Blank Dr14 PDF Template

In navigating the complexities of tax-exempt purchases, entities such as Indiana University find guidance in specific legal documents like the Florida Certificate of Exemption (DR-14). This form plays a crucial role for eligible organizations, allowing them to make lease or purchase transactions without the burden of sales tax, pursuant to Florida section 212.08(7) of the Florida Statutes (F.S.). The utilization of the DR-14 form is tightly regulated, framing strict guidelines to ensure that its benefits are reserved exclusively for the organization's use. For instance, it demands that Indiana University stands as the direct buyer and financial settler, ensuring transactions are straightforwardly invoiced and paid for by the University, whether by check or credit card. Moreover, the stipulation that all acquisitions must purely serve the University's operational needs further cements the purpose behind this exemption—supporting the organization's exempt objectives without personal gains for individuals associated. Equally important are the instructional components of the DR-14 form, which mandate the distribution of a copy of the Florida Consumer's Certificate of Exemption to vendors, facilitating a compliant and transparent procurement process. Understanding the details and conditions outlined in the DR-14 form is indispensable for eligible entities aiming to capitalize on tax exemptions effectively and within the bounds of the law.

Preview - Dr14 Form

FLORIDA CERTIFICATE OF EXEMPTION (DR‐ 14)

***For internal Indiana University use only***

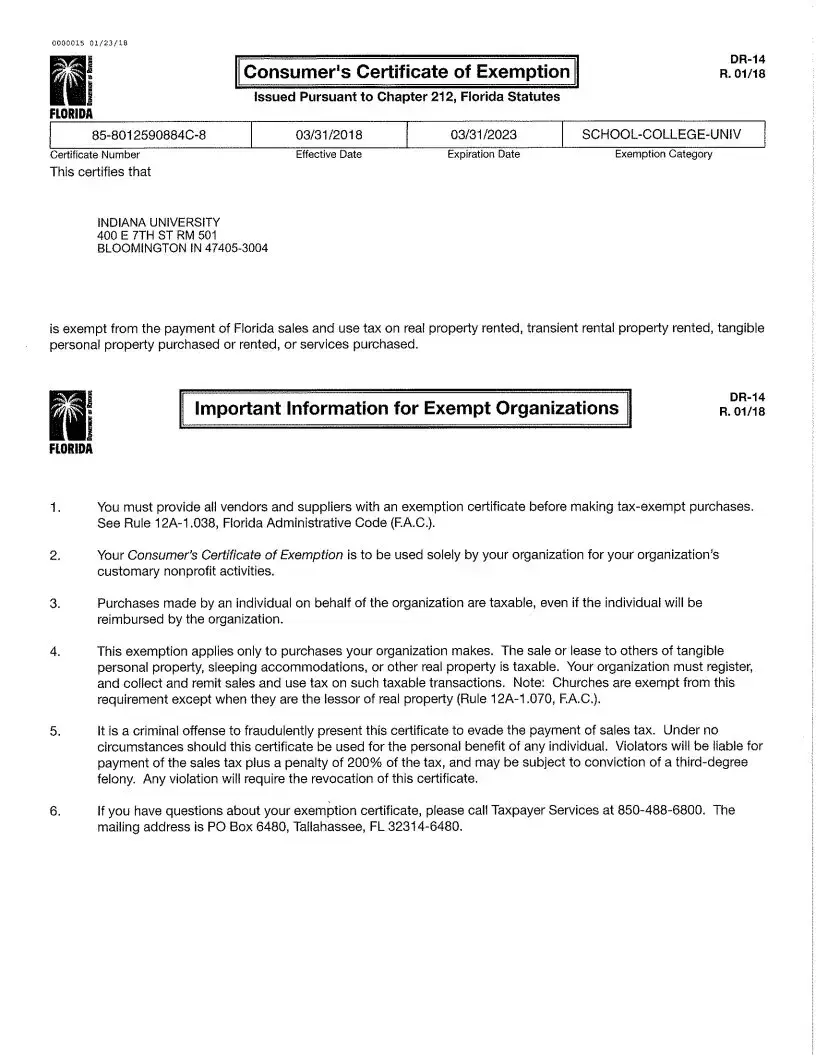

NOTE: According to Florida section 212.08(7), Florida Statutes (F.S.), Indiana University is authorized to make purchases and leases for its exclusive use without paying sales tax. The University must issue the attached certificate to vendors when purchasing tangible personal property or taxable services to qualify for the exemption.

