Blank Dwc 83 PDF Template

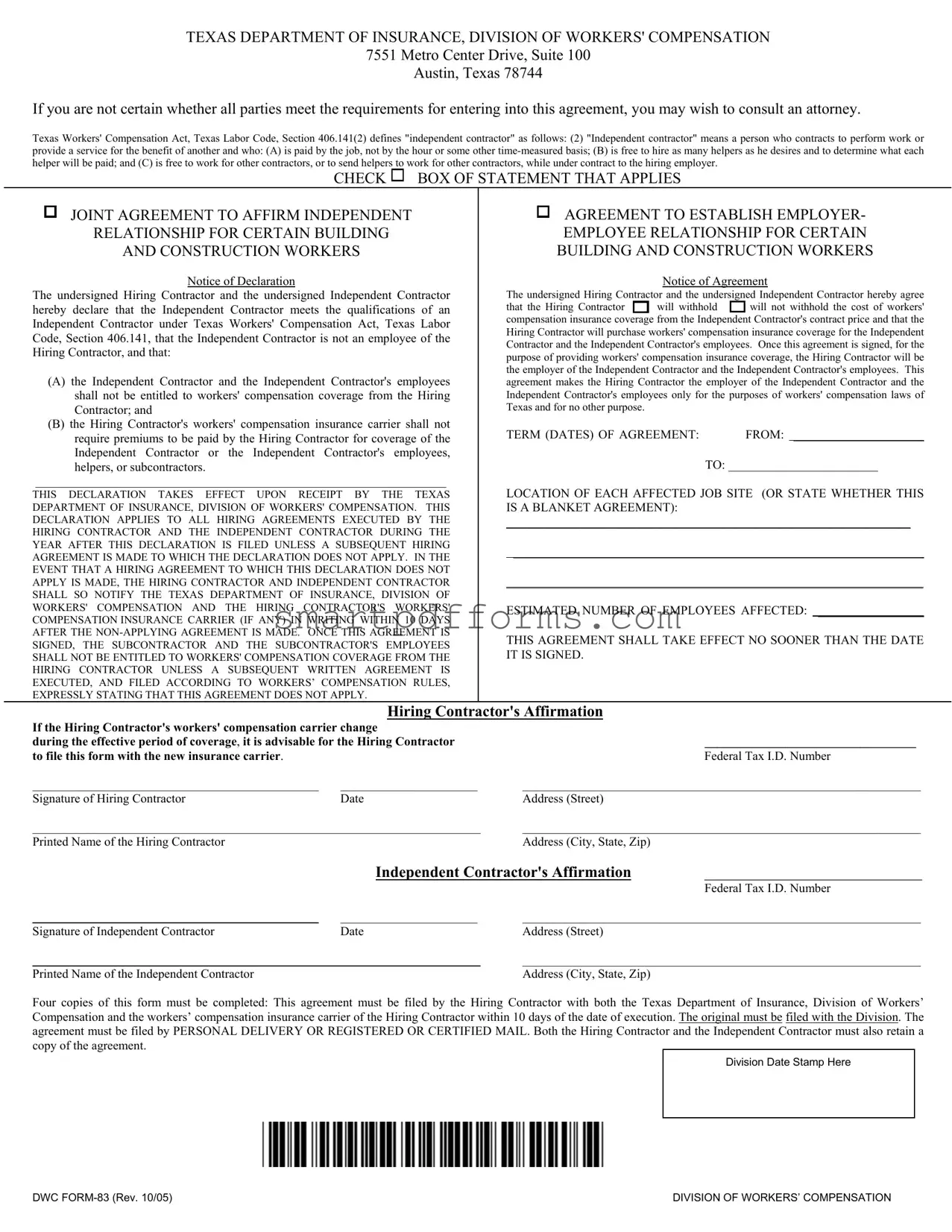

The DWC 83 form serves a critical role in the Texas construction industry, laying the groundwork for relationships between hiring contractors and independent contractors under the Texas Workers' Compensation Act, outlined in Texas Labor Code, Section 406.141. This essential document enables both parties to formally declare the nature of their working relationship, specifying whether an independent contractor or their employees will, or will not, be entitled to workers’ compensation coverage provided by the hiring contractor. With options to affirm the independent status of a contractor or, alternatively, to establish a temporary employer-employee relationship exclusively for workers' compensation purposes, this form provides a flexible framework to suit varied contractual needs. Upon completion, the agreement outlined in the DWC 83 form applies to all projects undertaken within a year from the date it's filed, unless a new agreement states otherwise. This arrangement can be established as a job-specific or as a blanket agreement, requiring notification to the Texas Department of Insurance, Division of Workers' Compensation, and the relevant workers’ compensation insurance carrier should any changes occur. Furthermore, this form's filing is a critical step in ensuring compliance, requiring personal delivery or registered/certified mail, with both parties keeping copies, thereby reinforcing commitment to the statutory and regulatory frameworks governing workers' compensation in Texas.

Preview - Dwc 83 Form

TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION

7551 Metro Center Drive, Suite 100

Austin, Texas 78744

If you are not certain whether all parties meet the requirements for entering into this agreement, you may wish to consult an attorney.

Texas Workers' Compensation Act, Texas Labor Code, Section 406.141(2) defines "independent contractor" as follows: (2) "Independent contractor" means a person who contracts to perform work or

provide a service for the benefit of another and who: (A) is paid by the job, not by the hour or some other

CHECK

BOX OF STATEMENT THAT APPLIES

BOX OF STATEMENT THAT APPLIES

JOINT AGREEMENT TO AFFIRM INDEPENDENT

RELATIONSHIP FOR CERTAIN BUILDING

AND CONSTRUCTION WORKERS

