Blank Florida Lawyers Support PDF Template

In today's rapidly evolving legal landscape, having readily accessible and up-to-date legal forms is crucial for attorneys, especially those specializing in probate law in Florida. Florida Lawyers Support Services, Inc. offers a comprehensive solution with its 2022 Probate Forms, meticulously developed by the Real Property, Probate, and Trust Law Section of The Florida Bar. These forms are the preferred choice among Probate Judges in Florida, ensuring compliance and smooth proceedings within the legal framework. Available in various formats, including a locked .pdf format on a flash drive for secure viewing and printing, or as physical copies, these forms cater to the diverse needs of legal professionals. Additionally, they provide an index with rule and statutory references for every form, making it easier for attorneys to navigate the complexities of probate law. With an option for a la carte orders to meet specific needs and all transactions facilitated directly through FLSSI.org, these forms are designed for ease of use and efficiency. Orders can be placed with a simple mail-in form or via email, supporting payments through major credit cards for convenience. This tailored approach, combined with the backing of The Florida Bar, ensures that legal practitioners have the most reliable, authoritative resources at their disposal for probate matters.

Preview - Florida Lawyers Support Form

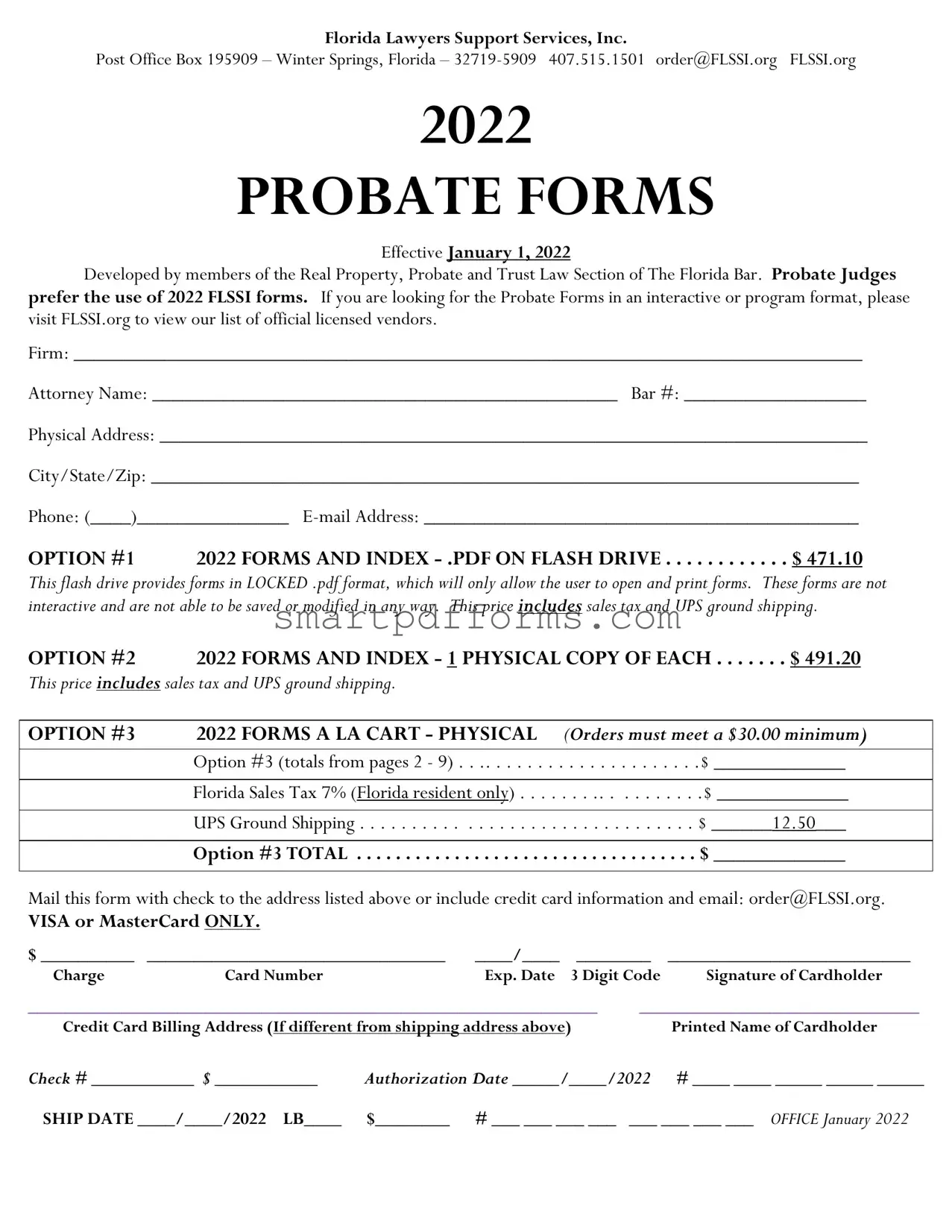

Florida Lawyers Support Services, Inc.