Indiana University must be the direct purchaser and payer of record. Purchases must be made in the following manner:

o Are directly invoiced and charged to Indiana University, and o Are directly paid by Indiana University via

check,

credit card

All purchases made using Form DR‐14 must benefit the University only. The form may not be used for the benefit of any officer, member, or employee of Indiana University.

The purchases must be made for use in carrying on the work of the organization and directly related to the University’s exempt purpose.

INSTRUCTIONS:

Provide a copy of the Florida Consumer's Certificate of Exemption to vendors

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | Florida Statutes, Section 212.08(7) provides the legal basis for the DR-14 form, allowing certain exemptions from sales tax. |

| User | Indiana University is authorized to use the DR-14 form for tax-exempt purchases or leases for its exclusive use. |

| Purchase Conditions | Purchases or leases must be directly invoiced and paid by Indiana University using check or credit card to qualify for exemption. |

| Benefit Restriction | The use of Form DR-14 is strictly for the benefit of Indiana University and cannot be used for personal benefit of any officer, member, or employee. |

| Usage Requirement | All purchases made with the DR-14 must support the university's exempt purpose and be directly related to carrying on its work. |

| Vendor Instructions | Vendors are required to be provided with a copy of the Florida Consumer's Certificate of Exemption when the DR-14 is used for purchases. |

Instructions on Utilizing Dr14

Filling out the DR-14 form is a straightforward process designed to ensure that Indiana University can make tax-exempt purchases or leases in Florida. This capability helps the University save on costs for goods and services that are essential for its operations. By following the steps below, the University can properly use this exemption. It's crucial that the form is accurately completed to comply with the specific requirements outlined by Florida law, ensuring that all transactions made under this exemption are lawful and directly benefit the University.

- Review Florida Statute 212.08(7) to understand the scope of tax exemptions available for educational institutions.

- Ensure that Indiana University is the direct purchaser and payer of record for the transaction. The purchase or lease must be invoiceable directly to Indiana University and directly paid by them using:

- Check,

- Credit card.

- Make certain that all purchases or leases made under this certificate are for the exclusive use of Indiana University and are not for the personal benefit of any officer, member, or employee.

- Confirm that the items or services purchased are used in carrying out the work of the University and are directly related to its exempt purposes.

- Obtain a copy of the Florida Consumer's Certificate of Exemption. This document can typically be requested from the Florida Department of Revenue or the administrative department of Indiana University responsible for tax matters.

- Provide the vendor with the Certificate of Exemption before completing the purchase or lease agreement. This step is essential to ensure that the transaction is processed without the addition of sales tax.

- Retain records of all transactions made using the DR-14 form for auditing and compliance purposes. Proper documentation should include a copy of the exemption certificate provided to the vendor, the purchase documentation, and proof of payment.

After the DR-14 form is filled out correctly and the purchase or lease is made, the transaction should process tax-exempt, saving Indiana University the cost of sales tax. It's important to follow these steps carefully to maintain compliance with Florida's tax laws and ensure the University benefits fully from this exemption. Remember, any misuse of the form can result in penalties or the revocation of tax-exempt status. Keeping meticulous records will assist in demonstrating compliance should any questions about the tax-exempt purchases arise.

Obtain Answers on Dr14

What is the DR-14 form used for?

The DR-14 form, known as the Florida Consumer's Certificate of Exemption, serves a specific purpose. It is used by entities such as Indiana University, which are authorized under Florida law, to make purchases or leases without paying the state sales tax. This exemption applies when the University acquires tangible personal property or taxable services that are essential for its operations. The fundamental condition is that these purchases or leases must be exclusively for the institution's use and directly contribute to carrying out its organizational work.

Who is eligible to use the DR-14 form?

Eligibility to use the DR-14 form is granted to entities like Indiana University that are recognized under Florida Statutes section 212.08(7), which permits certain organizations to obtain goods and services tax-free. This exemption is provided on the condition that the purchases are solely for the entity’s benefit and are directly related to its exempt objectives or activities.

