Blank Drop Shipment Certificate PDF Template

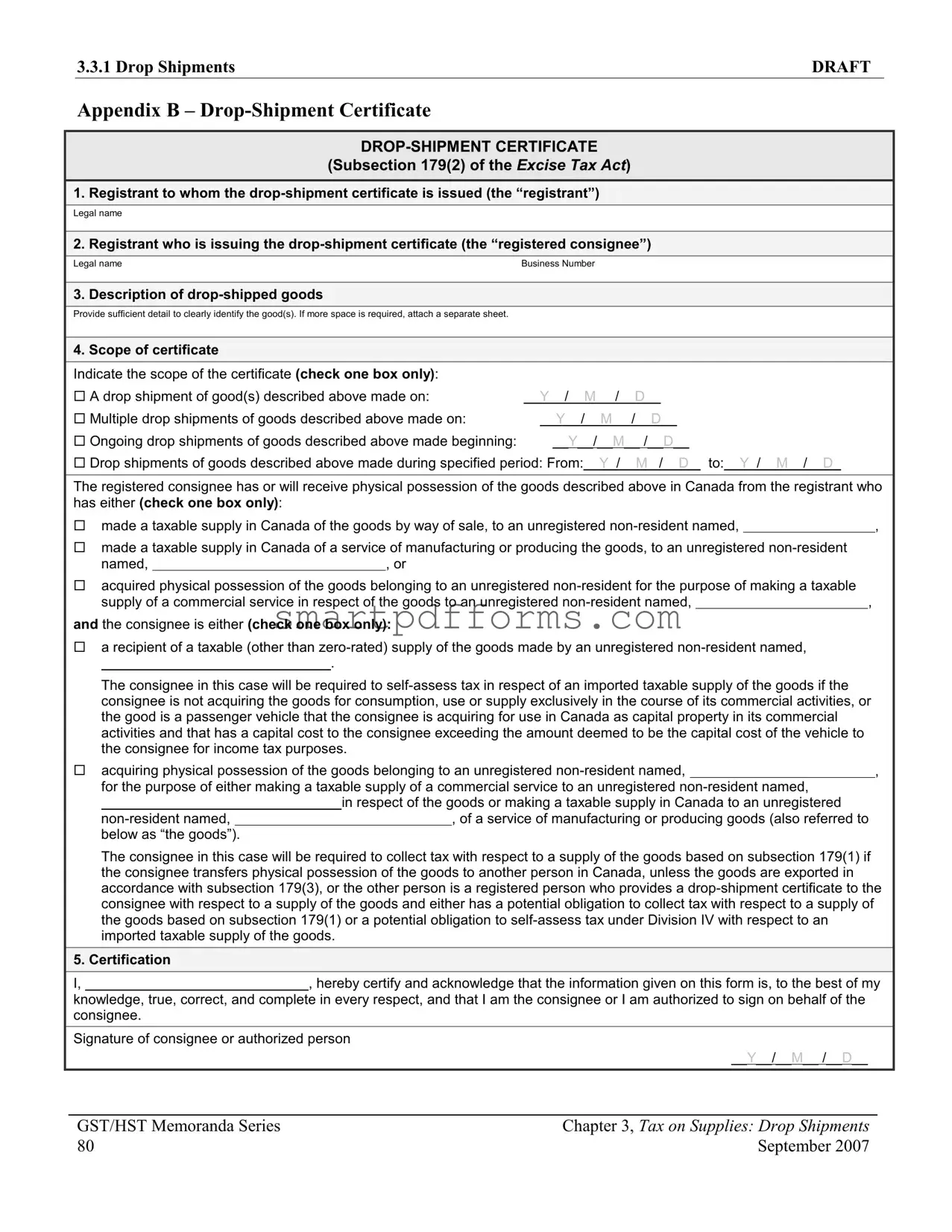

In the nuanced world of supply chain management, the Drop Shipment Certificate plays a pivotal role, especially for transactions under Canadian law, as outlined in the Excise Tax Act. This certificate facilitates transactions between businesses by allowing certain tax exemptions for goods that are shipped directly from a supplier to a final customer, bypassing the purchasing business. The form requires detailed information from both the registrant to whom the certificate is issued and the registrant issuing the certificate, including legal names and business numbers. Additionally, it mandates a comprehensive description of the goods being shipped, ensuring they are precisely identified. Options on the form specify the scope of the certificate, covering individual, multiple, ongoing, or specified-period drop shipments. The form further outlines the conditions under which the registered consignee, who receives the goods in Canada, can make taxable supplies or services regarding the goods to unregistered non-residents. Critical to compliance is the certification section at the end of the form, where the consignee or authorized individual attests to the accuracy and completeness of the information provided. The presence of this form in drop shipment transactions underscores the complexities of tax obligations in international trade, making it essential for businesses to understand its application for compliance and to streamline their operations effectively.

