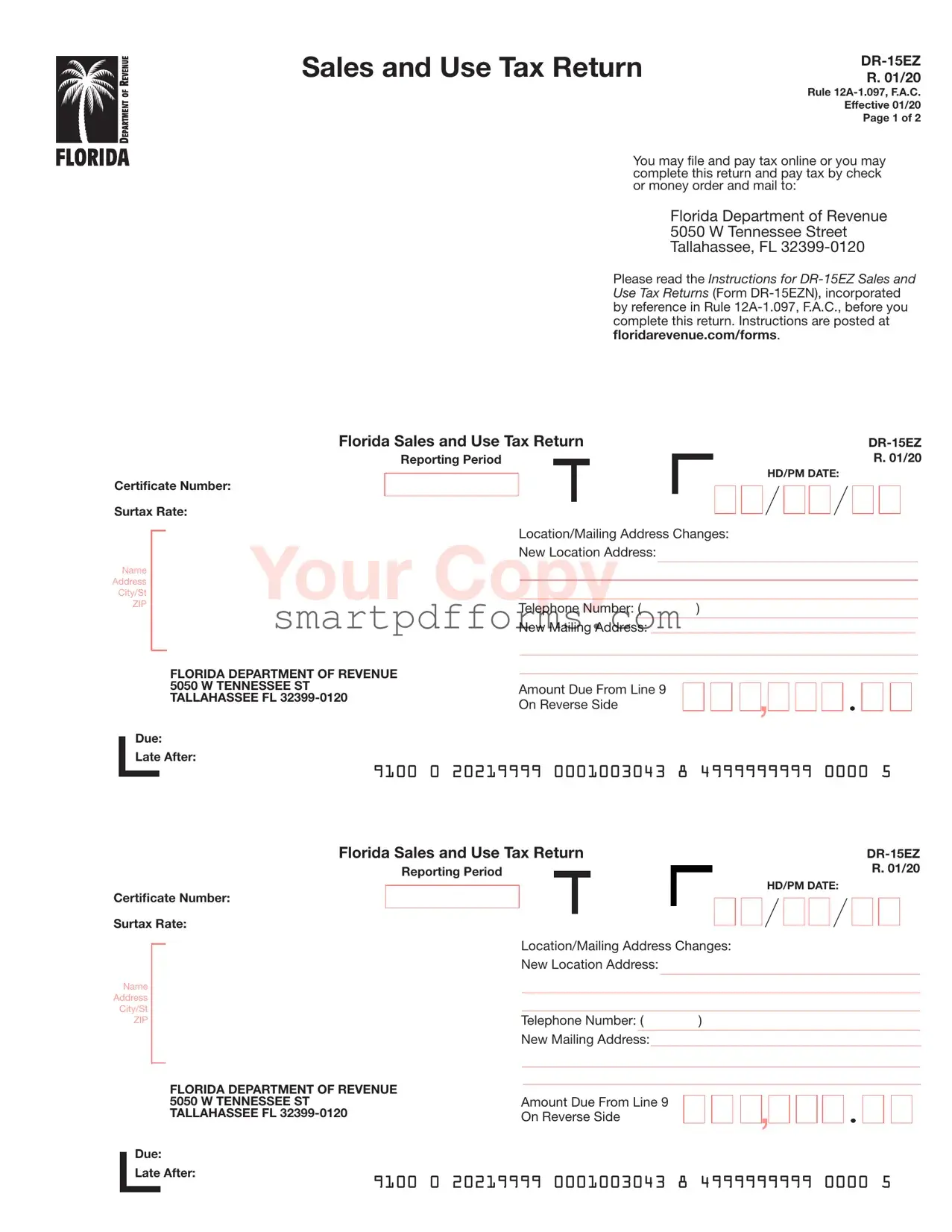

Blank Dr 15Ez Sales Tax PDF Template

For businesses in Florida, navigating tax obligations is a critical task, and the DR-15EZ Sales and Use Tax Return form plays a significant role in this process. Updated in January 2020, this form is designed for the reporting and payment of sales and use taxes to the Florida Department of Revenue. Businesses have the option to submit this form either online for convenience and a potential collection allowance or via traditional mail accompanied by a check or money order. The allowance, a benefit for those who file and pay electronically, offers a deduction of 2.5% of the tax due up to the first $1,200, capped at $30, provided the transaction is completed by the specified deadline. The form requires detailed information, including gross sales, exempt sales, and taxable purchases, along with calculations for any applicable discretionary sales surtax. Additionally, the form outlines the due dates for submission and the consequences of late filings or payments, including penalties and interest charges. This method of tax reporting ensures compliance with state regulations and facilitates the accurate collection of taxes that support Florida's economy. Businesses must pay close attention to the preparation of the DR-15EZ to fulfill their tax obligations accurately and avoid any potential penalties for erroneous or late submissions.

Preview - Dr 15Ez Sales Tax Form

Sales and Use Tax Return

R. 01/20

Rule

Effective 01/20

Page 1 of 2

You may file and pay tax online or you may complete this return and pay tax by check or money order and mail to:

Florida Department of Revenue

5050 W Tennessee Street

Tallahassee, FL

Please read the Instructions for

Florida Sales and Use Tax Return

Reporting Period

Certificate Number:

Surtax Rate:

R. 01/20

HD/PM DATE:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

Your CopyNew Location Address:

Telephone Number: ( )

New Mailing Address:_________________________________________

FLORIDA DEPARTMENT OF REVENUE |

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

TALLAHASSEE FL |

||

On Reverse Side |

||

|

,

,

Due: |

|

|

|

|

|

|

|

Late After: |

|

|

|

|

|

|

|

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

Florida Sales and Use Tax Return |

||||

|

Reporting Period |

|

R. 01/20 |

|

|

||||

|

|

|

|

HD/PM DATE: |

|

|

|

|

|

Certificate Number:

Surtax Rate:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

New Location Address:

Telephone Number: ( |

) |

|

|

|

|

New Mailing Address: |

|

|

FLORIDA DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||

TALLAHASSEE FL |

On Reverse Side |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due: |

|

|

|

|

|

|

|

|

Late After: |

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

|

R. 01/20

Page 2 of 2