How should the DR-14 form be presented to vendors?

When intending to make a tax-exempt purchase, the purchasing entity must provide the vendor with a copy of the Florida Consumer's Certificate of Exemption, the DR-14 form. This document serves as proof of the entity's eligibility for sales tax exemption, thereby informing the vendor of the tax-exempt status of the transaction.

Are there specific conditions under which purchases must be made using the DR-14 form?

Yes, there are stringent conditions outlined for purchases using the DR-14 form to qualify for sales tax exemption. These conditions include:

- The purchases must be directly invoiced to and paid for by the exempt entity, such as Indiana University.

- Payment can be made through various methods, including check or credit card, ensuring that the exempt entity is the direct purchaser and payer of record.

- All acquired goods or services must exclusively benefit the university and must not be for the personal use of any officer, member, or employee of the entity.

Can the DR-14 exemption be used for personal purchases by university employees?

No, the DR-14 exemption is strictly limited to purchases that are for the institution's use and are necessary for the furtherance of its exempt purposes. It is not permitted for personal use by university officers, members, or employees under any circumstances. Abuse of this exemption for personal benefit can lead to its revocation and potential legal consequences.

What types of purchases qualify for the DR-14 sales tax exemption?

Qualifying purchases under the DR-14 exemption generally include tangible personal property or taxable services that are essential for the exempt entity's operations. These purchases must be directly related to the activities or work of the organization, serving its exempt purpose. For an educational institution like Indiana University, this might encompass educational materials, office supplies, and services necessary for the institution's administration and academic functions.

What steps should an entity take if it loses its DR-14 form?

If an exempt entity such as Indiana University misplaces its DR-14 form, it should immediately contact the Florida Department of Revenue to request a duplicate. It is vital to maintain an active certificate to ensure uninterrupted tax-exempt purchasing. The entity may also need to review its internal procedures for safeguarding important documents to prevent such occurrences in the future.

Common mistakes

Filling out the Florida Certificate of Exemption, or DR-14 form, accurately is crucial for Indiana University to enjoy the benefits of a sales tax exemption on eligible purchases. However, a number of common mistakes can compromise the process, leading to potential complications. Here are nine typical errors people tend to make:

Not ensuring that Indiana University is listed as the direct purchaser and payer on records. It’s crucial for the university to directly initiate and complete the purchase.

Overlooking the requirement for purchases to be invoiced and charged directly to Indiana University. This direct billing is a key criterion for the exemption.

Failing to use an acceptable payment method. The form specifies that payments must be made directly by Indiana University, either by check or credit card.

Using the form for transactions that do not exclusively benefit the University. Every purchase made under this exemption must be for the University’s use only.

Benefiting an officer, member, or employee of Indiana University with the purchase. This directly contravenes the stipulations for the sales tax exemption.

Not connecting the purchase to the university’s exempt purpose. All items bought must have a direct relation to the work and goals of the university.

Omitting to provide a copy of the certificate to vendors. This document verifies the university's eligibility for tax-exempt purchases.

Assuming all tangible personal property and taxable services are covered without checking specific eligibility. Not every item or service may qualify for exemption.

Completing the form with inaccurate information, whether about the purchaser, the nature of the goods or services, or the payment method. Accuracy is paramount in these documents.

Avoiding these mistakes is imperative to ensure the smooth and lawful acquisition of goods and services by Indiana University under the DR-14 form. Proper adherence to the form’s requirements safeguards the university’s interests and ensures compliance with Florida’s tax exemption statutes.

Documents used along the form

When navigating the complexities of tax-exempt purchases in Florida, especially for educational institutions like Indiana University, it’s essential to be well-versed in the documentation required to support such transactions. The Florida Certificate of Exemption (DR-14) is a critical document for these institutions, ensuring they can make purchases without paying sales tax as per Florida Statutes. However, the DR-14 form is often just the starting point. Other forms and documents frequently accompany the DR-14 to complete this tax-exempt process, each serving a unique but complementary role to ensure compliance and proper record-keeping.

