Blank F8 PDF Template

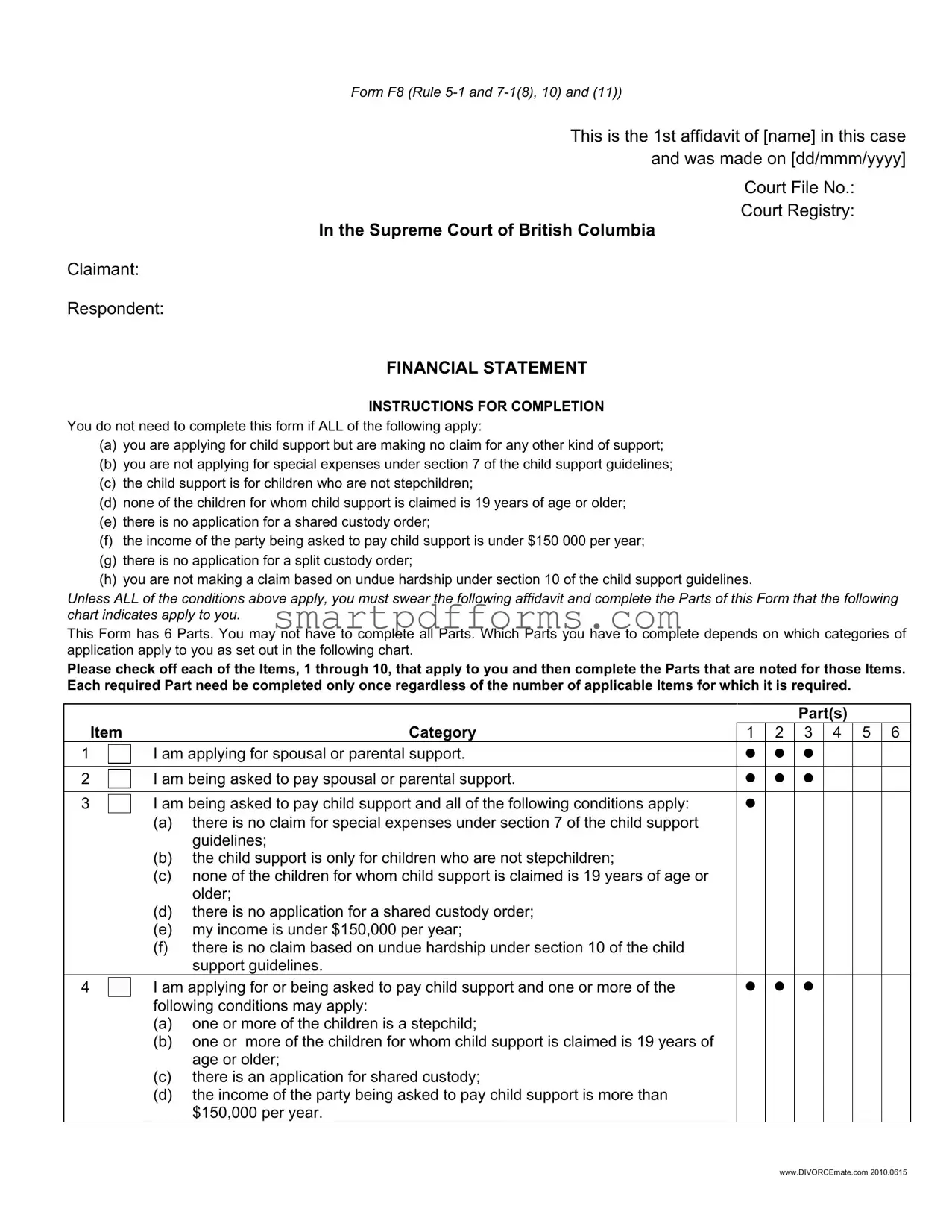

In the landscape of legal forms important for family law in the Supreme Court of British Columbia, the F8 form stands out for its comprehensive approach to financial disclosures during a divorce or separation. The essence of this form, also known as the Financial Statement, is to present a clear, sworn statement of one's financial standing, which is crucial in resolving matters related to child support, spousal support, and other financial claims. Its structure is designed to ensure that parties provide all necessary information about their income, assets, and expenses in a detailed manner. Starting with a declaration that sets the stage for the affidavit, it guides the declarant through several parts where they're required to disclose employment information, income details from various sources, and adjust these figures in accordance to specific guidelines. The requirement to complete this form is waived only under a very specific set of conditions, directly linked to the simplicity or complexity of the financial issues at stake. Whether one is applying for child support without any other claims, or dealing with shared custody orders and incomes exceeding certain thresholds, the F8 becomes an indispensable document. It cleverly breaks down income types and expected changes, ensuring that any claims made are well-supported, and any ordered payments are fair and in line with the financial realities of both parties involved.

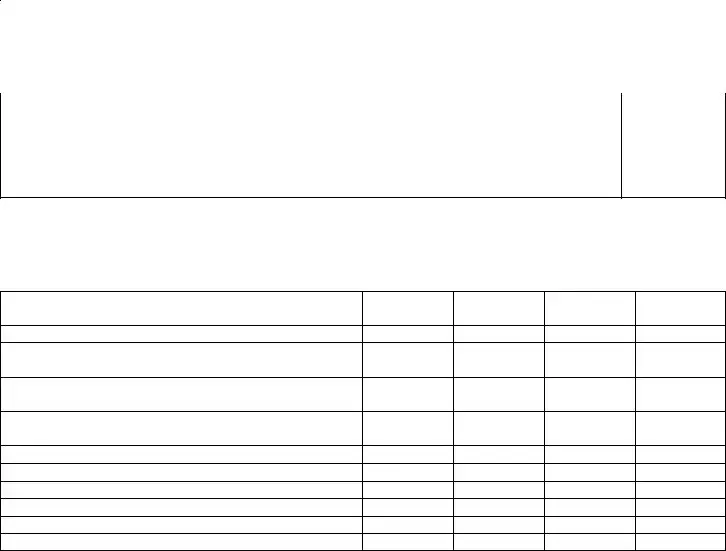

Preview - F8 Form

Form F8 (Rule

This is the 1st affidavit of [name] in this case and was made on [dd/mmm/yyyy]

