Blank Fifth Third Bank Direct Deposit PDF Template

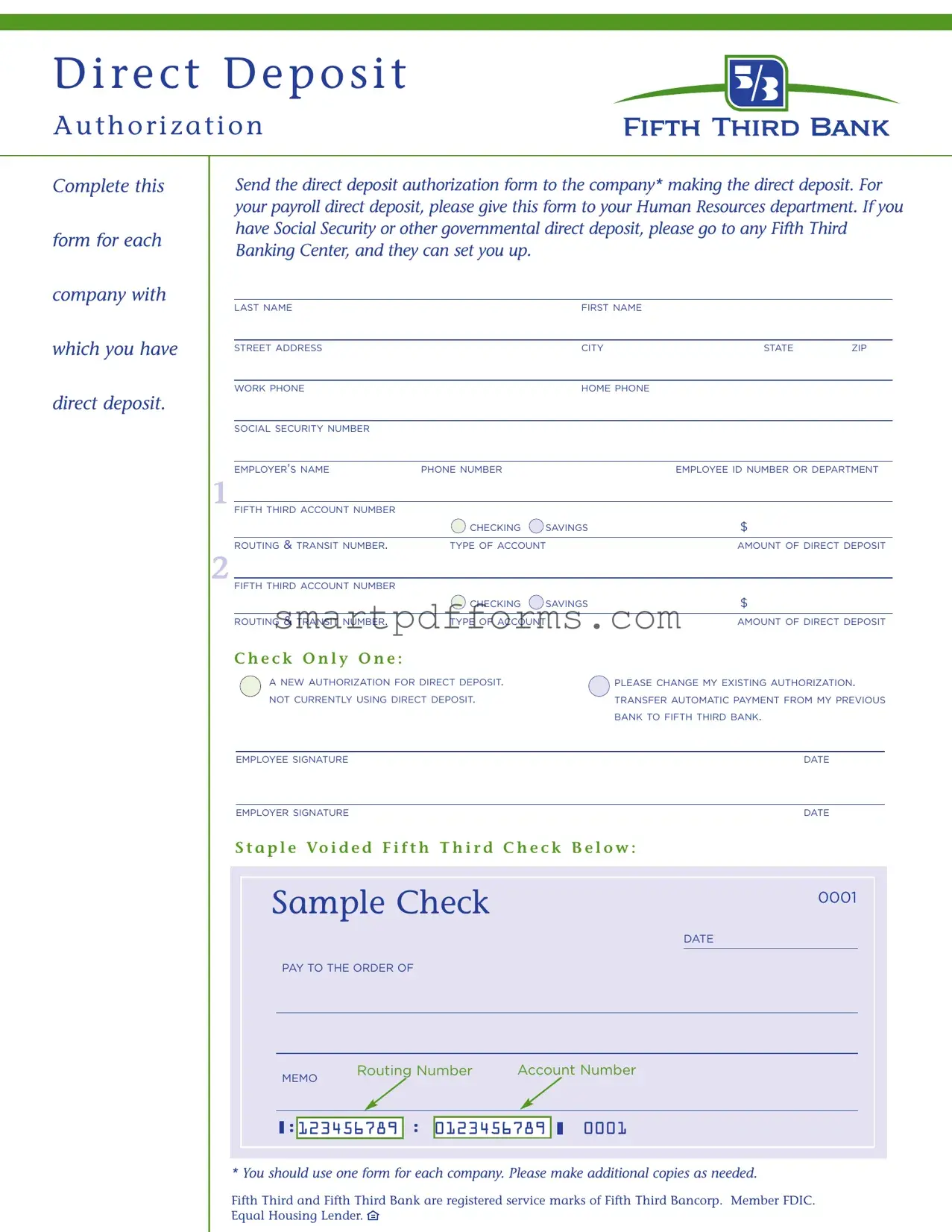

The Fifth Third Bank Direct Deposit Authorization Form embodies the bridge between an individual's earnings and their timely deposit into a Fifth Third Bank account, streamlining the payroll or governmental direct deposit process. This diligently structured form requires completion for each separate company from which an individual anticipates direct deposit funds. It incorporates essential personal and employment details, including names, contact information, and social security numbers, alongside specific employer identifiers. Moreover, it allows the accountholder to designate their preferred accounts (checking or savings) for deposit, stipulate the deposit amounts, and provide the crucial routing and transit numbers to ensure accurate processing. Notably, the form presents options to initiate a new direct deposit, amend an existing authorization, or facilitate the transfer of automatic payments from another bank to Fifth Third Bank, necessitating signatures from both the employee and employer to validate the agreement. The form’s comprehensive nature underscores the importance of meticulous accuracy in filling out such financial documents, wherein a simple oversight could hinder the efficient management of one’s finances. To further facilitate this process, individuals are prompted to attach a voided Fifth Third check, confirming their account details, thus epitomizing the form's role in fostering financial security and convenience.

