Blank Edward Jones Account PDF Template

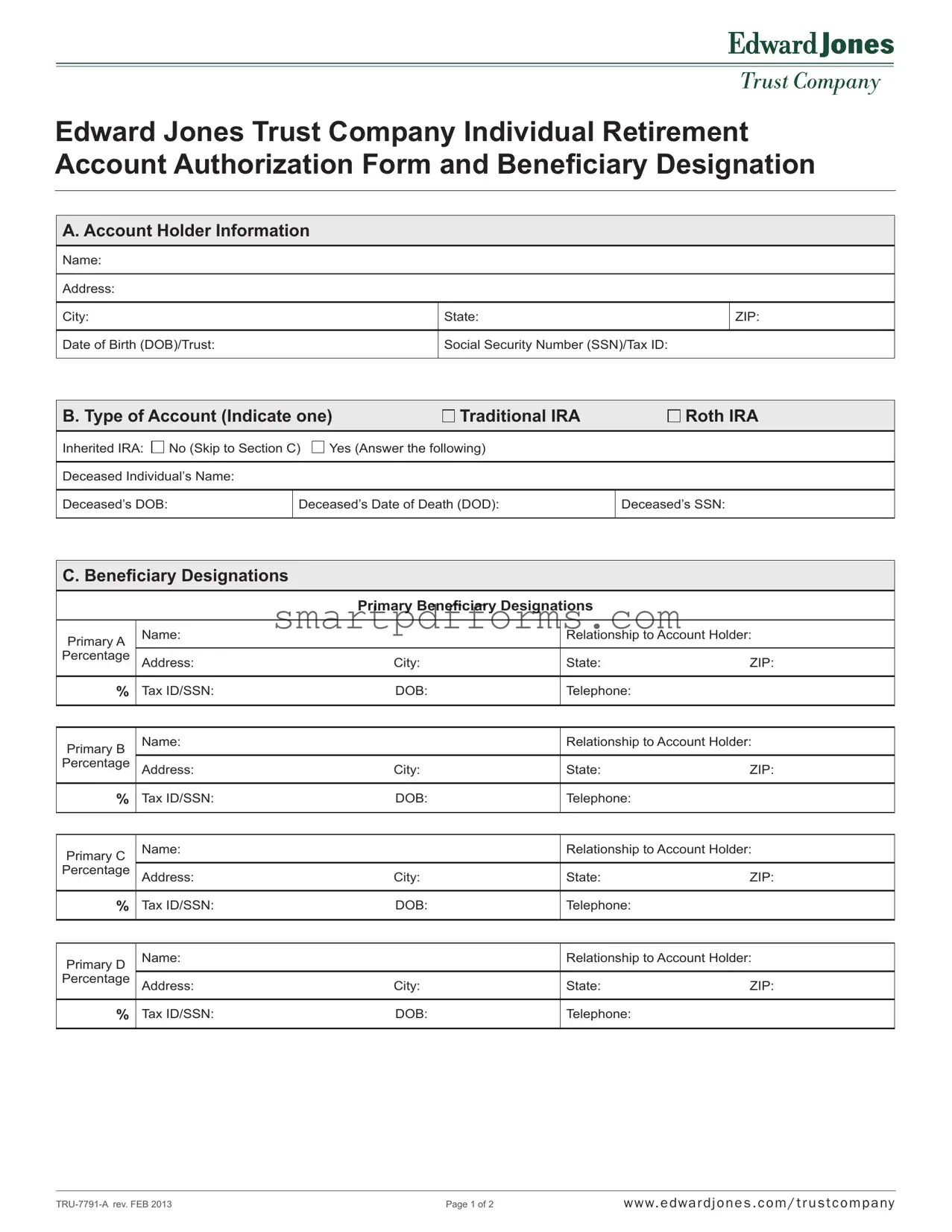

Navigating the process of setting up an Individual Retirement Account (IRA) requires attention to detail and an understanding of the legal implications involved. The Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation serves as a pivotal step for individuals aiming to secure their retirement investments. This document not only captures the account holder's essential information, such as name, address, and social security number, but it also delineates between different types of IRAs—Traditional, Roth, and Inherited. The inclusion of beneficiary designations further complicates the process, demanding precise details about primary and contingent beneficiaries, including their relationship to the account holder, their percentage share, and personal identification information. The account holder's acceptance section underscores the significant legal commitments being undertaken, including the acknowledgment of the account's terms and an arbitration provision that may influence the resolution of disputes. Moreover, for married account holders residing in or formerly from community property states, the form introduces an additional layer of complexity through the requirement for spousal consent if the spouse is not named as the 100% primary beneficiary. This consent not only acknowledges the spouse's agreement to the beneficiary designations but also involves a conveyance of their potential community or marital property rights upon the death of the account holder. This form, therefore, encapsulates a series of important decisions and legal understandings necessary for the establishment and maintenance of an IRA with Edward Jones Trust Company.

Preview - Edward Jones Account Form

Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneiciary Designation

A. Account Holder Information

Name:

Address:

City: |

State: |

ZIP: |

|

|

|

Date of Birth (DOB)/Trust: |

Social Security Number (SSN)/Tax ID: |

|

|

|

|

B. Type of Account (Indicate one) |

Traditional IRA |

Roth IRA |

|

|

|

Inherited IRA: |

No (Skip to Section C) |

Yes (Answer the following) |

|

|

|

Deceased Individual’s Name: |

|

|

Deceased’s DOB:

Deceased’s Date of Death (DOD):

Deceased’s SSN:

