591.5(h)(2)]

Attachment: Copy of Official Orders.

13. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards, but does conform to applicable Federal Theft Prevention Standards, and I am eligible to import it because I am registered with NHTSA pursuant to 49 CFR Part 592 and such registration is not suspended and has not been revoked, I have informed NHTSA that I intend to petition, or I have petitioned, that agency to decide that the vehicle to be imported is eligible for importation, and NHTSA has granted me permission in writing to import the vehicle for that purpose. If the Administra- tor of NHTSA dismisses my petition, or decides that the vehicle is not eligible for importation, or if I withdraw my petition or I fail to submit a petition covering the vehicle within 180 days from the date of entry, then I state that I will deliver such vehicle, unless it is destroyed, to the Secretary of Homeland Security for export, or abandon it to the United States, within 30 days from the date of the dismissal, denial, or withdrawal of my petition, as appropriate, or within 210 days from the date of entry if I fail to submit a petition covering the vehicle. If the Administrator of NHTSA grants my petition, then I state that within 15 days from the date that I am notified of that decision, I will furnish a bond, in an amount equal to 150 percent of the entered value of the vehicle as determined by the Secretary of the Treasury, unless the vehicle is destroyed, to ensure that I will bring the vehicle into conformity with all applicable Federal Motor Vehicle Safety and Bumper standards within 120 days from the date the petition is granted, or will deliver the vehicle to the Secretary of Homeland Security for export, or abandon it to the United States. If the vehicle is destroyed, then I state that I will furnish NHTSA with documentary proof of that destruction within 15 days from the date that it occurs.

13. The vehicle does not conform to all applicable Federal Motor Vehicle Safety and Bumper Standards, but does conform to applicable Federal Theft Prevention Standards, and I am eligible to import it because I am registered with NHTSA pursuant to 49 CFR Part 592 and such registration is not suspended and has not been revoked, I have informed NHTSA that I intend to petition, or I have petitioned, that agency to decide that the vehicle to be imported is eligible for importation, and NHTSA has granted me permission in writing to import the vehicle for that purpose. If the Administra- tor of NHTSA dismisses my petition, or decides that the vehicle is not eligible for importation, or if I withdraw my petition or I fail to submit a petition covering the vehicle within 180 days from the date of entry, then I state that I will deliver such vehicle, unless it is destroyed, to the Secretary of Homeland Security for export, or abandon it to the United States, within 30 days from the date of the dismissal, denial, or withdrawal of my petition, as appropriate, or within 210 days from the date of entry if I fail to submit a petition covering the vehicle. If the Administrator of NHTSA grants my petition, then I state that within 15 days from the date that I am notified of that decision, I will furnish a bond, in an amount equal to 150 percent of the entered value of the vehicle as determined by the Secretary of the Treasury, unless the vehicle is destroyed, to ensure that I will bring the vehicle into conformity with all applicable Federal Motor Vehicle Safety and Bumper standards within 120 days from the date the petition is granted, or will deliver the vehicle to the Secretary of Homeland Security for export, or abandon it to the United States. If the vehicle is destroyed, then I state that I will furnish NHTSA with documentary proof of that destruction within 15 days from the date that it occurs.

Attachment: Copy of NHTSA permission letter.

NAME OF IMPORTER |

(Please type) |

IMPORTER'S ADDRESS (Street, City, State, Zip Code) |

|

|

|

NAME OF DECLARANT |

(Please type) |

DECLARANT'S ADDRESS |

DECLARANT'S CAPACITY

DECLARANT'S SIGNATURE

DATE SIGNED

PAPERWORK REDUCTION ACT STATEMENT: A federal agency may not conduct or sponsor, and a person is not required to respond to, nor shall a person be subject to a penalty for failure to comply with, a collection of information subject to the requirements of the Paperwork Reduction Act unless that collection of information displays a current valid OMB Control Number. The OMB Control Number for this information collection is

