Blank Essential Super Withdrawal PDF Template

The Essential Super Withdrawal form is a crucial document for individuals looking to access their superannuation funds under specific circumstances. It caters to those who intend to either withdraw all or a portion of their funds as a lump sum or initiate a rollover to another super fund. Such financial decisions necessitate a thorough understanding of various conditions like eligibility criteria, conditions of release, and potential tax implications that might arise due to withdrawal, especially for individuals under the age of 60. This form also outlines considerations such as the possible cessation of insurance cover which could have significant implications on one’s financial security. Additionally, the withdrawal could impact the ability to claim deductions for personal super contributions and might even affect long-term retirement goals due to the intricacies of investment markets and the tax-effective nature of superannuation savings. Colonial First State Investments Limited, the trustee for Commonwealth Essential Super, emphasizes the importance of consulting a financial adviser to navigate these complexities. The document further provides procedural details for withdrawal, including identification and verification processes, and advises on the operational mechanics of transaction processing, highlighting the need for compliance with Anti-Money Laundering and Counter-Terrorism Financing laws. This comprehensive approach underscores the necessity of informed decision-making when considering accessing super funds.

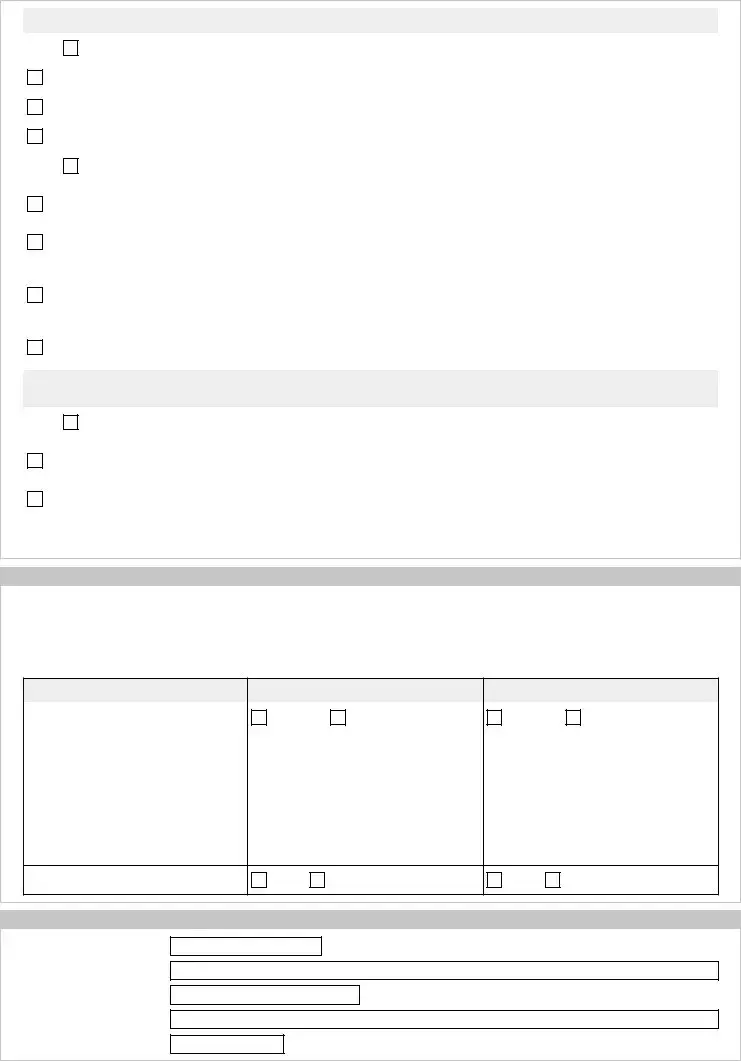

Preview - Essential Super Withdrawal Form

Essential Super withdrawal form

Is this the right form for me?

This form can be used to withdraw some or all of the units in your fund, as a rollover to another super fund, or to be withdrawn as cash. If you wish to cash out your super, you must meet a condition of release and the eligibility criteria to receive a super benefit. The current Product Disclosure Statement can provide you with further information, or call us on 13 40 74.

You can read more about how to make a withdrawal from your fund, as well as details on how and when unit prices are calculated on the next page.

We also recommend you read the following information regarding potential implications your withdrawal may have on you or your investment before completing your request.

Some things to consider before making a withdrawal

1 Paying tax

Generally, if you roll over your super to another provider, you will not be taxed. However, if you make a cash withdrawal from a super fund, and if you’re under 60, you may have to pay tax. If you’re 60 or over, lump sum withdrawals and pension payments are tax free. Whether you’re under or over 60, a cash withdrawal could affect your eligibility for tax offsets and entitlements. A financial adviser can help you identify possible ways to ensure you don’t have an unnecessary tax liability.

2 Loss of insurance cover

Many super funds offer insurance to members for death, total & permanent disablement or salary continuance cover. If you cash out or transfer your super, your insurance cover may cease. Insurance is an important benefit and you should consider issues like the need to complete new application forms and arrange medical examinations, whether it’s possible that your premiums will increase, and if it’s likely that you may be denied cover.

3Reduction or loss of deduction for personal super contributions

If you’re cashing out or transferring some or all of your super, this withdrawal could reduce your eligibility to claim a deduction for personal super contributions made during the current or previous financial year. Also, if you’re requesting a rollover of some or all of your super to commence a pension, then this rollover could result in a loss of your eligibility to claim a deduction for any personal super contributions.

