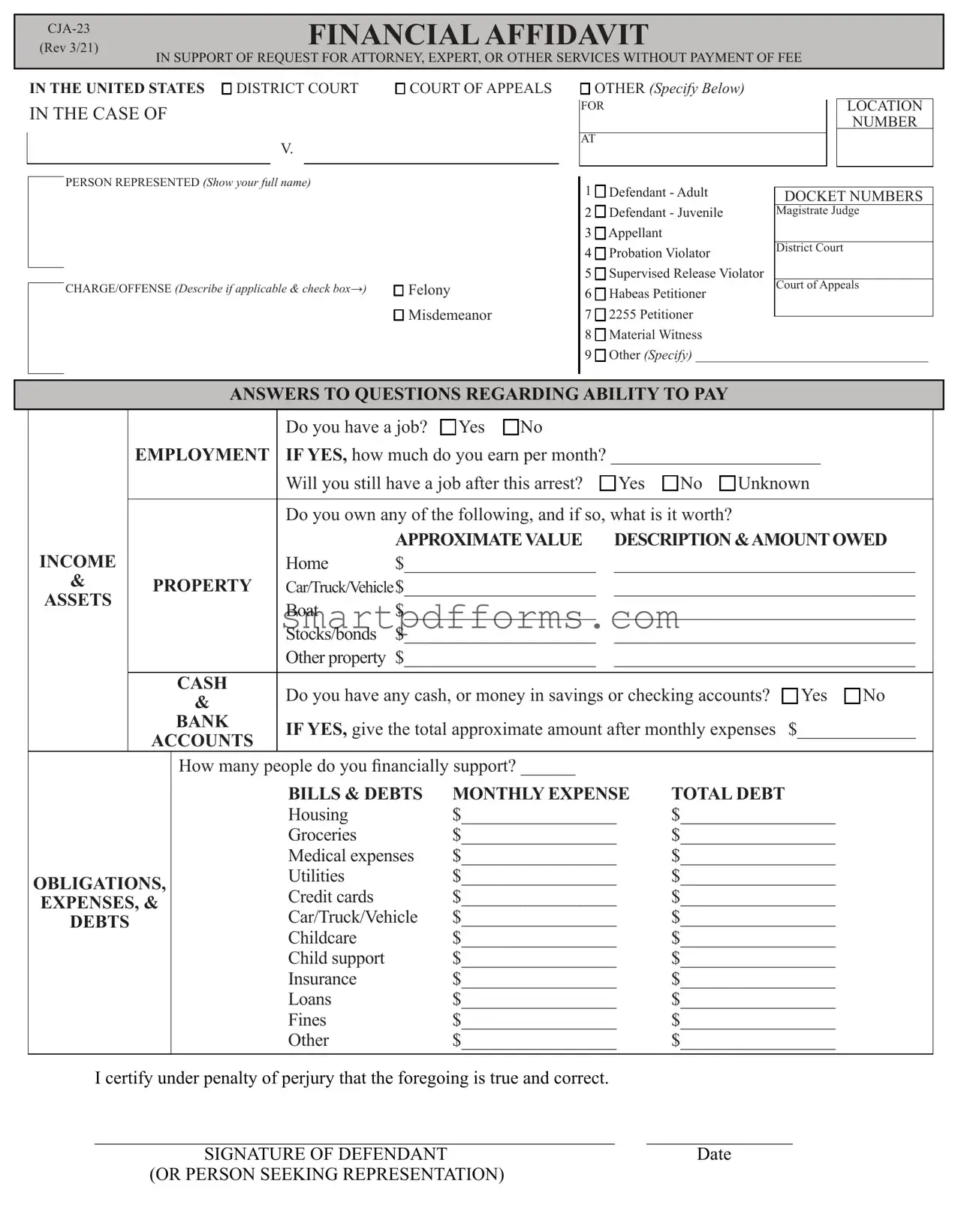

Blank Financial Affidavit CJA-23 PDF Template

In the realm of legal aid and representation, ensuring that individuals have the means to afford proper legal counsel is crucial. This is where the Financial Affidavit CJA-23 form steps into the spotlight. It serves as a vital tool in determining whether a person qualifies for court-appointed counsel based on their financial situation. For many, navigating the complexities of the legal system can be daunting, especially when financial resources are limited. The CJA-23 form assists in bridging this gap by meticulously assessing the financial capacity of individuals to pay for legal services. It covers various aspects of a person's financial life, including income, assets, debts, and expenses. This detailed evaluation is designed to uphold the fundamental right to legal representation, ensuring that it is not denied because of economic hardships. As it weaves its way through the fabric of the legal aid system, the CJA-23 form embodies a commitment to fairness and equality before the law, safeguarding access to justice for all.

Preview - Financial Affidavit CJA-23 Form

FINANCIAL AFFIDAVIT |

|

(Rev 3/21) |

|

|

IN SUPPORT OF REQUEST FOR ATTORNEY, EXPERT, OR OTHER SERVICES WITHOUT PAYMENT OF FEE |

IN THE UNITED STATES |

DISTRICT COURT |

COURT OF APPEALS |

IN THE CASE OF

V.

PERSON REPRESENTED (Show your full name)