Preview - Fifth Third Bank Direct Deposit Form

D i r e c t D e p o s i t

A u t h o r i z a t i o n

Complete this

form for each

company with

which you have

direct deposit.

Send the direct deposit authorization form to the company* making the direct deposit. For your payroll direct deposit, please give this form to your Human Resources department. If you have Social Security or other governmental direct deposit, please go to any Fifth Third Banking Center, and they can set you up.

|

LAST NAME |

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

CITY |

STATE |

ZIP |

|

|

|

|

|

|

|

WORK PHONE |

|

HOME PHONE |

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER’S NAME |

PHONE NUMBER |

|

EMPLOYEE ID NUMBER OR DEPARTMENT |

|

1 |

|

|

|

|

|

FIFTH THIRD ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

SAVINGS |

$ |

|

|

|

|

|

||

|

ROUTING & TRANSIT NUMBER. |

TYPE OF ACCOUNT |

AMOUNT OF DIRECT DEPOSIT |

||

2 |

|

|

|

|

|

FIFTH THIRD ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

SAVINGS |

$ |

|

|

|

|

|

||

|

ROUTING & TRANSIT NUMBER. |

TYPE OF ACCOUNT |

AMOUNT OF DIRECT DEPOSIT |

||

C h e c k O n l y O n e :

A NEW AUTHORIZATION FOR DIRECT DEPOSIT. |

PLEASE CHANGE MY EXISTING AUTHORIZATION. |

NOT CURRENTLY USING DIRECT DEPOSIT. |

TRANSFER AUTOMATIC PAYMENT FROM MY PREVIOUS |

|

BANK TO FIFTH THIRD BANK. |

|

|

EMPLOYEE SIGNATURE |

DATE |

|

|

EMPLOYER SIGNATURE |

DATE |

S t a p l e V o i d e d F i f t h T h i r d C h e c k B e l o w :

Sample Check |

0001 |

||

|

|

||

|

|

DATE |

|

|

PAY TO THE ORDER OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEMO |

Routing Number |

Account Number |

||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

: |

123456789 |

: |

0123456789 |

|

|

0001 |

||

|

|

|

|

|

|

|

|

|

|

* You should use one form for each company. Please make additional copies as needed.

Fifth Third and Fifth Third Bank are registered service marks of Fifth Third Bancorp. Member FDIC. Equal Housing Lender.

Form Data

| Fact Name | Description |

|---|---|

| Form Usage | This form is used to set up direct deposits for payroll, Social Security, or other governmental deposits into a Fifth Third Bank account. |

| Multiple Deposits | Individuals can use the form to authorize more than one direct deposit, allowing flexibility in managing finances. |

| Account Options | Depositors can choose between having their funds deposited into either a checking or savings account, providing options to meet their banking needs. |

| Special Instructions | For changes to existing direct deposit authorizations or to transfer automatic payments from a different bank, specific sections of the form must be completed, ensuring accurate processing of requests. |

Instructions on Utilizing Fifth Third Bank Direct Deposit

Filling out a Fifth Third Bank Direct Deposit form is a simple process that allows your employer or a government agency to directly deposit funds into your bank account, eliminating the need for physical checks. This method not only ensures that your funds are deposited quickly but also securely. Whether it's for receiving your salary, Social Security, or other governmental benefits, it's important to complete the form accurately to avoid any delays in receiving your funds. The following steps will guide you through the process of filling out the form.

- Start by writing your last name, first name, and middle initial (if applicable) in the designated spaces.

- Enter your complete street address, including any apartment or suite number, city, state, and ZIP code.

- Provide your work phone and home phone numbers in the respective fields.

- Fill in your Social Security Number in the space provided.

- Write the full name of your employer and the employer's phone number. If you are setting up direct deposit for government benefits, include the name of the agency.

- Include your employee ID number or your department if required. This information might not be mandatory for non-employment related deposits.

- For the account into which you want the direct deposit made, provide the Fifth Third account number. Check the appropriate box to indicate whether it is a checking or savings account.

- Enter the routing and transit number for Fifth Third Bank.

- Specify the type of account by checking the appropriate box for either Checking or Savings.