Preview - Drop Shipment Certificate Form

3.3.1 Drop Shipments |

DRAFT |

|

|

Appendix B –

(Subsection 179(2) of the EXCISE TAX ACT)

1. Registrant to whom the

Legal name

2. Registrant who is issuing the

Legal nameBusiness Number

3. |

Description of |

|

|

|

|

|

Provide sufficient detail to clearly identify the good(s). If more space is required, attach a separate sheet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Scope of certificate |

|

|

|

|

|

Indicate the scope of the certificate (check one box only): |

|

|

|

|

|

|

|

A drop shipment of good(s) described above made on: |

__Y__/__M__ /__D__ |

||||

|

Multiple drop shipments of goods described above made on: |

__Y__/__M__ /__D__ |

||||

|

|

|

|

|

|

|

|

Ongoing drop shipments of goods described above made beginning: |

|

|

__Y__/__M__ /__D__ |

|

|

Drop shipments of goods described above made during specified period: From:__Y_/__M_ /__D_ to:__Y_/__M__/__D_

The registered consignee has or will receive physical possession of the goods described above in Canada from the registrant who has either (check one box only):

made a taxable supply in Canada of the goods by way of sale, to an unregistered |

|

, |

||||

|

|

|

|

|

|

|

made a taxable supply in Canada of a service of manufacturing or producing the goods, to an unregistered |

|

|

||||

named, |

|

, or |

|

|

||

acquired physical possession of the goods belonging to an unregistered |

|

|

||||

supply of a commercial service in respect of the goods to an unregistered |

|

, |

|

|||

and the consignee is either (check one box only):

arecipient of a taxable (other than

.

The consignee in this case will be required to

acquiring physical possession of the goods belonging to an unregistered |

|

, |

|||

for the purpose of either making a taxable supply of a commercial service to an unregistered |

|

||||

|

|

in respect of the goods or making a taxable supply in Canada to an unregistered |

|

||

|

|

, of a service of manufacturing or producing goods (also referred to |

|

||

below as “the goods”). |

|

|

|

|

|

The consignee in this case will be required to collect tax with respect to a supply of the goods based on subsection 179(1) if the consignee transfers physical possession of the goods to another person in Canada, unless the goods are exported in accordance with subsection 179(3), or the other person is a registered person who provides a

5. Certification

I,, hereby certify and acknowledge that the information given on this form is, to the best of my

knowledge, true, correct, and complete in every respect, and that I am the consignee or I am authorized to sign on behalf of the consignee.

Signature of consignee or authorized person

|

|

__Y__/__M__ /__D__ |

|

|

|

|

|

|

|

|

|

|

GST/HST Memoranda Series |

Chapter 3, Tax on Supplies: Drop Shipments |

|

|

80 |

September 2007 |

|

Form Data

| Fact Name | Description |

|---|---|

| Legal Framework | The Drop Shipment Certificate operates under the EXCISE TAX ACT, particularly subsection 179(2). |

| Participants | Two main participants: the registrant to whom the certificate is issued, and the registering consignee who issues the certificate. |

| Goods Description | Details of the good(s) being drop-shipped must be sufficiently clear. Additional information can be attached if needed. |

| Certificate Scope | The scope can be for a single drop shipment, multiple shipments, ongoing shipments, or shipments within a specified period. |

| Consignee Obligations | The consignee is responsible for tax matters, including self-assessment or tax collection, depending on the nature of the goods and the supply chain. |

Instructions on Utilizing Drop Shipment Certificate

Filling out the Drop Shipment Certificate form is a critical step in ensuring compliance with the Excise Tax Act in Canada. It serves as an essential document for businesses involved in drop shipping, as it helps detail transactions and clarify tax obligations. Proper completion and submission of this certificate guard against tax-related complications and enable a smoother operation of cross-border transactions. Highlighted below is a structured guideline intended to simplify the form completion process for businesses, ensuring clarity, accuracy, and compliance.

