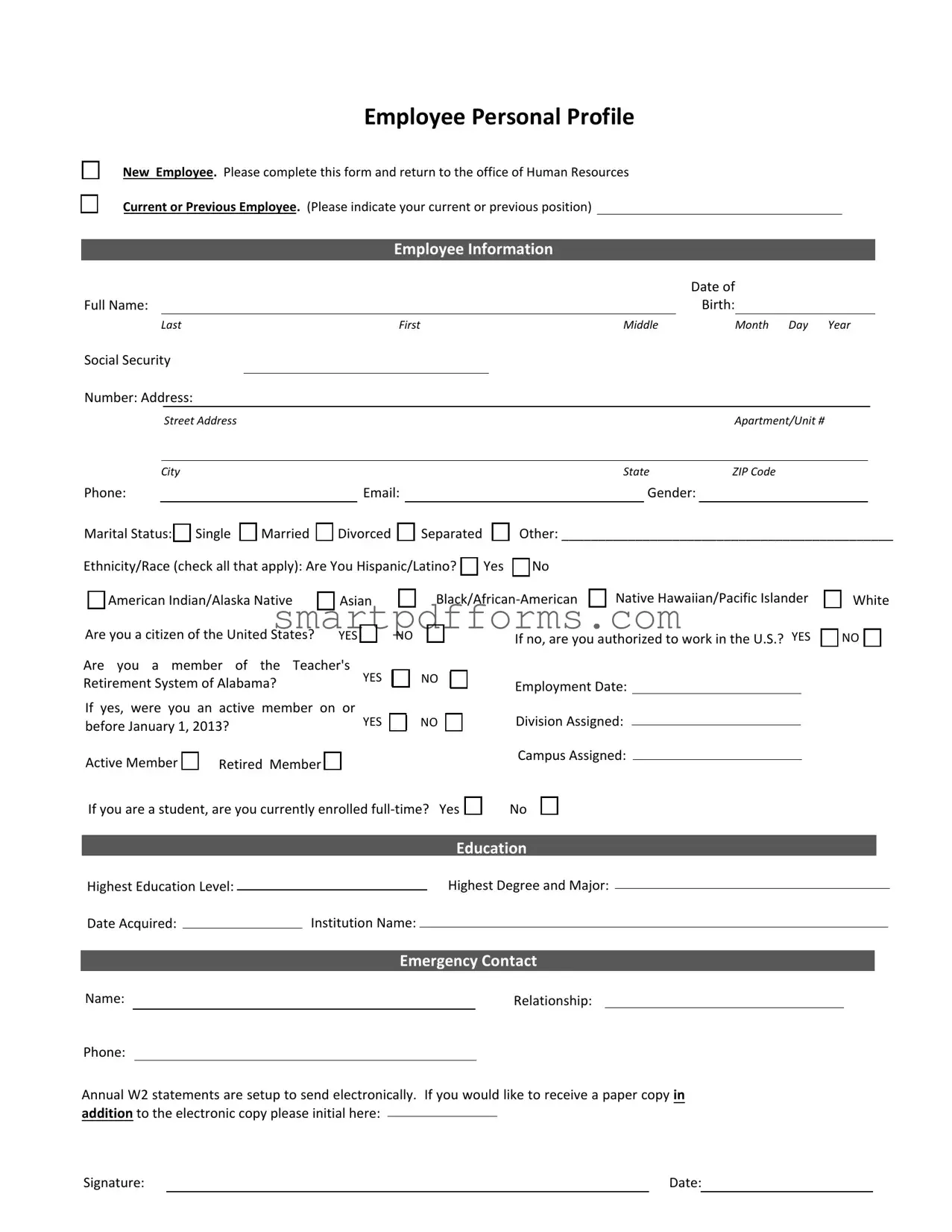

Blank Employee Profile PDF Template

The Employee Profile form serves as a foundational document, bridging the gap between new hires or existing employees and the organizational framework within which they will operate. By requesting detailed personal and professional information—ranging from basic identifiers such as name, birth date, and Social Security Number to more intricate details like ethnicity, marital status, and educational background—this form comprehensively gathers the data necessary for human resources departments to manage employee records effectively. Additionally, critical aspects like citizenship status, work authorization, and membership in specific retirement systems underscore the legal and procedural necessities that underpin employment relationships. The inclusion of emergency contact information, alongside preferences for receiving annual W2 statements, illustrates the blend of regulatory compliance and personal consideration that characterizes modern HR practices. This form, in essence, encapsulates the employee’s identity within the organization, delineating both their demographic footprint and their professional alignment, such as the division and campus assigned, thus playing a pivotal role in the administrative ecosystem of employment.

