Blank Florida Ifta Application PDF Template

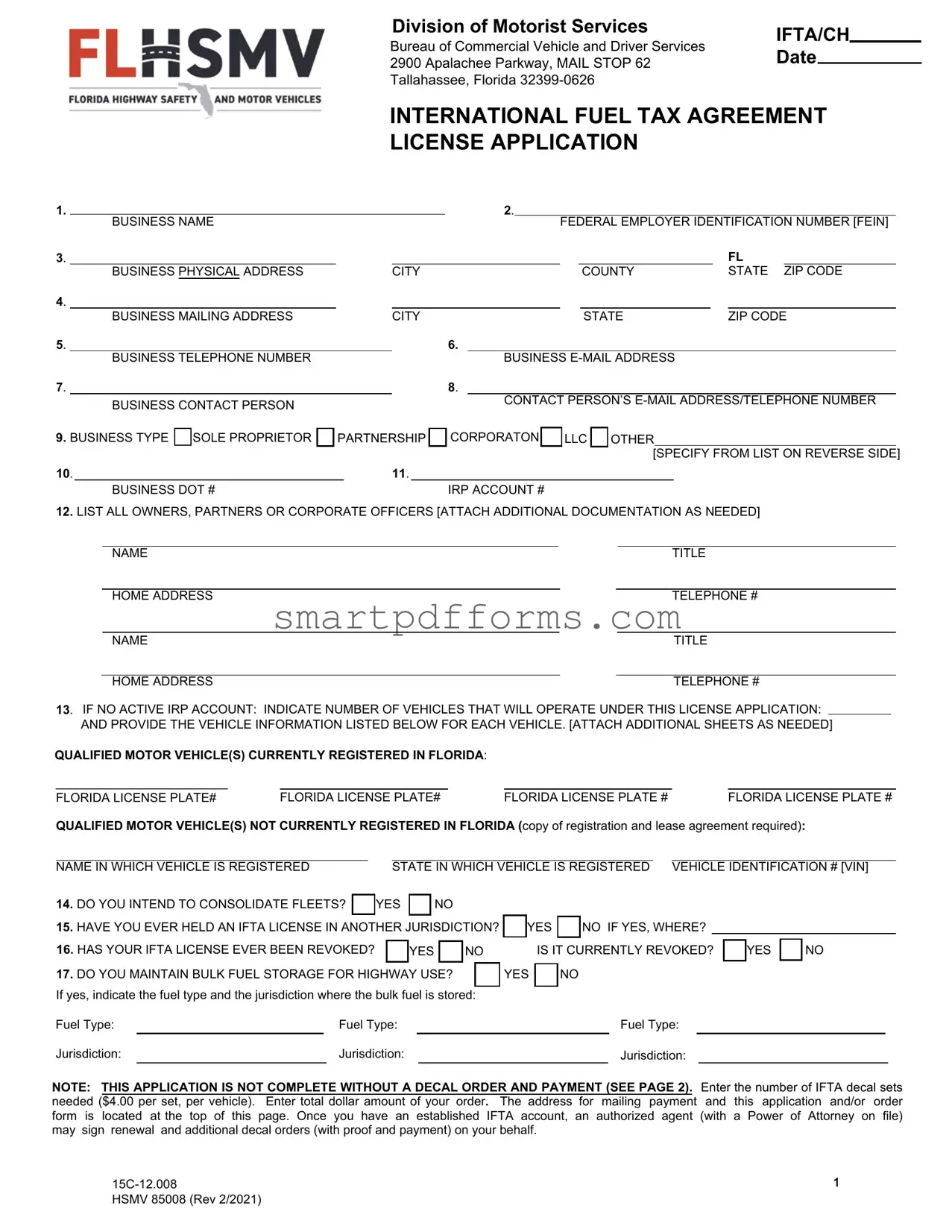

Navigating the complexities of commercial vehicle operation in Florida, the International Fuel Tax Agreement (IFTA) License Application emerges as a pivotal document for businesses engaged in interstate and international transportation. Managed by the Florida Highway Safety and Motor Vehicles Division, this comprehensive application encompasses essential details such as the business name, federal employer identification number (FEIN), and physical as well as mailing addresses, underscoring the need for accurate and current information. It delves deeper by requesting specific data on the type of business ownership, U.S. Department of Transportation (DOT) number, and the International Registration Plan (IRP) account number if applicable, offering a pathway to streamlined tax reporting and compliance across member jurisdictions. The form mandates the listing of all owners, partners, or corporate officers, ensuring accountability and transparency. Vehicle information, a cornerstone of the application, requires meticulous documentation of all vehicles operating under the license, catering to both Florida-registered and out-of-state vehicles. Moreover, the application probes into the applicant's history with IFTA in other jurisdictions, the status of any previous licenses, and the existence of bulk fuel storage, painting a comprehensive picture of the applicant's operational and compliance status. Notably, the application process concludes with a decal order and payment section, symbolizing the final steps toward obtaining licensure. This form not only facilitates compliance with the tax elements of the IFTA but also serves as a testament to the business’s commitment to adhering to regulatory requirements in the realm of commercial transportation.

Preview - Florida Ifta Application Form

|

|

FLHSMV |

|

|

Division of Motorist Services |

|

IFTA/CH |

|

|

||||||||||

|

|

2900 Apalachee Parkway, MAIL STOP 62 |

|

Date |

|||||||||||||||

|

|

|

|

Bureau of Commercial Vehicle and Driver Services |

|

|

|

|

|

|

|||||||||

|

|

|

|

Tallahassee, Florida |

|

|

|

|

|

|

|||||||||

|

|

FLORIDA HIGHWAY SAFETY |

INTERNATIONAL FUEL TAX AGREEMENT |