- Registrant Information: Begin by entering the legal name of the registrant to whom the drop-shipment certificate is issued. This is the entity receiving the goods.

- Registered Consignee Details: Input the legal name and business number of the registrant issuing the drop-shipment certificate. This refers to the entity responsible for sending the goods.

- Description of Drop-Shipped Goods: Clearly describe the good(s) being shipped. Include sufficient detail to identify the goods distinctly. If the space provided is insufficient, attach a separate sheet with the complete details.

- Scope of Certificate: Indicate the scope of the certificate by checking the appropriate box. You will select from four options: a single drop shipment on a specified date, multiple drop shipments on specified dates, ongoing drop shipments starting from a specified date, or drop shipments within a specified period. Fill in the corresponding dates as required.

- Nature of Transaction: Here, you need to specify the transaction's nature by checking the relevant box. Options include whether the registrant made a taxable supply of goods by sale, supplied a service of manufacturing or producing the goods, or acquired the goods for the purpose of making a taxable supply of a commercial service, all involving an unregistered non-resident.

- Consignee’s Tax Obligation: Choose the appropriate box that describes the consignee's tax obligation based on the nature of the goods received and the planned use. This section helps determine the consignee's requirement to either self-assess tax or collect tax in relation to the supplied goods.

- Certification: The final step involves certification. The consignee or an authorized person must certify the accuracy and completeness of the information provided in the form. Enter the name of the certifying individual, then sign and date the form in the indicated spaces, marking the year (Y), month (M), and day (D).

After completing the form, ensure all information is accurate and that any additional documents or details referred to are attached. Subsequently, submit the completed Drop Shipment Certificate to the relevant tax authority or as directed by the Excise Tax Act guidelines. Timely and precise submission of this form is crucial for maintaining compliance and facilitating effective tax management for businesses involved in drop shipping.

Obtain Answers on Drop Shipment Certificate

What is a Drop Shipment Certificate?

A Drop Shipment Certificate is a document outlined under subsection 179(2) of the EXCISE TAX ACT in Canada. It serves as an official record between businesses (registrants and registered consignees) involved in the drop shipment process, detailing the transaction of goods being delivered directly from one business to another without passing through the business that ultimately sells the product to the final consumer.

Who needs to issue a Drop Shipment Certificate?

The registrant who is issuing the drop-shipment certificate (the "registered consignee") needs to issue the certificate. This entity is essentially the middleman who receives goods from another registrant (the entity making or selling the goods) and is responsible for either selling or further processing the goods before they are sold to the final consumer.

What information is required on the Drop Shipment Certificate?

The certificate must include:

- The legal names of both the registrant to whom the certificate is issued and the registrant issuing the certificate, along with the latter’s Business Number.

- A detailed description of the drop-shipped goods to clearly identify them. Additional sheets can be attached if more space is needed.

- The scope of the certificate, indicating whether it applies to a single drop shipment, multiple drop shipments, ongoing drop shipments, or shipments within a specified period.

- The registered consignee’s certification, including the acknowledgment of the truth and completeness of the information provided and the date of certification.

How does one determine the scope of the certificate?

The scope is determined by what the registered consignee intends with the goods received. It can be for a one-time drop shipment, multiple shipments on specified dates, ongoing shipments starting from a specific date, or shipments within a set timeframe. The correct box should be checked accordingly on the form.

What obligations do consignees have under the EXCISE TAX ACT with respect to drop shipments?

Consignees have different obligations based on how they acquire and use the goods:

- If the goods are for their commercial activities but not exclusively, or if a passenger vehicle acquired exceeds the deemed capital cost for income tax purposes, they need to self-assess tax.

- If consignees transfer physical possession of the goods to someone else in Canada, they are required to collect tax, unless the goods are exported or the receiving party is a registered person with a valid drop-shipment certificate and thus may have a potential obligation to collect or self-assess tax.

What types of transactions are covered under the Drop Shipment Certificate?

This certificate covers transactions where goods are drop-shipped from one business to another. It includes:

- Transactions where goods are sold by a registrant to an unregistered non-resident, then physically possessed by the registered consignee in Canada.

- Provision of services for manufacturing or producing goods in Canada for an unregistered non-resident.

