Blank Federal Supporting PDF Template

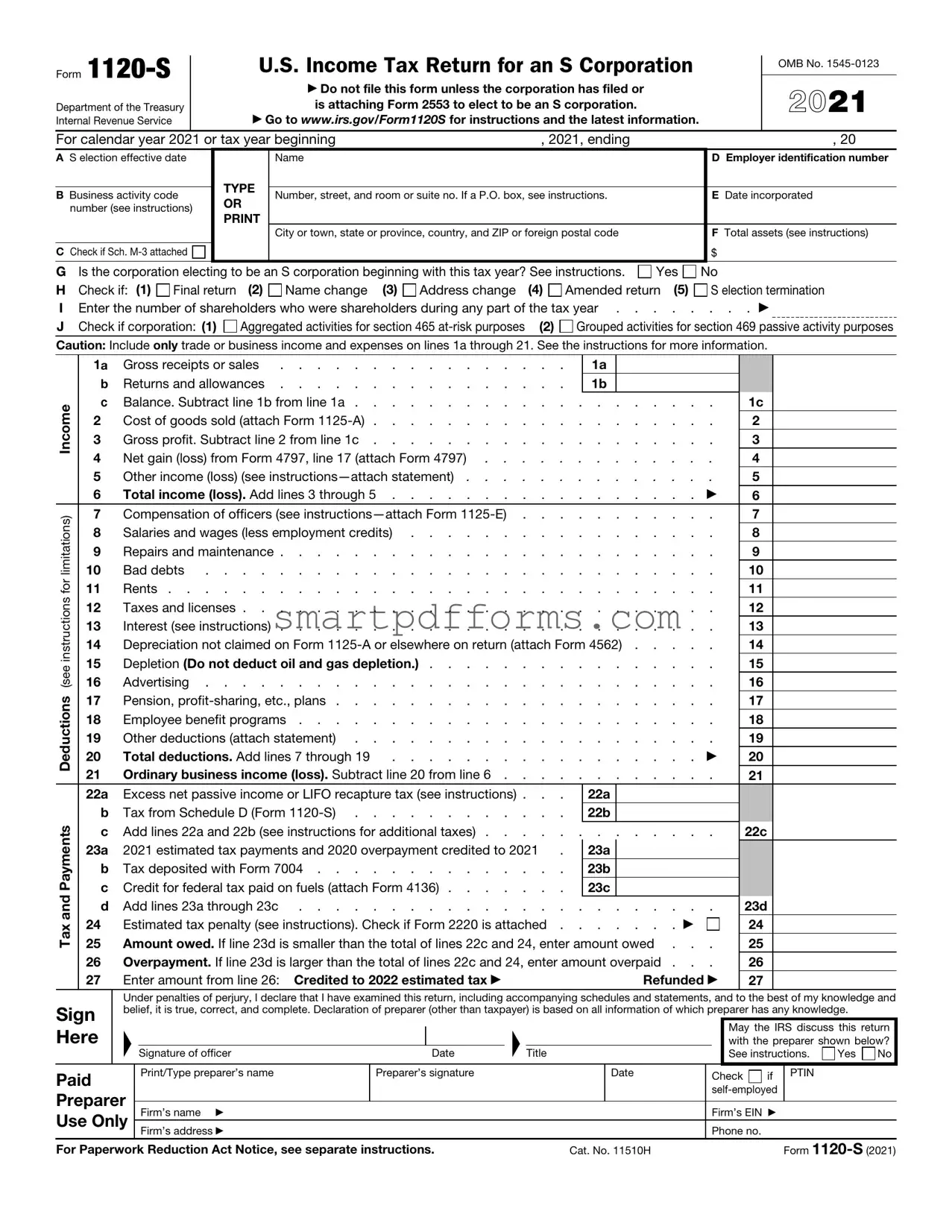

The Federal Form 1120-S is an essential document for S Corporations within the United States, serving as a vessel for reporting annual income taxes to the Internal Revenue Service (IRS). This form captures a broad spectrum of financial information, including income, deductions, tax, payments, and shareholder distributions, emphasizing the unique tax structure S Corporations benefit from—passing income directly to shareholders to avoid double taxation. Key components of Form 1120-S such as gross receipts, cost of goods sold, deductions, and earnings give a comprehensive overview of a corporation's fiscal health and obligations. Furthermore, the form accommodates various schedules detailing the shareholders’ pro rata share items, balance sheets, and additional information on transactions that might influence tax liability, like debt forgiveness or international dealings. Moreover, instructions for electing S corporation status (via Form 2553), details on accounting methods, and information on specific deductions such as officer compensation or rent, highlight the complexity of tax planning and compliance for businesses. Together, these elements underscore the importance of meticulous record-keeping and strategic financial planning for S Corporations navigating federal tax obligations.

