Blank Fl 150 PDF Template

In the complex landscape of family law proceedings, the FL-150 form stands as a cornerstone document required by the Superior Court of California, serving a critical function in the adjudication of financial matters within cases of divorce, child support, and alimony. Commonly referred to as the Income and Expense Declaration, this form requires an individual to provide a detailed account of their financial standing, including employment status, income sources, monthly expenses, assets, and liabilities. Intended to foster transparency and fairness, the form includes sections for disclosing salary, wages, bonuses, business income, and even extraordinary financial circumstances, thus ensuring a comprehensive review by the court. It also necessitates the inclusion of personal details, such as the number of dependents and their health care expenses, to guide the court in making informed decisions regarding financial obligations. The FL-150’s rigor in capturing intricate financial details makes it an indispensable tool for attorneys and self-represented litigants alike, striving to secure an equitable resolution in family law cases. This declaration not only paves the way for calculated judgments on spousal or child support but also provides a factual basis for modifying orders as financial circumstances evolve, highlighting its pivotal role throughout the legal process.

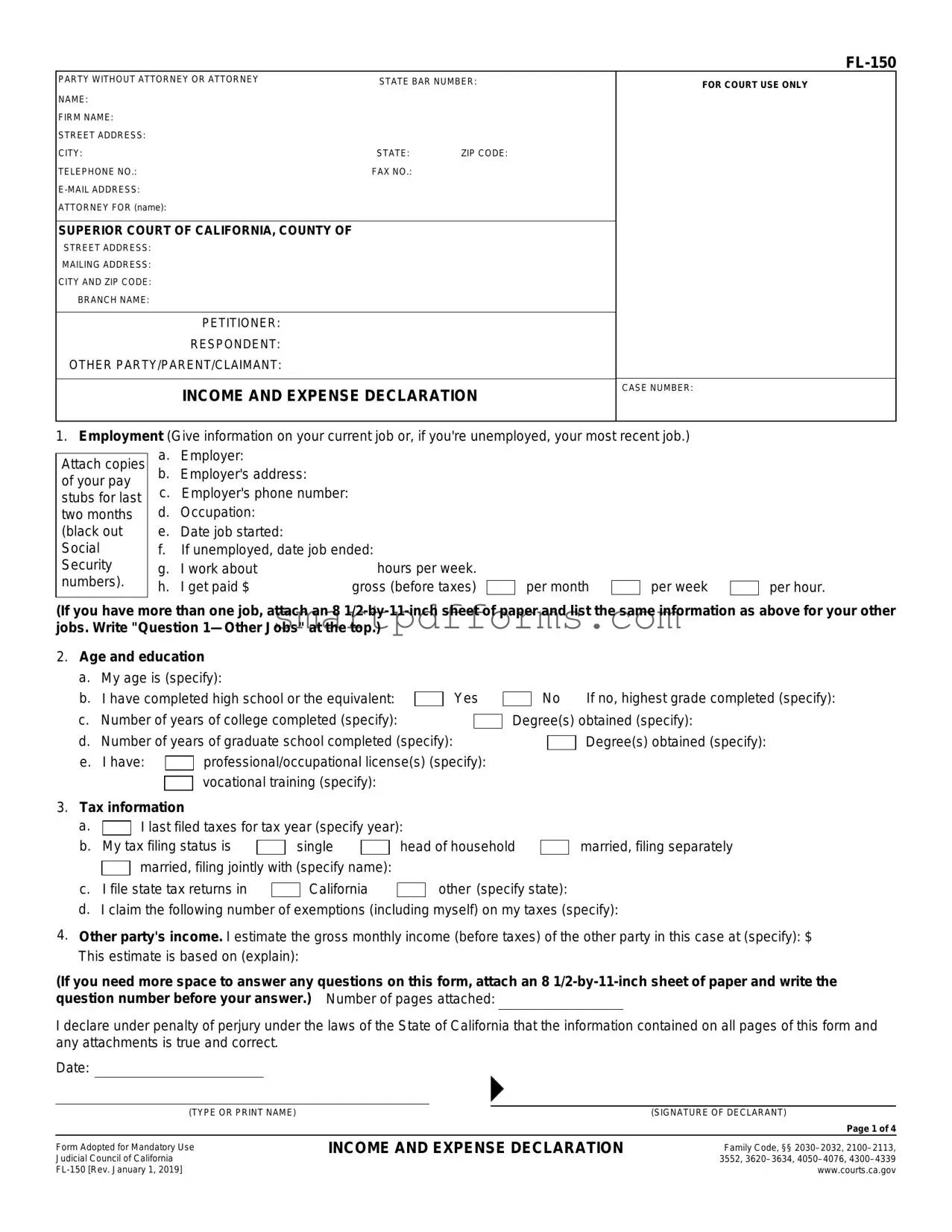

Preview - Fl 150 Form

PARTY WITHOUT ATTORNEY OR ATTORNEY |

STATE BAR NUMBER: |

|

NAME: |

|

|

FIRM NAME: |

|

|

STREET ADDRESS: |

|

|

CITY: |

STATE: |

ZIP CODE: |

TELEPHONE NO.: |

FAX NO.: |

|

|

|

|

ATTORNEY FOR (name): |

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET ADDRESS:

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

INCOME AND EXPENSE DECLARATION

FOR COURT USE ONLY

CASE NUMBER:

1.Employment (Give information on your current job or, if you're unemployed, your most recent job.)

Attach copies of your pay stubs for last two months (black out Social Security numbers).

a.Employer:

b. Employer's address:

c.Employer's phone number: d. Occupation:

e. Date job started:

f. If unemployed, date job ended:

g. |

I work about |

hours per week. |

h. |

I get paid $ |

gross (before taxes) |

per month

per week

per hour.

(If you have more than one job, attach an 8

2.Age and education

a.My age is (specify):

b. |

I have completed high school or the equivalent: |

|

|

Yes |

|||

|

|

||||||

c. Number of years of college completed (specify): |

|

|

|||||

|

|

||||||

d. Number of years of graduate school completed (specify): |

|

|

|||||

e. |

I have: |

|

professional/occupational license(s) (specify): |

||||

|

|||||||

|

|

|

vocational training (specify): |

|

|

||

|

|

|

|

|

|||

No If no, highest grade completed (specify): Degree(s) obtained (specify):

