Blank Florida Lottery Claim PDF Template

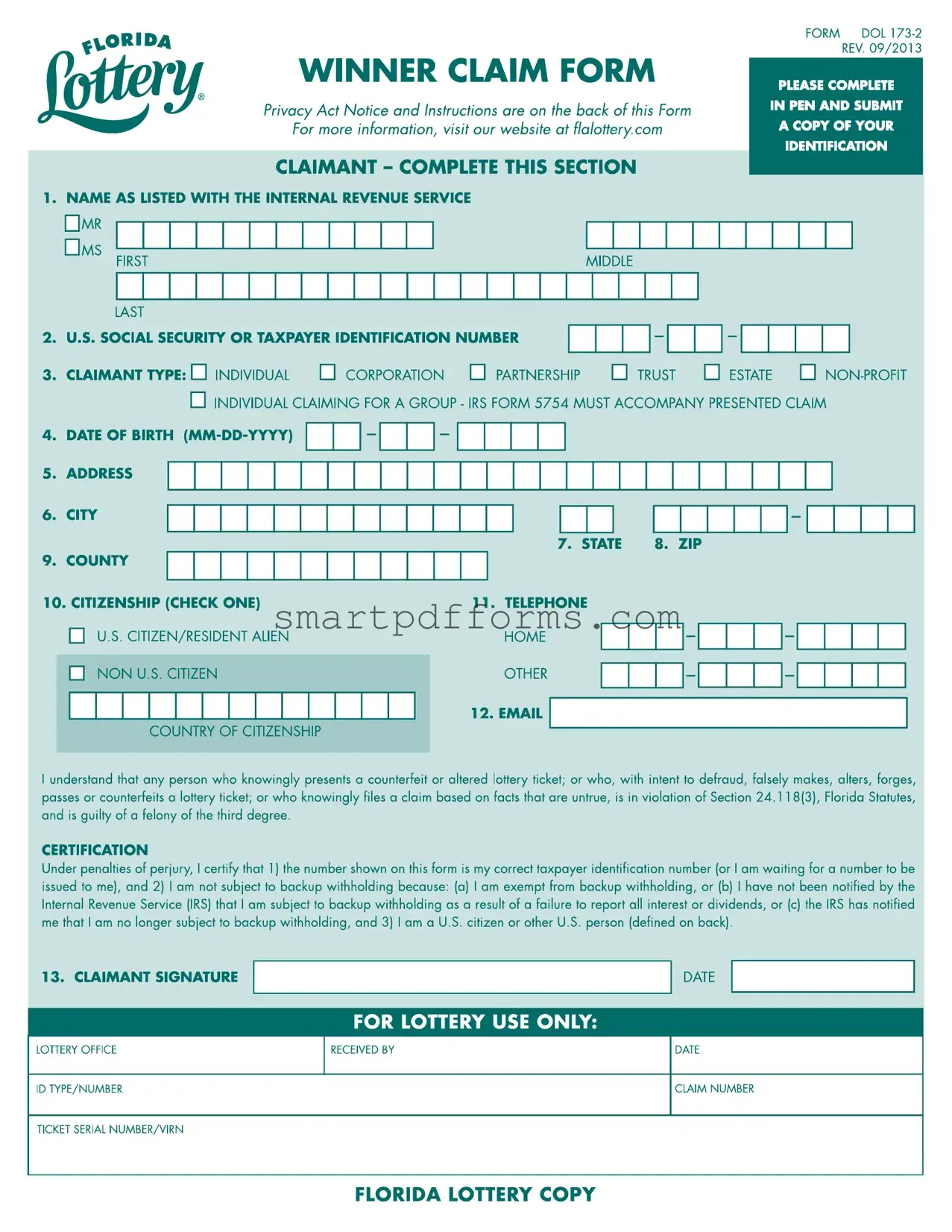

The Florida Lottery Winner Claim Form, officially designated as FORM DOL 173-2 (revised September 2013), serves as a crucial tool for lottery winners in the state to rightfully claim their prizes. It mandates comprehensive information from claimants, including but not limited to the name as registered with the Internal Revenue Service, social security or taxpayer identification number, and claimant type (individual, corporation, partnership, or trust). It also emphasizes the importance of accompanying IRS Form 5754 for group claims. Alongside the personal details, claimants are required to affirm their understanding of the legal ramifications of falsifying claims or presenting altered tickets under the Florida Statutes, highlighting the felony charges associated with such acts. The form further necessitates certifications regarding the claimant's tax withholding status and citizenship or residency, underscoring the legal adherence to tax laws. Equally important, it outlines detailed instructions for claiming prizes, the care of lottery tickets, and the various thresholds for claiming prizes at retailers, lottery offices, or via mail—specifying the documentation needed alongside the claim. It also alerts to the imperative collection of social security numbers for claims over $600 for taxation and lawful deductions, underlined by the Federal Privacy Act. Additionally, it underscores the necessity of presenting valid identification with the claim. This form not only facilitates the claim process but also serves as a deterrent against fraudulent claims, ensuring that only rightful winners receive their due awards, all while maintaining compliance with federal and state regulations.