PRIVACY ACT OF 1974 COMPLIANCE INFORMATION: The following information is provided in accordance with 5 U.S.C. 522a(e)(3) and applies to this form. The information required on this form is required by 49 U.S.C. Chapters 301, 325 and 331. This information is used by the U.S. Department of Transportation, National Highway Traffic Safety Administration (NHTSA) to monitor the importation of motor vehicles and motor vehicle equipment to ensure compliance with Federal Motor Vehicle Safety Standards, Bumper Standards and Theft Prevention Standards. The records may be routinely used by the cited agencies, the Environmental Protection Agency, and State Divisions of Motor Vehicles. In instances of alleged fraud, records may be used by law enforcement agencies. Failure to provide the required information will result in the refusal of entry of the vehicle(s) or equipment into the United States.

75124 |

Form Data

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Identification | The form is known as DOT HS 7, for the declaration of importation of motor vehicles and motor vehicle equipment subject to federal standards. |

| 2 | Expiration Date | The form's current expiration date is 09-30-2022 as indicated at the top of the document. |

| 3 | Governing Laws | The form is governed by Public Law 100-562 49 U.S.C. Chapter 301, covering Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards. |

| 4 | Requirements for Importation | The form specifies various scenarios under which a vehicle or equipment can be imported, such as age, compliance with standards, for personal use, etc. |

| 5 | Penalty for False Declaration | Anyone knowingly making a false declaration can face a fine up to $10,000 or imprisonment for not more than 5 years, or both according to 18 U.S.C. 1001. |

| 6 | Obligations for Non-Conforming Vehicles | It describes conditions under which non-conforming vehicles may be imported, such as eligibility for import due to NHTSA determination or temporary imports for personal use. |

| 7 | Submission Requirements | Importers must submit this form along with other documents like bond attachments, manufacturer's confirmation letter, or contracts with Registered Importers as applicable. |

| 8 | Exemptions and Special Provisions | Several exemptions are outlined, including vehicles over 25 years old, those imported for research or competitions, and specific diplomatic and military exceptions. |

| 9 | Privacy and Paperwork Reduction | The form includes statements on the Privacy Act of 1974 and the Paperwork Reduction Act, emphasizing the importance of the information collected for compliance monitoring. |

Instructions on Utilizing Dot Hs 7

Once you're ready to import a vehicle or vehicle equipment into the United States, the DOT HS 7 form becomes an essential document you need to fill out. This form helps in declaring the compliance of your import with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards. Completing this form accurately is crucial as it provides necessary information to U.S. Customs and Border Protection and the National Highway Traffic Safety Administration (NHTSA), ensuring your vehicle meets all required regulations. The steps outlined below will guide you through the process of filling out the form correctly.

- Start by entering the PORT OF ENTRY including the respective CUSTOMS PORT CODE at the top of the form.

- Fill in the CUSTOMS ENTRY NO. and the ENTRY DATE to document when and where the vehicle or equipment entered the country.

- Provide the MAKE OF VEHICLE, MODEL YEAR, and the VEHICLE IDENTIFICATION NUMBER (VIN) in the designated fields.

- If applicable, enter the REGISTERED IMPORTER NAME and its NHTSA REGISTRATION NUMBER. This is required when box 3 is checked, indicating the vehicle is being imported by a registered importer.

- Fill in the VEHICLE ELIGIBILITY NO. if box 3 is checked, indicating NHTSA has determined the vehicle is eligible for importation.

- In the DESCRIPTION OF MERCHANDISE section, specify if the import is a motor vehicle or motor vehicle equipment.

- Check the box that corresponds to your situation under the section titled DECLARE THE FOLLOWING (Items 1 through 13). Each option requires different kinds of documentation, so be sure to attach the necessary documents as indicated.

- Include the NAME OF IMPORTER as it should appear officially, followed by the IMPORTER'S ADDRESS.

- Provide the NAME OF DECLARANT if it is different from the importer, along with the declarant's ADDRESS and CAPACITY in which they are filling the form.

