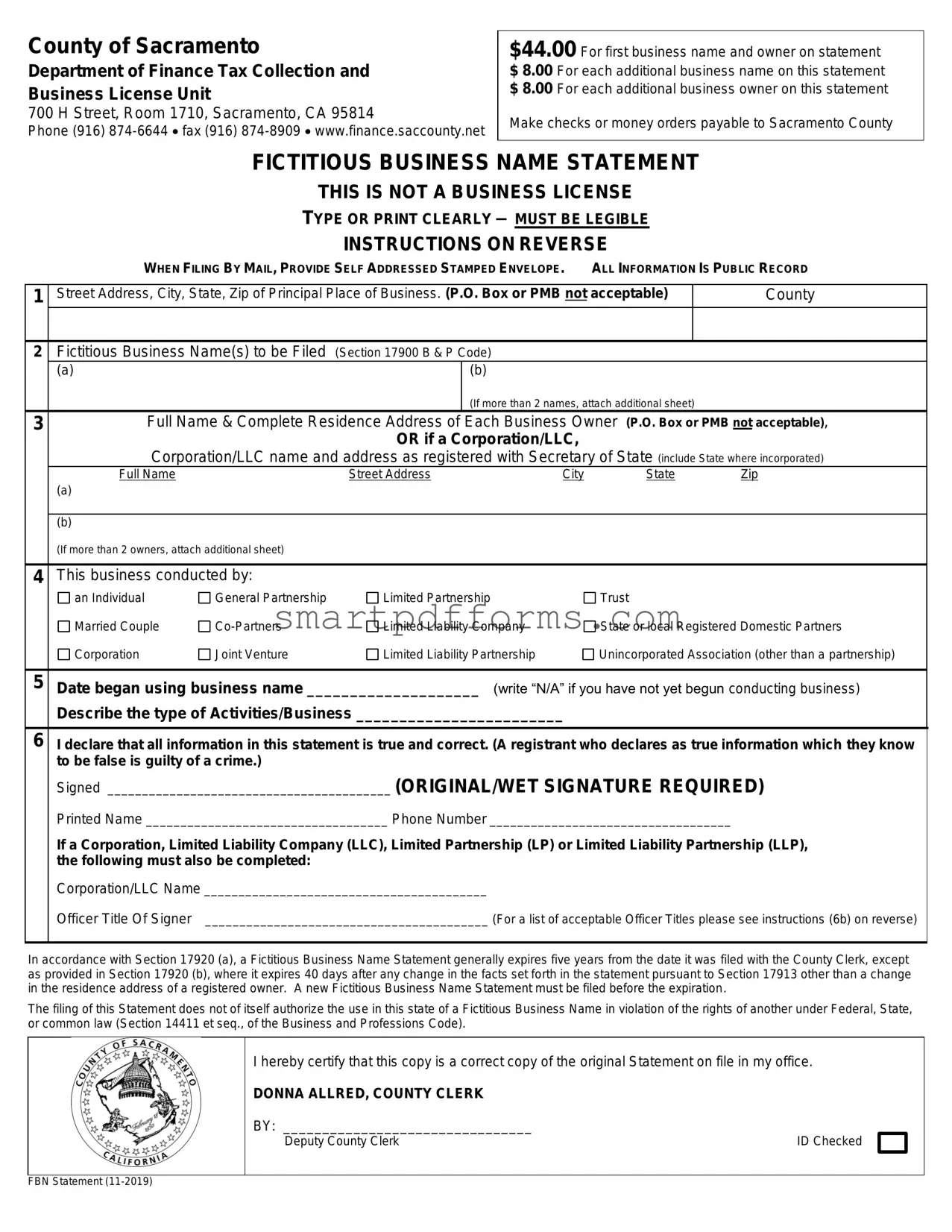

Blank Fictitious Business Name Statement PDF Template

At the heart of commencing a business under a name other than one's own, lies the Fictitious Business Name Statement, a crucial document for entrepreneurs steering their ventures within the vicinity of Sacramento, California. This requisite form, facilitated by the County of Sacramento Department of Finance, encases essential details for the registration of a business name, a fundamental step mandated for a broad spectrum of business establishments including individuals and partnerships, all the way to corporations and limited liability companies. Structured with a view to promoting clarity and preventing identity confusion in the business ecosystem, the form outlines a comprehensive fee structure, starting at $44.00 for the initial business name and owner, with an additional charge for extra names or owners. It sets forth a procedural directive requiring submissions to be both legible and complete, emphasizing the need for physical addresses over P.O. Boxes or PMBs, thereby underlining the importance of transparency. Furthermore, the form delineates the process for those conducted by varying legal entities—ranging from individuals to corporations—mandating specifics like the commencement date of the business name's use, the type of business activities, and a declaration attesting to the truthfulness of the information provided, which is safeguarded under the penalty of perjury. The document also highlights mandatory publication requirements, aiming to solidify the business name's public recognition, alongside detailing conditions under which the statement expires or requires renewal. Importantly, it underscores the document's role in granting the right to use a business name in the state, contingent upon adherence to the stipulations set forth, thereby safeguarding the interests of both the business and the broader community.

Preview - Fictitious Business Name Statement Form

County of Sacramento

Department of Finance Tax Collection and Business License Unit

700 H Street, Room 1710, Sacramento, CA 95814

Phone (916)

$44.00 For first business name and owner on statement $ 8.00 For each additional business name on this statement $ 8.00 For each additional business owner on this statement

Make checks or money orders payable to Sacramento County

FICTITIOUS BUSINESS NAME STATEMENT

THIS IS NOT A BUSINESS LICENSE

TYPE OR PRINT CLEARLY – MUST BE LEGIBLE

INSTRUCTIONS ON REVERSE

|

WHEN FILING BY MAIL, PROVIDE SELF ADDRESSED STAMPED ENVELOPE. |

