Blank Fee Worksheet PDF Template

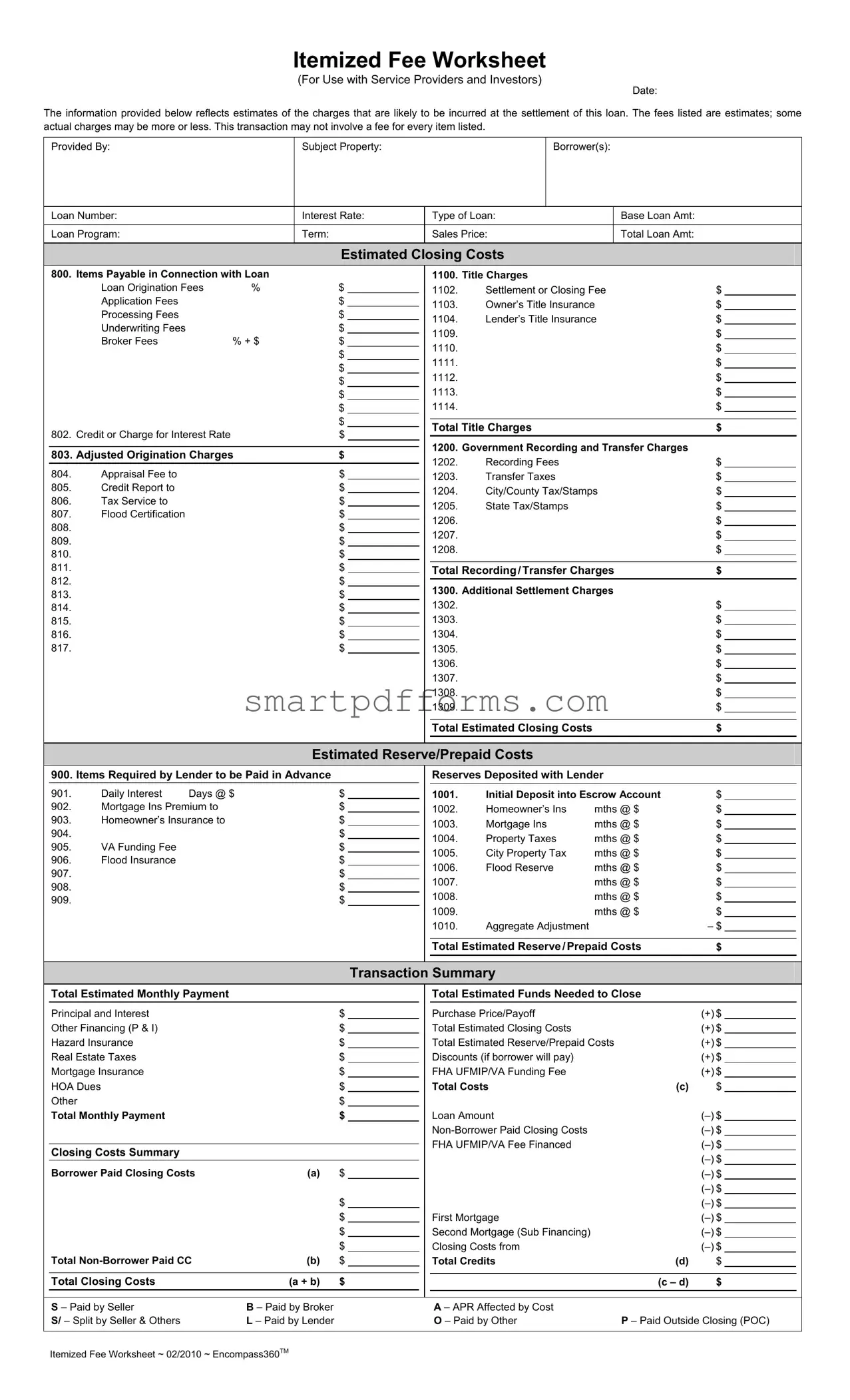

Understanding the complexities of acquiring a loan for a house purchase can be a daunting process, especially when it comes to the financial aspects. One critical document in this process is the Itemized Fee Worksheet, which serves as a comprehensive breakdown of the estimated costs associated with finalizing a loan. Prepared for use by service providers and investors, this document outlines the anticipated charges individuals are likely to encounter at the settlement of their loan, including, but not limited to, loan origination fees, title charges, government recording, and transfer charges, as well as additional settlement charges. It's crucial to note that these fees are estimates, meaning the actual costs may vary. The worksheet also delineates items payable in connection with the loan, estimated closing costs, and reserve/prepaid costs, providing a detailed forecast of the total funds needed to close the transaction. This transparency allows borrowers to understand precisely where their money is going, making the Itemized Fee Worksheet an indispensable tool for anyone navigating the purchase of a property.

Preview - Fee Worksheet Form

Itemized Fee Worksheet

(For Use with Service Providers and Investors)

Date:

The information provided below reflects estimates of the charges that are likely to be incurred at the settlement of this loan. The fees listed are estimates; some actual charges may be more or less. This transaction may not involve a fee for every item listed.

|

Provided By: |

|

|

Subject Property: |

|

|

|

Borrower(s): |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Loan Number: |

|

|

Interest Rate: |

|

Type of Loan: |

|

Base Loan Amt: |

|

|

|

||||||

|

Loan Program: |

|

|

Term: |

|

|

|

|

Sales Price: |

|

Total Loan Amt: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Estimated Closing Costs |

|

|

|

|

|

||||||

800. |

Items Payable in Connection with Loan |

|

|

|

1100. |

Title Charges |

|

|

|

|

|

||||||

|

|

Loan Origination Fees |

% |

|

$ |

|

|

1102. |

Settlement or Closing Fee |

$ |

|

|

|||||

|

|

|

|

|

|||||||||||||

|

|

Application Fees |

|

|

|

$ |

|

|

1103. |

Owner’s Title Insurance |

$ |

|

|

||||

|

|

|

|

|

|

|

|||||||||||

|

|

Processing Fees |

|

|

|

$ |

|

|

1104. |

Lender’s Title Insurance |

$ |

|

|

||||

|

|

Underwriting Fees |

|

|

|

$ |

|

|

|

|

|||||||