Notice of Declaration

The undersigned Hiring Contractor and the undersigned Independent Contractor hereby declare that the Independent Contractor meets the qualifications of an Independent Contractor under Texas Workers' Compensation Act, Texas Labor Code, Section 406.141, that the Independent Contractor is not an employee of the Hiring Contractor, and that:

(A)the Independent Contractor and the Independent Contractor's employees shall not be entitled to workers' compensation coverage from the Hiring Contractor; and

(B)the Hiring Contractor's workers' compensation insurance carrier shall not require premiums to be paid by the Hiring Contractor for coverage of the Independent Contractor or the Independent Contractor's employees,

helpers, or subcontractors.

__________________________________________________________________

THIS DECLARATION TAKES EFFECT UPON RECEIPT BY THE TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION. THIS DECLARATION APPLIES TO ALL HIRING AGREEMENTS EXECUTED BY THE HIRING CONTRACTOR AND THE INDEPENDENT CONTRACTOR DURING THE YEAR AFTER THIS DECLARATION IS FILED UNLESS A SUBSEQUENT HIRING AGREEMENT IS MADE TO WHICH THE DECLARATION DOES NOT APPLY. IN THE EVENT THAT A HIRING AGREEMENT TO WHICH THIS DECLARATION DOES NOT APPLY IS MADE, THE HIRING CONTRACTOR AND INDEPENDENT CONTRACTOR SHALL SO NOTIFY THE TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION AND THE HIRING CONTRACTOR'S WORKERS' COMPENSATION INSURANCE CARRIER (IF ANY) IN WRITING WITHIN 10 DAYS AFTER THE

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

Notice of Agreement

The undersigned Hiring Contractor and the undersigned Independent Contractor hereby agree

that the Hiring Contractor

will withhold

will withhold

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.

TERM (DATES) OF AGREEMENT: |

FROM: _____________________ |

|

TO: ________________________ |

LOCATION OF EACH AFFECTED JOB SITE (OR STATE WHETHER THIS IS A BLANKET AGREEMENT):

_________________________________________________________________

__________________________________________________________________

___________________________________________________________________

ESTIMATED NUMBER OF EMPLOYEES AFFECTED: _________________

THIS AGREEMENT SHALL TAKE EFFECT NO SOONER THAN THE DATE IT IS SIGNED.

