Blank Fha Amendatory Clause PDF Template

The FHA Amendatory Clause form plays a crucial role in the home buying process, especially for those securing loans through the Federal Housing Administration (FHA). This document, fundamental in nature, specifically protects the buyer by ensuring that they are not bound to purchase a property if its appraised value does not meet or exceed the agreed-upon sale price. Essentially, it serves as a safeguard, permitting the buyer to back out of the contract without facing penalties, such as the forfeiture of earnest money, if the appraised value falls short. Moreover, the clause grants buyers the option to proceed with the purchase even if the appraisal is lower, highlighting an element of flexibility in real estate transactions. It's notable that the document requires acknowledgment from both the buyer and the seller regarding the appraisal contingency, emphasizing its importance in the transaction. Additionally, it incorporates a real estate certification, where all parties involved in the deal—buyers, sellers, and their respective agents—certify that all information and agreements related to the sale are true and part of the contract, underscoring the clause’s role in maintaining transparency and integrity throughout the process. Furthermore, it includes a stern warning about the severe consequences of making false statements, reflecting its compliance with federal law and its commitment to preventing fraud in real estate transactions.

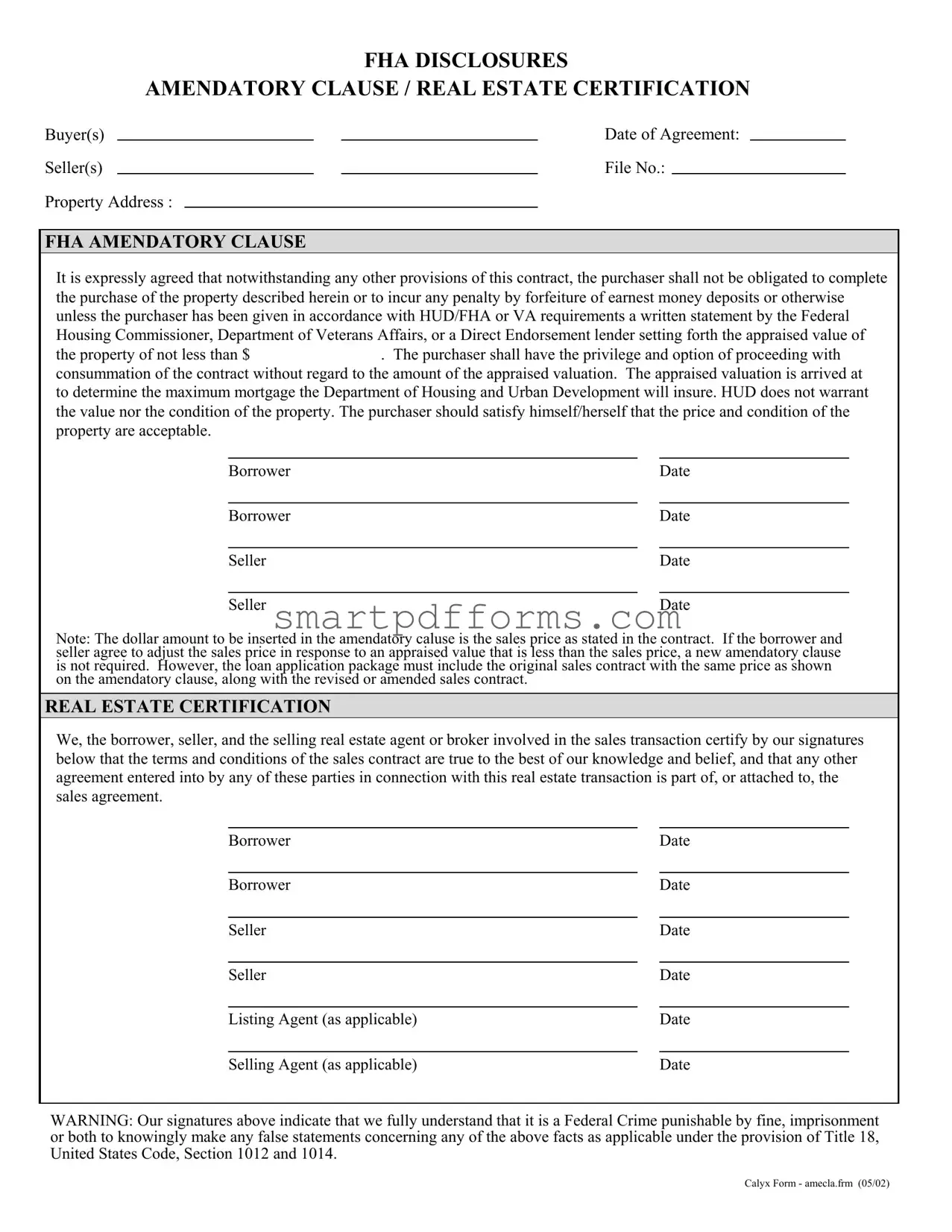

Preview - Fha Amendatory Clause Form

FHA DISCLOSURES

AMENDATORY CLAUSE / REAL ESTATE CERTIFICATION

Buyer(s) |

|

|

|

|

Date of Agreement: |

|

|

Seller(s) |

|

|

|

|

File No.: |

|

|

Property Address : |

|

|

|

|

|

|

|

FHA AMENDATORY CLAUSE

It is expressly agreed that notwithstanding any other provisions of this contract, the purchaser shall not be obligated to complete the purchase of the property described herein or to incur any penalty by forfeiture of earnest money deposits or otherwise unless the purchaser has been given in accordance with HUD/FHA or VA requirements a written statement by the Federal Housing Commissioner, Department of Veterans Affairs, or a Direct Endorsement lender setting forth the appraised value of