- W-9 Form, Request for Taxpayer Identification Number and Certification: This form is often required by sellers to document the tax-exempt entity’s taxpayer identification number (TIN). It’s a prerequisite for entities conducting business as it helps prevent tax evasion by ensuring all parties are properly registered with the IRS.

- Purchase Order (PO): A purchase order is a document sent from a buyer to a seller with details about a purchase, including types of items, quantities, and prices. For tax-exempt transactions, the PO should reference the DR-14 form and indicate that the purchase is for the exclusive use of the exempt entity, thereby qualifying it for tax-exempt status.

- Certificate of Authority: This document might be required if the purchase involves items that are regulated or require additional governmental oversight. It serves as proof that the entity is authorized to make certain purchases or engage in activities that are tax-exempt.

- Annual Resale Certificate for Sales Tax: While mainly used by entities that resell items, this certificate can also be relevant for tax-exempt organizations. For example, it would allow an educational institution to purchase goods without paying sales tax, not for direct use but for resale in fundraising activities. Sure, it's a more niche application concerning tax exemption, but it's essential for those occasions.

In the grand scheme of things, successfully leveraging tax-exempt status for purchases in Florida requires more than just the DR-14 form—it’s about assembling the right set of accompanying documents to ensure every transaction is compliant. This attention to detail not only supports an institution's financial efficiency but also upholds its commitment to legal and ethical practices. Understanding each document's role contributes significantly to navigating the sometimes murky waters of tax-exempt purchases, ensuring that educational institutions can focus more on their core mission of delivering high-quality education.

Similar forms

Sales Tax Exemption Certificate (General): Just like the Florida Certificate of Exemption (DR-14), this document is used by qualifying organizations to certify their exemption from paying sales tax on purchases. Both forms serve a similar purpose but differ in their jurisdiction and the specific criteria they cover. Essentially, they enable organizations to buy goods or services tax-free, provided these purchases are made for the organization's exclusive use and directly related to its exempt purposes.

Resale Certificate: Although used in a different context, the Resale Certificate shares a common functionality with the DR-14 form – it's about tax exemption. While the DR-14 form is for tax-exempt purchases by eligible entities, such as educational institutions, for their direct use, the Resale Certificate is employed by businesses to purchase goods without paying sales tax, under the condition that the goods are to be resold. Both certificates require the purchaser to declare their eligibility for the exemption.

Streamlined Sales and Use Tax Agreement Certificate of Exemption: This form is part of a multistate effort to simplify tax exemption procedures for sellers and purchasers. Similar to the DR-14 form, it allows tax-exempt purchases. However, its scope is broader, covering multiple states that are participants in the agreement. Like the DR-14, it requires the purchaser to be the direct payer and specifies that purchases must be for the entity’s exclusive use.

Nonprofit Postal Permit Application: At first glance, this might seem unrelated, but it aligns closely with the spirit of the DR-14. This application allows nonprofit organizations to send mail at special rates, essentially providing a financial break similar to a tax exemption. Both documents underscore the requirement for purchases or services (mailing, in the postal permit's case) to be directly related to the organization's nonprofit activities.

Dos and Don'ts

When filling out the Florida Certificate of Exemption (DR-14) form, there are several important practices to follow and mistakes to avoid. Ensuring accuracy and compliance with the stipulations set forth by Florida Statutes can streamline the process of obtaining tax exemptions for qualifying purchases by Indiana University. Here are seven dos and don'ts for completing the DR-14 form:

- Do ensure that Indiana University is listed as the direct purchaser and payer on all records for the transaction. This is crucial for the exemption to be valid.

- Do provide vendors with a copy of the Florida Consumer's Certificate of Exemption as required. This step is often overlooked but is mandatory.

- Do make purchases that are directly invoiced and charged to Indiana University, using the university’s check or credit card. This ensures the purchase is traceable back to the University.

- Do confirm that all purchases made using the Form DR-14 are solely for the benefit of the University and its exempt purposes. It's imperative that these purchases support the ongoing work of the institution.

- Don't use the Form DR-14 for personal benefit or for the benefit of any officer, member, or employee outside of their professional capacity at Indiana University. This misuse could lead to the revocation of the exemption status.