Hiring Contractor's Affirmation

If the Hiring Contractor's workers' compensation carrier change |

|

|

during the effective period of coverage, it is advisable for the Hiring Contractor |

__________________________________ |

|

to file this form with the new insurance carrier. |

|

Federal Tax I.D. Number |

______________________________________________ |

______________________ |

________________________________________________________________ |

Signature of Hiring Contractor |

Date |

Address (Street) |

________________________________________________________________________ |

________________________________________________________________ |

|

Printed Name of the Hiring Contractor |

|

Address (City, State, Zip) |

|

Independent Contractor's Affirmation |

____________________________ |

|

|

|

|

Federal Tax I.D. Number |

______________________________________________ |

______________________ |

________________________________________________________________ |

|

Signature of Independent Contractor |

Date |

Address (Street) |

|

________________________________________________________________________ |

________________________________________________________________ |

||

Printed Name of the Independent Contractor |

|

Address (City, State, Zip) |

|

Four copies of this form must be completed: This agreement must be filed by the Hiring Contractor with both the Texas Department of Insurance, Division of Workers’ Compensation and the workers’ compensation insurance carrier of the Hiring Contractor within 10 days of the date of execution. The original must be filed with the Division. The agreement must be filed by PERSONAL DELIVERY OR REGISTERED OR CERTIFIED MAIL. Both the Hiring Contractor and the Independent Contractor must also retain a copy of the agreement.

Division Date Stamp Here

DWC |

DIVISION OF WORKERS’ COMPENSATION |

Form Data

| Fact | Detail |

|---|---|

| 1. Form Name | DWC Form-83 |

| 2. Issuing Body | Texas Department of Insurance, Division of Workers' Compensation |

| 3. Purpose | To affirm independent contractor status for building and construction workers, or establish employer-employee relationships for the purposes of workers' compensation. |

| 4. Address of Issuing Body | 7551 Metro Center Drive, Suite 100 Austin, Texas 78744 |

| 5. Governing Law | Texas Workers' Compensation Act, Texas Labor Code, Section 406.141 |

| 6. Definition Highlight | Defines an "independent contractor" under specific parameters such as being paid by the job, freedom to hire helpers, and the ability to work for others. |

| 7. Filing Requirement | The form must be filed with the Texas Department of Insurance, Division of Workers' Compensation, and the hiring contractor's workers' compensation insurance carrier within 10 days of execution. |

| 8. Delivery Method | Must be filed by personal delivery or registered or certified mail. |

| 9. Number of Copies Required | Four copies of this form must be completed and properly distributed. |

| 10. Document Validity | This declaration applies to all hiring agreements executed by the hiring contractor and independent contractor for one year after filing unless a subsequent agreement declares otherwise. |

Instructions on Utilizing Dwc 83

Filling out the DWC 83 form is a straightforward process, but it requires attention to detail to ensure that all information is provided accurately. This form is key in declaring the relationship between a Hiring Contractor and an Independent Contractor, especially in the context of workers' compensation in Texas. Below is a step-by-step guide to help you complete the form accurately.

- Start by reading the instructions and definitions at the top of the form carefully to ensure that the Independent Contractor meets the specified criteria.

- Choose the correct statement that applies to your situation – either the joint agreement to affirm independent relationship or the agreement to establish employer-employee relationship for certain building and construction workers.

- If choosing the agreement to affirm an independent relationship, check the box next to the corresponding statement. Fill out the applicable sections concerning workers' compensation coverage denial.

- If opting for an employer-employee relationship, check the box next to that statement and decide whether the costs of workers’ compensation insurance coverage will be withheld from the Independent Contractor’s contract price. Complete the sections pertaining to the provision of workers' compensation insurance coverage accordingly.

- Enter the term (start and end dates) of the agreement. Be precise with the dates to avoid any ambiguity regarding the agreement's duration.