Preview - Florida Lottery Claim Form

Form Data

| Fact Name | Fact Detail |

|---|---|

| Form Revision | The current version of the Florida Lottery Winner Claim Form is DOL 173-2, revised in September 2013. |

| Website for More Information | Further details and instructions can be found on the Florida Lottery's official website, flalottery.com. |

| Required Identification | A copy of the claimant's identification must accompany claims of $600 and over. The ID should be valid and issued within the last 5 years. |

| Governing Law for False Claims | Submitting false claims is a felony of the third degree under Section 24.118(3), Florida Statutes. |

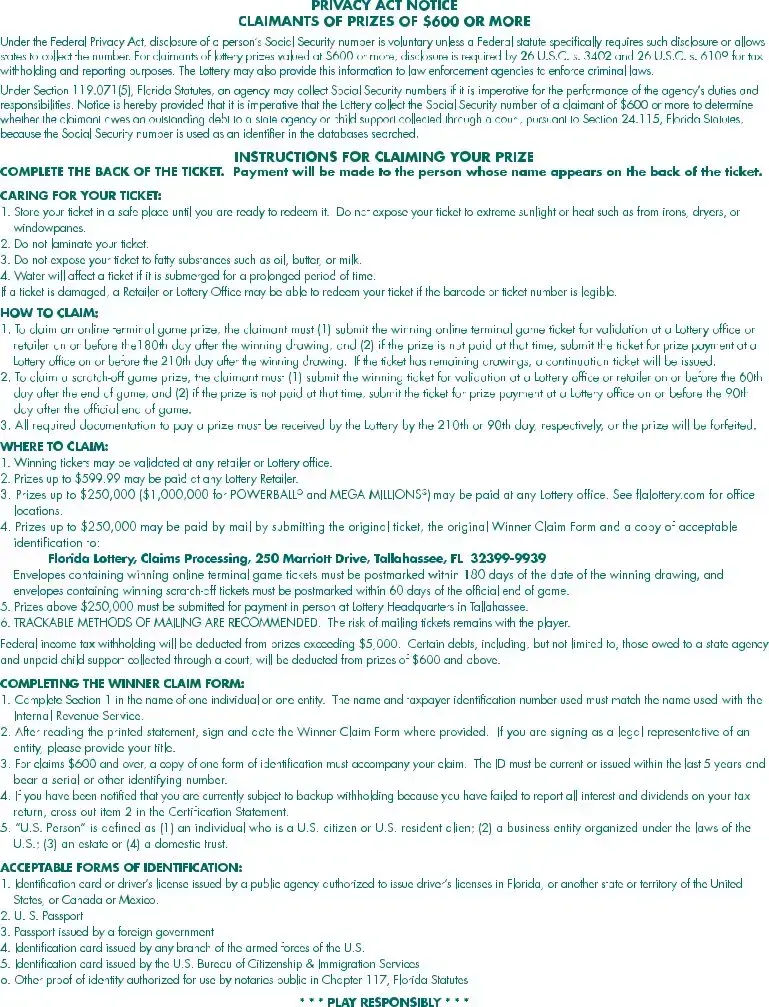

| Privacy Act Notice | Under the Federal Privacy Act, providing one's Social Security number is voluntary unless required by law. For prizes of $600 or more, this disclosure is mandatory for tax purposes. |

| Prize Claim Requirements | For claiming prizes, winners must complete the back of their ticket, store it safely, and avoid damaging it. Prizes up to $250,000 can be claimed by mail or at any Lottery office. |

| Tax Deductions and Debts | Federal income tax withholding is deducted from prizes exceeding $5,000. Also, debts to state agencies or unpaid child support collected through a court will be deducted from prizes of $600 and above. |