Preview - Federal Supporting Form

Form |

|

|

|

|

|

U.S. Income Tax Return for an S Corporation |

|

|

OMB No. |

||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ Do not file this form unless the corporation has filed or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

||

Department of the Treasury |

|

|

|

|

|

|

is attaching Form 2553 to elect to be an S corporation. |

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

▶ Go to www.irs.gov/Form1120S for instructions and the latest information. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

For calendar year 2021 or tax year beginning |

, 2021, ending |

|

, 20 |

||||||||||

A S election effective date |

|

|

|

|

Name |

|

|

|

D Employer identification number |

||||

|

|

|

|

|

TYPE |

|

|

|

|

|

|

||

B |

Business activity code |

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

E Date incorporated |

|||||||

|

OR |

|

|

|

|||||||||

|

number (see instructions) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

F Total assets (see instructions) |

||

|

|

|

|

|

|

|

|

|

|

|

|||

C Check if Sch. |

|

|

|

|

|

|

|

|

$ |

|

|||

G Is the corporation electing to be an S corporation beginning with this tax year? See instructions. |

Yes |

No |

|||||||||||

H |

Check if: (1) Final return |

|

(2) Name change (3) Address change |

(4) Amended return (5) |

|

S election termination |

|||||||

I |

Enter the number of shareholders who were shareholders during any part of the tax year |

|

. . . ▶ |

||||||||||

J |

Check if corporation: (1) |

|

Aggregated activities for section 465 |

(2) Grouped activities for section 469 passive activity purposes |

|||||||||

Caution: Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information.

Tax and Payments Deductions (see instructions for limitations) Income

1a |

Gross receipts or sales |

|

1a |

|

|

|

|

|

|

b |

Returns and allowances |

|

1b |

|

|

|

|

|

|

c |

Balance. Subtract line 1b from line 1a |

. . . . . . . . |

1c |

|

|||||

2 |

Cost of goods sold (attach Form |

. . . . . . . . |

2 |

|

|||||

3 |

Gross profit. Subtract line 2 from line 1c |

. . . . . . . . |

3 |

|

|||||

4 |

Net gain (loss) from Form 4797, line 17 (attach Form 4797) |

. . . . . . . . |

4 |

|

|||||

5 |

Other income (loss) (see |

. . . . . . . . |

5 |

|

|||||

6 |

Total income (loss). Add lines 3 through 5 |

. . . . |

. |

. . |

▶ |

6 |

|

||

7 |

Compensation of officers (see |

. . . . . . . . |

7 |

|

|||||

8 |

Salaries and wages (less employment credits) |

. . . . . . . . |

8 |

|

|||||

9 |

Repairs and maintenance |

. . . . . . . . |

9 |

|

|||||

10 |

Bad debts |

. . . . . . . . |

10 |

|

|||||

11 |

Rents |

. . . . . . . . |

11 |

|

|||||

12 |

Taxes and licenses |

. . . . . . . . |

12 |

|

|||||

13 |

Interest (see instructions) |

. . . . . . . . |

13 |

|

|||||

14 |

Depreciation not claimed on Form |

14 |

|

||||||

15 |

Depletion (Do not deduct oil and gas depletion.) |

. . . . . . . . |

15 |

|

|||||

16 |

Advertising |

. . . . . . . . |

16 |

|

|||||

17 |

Pension, |

. . . . . . . . |

17 |

|

|||||

18 |

Employee benefit programs |

. . . . . . . . |

18 |

|

|||||

19 |

Other deductions (attach statement) |

. . . . . . . . |

19 |

|

|||||

20 |

Total deductions. Add lines 7 through 19 |

. . . . |

. |

. . |

▶ |

20 |

|

||

21 |

Ordinary business income (loss). Subtract line 20 from line 6 . . . . |

. . . . . . . . |

21 |

|

|||||

22a |

Excess net passive income or LIFO recapture tax (see instructions) . . . |

|

22a |

|

|

|

|

|

|

b |

Tax from Schedule D (Form |

|

22b |

|

|

|

|

|

|

c |

Add lines 22a and 22b (see instructions for additional taxes) |

. . . . . . . . |

22c |

|

|||||

23a |

2021 estimated tax payments and 2020 overpayment credited to 2021 . |

|

23a |

|

|

|

|

|

|

b |

Tax deposited with Form 7004 |

|

23b |

|

|

|

|

|

|

c |

Credit for federal tax paid on fuels (attach Form 4136) |

|

23c |

|

|

|

|

|

|

d |

Add lines 23a through 23c |

. . . . . . . . |

23d |

|

|||||

24 |

Estimated tax penalty (see instructions). Check if Form 2220 is attached . |

. . . . |

. |

. ▶ |

|

24 |

|

||

25 |

Amount owed. If line 23d is smaller than the total of lines 22c and 24, enter amount owed . . . |

25 |

|

||||||

26 |

Overpayment. If line 23d is larger than the total of lines 22c and 24, enter amount overpaid . . . |