|

|

|

|

|

|

|

1109. |

|

|

|

|

$ |

|

|

|||

|

|

Broker Fees |

|

% + $ |

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

1110. |

|

|

|

|

$ |

|

|

||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1111. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1112. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1113. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

$ |

|

|

1114. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Title Charges |

|

|

$ |

|

|

|||

802. |

Credit or Charge for Interest Rate |

|

|

$ |

|

|

|

|

|

|

|

||||||

|

|

|

|

1200. |

Government Recording and Transfer Charges |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

803. Adjusted Origination Charges |

$ |

|

|

|

|

|

||||||||||

|

|

|

1202. |

Recording Fees |

|

|

$ |

|

|

||||||||

804. |

Appraisal Fee to |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1203. |

Transfer Taxes |

|

|

$ |

|

|

||||||

|

|

|

|

|

|

|

|||||||||||

805. |

Credit Report to |

|

|

|

$ |

|

|

1204. |

City/County Tax/Stamps |

$ |

|

|

|||||

806. |

Tax Service to |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1205. |

State Tax/Stamps |

|

|

$ |

|

|

||||||

807. |

Flood Certification |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1206. |

|

|

|

|

$ |

|

|

|||||

808. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1207. |

|

|

|

|

$ |

|

|

||||

809. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1208. |

|

|

|

|

$ |

|

|

||||

810. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

811. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Total Recording/Transfer Charges |

$ |

|

|

|||||||

|

|

|

|

|

|

||||||||||||

812. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1300. |

Additional Settlement Charges |

|

|

|

|||||||

813. |

|

|

|

|

$ |

|

|

|

|

|

|||||||

814. |

|

|

|

|

$ |

|

|

1302. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

815. |

|

|

|

|

$ |

|

|

1303. |

|

|

|

|

$ |

|

|

||

816. |

|

|

|

|

$ |

|

|

1304. |

|

|

|

|

$ |

|

|

||

817. |

|

|

|

|

$ |

|

|

1305. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

1306. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1307. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1308. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1309. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Total Estimated Closing Costs |