Court File No.:

Court Registry:

In the Supreme Court of British Columbia

Claimant:

Respondent:

FINANCIAL STATEMENT

INSTRUCTIONS FOR COMPLETION

You do not need to complete this form if ALL of the following apply:

(a)you are applying for child support but are making no claim for any other kind of support;

(b)you are not applying for special expenses under section 7 of the child support guidelines;

(c)the child support is for children who are not stepchildren;

(d)none of the children for whom child support is claimed is 19 years of age or older;

(e)there is no application for a shared custody order;

(f)the income of the party being asked to pay child support is under $150 000 per year;

(g)there is no application for a split custody order;

(h)you are not making a claim based on undue hardship under section 10 of the child support guidelines.

Unless ALL of the conditions above apply, you must swear the following affidavit and complete the Parts of this Form that the following chart indicates apply to you.

This Form has 6 Parts. You may not have to complete all Parts. Which Parts you have to complete depends on which categories of application apply to you as set out in the following chart.

Please check off each of the Items, 1 through 10, that apply to you and then complete the Parts that are noted for those Items. Each required Part need be completed only once regardless of the number of applicable Items for which it is required.

|

|

|

|

|

Part(s) |

Item |

Category |

1 |

2 |

3 4 5 6 |

|

1 |

|

I am applying for spousal or parental support. |

|

|

|

|

|||||

|

|

|

|

|

|

2 |

|

I am being asked to pay spousal or parental support. |

|

|

|

|

|||||

|

|

|

|

|

|

3 |

|

I am being asked to pay child support and all of the following conditions apply: |

|

|

|

|

|

|

|||

(a)there is no claim for special expenses under section 7 of the child support guidelines;

(b)the child support is only for children who are not stepchildren;

(c)none of the children for whom child support is claimed is 19 years of age or older;

(d)there is no application for a shared custody order;

(e)my income is under $150,000 per year;

(f)there is no claim based on undue hardship under section 10 of the child support guidelines.

4 |

|

I am applying for or being asked to pay child support and one or more of the |

|

|

|

|

following conditions may apply: |

|

|

|

|

(a) |

one or more of the children is a stepchild; |

|

|

|

(b) |

one or more of the children for whom child support is claimed is 19 years of |

|

|

|

|

age or older; |

|

|

|

(c) |

there is an application for shared custody; |

|

|

|

(d) |

the income of the party being asked to pay child support is more than |

|

|

|

|

$150,000 per year. |

|

www.DIVORCEmate.com 2010.0615

Form F8 – Financial Statement |

|

|

|

|

Page 2 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part(s) |

|

||

Item |

Category |

1 |

2 |

3 |

4 |

5 |

6 |

|

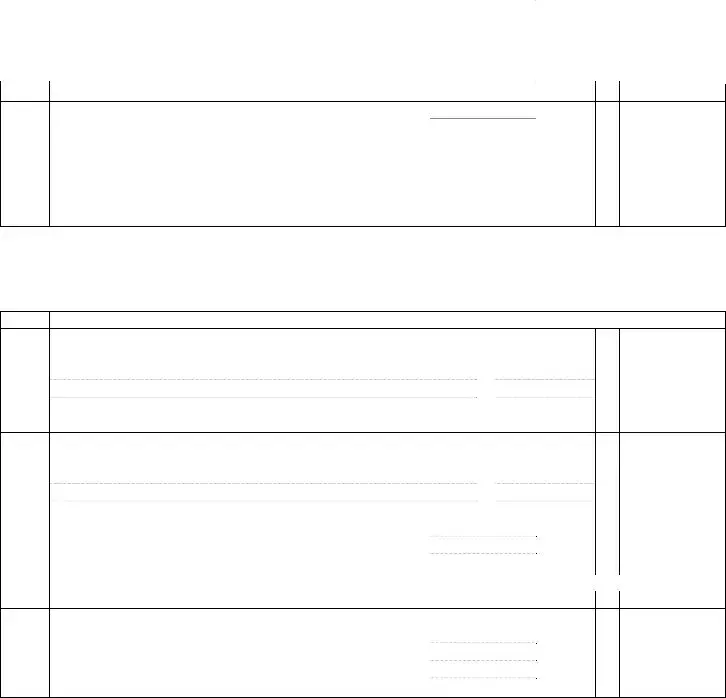

5 |

|

I am being asked to pay child support and I intend to make a hardship claim under |

|

|

|

|

|

|

|

|

|||||||

|

|

the child support guidelines. |

|

|

|

|

|

|

6 |

|

I am applying for child support and the opposite party intends to make a hardship |

|

|

|

|

|

|

|

|

|

||||||

|

|

claim under the child support guidelines. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

Either I claim child support or I am being asked to pay child support and there is |

|

|

|

|

|

|

|

|

a claim for special expenses under section 7 of the child support guidelines. |

|

|

|

|

|

|

8 |

|

I am making or responding to a property claim under Part 5 of the Family |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Relations Act. |

|

|

|

|

|

|

Include parts |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

I, [name], of [address for service], SWEAR (OR AFFIRM) THAT:

1.The information set out in this financial statement is true and complete to the best of my knowledge.