Post Office Box 195909 – Winter Springs, Florida –

2022

PROBATE FORMS

Effective January 1, 2022

Developed by members of the Real Property, Probate and Trust Law Section of The Florida Bar. Probate Judges prefer the use of 2022 FLSSI forms. If you are looking for the Probate Forms in an interactive or program format, please visit FLSSI.org to view our list of official licensed vendors.

Firm: ______________________________________________________________________________

Attorney Name: ______________________________________________ Bar #: __________________

Physical Address: ______________________________________________________________________

City/State/Zip: ______________________________________________________________________

Phone: (____)_______________

OPTION #1 2022 FORMS AND INDEX

This flash drive provides forms in LOCKED .pdf format, which will only allow the user to open and print forms. These forms are not interactive and are not able to be saved or modified in any way. This price includes sales tax and UPS ground shipping.

OPTION #2 |

2022 FORMS AND INDEX - 1 PHYSICAL COPY OF EACH |

$ 491.20 |

||

This price includes sales tax and UPS ground shipping. |

|

|

|

|

|

|

|

||

OPTION #3 |

2022 FORMS A LA CART - PHYSICAL |

(Orders must meet a $30.00 minimum) |

||

|

Option #3 (totals from pages 2 - 9) . |

. .. . . . . . . |

. . . . . . . . . . . . . .$ _____________ |

|

|

|

|

||

|

Florida Sales Tax 7% (Florida resident only) . . . . |

. . . .. . . . . . . . . .$ _____________ |

||

|

|

|

||

|

UPS Ground Shipping |

. . . . . . . . . . . . . . . . . . . . . . $ ______12.50___ |

||

|

|

|

|

|

|

Option #3 TOTAL |

. . . . . . . . . . |

. . . . . . . . . . . . . . $ _____________ |

|

|

|

|

|

|

Mail this form with check to the address listed above or include credit card information and email: order@FLSSI.org.

VISA or MasterCard ONLY.

$ __________ |

________________________________ |

____/____ |

________ |

__________________________ |

||

Charge |

Card Number |

|

Exp. Date |

3 Digit Code |

Signature of Cardholder |

|

_____________________________________________________________ |

______________________________ |

|||||

Credit Card Billing Address (If different from shipping address above) |

|

Printed Name of Cardholder |

||||

Check # ___________ $ ___________ |

Authorization Date _____/____/2022 |

# ____ ____ _____ _____ _____ |

||||

SHIP DATE ____/____/2022 LB____ |

$________ |

# ___ ___ ___ ___ |

___ ___ ___ ___ OFFICE January 2022 |

|||

INDEX of all probate forms; includes rule and statutory references pertaining to each form.

#______@ $25.00 each

I.GENERAL PROBATE RELATED FORMS

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#_____@ $2.50 each

#______@ $5.00 each

#_____@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#_____@ $2.50 each

#_____@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

2

#______@ $2.50 each

#______@ $2.50 each

II.FORMS FOR ABBREVIATED PROBATE PROCEEDINGS

#______@ $7.50 each

– single petitioner)

#______@ $10.00 each

#______@ $10.00 each

– single petitioner)

#______@ $10.00 each

–multiple petitioners))

#______@ $10.00 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#_____@ $2.50 each

#_____@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

3

#______@ $5.00 each

III.OPENING FORMAL ADMINISTRATION

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

4

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

Nonresident

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

5

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

6

#______@ $2.50 each

#______@ $2.50 each

#_______@ $5.00 each

#______@ $2.50 each

IV. SPECIAL PROCEEDINGS

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

7

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

V.CLOSING ADMINISTRATION

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $17.50 each

#______@ $5.00 each

8

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $7.50 each

Certificate of Distribution of Real Property (corporate

representatives)