Preview - Employee Profile Form

Employee Personal Profile

New Employee. Please complete this form and return to the office of Human Resources

Current or Previous Employee. (Please indicate your current or previous position)

Employee Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of |

|

|

|

|

|

|

|

|

|

||

Full Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birth: |

|

|

|

|

|

|

|

|

|

|

|||

|

|

Last |

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

Middle |

|

|

Month |

Day |

Year |

|||||||||||||

Social Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Number: Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment/Unit # |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

||||||

Phone: |

|

|

|

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

Gender: |

|

|

|

|

|

|

|

|

|

|

||||||

Marital Status: |

Single |

|

Married |

Divorced |

|

|

Separated |

|

|

Other: _____________________________________________ |

||||||||||||||||||||||||||

Ethnicity/Race (check all that apply): Are You Hispanic/Latino? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

☐ American Indian/Alaska Native |

Asian |

|

|

|

Black/African‐American |

Native Hawaiian/Pacific Islander |

|

White |

||||||||||||||||||||||||||||

Are you a citizen of the United States? |

YES |

|

NO |

|

|

|

|

|

If no, are you authorized to work in the U.S.? |

YES |

NO |

|||||||||||||||||||||||||

Are you a member of the Teacher's |

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Retirement System of Alabama? |

|

|

|

|

|

|

Employment Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

If yes, were you an active member on or |

YES |

|

|

NO |

|

|

Division Assigned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

before January 1, 2013? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Active Member |

Retired Member |

|

|

|

|

|

|

|

|

|

|

Campus Assigned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

If you are a student, are you currently enrolled |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Education |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Highest Education Level: |

|

|

|

|

|

|

|

|

|

Highest Degree and Major: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Institution Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Date Acquired: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Emergency Contact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Phone:

Annual W2 statements are setup to send electronically. If you would like to receive a paper copy in addition to the electronic copy please initial here:

Signature: |

|

Date: |

|

|

|

|

|

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is designed for both new employees and those who have previously worked in the organization to provide their personal and professional details to the Human Resources office. |

| Employee Information Required | The form requests detailed personal information, including full name, date of birth, social security number, contact details, gender, marital status, ethnicity/race, citizenship status, and educational background. |

| Employment Specifics | It inquires about the employee's status with the Teacher's Retirement System of Alabama, including membership status and division and campus assignments. |

| Work Authorization | Employees must indicate whether they are U.S. citizens or, if not, whether they are authorized to work in the U.S. |

| Educational Background | The form collects information on the highest level of education achieved, the degree and major, the institution name, and the date the degree was obtained. |

| Governing Laws | For employees who are members of the Teacher’s Retirement System of Alabama, relevant state laws and regulations would govern aspects of their employment and retirement benefits. |

Instructions on Utilizing Employee Profile

Filling out the Employee Profile form is an important step in the hiring process or updating your records if you're a current or previous employee. This form gathers essential information about your identity, background, and preferences. Accurately completing this document ensures that the Human Resources office has all the necessary details to support your employment effectively. Below are step-by-step instructions on how to fill out this form.

- Under the section titled "Employee Personal Profile," check the appropriate box to indicate whether you are a new employee or a current/previous employee. If current or previous, specify your position.

- Fill in your full name, starting with your last name, then your first name, and middle name.

- Enter your date of birth by specifying the month, day, and year.

- Provide your Social Security Number in the designated space.

- Under Address, write your street address in the first line. If applicable, include your apartment/unit number in the next line. Then, fill in your city, state, and ZIP code.

- For Phone and Email, enter your current contact information.

- Select your Gender and Marital Status by checking the appropriate box. If selecting "Other" for Marital Status, specify the details in the provided space.