CHARGE/OFFENSE (Describe if applicable & check box→) |

Felony |

|

Misdemeanor |

|

OTHER (Specify Below) |

|

|

|

|

|

FOR |

|

|

|

LOCATION |

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

AT |

|

|

|

|

|

|

|

|

|

|

|

1 |

Defendant - Adult |

|

|

|

|

|

||||

|

DOCKET NUMBERS |

||||

|

2 |

Defendant - Juvenile |

Magistrate Judge |

||

|

3 |

Appellant |

|

|

|

|

4 |

Probation Violator |

District Court |

||

|

|

|

|

||

|

5 |

Supervised Release Violator |

|

|

|

|

6 |

Habeas Petitioner |

Court of Appeals |

||

|

|

|

|

||

|

7 |

2255 Petitioner |

|

|

|

|

|

|

|

||

|

8 |

Material Witness |

|

|

|

|

9 |

Other (Specify) __________________________________ |

|||

|

|

|

|

|

|

ANSWERS TO QUESTIONS REGARDING ABILITY TO PAY

|

|

|

|

Do you have a job? |

� Yes � No |

|

|

|

|

|

|

EMPLOYMENT |

IF YES, how much do you earn per month? _______________________ |

||||||

|

|

|

|

Will you still have a job after this arrest? |

� Yes |

� No � Unknown |

|||

|

|

|

|

|

|

||||

|

|

|

|

Do you own any of the following, and if so, what is it worth? |

|

||||

INCOME |

|

|

|

|

APPROXIMATEVALUE |

DESCRIPTION &AMOUNTOWED |

|||

|

|

|

Home |

$_____________________ |

_________________________________ |

||||

& |

|

PROPERTY |

Car/Truck/Vehicle$_____________________ |

_________________________________ |

|||||

ASSETS |

|

|

|

Boat |

$_____________________ |

_________________________________ |

|||

|

|

|

|

||||||

|

|

|

|

Stocks/bonds |

$_____________________ |

_________________________________ |

|||

|

|

|

|

Other property $_____________________ |

_________________________________ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH |

Do you have any cash, or money in savings or checking accounts? |

� Yes � No |

||||

|

|

& |

|||||||

|

|

|

BANK |

IF YES, give the total approximate amount after monthly expenses |

$_____________ |

||||

|

|

ACCOUNTS |

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

How many people do you financially support? ______ |

|

|

|

|||

|

|

|

|

BILLS & DEBTS |

MONTHLY EXPENSE |

TOTAL DEBT |

|||

|

|

|

|

Housing |

|

$_________________ |

$_________________ |

||

|

|

|

|

Groceries |

|

$_________________ |

$_________________ |

||

|

|

|

|

Medical expenses |

$_________________ |

$_________________ |

|||

OBLIGATIONS, |

|

Utilities |

|

$_________________ |

$_________________ |

||||

|

Credit cards |

|

$_________________ |

$_________________ |

|||||

EXPENSES, & |

|

|

|||||||

DEBTS |

|

|

Car/Truck/Vehicle |

$_________________ |

$_________________ |

||||

|

|

|

|

Childcare |

|

$_________________ |

$_________________ |

||

|

|

|

|

Child support |

|

$_________________ |

$_________________ |

||

|

|

|

|

Insurance |

|

$_________________ |

$_________________ |

||

|

|

|

|

Loans |

|

$_________________ |

$_________________ |

||

|

|

|

|

Fines |

|

$_________________ |

$_________________ |

||

|

|

|

|

Other |

|

$_________________ |

$_________________ |

||

I certify under penalty of perjury that the foregoing is true and correct.

_________________________________________________________ |

________________ |

SIGNATURE OF DEFENDANT |

Date |

(OR PERSON SEEKING REPRESENTATION) |

|

Instructions for CJA Form 23 Financial Affidavit