- Provide the location of each affected job site. If it is a blanket agreement that applies to multiple sites, state this clearly.

- Indicate the estimated number of employees affected by this agreement. This helps in understanding the scope and impact of the agreement in terms of workers' compensation coverage.

- In the section labeled "Hiring Contractor's Affirmation," the Hiring Contractor must provide their Federal Tax I.D. Number, signature, date of signing, printed name, and complete address.

- In the "Independent Contractor's Affirmation" section, the Independent Contractor must also supply their Federal Tax I.D. Number, signature, date of signing, printed name, and complete address.

- Remember to make four copies of the completed form. File the original with the Texas Department of Insurance, Division of Workers’ Compensation via personal delivery or registered or certified mail within 10 days of the date of execution. The Hiring Contractor should also send a copy to their workers' compensation insurance carrier and both the Hiring Contractor and the Independent Contractor should retain a copy for their records.

Once the form is correctly filled in and filed, it serves as a declaration of the defined working relationship for the duration specified. This ensures clarity in the responsibilities of both parties, especially concerning workers' compensation insurance in Texas. Keep in mind to update this form or file a new one if any changes occur in the relationship or terms outlined in the agreement.

Obtain Answers on Dwc 83

What is a DWC 83 form in Texas?

The DWC 83 form is an official document used within the Texas Workers' Compensation system. It serves two primary purposes: to affirm an independent relationship between a hiring contractor and an independent contractor for certain building and construction work, or to establish an employer-employee relationship for the same parties for the purposes of workers' compensation insurance. This form highlights the agreement's terms, including coverage details, the identity of the parties involved, and specific job site locations. Once filed, it dictates whether the independent contractor and their employees will or will not receive workers' compensation coverage from the hiring contractor.

Who needs to file a DWC 83 form?

Both hiring contractors and independent contractors engaged in building and construction work in Texas may need to file a DWC 83 form. This form is essential for those who wish to clearly define their working relationship concerning workers' compensation insurance. It's particularly relevant when contractors choose not to cover independent contractors and their employees under their workers' compensation insurance policies.

How and when should the DWC 83 form be filed?

The DWC 83 form must be completed and filed by the hiring contractor with both the Texas Department of Insurance, Division of Workers' Compensation, and the hiring contractor's workers' compensation insurance carrier within 10 days of the agreement's execution. The original form should be sent to the Division, and it's recommended to use personal delivery or registered or certified mail for filing. Importantly, both the hiring contractor and the independent contractor must keep a copy of the agreement for their records.

What are the implications of signing a DWC 83 form?

Signing a DWC 83 form has significant implications for both parties involved. For independent contractors and their workers, signing the form as an affirmation of independent contractor status means they will not be entitled to workers' compensation coverage from the hiring contractor. Conversely, if the form is signed to establish an employer-employee relationship, the hiring contractor agrees to provide workers' compensation coverage to the independent contractor and their employees, but only for the duration and under the conditions specified in the agreement.

Can a DWC 83 agreement be modified or terminated?

Any change to the working relationship defined in a DWC 83 form requires notifying the Texas Department of Insurance, Division of Workers' Compensation, and the hiring contractor's workers' compensation insurance carrier in writing within 10 days after making a non-applying agreement. This means if the parties enter into a new agreement that changes the status of the independent contractor (from not covered to covered by workers' compensation insurance, or vice versa), both entities need to be informed promptly.

What happens if a DWC 83 form is not filed correctly?

Failing to file a DWC 83 form correctly or within the specified timeline may result in the independent contractor being classified as an employee by default, thereby requiring the hiring contractor to provide workers' compensation coverage. This could lead to financial or legal complications, including penalties for non-compliance with the Texas Workers' Compensation Act. To avoid such issues, it's crucial to fill out and file the form accurately and promptly.

Where can I find a DWC 83 form or get help filling it out?