ALL INFORMATION IS PUBLIC RECORD |

||||||

|

|

|

|

|

||||

1 |

Street Address, City, State, Zip of Principal Place of Business. (P.O. Box or PMB not acceptable) |

|

County |

|||||

|

|

|

|

|

|

|

|

|

2 |

Fictitious Business Name(s) to be Filed |

(Section 17900 B & P Code) |

|

|

|

|

||

|

(a) |

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 names, attach additional sheet) |

|

|||

3 |

Full Name & Complete Residence Address of Each Business Owner (P.O. Box or PMB not acceptable), |

|||||||

|

|

|

OR if a Corporation/LLC, |

|

|

|

||

|

Corporation/LLC name and address as registered with Secretary of State (include State where incorporated) |

|||||||

|

Full Name |

|

Street Address |

City |

State |

Zip |

||

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 owners, attach additional sheet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

This business conducted by: |

|

|

|

|

|

|

|

|

an Individual |

General Partnership |

Limited Partnership |

|

Trust |

|

||

|

Married Couple |

Limited Liability Company |

State or local Registered Domestic Partners |

|||||

|

Corporation |

Joint Venture |

Limited Liability Partnership |

Unincorporated Association (other than a partnership) |

||||

|

|

|

||||||

5 |

Date began using business name ____________________ |

(write “N/A” if you have not yet begun conducting business) |

||||||

|

Describe the type of Activities/Business ________________________ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

6I declare that all information in this statement is true and correct. (A registrant who declares as true information which they know to be false is guilty of a crime.)

Signed _________________________________________ (ORIGINAL/WET SIGNATURE REQUIRED) Printed Name ___________________________________ Phone Number ___________________________________

If a Corporation, Limited Liability Company (LLC), Limited Partnership (LP) or Limited Liability Partnership (LLP), the following must also be completed:

Corporation/LLC Name _________________________________________

Officer Title Of Signer _________________________________________ (For a list of acceptable Officer Titles please see instructions (6b) on reverse)

In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, except as provided in Section 17920 (b), where it expires 40 days after any change in the facts set forth in the statement pursuant to Section 17913 other than a change in the residence address of a registered owner. A new Fictitious Business Name Statement must be filed before the expiration.