No If no, highest grade completed (specify): Degree(s) obtained (specify):

Degree(s) obtained (specify):

3.Tax information

a. |

|

I last filed taxes for tax year (specify year): |

|

|||||||||

|

|

|||||||||||

b. |

My tax filing status is |

|

|

single |

|

|

head of household |

|

married, filing separately |

|||

|

|

|

|

|||||||||

|

|

married, filing jointly with (specify name): |

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

c. |

I file state tax returns in |

|

|

|

California |

|

other (specify state): |

|

||||

|

|

|

|

|

||||||||

d. I claim the following number of exemptions (including myself) on my taxes (specify):

4.Other party's income. I estimate the gross monthly income (before taxes) of the other party in this case at (specify): $ This estimate is based on (explain):

(If you need more space to answer any questions on this form, attach an 8

I declare under penalty of perjury under the laws of the State of California that the information contained on all pages of this form and any attachments is true and correct.

Date:

(TYPE OR PRINT NAME) |

|

(SIGNATURE OF DECLARANT) |

Page 1 of 4

Form Adopted for Mandatory Use Judicial Council of California

INCOME AND EXPENSE DECLARATION

Family Code, §§

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

Attach copies of your pay stubs for the last two months and proof of any other income. Take a copy of your latest federal tax return to the court hearing. (Black out your Social Security number on the pay stub and tax return.)

5. Income (For average monthly, add up all the income you received in each category in the last 12 months |

|

|

Average |

|||||||||||||||||||

and divide the total by 12.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Last month monthly |

||||||||||

a. Salary or wages (gross, before taxes) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||||

................................................................................................................b. Overtime (gross, before taxes) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|||||||

c. |

.........................................................................................................................Commissions or bonuses |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

d. |

Public assistance (for example: TANF, SSI, GA/GR) |

|

|

currently receiving |

|

$ |

|

|

|

|||||||||||||

|

|

|||||||||||||||||||||

e. |

Spousal support |

|

|

from this marriage |

|

|

|

from a different marriage |

|

federally taxable* |

$ |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

f. |

Partner support |

|

|

from this domestic partnership |

|

|

from a different domestic partnership |

$ |

|

|

|

|||||||||||

|

|

|

|

|||||||||||||||||||

g. |

Pension/retirement fund payments |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