- Determine the amount of the direct deposit. If depositing your entire paycheck, you may write "100%" or the equivalent. If only a portion, specify the dollar amount or percentage.

- Repeat steps 6 to 10 if you wish to split your direct deposit between two Fifth Third accounts.

- Choose your direct deposit request by checking one of the boxes: A NEW AUTHORIZATION FOR DIRECT DEPOSIT, PLEASE CHANGE MY EXISTING AUTHORIZATION, NOT CURRENTLY USING DIRECT DEPOSIT, or TRANSFER AUTOMATIC PAYMENT FROM MY PREVIOUS BANK TO FIFTH THIRD BANK.

- Sign and date the form to authenticate your direct deposit request.

- If required, obtain your employer's signature and the date on the form to confirm the direct deposit arrangement.

- Attach a voided Fifth Third check below where indicated if this is for a new banking setup, to provide your employer or agency with your bank account and routing numbers.

Once you have completed all the steps, review the form to ensure all the information is correct and legible. Send the direct deposit authorization form to the appropriate company, employer, or government agency that will be making the deposits. For payroll direct deposits, this form should be handed to your Human Resources department. If setting up a direct deposit for Social Security or other governmental deposits, visit any Fifth Third Banking Center for assistance. Remember, accurate completion of this form is crucial for a seamless process in having your funds securely deposited into your account.

Obtain Answers on Fifth Third Bank Direct Deposit

Frequently Asked Questions (FAQ) about the Fifth Third Bank Direct Deposit Form

- How do I complete the Fifth Third Bank Direct Deposit Authorization Form?

To complete the form, provide your personal details like last and first name, street address, city, state, zip, work and home phone numbers, and your Social Security Number. Additionally, include your employer's name, phone number, and your employee ID number or department. Specify your Fifth Third account number, whether it's a checking or savings account, the routing and transit number, the type of account, and the amount of direct deposit. Select one option among 'a new authorization for direct deposit,' 'please change my existing authorization,' 'not currently using direct deposit,' and 'transfer automatic payment from my previous bank to Fifth Third Bank'. Finally, sign the form, and don't forget to staple a voided Fifth Third check below if applicable.

- Where do I send the completed direct deposit form?

Send the completed direct deposit authorization form to the company making the direct deposit. If the form is for your payroll direct deposit, please give it to your Human Resources department. For Social Security or other governmental direct deposits, please visit any Fifth Third Banking Center for assistance.

- Do I need a new form for each company depositing to my account?

Yes, you should use one form for each company. Make additional copies of the form as needed for each entity that will be making a direct deposit into your account.

- What should I do if I want to change my existing direct deposit information?

If you wish to alter your current direct deposit details, complete the direct deposit form again and select the option "Please change my existing authorization." Ensure you provide the updated account or deposit information and submit the form to the relevant company or your HR department.

- Can I set up direct deposit for both checking and savings accounts?

Yes, you can designate direct deposits into either your checking or savings account with Fifth Third Bank. Just indicate the type of account on the form and provide the pertinent account and routing numbers.

- How do I transfer automatic payments from my previous bank to Fifth Third Bank?

To transfer automatic payments from another bank to your Fifth Third Bank account, select the "Transfer automatic payment from my previous bank to Fifth Third Bank" option on the form. Be sure to provide the necessary account details for the Fifth Third account into which you wish the payments to be deposited.

- What is the routing and transit number, and where can I find it?

The routing and transit number is a nine-digit number used to identify your bank branch for direct deposit transactions. You can find this number on the bottom left corner of your checks, or you can ask any Fifth Third Banking Center for assistance.

- Is my personal information safe when filling out this form?

Fifth Third Bank takes customer privacy and security seriously. Ensure you submit your direct deposit form directly to your employer's HR department or a trusted company representative, and avoid sharing your personal information publicly to maintain your privacy.

Common mistakes

Filling out the Fifth Third Bank Direct Deposit Form accurately is crucial for ensuring your funds are deposited correctly and promptly. However, common mistakes can occur, potentially leading to delays or errors in receiving your direct deposit. Here are ten mistakes people often make on this form:

Not completing all required fields - Missing information can cause processing delays.

Entering incorrect bank account numbers - This might result in funds being sent to the wrong account.

Confusing the routing and account numbers - The routing number identifies your bank, while the account number specifies your account. Reversing these can lead to processing errors.

Failing to specify the account type (checking or savings) - This information guides where the deposit should go.

Incorrectly indicating the deposit amount - Whether a fixed amount or percentage, clarity here ensures the correct amount is deposited each time.