The filing of this Statement does not of itself authorize the use in this state of a Fictitious Business Name in violation of the rights of another under Federal, State, or common law (Section 14411 et seq., of the Business and Professions Code).

I hereby certify that this copy is a correct copy of the original Statement on file in my office.

DONNA ALLRED, COUNTY CLERK

BY: ________________________________

Deputy County Clerk |

ID Checked |

FBN Statement

NOTICE TO REGISTRANT PURSUANT TO SECTION 17924 BUSINESS & PROFESSIONS CODE (B & P Code)

Within 30 days after the fictitious business name statement has been filed with the County Clerk, the statement must be published in a newspaper of general circulation in the county where the fictitious business name was filed. The statement must be published once a week for four successive weeks with at least five days between each date of publication. An affidavit of publication must be filed with the county clerk within 30 days after the completion of the publication. If the registrant has no place of business in this state, the notice shall be published in a newspaper of general circulation in Sacramento County. (Section 17917 B & P Code, Section 6064 Government Code).

If refiling is required because the prior statement has expired, the refiling need not be published unless there has been a change in the information in the expired statement, provided the refiling is filed within 40 days of the date the statement expired. (Section 17917 B & P Code). Any person who executes, files, or publishes any fictitious business name statement, knowing that such statement is false, in whole or in part, is guilty of a misdemeanor and upon conviction thereof shall be fined not to exceed one thousand dollars ($1,000.00). (Section 17930 B & P Code).

According to Section 17900 B & P Code, “Fictitious Business Name” Means:

“(1) In the case of an individual, a name that does not include the surname of the individual”

INSTRUCTIONS FOR COMPLETION OF STATEMENT (Sec. 17913, 17914, 17915 B & P Code)

Type or print legibly. (P.O. Box, postal drop box, mailing suite and c/o addresses are not acceptable for either the business or residence address.)

1.Insert the street address and county of the principal place of business in California. The fictitious business name statement shall be filed with the clerk of the county in which the registrant has his principal place of business or if the registrant has no place of business in California, the Fictitious Business Name Statement shall be filed with the Clerk of Sacramento County.

2.Insert the fictitious business name or names if more than one name. Only those businesses operated at the same address may be listed on one statement.

3.Individual: insert full name and residence address of the individual.

Married Couple: insert full name and residence address of both spouses.

Partnership,

Trust: insert the full name and residence address of each trustee.

Corporation: insert the name and address of the corporation as set out in its articles of incorporation, and the state of incorporation.

Limited Liability Company (LLC): insert the name and address of the LLC as set out in its articles of organization, and the state of organization.

State or local Registered Domestic Partnership: insert full name and residence address of each domestic partner.

4.Indicate which of the terms best describes the ownership of the business.

5.Insert the date on which the registrant first began using business name(s) or expected date to begin. If the registrant has not yet begun transacting business and the expected date is unknown, insert “N/A”.

Describe the type activities/business that is occurring at address in section 1

6a. If the registrant is an individual, the statement must be signed by the individual; if a partnership or other association of other persons, by a general partner; if a trust, by a trustee; if a corporation, by an officer (title must be indicated); if a limited liability company, by an officer or a manager (title must be indicated). (Signature of an agent is not acceptable)

6b. If the registrant is a Corporation, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO.

If the registrant is an LLC, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO, Member, Managing Member, and Manager

IF YOU ARE FILING YOUR STATEMENT BY MAIL, PLEASE INCLUDE A

TRADE NAME REGISTRATION (Sec. 14411, 14412, 14415, 14416 B&P Code)

The filing of articles of incorporation with the state and/or a fictitious business name statement in the county establishes a rebuttable presumption within that county that the registrant or corporation has the exclusive right to use that business name, as well as any confusingly similar name, if the registrant or corporation is the first to register such name and is actively engaged in a business utilizing the name. The rebuttable presumption shall be applicable until the statement is abandoned or otherwise expires and no new statement has been filed by the registrant.