C. Beneiciary Designations

Primary Beneiciary Designations

Primary A |

Name: |

|

Relationship to Account Holder: |

|

Percentage |

Address: |

City: |

State: |

ZIP: |

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

|

|

|

|

|

Primary B |

Name: |

|

Relationship to Account Holder: |

|

Percentage |

Address: |

City: |

State: |

ZIP: |

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

|

|

|

|

|

Primary C |

Name: |

|

Relationship to Account Holder: |

|

Percentage |

Address: |

City: |

State: |

ZIP: |

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

|

|

|

|

|

Primary D |

Name: |

|

Relationship to Account Holder: |

|

Percentage |

Address: |

City: |

State: |

ZIP: |

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

Page 1 of 2 |

w w w. e dwa r d j o n e s . c o m / t r u s t c o m p a ny |

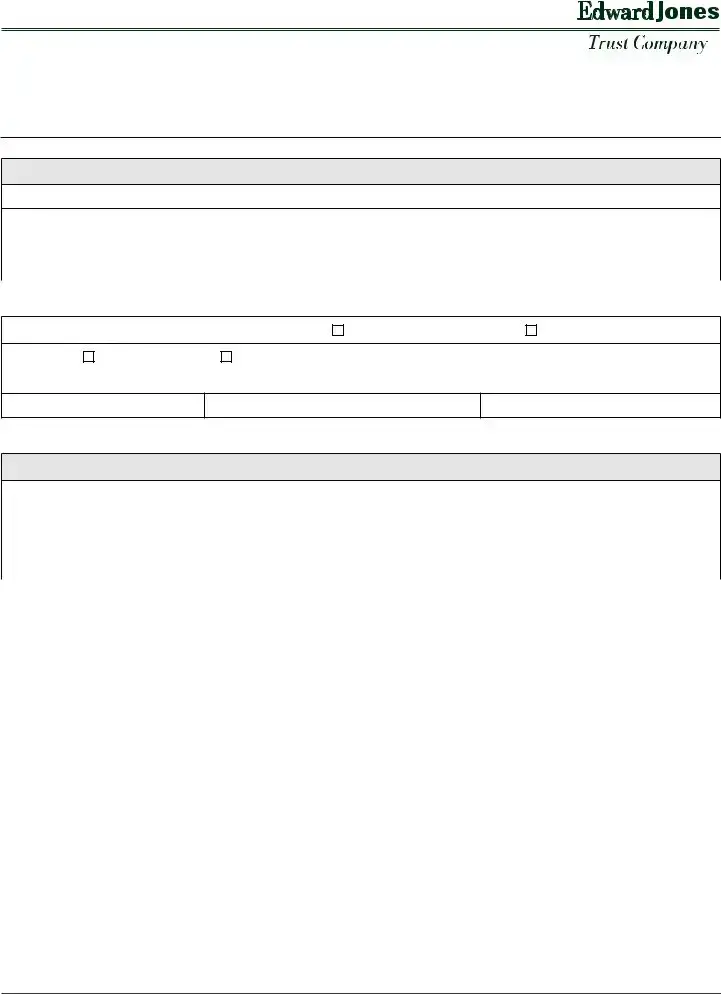

Contingent Beneiciary Designations

Contingent |

Name: |

|

Relationship to Account Holder: |

||

to Primary: |

|

|

|

|

|

Address: |

City: |

State: |

ZIP: |

||

________ |

|||||

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

||

|

|

|

|

||

Contingent |

Name: |

|

Relationship to Account Holder: |

||

to Primary: |

|

|

|

|

|

Address: |

City: |

State: |

ZIP: |

||

________ |

|||||

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

||

|

|

|

|

||

Contingent |

Name: |

|

Relationship to Account Holder: |

||

to Primary: |

|

|

|

|

|

Address: |

City: |

State: |

ZIP: |

||

________ |

|||||

|

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

||

|

|

|

|

||

Contingent |

Name: |

|

Relationship to Account Holder: |

||

to Primary: |

|

|

|

|

|

Address: |

City: |

State: |

ZIP: |

||

________ |

|||||

|

|

|

|

|

|

% |

Tax ID/SSN: |