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Estimated Reserve/Prepaid Costs |

|

|

|

|

|

|||||||

|

900. Items Required by Lender to be Paid in Advance |

|

|

|

|

Reserves Deposited with Lender |

|

|

|

||||||||

901. |

Daily Interest |

Days @ $ |

$ |

|

|

1001. |

Initial Deposit into Escrow Account |

$ |

|

|

|||||||

902. |

Mortgage Ins Premium to |

|

|

$ |

|

|

1002. |

Homeowner’s Ins |

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

||||||||||||

903. |

Homeowner’s Insurance to |

|

|

$ |

|

|

1003. |

Mortgage Ins |

mths @ $ |

$ |

|

|

|||||

904. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1004. |

Property Taxes |

mths @ $ |

$ |

|

|

||||||

905. |

VA Funding Fee |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1005. |

City Property Tax |

mths @ $ |

$ |

|

|

|||||||

906. |

Flood Insurance |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1006. |

Flood Reserve |

mths @ $ |

$ |

|

|

|||||||

907. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1007. |

|

|

mths @ $ |

$ |

|

|

|||||

908. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1008. |

|

|

mths @ $ |

$ |

|

|

|||||

909. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1009. |

|

|

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

1010. |

Aggregate Adjustment |

|

|

– $ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Total Estimated Reserve/Prepaid Costs |

$ |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Transaction Summary |

|

|

|

|

|

|||||

|

Total Estimated Monthly Payment |

|

|

|

|

|

|

Total Estimated Funds Needed to Close |

|

|

|

||||||

|

Principal and Interest |

|

|

|

$ |

|

|

|

Purchase Price/Payoff |

|

|

(+) $ |

|

|

|||

|

Other Financing (P & I) |

|

|

|

$ |

|

|

|

Total Estimated Closing Costs |

|

|

(+) $ |

|

|

|||

|

Hazard Insurance |

|

|

|

$ |

|

|

|

Total Estimated Reserve/Prepaid Costs |

(+) $ |

|

|

|||||

|

Real Estate Taxes |

|

|

|

$ |

|

|

|

Discounts (if borrower will pay) |

|

|

(+) $ |

|

|

|||

|

Mortgage Insurance |

|

|

|

$ |

|

|

|

FHA UFMIP/VA Funding Fee |

|

|

(+) $ |

|

|

|||

|

HOA Dues |

|

|

|

$ |

|

|

|

Total Costs |

|

(c) |

$ |

|

|

|||

|

Other |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Monthly Payment |

|

|

|

$ |

|

|

|

Loan Amount |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

FHA UFMIP/VA Fee Financed |

|

|

|

|

|||

|

Closing Costs Summary |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Borrower Paid Closing Costs |

|

(a) |

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

First Mortgage |

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

|

Second Mortgage (Sub Financing) |

|

|

|

|

|||

|

Total |

|

(b) |

$ |

|

|

|

Closing Costs from |

|

|

|||||||

|

|

$ |

|

|

|

Total Credits |

|

(d) |

$ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Total Closing Costs |

|

(a + b) |

$ |

|

|

|

|

|

|

|

(c – d) |

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

S – Paid by Seller |

|

B – Paid by Broker |

|

|

|

|

A – APR Affected by Cost |

|

|

|

|

|

||||

|

S/ – Split by Seller & Others |

|

L – Paid by Lender |

|

|

|

|

O – Paid by Other |

|

P – Paid Outside Closing (POC) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Itemized Fee Worksheet ~ 02/2010 ~ Encompass360TM

Form Data

| Fact Number | Description |

|---|---|

| 1 | This worksheet provides a detailed estimate of charges expected at the loan settlement. |

| 2 | Fees listed are estimated, actual charges might vary. |

| 3 | The worksheet includes both borrower and lender anticipated fees. |

| 4 | Includes sections for loan origination, title charges, government recording and transfer charges, and additional settlement charges. |

| 5 | It provides an estimated total of closing costs and reserve/prepaid costs. |

| 6 | Details the total estimated monthly payment and total estimated funds needed to close. |

| 7 | Breaks down borrower and lender payments, including the breakdown of who (seller, broker, lender, others) pays which fees. |

| 8 | Symbols such as S, B, A, L, O, and POC are used to indicate payment responsibility. |

| 9 | Governing law varies by state, impacting specific requirements or disclosures in the form. |