26 |

|

||||||

27 |

Enter amount from line 26: Credited to 2022 estimated tax ▶ |

|

|

|

Refunded ▶ |

27 |

|

||

|

|

|

|

|

|

|

|

|

|

Sign Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲ |

|

|

▲ |

|

|

May the IRS discuss this return |

||

|

|

|

||||||

|

|

|

|

with the preparer shown below? |

||||

Signature of officer |

Date |

Title |

|

See instructions. |

Yes |

No |

||

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

Check |

if |

PTIN |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Firm’s EIN ▶ |

|

|

||

Use Only |

|

|

|

|

|

|||

Firm’s address ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11510H |

|

|

Form |

|

|||

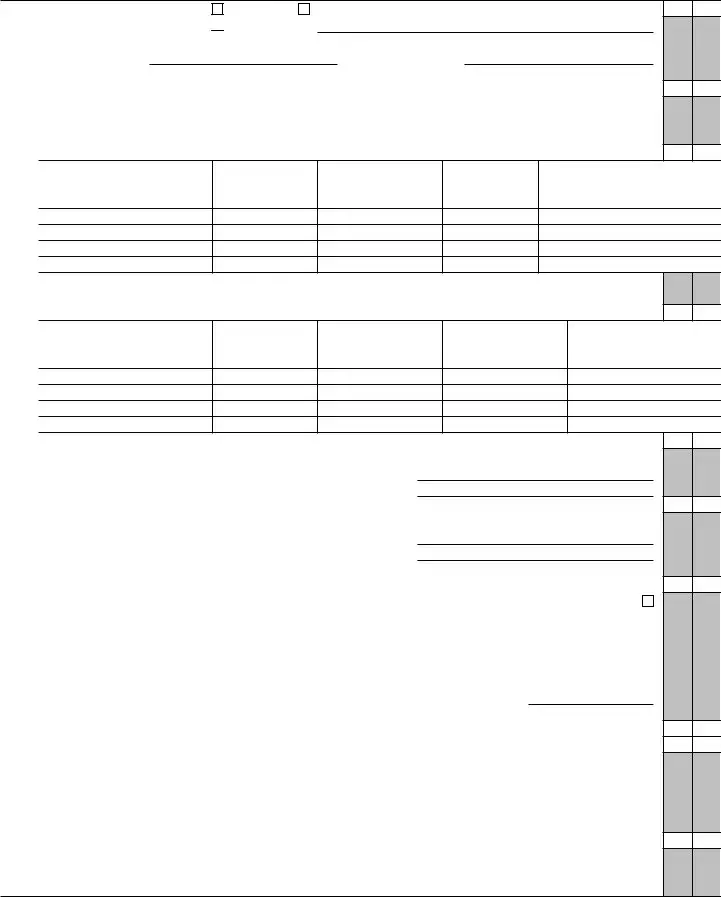

Form |

Page 2 |

|

Schedule B |

|

Other Information (see instructions) |

1 Check accounting method: a |

Cash |

b |

Accrual |

c

Other (specify) ▶

Other (specify) ▶

2 See the instructions and enter the:

a Business activity ▶ |

b Product or service ▶ |

3At any time during the tax year, was any shareholder of the corporation a disregarded entity, a trust, an estate, or a nominee or similar person? If “Yes,” attach Schedule

4At the end of the tax year, did the corporation:

aOwn directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v)

below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

(i)Name of Corporation

(ii)Employer Identification

Number (if any)

(iii)Country of Incorporation

(iv)Percentage of Stock Owned

(v)If Percentage in (iv) Is 100%, Enter the Date (if applicable) a Qualified Subchapter

S Subsidiary Election Was Made

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below . . . . . . .

(i)Name of Entity

(ii)Employer Identification

Number (if any)

(iii)Type of Entity

(iv)Country of Organization

(v)Maximum Percentage Owned in Profit, Loss, or Capital

5a At the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . . .

If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of restricted stock |

▶ |

(ii) |

Total shares of |

▶ |

bAt the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? . If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of stock outstanding at the end of the tax year |

. ▶ |

(ii)Total shares of stock outstanding if all instruments were executed ▶

6Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

|

information on any reportable transaction? |

. . . . . . . . . . . . . . . . . . . . . . . . |

7 |

Check this box if the corporation issued publicly offered debt instruments with original issue discount . . . . ▶ |

|

|

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount |

|

|

Instruments. |

|

8If the corporation (a) was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in the hands of a C corporation, and

(b) has net unrealized

gain reduced by net recognized

9Did the corporation have an election under section 163(j) for any real property trade or business or any farming business

in effect during the tax year? See instructions . . . . . . . . . . . . . . . . . . . . . . . .

10 Does the corporation satisfy one or more of the following? See instructions . . . . . . . . . . . . . .

aThe corporation owns a

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense.

If “Yes,” complete and attach Form 8990.

11 Does the corporation satisfy both of the following conditions? . . . . . . . . . . . . . . . . . .

aThe corporation’s total receipts (see instructions) for the tax year were less than $250,000.

bThe corporation’s total assets at the end of the tax year were less than $250,000. If “Yes,” the corporation is not required to complete Schedules L and

Form

Form |

Page 3 |

|

Schedule B |

Other Information (see instructions) (continued) |

Yes No |

12During the tax year, did the corporation have any

terms modified so as to reduce the principal amount of the debt? . . . . . . . . . . . . . . . . .

If “Yes,” enter the amount of principal reduction . . . . . . . . . . . . . . ▶ $

13During the tax year, was a qualified subchapter S subsidiary election terminated or revoked? If “Yes,” see instructions .