In every type of proceeding where appointment of counsel is authorized under 18 U.S.C. § 3006A(a) and related statutes, the United States magistrate judge or the court shall advise the person of their right to be represented by counsel and that counsel will be appointed if the person is financially unable to obtain counsel. Unless the person waives representation by counsel, the United States magistrate judge or the court, if satisfied after appropriate inquiry that the person is financially unable to obtain counsel, shall appoint counsel to represent the individual.

Determination of eligibility for representation under the CJA is a judicial function, however the court may designate court employees to obtain or verify the facts relevant to the financial eligibility determination. Employees of law enforcement agencies, including the United States Attorney’s Office, should not participate in the completion of the financial affidavit or seek to obtain information concerning financial eligibility from a person requesting the appointment of counsel. When practicable, employees of the federal public defender office should discuss with the person who indicates that he or she is not financially able to secure representation the right to appointed counsel and, if appointment of counsel seems likely, assist in completion of the financial affidavit.

Counsel must be appointed if the person seeking representation is “financially unable to obtain counsel.” 18 U.S.C. §3006A(b). (While courts often use “indigency”

as a shorthand expression to describe financial eligibility, indigency is not the standard for appointing counsel under the Criminal Justice Act.) In determining

whether a person is “financially unable to obtain counsel,” consideration should be

given to the cost of providing the person and his or her dependents with the necessities of life, the cost of securing pretrial release, asset encumbrance, and the likely cost of retained counsel. The initial determination of eligibility must be made

without regard to the financial ability of the person’s family to retain counsel,

unless their family indicates willingness and ability to do so promptly. Any doubts

about a person’s eligibility should be resolved in the person’s favor; erroneous

determinations of eligibility may be corrected at a later time. For additional guidance, see the Guide to Judiciary Policy, Volume 7A, Guidelines for Administering the CJA and Related Statutes (CJA Guidelines).

The CJA Form 23 is not a required statutory form. It is an administrative tool used to assist the court in appointing counsel. When a colorable claim is asserted that disclosure to the government of a completed CJA 23 would be

court may not adopt an unconditional requirement that the defendant complete the CJA 23 before his application for appointment of counsel will be considered. To do so may place the defendant in the constitutionally untenable position of having to choose between his Sixth Amendment right to counsel and his Fifth Amendment privilege against

Pursuant to Judicial Conference policy, financial affidavits seeking the appointment of counsel should not be included in the public case file and should not be made available to the public at the courthouse or via remote electronic access. If the financial affidavit is docketed it should be filed under seal. See, Guide to Judiciary Policy, Vol. 10, §340, Judicial Conference Policy on Privacy and Public Access to Electronic Case Files (March 2008) and Administrative Office of U.S. Courts Information Bulletin on Revised Judicial Conference Privacy Policy (May 2008).