the property of not less than $. The purchaser shall have the privilege and option of proceeding with consummation of the contract without regard to the amount of the appraised valuation. The appraised valuation is arrived at to determine the maximum mortgage the Department of Housing and Urban Development will insure. HUD does not warrant the value nor the condition of the property. The purchaser should satisfy himself/herself that the price and condition of the property are acceptable.

Borrower |

Date |

|

|

|

|

Borrower |

Date |

|

|

|

|

Seller |

|

Date |

|

|

|

Seller |

|

Date |

Note: The dollar amount to be inserted in the amendatory caluse is the sales price as stated in the contract. If the borrower and seller agree to adjust the sales price in response to an appraised value that is less than the sales price, a new amendatory clause is not required. However, the loan application package must include the original sales contract with the same price as shown on the amendatory clause, along with the revised or amended sales contract.

REAL ESTATE CERTIFICATION

We, the borrower, seller, and the selling real estate agent or broker involved in the sales transaction certify by our signatures below that the terms and conditions of the sales contract are true to the best of our knowledge and belief, and that any other agreement entered into by any of these parties in connection with this real estate transaction is part of, or attached to, the sales agreement.

Borrower |

Date |

|

|

|

|

Borrower |

Date |

|

|

|

|

Seller |

|

Date |

|

|

|

Seller |

|

Date |

|

|

|

Listing Agent (as applicable) |

|

Date |

|

|

|

Selling Agent (as applicable) |

|

Date |

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment or both to knowingly make any false statements concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Calyx Form - amecla.frm (05/02)