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

9

Form Data

| Fact Name | Description |

|---|---|

| Organization Name | Florida Lawyers Support Services, Inc. |

| Location and Contact | Winter Springs, Florida, 407.515.1501, order@FLSSI.org |

| Form Availability Date | Effective January 1, 2022 |

| Form Development | Developed by members of the Real Property, Probate and Trust Law Section of The Florida Bar |

| Judicial Preference | Probate Judges prefer the use of 2022 FLSSI forms |

| Product Options | Available in .PDF on flash drive or as a physical copy |

| Governing Law | Florida probate law |

Instructions on Utilizing Florida Lawyers Support

Filling out the Florida Lawyers Support Services form is vital for lawyers who need the updated probate forms for their legal practices. This process ensures you have the most current documentation preferred by Probate Judges for the year 2022. Here is a straightforward guide on how to properly fill out the form:

- Start by clearly printing your firm's name in the space provided.

- Enter the attorney's full name next.

- Include the attorney's Bar number, ensuring accuracy for verification purposes.

- Provide the physical address of the firm, including city, state, and zip code.

- Fill in the firm's phone number, including the area code in the brackets provided.

- Type in a valid e-mail address that is used for official correspondence.

- Choose your preferred option for receiving the forms:

- Option #1 if you prefer the forms on a flash drive.

- Option #2 for a physical copy of each form.

- Option #3 if you wish to select forms a la carte (remember to meet the $30.00 minimum).

- For Option #3, total the amounts from pages 2 to 9, and then calculate and add the 7% Florida Sales Tax if you are a Florida resident. Include the UPS Ground Shipping fee of $12.50.

- Indicate the total amount due for Option #3.

- For payment, fill in your credit card information or check details, including card number, expiration date, 3-digit code, and signature of the cardholder. If the billing address differs from the shipping address already provided, make sure to list it as well.

- Finally, include the printed name of the cardholder, check number (if applicable), and the authorization date.

After filling out the form, review all information for accuracy. Then, mail this form with the appropriate payment to the address listed at the top, or you can choose to email the form with credit card payment information to order@FLSSI.org. Once your order and payment are processed, expect the delivery of your selected form option on the ship date mentioned in the form. This comprehensive suite of documents will support your legal practice in probate matters, streamlining the process with updated and preferred forms.

Obtain Answers on Florida Lawyers Support

Frequently Asked Questions about Florida Lawyers Support Services Probate Forms

- What are FLSSI Probate Forms?

- How can I purchase FLSSI Probate Forms?

- Option #1: A set of forms and an index on a flash drive in locked PDF format, priced at $471.10, including sales tax and shipping.

- Option #2: One physical copy of each form and index, priced at $491.20, including sales tax and shipping.

- Option #3: Forms a la carte in physical format, with a minimum order of $30.00 plus Florida sales tax of 7% and shipping costs of $12.50.

- Are these forms editable?

- Can I get these forms if I'm not a Florida resident?

FLSSI Probate Forms are standardized legal documents created by the Florida Lawyers Support Services, Inc., as of January 1, 2022. These forms have been developed by members of the Real Property, Probate and Trust Law Section of The Florida Bar and are preferred by Probate Judges in Florida. Designed to streamline the probate process, these forms include petitions, notices, orders, and various other documents necessary for probate proceedings.

There are three options available for purchasing FLSSI Probate Forms.

The forms provided on the flash drive (Option #1) are in a locked PDF format, meaning they can only be opened and printed. These documents are not interactive and cannot be saved or modified in any manner. If you need editable forms, it's best to contact FLSSI or visit their website for alternative options.

Yes, the FLSSI Probate Forms are available for purchase by both residents and non-residents of Florida. However, it's important to note that these forms are specifically designed to comply with Florida law and are intended for use within Florida's legal system. If you're practicing outside of Florida or dealing with a probate matter in another state, you should seek local legal resources.

Common mistakes

Not verifying the forms are up to date before filling them out. The document clearly states "2022 PROBATE FORMS Effective January 1, 2022" which underscores the importance of ensuring the forms being used are the most current for the task at hand. Using outdated forms can result in delays or rejection of filings.

Ignoring specific instructions related to Florida residents. The form mentions "Florida Sales Tax 7% (Florida resident only)", indicating that certain fields and calculations are applicable only to residents of Florida. Overlooking such details can lead to incorrect submissions.

Choosing the wrong option for their needs among the available options (Option #1, Option #2, and Option #3). Each option caters to different needs, such as digital vs. physical copies of the forms. Misunderstanding the content and benefits of each option could lead to unnecessary expenses or not receiving the required format.