Generally, this will only apply to

4 Falling short of your retirement goals

Super is a

5 Mistiming investment markets

If you’re cashing out or transferring your super because of disappointing performance, you may be leaving

the fund at an inappropriate time. If the value of your investment has fallen, you are only making a loss on paper. Selling your investment crystallises any losses you have made due to a decrease in the current unit price.

18915/0713

Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) is the Trustee of Commonwealth Essential Super ABN 56 601 925 435 (Fund) and the issuer of interests in Essential Super which is a product of the Fund. A Product Disclosure Statement (PDS) for Essential Super is available from commbank. com.au/super or by calling 13 40 74. You should read the PDS and assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision. Colonial First State is a wholly owned subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124 (the Bank). The Bank provides certain distribution and administrative services to the Trustee. The Bank and its subsidiaries do not guarantee the performance of Essential Super or the repayment of capital by Essential Super. An investment in Essential Super is via a superannuation trust and is therefore not an investment in, deposit with or other liability of the Bank or its subsidiaries.

An investment in Essential Super is subject to risk, loss of income and capital invested. |

|

Page 1 of 10 |

Have you spoken to a financial adviser?

Make sure you understand the potential impacts this withdrawal may have on your investment strategy. If you have a financial adviser, they can be invaluable in this process as they can review your situation and help you:

•assess the impacts of the decision

•explain what may happen and discuss alternative options with you

•assist you in balancing your

If you don’t have an adviser we are here to help so please call us on 13 40 74. Although we are not licensed financial advisers, we may be able to help you understand some of the implications of withdrawing, or refer you to a qualified financial adviser.

How do I make a withdrawal from my investment?

You can withdraw to rollover to another superannuation fund (not an income stream) at any time, subject to minimum account balance requirements. In any other case, you must meet a condition of release and the eligibility criteria for a super benefit. The current Product Disclosure Statement provides you with further information. You must also complete the attached Identification and Verification form so that we can establish your identity (if this has not already been completed). We normally pay a super benefit within seven working days of receiving your request. Longer periods may apply from time to time. In extraordinary circumstances, we may suspend or restrict withdrawals.

If you would like your super benefit to be credited to your bank account, original (ie not faxed) advice of your bank account details must be held or received at the time of the request.

If we receive your withdrawal request at our Sydney office before 3pm, Sydney time, on a NSW business day, the exit unit price calculated at the end of that day will apply. Where an option is suspended, restricted or unavailable, we may not process withdrawal requests. Any decisions whether to process withdrawals or partial withdrawals will be made in the best interests of investors as a whole, and if any payment is to be made, then the exit price used to calculate this payment will be the one determined at the time the payment is made. Withdrawals received after 3pm are calculated at the following day’s exit unit price. Unless otherwise specified, the amount requested is net of lump sum tax. Should you wish to cancel your withdrawal request, you must advise us before 3pm Sydney time on the day your original request is received by the trustee.

Temporary resident visa holders

From 1 April 2009, if you have at any stage been a temporary resident, you may only be able to withdraw your super benefits under limited conditions of release. Please refer to our brochure for information on Temporary Residents available at commbank.com.au/super or by calling us on 13 40 74.

Unit prices and transaction processing

The trustee calculates unit prices each NSW business day. When you request to contribute, switch or withdraw your investment your request must be received before the relevant

to consider this when making your transaction requests. Please refer to a copy of the current Product Disclosure Statement (PDS) for further details.

Please phone us on 13 40 74 or send an email to contactessentialsuper@cba.com.au if you require further information in order to understand your benefit entitlements, including information about any fees or charges that may apply to any rollover you intend to make and information about the effect of the rollover on your benefit entitlements. You can also contact a financial adviser to discuss the effects of any

We are required to comply with these laws, including the need to establish your identity (and, if relevant, the identity of other persons associated with your account). Additionally, from time to time, we may require additional information to assist with this process. We may be required to report information about you to the relevant authorities. We may not be able to tell you when this occurs. We may not be able to transact with you or other persons. This may include delaying, blocking, freezing or refusing to process a transaction or ceasing to provide you with a product or service. This may impact on your investment and could result in a loss of income and principal invested.

Page 2 of 10

B3AKBK

Essential Super

WITHDRAWAL FORM

Please phone us on 13 40 74 with any questions.

Please complete this form using BLACK INK and print well within the boxes in CAPITAL LETTERS. Mark appropriate answer boxes with a cross like the following × . Start at the left of each answer space and leave a gap between words. Please complete all fields to ensure that we hold the correct details.

Fields marked with an asterisk (*) must be completed for the purposes of

1 INVESTOR DETAILS

Essential Super account number

Title

Mr

Mrs

Miss

Ms

Other

Full given name(s)*

Surname* (Please supply relevant certified documents if details have changed)

Date of birth*

D D / M M / Y Y Y Y

Occupation and industry* (If retired, state RETIRED)

Your main country of residence, if not Australia*

Residential address (PO Box is NOT acceptable)*

|

|

|

State |

Postcode |

Country |

|

|

|

Postal address for all communications and cheque payments (if applicable)

Cross (X) box where appropriate:

Same as residential address, as above

Same as existing postal address on account

Different address as provided below:

|

|

|

|

|

|

|

|

|

|

State |

Postcode |

Country |

|||

|

|

|

|

|

|

|

|

Work phone number |

|

Home phone number |

|

|

Mobile phone number |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax number

Email address

By providing your email address, you agree that we may use this address to provide you with information about your investment (such as transaction confirmations, statements, reports and other material). From time to time we may still need to send you letters in the post.