Form Data

| Fact Number | Description |

|---|---|

| 1 | The FHA Amendatory Clause ensures that a buyer is not obligated to complete the purchase of a property if the appraisal does not meet or exceed the specified amount. |

| 2 | It states that the purchaser can withdraw without losing their earnest money if the appraised value comes in lower than the agreed price. |

| 3 | The clause is required by the Department of Housing and Urban Development (HUD) for all sales transactions involving FHA loans. |

| 4 | The form must include the sales price as stated in the contract, and any adjustments to the sales price in response to the appraisal must be documented in a revised sales contract included in the loan package. |

| 5 | HUD does not guarantee the value or condition of the property. It's up to the buyer to ensure the property’s price and condition are acceptable. |

| 6 | The Real Estate Certification section requires signatures from the buyer, seller, and agents, certifying the accuracy and truthfulness of the contract terms and any agreements made. |

| 7 | Signing the Real Estate Certification falsely is a federal crime that could result in fine, imprisonment, or both, as per Title 18, United States Code, Sections 1012 and 1014. |

| 8 | The Amendatory Clause gives the buyer the right to proceed with the purchase even if the appraised value is less than the agreed-upon sale price. |

| 9 | This form was created and updated by Calyx on May 2002, indicating the form’s version date for reference. |

Instructions on Utilizing Fha Amendatory Clause

Filling out the FHA Amendatory Clause form is a step that needs careful attention. This form plays a crucial role in home buying processes involving FHA loans. It ensures that the buyer is not obligated to buy the property if the appraisal doesn't meet or exceed the stated purchase price unless they decide to proceed regardless of the appraisal. Additionally, it confirms everyone involved is truthful about the real estate transaction.

Here’s how to fill out the form:

- Start with the Buyer(s) section by entering the full name(s) of the buyer(s).

- Enter the Date of Agreement which refers to the date when the agreement to purchase was made.

- Proceed to the Seller(s) section and fill in the full name(s) of the seller(s).

- In the File No. field, input the transaction or file number if available.

- For the Property Address field, write the complete address of the property being purchased.

- Under the FHA Amendatory Clause, notice the clause is pre-filled; no action is needed other than understanding its content.

- The clause mentions a dollar amount. This is typically the sales price and should be noted, but you do not fill anything here.

- Each Borrower and Seller must sign and date their respective sections to acknowledge the clause.

- Next is the Real Estate Certification section, where all parties involved in the sale including borrowers, sellers, and the real estate agents (if applicable) must provide their signatures and the date. This certifies that the information provided is accurate to the best of their knowledge.

- The last part contains a warning about the legal repercussions of providing false information. While there's nothing to fill out here, it's crucial for all parties to read and understand this warning before signing the form.

Once everyone has signed and dated the form in their respective sections, it's ready to be submitted with your loan application package. Remember, this form is vital for the integrity of the transaction, ensuring that all parties agree to the terms based on accurate and honest information.

Obtain Answers on Fha Amendatory Clause

- What is an FHA Amendatory Clause?

The FHA Amendatory Clause is a legal document included in the sales contract when an individual purchases a home with financing through the Federal Housing Administration (FHA). It stipulates that the buyer is not obligated to complete the purchase if the appraised value of the home is less than the agreed-upon sales price. Essentially, it protects the buyer by allowing them to back out of the contract without penalty if the appraisal does not meet the specified criteria. The clause also notes that the buyer may choose to proceed with the purchase despite the appraised value.

- Why is the FHA Amendatory Clause important?

This clause is crucial because it ensures buyers are not forced into a situation where they must close on a property valued less than the price they agreed to pay. Since FHA loans are primarily for buyers with lower down payments who may not have extensive financial resources, this clause provides significant protection. It underscores the buyer's right to know and make decisions based on the home's appraised value, ensuring they are not overpaying based on the FHA's insurance limits.

- When is the FHA Amendatory Clause used?

The clause is utilized in transactions involving FHA loans. It is a required part of the sales contract and must be signed by both the buyer and seller, often early in the sale process. It comes into play if an appraisal reveals the property's market value is below the agreed sale price, thereby allowing the buyer to renegotiate or withdraw from the contract under the terms set by the FHA.

- What happens if the appraisal comes in lower than the sale price?

If the appraisal value is lower than the sale price, the FHA Amendatory Clause grants the buyer the opportunity to exit the agreement without losing their earnest money. Alternatively, the buyer and seller may negotiate to adjust the sale price to match the appraised value. If they decide to adjust the price, a new amendatory clause is not necessary; however, the loan application must still include the original sales contract and any revised agreements reflecting the new price.