Instructions on Utilizing Florida Lottery Claim

After securing a winning lottery ticket, the next step is to officially claim your prize. This process involves filling out the Florida Lottery Winner Claim Form attentively to ensure your prize is successfully awarded. There's a specific form, DOL 173-2 REV. 09/2013, that requires accurate and complete information. This process is vital for both your protection and to comply with legal requirements. Following the instructions provided ensures a smooth claim process, allowing you to receive your prize without unnecessary delays or complications. Here's a step-by-step guide to fill out the Florida Lottery Claim Form:

- Locate the section labeled "CLAIMANT - COMPLETE THIS SECTION".

- In the space provided, enter your name exactly as it is listed with the Internal Revenue Service. Be sure to check the appropriate title (MR or MS) and accurately fill in your First, Last, and Middle names, if applicable.

- Input your U.S. Social Security or Taxpayer Identification Number in the designated space.

- Mark the box that corresponds to your claimant type: INDIVIDUAL, CORPORATION, PARTNERSHIP, or TRUST. If claiming for a group as an individual, remember IRS Form 5754 must accompany your claim.

- Fill in your Date of Birth in the MM-DD-YYYY format.

- For questions regarding citizenship, check the appropriate box to indicate if you are a NON-PROFIT U.S. CITIZEN/RESIDENT ALIEN or NON U.S. CITIZEN. Additionally, provide your home country if you're not a U.S. citizen.

- Provide a valid email address in the space allotted for better communication and updates regarding your claim.

- Carefully read the certification statement that mentions the legal implications of submitting false claims or altering lottery tickets.

- Upon agreeing to the certification, sign your name in the space labeled "CLAIMANT SIGNATURE," and enter the date next to it.

- Fill in the required information about the claim including ID TYPE/NUMBER, TICKET SERIAL NUMBER/VIRN, and CLAIM NUMBER if available.

After completing the form:

- Review all provided information ensuring accuracy and completeness.

- Attach a copy of your identification, adhering to the listed acceptable forms. This is a crucial step for claims of $600 and over.

- Mail the original ticket, the completed Winner Claim Form, and required identification documents to the Florida Lottery, Claims Processing, 250 Marriott Drive, Tallahassee, FL 32399-9939, if not submitting in person. Remember, the method of mailing should be trackable to ensure safe delivery.

By following these steps methodically, you can anticipate a straightforward claim process. Keep in mind that tickets have validation periods based on the type of game won, so prompt action is advisable. Claiming your lottery prize is a significant event, and by ensuring the accuracy and completeness of your submitted claim form, you help facilitate a smooth transition to receiving your winnings.

Obtain Answers on Florida Lottery Claim

Who can fill out the Florida Lottery Winner Claim Form?

Anyone who has won a prize from the Florida Lottery can fill out the claim form. This includes individuals, corporations, partnerships, trusts, or groups claiming through an individual. The person or entity must match the name listed with the Internal Revenue Service (IRS) and provide a valid U.S. Social Security Number or Taxpayer Identification Number.

What identification is required to claim a lottery prize in Florida?

When claiming a prize of $600 or more, you must submit a copy of one form of acceptable identification. Acceptable forms include a driver's license or identification card issued by any U.S., Canadian, or Mexican public agency; U.S. or foreign government passport; U.S. armed forces identification card; U.S. Bureau of Citizenship & Immigration Services identification card; or other proof of identity authorized for use by notaries public in Florida. The ID must be current or issued within the last 5 years and have a serial or other identifying number.

Where do I claim my Florida Lottery prize?

Where you claim your prize depends on the amount you've won:

- Prizes up to $599.99 can be claimed at any Florida Lottery retailer.

- Prizes up to $250,000 (or $1,000,000 for POWERBALL® and MEGA MILLIONS®) can be claimed at any Florida Lottery office. Office locations can be found on flalottery.com.

- Prizes up to $250,000 can also be claimed by mail by sending the required documents to the Florida Lottery's Tallahassee address.

- Prizes above $250,000 must be claimed in person at the Florida Lottery Headquarters in Tallahassee.

What happens if a lottery ticket is damaged?

If your lottery ticket is damaged, a retailer or Lottery Office may still be able to redeem it if the barcode or ticket number is legible. However, take care to store your ticket safely, avoid exposing it to extreme conditions like sunlight or heat, and do not laminate or submerge it in water.