Incorrectly filling out credit card information. The form requires detailed credit card information including "Charge Card Number," "Exp. Date," and "3 Digit Code". Input errors here can lead to payment failures, delaying the order process.

Overlooking the need to sign the form. There's a clearly marked section for the "Signature of Cardholder" which is a common oversight. Unsigned forms may not be processed, as the signature is necessary for authorization.

Not providing the correct shipping or billing address, especially if different. The form separates "Credit Card Billing Address (If different from shipping address above)". Failing to specify an alternate billing address, when applicable, could lead to billing issues or even the shipment of materials to the wrong address.

Attention to detail is crucial when filling out any legal form, especially those related to probate, to ensure the process moves forward without unnecessary delays or complications.

Documents used along the form

When dealing with the complexities of probate in Florida, the Florida Lawyers Support Services form is a crucial starting point. However, it's just one of many documents individuals might need to navigate the process effectively. Here's a look at other essential forms and documents that are frequently used in conjunction with the Florida Lawyers Support form.

- Death Certificate: This is the official document proving the death of the decedent. It's required for many steps in the probate process, including validating the will and transferring assets.

- Will: The decedent's last will and testament outlines their wishes for distributing their assets and may appoint a personal representative.

- Trust Documents: If the decedent created any trusts, these documents are necessary to manage and distribute the assets placed in trust according to the terms set forth.

- Inventory of the Estate: A detailed list of all assets belonging to the estate at the time of death. This includes bank accounts, real estate, stocks, and personal property among others.

- Notice to Creditors: This document is used to notify potential creditors of the decedent's death so they can make claims against the estate for any outstanding debts.

- Petition for Probate Administration: If formal administration is required, this petition is filed with the probate court to initiate the process.

- Affidavit of No Florida Estate Tax Due: This affidavit may be needed if the estate is required to assert that no estate tax is due in Florida.

- Letters of Administration: Issued by the court, these documents give the personal representative the authority to act on behalf of the estate.

Navigating probate can be a daunting task. Each document plays a crucial role in ensuring the process is completed accurately and efficiently. Professionals involved in probate administration often utilize these forms to carry out their legal duties, respect the wishes of the deceased, and settle the estate in accordance with Florida law.

Similar forms

The Safe Deposit Box Access Forms (e.g., Petition to Open Safe Deposit Box and Order to Open Safe Deposit Box) are similar to the Access to Safety Deposit Box forms in other states, which are also used to gain legal access to a decedent's safe deposit box, usually to locate a will or other important documents.

Caveat Forms (e.g., Caveat by Creditor and Caveat by Interested Person) are comparable to challenge or notice forms in estate proceedings in other jurisdictions. These forms serve to notify the court that someone intends to challenge the will or administration of the estate.

Notice and Service Forms (e.g., Formal Notice, Proof of Service of Formal Notice) are similar to notice requirements in other states where formal notification must be sent to interested parties or potential challengers during probate procedures to ensure due process.

Summary Administration Forms (e.g., Petition for Summary Administration, Order of Summary Administration) resemble streamlined or simplified probate procedures available in many other states designed for estates under a certain value or meeting specific criteria, allowing for a more rapid distribution of assets.

The Disposition of Personal Property without Administration form is akin to Small Estate Affidavits or Summary Procedures in other states, where if an estate meets certain criteria, such as having a low total value, it can bypass the usual probate process.

Letters of Curatorship and Related Forms parallel temporary or emergency guardianship or conservatorship documents found in other states' laws, used when an immediate appointment is necessary to manage the decedent's estate temporarily.

Formal Administration Opening Forms (e.g., Petition for Administration, Order Admitting Will to Probate) are similar to the initial filing documents in other states that start the formal probate process, including petitioning for the appointment of an executor or personal representative and proving the will.

The Waiver of Notice Forms mirror documents in other probate courts where parties can consent to bypass certain notices or hearings, thereby expediting the process by removing procedural steps.

Oaths and Bonds Forms (e.g., Oath of Personal Representative, Bond of Personal Representative) reflect requirements in many jurisdictions for personal representatives or executors to swear to fulfill their duties faithfully and, in some cases, to post a bond as financial security for their actions.

Designation and Email Address Forms (e.g., Notice of Designation of Email Addresses for Service of Documents) are akin to modern procedural requirements in various jurisdictions that allow for and formalize electronic communications in legal processes, emphasizing the legal system's adaptation to digital communication.

Dos and Don'ts

When filling out the Florida Lawyers Support form, it is important to keep in mind the following do's and don'ts to ensure a smooth process:

- Do ensure all the information provided is accurate and complete. Inaccuracies can delay the process or result in the need to submit corrections.

