Blank Florida Proof Loss PDF Template

When residents of Florida face property damage and need to file an insurance claim, the Florida Proof of Loss form becomes a critical document. This form is a formal statement that policyholders must provide to their insurers to substantiate the losses they're claiming. It requires detailed information, including the policy number, the date and time of loss, and a comprehensive listing of the damages. According to Florida Statutes Section 817.234, submitting a proof of loss that includes false, incomplete, or misleading information could lead to felony charges. This makes it vital for individuals to approach this document with accuracy and honesty. The form also necessitates disclosure of any other insurance policies that may cover the loss, any changes in property title or occupancy, and a detailed account of the loss, including the actual cash value of the property at the time of the loss and a breakdown of damages. Not only does the proof of loss form require the signature of the insured, but it must also be notarized in the state of Florida, reinforcing its significance and the solemnity of the declaration it embodies.

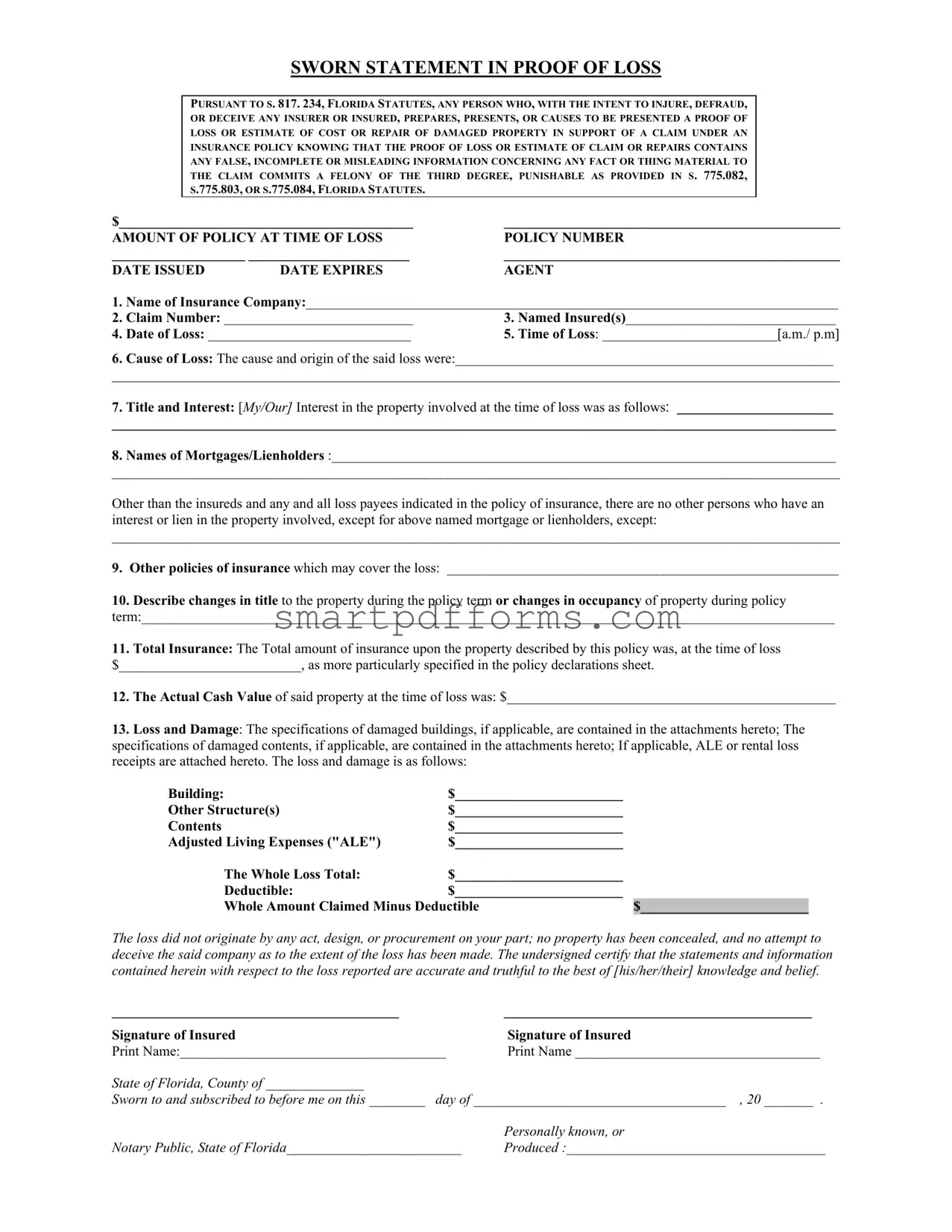

Preview - Florida Proof Loss Form

SWORN STATEMENT IN PROOF OF LOSS

PURSUANT TO S. 817. 234, FLORIDA STATUTES, ANY PERSON WHO, WITH THE INTENT TO INJURE, DEFRAUD, OR DECEIVE ANY INSURER OR INSURED, PREPARES, PRESENTS, OR CAUSES TO BE PRESENTED A PROOF OF LOSS OR ESTIMATE OF COST OR REPAIR OF DAMAGED PROPERTY IN SUPPORT OF A CLAIM UNDER AN INSURANCE POLICY KNOWING THAT THE PROOF OF LOSS OR ESTIMATE OF CLAIM OR REPAIRS CONTAINS ANY FALSE, INCOMPLETE OR MISLEADING INFORMATION CONCERNING ANY FACT OR THING MATERIAL TO THE CLAIM COMMITS A FELONY OF THE THIRD DEGREE, PUNISHABLE AS PROVIDED IN S. 775.082, S.775.803, OR S.775.084, FLORIDA STATUTES.

$__________________________________________ |

________________________________________________ |

|

AMOUNT OF POLICY AT TIME OF LOSS |

POLICY NUMBER |

|

___________________ _______________________ |

________________________________________________ |

|

DATE ISSUED |

DATE EXPIRES |

AGENT |

1.Name of Insurance Company:____________________________________________________________________________

2. |

Claim Number: ___________________________ |

3. |

Named Insured(s)______________________________ |

4. |

Date of Loss: _____________________________ |

5. |

Time of Loss: _________________________[a.m./ p.m] |

6.Cause of Loss: The cause and origin of the said loss were:______________________________________________________

________________________________________________________________________________________________________

7.Title and Interest: [My/Our] Interest in the property involved at the time of loss was as follows: ____________________

_____________________________________________________________________________________________

8.Names of Mortgages/Lienholders :________________________________________________________________________

________________________________________________________________________________________________________

Other than the insureds and any and all loss payees indicated in the policy of insurance, there are no other persons who have an interest or lien in the property involved, except for above named mortgage or lienholders, except:

________________________________________________________________________________________________________

9.Other policies of insurance which may cover the loss: ________________________________________________________