[Check whichever of the following boxes is correct and complete any required information.]

2.[ ] I do not anticipate any significant changes in the information set out in this financial statement. [ ] I anticipate the following significant changes in the information set out in this financial statement:

SWORN/AFFIRMED BEFORE ME at [Sworn City]

British Columbia on [dd/mmm/yyyy]

A Commissioner for taking affidavits for British Columbia

[Print name or affix stamp of commissioner]

[name]

Form F8 – Financial Statement |

Page 3 |

PART 1 – INCOME

A.Employer information:

[ ] I am employed by [name and address of employer] [ ] I am self employed as [trade or occupation]

[ ] I operate an unincorporated business, the name and address of which is [name and address of business]

B.Documentation supplied:

I have attached to this statement or serve with it a copy of each of the following applicable income

documents: (Check the first 2 boxes and check each other box that applies to you and provide the documents referred to beside each checked box)

[x] every personal income tax return, including all attachments, that I have filed for each of the 3 most recent taxation years;

[x] every income tax notice of assessment or reassessment I have received for each of the 3 most recent taxation years;

[] (if you are an employee) my most recent statement of earnings indicating the total earnings paid in the year to date, including overtime, or, if such a statement is not provided by my employer, a letter from my employer setting out that information, including my rate of annual salary or remuneration;

[] (if you are receiving Employment Insurance benefits) my 3 most recent EI benefit statements;

[] (if you are receiving Workers’ Compensation benefits) my 3 most recent WCB benefit statements;

[] (if you are receiving social assistance) a statement confirming the amount of social assistance that I receive;

[] (if you are

(i)the financial statements of my business or professional practice, other than a partnership, and

(ii)a statement showing a breakdown of all salaries, wages, management fees or other payments or benefits paid to, or on behalf of, persons or corporations with whom I do not deal at arm’s length;

[] (if you are a partner in a partnership) confirmation of my income and draw from, and capital in, the partnership for its 3 most recent taxation years;

[] (if you control a corporation) for the corporation’s 3 most recent taxation years

(i)the financial statements of the corporation and its subsidiaries, and

(ii)a statement showing a breakdown of all salaries, wages, management fees or other payments or benefits paid to, or on behalf of, persons or corporations with whom the corporation and every related corporation does not deal at arm’s length;

[] (if you are a beneficiary under a trust) the trust settlement agreement and the trust’s 3 most recent financial statements;

[] (if you own or have an interest in real property) the most recent assessment notice issued from an assessment authority for the property.

NOTE: If the applicable income documents are not attached to or served with this financial statement, they must nonetheless be provided to the other party if and as required by Rule

Form F8 – Financial Statement |

Page 4 |

C.ANNUAL INCOME

If line 150 (total income) of your most recent federal income tax return sets out what you expect your income will be for this year and you are not obliged under Note 1 below to complete Schedule A of this Form, ignore lines 1 to 7 below and record the number from line 150 of your most recent federal income tax return at line 8 below. Otherwise, record what you expect your income for this year to be from each of the following sources of income that applies to you. Record gross annual amounts.

LINE |

GUIDELINE INCOME FOR BASIC CHILD SUPPORT CLAIM |

|

|

|

||||||||||||

|

Sources and amounts of annual income |

|

|

|

|

|

|

|

|

|

|

|

||||

1 |

Employment income |

paid: |

|

|

|

|

|

monthly |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

twice each month |

every 2 weeks |

|

|

weekly |

|

|

annually |

+ |

|

$0.00 |

|||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Employment insurance benefits |

|

|

|

|

|

|

|

|

+ |

|

|

||||

3 |

Workers’ compensation benefits |

|

|

|

|

|

|

|

|

+ |

|

|

||||

4 |

Interest and investment income |

|

|

|

|

|

|

|

|

+ |

|

|

||||

5 |

Pension income |

|

|

|

|

|

|

|

|

|

+ |

|

|

|||

6 |

Social assistance income relating to self |

|

|

|

|

|

|

|

|

+ |

|

|

||||

7 |

Other income (attach Schedule A) – see Note 1 |

|

|

|

|

|

|

|

|

+ |

|

$0.00 |

||||

8 |

|

|

|

|

Child support guidelines income before adjustments |

= |

|

$0.00 |

||||||||

|

(If you are required to complete lines 1 through 7 above, total the amounts of those lines here. |

|

|

|

||||||||||||

|

Otherwise, record the number from line 150 of your most recent federal |

|

|

|

|

|

|

|||||||||

|

income tax return) |

|

|

|

|

|

|

Line 150 Income (if applicable) |

|

|

|

|||||

|

Adjustments to income |

|

|

|

|

|

|

|

|

|

|

|

|

|||

9 |

Subtract union and professional dues |

|

|

|

|

|

|

|

|

- |

|

|

||||

10 |

Adjustments in accordance with Schedule III of the Guidelines per line 8 |

+ |

|

$0.00 |

||||||||||||

|

of Schedule B (attached) – see Note 2 |

|

|

|

|

|

|

|

|

|

|

|

||||

11 |

|

|

|

Child support guidelines income for basic child support |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

|

|

(line 8 as adjusted by lines 9 and 10) |

|

|

|

|||||

|

|

|

|

|

||||||||||||

|

CHILD SUPPORT GUIDELINE INCOME TO DETERMINE SPECIAL EXPENSES |

|

|

|

||||||||||||

|

Child support guideline income (from line 11 of this table) |

|

|

|

+ |

|

$0.00 |

|||||||||

12 |

Add spousal support received from the other party to the family law case |

+ |

|

|

||||||||||||

13 |

Subtract spousal support paid to the other party to the family law case |

- |

|

|

||||||||||||

14 |

Add Universal Child Care Benefits relating to children for whom special or |

+ |

|

|

||||||||||||

|

extraordinary expenses are sought |

|

|

|

|

|

|

|

|

|

|

|

||||

15 |

|

|

|

Child support guidelines income to determine special expenses |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