For questions on the use of this form or instructions, please contact the Defender Services Office, Legal and Policy Division at

Form Data

| Fact Number | Description |

|---|---|

| 1 | The Financial Affidavit CJA-23 is a form used in the Federal Court system to determine a defendant's eligibility for court-appointed counsel. |

| 2 | This affidavit requires detailed personal financial information from the defendant, including income, assets, liabilities, and expenses. |

| 3 | The form is used under the Criminal Justice Act (CJA), which ensures that individuals facing federal criminal charges can receive legal representation, even if they cannot afford it. |

| 4 | Accuracy is paramount when completing the CJA-23 form. False statements can lead to perjury charges or the revocation of court-appointed counsel. |

| 5 | Completion of the form typically occurs early in the legal process, often during the individual's first appearance in court or shortly thereafter. |

| 6 | Judges review the completed CJA-23 form to determine if the defendant qualifies for a public defender based on financial hardship. |

| 7 | While the CJA-23 form is federal, each federal district may have additional procedures or requirements concerning its completion and submission. |

Instructions on Utilizing Financial Affidavit CJA-23

After being charged with a federal offense, individuals often face the daunting task of navigating the legal system, which includes the financial aspects of their defense. A critical step in this journey involves completing the Financial Affidavit CJA-23 form. This document is essential for those seeking appointed counsel due to an inability to afford private representation. The process may seem complex, but by following these step-by-step instructions, filers can ensure their applications are complete and accurately convey their financial situation.

- Begin by collecting all necessary financial documents, including recent pay stubs, tax returns, and bank statements. These will provide accurate information for the questions asked.

- Enter your full legal name, social security number, and case number at the top of the form. This information is crucial for the court to properly identify your case and records.

- Detail your employment status. If employed, include your employer's name, address, and the length of your employment. Complete information ensures the court understands your financial inflow.

- List all sources of income, including wages, salaries, benefits (such as unemployment or VA benefits), and any other income like pensions or child support. Honesty and thoroughness are vital here to accurately assess your financial status.

- Provide information on your dependents. This includes their names, ages, and relationship to you. This helps the court evaluate your financial responsibilities and how they impact your ability to afford legal representation.

- Detail your assets. This section includes bank accounts (with current balances), real estate, vehicles, and any other significant assets. Accurate valuations are important for a clear understanding of your financial resources.

- Document your monthly expenses. Include rent or mortgage payments, utilities, food, transportation, and any other regular expenses. This gives the court insight into your cost of living and financial obligations.

- Sign and date the form. Your signature verifies that the information provided is true and correct to the best of your knowledge. Falsifying information on a financial affidavit can have legal consequences.

- Finally, submit the completed form to the appropriate office or individual as directed. This may be the clerk's office, your attorney, or another designated party.

Completing the Financial Affidavit CJA-23 form is a critical step in securing legal representation if you cannot afford it. Through careful preparation and thorough response, you can provide the court with a clear picture of your financial situation, thereby aiding in their decision-making process related to your representation. Remember, this form is about assessing your financial ability to pay for legal services, not about judging your financial choices or circumstances.

Obtain Answers on Financial Affidavit CJA-23

-

What is the Financial Affidavit CJA-23 form?

The Financial Affidavit CJA-23 form is a document used in the United States federal court system. It’s designed to assess the financial ability of a defendant to afford an attorney. By providing detailed information about their financial situation, defendants enable the court to determine whether they qualify for a court-appointed attorney under the Criminal Justice Act (CJA).

-

Who needs to fill out the CJA-23 form?

Any defendant in a federal criminal case who cannot afford to hire private counsel may need to fill out the form. It's also required for individuals seeking representation in other proceedings covered by the CJA, such as witnesses, appellants, and probationers facing modifications of their conditions or revocation.

-

What kind of information is required on the form?

The form asks for detailed personal financial information. This includes current employment status and income, assets (such as cash on hand, bank accounts, property), liabilities (debts and other financial obligations), and expenses. The intention is to provide a comprehensive view of the individual's financial standing.

-

How does completing the CJA-23 form affect eligibility for a court-appointed attorney?