.........................................................................................................h. Social Security retirement (not SSI) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|||||||

i. |

Disability: |

|

|

Social Security (not SSI) |

|

|

|

|

State disability (SDI) |

|

Private insurance |

$ |

|

|

|

|||||||

|

|

|

|

|

|

|||||||||||||||||

j. |

Unemployment compensation |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

k. |

............................................................................................................................Workers' compensation |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

l. |

Other (military allowances, royalty payments) (specify): |

|

|

|

|

|

$ |

|

|

|

||||||||||||

6.Investment income (Attach a schedule showing gross receipts less cash expenses for each piece of property.)

a. |

Dividends/interest |

$ |

b. |

Rental property income |

$ |

c. |

Trust income |

$ |

d. |

Other (specify): |

$ |

7. Income from |

$ |

||||||

I am the |

|

owner/sole proprietor |

|

business partner |

|

other (specify): |

|

|

|

|

|

||||

Number of years in this business (specify):

Name of business (specify):

Type of business (specify):

Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. Black out your Social Security number. If you have more than one business, provide the information above for each of your businesses.

8. Additional income. I received

Additional income. I received

9. Change in income. My financial situation has changed significantly over the last 12 months because (specify):

Change in income. My financial situation has changed significantly over the last 12 months because (specify):

10.Deductions

a. |

Required union dues |

$ |

|||

b. Required retirement payments (not Social Security, FICA, 401(k), or IRA) |

.................................................................. |

$ |

|||

c. Medical, hospital, dental, and other health insurance premiums (total monthly amount) |

$ |

||||

d. Child support that I pay for children from other relationships |

$ |

||||

e. |

Spousal support that I pay by court order from a different marriage |

|

|

federally tax deductible* |

$ |

|

|||||

f. Partner support that I pay by court order from a different domestic partnership |

$ |

||||

g. |

Necessary |

$ |

|||

11.Assets

a. |

Cash and checking accounts, savings, credit union, money market, and other deposit accounts |

$ |

||||

b. Stocks, bonds, and other assets I could easily sell |

$ |

|||||

c. |

All other property, |

|

real and |

|

personal (estimate fair market value minus the debts you owe) |

$ |

|

|

|||||

Last month

Total

*Check the box if the spousal support order or judgment was executed by the parties and the court before January 1, 2019, or if a

INCOME AND EXPENSE DECLARATION |

Page 2 of 4 |

PETITIONER:

RESPONDENT: OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

12.The following people live with me:

Name |

Age |

How the person is |

That person's gross |

Pays some of the |

|

|||

related to me (ex: son) |

monthly income |

household expenses? |

||||||

a. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

b. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

c. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

d. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

e. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

13.Average monthly expenses

a. Home:

(1)

Rent or

Rent or

If mortgage:

(a)average principal:

(b)average interest:

Estimated expenses

mortgage.......... $

$

$

|

Actual expenses |

|

Proposed needs |

|

|

|

|

|

|||

|

h. |

Laundry and cleaning |

$ |

||

|

i. |

Clothes |

$ |

||

|

j. |

Education |

$ |

||

|

k. |

Entertainment, gifts, and vacation |

$ |

||

|

l. |

Auto expenses and transportation |

|

||

|

(2) |

Real property taxes |

$ |

|

(3) |

Homeowner's or renter's insurance |

$ |

|

|

(if not included above) |

|

|

(4) |

Maintenance and repair |

$ |

b. |

$ |

||

c. |

Child care |

$ |

|

d. Groceries and household supplies |

$ |

||

e. |

Eating out |

$ |

|

f. Utilities (gas, electric, water, trash) |

$ |

||

g. |

Telephone, cell phone, and |

$ |

|

14.Installment payments and debts not listed above

|

(insurance, gas, repairs, bus, etc.) |

$ |

m. Insurance (life, accident, etc.; do not include |

$ |

|

|

auto, home, or health insurance) |

|

n. |

Savings and investments |

$ |

o. |

Charitable contributions |

$ |

p. Monthly payments listed in item 14 |

$ |

|

|

(itemize below in 14 and insert total here) |

|

q. |

Other (specify): |

$ |

r.TOTAL EXPENSES

the amounts in a(1)(a) and (b)) |

$ |

|

|

|

|

s. Amount of expenses paid by others |

$ |

|

Paid to |

For |

Amount |

Balance |

Date of last payment |

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

15.Attorney fees (This information is required if either party is requesting attorney fees):

a.To date, I have paid my attorney this amount for fees and costs (specify): $

b.The source of this money was (specify):

c.I still owe the following fees and costs to my attorney (specify total owed): $

d.My attorney's hourly rate is (specify):

I confirm this fee arrangement.