Page 3 of 10

2 Residency details – this section must be completed

If you do not complete this section your request may be delayed. If you are completing a rollover request to another superannuation fund, you can proceed to Section 3. If you are requesting to cash out your super benefit or requesting a rollover to commence a pension, you must complete the section below.

Cross (X) box as applicable

Australian citizen/resident

New Zealand citizen

Holder of Retirement Visa subclass 405/410

If you have selected any of the above, please proceed to section 3 of this form.

Temporary resident visa holder of Australia

•Please complete Section 8 – Temporary resident visa holder – Conditions of release. Please obtain the ‘Temporary resident brochure for superannuation’ available at commbank.com.au/super or by calling us on 13 40 74 for further information on the super benefits you are entitled to.

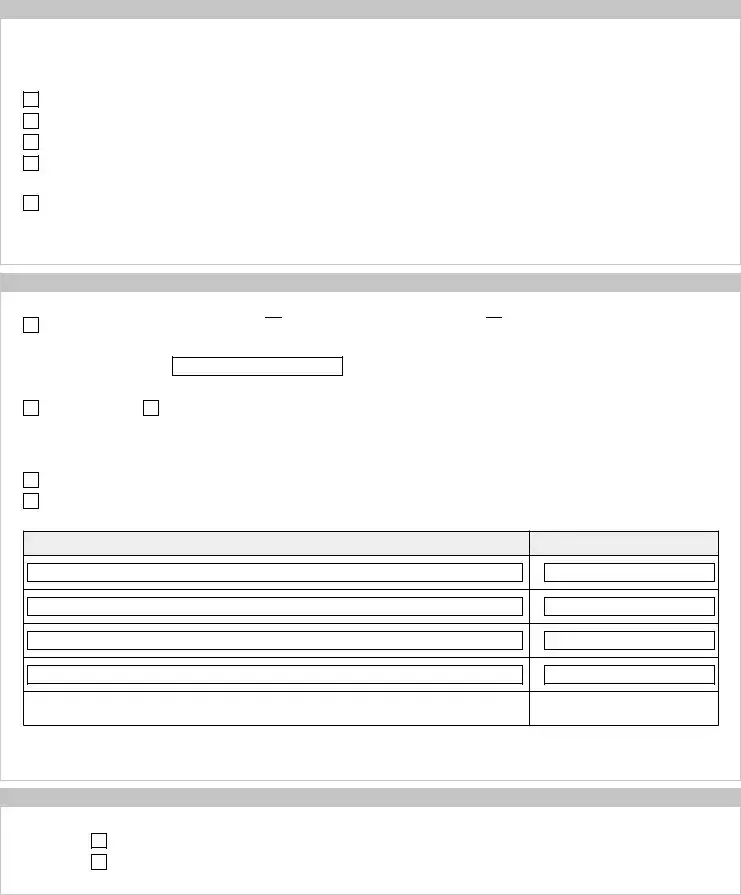

3 Withdrawal instructions

Unless otherwise indicated, the amount shown should be NET of tax and withdrawal adjustments.

I would like to close my account. Please

Pay to me (proceed to section 4) or

Pay to me (proceed to section 4) or  Rollover (proceed to section 6)

Rollover (proceed to section 6)

OR

I would like to withdraw $

This payment is to be:

Paid to me OR

Rolled over to another superannuation fund(s)

Please note: If you close your account without providing your Tax File Number, you may not be able to claim back any TFN tax that has been deducted.

Cross (X) one box only. If no option is selected, we will redeem as per your existing investment weightings.

I would like this withdrawal to be made in line with my investment allocation on the date of this transaction.

I would like this withdrawal to be made from my account as shown below. If this is a full withdrawal from an option, write ‘balance’ next to that option.

Option name |

Amount |

$

$

$

$

TOTAL $ |

0 |

Please note: If you have specified a restricted, suspended or unavailable option, we may not be able to process your request immediately. You should refer to our website for important information on any changes to the availability of particular investment options.

4 Payment instructions

Your instructions in this section overrides previous nominations. Only one method can be selected. Please cross (X) one:

Credit

Cheque

XCredit my Australian financial institution account shown in section 5

XMail a cheque to my address. Cheques issued are not bank cheques

Please note: If no payment method is selected, a cheque will be issued.

Page 4 of 10

5 Details of account to be credited

Please note: New bank account details via fax cannot be accepted, unless sent from a Commonwealth Bank branch. Name of Australian financial institution

Branch name

Branch number (BSB) |

Account number |

|

|

|

|

|

|

|

Name of account holder

You can only nominate a bank account that is held in your name.

6 Rollover details

Complete this section if you would like your withdrawal to be rolled over to another institution. Please complete all details and ensure that you provide us with a valid Australian Business Number (ABN) or Unique Superannuation Identifier (USI).

Rollover 1

Amount |

|

|

Account/Membership number of fund |

|

||

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND USI |

|

|||

ABN |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rollover institution, fund name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal address

|

|

|

|

|

|

|

|

|

|

|

|

State |

Postcode |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rollover 2 |

|

|

|

|

|

|

|

Amount |

|

|

Account/Membership number of fund |

|

|||

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABN |

|

AND USI |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rollover institution, fund name

Postal address

|

|

|

State |

Postcode |

Country |

|

|

|

Note: If you require more than 2 rollovers to another institution, please attach a signed letter with your withdrawal form with the above details.