EXPIRATION OF FICTITIOUS BUSINESS NAME STATEMENT (Sec. 17920 B&P Code)

(a)In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, unless the statement expires earlier under (b) or (c) below. A NEW FICTITIOUS BUSINESS NAME STATEMENT MUST BE FILED BEFORE THE EXPIRATION.

(b)A fictitious business name statement expires 40 days after any change in the facts as set forth in the statement, except (1) a change in the residence address of an individual, general partner, or trustee does not cause the statement to expire, and (2) the filing of a statement of withdrawal from partnership by a withdrawing partner does not cause the statement to expire. A NEW STATEMENT MUST BE FILED WITHIN 40 DAYS AFTER A CHANGE IN THE INFORMATION REQUIRED ON THIS STATEMENT.

(c)A fictitious business name statement expires when the registrant files a statement of abandonment of use of the fictitious business name statement.

ONCE FILED, ALL INFORMATION ON THE FICTITIOUS BUSINESS NAME STATEMENT IS PUBLIC RECORD

For additional information on fictitious business names, refer to our Website at www.finance.saccounty.net

Form Data

| Fact Name | Description |

|---|---|

| Application Fees | $44.00 for the first business name and owner, and $8.00 for each additional business name or owner on the statement. |

| Location | Sacramento County Department of Finance Tax Collection and Business License Unit, 700 H Street, Room 1710, Sacramento, CA 95814. |

| Contact Information | Phone: (916) 874-6644, Fax: (916) 874-8909, Website: www.finance.saccounty.net |

| Publication Requirement | Within 30 days after filing, the statement must be published in a local newspaper once a week for four weeks. |

| Legal Framework | Governed by Section 17900 B & P Code and related sections; requires accurate and current information under penalty of perjury. |

| Expiration and Renewal | Generally expires five years from the date of filing unless changes necessitate earlier renewal. |

Instructions on Utilizing Fictitious Business Name Statement

Fictitious Business Name Statement forms are crucial documents for individuals and entities looking to conduct business under a name other than their own. This process, often seen as a formality, is indeed a foundational step towards establishing a brand's identity in the market. In essence, it's the bridge between an idea and a legally recognized business, allowing operations to commence under a chosen name. This guide is aimed to simplify the process, ensuring that every field is correctly filled out to avoid any potential hurdles in the journey of transforming a concept into a tangible business.

- Firstly, determine the principal place of business and provide the street address, city, state, and ZIP code in the relevant section. Remember, a P.O. Box or PMB is not valid for this purpose.

- Next, insert the fictitious business name or names you intend to register. If more than two names are desired, attach an additional sheet with the extra names listed following the format provided.

- For each business owner, list the full name and complete residence address. In cases involving a corporation, LLC, or other entities, include the entity's name and address as registered with the Secretary of State. Similar to the business names, if you have more than two owners, additional sheets are required.

- Identify the nature of the business ownership by selecting the appropriate box from the provided options. This could range from an individual to various types of partnerships and corporate structures.

- Indicate the date the business name began being used or, if not yet in use, state “N/A”. Following, describe the type of activities or business conducted.

- At the bottom, ensure the statement is signed and dated by the registrant. If the business is an entity such as a corporation or LLC, the signatory must state their title. Remember, an original wet signature is required.

Once the form is completed, enclose the appropriate filing fee with your document. If mailing, include a self-addressed stamped envelope for the return of endorsed copies. After filing, remember the next step involves publishing the statement in a newspaper of general circulation within the county where the fictitious name is filed, a critical step in solidifying the public presence of your business name. It's the legal declaration of your business’s existence under the fictitious name, hence an act not to be overlooked. The journey from idea to a fully operational business under a chosen name requires meticulous attention to these procedures. Following these steps diligently ensures that your path to business legitimacy is smooth and uninterrupted.

Obtain Answers on Fictitious Business Name Statement

-

What is a Fictitious Business Name Statement and who needs to file it?

A Fictitious Business Name Statement allows a business to operate under a name other than its legal name. When an individual, partnership, corporation, or other entity wishes to conduct business using a name that does not include the legal names of the owners or differs from the entity’s legal name, a Fictitious Business Name Statement should be filed with the county clerk's office. This requirement helps to ensure transparency and protects consumers by providing a way to identify the actual owners of a business.