- Ensure the DECLARANT'S SIGNATURE and DATE SIGNED are included at the bottom of the form.

After completing the DOT HS 7 form, submit it alongside any required attachments to the proper authorities as part of your vehicle importation packet. Ensuring all information is accurate and complete will aid in a smoother process at the port of entry, facilitating compliance checks and any necessary registrations following the vehicle's arrival in the United States. Remember, this form is a declaration of compliance with specific standards, and any inaccuracies may result in penalties, including fines or refusal of the vehicle's entry into the country.

Obtain Answers on Dot Hs 7

What is a DOT HS-7 form?

The DOT HS-7 form is an essential declaration for importing motor vehicles and motor vehicle equipment into the United States. It certifies compliance with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards under Public Law 100-562 and 49 U.S.C. Chap. 301. This form must be completed by importers and submitted at the time of entry to declare the vehicle or equipment's compliance status with the applicable U.S. standards.

Why do I need to fill out the DOT HS-7 form?

Filling out the DOT HS-7 form is mandatory for anyone looking to import motor vehicles or motor vehicle equipment into the United States. This form ensures that the imported vehicles or equipment meet all federal safety, bumper, and theft prevention standards, safeguarding public health and safety. Failure to properly complete and submit this form can result in the denial of entry for the vehicle(s) or equipment into the U.S.

What are the penalties for making a false declaration on the DOT HS-7 form?

Making a false declaration on the DOT HS-7 form is a serious offense, with individuals subject to a fine of not more than $10,000 or imprisonment for not more than 5 years, or both. These penalties underscore the importance of accurately completing the form, reflecting the gravity of ensuring vehicle compliance with U.S. standards.

How do I know which box to check on the DOT HS-7 form?

The DOT HS-7 form contains several boxes, each representing different categories of import eligibility based on compliance with Federal standards. Deciding which box to check depends on specific criteria related to the vehicle or equipment you are importing, such as age, manufacturing standards, and intended use in the U.S. For instance, Box 1 is for vehicles 25 years old or more, which are exempt from compliance; Box 2A covers vehicles that fully conform to U.S. standards, and so on. It's crucial to review the explanations provided for each box carefully and select the one that accurately fits your importation scenario.

Where can I find a DOT HS-7 form?

The DOT HS-7 form can be obtained from the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) website or through U.S. Customs and Border Protection at the port of entry when you are importing a vehicle or equipment. It is also advisable to consult with a professional or the NHTSA directly to ensure you have the most current form and information.

What documentation do I need to attach to my DOT HS-7 form?

The required attachments for a DOT HS-7 form depend on the importation scenario and the compliance category under which the vehicle or equipment falls. Common attachments include, but are not limited to, the manufacturer's confirmation letter of compliance for Canadian vehicles, a bond if the vehicle does not meet all U.S. standards but is eligible for import, contracts with a registered importer, or documentary proof of eligibility under special conditions. It's essential to carefully review the instructions for each box you check to ensure you include all necessary documentation.

Common mistakes

Not checking the appropriate box for the type of declaration being made is a common mistake. The form contains multiple options to declare the specific compliance or exemption status of the vehicle or equipment being imported. Failure to accurately select the correct box can lead to delays or refusal of entry.

Forgetting to provide the make, model, and Vehicle Identification Number (VIN) of the vehicle being imported. This information is crucial for identifying the vehicle and verifying its eligibility for importation.

Overlooking the need to include the Registered Importer's Name and NHTSA Registration Number when Box 3 is checked. This is necessary when importing a vehicle that does not conform to all applicable Federal safety standards but is eligible for importation.

Not attaching the required documents such as the DOT Bond, Contract with a Registered Importer, or manufacturer's confirmation letter. These documents are essential for proving the vehicle's compliance or eligibility for importation under specific conditions.

Failure to sign and date the form. The signature of the declarant and the date signed are required to verify that the information provided is accurate and that the person making the declaration is authorized to do so.