(line 11 as adjusted by lines 12, 13 and 14) |

|

|

|

|||||||

|

|

|

|

|

||||||||||||

|

INCOME TO BE INCLUDED FOR SPOUSAL OR PARENTAL SUPPORT CLAIM |

|

|

|

||||||||||||

|

Child support guideline income (from line 11 of this table) |

|

|

|

+ |

|

$0.00 |

|||||||||

16 |

Total child support received |

|

|

|

|

|

|

|

|

|

+ |

|

|

|||

17 |

Social assistance received for other members of household |

|

|

|

+ |

|

|

|||||||||

18 |

Child Tax Benefit and BC Family Bonus |

|

|

|

|

|

|

|

|

+ |

|

|

||||

19 |

|

|

|

Total income to be used for a spousal or parental support claim |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

|

|

|

(line 11 plus lines 16, 17 and 18) |

|

|

|

||||

Note: |

1. You must complete Schedule A of this Form and include, at line 7 above, the total income recorded at line 11 of |

|

||||||||||||||

|

|

Schedule A, if you expect to receive income this year from any of the following sources: |

|

|

|

|||||||||||

|

|

(a) taxable dividends from Canadian corporations; |

|

(e) |

registered retirement savings income; |

|

||||||||||

|

|

(b) net partnership income (limited or |

|

(f) |

|

|

|

|||||||||

|

|

|

|

partners only); |

|

|

(g) any other taxable income that is not included in |

|

||||||||

|

|

(c) |

rental income; |

|

|

|

|

paragraphs (a) to (f) or in lines 1 to 5 of Schedule A. |

||||||||

|

|

(d) |

taxable capital gains; |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.If there are any adjustments as set out in Schedule III of the child support guidelines that apply to you, you must

(a)complete Schedule B of this Form, and

(b)include at line 10 above, the amount recorded at line 8 of that completed Schedule B.

Form F8 – Financial Statement |

|

|

|

|

Page 5 |

|

|

|

SCHEDULE A – OTHER INCOME |

|

|

|

|

|

|

|

|

|

|

|

LINE |

OTHER SOURCES OF INCOME |

|

|

|

||

1 |

Self employment income: |

Gross = |

|

Net = |

+ |

|

|

Note: Provide financial statements of the business, including any statement of business activities filed |

|

|

|||

|

as part of your income tax return |

|

|

|

|

|

2 |

Other employment income |

|

|

|

+ |

|

3 |

Net partnership income: limited or |

|

+ |

|

||

4 |

Rental income: |

Gross = |

|

Net = |

+ |

|

|

|

|

|

|

||

5 |

Total amount of dividends from Taxable Canadian Corporations |

|

+ |

|

||

6Total capital gains

|

minus total capital losses |

- |

= |

+ |

$0.00 |

|

|

|

|

|

|

|

|

7 |

Spousal support from another relationship or marriage |

|

|

|

+ |

|

8 |

Registered retirement savings plan income |

|

|

|

+ |

|

9 |

Net federal supplements |

|

|

|

+ |

|

10 |

Any other income |

|

|

|

+ |

|

11 |

|

Total of lines 1 through 10 |

= |

$0.00 |

||

SCHEDULE B – ADJUSTMENTS TO INCOME

LINE DEDUCTIONS

1Employment expenses, other than union or professional dues, claimed under Schedule III of the Child Support Guidelines (list)

|

Total |

- |

$0.00 |

2 |

Actual business investment losses during the year |

- |

|

3Carrying charges and interest expenses paid and deductible under the Income Tax Act (Canada): (list)

|

|

|

Total |

- |

$0.00 |

4 |

Prior period earnings |

|

|

|

|

|

minus reserves |

- |

= |

- |

$0.00 |

|

|

|

|

||

5 |

Portion of partnership and sole proprietorship income required to be reinvested |