How do I complete the Winner Claim Form?

To correctly fill out the Winner Claim Form, complete Section 1 in the name of one individual or entity, matching the information with the IRS. Sign and date the form, providing your title if representing an entity. If claiming a prize of $600 and over, include a copy of one form of acceptable identification. If subject to backup withholding due to unreported interest or dividends, cross out item 2 in the certification section. Remember, the form must be completed in pen.

What is the deadline for claiming a lottery prize in Florida?

Deadlines for claiming your prize vary by the type of game:

- For online terminal games, submit the ticket for validation within 180 days after the winning drawing. If not paid at that time, submit it for payment on or before the 210th day after the drawing.

- For scratch-off games, tickets must be submitted for validation at a Lottery office or retailer within 60 days after the game's end, and for prize payment within 90 days after the game’s official end.

What legal warnings should I be aware of when claiming a Florida Lottery prize?

Be mindful that presenting a counterfeit or altered lottery ticket, or filing a claim based on false information, is a violation of Florida law and constitutes a third-degree felony. Additionally, by signing the Winner Claim Form, you certify under penalties of perjury that the tax information provided is correct and that you are a U.S. citizen or another U.S. person, as defined on the form's back.

Common mistakes

When filling out the Florida Lottery Claim Form, people often make a variety of mistakes. These errors can delay the processing of their claim or even result in the denial of their winnings. Here are four common mistakes to avoid:

- Incorrect or Inconsistent Information: A common error is not providing information that exactly matches the records of the Internal Revenue Service (IRS). The name and taxpayer identification number listed in Section 1 of the form must align precisely with IRS records. This includes the proper notation of any middle names or initials.

- Failure to Sign and Date the Form: The Winner Claim Form requires a signature and date at the bottom of the form, certifying under penalties of perjury that the information provided is accurate. Skipping this step or filling it out improperly can nullify the claim.

- Omitting Required Identification: For claims of $600 and over, the claimant must attach a copy of one form of acceptable identification. Not submitting valid, current identification—or failing to include identification that bears a serial or other identifying number—can result in a delay or denial of the claim. The list of acceptable forms of ID includes driver's licenses, passports, and identification cards issued by the armed forces, among others.

- Ignoring Specific Sections for Non-U.S. Citizens or Those Subject to Backup Withholding: Non-U.S. citizens or individuals currently subject to backup withholding for failing to report all interest and dividends must pay careful attention to specific areas of the form. Failing to appropriately denote backup withholding status or not identifying correctly as a U.S. person—defined as a U.S. citizen, U.S. resident alien, a business entity organized under U.S. laws, an estate, or a domestic trust—can interfere with the successful processing of a claim.

Avoiding these errors can expedite the claim process, ensuring that winners receive their prizes without unnecessary delay. Always read the instructions carefully and double-check that all provided information is complete and accurate before submitting the form.

Documents used along the form

When submitting a Florida Lottery Winner Claim Form, several additional forms and documents may be needed to ensure a smooth processing of the claim. These supplementary items are essential for various verification and legal compliance purposes.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct taxpayer identification number (TIN) to the entity that must file an information return with the IRS to report winnings.

- IRS Form 5754: Statement by Person(s) Receiving Gambling Winnings. If winnings are being shared, this form is necessary for the distribution of the prize amount among the group members, ensuring the correct reporting and tax withholding for each individual.

- Photo Identification: Valid government-issued photo ID (e.g., driver’s license, passport) is required to verify the identity of the claimant. This aligns with the requirement to submit a copy of one form of identification with claims of $600 and over.

- Proof of Social Security Number: A Social Security card or document issued by a government agency that contains the full Social Security number (SSN). Required for tax reporting and withholding purposes.

- Debt Clearance Form: Certain claimants might need to provide documentation or clearance regarding outstanding debts, such as back taxes or child support, which the lottery is legally obligated to check before disbursing large prizes.

- Direct Deposit Form: For claimants opting to receive their winnings through direct deposit, this form is necessary to provide the banking details for transferring the prize money.

- Power of Attorney Documentation: If a claim is being filed on behalf of another person, documentation establishing Power of Attorney may be required to authorize the transaction and manage the winnings.

The above list encapsulates key documents and forms that are commonly used in conjunction with the Florida Lottery Winner Claim Form. It is crucial for winners to prepare and submit all required paperwork accurately to ensure the timely and correct payment of their prize money. Understanding the purpose of each document aids in navigating the claim process efficiently.