Page 5 of 10

7 Tax file number notification

I acknowledge that I am aware that:

•my provision, and your receipt, of my tax file number are authorised under the Superannuation Industry (Supervision) Act 1993

•if I provide my tax file number to you, you will use it only for legal purposes. This includes finding and identifying any superannuation benefits which you hold on my behalf, calculating tax on any superannuation benefits, calculating tax on my superannuation contributions and providing information to the Commissioner of Taxation. These purposes may change in future.

If I provide my TFN to you, I consent to you using it to:

•seek information about my superannuation accounts from the Australian Taxation Office (ATO) using the ATO’s Supermatch program or other facility provided by the ATO, or

•to locate information about superannuation accounts which I hold with other superannuation providers, and

•contacting those providers regarding my superannuation accounts.

I don’t have to supply my tax file number, and if I choose not to, I will commit no offence. However, if I don’t provide my tax file number:

•more tax may become payable on my taxable superannuation contributions and superannuation benefits

•you may be required to refund any other superannuation contributions (including a personal or

•in the future it may be more difficult to locate or amalgamate my superannuation benefits

These consequences may change in the future.

If I provide my tax file number to you, you may provide it to another superannuation fund trustee or Retirement Savings Account provider to whom my superannuation benefits are to be rolled over, unless I request you not to do so in writing. You may also give my tax file number to the Commissioner of Taxation. In all other respects my TFN will be treated as confidential.

My tax file number is:

8 Conditions of release

Please indicate what type of super benefit you are eligible for. If you are, or once were, a temporary resident, please refer to Section 2.

a retirement benefit – I am aged 55 to 64 and have permanently retired and never intend to become engaged in gainful employment for 10 or more hours per week

a retirement benefit – I am aged 60 to 64 and have ceased a gainful employment arrangement since turning age 60

a retirement benefit – I am aged 65 or older

an unpreserved cash benefit – I am withdrawing unrestricted

an unpreserved cash benefit – I am withdrawing restricted

a total and permanent disablement (TPD) benefit – I am permanently incapacitated1

a financial hardship benefit – I am in severe financial hardship1

a compassionate grounds benefit – Compassionate grounds as approved by Medicare1

a terminal illness benefit – I have a terminal medical condition1

a

a termination payment – I have ceased gainful employment with the sponsor that established this account and the balance is less than $200.

a termination payment – I have ceased gainful employment with the sponsor that established this account and the balance is less than $200.

Please read the current PDS for more information on when you can be paid your super. This PDS is available free of charge on our website at commbank.com.au/super or by calling us on 13 40 74.

1 We have additional requirements to process the withdrawal on these grounds. Please call us on 13 40 74 for further information.

Temporary Resident Visa Holder – Conditions of release

Only complete this section if you are a temporary resident visa holder and wish to have any preserved or restricted

Please indicate what type of super benefit you are eligible for:

a total and permanent disablement (TPD) benefit – I am permanently incapacitated1

a terminal illness benefit – I have a terminal medical condition1

an unpreserved cash benefit – I am withdrawing unrestricted

a retirement benefit – prior to 1 April 2009, I turned aged 60 or older and ceased a gainful employment arrangement

a retirement benefit – prior to 1 April 2009, I turned age 65 or older

an unpreserved cash benefit – I am withdrawing restricted

1 We have additional requirements to process the withdrawal on these grounds. Please call Investor Services on 13 13 36 for further information.

Page 6 of 10

9 Declaration and signature

I declare that:

•I have received and read the Essential Super PDS and I acknowledge I have access to all statements and information that are incorporated by reference, together referred to below as ‘the PDS’

•I acknowledge I am bound by the Commonwealth Essential Super Trust Deed (as amended from time to time), and

•I acknowledge I am bound by the terms and conditions of the PDS.

•all details in this form are true and correct

•if this form is signed under Power of Attorney, the Attorney declares that they have not received notice of revocation of that power (a certified copy of the Power of Attorney should be submitted with this application unless we have already sighted it)

•I have read and understood the important information provided with this form.

I acknowledge and agree that the trustee and/or its related entities (‘the Group’) will not be liable to me or other persons for any loss suffered (including consequential loss) where transactions are delayed, blocked, frozen or where the Group refuses to process a transaction or ceases to provide me with a product or service.

Investments in Essential Super USI FSF1332AU (referred to as ‘the fund’) are offered from Commonwealth Essential Super ABN 56 601 925 435 by Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468.

Signature

✗

Date signed

D D / M M / Y Y Y Y

Print name

If you are signing under a Power of Attorney, please comply with the following:

•attach a certified copy of the Power of Attorney document

•each page of the Power of Attorney document must be certified by a Justice of the Peace, Notary Public or Solicitor.

•please also supply a certified copy of the identification documents for the Attorney, containing a sample of their signature,

eg Drivers Licence, Passport, etc. The Attorney will also need to complete a power of attorney identification form which can be obtained by phoning us on 13 40 74.

Please send the completed form to:

Essential Super

Reply Paid 86495, Sydney NSW 2001

Page 7 of 10

This page has been left blank intentionally.