- |

|

||

|

ADDITIONS |

|

|

|

|

6 |

Capital cost allowance for real property |

|

|

+ |

|

7Employee stock options in

minus amount paid for shares |

- |

|

|

minus amount paid to acquire option |

- |

= + |

$0.00 |

|

|

|

|

8 |

|

Total adjustments |

$0.00 |

Form F8 – Financial StatementPage 6

PART 2 – EXPENSES

|

Monthly |

|

Compulsory deductions |

|

|

CPP contributions |

|

|

EI premiums |

|

|

Income Taxes |

|

|

Employee pension contributions |

|

|

Other (specify) |

|

|

|

|

|

Compulsory Deductions |

$0.00 |

|

Housing |

|

|

Rent or mortgage |

|

|

Property taxes |

|

|

Property insurance |

|

|

Water, sewer, garbage |

|

|

Strata fees |

|

|

House repairs and maintenance |

|

|

Other (specify) |

|

|

|

|

|

Housing |

$0.00 |

|

Utilities |

|

|

Heat and electricity |

|

|

Telephone |

|

|

Cable TV |

|

|

Other (specify) |

|

|

|

|

|

Utilities |

$0.00 |

|

Household expenses |

|

|

Food |

|

|

Household supplies |

|

|

Meals outside the home |

|

|

Furnishings and equipment |

|

|

Other (specify) |

|

|

|

|

|

Household expenses |

$0.00 |

|

Transportation |

|

|

Public transit, taxis |

|

|

Gas and oil |

|

|

Car insurance and license |

|

|

Parking |

|

|

Repairs and maintenance |

|

|

Lease payments |

|

|

Other (specify) |

|

|

Transportation |

$0.00 |

|

Other |

|

|

Charitable donations |

|

|

Vacation |

|

|

Pet care |

|

|

Newspapers, publications |

|

|

Other (specify) |

|

|

Form F8 – Financial Statement |

Page 7 |

||

|

|

|

|

|

|

|

|

Other |

$0.00 |

||

Health |

|

||

MSP premiums |

|

|

|

Extended health premiums |

|

|

|

Dental plan premiums |

|

|

|

Health care (net of coverage) |

|

|

|

Drugs (net of coverage) |

|

|

|

Dental care (net of coverage) |

|

|

|

Other (specify) |

|

|

|

Health |

$0.00 |

||

Personal |

|

||

Clothing |

|

|

|

Hair care |

|

|

|

Toiletries, cosmetics |

|

|

|

Education (specify) |

|

|

|

Life insurance |

|

|

|

Dry cleaning/laundry |

|

|

|

Entertainment/recreation |

|

|

|

Gifts |

|

|

|

Other (specify) |

|

|

|

Personal |

$0.00 |

||

Children |

|

||

Child care |

|

|

|

Clothing |

|

|

|

Hair care |

|

|

|

School fees and supplies |

|

|

|

Entertainment/recreation |

|

|

|

Activities and lessons |

|

|

|

Gifts |

|

|

|

Insurance |

|

|

|

Other (specify) |

|

|

|

|

|

|

|

Children |

$0.00 |

||

Savings |

|

||

RRSP |

|

|

|

RESP |

|

|

|

Other (specify) |

|

|

|

|

|

|

|

Savings |

$0.00 |

||

Support payments to others (specify) |

|

||

|

|

|

|

|

|

|

|

Support payments to others |

$0.00 |

||

Debt payments (specify) |

|

||

|

|

|

|

|

|

|

|

Debt payments |

$0.00 |

||

TOTAL MONTHLY EXPENSES |

$0.00 |

||

TOTAL ANNUAL EXPENSES |

$0.00 |

||

(multiply TOTAL MONTHLY EXPENSES BY 12) |

|||

|

|||

Form F8 – Financial Statement |

|

|

Page 8 |

|

PART 3 – PROPERTY |

|

|

||

ASSETS |

|

|

|

|

|

|

|

|

|

1. Real Estate |

|

|

|

|

• Attach a copy of the most recent assessment notice for any property that you own or in which you have an |

|

|||

interest. |

|

|

|

|

• Provide details, including address or legal description and nature of interest, of any interest you have in land, |

|

|||

including leasehold interests and mortgages, whether or not you are registered as owner. |

|

|

||

• Record the estimated market value of your interest without deducting encumbrances or costs of disposition. |

|

|||

(Record encumbrances under DEBTS below.) |

|

|

|

|

Details |

|

Date Acquired |

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate |

$0.00 |

|

2. Vehicles |

|

|

|

|

• List cars, trucks, motorcycles, trailers, motor homes, boats, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicles |

$0.00 |

|

3. Financial assets |

|

|

|

|

• List savings and chequing accounts, term deposits, GIC’s, stocks, bonds, Canada Savings Bonds, mutual |

|

|||

funds, insurance policies (indicate beneficiaries), accounts receivable, etc. |

|

|

||

• Record account number and name of institution where accounts are held. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial assets |

$0.00 |

|

4. Pensions and RRSP’s |

|

|

|

|

• Record name of institution where accounts are held, name and address of pension plan and pension details. |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Pensions and RRSP’s |

$0.00 |

|

5. Business Interests |

|

|

|

|

• List any interest you hold, directly or indirectly, in any unincorporated business, including partnerships, trusts |

|

|||

and joint ventures. |

|

|

|

|

• List any interests you hold in incorporated businesses. |

|

|

|

|

• Record the name and address of the company. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business interests |

$0.00 |

|

6. Other |

|

|

|

|

• Include precious metals, collections, works of art and any jewellery or household items of extraordinary value. |

|

|||

• Include location of safety deposit boxes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

$0.00 |

|

|

|

TOTAL |

$0.00 |

Form F8 – Financial Statement |

Page 9 |

DEBTS

Show your debts & other liabilities, whether arising from personal or business dealings, by category, such as mortgages, charges, liens, notes, credit cards, accounts payable and tax arrears. Include contingent liabilities such as guarantees and indicate that they are contingent.

Secured Debt Details |

Date Incurred |

Amount |

|

(list mortgages and other secured debts) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured debts |

$0.00 |

|

Unsecured Debt Details |

|

|

|

(list bank loans, personal loans, credit cards and other unsecured debts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured debts |

$0.00 |

|

|

|

TOTAL |

$0.00 |

DISPOSAL OF PROPERTY

(List all property disposed of during the 2 years preceding this statement or, if the parties married within that 2 year period, since the date of marriage.)

Description |

Date of Disposal |

Value |

(describe the property disposed of) |

(month, day, year) |

|

|

|

|

|

|

|

|

|

|

Total |

$0.00 |

PART 4 – SPECIAL OR EXTRAORDINARY EXPENSES

Note:

1.Provide a separate statement under this Part 4 for each child for whom a claim is made.

2.To calculate a net amount, subtract, from the gross amount, subsidies, benefits, income tax deductions or credits relating to the expense.