Omitting the Name and Address of the Importer. This information is necessary for communication and record-keeping purposes.

Incorrectly stating the vehicle or equipment's conformity status with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards. It is imperative to accurately declare the vehicle or equipment's compliance to avoid legal issues.

Failure to provide evidence of eligibility for nonconformity exceptions, such as for vehicles intended solely for export, research, display, or testing purposes. Each exception requires specific documentation as proof of eligibility.

Misunderstanding or not adhering to the compliance deadlines and requirements set by NHTSA, such as the timeframe for bringing a nonconforming vehicle into compliance or for exporting or destroying it if necessary. This can lead to significant legal and financial consequences.

Documents used along the form

When importing a motor vehicle or motor vehicle equipment into the United States, the DOT HS-7 form plays a crucial role in declaring the vehicle's compliance with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards. However, this form is often just one part of a package of documents needed to ensure legal and hassle-free importation. Other essential forms and documents usually accompany the DOT HS-7 form to address various regulatory requirements and clarify the specifics of the vehicle or equipment being imported.

- EPA Form 3520-1: This form is required by the United States Environmental Protection Agency (EPA) for the importation of on-road vehicles and engines. It declares the vehicle's emissions compliance, ensuring that the imported vehicle meets the necessary environmental standards set by the EPA.

- EPA Form 3520-21: Similar to EPA Form 3520-1 but specific to nonroad vehicles and engines/equipment, this form is necessary to declare that the imported items comply with EPA's emissions standards. It's essential for importing things like off-highway motorcycles, all-terrain vehicles (ATVs), and lawn and garden equipment.

- Copy of the Manufacturer's Letter of Conformity: This document is crucial when importing a vehicle claimed to conform to all applicable U.S. Federal Motor Vehicle Safety Standards as evidenced by the original manufacturer. The letter must confirm that the vehicle meets these standards or, if applicable, lists any exceptions.

- Bond for Non-Conforming Vehicles: When importing a vehicle that does not meet U.S. Federal Motor Vehicle Safety and Bumper Standards, a bond equal to 150 percent of the vehicle's entered value must be posted with Customs. This bond assures that funds are available to bring the vehicle into compliance, export it, or abandon it to the United States if it can't be made compliant.

These documents are foundational to the legal importation process, each serving to verify different aspects of compliance with U.S. laws and regulations. Together with the DOT HS-7 form, they form a comprehensive documentation package that facilitates the legal entry of vehicles and equipment into the United States. Understanding and preparing these documents in advance can significantly streamline the importation process, ensuring a smoother transaction for importers.

Similar forms

The EPA form 3520-1 is similar to the DOT HS-7 form because it is required for the importation of motor vehicles or engines into the United States. Both forms serve as a declaration to ensure compliance with U.S. federal regulations, specifically focusing on environmental standards for EPA 3520-1 and safety, theft prevention, and bumper standards for DOT HS-7.

The Customs and Border Protection (CBP) Entry Summary (Form 7501) parallels the DOT HS-7 form as both are crucial for the legal entry of goods into the United States. Form 7501 is used to determine the admissibility, classification, and valuation of goods for duty purposes, while the DOT HS-7 form specifically addresses the importation of motor vehicles and motor vehicle equipment concerning adherence to federal standards.

The NHTSA Form 566, similar to the DOT HS-7, is required for the certification of compliance with Federal Motor Vehicle Safety Standards (FMVSS). Both forms ensure that vehicles or equipment imported or manufactured meet U.S. safety regulations. While the DOT HS-7 is used by importers for declaration upon entry, Form 566 is generally submitted by manufacturers to certify compliance from the onset.

The Registered Importer (RI) Application (HS-7D), like the DOT HS-7, involves the importation of vehicles to the U.S. The HS-7D is specifically for businesses applying to become RIs to modify nonconforming vehicles to meet U.S. standards, whereas the DOT HS-7 form is for declarations by importers at the point of entry, potentially involving vehicles modified by RIs.