Page 8 of 10

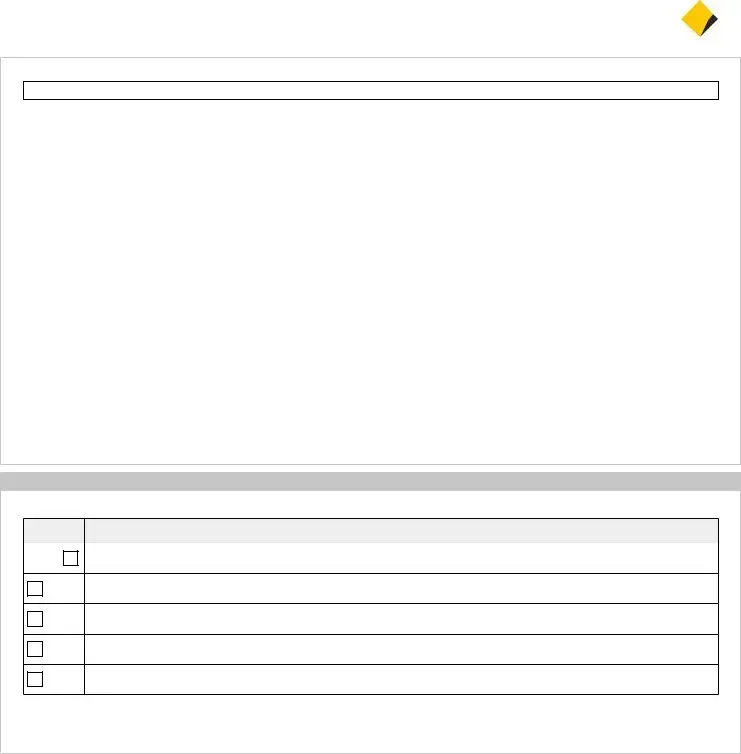

Essential Super

IDENTIfiCATION AND VERIfiCATION FORM – INDIVIDUALS

Full name of member

You or your adviser may also like to complete this form so that we can establish your identity (for the purposes of

Financial advisers undertake identification and verification procedures by completing sections A to C of this form or by using other industry standard forms.

If you do not have a financial adviser, you will need to complete section A of this form and provide certified copies of the ID documents (do not send original documents).

The list of the parties who can certify copies of the documents is set out below. To be correctly certified we need the ID documents to be clearly noted ‘True copy of the original document’. The party certifying the ID documents will also need to state what position they hold and sign and date the certified documents. If this certification does not appear, you may be asked to send in new certified documents.

List of persons who can certify documents* (for the purposes of

•Justice of the Peace

•Solicitor

•Police Officer

•Magistrate

•Notary Public (for the purposes of the Statutory Declaration Regulations 1993)

•Employee of Australia Post (with two or more years of continuous service)

•Your financial adviser (provided they have two or more years of continuous service)

•Your accountant (provided they hold a current membership to a professional accounting body)

•Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955)

•An officer of a bank, building society, credit union or finance company provided they have two or more years of continuous service.

* There are additional persons who can certify documents. A full list of the persons who can certify documents is available from our forms library at commbank.com.au/super

Section A: Verification procedure

Complete Part 1 (or if the individual does not own a document from Part 1, then complete either Part 2 or Part 3).

Part 1 |

Acceptable primary photographic ID documents |

|

|

|

|

Cross |

|

|

× |

Select ONE valid option from this section only |

|

|

||

Australian State/Territory driver’s licence containing a photograph of the person

Australian passport (a passport that has expired within the preceding two years is acceptable)

Card issued under a State or Territory for the purpose of proving a person’s age containing a photograph of the person

Foreign passport or similar travel document containing a photograph and the signature of the person¹

1Documents that are written in a language that is not English must be accompanied by an English translation prepared by an accredited translator. An accredited translator is any person who is currently accredited by the National Accreditation Authority for Translators and Interpreters Ltd (NAATI) at the level of Professional Translator or above.

Continued over the page…

Page 9 of 10

Part 2 |

Acceptable secondary ID documents – should only be completed if the individual does not own a document from Part 1 |

|

|

Cross × |

Select ONE valid option from this section |

|

Australian birth certificate |

|

|

|

Australian citizenship certificate |

|

|

|

Pension card issued by Department of Human Services (previously known as Centrelink) |

|

|

Cross × |

AND ONE valid option from this section |

|

A document issued by the Commonwealth or a State or Territory within the preceding 12 months that records the |

|

provision of financial benefits to the individual and which contains the individual’s name and residential address |

|

|

|

A Notice of Assessment issued by the Australian Taxation Office within the preceding 12 months which contains the |

|

individual’s name and residential address |

|

|

|

A document issued by a local government body or utilities provider within the preceding three months which records |

|

the provision of services to that address or to that person (the document must contain the individual’s name and |

|

residential address) |

|

|

|

If under the age of 18, a notice that was issued to the individual by a school principal within the preceding three |

|

months; and contains the name and residential address; and records the period of time that the individual attended |

|

that school |

|

|

|

|

|

Acceptable foreign photographic ID documents – should only be completed if the individual does not own |

Part 3 |

a document from Part 1 |

|

|

Cross × |

Select one valid option from this section only |

|

Foreign driver’s licence that contains a photograph of the person in whose name it is issued and the individual’s date |

|

of birth¹ |

|

|

|

National ID card issued by a foreign government containing a photograph and a signature of the person in whose |

|

name the card was issued¹ |

|

|

1Documents that are written in a language that is not English must be accompanied by an English translation prepared by an accredited translator. An accredited translator is any person who is currently accredited by the National Accreditation Authority for Translators and Interpreters Ltd (NAATI) at the level of Professional Translator or above.

Section B: Record of verification procedure

FINANCIAL ADVISER USE ONLY

Verify the individual’s full name and date of birth OR residential address.

By completing this Record of Verification Procedure I declare that I have verified the identity of the Customer as required by AML/ CTF Rules and that this identification procedure has been performed by an AFSL holder or an authorised representative of an AFSL holder.