- Indicate your Ethnicity/Race by checking all applicable boxes. Also, answer whether you are Hispanic/Latino.

- Answer the citizenship question. If you're not a U.S. citizen, specify whether you are authorized to work in the U.S.

- If relevant, answer whether you are a member of the Teacher's Retirement System of Alabama, including specifics about your membership status as of January 1, 2013.

- Fill in your Employment Date, Division Assigned, and Campus Assigned.

- If you are a student, indicate whether you are enrolled full-time.

- In the Education section, provide the highest level of education achieved, including the degree and major, name of the institution, and the date acquired.

- For the Emergency Contact section, list the name, relationship, and phone number of your contact.

- If you prefer to receive a paper copy of your annual W2 statement in addition to the electronic copy, put your initials in the space provided.

- Finally, sign and date the form at the bottom to verify that all the information provided is accurate.

Once you have completed the form, return it to the office of Human Resources. This will help update or create your profile in the company's system, ensuring that your employment records are current. Human Resources may reach out to you if they need further information or to clarify any details you've provided.

Obtain Answers on Employee Profile

-

Who needs to complete the Employee Profile form?

This form must be completed by all individuals newly hired or currently employed who need to update their information. New employees should fill it out as part of their onboarding process. Current or previous employees must indicate their current or past position when updating or confirming their details.

-

What information is required on the Employee Profile form?

The form requires detailed personal information including full name, date of birth, social security number, address, phone number, email, gender, marital status, and ethnicity/race. It also asks about U.S. citizenship status, authorization to work in the U.S., and membership in the Teacher's Retirement System of Alabama. Employment details, highest level of education, information on the highest degree obtained, and emergency contact are also required. Lastly, employees can indicate their preference for receiving annual W2 statements electronically or in paper form.

-

Where should the completed Employee Profile form be submitted?

All completed forms should be returned to the office of Human Resources. This can usually be done either in person or through the department's designated electronic submission method. It's advisable to confirm the preferred submission method with your Human Resources department to ensure prompt and secure handling of your personal information.

-

How does one indicate a preference for receiving W2 statements?

Employees have the option to receive annual W2 statements electronically by default. If an employee prefers to receive a paper copy in addition to the electronic version, they must indicate this preference by initialing the designated space provided on the form. This ensures that Human Resources processes your request accurately and sends your W2 statements in your preferred format.

Common mistakes

One common mistake is failing to provide complete information in the Employee Information section. Individuals often leave out middle names, apartment or unit numbers, or incorrectly format their phone numbers. These details are crucial for accurate records and ensuring that all correspondence reaches the employee. It is important to double-check that every field is filled out correctly and completely.

Another frequent error occurs in the Marital Status and Ethnicity/Race sections, where employees either skip these questions entirely or do not check all the applicable boxes. It's vital to carefully read and respond to each option provided. These pieces of information are often used for demographic purposes and, in some cases, may affect benefit eligibility. Employee responses help create a complete demographic profile, making it important to consider each selection carefully.

Incorrectly answering the questions about citizenship and work authorization in the United States is also a common mistake. Some individuals may inadvertently check "No" for being a citizen without noticing the follow-up question about work authorization, or vice versa. This part of the form is crucial for determining employment eligibility and ensuring compliance with legal requirements. Ensuring accurate responses in this section helps to avoid potential delays or complications in the hiring process.

Finally, a notable error involves the Emergency Contact section, where often, contact details are either incomplete or outdated. The importance of providing up-to-date and reliable contact information cannot be overstated, as this information could be critical in case of an emergency. Employees should ensure that the emergency contact is someone who is usually available and that their details are kept current.

- Complete all sections fully and accurately, paying special attention to details like full names, addresses, and phone numbers.

- Read each question thoroughly, ensuring you check all boxes that apply to questions about marital status and ethnicity/race.

- Clearly indicate your citizenship status and work authorization to prevent any misunderstandings that could affect your employment status.

- Provide current and reliable emergency contact information, making sure to update it if any changes occur.