10.Describe changes in title to the property during the policy term or changes in occupancy of property during policy

term:___________________________________________________________________________________________________

11.Total Insurance: The Total amount of insurance upon the property described by this policy was, at the time of loss $__________________________, as more particularly specified in the policy declarations sheet.

12.The Actual Cash Value of said property at the time of loss was: $_______________________________________________

13.Loss and Damage: The specifications of damaged buildings, if applicable, are contained in the attachments hereto; The specifications of damaged contents, if applicable, are contained in the attachments hereto; If applicable, ALE or rental loss receipts are attached hereto. The loss and damage is as follows:

Building: |

$________________________ |

|

Other Structure(s) |

$________________________ |

|

Contents |

$________________________ |

|

Adjusted Living Expenses ("ALE") |

$________________________ |

|

The Whole Loss Total: |

$________________________ |

|

Deductible: |

$________________________ |

|

Whole Amount Claimed Minus Deductible |

$________________________ |

|

The loss did not originate by any act, design, or procurement on your part; no property has been concealed, and no attempt to deceive the said company as to the extent of the loss has been made. The undersigned certify that the statements and information contained herein with respect to the loss reported are accurate and truthful to the best of [his/her/their] knowledge and belief.

_________________________________________ |

____________________________________________ |

Signature of Insured |

Signature of Insured |

Print Name:______________________________________ |

Print Name ___________________________________ |

State of Florida, County of ______________

Sworn to and subscribed to before me on this ________ day of ____________________________________ , 20 _______ .

|

Personally known, or |

Notary Public, State of Florida_________________________ |

Produced :_____________________________________ |

Form Data

| Fact Name | Description |

|---|---|

| Legal Warning | The form includes a strict warning under Florida Statute S. 817.234, highlighting that falsifying information is a felony of the third degree. |

| Purpose | Designed to provide a detailed account of loss or damage for a claim under an insurance policy. |

| Governing Laws | The form is governed by several statutes including S. 775.082, S.775.803, and S.775.084, indicating the penalties for fraudulent claims. |

| Required Details | It necessitates comprehensive details such as policy number, date of loss, cause of loss, and declaration of the total insurance and actual cash value of the property. |

| Verification and Signature | Insured individuals must sign and print their names, certifying the accuracy of the provided information under penalty of perjury. |

Instructions on Utilizing Florida Proof Loss

After experiencing damage or loss, accurately completing the Florida Proof of Loss form is essential for filing a claim with your insurance company. This document requires detailed information about the policy, loss, and damages to support your claim. It is crucial to approach this task with attention to detail and truthfulness to ensure the processing of your claim goes smoothly. Misrepresentation can lead to serious legal consequences. Here, we outline the steps to fill out the form effectively.