File and Pay Online to Receive a Collection Allowance. When you electronically file your tax return and pay timely, you are entitled to deduct a collection allowance of 2.5% (.025) of the first $1,200 of tax due, not to exceed $30. To pay timely, you must initiate payment and receive a confirmation number, no later than 5:00 p.m. ET on the business day prior to the 20th. More information on filing and paying electronically, including aFlorida eServices Calendar of Electronic Payment Deadlines (Form

Due Dates. Returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

A return must be filed for each reporting period, even if no tax is due.If the 20th falls on a Saturday, Sunday, or a state or federal holiday, returns are timely if postmarked or hand delivered on the first business day following the 20th.

Penalty. If you file your return or pay tax late, a late penalty of 10% of the amount of tax owed, but not less than $50, may be charged. The $50 minimum penalty applies even if no tax is due. A floating rate of interest also applies to late payments and underpayments of tax.

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Include these in |

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

|

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

|

Date |

|

|

|

|

Telephone # |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

|

|||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

|

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include these in |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collection |

Allowance |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

||||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The form is known as the DR-15EZ Sales and Use Tax Return. |

| 2 | It falls under the governance of Rule 12A-1.097, F.A.C. |

| 3 | The effective version is from January 2020. |

| 4 | Filers may submit returns and payments online or by mail to the Florida Department of Revenue. |

| 5 | Instructions can be found in the Form DR-15EZN, incorporated by reference in Rule 12A-1.097, F.A.C. |

| 6 | A collection allowance of 2.5% is offered for timely online filings and payments, capped at $30. |

| 7 | Returns and payments are due on the 1st and considered late after the 20th day following each reporting period. |

| 8 | If the due date falls on a non-business day, returns are timely if postmarked the next business day. |

| 9 | Late filings or payments incur a minimum late penalty of 10% of the tax owed or $50, whichever is greater. |

| 10 | The form requires details such as gross sales, exempt sales, and taxable sales/purchases, among others. |

Instructions on Utilizing Dr 15Ez Sales Tax

Filling out the DR-15EZ Sales Tax form is a straightforward task that businesses operating in Florida need to complete periodically. This form allows businesses to report and remit sales and use taxes they collected during a specific reporting period. Given its importance in maintaining compliance with state tax regulations, it's essential to fill out this form accurately and submit it by the due dates to avoid penalties. The instructions listed below will guide you through each step of completing the DR-15EZ form, ensuring that the process is as smooth and error-free as possible.