The DWC 83 form is available through the Texas Department of Insurance, Division of Workers' Compensation website. For assistance in filling out the form correctly, consulting an attorney familiar with Texas workers' compensation laws is advisable. Additionally, the Division of Workers' Compensation offers resources and guidance that can help both hiring contractors and independent contractors understand their rights and responsibilities under the law.

Common mistakes

When filling out the DWC 83 form, it's crucial to avoid common pitfalls to ensure that the document accurately reflects the agreement between the hiring contractor and the independent contractor. Below, we outline some of the most frequent mistakes people make during this process. Ensuring correct completion can help avoid unnecessary delays or complications.

-

Failing to check the appropriate box to indicate whether it is a joint agreement to affirm an independent relationship or an agreement to establish an employer-employee relationship for certain building and construction workers. This distinction is critical for clarifying the nature of the relationship for workers' compensation purposes.

-

Omitting the "TERM (DATES) OF AGREEMENT" section is another common oversight. Specifying the time frame is essential, as it determines the period during which the agreement will be in effect.

-

Inaccurate or incomplete job site locations. If the agreement covers specific sites, each should be clearly listed. A blanket agreement that applies to all job sites must clearly state this to avoid any ambiguity.

-

Not providing an estimated number of employees affected. This figure is important for insurance purposes, reflecting the scope of the agreement's coverage.

-

Incorrect Federal Tax I.D. Numbers. Both the hiring contractor and the independent contractor must ensure their Federal Tax I.D. Numbers are accurate to ensure legal compliance and proper tax documentation.

-

Failure to sign and date the agreement. Both parties' signatures and the date of execution are necessary to authenticate the document and indicate agreement to its terms.

-

Not filing the form correctly. The DWC 83 form must be filed with both the Texas Department of Insurance, Division of Workers’ Compensation and the workers’ compensation insurance carrier of the hiring contractor within 10 days of execution. The original must be filed with the Division, preferably by personal delivery or registered or certified mail.

-

Forgetting to retain copies of the agreement. Both the hiring contractor and the independent contractor are required to keep a copy of the agreement for their records, which is crucial for future reference and verification purposes.

Ensuring the careful completion of the DWC 83 form can streamline the process, make clear the relationship between parties, and facilitate the appropriate handling of workers' compensation matters.

Documents used along the form

In the complex and ever-evolving landscape of workers' compensation in Texas, navigating through the paperwork can be a daunting task. The DWC 83 form is just the tip of the iceberg when it comes to the documentation needed to ensure compliance and facilitate processes within the framework of workers' compensation laws. This form, pivotal for declaring the relationship between hiring contractors and independent contractors, sets the stage for several other documents that may be required depending on the specifics of the employment arrangement and the nature of the work being performed. Here's a glance at some of these essential documents and a brief description of each.

- W-9 Request for Taxpayer Identification Number and Certification: This IRS form is crucial for independent contractors as it provides the hiring contractor with the taxpayer identification number (TIN) or social security number (SSN), which is needed for reporting purposes.

- DWC 69 Employee's Claim for Compensation for a Work-Related Injury or Occupational Disease: In case of an injury or occupational disease, this form is used by employees to claim workers' compensation benefits, a critical step in initiating the benefits process.

- DWC 1 Employer's First Report of Injury or Illness: Employers use this form to report an employee's injury or illness to the Texas Department of Insurance, Division of Workers' Compensation, key for the worker's compensation claim process.

- Notice of Injured Employee Rights and Responsibilities in the Texas Workers' Compensation System: This document informs injured employees about their rights and responsibilities under the Texas workers' compensation system, ensuring they are equipped with the knowledge to navigate their claim.

- DWC 73 Request for Paid Leave: For employees seeking to use their paid leave in lieu of workers' compensation income benefits, this form facilitates the request process, making it simpler for both employee and employer.

- Certificate of Insurance: This document serves as proof of workers' compensation insurance coverage, a necessity for hiring contractors to verify compliance with Texas laws and regulation.