- Do check the form for specific submission requirements, such as signatures and the necessity for original documents versus copies.

- Do use the most current version of the form, as laws and regulations change over time. The 2022 Probate Forms are the latest available and are preferred by Probate Judges.

- Do not modify or attempt to save the locked PDF forms provided on the flash drive in OPTION #1, as these are intended only for opening and printing.

- Do not forget to include payment for the selected option. For checks, make sure they are properly signed and dated. If paying by credit card, ensure all details are filled out correctly.

- Do not omit any required personal or firm information, including the Attorney Name, Bar Number, or contact details, as this is essential for the processing of your order.

Misconceptions

When it comes to understanding the Florida Lawyers Support Services, Inc. (FLSSI) and its offerings, a handful of misconceptions can surface, reflecting a need for greater clarity among legal professionals and the public alike. The importance of demystifying these aspects cannot be overstated, as they play a crucial role in the effective handling of probate forms in the state of Florida.

Misconception 1: FLSSI Probate Forms are Optional for Legal Proceedings

One common misconception is that the use of FLSSI's probate forms is a matter of preference rather than necessity. However, these forms are highly recommended by probate judges throughout Florida, suggesting that their usage can significantly streamline the probate process. These forms are precisely developed by the Real Property, Probate and Trust Law Section of The Florida Bar to ensure consistency, accuracy, and compliance with Florida law, making them more than just optionally convenient.

Misconception 2: Forms Can Be Altered after Purchase

It's mistakenly believed that once purchased, the FLSSI forms, especially those provided in LOCKED .pdf format on a flash drive, can be edited or modified to suit individual case needs. The truth is, these forms are locked to prevent alterations, ensuring their integrity and that they remain in their approved format. This standardization helps maintain legal consistency across cases and courts.

Misconception 3: FLSSI Forms are Immediately Accessible Upon Order

Another incorrect assumption is that FLSSI probate forms, once ordered, are instantly accessible or delivered immediately. In reality, physical products such as flash drives or printed forms require processing and shipping time, as indicated by their handling of orders through mail and UPS ground shipping. The processing time means practitioners must plan accordingly and not expect instantaneous access upon ordering.

Misconception 4: The Forms are Only for Attorneys

While the ordering process and the content of the forms may seem attorney-centric, given the requirement to provide a Bar number during the purchase, many of the forms, such as those related to opening a safe deposit box or the appointment of a curator, can also be utilized by individuals representing themselves in probate matters. This aspect emphasizes FLSSI’s broader utility beyond just the legal professional community, although legal advice may be necessary in complex situations.

Correcting these misconceptions is essential for the proper use and understanding of FLSSI offerings. Whether for legal professionals or individuals navigating the probate process, recognizing the intended use, limitations, and accessibility of the FLSSI probate forms ensures smoother proceedings and adherence to Florida’s legal standards.

Key takeaways

When filling out and using the Florida Lawyers Support Services (FLSSI) form for 2022 Probate Forms, there are several key points to keep in mind:

- The 2022 FLSSI Probate Forms were developed by members of the Real Property, Probate and Trust Law Section of The Florida Bar and are preferred by Probate Judges for use in proceedings.

- Options available for obtaining these forms include a locked .pdf format on a flash drive, allowing only for opening and printing of the forms without the possibility of saving or modifying them, and a physical copy of each form.

- For those requiring specific forms, Option #3 allows for a la carte orders, with a minimum purchase requirement of $30.00. This option totals the cost of selected forms plus Florida sales tax for residents, and a set UPS ground shipping fee.

- To place an order, you can mail the form with a check to the address provided or use the email option to order with a credit card, accepting only VISA or MasterCard. It's important to include all necessary information, such as the card number, expiration date, 3-digit code, and the signature of the cardholder, along with the billing address if it differs from the shipping address.

Additionally, the index includes rule and statutory references for each form, aiding in the appropriate selection and use of each document within probate proceedings. This meticulous detailing ensures that practitioners can confidently navigate through the probate process with the correct forms and understandings at hand.

Popular PDF Forms

Household Composition Letter From Landlord - Offers caseworkers a reliable method for confirming a client's residence and living situation through third-party verification.

Da Form 3439 - Positions itself as a critical tool in the employment selection process, ensuring candidates meet high standards.

137/3 - Facilitates access to military benefits for adult dependents who are incapacitated and unable to support themselves.