- Start by reading the Instructions for DR-15EZ Sales and Use Tax Returns (Form DR-15EZN) to familiarize yourself with the form's requirements. These instructions can be found at floridarevenue.com/forms.

- Enter the reporting period in the designated area at the top right of the form.

- Fill in the Certificate Number and Surtax Rate applicable to your business location.

- Write your business's DATE (Date, Address, Telephone, and Email) information clearly, including any new location or mailing address changes.

- On the reverse side of the form, calculate and enter the Gross Sales your business made during the reporting period. Do not include tax in this amount.

- Deduct Exempt Sales from the Gross Sales and report the amount. Remember, these sales should also be included in the Gross Sales figure reported in step 5.

- Report Taxable Sales/Purchases, including Internet and out-of-state purchases, in the designated area.

- Calculate the Total Tax Due, including any Discretionary Sales Surtax, and enter the amount.

- If applicable, subtract any Lawful Deductions and the DOR Credit Memo from the Total Tax Due.

- Enter the Net Tax Due before any collection allowance, penalties, or interest.

- Detail the Discretionary Sales Surtax Information in sections A and B as instructed on the form.

- Calculate the Less Collection Allowance or add any Plus Penalty and Interest if filing electronically and/or if applicable due to late filing.

- Finally, enter the Amount Due With Return, ensuring it matches the amount calculated on the front of the form.

- Review the form thoroughly, then sign and date the declaration at the bottom affirming the accuracy of the information provided. If a preparer assisted with the form, ensure their signature and date are also included.

- Remember not to fold or staple the form and, if mailing, send it to the Florida Department of Revenue at the address provided on the form along with any payment due.

By following these steps, you can accurately complete the DR-15EZ Sales Tax form. Ensure that it is submitted by the due date to avoid any penalties. For businesses opting for electronic filing, advantages include a collection allowance and potentially avoiding late fees through timely electronic submissions.

Obtain Answers on Dr 15Ez Sales Tax

What is the DR-15EZ Sales and Use Tax Return?

The DR-15EZ Sales and Use Tax Return is a document utilized by businesses to report and pay the sales and use taxes they have collected from customers to the Florida Department of Revenue. It's designed for certain sales tax registrants based on criteria such as the type of business and the volume of sales. This form allows businesses to calculate the tax due, including any discretionary sales surtax applicable, and provides the option to deduct a collection allowance if the return and payment are filed electronically and on time.

How can I file the DR-15EZ form?

This form can be filed in two ways: electronically via the Florida Department of Revenue eServices, or traditionally by mailing a completed physical form to the specified address. Filing online is encouraged as it streamlines the processing and allows for an electronic record of submission. Additionally, electronic filers may be eligible for a collection allowance, which is a deduction in the amount owed.

What are the due dates for filing the DR-15EZ?

Returns and payments are due on the first day of the month following the end of the reporting period but are considered late if not submitted by the 20th day of that month. Should the 20th fall on a weekend or public holiday, the next business day becomes the deadline. Timely submission is critical to avoid penalties and interest charges.

Is there a penalty for late filing or payment?

Yes, late filings or payments are subject to a penalty of 10% of the tax owed, with a minimum penalty of $50, even if no tax is due for the period. Late payments may also incur interest, which is calculated at a floating rate. Ensuring timely submission helps avoid these additional costs.

What is a collection allowance, and who is eligible?

The collection allowance is a benefit for taxpayers who file their sales and use tax return electronically and pay any tax due on time. It allows them to keep 2.5% of the first $1,200 of tax due, up to a maximum of $30. This incentive is designed to promote timely and efficient filing through electronic means.

Can I claim a collection allowance if I file by mail?

No, the collection allowance is only available to taxpayers who file their return and make their payment electronically. This is an incentive to encourage electronic filing, which is more efficient for both the taxpayer and the Department of Revenue.

What should I do if my business address has changed?