Documents used along the form

When an individual is hired, the Employee Profile form serves as the cornerstone document, capturing essential personal and employment details. However, to comprehensively integrate a new employee into the company's system and ensure compliance with legal and operational requirements, several other forms and documents typically accompany this profile. These complementary documents not only reinforce the data collected but also address regulatory, tax, and welfare aspects of employee management.

- I-9, Employment Eligibility Verification: This form is mandated by the U.S. government to verify an employee's legal right to work in the United States. It requires employees to present documentation proving their identity and employment authorization.

- W-4, Employee's Withholding Certificate: The W-4 form is crucial for determining the amount of federal income tax to withhold from an employee's paycheck. Employees provide information about their filing status, multiple jobs, dependents, and any other adjustments that affect withholding.

- Direct Deposit Authorization Form: This form allows employees to authorize the direct deposit of their paychecks into their bank accounts. It typically requires the employee's bank account information and may also include a space for attaching a voided check.

- Emergency Contact Information Form: Though some details might be included in the Employee Profile form, a comprehensive and separate Emergency Contact Information Form ensures that the employer can quickly contact designated individuals in case of an emergency. This form usually requests multiple contacts, specifying their names, relationships, and contact details.

Collectively, these documents ensure a smooth and compliant onboarding process. They address critical legal requirements, facilitate efficient payroll setup, and ensure that the employer is prepared for any emergencies. Beyond fulfilling legal obligations, the careful collection and management of these forms underscore the employer's commitment to their employees' welfare, setting the foundation for a positive working relationship.

Similar forms

Job Application Form: Similar to the Employee Profile form, a job application form collects personal information, employment history, and educational credentials from candidates. Both forms serve as key documents to verify an applicant's identity, background, and qualifications for employment.

Emergency Contact Information Form: This document, like the emergency contact section of the Employee Profile, gathers names, relationships, and phone numbers of individuals to be contacted in an emergency. Both forms prioritize employee safety and preparedness by maintaining up-to-date contact information.

W-4 Form: The W-4 form, used for tax purposes, captures an employee's filing status and allowances, akin to how the Employee Profile form records personal and demographic details to comply with employment and tax legislation. Both documents are essential for the accurate processing of payroll and taxes.

New Hire Reporting Form: Similar to the Employee Profile form, the New Hire Reporting Form is used by employers to report new employees to a state directory, usually for child support enforcement purposes. Both forms collect employee information promptly after hiring, ensuring compliance with state employment regulations.

Diversity and Inclusion Survey: This survey closely resembles the segment of the Employee Profile form that asks about ethnicity/race and veteran status. Both are used to monitor and promote diversity within the workplace, ensuring an inclusive environment by gathering demographic data for analysis and reporting.

Dos and Don'ts

When filling out the Employee Profile Form, it's important to approach the task with attention to detail and accuracy. Below are lists of recommended do's and don'ts to guide you through the process.

Do:

- Double-check your personal information such as your full name, address, and contact details to ensure they are current and correct.

- Verify the accuracy of your social security number, as it is crucial for tax purposes and identity verification.

- Be honest about your marital status, citizenship, and work authorization status, as these can affect your employment benefits and eligibility.

- Select the appropriate ethnic/race categories that apply to you. This information is used for demographic purposes and is often required for federal reporting.

- Include the highest level of education you have completed, along with the degree and major, to accurately reflect your qualifications.

- Provide emergency contact details, making sure the contact is reliable and aware they’ve been listed as your emergency contact.

- Choose the correct response regarding your membership in the Teacher's Retirement System of Alabama, if applicable.

- If opting for a paper copy of W2 statements in addition to electronic ones, remember to place your initial in the designated space as consent.

- Sign and date the form to validate the information provided.

- Review the entire form once filled out to ensure all questions are answered and no mistakes have been made.

Don't:

- Avoid leaving any required fields blank. If a section does not apply to you, write “N/A” to indicate this.

- Do not provide false information. Dishonesty on official documents can lead to employment and legal consequences.

- Avoid using nicknames or initials unless specifically requested. Always use your legal name.

- Do not guess your social security number. Make sure to use the exact number as it appears on your social security card.

- Refrain from sharing sensitive information via email or other insecure methods after completing the form to protect your identity.

- Do not overlook the checkboxes for ethnicity/race and other binary questions. Accurately answering helps ensure compliance with federal regulations.