-

How much does it cost to file a Fictitious Business Name Statement in Sacramento County?

The base fee for filing a Fictitious Business Name Statement in Sacramento County is $44.00 for the first business name and owner listed on the statement. If you need to add more business names or owners to the same statement, each additional name or owner incurs an $8.00 fee. These fees are payable to Sacramento County and can be paid via check or money order.

-

What happens if I don't publish my Fictitious Business Name Statement?

After filing your Fictitious Business Name Statement with the County Clerk, you're required to publish the statement in a newspaper of general circulation in the county where the fictitious name was filed. This publication must occur once a week for four consecutive weeks. Failing to meet this publication requirement could result in your fictitious business name being rejected or invalidated. Remember, an affidavit of publication must also be filed with the county clerk within 30 days after the completion of the publication cycle.

-

When does a Fictitious Business Name Statement expire, and what do I need to do to renew it?

Generally, a Fictitious Business Name Statement expires five years from the date it was filed with the County Clerk, unless circumstances occur that would cause it to expire earlier, such as any changes in the facts set forth in the statement. If there's a change (excluding changes in residence address of a registered owner or a statement of withdrawal from a partnership), the statement expires 40 days after this change. To maintain the use of your fictitious business name, you must file a new statement before your current one expires or within 40 days following any significant changes. Remember, the renewal process may not require republishing in a newspaper unless there have been changes to the information provided in the expired statement.

Common mistakes

Filling out a Fictitious Business Name Statement form is a crucial step for many business owners aiming to operate under a name other than their own legal name. However, this process can be fraught with pitfalls that may lead to unnecessary complications and delays. Here are seven common mistakes people make when completing this form:

Not using the correct principal place of business address: Business owners sometimes provide a P.O. Box, postal drop box, mailing suite, or c/o address as their business address, which is not acceptable. The form requires the street address of the principal place of business in California.

Failing to list all fictitious business names accurately: If operating under multiple business names from the same address, all names need to be listed. Omitting any names or not attaching an additional sheet for extra names can cause issues with your filing.

Incomplete owner information: All owners must have their full names and complete residence addresses listed. For entities like corporations or LLCs, the correct registered name and address as listed with the Secretary of State must be provided. Using P.O. Boxes or PMBs for an owner's address is a common mistake.

Incorrectly identifying the business structure: The form provides options like individual, partnership, corporation, etc. Choosing the wrong entity type can lead to processing delays and could affect the legal standing of your business operations.

Omitting the start date or incorrect activity description: The date the business name began being used or an expected start date should be clearly indicated. Additionally, an adequate description of the business activities must be provided to avoid ambiguity.

Signature issues: The form needs the original signature of the appropriate party—depending on the business structure. For example, a corporation must have the signature of an officer with their title indicated. Using an agent's signature or failing to provide the correct signatory's title are issues that can invalidate the form.

Not following publication requirements: After filing the form, the business name must be published in a local newspaper for four successive weeks. Failure to do so or to provide proof of publication within the designated timeframe can put the fictitious business name registration in jeopardy.

Averting these mistakes not only smoothens the filing process but also ensures your business operates in compliance with local regulations. It's advisable to review the form instructions thoroughly and verify all information for accuracy before submission. Keeping abreast of the requirements can save time, effort, and potential legal complications down the road.

Documents used along the form

When entrepreneurs establish a new business under a name that does not include their own surname, filing a Fictitious Business Name Statement (FBNS) is a critical first step for legal recognition. However, this document often represents just the beginning of a necessary paperwork journey for business compliance and protection. Let’s explore five other crucial forms and documents commonly used in conjunction with an FBNS.

- Business License Application: Most businesses operating in a city or county are required to obtain a business license. This document signifies permission from the local government to operate legally within its jurisdiction.

- Employer Identification Number (EIN) Application: Provided by the Internal Revenue Service (IRS), an EIN, also known as a Federal Tax Identification Number, is needed for tax purposes. It’s essential for hiring employees, opening a business bank account, and filing tax returns.