Name of child: |

Annual |

Annual |

Monthly |

Monthly |

|

Gross |

Net |

Gross |

Net |

Child care expense

Medical/dental insurance premiums attributable to child

Health related expenses that exceed insurance reimbursement by at least $100

Extraordinary expenses for primary or secondary school

Post secondary education expenses

Extraordinary extracurricular expenses (list)

Subtract contributions from child

Total |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

Financial Statement |

|

|

|

Page 10 |

|

|

|

|

|

Name of child: |

Annual |

Annual |

Monthly |

Monthly |

|

Gross |

Net |

Gross |

Net |

Child care expense |

|

|

|

|

Medical/dental insurance premiums attributable to |

|

|

|

|

child |

|

|

|

|

Health related expenses that exceed insurance |

|

|

|

|

reimbursement by at least $100 |

|

|

|

|

Extraordinary expenses for primary or secondary |

|

|

|

|

school |

|

|

|

|

Post secondary education expenses |

|

|

|

|

Extraordinary extracurricular expenses (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract contributions from child |

|

|

|

|

Total |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

|

|

|

|

Name of child: |

Annual |

Annual |

Monthly |

Monthly |

|

Gross |

Net |

Gross |

Net |

Child care expense |

|

|

|

|

Medical/dental insurance premiums attributable to |

|

|

|

|

child |

|

|

|

|

Health related expenses that exceed insurance |

|

|

|

|

reimbursement by at least $100 |

|

|

|

|

Extraordinary expenses for primary or secondary |

|

|

|

|

school |

|

|

|

|

Post secondary education expenses |

|

|

|

|

Extraordinary extracurricular expenses (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract contributions from child |

|

|

|

|

Total |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

|

|

|

|

Name of child: |

Annual |

Annual |

Monthly |

Monthly |

|

Gross |

Net |

Gross |

Net |

Child care expense |

|

|

|

|

Medical/dental insurance premiums attributable to |

|

|

|

|

child |

|

|

|

|

Health related expenses that exceed insurance |

|

|

|

|

reimbursement by at least $100 |

|

|

|

|

Extraordinary expenses for primary or secondary |

|

|

|

|

school |

|

|

|

|

Post secondary education expenses |

|

|

|

|

Extraordinary extracurricular expenses (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract contributions from child |

|

|

|

|

Total |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

Form Data

| Fact | Detail |

|---|---|

| Form Name | Form F8 – Financial Statement |

| Applicable Rules | Rule 5-1 and 7-1(8), 10 and (11) |

| Purpose | To provide a financial affidavit in family law cases. |

| Exemption Conditions | Applicants for child support not claiming other supports or special expenses, among others. |

| Parts of the Form | 6 Parts, completion depends on the applicant's circumstances. |

| Affidavit Requirement | Sworn affidavit affirming the truthfulness and completeness of the provided financial statement. |

| Governing Law | The Supreme Court of British Columbia, Canada |

| Income Documentation | Includes tax returns, income tax notices of assessment, employment earnings, and other income sources. |

Instructions on Utilizing F8

Before diving into the specifics of completing the Form F8, also known as the Financial Statement, let's understand what comes next. After gathering all relevant financial information and documents, you will proceed to fill out the Form F8, following the outlined steps closely. This process is a necessary step towards ensuring your financial affairs are accurately represented within the legal context of your situation. Remember, accuracy and honesty are crucial in completing this form, as it helps in establishing a fair and effective resolution.

- Start by reading the instructions thoroughly to determine if you indeed need to fill out this form. Check the conditions listed at the beginning.

- Enter the 1st affidavit of (name) and the date it was made in the format (dd/mmm/yyyy).

- Fill in the Court File No.: and Court Registry: fields with the corresponding information.

- Under the sections Claimant and Respondent, fill out the names of the involved parties.

- Proceed to the section that lists items 1 through 10, checking off each item that applies to you. Refer to the chart to identify which parts of the form you must complete based on the items selected.

- Under PART 1 – INCOME, select the correct employment status box and provide the requested employer or business information.

- Check the boxes next to the required documents you have attached and provide documents referred to beside each checked box under the Documentation supplied section.

- Fill out the ANNUAL INCOME section with your expected income for the year from various sources, using gross annual amounts.

- If necessary, complete the adjustments to income according to guidelines in Schedule III and include these in the appropriate fields.

- For special expenses, support claims, and other incomes, follow the guidelines to add or subtract amounts as specified to determine the respective incomes for those categories.

- Complete SCHEDULE A – OTHER INCOME if applicable, including details of any additional income sources not covered in the main part of the form.

- In the section SCHEDULE B – ADJUSTMENTS TO INCOME, list any deductions or additions as per the child support guidelines that apply to your situation.

- Make sure to check off the statement regarding anticipated significant changes in your financial statement and provide details if there are any expected changes.

- Sign the affidavit before a Commissioner for taking affidavits in British Columbia, ensuring you include the date and location of signing as well as the printed name or stamp of the commissioner.

Upon completing these steps, you'll have accurately filled out the F8 Financial Statement. Ensure you've provided all necessary documentation and information truthfully to the best of your knowledge. This document will then play a crucial role in the legal considerations of your case, helping to guide decisions related to financial matters. It is advisable to double-check all the entered information for its accuracy and completeness before submission.

Obtain Answers on F8

-

What is Form F8 and who needs to complete it?

Form F8, known as the Financial Statement, is a crucial document in the Supreme Court of British Columbia for cases involving claims for support or division of property. You must complete this form unless your case solely involves applying for child support without any other claims for support, if the child support is not for stepchildren, all children are under 19, there's no shared or split custody order involved, the income of the party being asked for child support is under $150,000, and there are no undue hardship claims. If your situation does not meet all these criteria, Form F8 will need to be filled out thoroughly and truthfully.

-

What are the essential parts of Form F8 that need to be completed?

Form F8 comprises six parts, and which sections you need to complete depends on your case's specifics. For example, if you're applying for spousal or parental support, being asked to pay such support, or involved in child support claims that don't fit into the simplified criteria, you'll likely need to complete multiple sections. Important areas include personal and employer information, documentation of income such as tax returns, and detailed sections on your annual income. Carefully review the list of conditions at the beginning of the form to determine which parts apply to your case.