Filling out the form truthfully and completely allows the court to accurately assess the applicant's financial situation. If the court determines that the applicant cannot afford private legal representation, they will qualify for a court-appointed attorney, paid for by the federal government, at no cost to the defendant.

-

Where can one obtain the CJA-23 form?

The CJA-23 form can be obtained from the office of the federal public defender in the jurisdiction where the case is being heard, or it can be downloaded from the U.S. Courts website. Additionally, the court clerks’ offices in federal courthouses usually have copies of the form available.

-

Is assistance available for filling out the form?

Yes, assistance for filling out the form is available. Individuals can often receive help from the federal public defender's office in their district. Moreover, some court clerks’ offices provide aid or can direct individuals to resources that can help them complete the form.

-

Once completed, where should the CJA-23 form be submitted?

After completion, the form should be submitted to the court where the legal proceedings are taking place. This is typically done at the office of the clerk of the court. It's important to ask for a receipt or confirmation to ensure the form has been properly filed.

-

What happens if false information is provided on the CJA-23 form?

Providing false information on the CJA-23 form is considered a serious offense. It can lead to penalties, including criminal charges for fraud or perjury. The court relies on the accuracy of information provided to make fair determinations about legal representation eligibility.

-

Can the decision on a CJA-23 form be appealed?

Yes, if an individual disagrees with the court's decision regarding the CJA-23 form, they have the right to request a review or appeal the decision. The process for this may vary depending on the federal district, so it’s advisable to consult with legal counsel or the federal public defender's office for guidance on how to proceed.

Common mistakes

Filling out the Financial Affidavit CJA-23 form is a crucial step in the process of applying for legal representation if you cannot afford it. However, people frequently make mistakes during this process. Understanding these errors can help ensure that the information provided is accurate and complete, aiding in a smoother legal journey.

-

Not verifying personal information: Often, individuals rush through filling out their personal details such as their name, address, and Social Security number. Mistakes in this section can cause significant delays and confusion in the review process.

-

Underreporting income: One common mistake is failing to report all sources of income. This includes part-time jobs, freelance work, and even assistance from family members. Underreporting income can lead to inaccuracies that may affect the decision on your representation eligibility.

-

Overlooking assets: Assets such as property, vehicles, savings, and investments must be disclosed. Sometimes, individuals forget to list all of their assets, or they underestimate their value, which can impact the assessment of their financial situation.

-

Failing to disclose all debts and liabilities: Just as with assets, all debts and liabilities must be accurately reported. This includes loans, credit card debt, and any other financial obligations. Omitting or minimizing these can distort your financial picture.

-

Not understanding the definition of household income: Many individuals mistakenly report only their personal income when the form asks for household income. This includes the income of all household members, not just the applicant. Misunderstanding this can lead to incorrect reporting.

-

Skipping sections or leaving blanks: Sometimes, out of uncertainty or haste, people leave sections incomplete or entirely blank. If you're unsure about how to complete a section, it's better to seek clarification rather than leaving it empty.

To avoid these common mistakes, take your time filling out the Financial Affidavit CJA-23 form. Ensure you understand each section and double-check your responses. When in doubt, seeking advice or clarification can help prevent errors that could negatively influence your case.

Documents used along the form

When dealing with legal procedures, especially those concerning financial eligibility for appointed counsel under the Criminal Justice Act (CJA), the CJA-23 Financial Affidavit form becomes indispensable. However, this document doesn't operate in isolation. It's often accompanied by other forms and documents that help paint a fuller picture of an individual's financial standing, providing critical context for decisions regarding representation. Below is a list of other forms and documents frequently used alongside the CJA-23 form, each serving its unique purpose in the legal process.

- Pay Stubs: Recent pay stubs provide concrete evidence of an individual's earnings, allowing for an accurate assessment of their financial situation.

- Bank Statements: These statements offer insight into an applicant's savings, checking accounts, and overall financial health, revealing not just balances but also spending habits and financial responsibilities.

- Tax Returns: Often, tax returns from the previous year or two are requested. They give a detailed overview of an individual's financial history, including income sources and tax obligations.