- Articles of Incorporation or Organization: For entrepreneurs forming a corporation or a limited liability company (LLC), filing these documents with the state is necessary. They officially recognize the establishment of the corporation or LLC, laying out its structure and compliance obligations.

- Trademark Application: If a business name or logo is unique and intended for branding, filing for a trademark with the United States Patent and Trademark Office (USPTO) can protect it from unauthorized use by others.

- Seller’s Permit: For businesses that intend to sell goods or offer taxable services, obtaining a seller’s permit from the state’s department of revenue is crucial. It allows the collection of sales tax from customers on taxable sales.

Filing an FBNS is just one step in the multifaceted process of establishing a business. Beyond legal compliance, these additional forms and documents help secure a business’s operational, financial, and intellectual properties. While the process may seem daunting, thorough preparation and understanding of required documentation can pave the way for sustainable business success.

Similar forms

The Fictitious Business Name Statement form is essential for individuals and companies intending to conduct business under a name other than their own. This document formalizes the use of a business name in public records, ensuring legal protection and compliance with local regulations. There are several documents similar to the Fictitious Business Name Statement, each serving a unique purpose in the business and regulatory landscape.

Articles of Incorporation: Like the Fictitious Business Name Statement, Articles of Incorporation are filed to legally register a business entity—specifically, a corporation. While the Fictitious Business Name Statement registers a business name for public record, Articles of Incorporation establish the legal existence of a corporation, detailing its purpose, structure, and compliance with state regulations.

DBA (Doing Business As) Registration: A DBA registration is virtually synonymous with the Fictitious Business Name Statement in many jurisdictions. Both documents allow individuals and companies to conduct business under a name different from their official legal name, whether for branding purposes or to launch a new venture under an alias.

Trademark Application: A Trademark Application is another form that shares a similar objective with the Fictitious Business Name Statement—protecting a business identity. However, while the latter registers a business name for local legal use, a Trademark Application secures intellectual property rights on a name, logo, or slogan at a national or international level, preventing others from using similar identifiers.

Business License Application: This document also intersects with the purpose of the Fictitious Business Name Statement in that it is required for operational legality. A Business License Application permits the actual operation of a business in a specific locale. In contrast, the Fictitious Business Name Statement simply registers the business name without granting operational rights.

Limited Liability Company (LLC) Operating Agreement: While this document is more about the internal governance of an LLC, it aligns with the Fictitious Business Name Statement's broader goal of formalizing business structures and identities. An LLC Operating Agreement outlines the operational and financial decisions of an LLC, showing how these internal agreements also contribute to the legal framework within which businesses operate.

Each of these documents serves a critical role in establishing and protecting various aspects of a business. While their purposes may overlap with that of the Fictitious Business Name Statement, it is the combined use of these forms that fully secures a business's legal standing and operational rights.

Dos and Don'ts

When filling out the Fictitious Business Name Statement form, it is important to navigate the process with care to ensure all legal criteria are met accurately. Here are some key dos and don'ts to guide you through this process:

- Do: Type or print clearly in all sections of the form to ensure legibility. This is essential for the accuracy of public records and facilitates easier processing of your statement.

- Do: Provide the street address, city, state, and zip of the principal place of business. Remember, P.O. Box or PMB addresses are not acceptable for this purpose.

- Do: Accurately describe the type of business or activities that will be conducted under the fictitious business name. This description should give a clear understanding of your business operations.

- Don't: Use a P.O. Box or PMB for the business owner's residence address. Full residential or registered business addresses are required for transparency and legal verification purposes.

- Don't: Sign the form without reviewing all information for accuracy and completeness. Filing false information, knowingly or unknowingly, can lead to misdemeanor charges.

- Don't: Forget to include the required filing fee with your form. Failure to do so can delay the processing of your fictitious business name statement. Make checks or money orders payable to Sacramento County.