-

How do I know if I have to provide additional documents with my Form F8?

The F8 form requires you to attach or serve copies of certain financial documents alongside the form itself. These documents include, but are not limited to, your personal income tax returns from the last three years, notices of assessment, statements of earnings, benefits statements (if applicable), and financial statements of any businesses you own or have an interest in. The form provides a detailed checklist. Make sure each applicable box is ticked and the corresponding document is included. If the necessary income documents are not attached or served with the financial statement, they must be provided to the other party as required by the Supreme Court Family Rules.

-

What happens if I expect changes in my financial situation?

In the affidavit section of Form F8, you are asked to declare whether you anticipate any significant changes in your financial information. If you expect changes—such as an increase or decrease in your income, changes in employment, or any other financial adjustments—you must indicate this on the form and provide the anticipated details. It's vital to disclose this information, as it can affect the court's decision regarding support payments and settlements. Transparency and honesty in completing this form are paramount to ensuring a fair outcome in your case.

Common mistakes

When navigating the complexities of completing Form F8 for the Supreme Court of British Columbia, people often encounter a few common pitfalls. Recognizing and avoiding these mistakes can significantly smooth the process. Here's a simplified guide to help you through.

Not verifying eligibility: One common mistake is failing to determine whether they need to complete the form at all. The form explicitly outlines scenarios where filling it out is unnecessary.

Ignoring specific instructions: Each section of Form F8 serves a unique purpose, and skipping instructions can lead to incomplete or incorrect submissions.

Overlooking required attachments: Documentation is crucial for a comprehensive financial statement. Missing out on attaching required documents like tax returns or income statements can delay proceedings.

Estimating financial details: Accurate and precise financial information is paramount. Estimations can lead to miscalculations in obligations or entitlements.

Omitting changes in financial situations: Future financial changes must be disclosed. An anticipated job loss or salary increase affects financial assessments.

Failure to detail all sources of income: Every penny counts. Not listing all income sources, such as rental income or dividends, can result in an inaccurate portrayal of financial status.

Incorrectly calculating annual income: The form requires a detailed breakdown of annual income, and a wrong calculation can affect the outcomes for child or spousal support.

Overlooking the necessity of schedule attachments: For certain income types, additional schedules (Schedule A or B) are required. Neglecting these can invalidate the financial statement.

Avoiding these mistakes not only ensures a smoother process but also contributes to a fairer evaluation of financial circumstances, ultimately benefiting all parties involved in the legal proceedings.

Documents used along the form

When completing the Form F8 for financial matters in family law cases, several other forms and documents are often needed to ensure the court has a comprehensive understanding of the financial situation. These documents help paint a full picture of one's financial stance, supporting claims for support, division of property, and other financial orders. We’ll explore some of these key documents, helping you understand their purpose and importance in legal proceedings.

- Form F9 - Response to Financial Statement: This document is used by the opposing party to respond or contest the claims made in Form F8.

- Form F10 - Notice of Application: Utilized to notify the court and the other party of an intention to seek a court order, often related to financial matters discussed in Form F8.

- Form F30 - Affidavit: A sworn statement of fact that accompanies Form F8, providing evidence and detailed descriptions of financial circumstances.

- Income Tax Returns: Recent tax return documents are crucial for verifying the income details provided in Form F8.

- Pay Stubs: Current pay stubs offer real-time evidence of an individual's earnings, which are necessary to support the income declared in the financial statement.

- Property Assessments: Documents showing the value of real estate owned by the individual, relevant for property division and financial assessments.

- Bank Statements: These provide a snapshot of the individual's current financial status, illustrating the flow of money and supporting claims of expenses and income.

- Debt and Loan Statements: Documents detailing the individual's debts and liabilities are essential for a full financial disclosure in Form F8.

- Investment Records: Documentation of stocks, bonds, mutual funds, and other investments contribute to the overall picture of financial health and resources.

Each of these documents plays a vital role in family law proceedings, offering clarity and evidence to support financial claims and counterclaims. Together with Form F8, they ensure that the court has a detailed and accurate financial portrait, aiding in the decision-making process for issues related to support, property division, and other financial arrangements. Proper preparation and presentation of these documents can significantly impact the outcomes of family law cases, making it crucial for individuals to understand their significance and how they complement the Financial Statement (Form F8).

Similar forms

The Form 1040 used for filing individual income tax returns in the United States is similar to the F8 form. Both require detailed income information and documentation for accurate financial reporting and assessment.

Financial affidavits in family law cases, like those used in divorce or child support adjustments, share similarities with the F8 form. They necessitate thorough disclosure of financial status, including income, expenses, debts, and assets.

Forms related to applying for financial aid or scholarships also have parallels with the F8 form. Applicants must provide comprehensive income and financial information to determine eligibility and need.

The Free Application for Federal Student Aid (FAFSA) in the United States, while focused on educational funding, requires detailed financial information from students and families similar to what is requested in the F8 form.

Bank loan applications, particularly those for mortgages, resemble the F8 form because they require the applicant to furnish detailed income and financial information to assess loan eligibility and repayment capability.

Child support modification forms, used to adjust child support payments, require detailed financial disclosures similar to those in the F8 form, focusing on income, expenses, and financial obligations.

Spousal support affidavit forms, like the F8, require detailed financial information from both parties to determine the need for and the amount of spousal support during legal proceedings.

Bankruptcy filing documents, which necessitate a comprehensive disclosure of financial status including all sources of income, debts, assets, and monthly expenses, are also akin to the F8 form in their comprehensive nature.