DOB: |

Telephone: |

|

|

|

|

|

|

|

|

D. Account Holder’s Acceptance:

1.Underpenaltiesofperjury,IcertifythatthenumbershownonthisformismycorrectTaxpayerIdentiicationNumber.

2.I have received, read and understand the Edward Jones Trust Company Individual Retirement Account Trust Agreement applicable to the type of account indicated above and agree to its terms. I have received, read and understand the Individual Retirement Account (Trust) Disclosure Statement and Appendix applicable to the type of account indicated above and the Edward Jones Trust Company Disclosures and Fee Schedule.

3.THE EDWARD JONES TRUST COMPANY INDIVIDUAL RETIREMENT ACCOUNT TRUST AGREEMENT CONTAINS A BINDING ARBITRATION PROVISION, WHICH MAY BE ENFORCED BY THE PARTIES (PAGE 5, ARTICLE VIII, SECTION 15 OF THE TRADITIONAL IRA TRUST AGREEMENT AND PAGE 5, ARTICLE IX, SECTION 15 OF THE ROTH IRA TRUST AGREEMENT).

Signature of Account Holder |

Date |

|

|

Signature of Edward Jones Trust Company Representative |

Date |

E. Beneiciary Designation – Spousal Consent

The Spousal Consent must be completed if a married Account Holder currently lives or previously lived in a community property state at any time during the marriage and does not name his/her spouse as 100% primary beneiciary.

I represent that I (a) am the spouse of the Account Holder (“the Account Holder’s Spouse”); (b) am familiar with the assets contained in the

Account;(c)consenttoandjoinintheAccountHolder’sdesignationoftheBeneiciaryorBeneiciariesoftheAccount;(d)convey,upondeath oftheAccountHolder,myinterestinthecommunityormaritalpropertytothedesignatedbeneiciary(ies);and(e)agreenottomakeanyclaim againsttheBeneiciary(ies)oragainstEdwardJonesTrustCompanyasaresultofthedistributionofanyassetsintheAccountpursuanttothe termsoftheAccountHolder’sbeneiciarydesignation.