Date:

|

(TYPE OR PRINT NAME) |

|

|

(SIGNATURE OF DECLARANT) |

|

|

|

|

|

INCOME AND EXPENSE DECLARATION |

Page 3 of 4 |

|||

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

CHILD SUPPORT INFORMATION

(NOTE: Fill out this page only if your case involves child support.)

16.Number of children

a. |

I have (specify number): |

children under the age of 18 with the other parent in this case. |

|

b. |

The children spend |

percent of their time with me and |

percent of their time with the other parent. |

|

(If you're not sure about percentage or it has not been agreed on, please describe your parenting schedule here.) |

||

17.Children's

a. |

|

I do |

|

I do not |

have health insurance available to me for the children through my job. |

|

|

b.Name of insurance company:

c.Address of insurance company:

d.The monthly cost for the children's health insurance is or would be (specify): $ (Do not include the amount your employer pays.)

18. Additional expense for the children in this....................................................................case |

Amount per month |

||||

a. Childcare so I can work or get job training |

$ |

|

|

|

|

b. Children's health care not covered by insurance |

$ |

|

|

|

|

c. Travel expenses for visitation |

$ |

|

|

|

|

d. Children's educational or other special needs (specify below): |

$ |

|

|

|

|

19. Special hardships. I ask the court to consider the following special financial circumstances |

|||||

(attach documentation of any item listed here, including court orders): |

$ |

Amount per month For how many months? |

|||

a. Extraordinary health expenses not included in 18b |

|

|

|

|

|

b. Major losses not covered by insurance (examples: fire, theft, other |

$ |

|

insured loss) |

||

|

||

c. (1) Expenses for my minor children who are from other relationships and |

$ |

|

are living with me |

||

|

||

(2) Names and ages of those children (specify): |

|

(3) Child support I receive for those children............................................... $

The expenses listed in a, b, and c create an extreme financial hardship because (explain):

20.Other information I want the court to know concerning support in my case (specify):

INCOME AND EXPENSE DECLARATION |

|||||

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|

Print this form |

|

Save this form |

|

This Form button after you have printed the form. |

|

|

|||

|

|

|

|

|

|

Page 4 of 4

Clear this form

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The FL-150 form is used for declaring income and expenses in family law cases to assist in determining spousal or child support obligations. |

| Content Requirements | It requires detailed information about the declarant's employment, income sources, tax information, assets, monthly expenses, and, if applicable, attorney fees and child support details. |

| Attachment Necessity | Declarants must attach copies of their pay stubs for the last two months and proof of any other income, blacking out Social Security numbers for privacy. |

| Governing Law | The form is governed by the Family Code of California, §§ 2030–2032, 2100–2113, 3552, 3620–3634, 4050–4076, 4300–4339. |

Instructions on Utilizing Fl 150

Filling out the FL-150 form, or the Income and Expense Declaration, is a crucial step in many family law cases, including those involving support and custody issues. This form provides the court with a snapshot of a party's financial situation. The information you provide helps the court make informed decisions regarding support and other financial matters. Remember, accuracy is key as this document is filed under penalty of perjury. Here are the steps to fill out the form correctly.

- At the top of the form, fill in your details or your attorney's details in the "Party without attorney or attorney State Bar number" section, including names, addresses, phone numbers, and email.

- In the superior court information section, fill in the court's address, the case's city and zip code, and the branch name if known.

- Identify the parties involved by writing the names of the petitioner, respondent, and other parties/parents/claimants if applicable.

- Under "Case Number," write the case number assigned by the court.

- For question 1, provide information about your current or most recent job, including employer's name, address, phone number, occupation, employment dates, working hours, and your gross pay. Attach copies of your pay stubs for the last two months after blacking out social security numbers.

- In section 2, disclose your age and educational background, including the highest level completed and any degrees or vocational training obtained.

- Under "Tax Information" in section 3, detail your last tax filing year, filing status, state of filing, and number of exemptions claimed.

- For question 4, if applicable, estimate the other party's monthly gross income and provide a basis for the estimate.

- Section 5 asks for detailed information about your income sources, including salary, overtime, commissions, public assistance, spousal or partner support, and any additional income like pensions, retirement, disability, or unemployment benefits. Calculate the average monthly income for each.

- Provide details about any investment income in section 6.

- In section 7, discuss income from self-employment and attach required documentation.