- Is it mandatory for all parties to sign the FHA Amendatory Clause?

Yes, it is mandatory for all parties involved in the transaction, including the buyer, seller, and their respective real estate agents or brokers, to sign the FHA Amendatory Clause. Their signatures confirm that they understand and agree to the terms outlined in the document. Furthermore, they must also sign the Real Estate Certification, certifying the accuracy and honesty of the information provided in relation to the sales agreement.

- What are the repercussions of not adhering to the FHA Amendatory Clause?

Non-adherence to the terms of the FHA Amendatory Clause can lead to severe consequences. Since all parties involved in the transaction must certify that all information provided is accurate to the best of their knowledge, knowingly providing false information is a federal crime. Violations can result in fines, imprisonment, or both, under Title 18, United States Code, Sections 1012 and 1014. This legal framework ensures honesty and integrity within real estate transactions involving FHA financing.

Common mistakes

Not entering the correct sales price: Sometimes people fill in a different amount than what's on their sales contract. This is a big no-no because the dollar amount in the FHA Amendatory Clause must match the sales price stated in the contract. If there's a change, the sales contract must be updated to reflect it.

Forgetting to include all parties' signatures: The form requires signatures from the buyer, seller, and their real estate agents (if applicable). Missing any of these signatures can make the document incomplete and delay the home buying process.

Overlooking the need for a revised clause after adjusting the sales price: If the buyer and seller agree to change the sales price based on the appraised value, many forget that while a new amendatory clause isn't needed, the loan application package must have the original and amended contracts. This oversight can lead to processing delays or issues with loan approval.

Not providing a written appraisal statement: The clause clearly states that the buyer isn’t obligated to complete the purchase without a written appraisal from an official body like HUD/FHA or VA showing the property’s value. Sometimes, people proceed without having this crucial document in hand, risking the entire transaction.

Failing to use the clause when required: There are situations where the FHA Amendatory Clause is a must but is mistakenly overlooked. Not using the clause when it's mandatory can put buyers in a position where they might have to complete a purchase even if the appraisal doesn't support the sales price or face losing their earnest money without protection.

Making any of these mistakes can complicate what should be an exciting journey toward homeownership. Understanding and avoiding these pitfalls helps ensure a smoother process.

Documents used along the form

The FHA Amendatory Clause form is an essential document for home buyers using FHA financing, but it's just one of many documents needed throughout the home buying process. Understanding the associated forms and documents can help ensure a smooth and compliant transaction. Below is a list of other forms and documents often used alongside the FHA Amendatory Clause form, each serving a unique purpose in the real estate transaction.

- Uniform Residential Loan Application: This comprehensive application is required by lenders to obtain necessary information from the borrower to make a decision on a mortgage loan.

- Real Estate Purchase Agreement: This document outlines the terms and conditions of the sale between the buyer and seller, including the purchase price and closing date.

- Home Inspection Report: A report detailing the condition of the property, identifying any repairs that may be necessary before the sale can proceed.

- Appraisal Report: An evaluation of the property's market value conducted by a licensed appraiser, necessary to ensure the property meets or exceeds the amount of the loan.

- Closing Disclosure: A form provided to the borrower at least three business days before closing, detailing the final transaction costs.

- Title Insurance Policy: This policy protects the buyer and lender from any legal challenges to the ownership of the property after the sale.

- Preliminary Title Report: A report that shows any liens, encumbrances, or defects in the title that need to be addressed before closing.

- Proof of Homeowners' Insurance: Proof that the buyer has secured property insurance, a requirement for mortgage approval.

- Lead-Based Paint Disclosure: A document required for homes built before 1978, disclosing the presence of any known lead-based paint.