Signature of Spouse |

Print Spouse’s Name |

Date |

Witness for Spouse’s Signature:

Signature of Witness |

Print Witness’s Name |

Date |

Page 2 of 2 |

w w w. e dwa r d j o n e s . c o m / t r u s t c o m p a ny |

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation |

| Account Holder Information | Includes name, address, Date of Birth (DOB)/Trust, Social Security Number (SSN)/Tax ID |

| Type of Account Options | Traditional IRA, Roth IRA, Inherited IRA |

| Inherited IRA Provisions | If selected, requires deceased individual's name, DOB, Date of Death (DOD), and SSN |

| Beneficiary Designations | Allows designation of Primary and Contingent Beneficiaries with specified percentages |

| Account Holder’s Acceptance Clauses | Includes certification of Taxpayer Identification Number, acknowledgment of trust agreement and disclosures, and arbitration provision acceptance |

| Arbitration Provision Notice | Details about the binding arbitration provision located in the Individual Retirement Account Trust Agreement |

| Governing Law for Community Property States | Spousal Consent section relevant for account holders in or formerly in community property states |

| Documentation References | References to the Edward Jones Trust Company Individual Retirement Account Trust Agreement, Disclosure Statement, Appendix, and Disclosures and Fee Schedule |

Instructions on Utilizing Edward Jones Account

Filling out the Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation is a key step in managing your retirement savings. This comprehensive form helps you designate who will inherit your account, ensuring your assets are distributed according to your wishes. By following these instructions carefully, you can complete the form accurately and efficiently.

- Enter your full name, address, city, state, and ZIP code in the Account Holder Information section.

- Provide your Date of Birth (DOB) or Trust Date, and Social Security Number (SSN) or Tax ID.

- Under Type of Account, check the box next to the type of IRA you are opening: Traditional IRA, Roth IRA, or Inherited IRA.

- If you selected Inherited IRA, fill in the deceased individual’s name, DOB, Date of Death (DOD), and SSN.

- In the Beneficiary Designations section for Primary Beneficiary Designations, enter the name, relationship to account holder, percentage of benefits, address, city, state, ZIP, Tax ID/SSN, DOB, and telephone for each primary beneficiary (Primary A, B, C, D as applicable).

- For Contingent Beneficiary Designations, complete the details similarly for each contingent beneficiary, including name, relationship to account holder, address, city, state, ZIP, percentage of benefits, Tax ID/SSN, DOB, and telephone.

- In the Account Holder’s Acceptance section, read the statements carefully. Sign and date the form to certify that the information provided is accurate and that you agree to the terms of the Edward Jones Trust Company Individual Retirement Account Trust Agreement.

- If the Spousal Consent applies to you (married and live/lived in a community property state without naming your spouse as 100% primary beneficiary), have your spouse complete the Spousal Consent section. This includes the spouse’s signature, printed name, date, and also requires a witness’s signature and printed name.

Once you have completed these steps, review the form to ensure all information is correct and complete. Submit the form as directed to ensure your retirement account is set up according to your specifications. This careful planning supports the management of your assets and the future financial security of your beneficiaries.

Obtain Answers on Edward Jones Account

What types of Individual Retirement Accounts (IRAs) can I open with the Edward Jones Trust Company?

You have the option to open three types of IRAs with the Edward Jones Trust Company: a Traditional IRA, a Roth IRA, and an Inherited IRA. Each type caters to different financial needs and tax implications. When choosing an account, consider factors like tax advantages, eligibility, and whether the account is being opened as a beneficiary of a deceased individual's IRA.

How do I designate beneficiaries for my IRA?

The Edward Jones Trust Company Individual Retirement Account Authorization Form allows you to designate both primary and contingent beneficiaries. You can name one or more individuals or entities as primary beneficiaries, specifying the percentage of assets each will receive. If you want to provide for scenarios where a primary beneficiary cannot inherit, you can also name contingent beneficiaries. Ensure you provide accurate information such as name, relationship to the account holder, address, and tax identification number for each beneficiary designated.