It's important to notify the Florida Department of Revenue of any changes to your business location or mailing address. This can be done when filing your DR-15EZ form by providing the new address information in the designated section of the return. Keeping your address information current ensures that you receive important tax documents and communications on time.

What if I have no sales tax to report for the period?

Even if no sales tax was collected during the reporting period, a "zero return" must still be filed by the due date. Filing a zero return keeps your account in good standing and avoids the issuance of unnecessary notices and penalties for failure to file.

Common mistakes

When businesses tackle the task of filling out the DR-15EZ Sales Tax form for Florida, it's crucial to steer clear of common pitfalls to ensure accuracy and compliance. Here are seven mistakes often made while completing this form:

Failing to double-check the math: Small errors in addition or subtraction can lead to discrepancies in total tax due, resulting in either underpayment or overpayment.

Overlooking exempt sales: Not properly identifying or forgetting to include exempt sales can result in reporting a higher taxable amount than necessary.

Incorrect classification of taxable sales: Misunderstanding which items are taxable and which are exempt under Florida law can lead to inaccuracies on both Gross Sales and Taxable Sales/Purchases lines.

Neglecting the collection allowance: Eligible businesses that file and pay electronically might miss out on the collection allowance due to oversight or misunderstanding its application.

Improper reporting of discretionary sales surtax: Failing to correctly calculate or report the amount due from the discretionary sales surtax, which varies by county.

Forgetting to deduct DOR credit memos: Businesses sometimes overlook their eligible DOR credit memos, which could effectively reduce the net tax due.

Submitting late without accounting for penalties and interest: Late submissions require the addition of penalties and floating interest rates, which some filers fail to include.

Steering clear of these mistakes not only smooths the process but also guards against potential financial penalties. Keeping accurate records, understanding state-specific tax laws, and ensuring timely submissions are foundational practices that contribute significantly toward flawless tax reporting.

Accuracy is key: Always double-check figures and calculations to prevent errors.

Timeliness matters: Avoid penalties by adhering to filing and payment deadlines.

Know your exemptions: Familiarizing oneself with Florida's tax laws ensures proper classification and reporting of sales.

The steps toward successful navigation of tax obligations emphasize diligence, understanding, and prompt action. By carefully avoiding these common mistakes, businesses can foster compliance, ensure accuracy, and maintain good standing with the Florida Department of Revenue.

Documents used along the form

Filing the Florida Sales and Use Tax Return DR-15EZ is an essential task for many businesses, ensuring compliance with state tax regulations. However, this form doesn't stand alone in the realm of business documentation. Several other forms and documents frequently accompany the DR-15EZ, aiding in a comprehensive approach to tax filing and business administration. Understanding these documents helps streamline processes, ensuring accuracy and compliance.

- DR-15EZN Instructions: Detailed instructions for completing the DR-15EZ form, providing line-by-line guidance and clarifying common questions or concerns regarding the tax return process.

- DR-659 Florida eServices Calendar of Electronic Payment Deadlines: A calendar indicating critical dates for electronic payments, ensuring businesses meet tax payment deadlines and take advantage of potential benefits like collection allowances.

- Form DR-1: The Florida Business Tax Application, required for businesses to register for a sales tax certificate before utilizing the DR-15EZ form for tax filing.

- Form DR-26S: Application for Refund - Sales and Use Tax, used by businesses seeking a refund for overpaid sales taxes, often following a DR-15EZ submission that reveals an overpayment.

- Form DR-46NT: Notice of New Tax Rate, notifies businesses of changes in their applicable sales tax rate, impacting calculations on future DR-15EZ submissions.

- Form DR-15: Sales and Use Tax Return, a more detailed version of the DR-15EZ, for businesses with more complex tax filing needs or those not eligible to file with the EZ version.

- Form DR-15SW: Solid Waste and Surcharge Return, often filed alongside the DR-15EZ by businesses that deal with products or services subject to additional environmental fees.

- Form DR-2X: Amended Sales and Use Tax Report, enables businesses to correct any errors or omissions in previously submitted DR-15EZ forms, ensuring accuracy in reporting and payment.