Together, these forms and documents paint a fuller picture of the administrative aspect of workers' compensation in Texas. They ensure that all parties - from contractors to employees - are on the same page regarding expectations, responsibilities, and rights. Whether it's establishing the nature of the relationship between a contractor and an independent worker with the DWC 83 or dealing with the aftermath of a work-related injury, understanding and utilizing these documents can streamline the process, making it more manageable for everyone involved.

Similar forms

The DWC 84 form, similar to the DWC 83, is used in the Texas workers' compensation system to document agreements related to employment relationships, specifically for the provision of workers' compensation insurance. Both forms serve to define the nature of the working relationship, whether independent contractor or employer-employee, for workers' compensation purposes.

IRS Form W-9 is utilized by independent contractors to provide tax identification information to those they work for, somewhat similar to the DWC 83's function of identifying the independent contractor's tax ID and establishing their status for workers' compensation insurance purposes.

Form I-9, Employment Eligibility Verification, although primarily used for verifying the legal authority of employees to work in the United States, shares common goals with the DWC 83 — both ensure proper documentation of workers for legal and regulatory compliance.

The OSHA Form 300, which logs work-related injuries and illnesses, indirectly relates to the DWC 83 as both deal with workplace incidents. However, the DWC 83 focuses on the contractual relationship affecting compensation claims, whereas the OSHA Form 300 tracks the occurrences themselves.

Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, is used by the IRS to determine worker status as an employee or independent contractor. This serves a similar purpose as the DWC 83 in classifying workers to dictate their entitlement or exemption from workers' compensation coverage.

Workers' Compensation Exemption Form, available in states like Florida, allows certain workers to exempt themselves from workers' compensation insurance. This is somewhat akin to the DWC 83's provision allowing independent contractors to waive coverage under the hiring contractor’s policy.

The Independent Contractor Agreement, a general contract, formalizes the working relationship and terms between an independent contractor and their client. The DWC 83 also establishes a defined working relationship for insurance coverage purposes, specifically within the construction industry in Texas.

The Agreement to Provide Insurance Form, often used by employers to affirm providing worker's compensation insurance to their employees, parallels the DWC 83 in its aim to declare the responsibility for insurance coverage. However, the DWC 83 critically distinguishes between independent contractors and employees for this purpose.

Dos and Don'ts

When filling out the DWC 83 form, a declaration for establishing the nature of a working relationship between a hiring contractor and an independent contractor in Texas, individuals must be thorough and accurate. Below are essential do's and don'ts to consider:

- Do ensure that both parties understand the definition of an independent contractor according to the Texas Workers' Compensation Act to accurately affirm the relationship.

- Do not ignore the requirement to consult an attorney if there is any uncertainty about meeting the requirements for entering into this agreement.

- Do check the appropriate box that clearly states the nature of the agreement between the hiring contractor and the independent contractor.

- Do not overlook the importance of accurately filling out the term dates of the agreement, including the start and end dates.

- Do provide detailed information on the location of the job site(s) affected by the agreement or specify if it is a blanket agreement.

- Do not forget to include an estimated number of employees affected by this agreement to ensure proper coverage and compliance.

- Do make sure that both the hiring contractor and the independent contractor sign and date the form, including the provision of their Federal Tax I.D. Number and addresses. This action formalizes the agreement under the state's workers' compensation laws.

- Do not neglect to file the agreement with the Texas Department of Insurance, Division of Workers’ Compensation, and the hiring contractor’s workers’ compensation insurance carrier within 10 days of execution. Failure to do so can result in issues of compliance and coverage.

Following these guidelines ensures that both parties accurately represent their relationship under Texas law and comply with the requirements set forth in the DWC 83 form, avoiding potential legal and financial complications.

Misconceptions

There are several misconceptions about the DWC 83 form, which can lead to misunderstandings about its purpose and how it should be used in the context of Texas workers' compensation law. Here are ten common misconceptions explained:

The DWC 83 form automatically classifies a worker as an independent contractor. This is not true. The form is a declaration that a hiring contractor and a supposed independent contractor agree meets the definition under Texas law, but it does not by itself establish that legal status.