- Acquisition of goods by a consignee for the purpose of making a taxable supply of commercial services to an unregistered non-resident.

Is it required to attach additional documentation with the Drop Shipment Certificate?

Yes, if the space provided on the form is insufficient to clearly identify the goods being shipped, additional sheets detailing the goods must be attached to ensure clear identification and compliance with regulations.

What certifications must the consignee make on the Drop Shipment Certificate?

The consignee (or an authorized person on behalf of the consignee) must certify that the information given on the form is true, correct, and complete to the best of their knowledge. This includes their legal name, the transaction details related to the drop shipment, and the date of certification. A signature of the consignee or the authorized person along with the date underscores this certification.

Common mistakes

Filling out the Drop Shipment Certificate form is crucial for ensuring the proper handling and taxation of goods in compliance with the Excise Tax Act. However, several common mistakes can occur during this process. Recognizing and avoiding these errors can streamline transactions and prevent unnecessary complications. Here are seven common mistakes people make when completing the Drop Shipment Certificate form:

- Incorrect or Incomplete Registrant Information: Failing to provide the complete legal name or business number for either the registrant to whom the drop shipment certificate is issued or the registrant issuing the drop shipment certificate can lead to processing delays or rejections.

- Vague Descriptions of Goods: Not providing a sufficient detail to clearly identify the drop-shipped goods. In cases where more space is needed, some forget to attach a separate sheet to expand on the goods' description.

- Error in Scope Selection: Incorrectly indicating the scope of the certificate, such as failing to check the correct box for the type of drop shipment(s) being made (e.g., single, multiple, ongoing, or within a specified period). This error can cause confusion about the transaction's timeframe or continuity.

- Misunderstanding Taxable Supplies: Misinterpreting the details regarding the type of taxable supply being made (e.g., sale of goods, service of manufacturing, or a commercial service) and to whom it is provided (an unregistered non-resident). This misunderstanding could potentially lead to incorrect tax treatments.

- Overlooking Recipient Obligations: Not accurately identifying or acknowledging the obligations of the consignee, particularly in relation to self-assessing tax for imported taxable supplies or collecting tax based on physical possession changes within Canada. These obligations significantly affect how the transaction is taxed and reported.

- Signature and Certification Errors: Failing to have the consignee or an authorized individual sign the certification can result in the form being considered invalid. Additionally, providing incorrect information in this section, through either oversight or misunderstanding, can lead to legal complications.

- Ignoring Date and GST/HST Requirements: Omitting the date of certification or not understanding the implications of the GST/HST Memoranda Series cited at the end of the form, which can offer critical guidance on tax implications for drop shipments.

Understanding these common pitfalls can greatly improve the accuracy and effectiveness of completing the Drop Shipment Certificate. By addressing these areas carefully, participants in drop shipment transactions can help ensure compliance with relevant tax laws, leading to smoother and more efficient operations.

Documents used along the form

In conjunction with a Drop Shipment Certificate, several other documents often come into play to ensure a smooth and compliant transaction process. These forms not only help to streamline the business operation but also ensure adherence to legal stipulations and tax obligations pertaining to drop shipments.

- Commercial Invoice: This document is a requirement for all types of international shipments and serves as a contract and proof of sale between the buyer and seller. It contains vital information about the transaction, including the names and addresses of the seller and buyer, a detailed description of the goods, the value of the shipment, and the terms of sale. It's crucial for customs clearance and tax assessment purposes.

- Bill of Lading: The Bill of Lading acts as a receipt for the goods shipped, issued by the carrier to the shipper. It serves multiple roles, such as a document of title, thus enabling the transfer of goods, and as a contract between the carrier and shipper. Detailed information including the type, quantity, and destination of the goods is documented, which is vital for logistics and legal purposes.

- Import/Export Declaration: This is a mandatory document for businesses engaged in international trade. The declaration details the nature, value, and destination of the goods being shipped. This document is essential for customs clearance and is used by the governments to track imports and exports, determine duties and tariffs, and compile statistical data on international trade.

- Power of Attorney (POA): Relevant in scenarios where a third party, such as a customs broker or freight forwarder, is engaged to handle the customs clearance and documentation on behalf of the seller or buyer. The POA authorizes the third party to act on behalf of the company, making decisions and signing documents pertaining to the shipment's import or export.