- Expense Reports: Detailed reports of monthly expenses help in understanding the individual's cost of living, ensuring that financial assessments take into account all necessary outgoings, like rent, utilities, and groceries.

- Employment Verification Letter: This letter confirms an applicant's employment status and income, providing an official source to corroborate information presented in pay stubs.

- Benefits Statements: For those receiving government assistance, benefits statements validate these sources of income and help in calculating overall financial eligibility.

- Debt and Loan Statements: Information on any outstanding debts or loans contributes to a comprehensive understanding of an individual's financial commitments.

- Proof of Dependents: Documents verifying the number of dependents, such as birth certificates or custody agreements, are vital for assessing financial responsibility and determining eligibility based on household size.

- Legal Documents Pertaining to Financial Matters: Any existing legal documents that impact financial status, such as divorce decrees or bankruptcy filings, provide essential context for one's financial affidavit.

While the CJA-23 form is a crucial starting point, the combination of these documents provides a fuller, more accurate representation of an individual's financial situation. Together, they ensure that decisions regarding eligibility for appointed counsel are made fairly and with a comprehensive understanding of each applicant's circumstances. Navigating through the legal process may seem daunting, but being aware of and prepared with these accompanying forms and documents can significantly streamline the journey.

Similar forms

-

Loan Application: A loan application is similar to the Financial Affidavit CJA-23 form as both require the applicant to provide detailed personal financial information. This includes income, expenditures, debts, and assets. Lenders use this information to assess the applicant's creditworthiness and ability to repay the loan.

-

Means Test Form (Bankruptcy): The means test form used in bankruptcy proceedings bears resemblance to the Financial Affidavit CJA-23 form. Both documents are designed to evaluate an individual's financial status by examining their income, expenses, and debts. The means test determines eligibility for filing Chapter 7 bankruptcy or the terms of a Chapter 13 repayment plan.

-

Divorce Financial Statement: In divorce proceedings, a financial statement is often required to disclose each party's financial situation. Similar to the Financial Affidavit CJA-23, it collects detailed information on earnings, living expenses, assets, and liabilities. This helps in making decisions about alimony, child support, and division of property.

-

Income Tax Return: An Income Tax Return, while serving a different primary purpose, shares common elements with the Financial Affidavit CJA-23 form. Both require a detailed account of an individual’s income, which may include wages, investments, and other sources. These documents are integral in assessing financial standing and obligations.

-

Medicaid Application: Similar to the Financial Affidavit CJA-23 form, a Medicaid Application requires applicants to provide comprehensive information about their financial situation. This includes their income, assets, and other resources to determine eligibility for health insurance programs for low-income individuals and families.

-

Financial Aid Application (FAFSA): The Free Application for Federal Student Aid (FAFSA) is another document that shares similarities with the Financial Affidavit CJA-23 form. Both require detailed disclosure of financial information for the purpose of evaluation. The FAFSA assesses a student's financial need to determine their eligibility for various types of federal and state education aid.

Dos and Don'ts

Filling out the Financial Affidavit CJA-23 form correctly is crucial for ensuring you provide accurate and truthful information regarding your financial status. This document helps determine eligibility for court-appointed counsel among other legal financial assistance. To guide you through the process, here are eight dos and don'ts to consider:

- Do: Provide accurate information regarding your income, assets, expenses, and liabilities. Being truthful ensures the legal system can appropriately assess your financial situation.

- Do: Review all sections of the form carefully before submitting. This step helps prevent any unintentional mistakes or omissions that could affect your case or assistance eligibility.

- Do: Use ink if filling out the form by hand to ensure your entries are clear and permanent.

- Do: Attach additional pages if you need more space to complete any section of the form accurately. Ensure these pages are clearly marked and securely attached to your affidavit.

- Don't: Leave any sections blank unless they truly do not apply to your situation. If a section does not apply, mark it with "N/A" (not applicable) to indicate it was intentionally left unanswered.

- Don't: Guess on figures or estimates. Provide the most accurate and current information available to you. If necessary, take the time to verify account balances, monthly expenses, and income details before completing the form.