14a Did the corporation make any payments in 2021 that would require it to file Form(s) 1099? |

|

|||||||||||

b |

If “Yes,” did the corporation file or will it file required Form(s) 1099? |

|

||||||||||

15 |

Is the corporation attaching Form 8996 to certify as a Qualified Opportunity Fund? |

|||||||||||

|

If “Yes,” enter the amount from Form 8996, line 15 |

. . . . ▶ $ |

|

|

|

|

||||||

Schedule K |

Shareholders’ Pro Rata Share Items |

|

|

|

|

|

|

|

Total amount |

|||

|

|

1 |

Ordinary business income (loss) (page 1, line 21) |

. . . . . . |

. . |

1 |

|

|

||||

|

|

2 |

Net rental real estate income (loss) (attach Form 8825) |

. . . . . . |

. . |

2 |

|

|

||||

|

|

3a |

Other gross rental income (loss) |

|

3a |

|

|

|

|

|

||

|

|

b |

Expenses from other rental activities (attach statement) |

. . . . |

|

3b |

|

|

|

|

|

|

|

|

c |

Other net rental income (loss). Subtract line 3b from line 3a . . . |

. . . . . . |

. . |

3c |

|

|||||

(Loss) |

|

4 |

Interest income |

. . . . . . |

. . |

4 |

|

|

||||

|

5 |

Dividends: a Ordinary dividends |

. . . . . . |

. . |

5a |

|

|

|||||

|

|

|

||||||||||

Income |

|

|

b Qualified dividends |

|

5b |

|

|

|

|

|

||

|

6 |

Royalties |

. . . . . . |

. . |

6 |

|

|

|||||

|

|

|

|

|||||||||

|

|

7 |

Net |

. . . . . . |

. . |

7 |

|

|

||||

|

|

8a |

Net |

. . . . . . |

. . |

8a |

|

|||||

|

|

b |

Collectibles (28%) gain (loss) |

|

8b |

|

|

|

|

|

||

|

|

c |

Unrecaptured section 1250 gain (attach statement) |

|

8c |

|

|

|

|

|

||

|

|

9 |

Net section 1231 gain (loss) (attach Form 4797) |

. . . . . . |

. . |

9 |

|

|

||||

|

|

10 |

Other income (loss) (see instructions) . . . |

Type ▶ |

|

|

|

|

|

10 |

|

|

Deductions |

|

11 |

Section 179 deduction (attach Form 4562) |

. . . . . . |

. . |

11 |

|

|

||||

|

12a |

Charitable contributions |

. . . . . . |

. . |

12a |

|

|

|||||

|

|

|

||||||||||

|

|

b |

Investment interest expense |

. . . . . . |

. . |

12b |

|

|||||

|

|

c |

Section 59(e)(2) expenditures |

Type ▶ |

|

|

|

|

|

12c |

|

|

|

|

d |

Other deductions (see instructions) . . . . |

Type ▶ |

|

|

|

|

|

12d |

|

|

|

|

13a |

. . . . . . |

. . |

13a |

|

||||||

|

|

b |

. . . . . . |

. . |

13b |

|

||||||

Credits |

|

c |

Qualified rehabilitation expenditures (rental real estate) (attach Form 3468, if applicable) |

. . |

13c |

|

||||||

|

d |

Other rental real estate credits (see instructions) |

Type ▶ |

|

|

|

|

|

13d |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

e |

Other rental credits (see instructions) . . . |

Type ▶ |

|

|

|

|

|

13e |

|

|

|

|

f |

Biofuel producer credit (attach Form 6478) |

. . . . . . |

. . |

13f |

|

|||||

|

|

g |

Other credits (see instructions) |

Type ▶ |

|

|

|

|

|

13g |

|

|

International Transactions |

|

14 |

Attach Schedule |

|

|

|

||||||

|

|

|

|

|

||||||||

|

|

|

check this box to indicate you are reporting items of international tax relevance . . . |