ID document details |

Document 1 |

|

|

|

|

Document 2 (if required) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Verified from |

|

Original |

|

Certified copy |

|

|

Original |

|

Certified copy |

|||

|

|

|

|

|

||||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Document issuer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

||||||||

Issue date |

D D / M M / Y Y Y Y |

|

|

D D / M M / Y Y Y Y |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|||||||||

Expiry date |

D D / M M / Y Y Y Y |

|

|

D D / M M / Y Y Y Y |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accredited English translation

N/A

Sighted

N/A

Sighted

Section C: Financial adviser details – Identification and verification conducted by:

Date verified

Financial adviser’s name

Phone number

AFS licensee name

AFS Licence number

D D / M M / Y Y Y Y

Page 10 of 10

Form Data

| Fact Name | Description |

|---|---|

| Purpose of the Form | Used to withdraw units from the fund, either as a rollover to another super fund or as cash. |

| Conditions for Cash Withdrawal | Must meet a condition of release and eligibility criteria to receive a super benefit as cash. |

| Considerations Before Withdrawal | Includes potential tax implications, loss of insurance cover, and effects on retirement goals among others. |

| Financial Advice | Advises consulting a financial adviser to understand potential impacts on investment strategy. |

| Processing and Compliance | Details on unit prices, transaction processing, and compliance with Anti-Money Laundering and Counter-Terrorism Financing laws. |

Instructions on Utilizing Essential Super Withdrawal

Filling out the Essential Super Withdrawal form is an important step for individuals who wish to access their superannuation funds. Whether you're planning to roll over your balance to a new super fund or wish to withdraw cash, it's crucial to proceed with accuracy to ensure that your request is processed smoothly. The form requires detailed personal information, alongside decisions regarding the withdrawal or rollover amount, and how you'd like to receive these funds. Before starting, make sure you've reviewed considerations such as potential tax implications, insurance cover loss, and impacts on personal super contributions and retirement goals. Following the steps accurately will help facilitate a successful transaction.

- Investor Details: Provide your Essential Super account number, title (Mr, Mrs, Miss, Ms, Other), full given names, surname, date of birth, occupation and industry. If retired, simply state "RETIRED". Also include your main country of residence if not Australia, your residential address (note that PO Boxes are not accepted), and your postal address for communication.

- Residency Details: Indicate your residency status by marking the appropriate box. Choices include Australian citizen/resident, New Zealand citizen, non-resident, or holder of a Retirement Visa subclass 405/410. Temporary resident visa holders should proceed to Section 8 and reference the 'Temporary resident brochure for superannuation' for further instructions.

- Withdrawal Instructions: Specify your intention by either choosing to close your account or withdraw a specific amount. If withdrawing, indicate whether the payment is to be made to you or rolled over to another superannuation fund. Specify how you'd like the withdrawal to be distributed across your investment options if not proceeding with a full account closure.

- Payment Instructions: Select your preferred payment method by marking either to credit your Australian financial institution account or to mail a cheque to your address. This selection will override any previous nominations for payment methods.

- Details of Account to be Credited: If you've chosen to credit an account, provide the name of the Australian financial institution, branch name, branch number (BSB), account number, and the account holder's name. Ensure that the account is in your name.

- Rollover Details: Should you prefer to rollover your withdrawal to another superannuation fund, complete this section with details of the rollover institution(s), including account/membership numbers, Australian Business Number (ABN) or Unique Superannisation Identifier (USI), fund name, and postal address. If more than two rollovers are required, attach a separate letter with the necessary information.

Upon completing the form, review all sections to confirm the accuracy of the information provided. Any inaccuracies or incomplete fields could delay the processing of your request. If assistance is required at any stage, don't hesitate to contact the provided support number for guidance.

Obtain Answers on Essential Super Withdrawal

Is the Essential Super withdrawal form the correct one for me?

This form is applicable if you intend to withdraw some or all units from your fund, whether as a cash withdrawal or a rollover to another super fund. However, to cash out your super, specific conditions of release and eligibility criteria must be met. For further information, consult the current Product Disclosure Statement (PDS) or contact customer support.

What should I consider before withdrawing from my super fund?

Tax implications may arise, especially if you're under 60 years of age. It's beneficial to seek advice from a financial adviser to understand the tax liabilities that could apply to your withdrawal.

Withdrawing or transferring your super may lead to the loss of insurance cover provided by the super fund. Since insurance is a significant benefit, consider the necessity of new applications, potential increase in premiums, and the likelihood of coverage denial post-withdrawal.

Consider the impact on your eligibility for deductions for personal super contributions, which might be reduced or lost based on the nature of your withdrawal.

Reflect on the long-term implications on your retirement savings, noting that premature withdrawals could undermine your financial security in retirement.

Be cautious of the timing of your withdrawal, as it may lock in any unrealized investment losses, especially if the market value of your investment has recently decreased.

How do I proceed with a withdrawal?

Withdrawals for rollovers to another super fund can occur at any time, providing you meet the minimum account balance requirements. For a cash withdrawal, satisfying a condition of release along with the eligibility criteria is mandatory. Furthermore, completion of an Identification and Verification form is required for identity confirmation. Typically, super benefits are disbursed within seven business days following the receipt of your request, though delays can occur.

Can I cancel my withdrawal request?

Yes, you have the option to cancel your withdrawal request, but this must be communicated before 3pm Sydney time on the day your request is received by the trustee. Ensure to consider this timeframe to successfully cancel any unintended withdrawals.

What if I am a temporary resident?

If you have ever been a temporary resident of Australia, particular conditions of release apply to you. It's essential to review the brochure on Temporary Residents available on the Commonwealth Bank website or by contacting customer support for comprehensive information regarding your entitlements to super benefits under these specific circumstances.