These documents, when used in tandem with the Drop Shipment Certificate, create a comprehensive compliance and operational framework that not only meets legal requirements but also minimizes risks associated with international trade and logistics. Understanding and properly executing these forms can greatly contribute to the efficiency and legality of drop shipment operations.

Similar forms

The Commercial Invoice is similar to the Drop Shipment Certificate, as both documents contain detailed information about the goods being shipped, including a description and the legal names of the parties involved. However, the Commercial Invoice also typically includes the value of the goods and details necessary for customs clearance.

A Bill of Lading (BOL) shares similarities with the Drop Shipment Certificate since both are used in the shipping process and contain details about the goods, the shipper, and the recipient. The key difference is that a Bill of Lading acts as a receipt of shipment and a contract between the carrier and shipper, while the Drop Shipment Certificate focuses on the tax obligations associated with the transfer of goods.

The Packing List is similar in the way that it details the contents of a shipment, much like the description section of the Drop Shipment Certificate. However, its main purpose is to provide information about the quantities and packaging of shipped goods, without dealing with tax implications or certifying any tax-related matters.

Certificate of Origin documents bear resemblance to the Drop Shipment Certificate as they both certify certain information about the goods being shipped. A Certificate of Origin verifies the country in which the goods were manufactured, crucial for trade agreements and tariffs, contrasting with the tax-focused certification of drop-shipped goods in the Drop Shipment Certificate.

A Power of Attorney (POA) for Customs Clearance is somewhat akin to parts of the Drop Shipment Certificate that involve authorization. The POA grants a customs broker the authority to act on behalf of a business in the importation process, similar to how the Drop Shipment Certificate includes a section for the signature of an individual authorized to certify tax obligations on behalf of the consignee.

The Import Declaration is a document required by customs authorities, detailing the nature, value, and origin of the imported goods. While serving different purposes, it is similar to the Drop Shipment Certificate in that it provides necessary information about shipments crossing borders, but it is primarily used for assessing duties and taxes upon importation.

Sales Agreement or Contract documents, which outline the terms of a sale between two parties, share similarities with the certification and scope sections of the Drop Shipment Certificate. Both set the legal framework for the transaction, although the Sales Agreement covers a broader range of terms and conditions beyond the specifics of shipping and tax obligations.

Dos and Don'ts

Filling out a Drop Shipment Certificate form, in accordance with Subsection 179(2) of the Excise Tax Act, is a responsible task that needs careful attention to detail. Here are some dos and don'ts to ensure that you complete the form correctly and efficiently:

- Do carefully read the instructions provided with the form to understand the specific requirements and conditions that apply.

- Do ensure you accurately enter the legal names of both the registrant to whom the drop-shipment certificate is issued and the registrant who is issuing the certificate, along with the Business Number where required.

- Do provide a detailed description of the drop-shipped goods, including enough detail to clearly identify them. If the space provided is insufficient, attach a separate sheet with the additional details.

- Do accurately indicate the scope of the certificate by checking the appropriate box that applies to your shipment – whether it is a single drop shipment, multiple drop shipments, ongoing drop shipments, or shipments made during a specified period.

- Do ensure that the certification section at the end of the form is signed by the consignee or a person authorized to sign on behalf of the consignee, confirming the accuracy and completeness of the information provided.

- Don't skip any required fields or sections. Incomplete forms can lead to delays or refusal of your drop shipment certificate.

- Don't guess or provide vague descriptions of the goods being shipped. Lack of clarity can cause confusion and potential issues with the certificate's acceptance.

- Don't forget to check the correct boxes regarding the physical possession of the goods and the taxable supply status. This information is crucial for the proper processing of the certificate.

- Don't hesitate to seek assistance if you are unsure about any part of the form. Contacting a knowledgeable expert or the issuing authority can save time and prevent mistakes.

Completing the Drop Shipment Certificate accurately is essential for ensuring that your commercial transactions comply with the Excise Tax Act. By following these dos and don'ts, you can avoid common pitfalls and help streamline the process for everyone involved.

Misconceptions

When it comes to understanding the Drop Shipment Certificate in the context of the Excise Tax Act, various misconceptions often arise. Clearing up these misunderstandings ensures compliance and facilitates smoother transactions for businesses involved in drop shipping. Below are ten common misconceptions and their clarifications.