▶ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

Alternative MinimumTax Items(AMT) |

15a |

. . . . . . |

. . |

15a |

|

|||||||

b |

Adjusted gain or loss |

. . . . . . |

. . |

15b |

|

|||||||

c |

Depletion (other than oil and gas) |

. . . . . . |

. . |

15c |

|

|

||||||

|

|

|

||||||||||

|

|

d |

Oil, gas, and geothermal |

. . . . . . |

. . |

15d |

|

|||||

|

|

e |

Oil, gas, and geothermal |

. . . . . . |

. . |

15e |

|

|||||

|

|

f |

Other AMT items (attach statement) |

. . . . . . |

. . |

15f |

|

|||||

ItemsAffecting ShareholderBasis |

|

16a |

. . . . . . |

. . |

16a |

|

||||||

|

f |

Foreign taxes paid or accrued |

. . . . . . |

. . |

16f |

|

||||||

|

|

b |

Other |

. . . . . . |

. . |

16b |

|

|||||

|

|

c |

Nondeductible expenses |

. . . . . . |

. . |

16c |

|

|||||

|

|

d |

Distributions (attach statement if required) (see instructions) . . . |

. . . . . . |

. . |

16d |

|

|||||

|

|

e |

Repayment of loans from shareholders |

. . . . . . |

. . |

16e |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

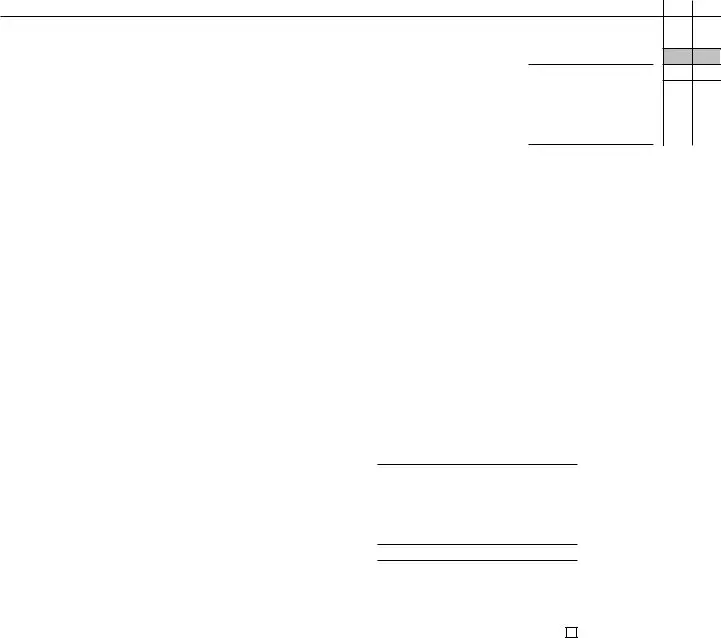

Form |

|

Form |

|

|

Page 4 |

|||

Schedule K |

|

Shareholders’ Pro Rata Share Items (continued) |

|

Total amount |

||

|

Information |

17a |

Investment income |

17a |

||

Other |

d |

Other items and amounts (attach statement) |

|

|

||

|

|

b |

Investment expenses |

17b |

||

|

|

c |

Dividend distributions paid from accumulated earnings and profits |

17c |

||

|

|

|

|

|

|

|

Recon- |

ciliation |

18 |

|

Income (loss) reconciliation. Combine the amounts on lines 1 through 10 in the far right |

|

|

|

|

|

|

|

||

|

|

|

|

column. From the result, subtract the sum of the amounts on lines 11 through 12d and 16f . |

18 |

|

Schedule L |

Balance Sheets per Books |

|

Beginning of tax year |

|

|

End of tax year |

|||||

|

|

Assets |

|

(a) |

|

(b) |

|

(c) |

|

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

|

|

|

2a |

Trade notes and accounts receivable . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less allowance for bad debts |

( |

|

) |

|

|

( |

) |

|

|

|

3 |

Inventories |

|

|

|

|

|

|

|

|

|

|

4 |

U.S. government obligations |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

||

6 |

Other current assets (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

7 |

Loans to shareholders |

|

|

|

|

|

|

|

|

|

|

8 |

Mortgage and real estate loans |

|

|

|

|

|

|

|

|

|

|

9 |

Other investments (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

10a |

Buildings and other depreciable assets . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated depreciation |

( |

|

) |

|

|

( |

) |

|

|

|

11a |

Depletable assets |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated depletion |

( |

|

) |

|

|

( |

) |

|

|

|

12 |

Land (net of any amortization) |

|

|

|

|

|

|

|

|

|

|

13a |

Intangible assets (amortizable only) . . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated amortization |

( |

|

) |

|

|

( |

) |

|

|

|

14 |

Other assets (attach statement) |

|

|

|

|

|

|

|

|

|

|

15 |

Total assets |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

16 |

Accounts payable |

|

|

|

|

|

|

|

|

|

|

17 |

Mortgages, notes, bonds payable in less than 1 year |

|

|

|

|

|

|

|

|

|

|

18 |

Other current liabilities (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

19 |

Loans from shareholders |

|

|

|

|

|

|

|

|

|

|

20 |

Mortgages, notes, bonds payable in 1 year or more |

|

|

|

|

|

|

|

|

|

|

21 |

Other liabilities (attach statement) . . . . |

|

|

|

|

|

|

|

|

|

|

22 |

Capital stock |

|

|

|

|

|

|

|

|

|

|

23 |

Additional |

|

|

|

|

|

|

|

|

|

|

24 |

Retained earnings |

|

|

|

|

|

|

|

|

|

|

25 |

Adjustments to shareholders’ equity (attach statement) |

|

|

|

|

|

|

|

|

|

|

26 |

Less cost of treasury stock |

|

|

|

( |

) |

|

|

( |

) |

|

27 |

Total liabilities and shareholders’ equity . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Form |

Page 5 |

|

Schedule |

Reconciliation of Income (Loss) per Books With Income (Loss) per Return |

|

Note: The corporation may be required to file Schedule

1 |

Net income (loss) per books . . . . |

|

|

5 |

|

Income recorded on books this year |

|

|

|||

2 |

Income included on Schedule K, lines 1, 2, |

|

|

|

|

not included on Schedule K, lines 1 |

|

|

|||

|

|

|

|

through 10 (itemize): |

|

|

|

||||

|

3c, 4, 5a, 6, 7, 8a, 9, and 10, not recorded |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

|

on books this year (itemize) |

|

|

a |

|

|

|

|

|||

3 |

Expenses recorded on books this year |

|

|

6 |

|

Deductions included on Schedule K, |

|

|

|||

|

|

|

|

|

|||||||

|

not included on Schedule K, lines 1 |

|

|

|

|

lines 1 through 12 and 16f, not charged |

|

|

|||

|

through 12 and 16f (itemize): |

|

|

|

|

against book income this year (itemize): |

|

|

|||

a |

Depreciation $ |

|

|

a |

|

Depreciation $ |

|

|

|

||

b |

Travel and entertainment $ |

|

|

7 |

|

Add lines 5 and 6 |

|

|

|||

|

|

|

|

|

|||||||

|

|

|

|

|

8 Income (loss) (Schedule K, line 18). |

|

|

||||

4 |

Add lines 1 through 3 |

|

|

|

|

Subtract line 7 from line 4 . . . . |

|

|

|||

Schedule |

Analysis of Accumulated Adjustments Account, Shareholders’ Undistributed Taxable Income |

|

|||||||||

|

|

Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account |

|

||||||||

|

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Accumulated |

|

(b) Shareholders’ |

|

(c) Accumulated |

(d) Other adjustments |

|

|

|

|

|

|

adjustments account |

|

undistributed taxable |

|

earnings and profits |

account |

|

|

|

|

|

|

|

|

|

income previously taxed |

|

|

|

|

1 |

Balance at beginning of tax year |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