||||||||||||||||

|

|

|

|

||||||||||||||||

|

|

|

|

LICENSE APPLICATION |

|

|

|

|

|

|

|||||||||

1. |

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER [FEIN] |

|

||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FL |

||||

|

|

BUSINESS PHYSICAL ADDRESS |

|

|

CITY |

|

|

|

|

|

COUNTY |

|

STATE |

ZIP CODE |

|

||||

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS MAILING ADDRESS |

|

|

CITY |

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

||||

5. |

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS TELEPHONE NUMBER |

|

|

|

|

BUSINESS |

|

|

|

|

|

|

||||||

7. |

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CONTACT PERSON |

|

|

|

|

CONTACT PERSON’S |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9.BUSINESS TYPE

SOLE PROPRIETOR

PARTNERSHIP

CORPORATON

LLC

OTHER

[SPECIFY FROM LIST ON REVERSE SIDE]

10. |

|

11. |

|

|

BUSINESS DOT # |

|

IRP ACCOUNT # |

12.LIST ALL OWNERS, PARTNERS OR CORPORATE OFFICERS [ATTACH ADDITIONAL DOCUMENTATION AS NEEDED]

NAME

HOME ADDRESS

NAME

HOME ADDRESS

TITLE

TELEPHONE #

TITLE

TELEPHONE #

13. IF NO ACTIVE IRP ACCOUNT: INDICATE NUMBER OF VEHICLES THAT WILL OPERATE UNDER THIS LICENSE APPLICATION: AND PROVIDE THE VEHICLE INFORMATION LISTED BELOW FOR EACH VEHICLE. [ATTACH ADDITIONAL SHEETS AS NEEDED]

QUALIFIED MOTOR VEHICLE(S) CURRENTLY REGISTERED IN FLORIDA: |

|

|

|

_________________________ |

FLORIDA LICENSE PLATE# |

FLORIDA LICENSE PLATE # |

FLORIDA LICENSE PLATE # |

FLORIDA LICENSE PLATE# |

|||

QUALIFIED MOTOR VEHICLE(S) NOT CURRENTLY REGISTERED IN FLORIDA (copy of registration and lease agreement required):

NAME IN WHICH VEHICLE IS REGISTERED

14.DO YOU INTEND TO CONSOLIDATE FLEETS?

STATE IN WHICH VEHICLE IS REGISTERED VEHICLE IDENTIFICATION # [VIN]

YES |

NO |

15. |

HAVE YOU EVER HELD AN IFTA LICENSE IN ANOTHER JURISDICTION? |

|

YES |

|

NO IF YES, WHERE? |

|||||||

16. HAS YOUR IFTA LICENSE EVER BEEN REVOKED? |

|

YES |

|

NO |

|

|

IS IT CURRENTLY REVOKED? |

|||||

|

|

|

|

|||||||||

17. |

|

|

|

|

|

|

|

|

|

|

||

DO YOU MAINTAIN BULK FUEL STORAGE FOR HIGHWAY USE? |

|

|

|

YES |

NO |

|||||||

If yes, indicate the fuel type and the jurisdiction where the bulk fuel is stored:

YES

NO

Fuel Type: |

|

|

Fuel Type: |

|

|

Fuel Type: |

Jurisdiction: |

|

|

Jurisdiction: |

|

|

Jurisdiction: |

NOTE: THIS APPLICATION IS NOT COMPLETE WITHOUT A DECAL ORDER AND PAYMENT (SEE PAGE 2). Enter the number of IFTA decal sets needed ($4.00 per set, per vehicle). Enter total dollar amount of your order. The address for mailing payment and this application and/or order form is located at the top of this page. Once you have an established IFTA account, an authorized agent (with a Power of Attorney on file) may sign renewal and additional decal orders (with proof and payment) on your behalf.

1 |

|

HSMV 85008 (REV 2/2021) |

|

NUMBER OF VEHICLES REQUIRING IFTA DECALS |

|

|

DECAL FEE PER VEHICLE |

|

|

X |

$4.00 |

|

TOTAL ENCLOSED |

$ |

|

(MAKE CHECK PAYABLE TO FLORIDA DIVISION OF MOTORIST SERVICES) |

|

|

I, THE UNDERSIGNED APPLICANT (BUSINESS OWNER OR COMPANY OFFICER) UNDERSTAND THAT, UNDER PENALTY OF PERJURY, I DECLARE I HAVE EXAMINED THIS APPLICATION AND DECAL ORDER AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS CORRECT AND COMPLETE. I AGREE TO COMPLY WITH ALL TAX REPORTING, PAYMENT,

PRINTED NAME |

|

TITLE |

|

TELEPHONE # (REQUIRED) |

APPLICANT SIGNATURE:

Owner

Company Officer |

DATE |

(SUNBIZ REGISTRATION REQUIRED) |

|

APPLICATION INSTRUCTIONS

1.BUSINESS NAME – Print the name of the motor carrier business making application. If the name is other than an individual's name, attach a copy of the corporation papers or fictitious trade name papers filed with the Florida Secretary of State.

2.FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) – Print your business’s FEIN. Your FEIN should always be referenced when inquiring

on your account.

The following contact information is needed for the business that is making application for an IFTA license. If your business will be using authorized agents to manage your IFTA correspondence and shipment of credentials, you must submit a completed, signed, and notarized Power of Attorney (POA) form (HSMV 96440). Once this POA form is on file, any one of your authorized agents may submit a request to update the shipping address you would like used for your IFTA routine correspondence and credentials.

3.BUSINESS PHYSICAL ADDRESS – Enter the Florida physical location (address, city & zip) of your motor carrier business or office. Post office boxes or rented mail boxes are NOT acceptable.

4.BUSINESS MAILING ADDRESS – Enter the address, city, state & zip used by the business. This address cannot be the address of a service provider or permitting company.

5.BUSINESS TELEPHONE NUMBER – Enter the business telephone number, including area code.

6.BUSINESS

7.CONTACT PERSON – Enter name of internal company person to contact about this account (if not licensee/company officer, attach letter designating this company employee).

8.CONTACT PERSON’S

9.TYPE OF BUSINESS OWNERSHIP – Specify the type of business you own. Other options are Limited Company, LTD Liability LTD Partnership, Limited Liability Partnership, Company Limited, Limited Partnership.

10.U.S. DOT NUMBER – Enter the U.S. DOT number of the business.

11.INTERNATIONAL REGISTRATION PLAN (IRP) ACCOUNT NUMBER – Enter your Florida IRP account number. If you do not have a Florida IRP account, you must provide VEHICLE INFORMATION for each vehicle in your fleet See #13, below.

12.OWNER, PARTNERS OR CORPORATE OFFICER’S NAME(S) – Print the name, home address, city, state & zip, title, and telephone number of every company officer. Attach additional pages to the application, as necessary.

13.VEHICLE INFORMATION – If you do not have a Florida IRP account, indicate the total number of qualified vehicles that will operate under this license application. Provide the license plate number of those vehicles that are registered in Florida and, for those vehicles registered out of state, the name, state of registration, and VIN (with attached proof). Attach additional pages to the application, as necessary.

14.Use a check mark to indicate whether you intend to consolidate ALL of your vehicles in Florida.

15.Use a check mark to indicate whether you have ever held an IFTA license in another jurisdiction and, if YES, indicate jurisdiction(s).