- Indicate any additional money received in the past 12 months in section 8.

- Section 9 asks for information on significant financial changes within the last year. Provide specifics.

- Document your deductions including union dues, retirement payments, and health insurance premiums in section 10.

- Section 11 requires details on your assets. Be thorough.

- List the people who live with you, their relationship to you, their income, and if they contribute to household expenses in section 12.

- Detail your average monthly expenses in section 13, including home costs, health-care, child care, groceries, and more.

- Section 14 asks for information on debts like installment payments. Specify amounts paid and owed.

- If applicable, fill in attorney fees paid or owed in section 15.

- The last page is for child support information. Fill this out if it applies to your case, detailing the number of children, their health-care expenses, additional expenses, and any special financial circumstances.

- Sign and date the form at the bottom, verifying the accuracy of the information under penalty of perjury.

After completing and signing the FL-150 form, make sure to attach any required documents, such as pay stubs or tax returns. Review the form and attached documents for accuracy before submitting them to the court. This careful preparation helps ensure the court has the information it needs to make fair and informed decisions about your case.

Obtain Answers on Fl 150

FAQ Section About the FL-150 Form

What is the purpose of the FL-150 form?

The FL-150 form, also known as the Income and Expense Declaration, is a crucial document used in family law proceedings within the California Superior Court. Its primary purpose is to provide the court with a comprehensive overview of the financial situation of a party involved in cases related to spousal support, child support, and any other financial disputes. By detailing an individual's income, expenses, assets, and debts, it enables the court to make informed decisions regarding financial obligations and entitlements.

How do I complete the employment section if I am currently unemployed?

If you are not currently employed, you should provide information about your most recent job in the employment section of the FL-150 form. Include details such as the name and address of your former employer, the phone number, your occupation, and the date your employment ended. It is also necessary to attach copies of your pay stubs from the last two months of your employment, with Social Security numbers blacked out, to give the court a clear picture of your former income.

Are there specific attachments required with the FL-150 form?

Yes, when submitting the FL-150 form, certain attachments are necessary to substantiate the information provided. These include copies of your pay stubs from the last two months and proof of any other income you indicated on the form, such as child support or pension payments. Additionally, you must take a copy of your most recent federal tax return to any court hearing, with your Social Security number redacted for your protection. In cases involving self-employment, attaching a profit and loss statement or a Schedule C from your last federal tax return is also required.

How do I report additional income, such as lottery winnings or inheritance?

To report one-time or additional sources of income like lottery winnings or an inheritance on the FL-150 form, you should use Section 8 titled "Additional income." Here, clearly specify the source and the amount received in the last 12 months. This information helps the court understand any temporary increases in your financial resources that might affect calculations for support or other financial matters.

What should I do if my financial situation has significantly changed recently?

If you have experienced a significant change in your financial situation within the last 12 months, detail this change in Section 9 of the form titled "Change in income." Specify the nature of the change (e.g., job loss, decrease/increase in pay, medical expenses) and, if possible, the impact it has had on your finances. This section allows the court to consider recent developments when assessing your current financial needs and capabilities.

Common mistakes

Filling out the FL-150 form can be a complex process that requires attention to detail. Unfortunately, many people make mistakes when completing this form, which can lead to delays or problems in their legal matters. Here are six common mistakes people make:

Not attaching pay stubs or proof of income: It's essential to attach copies of your pay stubs for the last two months or any other proof of income to validate the financial information provided. Failing to do so can result in the court not having enough information to make an informed decision.

Omitting information about other jobs: If you have more than one job, it's crucial to list all employment details on an additional sheet of paper. Neglecting to report additional employment can lead to inaccuracies in calculating your income and expenses.

Incorrect calculation of monthly income: When calculating your average monthly income, remember to add up all income received in each category over the last 12 months and then divide by 12. Errors in these calculations can drastically affect the outcome of your case.

Misunderstanding tax filing information: Accurately providing your last tax filing status, the state in which you file, and the number of exemptions claimed is crucial. Misreporting tax information can complicate your financial profile and affect negotiations or court decisions.

Underestimating expenses: It's important to give an accurate account of your monthly expenses. Underestimating or forgetting to list certain expenses can negatively affect the determination of your financial needs and obligations.

Forgetting to include information about assets: All assets, including checking and savings accounts, stocks, and real property, must be disclosed. Failure to accurately list assets can be seen as withholding information and negatively impact your case.