Common mistakes

Not checking if they meet the eligibility criteria and conditions of release before submitting a withdrawal request. It is essential to understand the terms under which you can withdraw funds, such as reaching a certain age or meeting specific conditions. Failing to meet these criteria can lead to the denial of your request.

Incomplete or incorrect personal details. The form requires accurate and complete information, including your Essential Super account number, full name, and other personal details. Errors or omissions can cause delays or result in the rejection of your application.

Forgetting to specify the withdrawal instructions clearly. You must indicate whether the withdrawal is to be paid to you, rolled over to another superannuation fund, or a combination of both. Unclear or missing instructions can prevent the processing of your request.

Selecting an incorrect payment method or providing incorrect bank account details. If you wish for the withdrawal to be credited to your bank account, ensuring the account name, BSB, and account number are correct is crucial. Mistakes here can lead to funds being sent to the wrong account or delays in payment.

Not understanding tax implications and insurance cover effects. Cash withdrawals, especially if under 60, can lead to tax liabilities and affect your tax offset and entitlements. Additionally, withdrawing or transferring your super can lead to the cessation of any linked insurance cover. It's vital to seek advice or thoroughly read the product disclosure statement to understand these impacts.

Overlooking the need for the Identification and Verification form. This form is necessary to establish your identity according to anti-money laundering laws. Failing to complete this form, if not previously done, can halt the entire withdrawal process.

Before submitting the Essential Super Withdrawal form, it is recommended to review all sections carefully, ensure that all required documents and forms are completed, and consider consulting with a financial adviser to understand the full implications of your withdrawal.

Documents used along the form

When handling the Essential Super Withdrawal form, it is important to have all necessary documentation prepared to ensure the process goes smoothly. Various forms and documents may be required to complement the withdrawal request, each serving a different purpose. Understanding these documents is crucial for a seamless process.

- Proof of Identity – This can include a passport, driver’s license, or any other government-issued identification to verify the identity of the person making the withdrawal.

- Product Disclosure Statement (PDS) – Provides detailed information about the superannuation product, including features, benefits, risks, and fees. It helps the investor make informed decisions.

- Tax File Number Declaration – Used for tax purposes, this form ensures taxes on withdrawals are calculated correctly, potentially avoiding unnecessary withholdings.

- Beneficiary Nomination Form – Allows the account holder to nominate or change the beneficiaries of their superannuation benefits.

- Direct Debit Request Form – If the withdrawal includes a rollover to another super fund, this form authorizes the transfer of funds to the new superannuation account.

- Statement of Advice (SOA) – Prepared by a financial adviser, it outlines the advice given, including any recommendations to withdraw or rollover superannuation funds, ensuring the advice suits the person’s financial situation and goals.

- Declaration of Concessional Contributions Form – Used to declare any personal contributions made to the super fund that the individual claims as a tax deduction.

- Notice of Intent to Claim or Vary a Deduction for Personal Super Contributions – Required if intending to claim a tax deduction for personal contributions made to the superannuation fund.

- Consent to Transfer Form – Necessary when transferring insurance cover from one super fund to another, this form ensures the seamless transfer of insurance benefits.

- Letter of Compliance – A document provided by the super fund confirming its compliance with superannuation regulations, often required when rolling over funds to a new provider.

Each of these documents plays a vital role in the superannuation withdrawal process, addressing various legal and regulatory requirements. Having these forms on hand, properly completed, can facilitate a quicker and more efficient withdrawal or rollover, ensuring that all legal obligations are met and the individual’s needs are addressed.

Similar forms

Documents similar to the Essential Super Withdrawal form include:

- 401(k) Distribution Form: This document is used when an individual decides to take money out of their 401(k) plan. Like the Essential Super Withdrawal form, it requires the account holder to specify whether they are taking a full or partial distribution and if the distribution should be transferred (rolled over) to another retirement account or received as cash.

- IRA Withdrawal Form: For withdrawing funds from an Individual Retirement Account (IRA), this form is similar because it also asks the account holder to state the reason for the withdrawal, adheres to certain tax implications, and includes options for direct deposit or check payment, mirroring the process outlined for superannuation withdrawals.

- Benefit Payment Request: Often used in pension plans, this form is another parallel, facilitating the request to receive benefits under various conditions, such as retirement or reaching a specific age, similar to meeting a condition of release on the Essential Super Withdrawal form.

- Life Insurance Claim Form: Similar in the aspect of providing crucial personal information and the reason for claiming (in this case, the event of death, disability, etc.), it partially resembles the withdrawal form’s requirenment for detailed personal and account information for processing.

- Annuity Withdrawal Request Form: This document allows annuity holders to request a partial or full withdrawal from their annuity account. It closely resembles the super withdrawal form by offering options for receiving the payment and necessitating tax consideration.

- Brokerage Withdrawal Request Form: Used to withdraw funds from a brokerage account, this form includes similar sections for banking details, tax considerations, and the option to receive funds as a check or direct deposit, akin to the choices given in the Essential Super Withdrawal form.

- Health Savings Account (HSA) Distribution Request: This form requests withdrawals from an HSA for eligible medical expenses. While for a different purpose, it aligns with the super withdrawal form in handling personal and account details, and the option for the distribution method.

- Tax File Number Declaration Form: While primarily used for tax purposes, this form requires detailed personal information similar to what is requested in the Essential Super Withdrawal form. It’s crucial for updating or providing tax details that could affect the withdrawal process, especially related to tax implications on the distributions.