Signing the DWC 83 form completely exempts hiring contractors from workers' compensation responsibilities. While the form does declare that an independent contractor and their employees are not entitled to workers' compensation from the hiring contractor, this does not exempt the hiring contractor from ensuring they comply with all relevant workers’ compensation laws, including accurately classifying workers.

All workers can be covered under the DWC 83 agreement. The DWC 83 form applies specifically to certain building and construction workers. Not all workers or industries are covered by the agreements this form enables.

Once signed, the DWC 83 agreement cannot be altered. The terms of the agreement apply to all hiring agreements made within a year after the declaration is filed unless a subsequent hiring agreement states otherwise. Changes can be made with proper notification to all relevant parties.

The DWC 83 form is the only document needed for contractor classification. Although important, the DWC 83 is part of a larger process of compliance with Texas Workers' Compensation Act. Other documentation and factors are considered in determining a worker’s status.

The agreement applies immediately upon signing. The agreement specified in the DWC 83 form does not take effect until the Texas Department of Insurance, Division of Workers’ Compensation receives it.

Submitting the DWC 83 form is voluntary for all parties. While entering into an agreement is a choice, once agreed upon, the form must be properly filed by the hiring contractor with the DWC and the workers' compensation insurance carrier, if any.

The DWC 83 form is a one-time filing. The form must be filed for each new or subsequent agreement that differs from the original declaration, and both the hiring contractor and independent contractor must keep a copy of each agreement.

Filing the DWC 83 affects federal tax obligations. The classification for workers’ compensation purposes under Texas law does not alter federal tax obligations or the way the IRS classifies workers.

The DWC 83 covers all job sites. The form requires specification of the job sites covered under the agreement or indicates if it is a blanket agreement. Details must be accurately provided.

It is crucial for both hiring contractors and independent contractors to fully understand the implications of the DWC 83 form and ensure they are in compliance with Texas law when entering into and documenting their working agreements.

Key takeaways

When filling out and using the DWC 83 form, understanding its purpose and how it operates is crucial for both hiring contractors and independent contractors. Here are five key takeaways:

- Definition of Independent Contractor: The Texas Workers' Compensation Act defines an "independent contractor" as someone who is paid by the job (not hourly), can hire helpers and decide their pay, and is free to work for others. This definition is vital for the DWC 83 form.

- Declaration of Independent Relationship: The form includes a declaration stating that the independent contractor and their employees or subcontractors are not considered employees of the hiring contractor for workers' compensation purposes. This declaration affects insurance coverages and premiums.

- Term and Scope of Declaration: The declaration applies to all hiring agreements made within a year after the form is filed, unless a new agreement states otherwise. Any changes to the hiring agreement affecting the declaration must be reported within 10 days.

- Agreement to Establish Employer-Employee Relationship: Alternatively, the form can be used to expressly establish an employer-employee relationship for workers' compensation purposes. This agreement necessitates the hiring contractor to provide workers' compensation insurance for the independent contractor and their employees.

- Procedure for Filing: Four copies of the DWC 83 form must be completed and filed appropriately. The hiring contractor must file the form with both the Texas Department of Insurance, Division of Workers’ Compensation and their workers' compensation insurance carrier within 10 days of execution. The document must be filed via personal delivery or registered/certified mail, and both parties must retain a copy for their records.

Accurate and timely filing of the DWC 83 form is essential for ensuring compliance with Texas Workers' Compensation Act requirements and for the proper management of workers' compensation insurance and liabilities.

Popular PDF Forms

Overhaulin Application 2023 - The Overhaulin' application form is your opportunity to pitch a story of automotive love, decay, and potential rebirth to a team that turns car dreams into reality.

Fbi Fingerprint Background Check - The go-to form for individuals in need of reviewing their FBI background checks for accuracy.

Commission Disbursement Authorization - Enhances client trust in real estate professionals by demonstrating a commitment to fair and organized financial dealings.