Instructions on Utilizing Fee Worksheet

Filling out the Fee Worksheet is a crucial step in preparing for the settlement of a loan, providing a clear overview of all the estimated charges that a borrower may incur. This document serves as a detailed list for both service providers and investors to understand and agree upon the financial details of the transaction. The worksheet includes various sections such as loan information, estimated closing costs, reserve/prepaid costs, and a transaction summary. By accurately completing each part of this form, borrowers can ensure a smoother process in finalizing their loan agreements. Below are step-by-step instructions on how to fill out this form correctly.

- Start by entering the Date at the top of the worksheet.

- Fill in the Provided By section with the name of the loan officer or institution.

- Enter the address of the Subject Property being financed.

- Provide the Borrower(s)’ full name(s).

- Include the Loan Number for reference.

- Specify the Interest Rate being applied to the loan.

- Choose the Type of Loan from the available options.

- Fill in the Base Loan Amount, then detail the Loan Program and Term length.

- Enter the Sales Price of the property.

- Calculate and enter the Total Loan Amount.

- Under Estimated Closing Costs, itemize each cost involved, starting with 800 items such as Loan Origination Fees, Application Fees, and so forth, filling in the respective amounts.

- In the 1100. Title Charges section, list all charges related to the title, like the Settlement or Closing Fee, Owner’s and Lender’s Title Insurance, and total these charges.

- Further, fill in the 1200 section with all Government Recording and Transfer Charges, including Recording Fees and Transfer Taxes.

- Proceed to itemize the 1300. Additional Settlement Charges, if there are any, and total the estimated closing costs.

- In the Estimated Reserve/Prepaid Costs section, 900 items required by the lender to be paid in advance, detail the Daily Interest, Mortgage Insurance Premium, Homeowner’s Insurance, and all other applicable charges.

- Complete the Transaction Summary by calculating and entering the totals for the Total Estimated Monthly Payment, Total Estimated Funds Needed to Close, and breakdown of Total Monthly Payment along with Discounts and Financing Charges.

- Finally, in the Closing Costs Summary, list down the Borrower Paid Closing Costs, Non-Borrower Paid Closing Costs, and Total Credits. Ensure to review and accurately calculate the Total Closing Costs (a + b) and subtract the amount from the Total Costs to get the final amount due at closing.

The comprehensive completion of each section ensures a clear and precise representation of the financial aspects of the loan transaction. After filling out the form, it’s important to review all sections for accuracy and compliance with the loan agreement's terms. This careful preparation aids in the efficient processing of the loan settlement and helps prevent potential discrepancies or misunderstandings between all parties involved.

Obtain Answers on Fee Worksheet

What is an Itemized Fee Worksheet?

The Itemized Fee Worksheet is a detailed document designed to provide borrowers and lenders with an estimate of the charges expected at the settlement of a loan. It lists various fees related to the loan, title, government recording, and additional settlement charges. The worksheet highlights both the borrower-paid and lender-paid costs, offering a comprehensive overview of potential expenses before closing.

Why is it important to have an Itemized Fee Worksheet?

Having an Itemized Fee Worksheet is crucial for both transparency and preparation. It helps borrowers understand the financial commitment they are about to make and ensures there are no surprises at the closing table. For lenders and investors, it facilitates clear communication of estimated costs, helping to maintain trust and avoid potential disputes.

Are the fees listed on the worksheet the final amounts I will be charged?

No, the fees listed on the Itemized Fee Worksheet are estimates based on the lender’s experience and current market conditions. Actual charges at the time of settlement may be higher or lower than the estimates provided. This document is intended as a guide to help you plan for the closing costs you will likely incur.

Can the number of items listed on the worksheet vary for different transactions?

Yes, not every transaction will involve a fee for every item listed on the worksheet. The number and type of charges can vary significantly based on the specifics of the loan, such as the type of loan, the property being financed, and the requirements of the lender.

What are "Items Payable in Connection with Loan"?