16.Use a check mark to indicate whether your IFTA license has ever been revoked.

17.Use a check mark to indicate whether you maintain bulk fuel tanks, and, if YES, indicate type of fuel stored and the jurisdiction where the bulk fuel tanks are located.

FOR OFFICIAL USE ONLY (WALK IN COUNTER)

DECAL #(S) |

|

PRESENTED TO (PRINT NAME): |

|

SIGNATURE OF RECIPIENT: |

DATE: |

Owner |

Company Officer |

|

(SUNBIZ REGISTRATION REQUIRED) |

HSMV 85008 (REV 2/2021)

Authorized Agent

(POA REQUIRED)

2

Form Data

| Fact | Detail |

|---|---|

| Form Identification | FLORIDA HIGHWAY SAFETY INTERNATIONAL FUEL TAX AGREEMENT LICENSE APPLICATION |

| Governing Regulation | 15C-12.008 |

| Application Fee | $4.00 per IFTA decal set, per vehicle |

| Essential Applicant Information Required | Business name, FEIN, business and mailing address, contact information, type of business ownership, U.S. DOT number, and possible IRP account number. |

| Special Requirements | Proof of IRP account or vehicle information for fleet, intention of fleet consolidation, prior IFTA license status, and bulk fuel storage information. |

Instructions on Utilizing Florida Ifta Application

Filling out the Florida IFTA (International Fuel Tax Agreement) Application form is an important step for carriers operating across state lines to ensure they are properly registered and comply with tax regulations. Here's a guide to accurately complete the form, ensuring your business maintains its compliance with Florida's fuel tax laws.

- Start with the BUSINESS NAME: Enter the legal name of your company as registered with the state.

- Enter your FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) in the space provided.

- For the FL BUSINESS PHYSICAL ADDRESS, input the physical location of your business in Florida, including city, county, state, and zip code. Remember, P.O. Boxes are not acceptable.

- Provide your BUSINESS MAILING ADDRESS, including city, state, and zip code. This should be where you receive your business correspondence.

- Include your BUSINESS TELEPHONE NUMBER with the area code.

- Write down the BUSINESS E-MAIL ADDRESS for official correspondence.

- Under BUSINESS CONTACT PERSON, list the name of the person within your company who can be contacted regarding this account. If this person is not a company officer, attach a letter designating this employee’s authority.

- Provide the CONTACT PERSON'S E-MAIL ADDRESS AND TELEPHONE NUMBER.

- Choose your BUSINESS TYPE (e.g., Sole Proprietor, Partnership, Corporation, LLC, etc.). Specify from the list or add another type if yours doesn't match the provided options.

- Input your U.S. DOT NUMBER.

- Enter your INTERNATIONAL REGISTRATION PLAN (IRP) ACCOUNT NUMBER if available, or provide the requested vehicle information if you don't have one.

- List all OWNERS, PARTNERS OR CORPORATE OFFICERS including their home address, name, title, and telephone number. Attach additional documentation as needed.

- Under VEHICLE INFORMATION, indicate the number of vehicles that will operate under this license application. For vehicles registered in Florida, provide the license plate numbers. For vehicles registered out of state, provide the name in which the vehicle is registered, the state, and the VIN, attaching copies of the registration and lease agreement if required.

- Mark whether you intend to CONSOLIDATE FLEETS within Florida.

- Check the appropriate boxes to indicate if you've ever held an IFTA license in another jurisdiction, if your IFTA license has ever been revoked, and whether you maintain bulk fuel storage, specifying the type of fuel and the jurisdiction of the bulk fuel tanks.

- Determine the NUMBER OF VEHICLES REQUIRING IFTA DECALS, multiplying by $4.00 per vehicle to calculate the TOTAL ENCLOSED payment amount. Make your check payable to the Florida Division of Motorist Services.

- Finally, the APPLICANT SIGNATURE section must be signed by the business owner or company officer, declaring the accuracy and completeness of the application under penalty of perjury. Include your printed name, title, telephone number, and date.

Once you have completed these steps, review the form to ensure all information is accurate and no section has been overlooked. Include your decal order and the appropriate payment before mailing the application to the address listed at the top of the form. This comprehensive approach helps in streamlining the process, making it smoother to obtain your IFTA license and stay in compliance with fuel tax reporting and payment obligations.

Obtain Answers on Florida Ifta Application

How do I apply for an IFTA license in Florida?