Not signing the form - An unsigned form is not valid and will not be processed.

Skipping the employer’s information section - This information is crucial for identification and processing purposes.

Forgetting to attach a voided check - A voided check provides verification and confirmation of your account details.

Selecting the wrong option for the deposit change - This could lead to unexpected outcomes, such as changing or discontinuing the wrong direct deposit.

Using outdated forms - Always ensure you're using the latest version to comply with current bank policies.

To prevent these mistakes:

Double-check all entered information for accuracy.

Ensure all required fields are filled in.

Attach a voided check when required.

Ask for help if you're unsure about any section of the form.

Correctly filling out the Fifth Third Bank Direct Deposit Form is the first step to a hassle-free direct deposit experience. By avoiding these common errors, you can ensure your pay is deposited on time, every time.

Documents used along the form

When setting up or managing direct deposits with Fifth Third Bank, it's not unusual for individuals to need additional forms and documents to ensure a smooth transaction process. These documents, ranging from account verification to financial planning tools, play critical roles in personal finance management. Understanding each document will help individuals effectively navigate their banking needs.

- Voided Check: Often required for setting up direct deposit to verify the account and routing numbers, ensuring funds are deposited into the correct account.

- Employment Verification Letter: This document proves an individual's employment status and income, which might be needed for loan applications or housing arrangements alongside the direct deposit setup.

- Bank Account Verification Letter: A formal document from Fifth Third Bank confirming the account holder's details, which might be required for certain financial transactions or account setups.

- Payroll Authorization Form: Used by employers to authorize the transfer of payroll funds directly into an employee's bank account, often accompanying the direct deposit form.

- Form W-4: Allows employers to withhold the correct federal income tax from an employee's pay, potentially adjusted based on direct deposit arrangements for tax liabilities.

- Government Benefit Enrollment Forms: Needed for setting up direct deposits for Social Security benefits or other government payments, requiring specific information about the recipient's bank account.

- Personal Identification Documents: Photocopies of government-issued identification (e.g., driver's license, passport) might be needed to verify identity when setting up a new banking service.

- Online Banking Enrollment Form: Required for individuals wishing to manage their direct deposits and other banking features online, providing access to Fifth Third Bank's digital services.

- Automatic Payment Authorization Forms: For those wishing to utilize direct deposit for automatic bill payments, this form authorizes Fifth Third Bank to regularly transfer funds to payees.

Each of these documents serves a specific purpose in the broader context of financial management, directly impacting how individuals interact with Fifth Third Bank and other financial institutions. Proper completion and submission of these forms ensure that direct deposits are processed efficiently, securely, and in a manner that meets the account holder's needs.

Similar forms

Payroll Authorization Form: Similar to the Fifth Third Bank Direct Deposit form, a payroll authorization form allows employees to set up or change their direct deposit details for receiving their salary. Both forms collect employee identification and bank account information to facilitate the direct deposit process.

Automatic Payment Enrollment Form: This form is used for setting up automatic payments from a bank account for regular expenses like mortgages, utilities, or subscriptions. It shares similarities with the direct deposit form by requiring bank routing and account numbers to process transactions directly from the account.

Change of Address Form for Banks: Although primarily used for updating postal addresses, this form, like the direct deposit form, is critical for maintaining accurate personal information in banking records. Both forms ensure that critical financial processes, such as direct deposit or mailing of bank statements, operate smoothly.

Bank Account Opening Form: Similar to sections of the direct deposit form, a bank account opening form collects personal, employment, and financial information to establish a new account. It requires detailed information to set up features like direct deposits or automatic payments.

Social Security Direct Deposit Form: This form enables recipients of Social Security benefits to receive their payments via direct deposit. It closely resembles the Fifth Third Bank Direct Deposit form by collecting personal and bank account information to direct funds into the correct account.

Tax Refund Direct Deposit Form: Used to receive tax refunds electronically, this form, like the direct deposit authorization, requires taxpayers to provide their bank account and routing numbers, ensuring the refund is deposited into the correct account promptly.

Investment Account Automatic Transfer Form: This document facilitates the transfer of funds from a checking or savings account into an investment account at regular intervals. It is akin to the Fifth Third Bank Direct Deposit form as both involve setting up recurring transactions using bank account details.

Dos and Don'ts

Filling out the Fifth Third Bank Direct Deposit form requires attention to detail to ensure the process is seamless and error-free. Below are recommendations for completing the form correctly.

Things You Should Do:

- Double-check personal information such as your name, street address, city, state, and zip for accuracy.