"Items Payable in Connection with Loan" refers to fees directly associated with processing, approving, and funding the loan. This category may include loan origination fees, application fees, underwriting fees, and broker fees, among others.

What are "Title Charges"?

Title charges encompass the costs related to ensuring that the title to the property is clear and can be legally transferred. These fees may include the cost of title insurance for both the owner and the lender, settlement or closing fees, and any additional fees required to resolve title issues.

What are "Government Recording and Transfer Charges"?

Government recording and transfer charges are fees imposed by local governments for recording the deed and mortgage and transferring ownership of the property. These might include recording fees, transfer taxes, and city/county/state tax stamps.

What are "Additional Settlement Charges"?

Additional Settlement Charges include miscellaneous expenses necessary to complete the real estate transaction. This can cover a wide range of services such as surveys, pest inspections, and any necessary repairs that were agreed upon before closing.

What does "Estimated Reserve/Prepaid Costs" mean?

"Estimated Reserve/Prepaid Costs" represent funds that the lender requires the borrower to pay in advance at closing. These costs typically include prepaid interest, initial deposits into the escrow account for homeowners insurance and property taxes, and any other prepaid items required by the lender.

How are the "Total Estimated Funds Needed to Close" calculated?

The "Total Estimated Funds Needed to Close" is calculated by summing the total estimated closing costs, estimated reserve/prepaid costs, purchase price/payoff, and any discounts or additional financing. It then subtracts any loan amounts, borrower-paid closing costs, financed fees, and credits or contributions from sellers, brokers, or others. This provides a comprehensive estimate of the total amount a borrower needs to bring to the closing.

Common mistakes

When filling out the Itemized Fee Worksheet, a critical document for use with service providers and investors, people often make several mistakes. These errors can affect the accuracy of the estimates provided and potentially the final understanding of the charges likely to be incurred at the settlement of a loan. Recognizing and avoiding these common mistakes can streamline the loan process, ensuring all parties have a clear and accurate financial picture.

Not Checking the Accuracy of Basic Information: Failing to verify the date, borrower information, loan number, and property details can lead to confusion and incorrect processing of the loan file.

Incorrect Loan and Financial Details: Misstating the interest rate, type of loan, base loan amount, loan program, term, sales price, or total loan amount can significantly impact the loan terms and the accuracy of the worksheet.

Overlooking Fees and Charges: Skipping items payable in connection with the loan, title charges, adjusted origination charges, and additional settlement charges can lead to an underestimation of the total costs.

Miscalculating Reserve/Prepaid Costs: Errors in calculating the initial deposit into the escrow account, homeowner’s insurance, mortgage insurance, property taxes, and other reserves/prepaid costs can affect the total estimated reserve/prepaid costs section.

Misunderstanding the Transaction Summary: Incorrectly adding up the total estimated monthly payment, total estimated funds needed to close, and other financing details can result in a misrepresentation of the borrower's financial commitments.

Confusion Over Closing Costs Summary: Misidentifying payer labels such as S (paid by seller), B (paid by broker), and others, as well as inaccurately calculating the borrower paid and non-borrower paid closing costs can distort the overall financial settlement of the loan.

Neglecting to Account for Prepayments and Discounts: Omitting details like discounts if the borrower will pay, FHA UFMIP/VA Funding Fee, and other prepayments can lead to incomplete financial disclosure on the worksheet.

By steering clear of these mistakes, individuals can ensure a smoother transaction. An accurate and thoroughly checked Itemized Fee Worksheet helps all parties gain clarity about the financial aspects of the loan, paving the way for a more successful lending experience.

Documents used along the form

When discussing the financial aspects of obtaining a new loan, various documents and forms beyond the Itemized Fee Worksheet are commonly required to ensure a clear, comprehensive understanding of the financial responsibilities and the details of the upcoming transaction. Each of these documents plays a vital role in the mortgage process, offering a complete picture of the borrower's financial engagement.

- Loan Estimate: This form provides an early, detailed estimate of the loan terms, projected payments, and closing costs associated with the loan. It is designed to give borrowers a comprehensive overview of what to expect financially, allowing for comparisons and informed decision-making.