2 |

Ordinary income from page 1, line 21 . . . |

|

|

|

|

|

|

|

|

||

3 |

Other additions |

|

|

|

|

|

|

|

|

||

4 |

Loss from page 1, line 21 |

( |

|

) |

|

|

|

|

|

||

5 |

Other reductions |

( |

|

) |

|

|

|

( |

) |

||

6 |

Combine lines 1 through 5 |

|

|

|

|

|

|

|

|

||

7 |

Distributions |

|

|

|

|

|

|

|

|

||

8 |

Balance at end of tax year. Subtract line 7 from |

|

|

|

|

|

|

|

|

||

|

line 6 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Form |

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Form 1120-S is used by corporations electing to be S corporations to report their income, deductions, gains, losses, etc. |

| S Corporation Election Requirement | Corporations must file Form 2553 to elect the status of an S corporation before filing Form 1120-S. |

| Website for Information and Instructions | The IRS website provides instructions and the latest information for Form 1120-S at www.irs.gov/Form1120S. |

| Reporting Period | The form is used for reporting financial activities for a calendar year or a tax year beginning in 2021. |

| Governing Law | The tax reporting and liabilities for S corporations are governed by the Internal Revenue Code and regulations issued by the Internal Revenue Service. |

Instructions on Utilizing Federal Supporting

Once you've gathered all the necessary documentation and are ready to begin, filling out the Form 1120-S for your S corporation will be a more straightforward process. After completing this form, it will be reviewed by the IRS, and any required adjustments or additional documentation will be requested. Efficiently completing this form is critical for meeting compliance requirements and ensuring the accurate reporting of income, deductions, and taxes for your S corporation.

- Begin by verifying the corporation has filed or is attaching Form 2553 to elect S corporation status.

- Enter the fiscal year or calendar year for which taxes are being filed at the top of the form.

- Fill in the S election effective date if applicable.

- Provide the corporation's name, Employer Identification Number (EIN), business activity code, business address, date of incorporation, and total assets in sections A through F.

- Answer whether the corporation is electing to be an S corporation beginning with this tax year in section G.

- Check the appropriate boxes if the return is a final return, if there has been a name change, address change, the return is amended, or if the S election has been terminated in section H.

- In section I, enter the number of shareholders who were shareholders at any part of the tax year.

- Mark the appropriate checkboxes in section J if applicable for aggregated or grouped activities.

- Calculate and enter the values for income, deductions, and taxes in the respective sections. This includes reporting gross receipts or sales, subtracting returns and allowances, cost of goods sold, and then calculating gross profit.

- List compensation of officers, salaries and wages, and other expense items down to line 20 for total deductions.

- Calculate ordinary business income (loss) by subtracting total deductions from total income (line 21).

- Complete the tax and payments section, including calculated taxes, credits, estimated tax payments, and the estimated tax penalty if applicable.

- Decide how any overpayment is to be allocated and sign the form. Ensure an officer of the corporation signs and dates the form, providing their title.

- Fill out Schedule B, Other Information, according to the instructions provided for each line.

- Complete Schedules K, L, M-1, M-2, and any other required schedules or forms as outlined in the instructions.

- If a paid preparer completed the form, ensure their information is filled in at the bottom of the form.

Once all necessary information is accurately filled in, review the entire form and attached schedules to ensure completeness and correctness. If everything is in order, submit the form to the IRS by the filing deadline. Keep a copy for your records.

Obtain Answers on Federal Supporting

Frequently Asked Questions about the Federal Supporting Form for S Corporations (Form 1120-S)

- What is Form 1120-S?

- Who needs to file Form 1120-S?

- When is Form 1120-S due?

- What information is needed to complete Form 1120-S?

- The corporation’s Employer Identification Number (EIN), address, and the date of S corporation election.

- Financial information including gross receipts or sales, returns and allowances, cost of goods sold, and deductions for expenses like salaries, rents, and taxes.

- Information on tax and payments, including estimated tax payments and taxes owed or overpayments.

- Details on assets, liabilities, and shareholders’ equity from the balance sheets.

- How does a corporation elect S status?

- What happens if an S corporation fails to file Form 1120-S?

- Can I e-file Form 1120-S?

Form 1120-S is the U.S. Income Tax Return for an S Corporation. It's filed by S corps to report their income, gains, losses, deductions, credits, and other information required by the Internal Revenue Service (IRS).

Any corporation that has elected to be treated as an S corporation by filing Form 2553 and has received IRS approval must file Form 1120-S. This applies even if the corporation had no income or activity during the tax year.

For corporations on a calendar year, Form 1120-S is due by March 15th of the following year. If the corporation operates on a fiscal year, the form is due by the 15th day of the third month after the end of the fiscal year. An extension can be requested by filing Form 7004.

To elect S status, a corporation must file Form 2553, Election by a Small Business Corporation, with the IRS. This form should be filed within two months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the previous tax year.

If an S corporation doesn't file Form 1120-S by the due date, including extensions, it may be subject to penalties for failing to file. The penalty is based on the number of shareholders and the length of time the return is late.