Each document or form serves a unique purpose, supporting businesses through various aspects of tax compliance, from registration and payment to amendments and refunds. Together, they form a robust framework, enabling businesses to navigate the complexities of sales and use tax with greater ease and precision. Knowledge of these documents not only aids in compliance but also in maximizing operational efficiencies and fiscal responsibilities.

Similar forms

The 1040 U.S. Individual Income Tax Return form shares similarities in guiding taxpayers through the process of calculating taxes due, adjusting for allowable deductions and credits, and determining the net amount owed to or refundable by the government, akin to the process seen in the DR-15EZ Sales Tax form for determining taxable sales, deductions, surtax, and net tax due.

The W-2 Wage and Tax Statement is similar because it involves reporting income and taxes withheld, akin to how the DR-15EZ form involves reporting gross sales and calculating tax owed, though the contexts differ between employment income and sales transactions.

The Form 1120, U.S. Corporation Income Tax Return, parallels in its purpose to report earnings, calculate taxable income after deductions, and determine tax due or refundable, mirroring the calculations of gross sales, exempt sales, and net tax due found in the DR-15EZ.

Schedule C (Form 1040), Profit or Loss from Business, is similar as it is used by sole proprietors to report business revenue, expenses, and net profit, which correlates with the DR-15EZ's function of reporting gross sales, applying deductions, and calculating the taxable amount.

The Form 1099-MISC, Miscellaneous Income shares similarities as it involves reporting various types of income that are not salary from employment, which requires the recipient to calculate tax obligations, somewhat like the DR-15EZ form's reporting of sales and calculation of sales tax dues.

State Income Tax Returns, similar to the federal ones, require taxpayers to report their income and calculate their tax based on state-specific regulations and rates, resonating with the DR-15EZ’s approach to reporting and calculating tax due under Florida’s sales and use tax law.

The Form 941, Employer's Quarterly Federal Tax Return, while focused on payroll taxes, reflects a pattern of reporting total amounts, subtracting adjustments, and calculating a net amount due, much like the process of determining net tax due on the DR-15EZ form.

Form 8868, Application for Extension of Time To File an Exempt Organization Return, although it serves a different purpose by requesting more time for filing, it hinges on the understanding and preliminary calculation of financial obligations, akin to the DR-15EZ's role in sales tax reporting and payment.

Dos and Don'ts

When tackling the DR-15EZ Sales Tax form, accuracy and attention to detail cannot be overstated. Whether you are a seasoned business owner or navigating Florida's sales tax requirements for the first time, adhering to a set of dos and don'ts can streamline the process, ensuring compliance and avoiding potential pitfalls. Here are key practices to follow:

- Do thoroughly read the instructions provided by the Florida Department of Revenue before beginning your form. Understanding the requirements can save you from making errors that could cost time and money.

- Do ensure all the information about your business is current and accurate, including the certificate number, name, and addresses. This helps in avoiding processing delays.

- Do report gross sales accurately, making sure not to include the sales tax collected in this amount. Overlooking this detail can lead to inaccuracies in your tax liability.

- Do itemize exempt sales clearly, as these figures are essential for calculating your taxable sales accurately.

- Do consider filing and paying electronically to qualify for the collection allowance, which can be a valuable financial benefit for your business.

- Don't delay your submission or payment. Late filing or payment can result in penalties that add unnecessary costs to your business operations.

- Don't overlook the discretionary sales surtax. Remember, this may apply depending on the location of your business and where the taxable transaction takes place.

- Don't forget to sign and date the form. Unsigned forms are considered incomplete and can be rejected or lead to delays.

- Don't ignore the rounding instructions when calculating dollars and cents. Proper rounding is essential for accurate tax calculations and payments.

- Don't fold or staple the return if you're submitting it by mail. This helps in ensuring that your form is processed efficiently without any hitches.

Following these guidelines can significantly ease the process of completing the DR-15EZ Sales Tax form. It not only streamlines your filing process but also safeguards you against common mistakes that could lead to penalties or fines. Always keep abreast of any changes to tax laws and requirements by visiting the Florida Department of Revenue's website or consulting with a tax professional.

Misconceptions

Understanding the DR-15EZ Sales Tax form can sometimes be confusing, leading to various misconceptions. Here's a list of common misunderstandings and clarifications to help you navigate this form with confidence.