The Vehicle Import Compatibility (VIC) List, although not a form, complements information required on the DOT HS-7. It specifies vehicles eligible for importation based on their ability to be modified to comply with U.S. standards. Importers reference the VIC List when completing the DOT HS-7 to indicate eligibility for importation under box 3 or other applicable conditions.

The Federal Communications Commission (FCC) Form 740, for the Importation of Radio Frequency Devices, is akin to the DOT HS-7 in the realm of regulatory compliance. While the DOT HS-7 ensures vehicles meet safety and environmental standards, the FCC Form 740 is concerned with the electromagnetic interference of imported electronics, highlighting governmental oversight across different types of imports.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) Form 5100.31, required for the importation of alcohol and tobacco products, shares similarities with the DOT HS-7 through its emphasis on regulatory compliance for specific goods. Both forms cater to different sectors but ultimately serve to certify that imports comply with U.S. laws and regulations.

The Application for Permanent Importation of a Vehicle (EPA Form 3520-1), although listed directly in relation to the EPA, is worth mentioning separately because it specifically deals with the environmental compliance of vehicles, supporting the DOT HS-7 in ensuring vehicles meet all necessary U.S. importation standards, including those for emissions.

Dos and Don'ts

Filling out the DOT HS-7 form, which is essential for the importation of motor vehicles and motor vehicle equipment into the United States, requires careful attention to detail and an understanding of specific regulations. To aid in this process, here’s a comprehensive list of dos and don'ts:

- Do carefully read the entire form before starting to ensure a comprehensive understanding of the requirements.

- Do verify the vehicle or equipment’s eligibility under the Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards before beginning the process.

- Do include the correct make, model year, and vehicle identification number (VIN) of the vehicle being imported to avoid any discrepancies.

- Do attach all required documents, such as manufacturer's confirmation letter, DOT bond, or contract with a registered importer, where applicable. Failure to do so could result in delays or denial of importation.

- Do ensure all fields are completed accurately to avoid rejection of the form. Inaccuracies can lead to significant delays in the importation process.

- Do sign and date the form to certify the accuracy of the information provided. An unsigned form is not valid.

- Do retain a copy of the completed form and all attachments for your records. This documentation could be crucial in resolving any future issues.

- Don't guess or provide estimated information. Accuracy is key when reporting details such as the entry date and customs entry number.

- Don't overlook the importance of checking the boxes that apply to your importation situation. They play a critical role in determining whether your vehicle or equipment meets U.S. standards.

- Don't ignore the paperwork reduction act statement and privacy act of 1974 compliance information at the bottom of the form. Understanding your rights and responsibilities under these acts is critical.

By following these guidelines, individuals can ensure a smoother process when importing vehicles or equipment into the United States, while adhering to the federal requirements. Remember, when in doubt, consulting with a professional who specializes in vehicle importation can provide clarity and further assistance.

Misconceptions

When it comes to importing vehicles and vehicle equipment into the United States, the Dot HS-7 form plays a crucial role. However, there are many misconceptions surrounding this form and its requirements. Let’s clear some of these up:

- Misconception #1: The HS-7 form is only for cars.

This form is not just for passenger cars; it applies to all motor vehicles, including motorcycles, trucks, and buses, as well as motor vehicle equipment. Understanding this broad application is crucial for compliance.

- Misconception #2: Personal vehicles are exempt from compliance.

Even if importing a vehicle for personal use, one must still complete the HS-7 form and ensure the vehicle meets all applicable Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards unless an exemption applies.

- Misconception #3: If a vehicle is over 25 years old, no further action is required.

While it's true that vehicles 25 years or older are generally exempt from Federal Motor Vehicle Safety Standards, they still must be declared on the HS-7 form. This exemption doesn’t automatically apply to all standards or requirements.

- Misconception #4: Completing the HS-7 form is all you need to do for importation.