Yes, S corporations can e-file Form 1120-S. E-filing is encouraged for faster processing, and in some cases, it's required based on the volume of returns a tax preparer files.

For the most up-to-date information and for instructions on how to fill out Form 1120-S, taxpayers should visit the official website of the IRS or consult with a tax professional.

Common mistakes

Not attaching Form 2553: One common mistake is not attaching Form 2553, the Election by a Small Business Corporation. This form is crucial for electing S corporation status, and without it, Form 1120-S should not be filed.

Inaccurate information about the business: Including incorrect or outdated business activity codes, employer identification numbers, or addresses can cause processing delays. It's vital to ensure all business information provided is current and accurate.

Failing to report all income: All forms of income, including gross receipts or sales, returns and allowances, and other incomes such as dividends and interest, must be accurately reported. Overlooking or misreporting income can lead to discrepancies.

Incorrect deductions: Another mistake is incorrect deduction claims. Deductions for salaries, wages, repairs, maintenance, and other expenses must comply with IRS rules. Exaggerating deductions or claiming ineligible expenses can trigger audits.

Incomplete Schedules K and L: Schedules K and L are integral parts of Form 1120-S. Schedule K lists shareholders' pro-rata share items while Schedule L focuses on the corporation's balance sheets. Failing to complete these schedules accurately can result in incomplete filing.

Miscalculating tax or payments: The tax and payments section, including estimated tax payments, tax deposits, and credits for federal tax paid on fuels, often sees miscalculations. Ensuring the math adds up is crucial for the correct tax amount to be assessed.

Ignoring signature and date fields: The form is not valid without the signature of an authorized corporate officer and the date. Omitting these can cause the IRS to treat the return as incomplete, leading to unnecessary follow-ups.

To avoid these common pitfalls:

- Double-check all entries for accuracy.

- Ensure all requisite schedules and supplementary forms are attached.

- Review tax calculations meticulously.

- And finally, confirm that all required signatures are in place before submission.

By paying attention to these details, businesses can avoid errors and ensure their Form 1120-S is correctly completed and submitted.

Documents used along the form

When preparing the Form 1120-S, U.S. Income Tax Return for an S Corporation, it is critical to understand that this form doesn't stand alone. The completion and filing of this form often necessitate the inclusion of additional forms and documents to provide a comprehensive overview of the S Corporation's tax situation. These supplemental materials ensure compliance with tax regulations and support the information presented in the Form 1120-S.

- Form 2553: Election by a Small Business Corporation - This form is necessary for an entity to elect S Corporation status. It must be filed with the IRS to confirm that the corporation meets all the requirements set forth for S Corporations.

- Form 1125-E: Compensation of Officers - If an S Corporation pays its officers, this form details the amounts paid and is attached to the Form 1120-S to report the compensation of officers.

- Form 1125-A: Cost of Goods Sold - Corporations that sell goods need to include this form with their tax return to detail the costs associated with producing or purchasing the goods they have sold during the tax year.

- Form 4562: Depreciation and Amortization - This document is used to report the depreciation and amortization of the corporation's property, providing a detailed breakdown of these deductions.

- Form 4797: Sales of Business Property - This form is necessary for reporting the sale or exchange of property used in the business, including the calculation of gain or loss from such transactions.

- Form 8990: Limitation on Business Interest Expense Under Section 163(j) - For corporations subject to limitations on the deduction of business interest, this form provides the necessary calculations and reporting.

To ensure that an S Corporation's tax return is complete and accurate, each of these forms must be filled out with precise information and included where applicable. The combination of these documents with the Form 1120-S offers a full picture of the corporation's income, expenses, and tax obligations, thus fulfilling federal tax requirements. Understanding and utilizing these additional forms appropriately can aid in maximizing tax benefits and minimizing liabilities for the corporation.

Similar forms

Form 1120 (U.S. Corporation Income Tax Return): Similar to Form 1120-S, this is another integral document for corporate taxation in the United States. However, it is utilized by C Corporations rather than S Corporations. Both forms require detailed financial information about the business's income, deductions, and tax liability. They also include schedules that demand data on shareholders, deductions, and tax computations. The primary distinction lies in their applicability to different types of corporations under the U.S. Internal Revenue Code, reflecting each corporation type's unique tax obligations and benefits.

Form 1065 (U.S. Return of Partnership Income): This form is used by partnerships to report their income, gains, losses, deductions, and credits to the IRS. Like Form 1120-S, Form 1065 requires the entity to distribute shares of income and losses to its members, who then report this information on their personal tax returns. Both forms serve a similar purpose in ensuring that the income from pass-through entities is taxed at the individual level, though they cater to different types of entities (partnerships vs. S corporations).

Form 1040 (U.S. Individual Income Tax Return): At first glance, Form 1040, the standard federal income tax form for individuals, might seem quite different from Form 1120-S. However, they are connected through the S corporation’s pass-through taxation mechanism. Shareholders of an S corporation report their share of the corporation's income and losses on their personal tax returns using Schedule E (Supplemental Income and Loss), which ultimately feeds into Form 1040. This linkage highlights the flow-through nature of S corporations, where the income is passed directly to shareholders to be reported on their individual taxes.