- Misconception 1: Online filing isn't necessary if you're comfortable with paper forms.

While you can file using paper forms, filing your tax return online is not only encouraged but also comes with benefits, such as receiving a collection allowance.

- Misconception 2: The collection allowance is automatically applied to your return.

You must electronically file and pay your taxes timely to be eligible for the collection allowance of 2.5% of the first $1,200 of tax due.

- Misconception 3: There’s no penalty for late submission if the amount due is zero.

Even if no tax is due, a minimum late penalty of $50 can be charged if the return is filed or the payment is made after the due date.

- Misconception 4: Discretionary sales surtax applies to all sales.

Discretionary sales surtax is applied based on specific conditions, not to all taxable sales and purchases.

- Misconception 5: All purchases from the internet or out-of-state need to be included in taxable sales.

Only those internet or out-of-state purchases for which no Florida sales tax was charged should be included as taxable sales/purchases.

- Misconception 6: Gross sales include tax collected.

Gross sales must be reported without including the tax collected to avoid inflating the actual sales figures.

- Misconception 7: Filing a return isn't necessary if no sales were made during the reporting period.

A return must be filed for each reporting period, even if there were no sales and, thus, no tax due.

- Misconception 8: The due date is flexible based on the business owner's discretion.

Returns and payments are due on the 1st and late after the 20th day of the month following the reporting period, not based on the filer's personal schedule.

- Misconception 9: Only businesses within Florida need to file the DR-15EZ form.

Any business selling taxable goods or services to Florida customers must file, regardless of where the business is located.

- Misconception 10: Penalties are a fixed percentage for all late filings.

The late penalty starts at 10% of the tax owed, but not less than $50. However, interest and penalties can increase depending on how late the payment and return are filed.

Keeping these clarifications in mind will help you correctly complete and file your DR-15EZ Sales Tax form, avoiding common pitfalls and ensuring compliance with Florida tax regulations.

Key takeaways

Filling out and using the DR-15EZ Sales Tax form accurately is crucial for businesses to comply with the Florida Department of Revenue's requirements. Below are five key takeaways to ensure that you are handling the process correctly:

Electronic Filing Benefits: By filing the DR-15EZ Sales Tax form and paying the tax online timely, businesses can benefit from a collection allowance. This allowance is 2.5% of the first $1,200 of the tax due, which can reduce the total amount owed by up to $30. It's important to initiate the payment process and receive a confirmation number before 5:00 p.m. ET on the business day prior to the 20th of the month to qualify.

Understanding Due Dates: The DR-15EZ form and its payment are due by the 1st and considered late after the 20th day of the month following the end of each reporting period. Note that if the 20th falls on a weekend or a public holiday, the deadline extends to the next business day. Ensuring your return is filed timely can help avoid penalties.

Penalty for Late Filing or Payment: A minimum penalty of $50 will be applied if the return or the tax payment is late. This applies even when no tax is due for the period. The penalty can increase to 10% of the tax owed if the amount due is greater than $500. Keeping track of filing and payment deadlines can save you from these unnecessary costs.

Filing Even When No Tax is Due: It's important to file a return for every reporting period, even if your business has not engaged in taxable sales or purchases during that time. Filing a "zero return" is necessary to stay in compliance and avoid potential penalties for failure to file.

Accurate Reporting: The DR-15EZ form requires detailed reporting, including gross sales, exempt sales, and taxable sales/purchases. Being meticulous with these numbers ensures accurate tax calculation. Remember, exempt sales must be included in the gross sales figure but separated out to clarify which portions of your sales are not subject to tax.

By understanding these key aspects of the DR-15EZ form, businesses can better manage their sales tax obligations in Florida, avoid common pitfalls, and take advantage of benefits such as the collection allowance. Always refer to the latest instructions provided by the Florida Department of Revenue to ensure compliance with current tax laws.

Popular PDF Forms

Can You Buy a Pistol in North Carolina Without a Permit - Authority to purchase is contingent upon a clean record, as indicated by the provost marshal's action section.

Incidental Report - In the science lab, a child accidentally spilled boiling water on their hand, leading to burns and quick medical response.

Spain Visas - Documents presented checklist, aiding applicants in ensuring all necessary documentation is submitted.