Property settlement agreements in the context of divorce or separation require detailed disclosure of financial information, similar to the F8 form, to fairly divide property, assets, and debts.

Dos and Don'ts

Filling out the Form F8, which is a financial statement required in certain family law cases before the Supreme Court of British Columbia, requires attention to detail and an understanding of what is required. Here are six things one should do and six things one should not do when completing this form:

Do:

- Read instructions carefully: Before filling out the form, read through all the instructions to ensure you understand which parts apply to your situation.

- Provide complete and accurate information: Fill out every section that applies to you with up-to-date and correct information to the best of your knowledge.

- Check off the appropriate boxes: Clearly indicate your situation by checking off the correct boxes, especially those that outline which parts of the form you need to complete based on your circumstances.

- Attach required documentation: Make sure to attach all the required financial documents, such as your income tax returns, notices of assessment, and statements of earnings.

- Sign and date the form: Ensure that you sign and date the form in the designated areas to affirm the truthfulness and completeness of the information provided.

- Review for completeness: Before submitting, review the form to ensure you haven't missed any sections that apply to you and that all information is complete and accurate.

Don't:

- Skip parts without consideration: Don't ignore sections without evaluating whether they apply to your situation; certain parts might seem irrelevant but are necessary based on your circumstances.

- Estimate financial information: Avoid guessing or estimating financial details. Use actual figures from your financial documents to ensure accuracy.

- Leave blanks in applicable sections: If a section applies to you, don't leave it blank. Complete each required field with the relevant information.

- Provide outdated financial documents: Don't attach financial documents that are not current or do not cover the required periods as specified in the instructions.

- Forget to check for required supplements: If you are required to fill out Schedule A or B based on adjustments to your income or other income sources, do not overlook these supplements to the form.

- Ignore the instruction notes: Each section has notes and instructions intended to guide you; disregarding these can lead to errors or omissions that could affect your case.

Misconceptions

Many people have misconceptions about the Form F8, especially about its complexity and requirements. By breaking down these misconceptions, individuals can approach this form with more clarity and confidence.

- Misconception 1: The Form F8 Is Only for Child Support Matters

This is a common misunderstanding. While Form F8 is indeed used in relation to child support, its scope is much broader. It's also critical for spousal or parental support claims, sharing financial information for property claims, and more complex custody arrangements like shared or split custody. The form captures a comprehensive snapshot of an individual's financial situation, making it a pivotal document in various family law proceedings.

- Misconception 2: You Need to Fill Out Every Part of the Form

Not everyone must complete all six parts of Form F8. Which sections need to be filled out depend significantly on the specific circumstances of your case. For instance, some parts are only relevant if you're applying for spousal support, making a property claim, or if there are claims for special expenses under section 7 of the child support guidelines. Each scenario outlined in the form determines which sections are necessary for your situation.

- Misconception 3: The Financial Statement is Optional

There's a belief that the financial statement section is optional or only required under certain conditions. However, unless you meet very specific criteria (like applying solely for child support with no other claims), completing the financial statement part of Form F8 is a must. This section is crucial for accurately presenting your financial status, which helps in determining support obligations and property divisions.

- Misconception 4: Only Current Income Information Is Required

Another misconception is that the form only requires information about your current income. In reality, Form F8 requires details about your income over the past three years, including tax returns, notices of assessment, and documentation for various sources of income. This historical data provides a more accurate and fair representation of an individual's financial situation, which is essential for establishing fair support payments and understanding financial standings.

Understanding these misconceptions about Form F8 can greatly help individuals navigate their family law proceedings more effectively. By knowing what is expected, individuals can prepare their forms more accurately, leading to smoother legal processes.

Key takeaways

Filling out the Form F8, associated with financial statements required in the Supreme Court of British Columbia, involves detailed documentation and an understanding of eligibility criteria. Here are nine key takeaways for its effective completion and utilization:

- The F8 form must be completed unless all specific conditions outlined—relating primarily to child support without additional claims—are met. This ensures the form's applicability is limited to those who need to detail their financial circumstances comprehensively.

- It lays out a structured affidavit, requesting affirmation that the provided financial information is true to the best of the claimant's or respondent's knowledge, thereby underscoring the importance of accuracy and honesty in reporting.

- Applicants must attach crucial financial documents, such as personal income tax returns and notices of assessment for the three most recent taxation years, substantiating their financial situation with verifiable evidence.

- Different sections of the Form F8 are activated depending on the nature of the support and claims being made—such as spousal or parental support, child support under specific conditions, and claims for special expenses or hardship, indicating a tailored approach to gathering relevant financial information.

- Employment status, whether employed, self-employed, or a business operator, dictates the specific financial documentation required, emphasizing the form’s adaptability to varied income scenarios.

- Annual income calculation involves a comprehensive inclusion of various sources such as employment, benefits, pensions, and other incomes, providing a holistic view of an individual's financial capacity.

- The form allows for adjustments to the reported income based on guidelines, union dues, and professional fees, recognizing that gross income does not always accurately represent the funds available for support payments.

- Special sections address additional income sources or adjustments, like capital gains, dividends, and business losses, ensuring a nuanced consideration of an individual’s financial landscape.

- Upon completion, the form requires affirmation before a commissioner, reinforcing the legal gravity and accountability of the information provided.

This structured and comprehensive approach ensures that all parties have a clear understanding of the financial bearings of individuals involved in support or property claim cases, facilitating equitable resolutions.

Popular PDF Forms

Vtr 275 - Specifies clearly the role of personal check, money order, or cashier's check in making payments.

Form W-8ben-e Instructions - Employers who misclassify employees as independent contractors can use the SS-8 form to correct their tax filings.