What is required for the spousal consent section, and when is it necessary?

Spousal consent is necessary if the account holder is married, lives or has lived in a community property state during the marriage, and chooses not to name the spouse as the 100% primary beneficiary. This section requires the spouse to acknowledge and consent to the beneficiary designations made by the account holder, transferring any community or marital property rights to the designated beneficiaries upon the account holder’s death. The spouse must sign and print their name, and the signature must be witnessed and validated by another signature.

What does accepting the terms of the Edward Jones Trust Company IRA entail?

By signing the Edward Jones Trust Company Individual Retirement Account Authorization Form, the account holder affirms under penalty of perjury that their tax identification number is correct. They also acknowledge having received, read, and understood the Trust Agreement and Disclosure Statement relevant to the type of account chosen, agreeing to the terms outlined. Notably, the agreement contains a binding arbitration provision, which may be enforced by the parties, indicating that disputes may be settled through arbitration rather than court litigation.

Common mistakes

Not correctly entering the full legal name in the Account Holder Information section, which can lead to issues with account recognition and transactions.

Omitting or inaccurately providing the Social Security Number (SSN)/Tax ID. This mistake is crucial as it may lead to tax reporting and identification issues.

Incorrectly indicating the type of account. Selecting the wrong account type, such as Traditional IRA instead of Roth IRA, impacts the tax implications and withdrawal rules associated with the account.

Skipping the Inherited IRA section when applicable. If the IRA is inherited, failing to complete this section leaves out critical information regarding the deceased individual.

In the Beneficiary Designations, not fully completing the information for each primary and contingent beneficiary. This includes the relationship to the account holder, percentage allocation, and their personal details. Incomplete information can complicate or delay the disbursement process.

Miscalculating the total percentage allocated to all beneficiaries. The total allocated percentage must equal 100%; otherwise, it could result in unintended distribution proportions.

Forgetting to complete the Spousal Consent section when required by the account holder’s marital status and residence in a community property state. This oversight can have legal implications regarding the disbursement of account funds.

Failing to sign and date the Account Holder’s Acceptance section. Without the account holder's signature, the form is not legally binding and the account cannot be processed.

Not ensuring the Spouse’s Signature is witnessed in the Spousal Consent section. This is a verification step needed to authenticate the form, especially in community property states.

Common errors found when completing the Edward Jones Account form include:

Do not carefully review the entire form for accuracy and completeness before submission.

Ignore the instructions provided, leading to errors in form completion.

Omit essential documents or fail to provide additional information when requested, causing delays in the processing of their account.

In addition to these specific mistakes, people often:

Documents used along the form

Opening an account with Edward Jones Trust Company involves more than just completing the Individual Retirement Account Authorization Form and Beneficiary Designation. A variety of additional documents are typically required to ensure that your financial and estate planning goals are fully met and legally documented. Below is a list of forms and documents often used alongside the Edward Jones Account form to facilitate a comprehensive approach to account setup and management.

- Individual Retirement Account (IRA) Transfer Form: This document is used for transferring assets from an existing IRA (at another institution) to an IRA at Edward Jones Trust Company, ensuring that the transfer is executed correctly to avoid tax penalties.

- New Account Application: A general form required for opening any new account. It captures personal information, investment objectives, and financial status, providing a foundation for client-advisor relations.

- W-9 Form: Used to provide your correct Taxpayer Identification Number (TIN) to Edward Jones, which is necessary for reporting to the IRS any interest, dividends, and capital gain distributions earned in your account.

- Power of Attorney (POA) Document: A legal document that designates another person to make decisions about your investments and handle transactions on your behalf in the account.

- Uniform Gifts/Transfers to Minors Act (UGMA/UTMA) Custodial Agreement: If opening a custodial account for a minor, this agreement outlines the custodian's responsibilities and the terms under which the account operates.

- Trust Certification Form: For accounts under a trust, this form certifies the trust's existence, identifies the trustees, and outlines their powers, facilitating the account's alignment with the trust's terms.