Form 2553 (Election by a Small Business Corporation): Mentioned in the content of Form 1120-S, Form 2553 is the document filed by corporations to elect S corporation status. This form is directly related to Form 1120-S as it must be approved by the IRS before a corporation can file its taxes using Form 1120-S. Essentially, Form 2553 sets the stage for the unique tax treatment received by S corporations, allowing them to pass income directly to shareholders and avoid double taxation at the corporate level. This decision greatly impacts how the entity is taxed and requires careful consideration and planning.

Dos and Don'ts

When filling out the Federal Supporting Form 1120-S for an S Corporation, it's crucial to follow guidelines precisely to ensure accurate and compliant submission. Here are some important dos and don'ts to consider:

- Do ensure that the corporation has filed or is attaching Form 2553 to elect to be an S corporation. This form is necessary for the S corporation election and must be filed with the Internal Revenue Service (IRS).

- Do go to the IRS website for instructions and the latest information on Form 1120-S. Guidelines and tax laws may change, so it's important to have the most current information.

- Do carefully report all income, deductions, and credits as instructed. Accurate reporting is essential for compliance with tax laws and to prevent errors that could lead to audits or penalties.

- Do complete all required sections and attach necessary schedules and forms, such as Form 1125-A for cost of goods sold, Form 1125-E for compensation of officers, and Form 4562 for depreciation and amortization.

- Don't file this form unless the corporation has made an S election. Filing Form 1120-S without having an approved S election can lead to incorrect tax filing status and potential issues with the IRS.

- Don't include non-business income and expenses in sections designated only for trade or business activity. Mixing personal and business finances can lead to complications and potential inaccuracies in reported financials.

- Don't neglect to sign and date the form. An unsigned form is considered invalid and will not be processed by the IRS, leading to delays and possible penalties.

- Don't overlook the requirement to report certain information such as changes in corporate structure or financial status, which can include a final return, name change, address change, amended return, or S election termination.

By following these guidelines, you can ensure a smoother process when completing and filing the Federal Supporting Form 1120-S for your S Corporation.

Misconceptions

When navigating the complexities of Form 1120-S U.S. Income Tax Return for an S Corporation, misconceptions can arise. Understanding these aspects can ensure accurate filing and compliance.

- Misconception 1: All corporations can elect S status. In reality, there are specific eligibility criteria, including the number of shareholders and the type of shareholders allowed.

- Misconception 2: Filing Form 1120-S alone is sufficient to elect S corporation status. The corporation must also file Form 2553 to elect S corporation status before filing Form 1120-S.

- Misconception 3: S corporations can deduct charitable contributions on Form 1120-S. While S corporations can make charitable contributions, these deductions pass through to the shareholders and are not deducted on Form 1120-S.

- Misconception 4: An S corporation’s income is not subject to double taxation. True, but it's crucial to understand this benefit comes from the pass-through characteristic that allows income to be taxed at the shareholder level only.

- Misconception 5: Form 1120-S includes calculations for estimated tax payments. S Corporations are generally exempt from estimated tax payments; however, shareholders might have to make estimated tax payments for their share of the corporation's income.

- Misconception 6: S corporations do not need to worry about payroll taxes. S corporations must still pay payroll taxes on any wages paid to employees, including officers of the corporation.

- Misconception 7: The S election is effective immediately upon filing Form 2553. The effective date of the S corporation election depends on the date the election is filed and the specific election requested on Form 2553.

- Misconception 8: Losses reported by S corporations can always be deducted by shareholders. Shareholders can deduct losses only up to the extent of their basis in the corporation’s stock and any debt owed to them by the S corporation.

- Misconception 9: Income reported on Form 1120-S is taxed at corporate rates. Income from an S corporation is taxed at the individual tax rates of the shareholders, not at corporate rates.

Correctly understanding these elements of Form 1120-S ensures proper reporting and compliance, avoiding potential issues with the Internal Revenue Service.

Key takeaways

Filling out and using the Federal Supporting Form, specifically Form 1120-S for U.S. Income Tax Return for an S Corporation, requires attention to detail and an understanding of the form’s framework and intentions. Here are six key takeaways:

- An S Corporation must have filed or be attaching Form 2553 to elect S corporation status before using Form 1120-S.

- The form captures a full year's financial activity, requiring accurate reporting of income, deductions, tax, and payments. It serves as a critical document for both the corporation and its shareholders.

- Business activity codes, entered in section A of the form, help classify the corporation's primary income source. This classification aids in tax determination and ensures compliance with specific tax codes and regulations.

- Total assets reported on the form must be accurate as they can influence tax liability calculations, including depreciation and amortization deductions.

- The form demands detailed disclosure of relationships and transactions with shareholders and other entities, ensuring transparency and adherence to tax laws regarding shareholder benefits and entity relationships.

- End-of-year financial statements are reconciled through schedules, such as Schedule L (Balance Sheets per Books) and Schedule M-1 (Reconciliation of Income), to align bookkeeping with tax reporting, which can reveal discrepancies or audit triggers if not done meticulously.

Thorough understanding and accurate completion of Form 1120-S are vital for maintaining compliance with IRS regulations, avoiding penalties, and ensuring the proper tax treatment for S Corporations and their shareholders.

Popular PDF Forms

4681 - Details on the recourse and nonrecourse debt distinctions and their significance for tax reporting are explained.

How Long After Qme Settlement - Aids in establishing the timelines crucial for compliance with statutory deadlines in workers' compensation matters.