Together, these documents work in concert with the FHA Amendatory Clause to protect the interests of all parties involved in a real estate transaction. Proper completion and understanding of each form ensure legal compliance, reduce risk, and can lead to a successful home purchase. Knowing the role and requirement of each form can significantly ease the home buying process for buyers, sellers, and agents alike.

Similar forms

The Uniform Residential Loan Application: This document, similar to the FHA Amendatory Clause form, is integral in the home buying process, particularly for those seeking mortgage loans. Both require detailed information about the buyers, the property in question, and the terms of the sale. While the FHA Amendatory Clause specifically addresses the conditions under which a buyer can back out of a contract based on appraisal values, the Uniform Residential Loan Application gathers the financial information needed to determine loan eligibility.

Real Estate Purchase Agreement: This agreement outlines the terms and conditions of a real estate transaction between a buyer and a seller, similar to the FHA Amendatory Clause form that also details specifics about the property sale, including an appraisal contingency. Both documents serve as binding agreements that ensure the clear communication of the sale terms, price, and conditions that must be met for the transaction to proceed.

The Appraisal Contingency Addendum: Similar to the FHA Amendatory Clause, this addendum is a provision in real estate contracts that makes the purchase conditional upon the results of an appraisal. If the appraised value is less than the specified amount, the buyer is given the option to terminate the contract. Both documents protect the buyer by ensuring they aren't obligated to overpay for a property based on the appraised value.

Property Disclosure Statement: This statement, which sellers provide to inform the buyer about the property's condition and history, shares its purpose with the FHA Amendatory Clause by ensuring transparency in real estate transactions. Although the Property Disclosure Statement focuses more on the condition of the property and the FHA Amendatory Clause on the financial and legal aspects, both aim to ensure that the buyer is fully informed before proceeding with the purchase.

Loan Estimate Form: This document provides estimates of the terms and costs of a proposed mortgage loan, similarly to how the FHA Amendatory Clause form contains crucial information that affects the financial aspect of buying a home, including the necessity of an appraisal to determine the property's value. Both forms are essential tools for buyers to understand the financial commitments involved in purchasing a home.

Closing Disclosure: This form outlines the final terms and costs of a mortgage, similar to the FHA Amendatory Clause, which also deals with the financial implications of a real estate transaction. Both documents play a critical role in the closing process of homebuying, ensuring that the buyer is informed of and agrees to the final terms and costs associated with their mortgage and property purchase.

Dos and Don'ts

When filling out the FHA Amendatory Clause form, understanding what to do and what not to do is crucial for a smooth and legally compliant home buying process. Below is a guide to help navigate this form:

Do:- Verify the accuracy of all the information: Ensure that details such as the date of the agreement, property address, and the sales price are correct and match other documents.

- Review the appraised value statement: Confirm that the statement from HUD/FHA or VA matches the appraisal and understand its impact on the mortgage.

- Ensure all parties sign and date: The form requires signatures from the buyer(s), seller(s), and if applicable, their real estate agents. Double-check that everyone signs and dates correctly.

- Include the necessary sales contracts: If the sales price is adjusted, ensure the initial sales contract and the revised/amended one are included in the loan application package.

- Understand the real estate certification: Recognize that by signing, all parties certify that the sales contract's terms and conditions are accurate and any additional agreements are attached.

- Pay attention to the warning about false statements: Be aware of the severe implications of making false statements on this form, as it is considered a federal crime.

- Consult with a professional if needed: If there is any confusion or concern regarding the FHA Amendatory Clause, consulting with a real estate professional or legal adviser is advisable.

- Rush through the form: Take your time to thoroughly review and understand each section of the form before filling it out.

- Skip over any sections: Each part of the FHA Amendatory Clause is important. Do not leave any sections blank unless they are specifically not applicable.

- Forget to check the appraised value: Not validating the appraised value can lead to complications with the FHA loan limits and your mortgage approval.

- Overlook the need for original and revised contracts: Failing to include these documents can delay or complicate the loan processing.