- Privacy Notice and Acknowledgment Form: This document provides information on how Edward Jones handles personal information and requires an acknowledgment from the account holder, ensuring awareness and consent.

Collecting and completing these documents, in addition to the Edward Jones Account form, creates a foundation for a secure and effective investment experience. Every document plays a critical role in establishing your account, protecting your assets, and aligning your investments with your long-term goals and legal requirements. Remember to consult with your financial advisor to understand the importance of each document thoroughly and ensure that your financial plan aligns with your expectations and regulations.

Similar forms

Stock Brokerage Account Application: Like the Edward Jones Account form, applications for stock brokerage accounts collect personal information, including name, address, and social security number, and require the account holder to agree with the terms and conditions. Both forms may also inquire about investment experience and objectives. Additionally, they both include an agreement clause and often have sections dedicated to designating beneficiaries, similar to the beneficiary designation feature in the Edward Jones form.

Bank Account Opening Form: This form collects similar personal data, such as name, address, date of birth, social security number, and identification details — much like the Edward Jones Trust Company Individual Retirement Account Authorization Form. Bank forms also detail the type of account being opened (savings, checking, etc.), paralleling the IRA account type selection (Traditional, Roth, Inherited IRA) in the Edward Jones document. Furthermore, many banks require beneficiary designations for their accounts, which align with the beneficiary designation process seen in the Edward Jones account form.

Life Insurance Application: Life insurance applications are quite similar in that they require the policyholder to provide personal and sensitive information, including the policyholder’s name, date of birth, and social security number, which mirrors the account holder information section of the Edward Jones form. Additionally, life insurance applications place a significant emphasis on beneficiary designations, requiring policyholders to name primary and, if desired, contingent beneficiaries for the policy proceeds, akin to the beneficiary designation in the Edward Jones form.

401(k) Plan Enrollment Form: Similar to the Edward Jones Account form, 401(k) enrollment forms collect personal information, such as name, address, social security number, and employment details, to establish and manage the retirement plan. These forms typically include sections for selecting investment options and designating primary and contingent beneficiaries, reflecting the beneficiary designation portion of the Edward Jones form. Additionally, participants must agree to the terms and conditions of the plan, paralleling the account holder's acceptance and spousal consent (if applicable) sections of the Edward Jones document.

Dos and Don'ts

When filling out the Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation, there are several key do's and don'ts to keep in mind to ensure the process goes smoothly and your intentions are clearly communicated.

Do:

- Double-check that all personal information, including your name, address, Social Security Number/Tax ID, and date of birth, is correct and matches your government-issued ID.

- Clearly indicate the type of account you're opening (Traditional IRA, Roth IRA, or Inherited IRA) by selecting the appropriate option.

- For beneficiary designations, specify the relationship of each beneficiary to you, their percentage of the account, and ensure all their information (name, address, Social Security Number/Tax ID, date of birth, and telephone) is filled out completely.

- Sign and date the form in section D to confirm your acceptance of the account terms, including the acknowledgment of the binding arbitration provision.

- If applicable, ensure the Spousal Consent section is completed, which requires the signature of your spouse and a witness, to legally designate beneficiaries other than your spouse in community property states.

Don't:

- Leave any fields incomplete, especially in sections concerning your beneficiaries. Incomplete information could lead to delays or disputes.

- Miss signing the form. Your signature, along with the date, is required to validate the form and the designations you've made.

- Forget to review the document for accuracy. Once submitted, making changes can be cumbersome.

- Overlook the need for a witness and spouse's signature in the spousal consent section if you live in a community property state and are designating someone other than your spouse as a primary beneficiary.

- Ignore the arbitration agreement. Understand that by signing the form, you're agreeing to binding arbitration in the event of disputes under the terms provided.

Misconceptions

When reviewing forms such as the Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation, misconceptions often arise due to the formal language and complex nature of these documents. It's crucial to understand not only what is being signed but also to debunk common misunderstandings associated with these forms.