- Any business can issue a Drop Shipment Certificate: Only registrants, as defined under the Excise Tax Act, can issue or be issued a Drop Shipment Certificate. This highlights the importance of being registered under the Act.

- The certificate covers all types of goods: The Drop Shipment Certificate is specific to the goods described within it. Adequate detail must be provided to clearly identify these goods, ensuring they are eligible under the terms of the certificate.

- One certificate is enough for multiple consignees: Each certificate is specific to transactions between the registrant issuing the certificate and the registered consignee. Separate certificates are required for different consignees.

- Physical possession of goods is not necessary: The Drop Shipment Certificate stipulates that the registered consignee must receive or will receive physical possession of the goods in Canada, contradicting the notion that physical possession is not a requirement.

- The certificate allows for indefinite drop shipments: The scope of the certificate must be clearly indicated, including specific dates or a defined period. It does not automatically permit indefinite drop shipments without properly defining the timespan.

- Tax obligations are optional: Depending on the nature of the transaction and the parties involved, the consignee may be required to self-assess tax or collect tax in respect to the goods. This underscores the legal tax obligations tied to the use of a Drop Shipment Certificate.

- Any goods can be re-exported without tax implications: The certificate details scenarios where goods can be exported by the consignee in accordance with specific subsections. However, this does not universally apply to all re-exported goods, which may have different tax implications.

- Signatory authority is flexible: The certification section mandates that only the consignee or an authorized person on behalf of the consignee can sign the Drop Shipment Certificate. It emphasizes the importance of authorized signatory power.

- Details on the certificate can be vague: The requirement for a thorough description of the drop-shipped goods and the necessity to attach a separate sheet if more space is needed highlight the need for specificity and completeness in the details provided.

- Certification does not imply legal compliance: While certification is a critical component, it alone does not ensure compliance with all applicable laws and regulations. Registrants must ensure that all aspects of their transactions align with the Excise Tax Act and other relevant legislation.

Understanding the specifics of the Drop Shipment Certificate can significantly aid in navigating the complexities of tax compliance and foster more effective business operations within the realm of drop shipping.

Key takeaways

Filling out and using the Drop Shipment Certificate form is essential for businesses involved in supply chains that utilize drop shipping methods. Understanding the key components and correct application of this form can significantly influence tax obligations and compliance with the Excise Tax Act. Here are six key takeaways to consider:

- Know the Parties Involved: The form differentiates between two main parties: the registrant to whom the certificate is issued and the registered consignee issuing the certificate. Clearly identifying these entities, along with their legal names and business numbers, is crucial for the document's validity.

- Detailed Description of Goods: It’s important to provide a thorough description of the drop-shipped goods. If the space provided is insufficient, attaching a separate sheet with complete details is advisable to avoid ambiguities.

- Defining the Scope: The form allows for specifying the scope of the certificate, catering to single or multiple drop shipments, whether they are ongoing or within a specified period. This section ensures that the certificate accurately reflects the nature of transactions it covers.

- Tax Implications: Depending on the transaction's nature, the certificate outlines situations where the consignee may be required to self-assess tax in respect of an imported taxable supply of goods or collect tax based on subsection 179(1). These requirements are contingent upon factors like the type of goods and the nature of their use.

- Signatory Authority: The certification section demands that the individual signing the form, whether the consignee or an authorized person, acknowledges the truthfulness and completeness of the information provided. This part of the form underscores the legal responsibility of the signatory to ensure accuracy.

- Documentation and Record-Keeping: Keeping a properly filled out Drop Shipment Certificate is a critical aspect of record-keeping for businesses. It not only supports tax compliance but also serves as proof of the nature of transactions for audits or disputes regarding tax obligations.

Understanding and correctly applying the details required in the Drop Shipment Certificate can facilitate smoother business operations and ensure compliance with tax laws. As with any tax-related document, seeking clarity on complex sections or consulting with a professional may prevent potential issues down the line.

Popular PDF Forms

Colorado Med 9 Form - Through the MED-9 form, the process of determining medical eligibility for the AND program is standardized, promoting fairness and consistency across applications.

Recognizance Vs Undertaking - Inclusion of detailed contact information for all parties ensures clear communication channels for any necessary updates or demands made under the agreement.

Metrolift Application Online - Encourages applicants to be detailed about their transportation needs and limitations for accurate service provision.