Understanding the requirements and common pitfalls of filing your fictitious business name statement can save you time and protect you from legal complications. Always ensure that every detail you provide is accurate and complete according to the form's instructions. This careful attention to detail will ensure a smoother path as you establish the legal identity of your business. Remember, this statement does not serve as a business license, so further steps may be required to fully comply with local, state, and federal regulations.

Misconceptions

When navigating the process of filing a Fictitious Business Name Statement, it's essential to clear up some common misconceptions to avoid unnecessary confusion or errors. Here are eight misunderstandings often encountered:

It's a Business License: Many believe that filing a Fictitious Business Name Statement is the same as obtaining a business license. In reality, this statement is primarily for public record reasons, allowing consumers and other businesses to identify the true owner of a business. A separate business license is typically needed to legally operate a business.

Only Necessary if You Have Employees: The requirement to file does not hinge on whether a business has employees. If you're operating under any name that doesn't include your surname or implies multiple owners (like "and Sons," "Brothers," etc.), you need to file, regardless of your business size or employee count.

Once Filed, the Name is Yours Forever: A common mistake is thinking a fictitious name filing secures the name indefinitely. The truth is, these names expire five years after filing unless an earlier expiration applies, such as a change in business facts. You must refile to maintain the right to your business name.

No Need to Publish if Refiling: There's a nuanced rule here. If refiling is necessary because the prior statement expired and no information has changed, then yes, you might not need to publish again. However, any change in information on the expired statement, or if the refiling is past the 40-day grace period, requires new publication.

Any Alteration in Business Details Affects the Filing: Only significant changes — like changes in the business address or ownership — necessitate refiling. Minor changes, such as altering your business hours or services, do not affect the validity of your existing fictitious name filing.

Residence Addresses are Acceptable for Business Location: The form clearly states that P.O. Boxes or PMB (private mailbox) addresses are not acceptable for either the business or the residence address. The intent is to have a physical location noted for the principal place of business.

Filing in Any County is Permissible: This is not the case. You are required to file in the county where your principal place of business resides. If there is no place of business in California, then filing must occur in Sacramento County.

All Business Owners Must Sign the Form: While it might seem logical to have all owners sign, the regulations specify that only certain individuals need to sign depending on the business structure. For example, an individual owner or a general partner in a partnership can sign, and the specific officer titles acceptable for corporations or LLCs are outlined in the instructions.

Understanding these misconceptions can help ensure the correct filing of your Fictitious Business Name Statement and compliance with legal requirements. It's always a good practice to review the form's instructions thoroughly or consult a legal professional if you're unsure about the specifics of your situation.

Key takeaways

When starting or running a business under a name that is different from your own, it's necessary to file a Fictitious Business Name Statement. This is a critical step for business owners in order to comply with legal requirements and establish their brand. Here are key takeaways regarding the process of filling out and using this form:

- Filing fees are required: There is a base fee for the first business name and owner listed on the statement, with additional costs for extra names or owners.

- Legibility is crucial: The form must be filled out clearly, whether typed or printed, as all information becomes a part of public record.

- Post Office Box limitations exist: Neither the business’s principal place of business nor the residence addresses of the business owner(s) can be a P.O. Box or PMB. Actual street addresses must be used.

- Ownership structure dictates the filing details: The form accommodates various business types, from sole proprietorships to corporations, and requires specific information based on the chosen entity.

- Publication is required: After filing the form, the business name must be published in a local newspaper for four consecutive weeks, with proof of this publication provided to the County Clerk.

- Renewal deadlines: The statement generally expires five years after filing but must be renewed earlier if there are changes in the business details, such as ownership or business address.

- False information has consequences: Filing or publishing any part of the statement that is known to be false is considered a misdemeanor that could lead to a fine.

Proper attention to the requirements and timelines for filing a Fictitious Business Name Statement supports business legitimacy and compliance with local laws. Taking these steps helps protect the business name and ensures that the company operates under a stable legal foundation.

Popular PDF Forms

State of Georgia Workers Compensation - Features a section for including comprehensive job description details, including duties, pay, and work schedule.

Home Office Form - This form helps delineate the percentage of your home used for business, which directly influences your deductions.