Misconception #1: You can only name one person as a beneficiary.

In reality, the form allows account holders to designate multiple primary and contingent beneficiaries, specifying the percentage of assets each should receive.Misconception #2: The form is only for individual account holders.

While it is marketed as an individual retirement account form, it also facilitates designations for inherited IRAs, accommodating situations where the account holder has passed away.Misconception #3: Spousal consent is not necessary.

If the account holder is married and resides in a community property state, and the spouse is not named as the 100% primary beneficiary, spousal consent is indeed required. This is a crucial step for married account holders to understand.Misconception #4: Beneficiary designations are irrevocable.

Beneficiary designations can generally be updated unless specified otherwise. Life changes such as marriage, divorce, or the birth of a child can prompt a review and alteration of beneficiary designations.Misconception #5: The account type selection is permanent.

While initial account type selection (Traditional IRA, Roth IRA, etc.) is important, account holders may have options to change account types in the future under specific circumstances, though this may have tax implications.Misconception #6: Tax ID numbers aren’t essential for beneficiaries.

The form requests tax ID numbers (or Social Security Numbers) for each beneficiary. This information is crucial for tax reporting and identity verification purposes.Misconception #7: All assets are distributed immediately upon death.

Distribution of assets to beneficiaries may be subject to processing times, tax considerations, and the specific terms of the account trust agreement.Misconception #8: The account holder’s signature is the only one required.

In cases of spousal consent, the spouse's signature (and a witness's signature for the spousal consent section) is also required, highlighting the importance of this agreement in certain states.Misconception #9: There are no arbitration provisions.

The account agreement contains a binding arbitration provision, meaning disputes may be resolved outside of court, emphasizing the importance of thoroughly understanding all terms.

Understanding these key aspects of the Edward Jones Account form is vital for making informed decisions regarding retirement planning and beneficiary designations. It’s always recommended to consult with a financial advisor or legal professional to ensure comprehension and proper completion of such documents.

Key takeaways

Filling out the Edward Jones Account form is an important step in managing your individual retirement plans and ensuring your assets are distributed according to your wishes after you pass away. Here are four key takeaways to understand when completing this form:

- Choice of Account Types is Critical: The form allows you to select the type of retirement account you wish to open - Traditional IRA, Roth IRA, or Inherited IRA. Each has its implications for tax and inheritance, requiring careful consideration. An Inherited IRA, for example, necessitates additional information about the deceased, emphasizing the need for clear records and decisions.

- Designation of Beneficiaries is a Must: Clearly naming primary and contingent beneficiaries is vital. This part of the form dictates who receives the assets in the account after the account holder's death. The details needed for each beneficiary include their name, relationship to the account holder, percentage of the assets to be received, and personal identification information. This action ensures your assets are distributed as per your wishes.

- Understanding the Legal Certifications and Consents: By signing the form, the account holder agrees to two major points: the acknowledgment of having received, read, and understood all pertinent documents related to the account type chosen, and the agreement to the terms spelled out in these documents. Of sufficient importance is the acknowledgment of the binding arbitration provision, which affects how disputes are resolved.

- Spousal Consent May Be Required: For those married and living or having lived in a community property state, naming someone other than the spouse as the primary beneficiary requires the spouse's consent. This section of the form is critical for such account holders, ensuring that the rights are waived knowingly and that the spouse agrees to the beneficiary designations.

Each section of the Edward Jones Account form is designed to protect the account holder and beneficiaries, comply with legal standards, and adhere to the company's policies. Proper completion and understanding of the form are crucial for effective estate planning and retirement preparation.

Popular PDF Forms

Tt Form - Enhance your banking experience with HSBC by utilizing its Telegraphic Transfer slip for secure and detailed payment instructions.

Transmittal Form Meaning - Streamlines the approval process by categorizing documents based on action required, from approval to corrections.

90 Day Performance Review Template - Assess the quality and consistency of work produced by the employee during the review period.