To apply for an IFTA License in Florida, you must complete the Florida IFTA Application form - HSMV 85008 (REV 2/2021). The form requires details such as business name, Federal Employer Identification Number (FEIN), business physical and mailing addresses, contact information, and the business type. Additionally, information about the business's DOT number, IRP account number, details of owners, partners, or corporate officers, and vehicle information for those without a Florida IRP account should be provided. If applicable, indicate whether you intend to consolidate fleets, if you have held an IFTA license in another jurisdiction, if your IFTA license has ever been revoked, and if you maintain bulk fuel storage. Complete the decal order, including payment, and submit the form along with any required attachments to the specified address, ensuring all information is accurate to comply with tax reporting, payment, record-keeping, and license display requirements.

Is a physical business location required for obtaining an IFTA license in Florida?

Yes, a physical business location within Florida is required for obtaining an IFTA license. The application form explicitly states that the business's physical address cannot be a post office box or rented mailbox. This requirement ensures that the business has a legitimate operation base within the state, complying with the standards set forth by the International Fuel Tax Agreement (IFTA).

Can I use an authorized agent to handle my IFTA license and correspondences?

Yes, businesses can use authorized agents to handle their IFTA licenses and correspondences. However, a completed, signed, and notarized Power of Attorney (POA) form (HSMV 96440) must be on file. Once this form is submitted and approved, any of the business's authorized agents can request updates to shipping addresses for IFTA correspondence and credentials on behalf of the business.

What do I need to do if my IFTA license has previously been revoked?

If your IFTA license has previously been revoked, you must disclose this information by checking the appropriate box on the application form. Revealing a past revocation is crucial for the review process. Depending on the circumstances and jurisdiction's policies, providing additional information or taking specific corrective actions might be necessary to qualify for a new license. It’s important to address the reasons behind the revocation and demonstrate compliance with all IFTA requirements to prevent future issues.

How do I submit the IFTA decal order and payment?

The application form includes a section for ordering IFTA decals, which requires specifying the number of vehicles and calculating the total fee based on the stated rate per vehicle. Complete this section, calculate the total amount due, and make a check payable to the Florida Division of Motorist Services for the total enclosed amount. The completed form, along with the decal order, payment, and any other required documentation, should be mailed to the address provided at the top of the application form. It’s imperative to ensure that all information is correct and the payment is accurate to avoid processing delays.

Common mistakes

Filling out the Florida International Fuel Tax Agreement (IFTA) Application form accurately is crucial for businesses to avoid delays or issues with their IFTA license. However, there are common mistakes made during this process. Recognizing and avoiding these errors can streamline the application process and ensure compliance with the requirements.

- Not providing the complete business name. It's important to list the business name exactly as it is registered, including the full legal name, to avoid processing delays.

- Entering an incorrect Federal Employer Identification Number (FEIN). Accuracy here is critical, as the FEIN is a key identifier for the business. Double-check this number for errors.

- Using a PO Box for the business physical address. The form requires a physical address, not a post office box or rented mailbox. This mistake can lead to the application being rejected.

- Omitting the business mailing address. Even if it's the same as the physical address, it needs to be listed separately to ensure all correspondence reaches the business.

- Forgetting the contact details. Both the business telephone number and the email address are essential for communication regarding the IFTA account.

- Incorrectly listing the type of business ownership. Selecting the wrong business structure (e.g., corporation, partnership) can affect the application's processing. Ensure the listed structure matches official documents.

- Not attaching additional documentation when required. Failing to include required details about fleet vehicles, additional business officers, or supporting documents can delay the application process.

To avoid these common mistakes, applicants should review their application thoroughly before submission. Ensuring all information is accurate, complete, and clearly written helps facilitate a smoother application process for a Florida IFTA license.

Documents used along the form

When businesses and individuals in Florida apply for the International Fuel Tax Agreement (IFTA) License, several other forms and documents are often required to support their application. These documents are necessary for ensuring compliance with Florida's regulations and the requirements of the IFTA. Below is a list of forms and documents commonly used alongside the Florida IFTA Application form:

- Power of Attorney (POA) Form (HSMV 96440): This document authorizes representatives to manage IFTA correspondence and credentials on behalf of the applicant. It must be completed, signed, and notarized.

- Proof of Federal Employer Identification Number (FEIN): This verifies the applicant’s business identity and is essential for tax administration.