- Closing Disclosure: Serving as a final review document, the Closing Disclosure outlines the actual terms of the loan, final closing costs, and any other fees to be paid. This document is given to the borrower at least three days before closing to ensure they understand all aspects of their financial commitment.

- Truth in Lending Act (TILA) Disclosure: This disclosure provides detailed information about the cost of your credit, including the annual percentage rate (APR), finance charge, amount financed, and total of payments. It is intended to promote informed use of consumer credit by helping borrowers understand the terms of their loans.

- Appraisal Report: An important document used by the lender to assess the property's market value. It includes a detailed analysis of the property and comparable properties in the area, ensuring the loan amount does not exceed the property’s value.

- Title Insurance Policy: This document offers protection to both the borrower and the lender against any loss resulting from disputes over property ownership. It ensures the property is free from liens or claims and that the lender has a valid lien on the property.

- Initial Escrow Statement: This statement outlines the estimated taxes, insurance premiums, and other charges anticipated to be paid from the escrow account during the first year of the loan. It provides a clear accounting of the funds collected and their designated purpose.

Navigating through the mortgage process can be daunting, with numerous forms and documents requiring attention. However, each of these documents serves a critical function, ensuring borrowers are well-informed, protected, and prepared for their financial responsibilities in obtaining and maintaining their new loan. Understanding the role and contents of these documents contributes to a smoother, more transparent mortgage process.

Similar forms

The Good Faith Estimate (GFE) document is similar to the Fee Worksheet because both provide an itemized list of estimated closing costs and fees associated with obtaining a mortgage. They both aim to inform the borrower about the expected expenses before closing.

HUD-1 Settlement Statement shares similarities with the Fee Worksheet, as both detail the actual charges incurred during the settlement process. Although the HUD-1 is used at closing to account for final costs, while the Fee Worksheet is an estimate.

The Loan Estimate is akin to the Fee Worksheet since it outlines the loan terms, projected payments, and closing costs for borrowers. It serves a similar purpose of offering early disclosures on loan expenses.

Closing Disclosure and the Fee Worksheet documents are similar because they both enumerate the fees and costs tied to the mortgage transaction. However, the Closing Disclosure provides final costs as opposed to estimated ones.

Annual Escrow Statement bears some resemblance to the Fee Worksheet by listing the insurance and tax expenses that are payable from the escrow account, though it focuses more on the annual operation of the escrow rather than initial settlement charges.

The Truth in Lending Act (TILA) disclosure is related to the Fee Worksheet as they both include information about the loan's terms, although TILA disclosures mainly zero in on the finance charges, APR, and other credit terms, rather than itemizing settlement fees.

Loan Application is somewhat similar to the Fee Worksheet in that it starts the process of detailing the financial relationship between borrower and lender, including preliminary information on loan amounts and property details, which sets the stage for detailed cost estimates seen in the Fee Worksheet.

Dos and Don'ts

Filling out the Fee Worksheet is a critical step in the loan process, ensuring that all estimated charges connected with your loan are accurately documented. Here are some key dos and don'ts to help you navigate this process effectively.

Dos:

- Review all sections carefully: Make sure to go over each section of the form to understand what fees and charges are applicable. This involves checking all the estimated fees in sections such as loan origination fees, title charges, government recording, and transfer charges as well as additional settlement charges.

- Verify the accuracy of estimated charges: Since these are estimates, it's important to have a clear understanding of what each charge entails and to verify their accuracy with your service provider or investor. This can help prevent any unexpected costs down the line.

- Update any changes promptly: If there are any changes to your loan details, such as the loan amount, interest rate, or type of loan, make sure these are reflected accurately on the form to ensure the estimates are current.

- Document all items payable and reserves: Pay special attention to items payable in connection with the loan and required reserves to be paid in advance or deposited with the lender, ensuring this information is complete and accurate.

Don'ts:

- Skip sections not immediately clear: If certain fees or charges are not clear, do not skip them. Instead, seek clarification to ensure that every part of the worksheet is filled out correctly, thus avoiding any misunderstandings.

- Underestimate the importance of reviewing with professionals: Always consult with professionals, such as your loan officer or a contract specialist, to review your completed worksheet. This step can provide an additional layer of assurance that everything is in order.