This form is a critical step, but it’s part of a broader process that includes Environmental Protection Agency (EPA) requirements, customs declarations, and possibly, modifications to meet U.S. standards.

- Misconception #5: Any vehicle can be imported if you pay the right fees.

Not all vehicles can be legally imported into the U.S., even with payments or bonds posted. Vehicles must meet or be brought into conformance with specific safety, bumper, and theft prevention standards, or qualify for an exemption or exclusion.

- Misconception #6: Only manufacturers can file the HS-7 form.

Importers, whether commercial entities or individuals, are responsible for submitting the HS-7 form when bringing a vehicle or equipment into the United States. You don’t have to be a manufacturer to import a vehicle.

- Misconception #7: The HS-7 form is the final step in the importation process.

Submitting the HS-7 form at the time of importation is just one of the early steps. Depending on the vehicle’s compliance, further actions such as modifications, inspections, and registrations may be necessary.

- Misconception #8: Used vehicles are not subject to the same standards as new vehicles.

Both new and used vehicles must comply with Federal Standards unless an exemption, such as the 25-year rule, applies. The HS-7 form must be accurately completed, reflecting the vehicle’s conformity status, regardless of age.

- Misconception #9: Imported vehicles for show or display are exempt from all standards.

While there are specific exemptions for vehicles imported under the show or display provision, importers must still comply with other applicable regulations and file the HS-7 form, noting the basis for eligibility.

Understanding these misconceptions is essential for anyone looking to import a vehicle or vehicle equipment into the United States. The HS-7 form is a critical document, but it's just one part of ensuring that your vehicle can legally hit U.S. roads.

Key takeaways

Understanding how to correctly complete and use the DOT HS-7 form is crucial when importing motor vehicles and motor vehicle equipment into the United States. The form is necessary for ensuring compliance with Federal Motor Vehicle Safety, Bumper, and Theft Prevention Standards. Here are key takeaways to guide you through the process:

- Familiarize yourself with the specific standards that your vehicle or equipment must meet for importation, including safety, bumper, and theft prevention requirements.

- Ensure that the vehicle is either 25 years old or more, or if it is a piece of motor vehicle equipment, confirm that it was manufactured at a time when no federal standards were applicable as per section 591.5(i).

- If the vehicle conforms to all applicable Federal standards and bears the certification label, be ready to provide proof as specified in sections 2A and 2B.

- Recognize the conditions under which a non-conforming vehicle can be imported, such as for personal use, temporary import by a nonresident, or for diplomatic reasons, and prepare to meet the additional requirements these exceptions entail.

- Understand the role and process of registering with the National Highway Traffic Safety Administration (NHTSA) if required, and the importance of providing a bond for vehicles deemed eligible for importation that do not conform to standards.

- Be aware of the exemptions that allow for the importation of non-conforming vehicles for specific purposes like research, demonstrations, show and display, or racing events, and prepare the necessary documentation to support the exemption claim.

- For vehicles not intended for use on public roads or equipment not part of a motor vehicle, documentation substantiating this claim must be attached.

- When importing a vehicle requiring further manufacturing to perform its intended function, include the necessary manufacturer's documentation outlining what standards the incomplete vehicle does not meet.

- Always provide accurate and honest information to avoid severe penalties, including fines or imprisonment, for knowingly making a false declaration.

Additionally, it's essential to submit the EPA Form 3520-1 or 3520-21 alongside the DOT HS-7 form to fulfill requirements under laws administered by the United States Environmental Protection Agency.

Completing the DOT HS-7 form accurately is a step towards ensuring a smooth importation process. Always double-check all entries and attached documents to prevent avoidable issues during importation.

Popular PDF Forms

Where to Get Official Transcripts - Dowling College necessitates a student's signature to process the transcript request, affirming the authenticity of the application.

Medication Refusal Documentation - This form is a formal sign-off by an employee to decline medical services after an injury, ensuring legal requirements are met and rights are acknowledged.