- Certificate of Incorporation or Fictitious Name Registration: This document proves the legal existence of a business and must be filed with the Florida Secretary of State.

- International Registration Plan (IRP) Documents: For applicants without a Florida IRP account, detailed vehicle information for the fleet needs to be provided, including copies of out-of-state vehicle registrations and lease agreements, if applicable.

- Proof of Bulk Fuel Storage: If applicants indicate that they maintain bulk fuel storage, documentation detailing the storage location, capacity, and type of fuel must be submitted.

- List of Qualified Motor Vehicles: A comprehensive list of vehicles intended for IFTA license coverage, including make, model, VIN, and registration information.

- VIN (Vehicle Identification Number) Documentation: Copies of vehicle registration documents indicating VINs for all vehicles that will operate under the IFTA license.

- Proof of Payment for IFTA Decals: Documentation showing the payment for the required IFTA decals, which must be displayed on qualified motor vehicles.

These additional forms and documents support the Florida IFTA Application form by providing thorough evidence of business legitimacy, vehicle eligibility, and compliance with tax laws. Applicants should ensure they have gathered all necessary documentation before submitting their IFTA application to the Florida Department of Highway Safety and Motor Vehicles to avoid delays in processing and to ensure their fleet can operate interstate seamlessly under IFTA guidelines.

Similar forms

The US DOT Number Application is similar to the Florida IFTA Application because it requires business identification information, such as the business name and the Federal Employer Identification Number (FEIN). Both forms are designed to collect data on the company for regulatory and tax purposes related to commercial vehicle operations.

The International Registration Plan (IRP) Application shares similarities with the Florida IFTA Application in that both require information on vehicles that will be operated under the respective licenses or plans, including details like the number of vehicles and, potentially, their license plate numbers or vehicle identification numbers (VINs).

Commercial Driver's License (CDL) Application Forms are akin to the IFTA Application in the aspect of collecting personal information of the individuals (owners, partners, corporate officers) connected with the operation. Although serving different purposes, both necessitate detailed contact information for responsibility and compliance reasons.

The Motor Carrier Identification Report (MCS-150) mirrors the IFTA Application form in needing business identification info, such as the business address, email, and DOT number. This form is crucial for obtaining a USDOT number and updates the Federal Motor Carrier Safety Administration (FMCSA) on your business details.

Fuel Tax Reporting Forms for different states resemble the IFTA Application since they both involve the administration of fuel usage for tax purposes. Even though each state might have its report form, the essence of providing detailed fuel usage by state and vehicle is the common thread.

Power of Attorney (POA) Forms in the trucking and logistics sector parallel the Florida IFTA Application in the capacity that a POA may be necessary to authorize agents to handle IFTA and other related matters on behalf of the business or individual. Authorization and representation are central to both documents.

The Business License Registration Forms for specific jurisdictions mimic the IFTA Application because they require detailed business information and the purpose of the business, which in the context of the IFTA, relates to fuel tax collection and compliance.

Hazardous Materials Registration Forms are comparable due to the mandatory disclosure of business and vehicle information for safety and regulatory compliance, similar to the data collection intention of the IFTA Application form for tax purposes.

Vehicle Lease Agreement Forms, when used for commercial purposes, share parallels with the IFTA Application since they might be required to prove the registration and rightful operation of leased vehicles under the IFTA license, specifically if these vehicles are not directly registered under the business's name.

The Bulk Storage Registration Forms are akin to the section in the IFTA Application that asks about maintaining bulk fuel storage. Both documents relate to the regulatory compliance of storing and using fuel, with the IFTA focusing on the taxation aspect of fuel use.

Dos and Don'ts

When completing the Florida IFTA Application form, it's essential to follow guidelines that ensure your application is accepted and processed efficiently. Here are four tips on what you should and shouldn't do:

What you should do:

Ensure that all the information you provide is accurate and current, including the business name, FEIN, and contact information. Accuracy is key to the processing of your application.

Attach all required additional documentation, such as proof of vehicle registration for those not registered in Florida, and if necessary, additional pages listing all owners, partners, or corporate officers.

Sign and date the application form to certify that the information provided is true and that you agree to comply with the IFTA requirements.

Include the correct payment for the number of IFTA decals needed, ensuring your check is made payable to the Florida Division of Motorist Services.

What you shouldn't do:

Do not use a post office box or rented mailbox as the business physical address. It’s crucial to provide a tangible Florida location.