Each of these documents shares common procedures regarding the withdrawal or distribution of funds, necessitating the provision of personal details, specifying the type of withdrawal, and understanding the tax or account implications that follow.

Dos and Don'ts

When completing the Essential Super Withdrawal form, it's important to understand the right and wrong ways to approach the process. To ensure a smooth experience, here are key dos and don'ts:

- Do carefully read the Product Disclosure Statement before you decide to withdraw funds. It contains crucial information that could impact your decision.

- Do ensure you meet a condition of release and eligibility criteria before withdrawing as cash. Different rules may apply based on your age and circumstances.

- Do fill out all required fields accurately and completely. Incomplete forms can delay processing.

- Do consult with a financial adviser, especially if you're unsure about the tax implications or investment strategies related to withdrawing your super.

- Do check your account details twice if you request a direct credit to your bank. Incorrect information can lead to delayed or misplaced funds.

- Don't overlook the potential tax implications. If you're under 60 and withdrawing as cash, you may be liable for taxes.

- Don't ignore the possibility of losing insurance cover. Withdrawing or transferring your super can affect your insurance benefits within the fund.

- Don't rush the decision without considering the impact on your retirement goals. Withdrawing now could reduce your savings for the future.

- Don't submit without reviewing the withdrawal form for errors. Errors can complicate and prolong the withdrawal process.

- Don't forget to consider the timing of your withdrawal, especially in down markets. Withdrawing at the wrong time can lock in losses.

Misconceptions

Several misconceptions about the Essential Super Withdrawal form have led to confusion among members. Understanding these nuances is crucial for making informed decisions regarding superannuation withdrawals or rollovers.

- Withdrawal is only for cashing out.

One common misunderstanding is that the Essential Super Withdrawal form is exclusively used for cashing out funds. In reality, the form serves multiple purposes, including withdrawing units from your fund as a rollover to another super fund or withdrawing as cash. This flexibility allows members to manage their super more effectively in line with their financial goals and needs.

- Tax implications are straightforward.

Another misconception revolves around the simplicity of tax implications. The reality is more complex, especially if you're under 60 years of age. Cashing out your super could result in a tax liability and possibly affect your eligibility for certain tax offsets and entitlements. The tax treatment depends on a variety of factors, including your age and the withdrawal's nature. This highlights the importance of consulting with a financial adviser to navigate the potential tax consequences.

- Insurance cover remains unaffected by withdrawal.

Many individuals mistakenly believe that withdrawing or rolling over their super does not impact their insurance cover. However, in most cases, withdrawing or transferring your super can lead to the cessation of any insurance cover provided by the fund. Before proceeding, it's critical to consider the implications for your insurance coverage, including potential premium increases or the need to undergo new medical assessments.

- Super withdrawals have no effect on future finances.

A significant misunderstanding is that withdrawing super does not impact future financial wellbeing. Early withdrawals can significantly affect your savings for retirement, not only by reducing your super balance but also by losing the potential compounding returns that could have accumulated over time. Making a withdrawal without careful consideration can jeopardize your ability to meet your long-term retirement goals.

In summary, it's vital to fully understand the details and implications of using the Essential Super Withdrawal form. Misconceptions can lead to unexpected outcomes, potentially affecting your financial security in retirement. Consulting with a financial adviser and thoroughly reading the Product Disclosure Statement (PDS) can provide clarity and assist in making decisions that align with your long-term financial objectives.

Key takeaways

When considering the withdrawal of your superannuation, it's essential to be informed about how the process works, its implications, and the right steps to take. Here are nine key takeaways about filling out and using the Essential Super Withdrawal form:

- Choosing the right form: Ensure this form is appropriate for your needs, whether withdrawing to cash or rolling over to another super fund.

- Meeting conditions: You must satisfy specific conditions and eligibility criteria to make a withdrawal, especially for cashing out your super.

- Considering tax implications: Be aware that cash withdrawals may be taxable if you're under 60, while rollovers generally aren't. Financial advice can help navigate these complexities.

- Insurance coverage: Withdrawing or transferring your super may lead to the cessation of any attached insurance benefits, which necessitates understanding the implications and possibly arranging new coverage.

- Potential impacts on tax deductions: Withdrawing from your super could affect your ability to claim a deduction for personal super contributions, particularly for self-employed individuals.

- Long-term retirement goals: Early withdrawal might compromise your retirement savings and the benefits of compound interest, so consider the long-term effects on your financial health.

- Market timing risks: Withdrawing during market downturns could realize paper losses, so it's crucial to assess the timing of your withdrawal.

- Procedural necessities: The Essential Super Withdrawal form requires complete and accurate information, including verifying your identity and understanding the implications of withdrawal timings and methods.

- Seek professional advice: Consulting with a financial adviser or the fund's support services can provide clarity and guidance tailored to your situation, especially for understanding potential taxation, investment, and insurance implications.

Completing the Essential Super Withdrawal form is a significant decision with immediate and future financial impacts. It's crucial to approach this process with a full understanding of the implications, possible penalties, and by seeking the right advice to ensure that your financial wellbeing is maintained. Remember, the choice to withdraw from your super fund should align with your long-term financial goals and retirement planning strategies.

Popular PDF Forms

Baker Act Florida Form - Gathers information to aid law enforcement in safely escorting individuals to a receiving facility for assessment.

Uscg Documentation Center - Filling out the CG-1258 helps establish eligibility for documentation and preferred ship's mortgage status.

Truck Wash Receipt - Recommendation for drivers to carefully review their Trailer Washout Tickets for complete details including the washout cost and trailer number to avoid any load rejection.