- Verify your Fifth Third account number and routing & transit number to ensure they are correct.

- Clearly indicate the type of account, whether checking or savings, to avoid any confusion.

- Specify the amount of direct deposit accurately if you're directing a specific amount to your account.

- For clarity and verification, attach a voided check from your Fifth Third account where indicated.

- Ensure both the employee and employer signatures are provided where required to validate the authorization.

Things You Shouldn't Do:

- Forget to indicate whether it's a new authorization, a change to an existing authorization, not currently using direct deposit, or a transfer automatic payment from another bank.

- Omit your social security number, as it's crucial for confirming your identity for payroll and government deposits.

- Leave the type of account (checking or savings) blank, as this will cause delays in processing your direct deposit.

- Ignore the need to provide contact information such as work and home phone numbers for any follow-up required.

- Sign the form without reviewing all the provided details for accuracy and completeness.

- Use the form without making sure it is the latest version or applicable to the type of deposit you are setting up.

Misconceptions

There are several misconceptions about the Fifth Third Bank Direct Deposit form that need to be clarified to ensure individuals have a correct understanding of how to properly utilize it:

- Only for Payroll purposes: A common misconception is that the Fifth Third Bank Direct Deposit form is exclusively for payroll direct deposits. In reality, this form can be used for a variety of direct deposits, including Social Security, pensions, and other government benefits. It is versatile and not limited solely to employment income.

- Necessity of Bank Visit for Government Deposits: Another misunderstanding is the belief that setting up direct deposits for Social Security or other governmental benefits requires a visit to a Fifth Third Banking Center. While visiting a banking center is an option, it’s also possible to arrange these types of direct deposits through the appropriate governmental agency directly, bypassing the need for an in-person bank visit.

- One Form Fits All: Some people might think that a single direct deposit authorization form can be used for directing deposits from multiple sources into their Fifth Third Bank account. However, the document specifies the need to complete a separate form for each company or deposit source, which helps in organizing and tracking different income streams efficiently.

- Immediate Transfer of Automatic Payments: There might be an expectation that electing to transfer automatic payments from a previous bank to Fifth Third Bank through this form will result in immediate action. The process actually requires coordination between the banks and the company making the automatic payments, which may involve a brief transition period. Therefore, immediate transfer is not guaranteed and planning for a short overlap between banks may be prudent.

Clearing up these misconceptions is crucial for effective financial management and ensures individuals can fully benefit from the services offered by Fifth Third Bank without encountering unforeseen complications.

Key takeaways

Filling out and using the Fifth Third Bank direct deposit form is a critical step for ensuring that your earnings are deposited into your bank account swiftly and securely. Here are five key takeaways to consider when completing this process:

- Completeness is crucial: Ensure all sections of the direct deposit authorization form are filled out entirely. This includes personal information (such as your name, address, and Social Security Number), employer details, and, most importantly, your banking information (account numbers, routing numbers, and the type of account).

- Accuracy matters: Double-check the routing and account numbers for correctness. Mistakes in these numbers can lead to delays in receiving your funds or the funds being deposited into the wrong account. The routing number identifies your bank, while the account number specifies your personal account within that bank.

- Choice of account type: Indicate clearly whether your direct deposit should go into a checking or savings account. This choice affects how you can access and use your funds once they are deposited.

- Understand the authorization: Be aware that by signing the direct deposit form, you're authorizing not just the deposit of funds but also, potentially, the correction of any errors. This means if an overpayment occurs, the company might withdraw the excess funds from your account.

- Keep your bank informed: If you are establishing direct deposit for government benefits like Social Security, it’s advised to visit a Fifth Third Banking Center. The bank staff can ensure your direct deposit setup is correctly handled, which might include additional steps or verification.

For payroll direct deposits, this form should be provided to your Human Resources department. Whereas for government direct deposits, Fifth Third Bank can offer personalized assistance. Always retain a copy of the completed direct deposit form for your records, and do not forget to attach a voided check if required, as this will include your account and routing numbers printed on it.

Attention to these details when completing the Fifth Third Bank direct deposit form not only facilitates a smoother transaction process but also safeguards your financial security.

Popular PDF Forms

Household Composition Letter From Landlord - Designed to assist a department in evaluating a household's circumstances by gathering information from landlords.

What Documents Do I Need to File Taxes - H&R Block's checklist is specifically designed to minimize oversights and inaccuracies in tax preparation, benefiting clients significantly.

1099r Tax Form - Must be sent to the recipient of the funds and the IRS to document the transaction.