Similar forms

The Internal Revenue Service (IRS) Tax Return Forms are similar to the Florida Lottery Claim Form in that they require the claimant's accurate taxpayer identification number and personal identification details. Both sets of documents are structured to ensure the correct reporting and withholding of taxes under federal law. Additionally, both documents include sections for certifications and signatures to attest to the accuracy of the provided information under penalty of perjury.

Bank Account Opening Forms share similarities with the Lottery Claim Form, mainly in the collection of personal identification information, such as name, Social Security Number, and citizenship status. These forms often require signatures for verification and include declarations regarding tax withholding similar to the certification section of the lottery form.

Employment Eligibility Verification Form I-9 is akin to the Lottery Claim Form as both require the verification of the claimant's or individual’s legal status in the United States, demanding proof of identity and eligibility to engage in employment or claim lottery winnings. The I-9 form, like the lottery claim form, uses personal information to comply with federal regulations.

Credit Card Application Forms resemble the Lottery Claim Form by needing personal and identification details, as well as a certification or declaration segment where the applicant must provide truthful information. These forms also assess eligibility based on provided details, similar to how the lottery form determines the rightful winner or claimant.

Forms for Filing Damage Claims with Insurance Companies are paralleled with the Florida Lottery Claim Form in that they request detailed personal information, policy or claim numbers, and often require supporting documentation for verification purposes. Both forms serve the purpose of validating the claimant's request for a payout based on established criteria.

Government Assistance Program Application Forms, such as those for Social Security benefits or unemployment insurance, necessitate detailed personal information, signatures for verification, and often, tax identification numbers. These forms, similar to the lottery claim form, are designed to ensure that benefits or payouts go to eligible individuals based on provided and verified information.

Passport Application Forms have sections for personal information, citizenship details, and require signatures, similar to the Lottery Claim Form. Both involve a process of identity verification, use of government-issued identification for support, and have strict guidelines for submission to prevent fraud.

Dos and Don'ts

When filling out the Florida Lottery Claim form, it is crucial to adhere to certain guidelines to ensure the process is smooth and your claim is processed without unnecessary delays. Here are things you should and shouldn't do:

Do's:- Complete the form in pen. This ensures that your information is legible and cannot be easily altered, which is essential for the verification process.

- Verify the name matches with the IRS. The name and taxpayer identification number on the form must be consistent with the records at the Internal Revenue Service to avoid issues with tax withholdings.

- Include a copy of your identification. Make sure the identification is current (or issued within the last 5 years) and has a serial or identifying number. This is crucial for claims $600 and over.

- Sign and date the form. This indicates that you have read and understood the statements on the form and that you are providing true information under the penalties of perjury.

- Use trackable methods of mailing. When mailing your claim, opt for a shipping method that allows tracking to ensure your documents reach their destination and to protect against loss.

- Protect your ticket. Store it in a safe place, away from extreme conditions and substances that could damage it, until you are ready to submit your claim.

- Submit the form by the deadline. Pay close attention to submission deadlines to ensure your prize claim is valid and processed in a timely manner.

- Don't use pencil. Writing in pencil could lead to altered information either accidentally or intentionally, which can invalidate your claim.

- Don't forget to include IRS Form 5754 if claiming for a group. Failing to include this form (when applicable) can delay or invalidate your claim.

- Don't laminate your ticket. Lamination could damage the ticket and make it difficult for lottery officials to validate.

- Don't leave the back of the ticket blank. Filling out the back of the ticket with the claimant's name ensures payment is made to the correct person.

- Don't expose your ticket to damaging substances. Protect your ticket from water, heat, and fatty substances to ensure it remains in good condition.

- Don't wait too long to claim your prize. Delays in submission can lead to missed deadlines and forfeited prizes.

- Don't submit without checking eligibility criteria. Ensure you meet all the eligibility criteria, including but not limited to, being of the age of majority and not having outstanding debts that could affect prize collection.

Misconceptions

When it comes to claiming winnings from the Florida Lottery, there are some common misconceptions that can cause confusion among winners. Understanding the actual process and requirements laid out in the claim form helps in ensuring a smooth and successful claim. Here's a closer look at those misconceptions:

Any form of identification is acceptable: This is not true. The form clearly specifies acceptable forms of identification, such as a driver's license, U.S. Passport, or identification card issued by a public agency, among others. An ID must be current or issued within the last five years and have a serial or other identifying number.