Remember, the FL-150 form plays a vital role in family law cases by providing a clear picture of your financial situation. Avoiding these mistakes can help ensure that the process goes smoothly and that you present your finances accurately.

Documents used along the form

When dealing with family law matters, especially those involving financial decisions such as child support, spousal support, or the division of property, the FL-150 form, or Income and Expense Declaration, is a fundamental document required in the State of California. It provides the court with crucial information about a party's financial situation. However, submitting this form often requires additional documents to fully articulate the financial picture to the court. Understanding these accompanying documents can further ensure that all necessary information is comprehensively presented.

- Recent Pay Stubs: These are necessary to corroborate the income declared in the FL-150 form. They provide tangible proof of current earnings, deductions, and the frequency of pay, which helps in accurately assessing one's financial capacity.

- Previous Year’s Tax Returns: Tax returns offer a detailed history of an individual's income sources, including wages, investments, and any other taxable income. They serve to verify what is reported on the FL-150 form and can also highlight any discrepancies.

- Proof of Child Care Expenses: If child care expenses are claimed on the FL-150 form, receipts or contracts detailing the costs involved are required. This documentation helps the court to determine the necessity and amount of child support obligations.

- Documentation of Educational or Special Needs Expenses: For children with educational or other special needs, it is critical to provide documentation such as invoices or letters from educational institutions or healthcare providers. This ensures that these particular needs are considered in any financial determinations.

- Proof of Health Insurance and Medical Expenses: If health insurance premiums are paid for oneself or for dependents, evidence in the form of policy statements or premium bills must be submitted. Additionally, receipts or statements for out-of-pocket medical expenses can support claims for reimbursement or adjustment in support calculations.

Together, the FL-150 form and these documents play a significant role in the judicial process by ensuring that all financial aspects are transparent and comprehensible, allowing the court to make informed decisions. For parties involved, properly completing and submitting these forms is crucial to the outcome of their case, impacting financial support levels and obligations. It is always recommended to seek professional guidance when dealing with such complex legal and financial matters to ensure accuracy and compliance with legal standards.

Similar forms

The Form E used in England and Wales during divorce and dissolution proceedings is similar to the FL-150. Both require detailed disclosure of income, assets, and expenses to ensure a fair distribution and maintenance arrangement.

The Child Support Worksheet in various U.S. states mirrors the FL-150 form. They both necessitate comprehensive financial information to calculate child support payments, focusing on income, expenses, and living arrangements.

The Uniform Financial Affidavit used in family law disputes across different jurisdictions resembles the FL-150. This document collects financial information crucial for resolving matters of spousal support, child support, and asset division.

The Financial Declaration Form in South Carolina's family courts shares similarities with the FL-150, as it's essential for disclosing financial circumstances in cases involving spousal and child support, along with property distribution.

The Case Information Statement (CIS) required in New Jersey divorce proceedings parallels the FL-150. It provides a comprehensive financial snapshot, influencing decisions on alimony, child support, and asset distribution.

The Sworn Financial Statement, mandatory in Colorado divorce and family law cases, is comparable to the FL-150. It mandates detailed financial disclosure to aid the equitable resolution of spousal and child support and division of property.

Financial Affidavit – Long Form used in Florida’s divorce cases also mirrors the FL-150. This form demands a thorough disclosure of financial status, impacting alimony, child support, and the division of assets and debts.

Dos and Don'ts

Filling out the FL-150 form, or the Income and Expense Declaration, is a critical step in family law cases in California. It ensures that the court has a comprehensive understanding of your financial situation. Here are five things you should do and five things you shouldn't do when completing the form.

Things You Should Do

Provide accurate and complete information about your income, expenses, assets, and debts. The information you provide will be used to determine financial support and division of property.

Attach copies of your pay stubs for the last two months as required. Make sure to black out your Social Security number to protect your privacy.

Include all sources of income, such as salary, wages, bonuses, commissions, and any government assistance you receive. If you have multiple jobs, list the information for each job separately as instructed.

Detail your monthly expenses accurately. This includes rent or mortgage, utilities, groceries, transportation, medical expenses, and any other regular expenses.

Sign the declaration at the end of the form. Your signature certifies that the information provided is true and correct to the best of your knowledge.

Things You Shouldn't Do

Do not leave any sections blank unless they truly do not apply to your situation. If a section is not applicable, indicate this by writing "N/A" or "None."