- Don't: Overlook the requirement to sign and date the form. Your signature is your affirmation that the information provided is true and accurate to the best of your knowledge.

- Don't: Disregard the need to update your information if your financial situation changes after you have submitted the form. Keeping your information current is essential, especially if you are receiving ongoing legal assistance.

Misconceptions

Many individuals have misconceptions about the Financial Affidavit CJA-23 form, which can lead to errors or hesitancy in completing it. It's crucial to understand what these misconceptions are to ensure accurate and timely submissions.

- All personal financial information is made public. Contrary to this belief, the details provided in the CJA-23 form are used strictly for determining eligibility for court-appointed counsel and are not published for public viewing.

- Only employed individuals need to fill it out. Whether you are employed, unemployed, or have an unconventional source of income, the CJA-23 form must be completed. It encompasses various types of financial statuses and arrangements.

- The form is only for federal criminal cases. While it's commonly associated with criminal proceedings, the CJA-23 form may also be required in other federal proceedings where representation is provided under the Criminal Justice Act.

- You need a lawyer to complete the form. It's designed for individuals to fill out without legal assistance. However, seeking clarification from a legal advisor on complex points can be beneficial.

- Once submitted, the information cannot be updated. If your financial situation changes after submission, updates can and should be made to ensure accurate representation of your current status.

- Filling out the form guarantees a court-appointed attorney. Completion of the CJA-23 form is a step in the process. Eligibility for a court-appointed attorney also depends on the court's assessment of your financial situation.

- Only income needs to be disclosed. The form requires disclosure of assets, liabilities, and expenditures, in addition to income. This comprehensive overview helps in determining financial eligibility.

- It’s acceptable to estimate financial information. Accuracy is critical. Providing estimates rather than actual figures can lead to incorrect assessments of financial eligibility and potentially delay proceedings.

Key takeaways

The Financial Affidavit CJA-23 form is an essential document used within the United States' judicial system, particularly for those seeking legal representation under the Criminal Justice Act (CJA). Understanding the nuances of filling it out can be vital for ensuring proper legal representation. Here are six key takeaways to guide individuals through the process:

- Accuracy is paramount: When completing the CJA-23 form, every piece of information provided must be accurate to the best of the applicant's knowledge. Misrepresentations, whether accidental or intentional, can lead to serious legal repercussions, including potential charges of fraud.

- Comprehensive financial disclosure: The form requires a detailed account of one's financial situation. This includes income, assets, debts, and expenses. It's not just about current earnings but about providing a full picture of one's financial health.

- Documentation is key: While the form itself is a declaration, having documentation to support the provided information is essential, especially in cases where the court might request verification. This can include pay stubs, bank statements, and other financial records.

- Privacy considerations: Given the sensitive nature of the information required on the CJA-23 form, it's handled with a high degree of confidentiality. However, applicants should be aware that their financial affidavits become part of the public record, accessible under certain legal circumstances.

- Legal help is available: Understanding and filling out legal documents can be complex, and it's beneficial to seek legal assistance when in doubt. Many legal aid organizations and public defenders' offices can provide guidance on how to accurately fill out the CJA-23 form.

- Periodic updates may be required: Depending on the duration of the legal proceedings, an applicant might be asked to update their financial affidavit to reflect any changes in their financial situation. Prompt compliance with such requests is necessary to maintain eligibility for representation under the CJA.

Filling out the CJA-23 form is a crucial step in obtaining legal representation for those who cannot afford it otherwise. By paying close attention to these key aspects, applicants can navigate the process more smoothly and ensure they meet the criteria set forth under the Criminal Justice Act.

Popular PDF Forms

609 Letter to Debt Collector - Enables a proactive approach to correcting credit report errors, safeguarding consumers' financial reputations.

Unenrolling From Plano Isd - Signatures from both the parent or guardian and a school administrator are needed to validate the withdrawal.

Usps Forms - Facilitates the provision of details regarding the primary business location and the main office of publication.