- Forget to check for completeness: Ensure that every applicable section of the fee worksheet is filled out. Leaving sections blank that should have estimated costs can lead to inaccuracies in your loan settlement.

- Ignore the transaction summary: The transaction summary includes critical financial information. Neglecting to review this section carefully can result in an unclear picture of the total estimated monthly payment, funds needed to close, and the overall loan amount.

Misconceptions

Understanding the Fee Worksheet form is essential when navigating the home-buying process, yet several misconceptions often arise. Here is a clarification of these common misunderstandings:

Every fee listed must be paid. This is not accurate. The Fee Worksheet provides estimates and potential fees, but not all items may apply to every transaction. Some charges could be more or less than estimated.

The fees on the worksheet are final. The figures given are estimates, which means the actual fees incurred may vary. The worksheet is a guide, not a set-in-stone document.

All lenders use the same fee worksheet format. While many lenders may use similar forms, there is no universal format for the Fee Worksheet. The structure and items listed can differ between lenders.

Itemized Fee Worksheets are only for the borrowers. These worksheets are also useful for service providers and investors to understand the estimated costs associated with the loan and the settlement.

If a fee is listed, it cannot be negotiated. Some fees may be fixed, but others, such as loan origination fees, can sometimes be negotiated with the lender.

The estimated closing costs are the only expenses to prepare for. Besides the estimated closing costs, borrowers should also consider reserve/prepaid costs, which may include items like insurance premiums and property taxes.

Fees related to title services are the lender's responsibility. While it's common for lenders to choose the title service providers, the associated fees are usually the borrower's responsibility, unless negotiated differently.

Credit report and appraisal fees are the same for everyone. The costs for credit reports and appraisals can vary based on the service provider, the property, and the borrower's credit history.

Discounts cannot be applied to fees listed on the Fee Worksheet. Discounts or lender credits might be available and can reduce the costs for the borrower. These potential discounts should be discussed with the lender.

Reserve/prepaid costs are optional. Items required by the lender to be paid in advance, such as insurance premiums and property taxes, are typically mandatory to ensure the property is adequately covered and taxes are paid.

When reviewing a Fee Worksheet, it's crucial for borrowers to ask questions and clarify any uncertainties with their lender. Understanding each charge and why it's necessary helps ensure there are no surprises when it comes time to close the loan.

Key takeaways

Understanding the Itemized Fee Worksheet is crucial for transparency and accuracy in financial transactions related to service providers and investors. This document provides an estimate of the charges expected at the settlement of a loan, helping borrowers make informed decisions.

- The worksheet outlines estimated fees associated with the loan, divided into various sections like items payable in connection with the loan, title charges, government recording, and transfer charges, additional settlement charges, and estimated reserve/prepaid costs.

- The Importance of Accurate Estimates cannot be overstated. Although the figures are preliminary and subject to change, they give borrowers a ballpark figure of the financial requirements for their loan settlement.

- Not every transaction involves a fee for every item listed. This highlights the need for borrowers to consult with their service providers to understand which fees apply to their specific situation.

- Understanding the breakdown of costs, such as loan origination fees, appraisal fees, title insurance, and government recording charges, is essential for borrowers. This detailed breakup helps them in assessing the total financial commitment towards the loan.

- The worksheet also provides a section for calculating the total estimated monthly payment and total estimated funds needed to close. This includes a summary of the purchase price, estimated closing costs, reserve/prepaid costs, and any discounts or additional fees.

Finally, the Itemized Fee Worksheet serves as an educational tool, empowering borrowers with the knowledge to discuss their loans confidently with lenders and negotiate terms if necessary. It is a vital part of the financial documentation that ensures transparency and helps manage expectations for all parties involved.

Popular PDF Forms

Contact Lens Prescription Pdf - This form serves as a comprehensive order sheet for contact lenses, meticulously crafted by the Illinois Department of Healthcare and Family Services to ensure accuracy in prescription and delivery.

Michigan Workers Independent Contractor Worksheet - It serves as an auditable record of a Michigan contractor’s independent operational status and engagement with multiple clients.

Scout Membership Number - The application includes sections for references and additional information, ensuring a thorough evaluation process.