Avoid guessing or estimating financial figures. Use actual numbers and provide documentation whenever possible. If you must estimate, make sure to note that the figure is an estimate.

Do not ignore the attachment instructions. If the form asks for additional documentation, such as tax returns or a profit and loss statement for self-employed individuals, be sure to include them.

Resist the temptation to underreport income or overstate expenses. Misrepresenting your financial situation can have serious legal consequences.

Don't forget to update the form if your financial situation changes significantly before your court date. Keeping the court informed of your current financial status is essential.

Misconceptions

Navigating the waters of legal documentation can feel insurmountable, especially when it comes to forms like the FL-150, or Income and Expense Declaration, in the state of California. Let's clear the air on some common misconceptions surrounding this form, ensuring you're armed with the correct information.

- Only the income-earner needs to complete it. There's a widespread belief that the FL-150 form only needs to be filled out by the party in the divorce or custody case who has a higher income. In truth, the form is designed to provide a comprehensive view of both parties' financial situations. It ensures fair decisions regarding spousal support, child support, and attorney fees, necessitating information from both individuals involved.

- It's optional to attach proof of income. Some might think it's sufficient to simply write down their income and expenses on the FL-150 without substantiating these figures. However, the form explicitly asks for attachments like pay stubs from the last two months and, if applicable, a copy of your latest federal tax return. This is to validate the declared income and ensure accuracy in the court's financial deliberations.

- Estimations are good enough for expenses. While estimating your expenses might seem practical, especially when you're unsure of the exact amounts, the court prefers (and sometimes requires) actual numbers. Providing estimates instead of actual expenses can lead to miscalculations in support amounts. Precise figures help paint a realistic picture of your financial needs.

- I only need to complete it once. A common misconception is that filling out the FL-150 is a one-and-done deal. However, financial situations change, and the courts may require an updated form to reflect these changes accurately. For example, if there's a significant change in income, a new job, or different expenses, you'll need to update your FL-150 to ensure all decisions are based on the most current information.

- My personal information is at risk. Given the requirement to attach sensitive financial documents, it's natural to worry about privacy. The form does take privacy into consideration, instructing filers to black out Social Security numbers on paystubs and tax returns to protect their information. Furthermore, the court has strict confidentiality rules to safeguard your personal and financial details.

Understanding these key points about the FL-150 form demystifies the process of completing it, highlighting the importance of accuracy, the necessity for evidence backing your claims, and the needs for updates when financial situations change. Remember, the goal of the FL-150 is to ensure fairness and transparency in the eyes of the court, making it crucial to approach this document with the seriousness it warrants.

Key takeaways

Filing out the FL-150 form, or the Income and Expense Declaration, is a critical process in various family law proceedings in California, including child support, spousal support, and divorce cases. Here are eight key takeaways to remember when completing and using this form:

- Accuracy is paramount. You must provide complete and truthful information about your financial situation, including all sources of income and all expenses. Incorrect or incomplete information can lead to delays, penalties, or an unfavorable outcome in your case.

- Attach supporting documents. The form requires you to attach copies of your pay stubs for the last two months and possibly other financial documents, such as tax returns. Black out your Social Security numbers for privacy.

- Clarify your employment status. If you are unemployed, you'll need to provide details about your most recent employment, including when the job ended.

- Detail your monthly income and expenses. The form requires a detailed account of your monthly income from all sources, as well as your monthly expenses. This includes unusual income or expenses.

- Report any changes in income. If your financial situation has significantly changed in the last 12 months, you are required to explain these changes on the form.

- Declare all assets and debts. You must provide information about all assets you hold, as well as any outstanding debts.

- List other household members. If you have people living with you, their income and whether they contribute to household expenses needs to be included.

- Provide child-related expenses if applicable. For cases involving child support, there’s a section to fill out regarding the children's health-care expenses, childcare costs, and other child-related financial details.

Overall, the FL-150 form plays a crucial role in the court's understanding of your financial situation. It’s important to take the time to fill it out carefully and accurately, and to update it as your financial situation changes. Failing to do so can impact the court's decisions regarding support and division of assets.

Popular PDF Forms

Commom App - There's a section for applicants living outside the country to provide additional information needed for international student admissions.

2166-9-2 - Formulated to capture the dynamic aspects of NCO duty performance, including specific missions and appointed duties.

Acha Healthcare - Designated sections for the cancer center scheduler to confirm appointment details and notify patients, fostering clear communication.