- Don't forget to ensure all purchases are for tangible personal property or taxable services that are directly related to the University’s exempt purposes. This is a requirement for the exemption to apply.

- Don't neglect to review and fully understand the stipulations outlined in Florida section 212.08(7), F.S. Compliance with these rules is crucial for the effective and lawful use of the exemption certificate.

Adhering to these guidelines can facilitate a smoother process in securing tax exemptions for eligible purchases by Indiana University, thereby ensuring compliance with Florida Tax Law and supporting the University's financial efficiency.

Misconceptions

- The DR-14 form is applicable to all Florida universities: This is a misconception because the form specifically applies to Indiana University, as authorized by Florida Statutes Section 212.08(7). Not all universities in Florida or institutions from other states are granted this exemption.

- It allows purchases for personal use: The DR-14 form strictly prohibits the use of the exemption for personal benefit. It clarifies that all purchases must solely benefit Indiana University and its operations, directly related to the University’s exempt purpose, not for the personal use of any officer, member, or employee.

- The form can be used for any type of purchase: This is incorrect as the DR-14 form is intended for the purchase of tangible personal property or taxable services only. It cannot be utilized for non-tangible purchases or services that are not subject to sales tax.

- Physical payment methods are not required: The correct procedure demands that Indiana University must be the direct payer, which includes payments made by check or credit card. This requirement is aimed at ensuring transparency and accountability in the exemption’s application.

- The exemption is automatically applied to all purchases by Indiana University: Vendors require a copy of the Florida Consumer's Certificate of Exemption to be presented at the time of purchase. This step is crucial to qualify for the sales tax exemption; it is not automatically applied.

- There is no direct invoicing requirement: Contrary to this belief, the DR-14 form stipulates that purchases must be directly invoiced and charged to Indiana University. This ensures that the transactions are officially recorded and can be directly linked to the university, maintaining the integrity of the exempt status.

Key takeaways

When dealing with the Florida Certificate of Exemption (DR-14), it's important to understand its purpose and the proper way to utilize it, specifically for entities like Indiana University. Below are seven key takeaways that should be kept in mind when filling out and using the DR-14 form. This guidance can be essential for efficient and lawful handling of tax exemptions for qualifying purchases.

- Exclusively for Indiana University's use: The DR-14 form is designed to facilitate tax-exempt purchases by Indiana University, underscoring the necessity of the form being used strictly for transactions that benefit the university directly.

- Requirement for direct invoicing and payment to Indiana University: In order for purchases to be eligible for exemption, they must be invoiced directly to Indiana University and paid directly by the institution, whether by check or credit card.

- No personal benefit allowed: The use of the DR-14 form is restricted to transactions that serve the interests of Indiana University. It cannot be employed for the personal benefit of any officer, member, or employee within the institution.

- Purchases must align with the university's exempt purposes: Exempt purchases must support the overarching mission of the university and be integral to its operations. This ensures that the benefits of tax exemptions are tied to the institution's educational objectives.

- Mandatory provision of the Consumer's Certificate of Exemption to vendors: To avail of the exemption, it is imperative to provide vendors with a copy of the Florida Consumer's Certificate of Exemption. This serves as evidence of Indiana University's eligibility for tax-exempt purchasing.

- Understanding Florida's tax exemption statutes: Knowledge of Section 212.08(7), Florida Statutes (F.S.), is vital. It lays the legal foundation for the exemption and helps in comprehending the scope and limitations of tax-exempt purchases in accordance with state law.

- Application of the DR-14 form is limited to tangible personal property or taxable services: The form is applicable exclusively to the purchase or lease of tangible personal property or services subject to sales tax, thus outlining the specific nature of transactions that qualify for exemption.

In summary, proper utilization of the DR-14 form necessitates a clear understanding of its limitations and requirements. Adherence to these guidelines not only ensures compliance with state tax laws but also supports the financial integrity and mission of Indiana University. Being meticulous with these details is crucial for the university’s administration and finance teams.

Popular PDF Forms

How Long After Qme Settlement - Ensures compliance with statutory obligations by detailing the transmission of medical-legal reports in workers' compensation proceedings.

Permission Slip Lds - Empowers parents and guardians to provide comprehensive safety and dietary information for participants in LDS activities.