- Do not ignore the section regarding your authorization to work in the U.S. if you are not a citizen, as this could impact your employment status.

- Avoid forgetting to list your emergency contact's relationship to you, as this information can be crucial in urgent situations.

- Do not skip the signature and date at the end of the form, as these are necessary for validating the document.

- Avoid rushing through the form. Taking your time can help prevent mistakes and ensure the accuracy of your information.

Misconceptions

When it comes to the Employee Profile form, there are several misconceptions that can create confusion for both employers and employees. These misconceptions can lead to mistakes in how the form is completed and understood. It's crucial to clear up these misunderstandings to ensure accurate and compliant human resources practices.

Misconception 1: Providing a Social Security Number (SSN) is Optional. Many employees believe that they can skip filling out their SSN due to privacy concerns. However, the SSN is vital for tax purposes and for verifying an employee's eligibility to work in the United States. Without it, accurately reporting wages and ensuring compliance with tax laws is challenging.

Misconception 2: Marital Status Does Not Affect Employment. While it might seem like a personal detail irrelevant to one's job, marital status can impact benefits, tax withholdings, and even survivor benefits in some employment scenarios. It's important for employees to provide accurate information to ensure they receive the correct benefits and tax treatment.

Misconception 3: Only U.S. Citizens Need to Complete the Form. There's a misunderstanding that the Employee Profile form is only for U.S. citizens. In reality, all employees, regardless of their citizenship status, must fill out the form. This information helps employers comply with immigration laws by verifying that all employees are authorized to work in the U.S.

Misconception 4: Educational Information is Irrelevant After Being Hired. Some employees think once they've secured the job, their educational background becomes irrelevant and thus, might neglect updating or accurately reporting their highest level of education. This information, however, can be crucial for internal promotions, professional development opportunities, and compliance with certain industry regulations that mandate specific educational qualifications.

Understanding and clarifying these misconceptions are fundamental steps in ensuring that both employees and employers fulfill their obligations correctly. It reinforces the importance of accurate data on employment forms, which ultimately protects both parties and ensures regulatory compliance.

Key takeaways

Filling out an Employee Profile form is a fundamental task when starting a new job or updating information at an existing position. It is essential to ensure the accuracy and completeness of the information provided. Here are key takeaways to consider when dealing with this form:

- Accuracy is critical: Ensure all information is accurate, especially personal details like your Social Security Number, date of birth, and contact information. Any errors can lead to issues with payroll, benefits, and official records.

- Update as necessary: It's not just about filling out the form once. Keep your information up to date, especially if you move, change marital status, or there are changes in your emergency contacts.

- Understand the sections: The form typically includes diverse sections, from personal information to employment details, education, and emergency contacts. Make sure you understand what each section requires before filling it out.

- Privacy matters: Some information, like ethnicity/race or marital status, may feel personal. Remember, this information is often used for statistical purposes and, in some cases, for identifying eligible benefits.

- Employment eligibility: Confirming whether you are authorized to work in the U.S. is a legal requirement. Be prepared to provide supporting documents if necessary.

- Educational background: Accurately recording your highest level of education and any degrees earned is important for job placement and potential advancement within the company.

- Benefits enrollment: Information on this form can affect your eligibility and enrollment in benefits like health insurance or retirement plans. Pay special attention to questions regarding previous memberships in benefit systems.

- Paper versus electronic statements: If you have a preference for receiving paper copies of documents like W2 statements, note it accordingly on the form. It's about ensuring you receive important information in the format you find most accessible.

Completing the Employee Profile form is more than a bureaucratic necessity; it plays a significant role in how you are integrated into the company's systems and how effectively you can be supported and rewarded throughout your employment. Take the time to fill it out thoughtfully and thoroughly.

Popular PDF Forms

Homestead Exemption Nevada - This legal document enables Nevada residents to declare a homestead exemption, detailing property types and owner status for official recording.

Claiming on Pet Insurance - State-specific fraud warnings highlight the legal implications of dishonest claim submissions in various jurisdictions.

Tenant Move Out Letter - An assertive yet polite notice from tenants to landlords, indicating move-out plans and requesting the return of the security deposit.