Avoid leaving sections of the application blank. If a section does not apply to your situation, clearly indicate with "N/A" or "None" as appropriate.

Do not forget to include the decal order and payment with your application, as your application is incomplete without it.

Refrain from submitting the application without reviewing all the information for accuracy and completeness. Any errors or omissions can delay the processing time.

Misconceptions

When navigating the complexities of the Florida International Fuel Tax Agreement (IFTA) Application, several misconceptions often arise. Understanding these misunderstandings can streamline the application process and ensure compliance with regulations.

- Any Address Will Suffice for the Business Location: The application mandates a Florida physical address for the motor carrier's main business office or location. Post office boxes or rented mailboxes do not meet this criterion, indicating the need for an actual, physical address within Florida.

- Service Provider Address for Business Mailing Address is Permissible: The business mailing address specified in the application cannot be that of a service provider or permitting company. This clarifies the requirement for the mailing address to be directly associated with the business applying for the IFTA license.

- All Types of Businesses Do Not Need to Supply FEIN: Contrary to what some might believe, every business applying for an IFTA license must provide their Federal Employer Identification Number (FEIN), showcasing the universal nature of this requirement across different business types.

- Authorized Agents Can Automatically Handle IFTA Matters: Businesses desiring to have authorized agents manage their IFTA correspondence and credentials need to file a completed, signed, and notarized Power of Attorney (POA) form. This emphasizes the necessity to officially authorize agents prior to their engagement in IFTA-related activities.

- Necessity of IFTA Decal for Each Vehicle is a Common Misunderstanding: The application includes a section for ordering IFTA decal sets, priced per set per vehicle. This signifies the need for acquiring and appropriately displaying IFTA decals for each qualifying vehicle, essential for compliance.

- Prior IFTA Licenses or Revocations in Other Jurisdictions Are Irrelevant: The application asks if the business has ever held an IFTA license in another jurisdiction or if such a license has ever been revoked. This indicates the importance of disclosing such information, impacting the processing and outcome of the current application.

Understanding these nuances and clarifying common misconceptions about the Florida IFTA Application form aids businesses in successful compliance and navigation of the IFTA licensing process.

Key takeaways

When preparing to fill out the Florida International Fuel Tax Agreement (IFTA) License Application, there are several key points to keep in mind to ensure that the process is completed accurately and efficiently. Understanding these points can help applicants navigate the application process smoothly and comply with all the necessary requirements.

- Accurate Business Information: It is crucial to provide accurate business information, including the business name, Federal Employer Identification Number (FEIN), and U.S. DOT number. This information should match the official documents and records associated with the business.

- Physical and Mailing Addresses: The application requires both a physical address in Florida and a mailing address. P.O. Boxes or rented mailboxes are not acceptable for the physical address, ensuring the location of actual business operations is documented.

- Designation of Contact Person: A specific contact person within the company should be designated for IFTA matters. This person's email address and telephone number must be provided, ensuring a direct line of communication for any IFTA-related inquiries or issues.

- Type of Business Ownership: Clearly specify the type of business ownership (e.g., Sole Proprietor, Partnership, Corporation, LLC) to avoid any confusion regarding the legal structure and responsibilities of the business under the IFTA.

- Vehicles and Consolidation: For applicants without an existing Florida IRP account, detailed vehicle information for each qualified motor vehicle is required, including whether there is an intention to consolidate all vehicles in Florida. This information is essential for determining IFTA decal needs and compliance.

- Previous IFTA License Information: Disclose any prior IFTA licenses held in other jurisdictions and any history of license revocation. This transparency is vital for establishing trust and compliance with the Florida Department of Highway Safety and Motor Vehicles.

Completing the Florida IFTA application thoroughly and accurately is the first step toward ensuring compliance with fuel tax laws across member jurisdictions. Alongside providing the necessary business and vehicle information, applicants must understand the importance of maintaining accurate records and adhering to tax reporting, payment, and decal display requirements as specified in the IFTA guidelines.

Popular PDF Forms

How to Get Highschool Transcript - Authorizes the transfer of a student’s records, helping a new school to adequately prepare for their arrival.

Colorado Department of Real Estate - Details utility payment responsibilities during the occupancy period.

Editable Frayer Model - An instructional tool from a literacy resource library, aimed at helping young learners grasp and apply complex vocabulary through structured analysis.