Social Security numbers are not necessary for lottery claims: In the case of prizes $600 or more, providing your Social Security number is mandatory for tax withholding and reporting purposes under federal law. The form emphasizes the importance of this requirement.

Claims can be submitted without signing the form: Every claim requires the claimant's signature. This certifies that the information provided is accurate and meets the perjury laws. Failing to sign the form can result in a denied claim.

All lottery winnings are tax-exempt: This is incorrect. Federal income tax withholding will be deducted from prizes exceeding $5,000. Plus, certain debts will be deducted from prizes of $600 and above, including unpaid child support or debts owed to a state agency.

You can claim your prize anytime: There are specific deadlines for claiming prizes, depending on the type of game won. For example, scratch-off game prizes must be claimed within 60 days after the end of the game, while online terminal game prizes have different deadlines.

Tickets can be claimed at any location: While some prizes may be claimed at any retailer, higher-value prizes must be claimed at designated Lottery offices or the Lottery Headquarters in Tallahassee, depending on the prize amount.

Original tickets are not required for claiming a prize: A common misconception is that a copy of the ticket is enough to claim a prize. However, the original ticket is required for validation and must be submitted along with the claim form and identification.

Claimants do not need to be U.S. citizens: While it's true that you don't necessarily need to be a U.S. citizen to claim a lottery prize, the claim form does require you to designate your citizenship status. Non-U.S. citizens must navigate different tax implications, and the form accommodates this fact.

Wins under $600 are automatically taxed: Actually, federal income tax withholding is only deducted from prizes exceeding $5,000. However, all winnings are subject to federal income tax, regardless of the amount, and it's the winner's responsibility to report smaller wins on their tax return.

Understanding these misconceptions and the actual requirements of the Florida Lottery Claim Form can help winners claim their prizes more efficiently and with less frustration.

Key takeaways

When seeking to claim a prize from the Florida Lottery, it's crucial to navigate the process accurately and efficiently. Below are key takeaways about filling out and utilizing the Florida Lottery Winner Claim Form to ensure a smooth transaction:

- Always complete the form in pen, providing clear and legible information to avoid any unnecessary delays in processing your claim.

- Ensure your name matches exactly as it appears with the Internal Revenue Service. Discrepancies may result in delays or denial of your claim.

- Include your Social Security or Taxpayer Identification Number as part of the claim process. This is essential for tax reporting and withholding purposes.

- Specify the claimant type accurately—whether individual, corporation, partnership, trust, or an individual claiming on behalf of a group.

- Remember to sign and date the form to certify that your information is accurate to the best of your knowledge and that you comply with the terms regarding perjury.

- Attach a copy of a valid form of identification along with your claim. Acceptable IDs include a driver’s license, U.S. passport, military identification, or any other authorized proof of identity.

- The form necessitates acknowledging understanding of the legal implications of presenting false or fraudulent information to claim a lottery prize.

- Claims for prizes of $600 or more are under scrutiny for tax withholding and reporting purposes under the Federal Privacy Act, mandating disclosure of your Social Security number.

- If you're claiming a prize on behalf of a group, IRS Form 5754 must accompany your claim to properly document the distribution of the prize among the group members.

- Prizes have specific timelines for claiming based on the type of game ticket. Online terminal game prizes must be submitted for payment within 180 to 210 days after the winning drawing, while scratch-off game prizes have a claim deadline of 60 to 90 days after the game's official end.

- Winning tickets can be validated and prizes claimed at any Lottery retailer, designated Florida Lottery Office, or by mail, with the amount determining where to claim your prize. Always consider using a trackable method of mailing for peace of mind.

Handling your Florida Lottery Claim Form with attention to detail and within the prescribed guidelines will help ensure that your prize claiming process is both successful and hassle-free. Remember to safeguard your ticket and follow the instructions meticulously to enjoy your winnings without complications.

Popular PDF Forms

Preschool Enrollment Form Template - Inquires about specific toileting needs, such as the use of potty or toilet, facilitating smooth transitions for bathroom use at preschool.

60th Wedding Anniversary Card From King - Request an on-air celebration to honor your loved one's 100th birthday or the rare achievement of 75 years of marriage.

Wisconsin Instruction Permit - Questions on the MV3001 regarding medical conditions and medication use highlight safety considerations in the licensing process.