- Ignore inaccuracies: If any discrepancies are found between the FHA Amendatory Clause and the sales contract, they must be corrected before proceeding.

- Allow unsigned or undated sections: Each required signature and date is crucial for the form's validity; missing signatures can void the agreement.

- Disregard the legal implications: The serious consequences of falsifying information on this form should not be underestimated.

Misconceptions

The FHA (Federal Housing Administration) Amendatory Clause is a vital document in real estate transactions involving FHA financing, yet it's often misunderstood. Let's clear up some common misconceptions:

It's only for the buyer's benefit: While it's true the clause primarily protects the buyer by ensuring they're not obligated to buy a property if the appraisal doesn't meet the selling price or if they don't receive FHA financing approval, it also benefits the seller by providing a clearer understanding of the buyer's financing condition.

It guarantees the sale price will match the appraisal: This is incorrect. The FHA Amendatory Clause simply states that the buyer isn't obligated to proceed if the appraisal comes in lower than the agreed-upon sale price. It doesn't ensure the sale price will be adjusted to match the appraisal.

Signing it locks the buyer into using FHA financing: Simply put, no. While the form is part of FHA loan documentation, signing it doesn't mean the buyer must stick with FHA financing if they qualify for other financing options that are more beneficial to them.

It's required for all home sales: This clause is only required for sales involving FHA financing. If the buyer isn't using an FHA loan to purchase the property, this clause would not be a part of the sales contract.

The clause allows a buyer to cancel for any reason: The clause specifically provides cancellation rights if the property does not appraise for the agreed selling price or if FHA financing is not approved. It doesn't grant the buyer a broad right to cancel for any reason without consequences.

If an appraisal comes in low, a new clause must be signed with a lower price: Not exactly. If both parties agree to adjust the sale price in response to an appraisal lower than the original selling price, a new FHA Amendatory Clause doesn't need to be re-signed. However, the original sales contract and any revised versions must be part of the loan application package.

It complicates the selling process: While any additional paperwork can seem like a hurdle, the FHA Amendatory Clause is straightforward. It clearly outlines the conditions under which a buyer can proceed with or withdraw from the sale, actually helping to prevent misunderstandings and providing transparency to all parties involved in the transaction.

Understanding the FHA Amendatory Clause thoroughly can help both buyers and sellers navigate FHA financing with confidence, ensuring a smoother transaction process.

Key takeaways

Here are eight key takeaways about filling out and using the FHA Amendatory Clause form:

- The FHA Amendatory Clause ensures that the buyer is not obligated to buy the property if the appraisal value is lower than the agreed-upon sale price, without any penalty.

- This clause gives buyers the option to proceed with the purchase regardless of the appraisal value, highlighting the importance of carefully considering the property's value and condition before finalizing a purchase.

- The appraised value mentioned in the clause is used to determine the maximum mortgage amount that the Department of Housing and Urban Development (HUD) will insure.

- HUD does not guarantee the property's value or condition, underscoring the need for buyers to do their due diligence.

- If the appraisal comes in lower than the selling price, the buyer and seller can agree to adjust the price. However, the original sales contract must still show the initial price, along with the revised contract reflecting any adjustments.

- Alongside the amendatory clause, a Real Estate Certification must be signed by the borrower, seller, and the involved real estate agents or brokers, confirming the truthfulness of the contract's terms and acknowledging that any other agreements are part of the sales contract.

- Signing the Real Estate Certification asserts that all parties understand making false statements in connection with the real estate transaction is a federal crime, subject to fines, imprisonment, or both.

- The necessity of including the dollar amount, which should be the sale price as stated in the sales contract, within the amendatory clause itself underscores the importance of transparency and accuracy in the transaction process.

Popular PDF Forms

Forwarding Mail - Options are included for forwarding mail addressed to individuals, businesses, or in the case of a deceased person.

Michigan Tr 205 - Cannot be used for mobile homes, vehicles acquired out of state, or if the applicant can still contact the titled owner.