- Gather all necessary documentation related to your insurance policy, the damages, and any estimates or receipts for repairs.

- Start by indicating the amount of policy at the time of loss and the policy number.

- Fill in the dates the policy was issued and expires, including the agent's information.

- Write the Name of Insurance Company.

- Enter your Claim Number.

- List the Named Insured(s), ensuring to include all parties the policy covers.

- Specify the Date of Loss and Time of Loss, indicating a.m. or p.m.

- Describe the Cause of Loss in detail.

- Explain your Title and Interest in the property at the time of loss.

- List any Names of Mortgages/Lienholders.

- Disclose any Other policies of insurance that may cover the loss.

- Describe any changes in title or occupancy of the property during the policy term.

- Enter the Total Insurance amount upon the property described by this policy at the time of loss.

- State the Actual Cash Value of the property at the time of loss.

- Detail the Loss and Damage. Include specifications of damaged buildings, contents, ALE or rental loss receipts, the total loss, deductible, and the whole amount claimed minus the deductible.

- Sign and print your name, affirming that the information provided is accurate and truthful to the best of your knowledge and belief. If there’s more than one insured, each must sign.

- Swearing and notarization: Take the completed form to a notary public, where you will swear to and sign the form before them.

The notary will fill out the section indicating that the form was sworn to and subscribed before them, including the date and their seal.

Once the form is filled out and notarized, submit it according to your insurance company's instructions, typically via mail or electronically. Keep copies of the completed form and all related documents for your records. Following these detailed steps ensures that your claim is presented clearly and accurately, aiding in the timely assessment and processing by your insurance provider.

Obtain Answers on Florida Proof Loss

FAQ: Florida Proof of Loss Form

What is a Florida Proof of Loss form?

A Florida Proof of Loss form is a formal statement provided to an insurance company after a loss. It documents the details of the loss and requests reimbursement based on the insurance policy's coverage. The form includes information such as the amount of loss, policy number, date and cause of the loss, and a detailed account of the damage.

When do I need to submit a Proof of Loss form?

Typically, you should submit a Proof of Loss form as soon as possible after experiencing a loss. Insurance policies often have specific time frames within which you need to file this form, commonly within 60 days of the loss. However, you should check your individual policy for exact requirements.

What information do I need to provide in the form?

The form requires various details, including the insurance company name, policy number, insured individual(s) names, date and time of the loss, cause of loss, details on the property interest and liens, any other insurance policies that might cover the loss, changes in property title or occupancy, total insurance, actual cash value of the property at the time of loss, and a breakdown of the loss and damage.

Is it important to be accurate and truthful in the Proof of Loss form?

Yes, it's critical to be accurate and truthful. Falsifying information or attempting to deceive the insurance company is a serious offense and is considered a felony in the state of Florida. It's punishable by law and can result in severe penalties.

Can I amend the Proof of Loss form after submission if I find more damage?

Yes, if you discover additional damage after submitting your initial Proof of Loss, you should notify your insurance company as soon as possible. They may allow you to amend your claim to include the new information.

What happens after I submit the form?

After submitting the form, the insurance company will review it as part of the claim process. They may request additional information, conduct an investigation, or proceed with claim adjustment based on the information provided. Cooperation with your insurer during this process is important for a timely resolution.

Where can I find help filling out the Florida Proof of Loss form?

If you're uncertain about how to proceed or need assistance, consider consulting with a legal advisor or a professional experienced in handling insurance claims. They can provide guidance and help ensure that your form is filled out correctly and that you're taking the right steps following a loss.

Common mistakes

Filling out the Florida Proof of Loss form accurately is crucial for insurance claims related to property damage. However, people often make mistakes during this process. Common errors include:

- Inaccurately stating the amount of policy at the time of loss, which can impact the claim adversely.

- Not providing the correct policy number, leading to delays in processing the claim.

- Failing to list all named insured(s) correctly, which can cause discrepancies in the claim.

- Incorrectly stating the date and time of loss, which is vital for the insurance company's investigation.

- Giving an incomplete or inaccurate cause of loss, affecting the assessment of the claim.

- Not correctly detailing the title and interest in the property at the time of loss, leading to complications in understanding ownership and rights over the property.

- Omitting or inaccurately listing names of mortgages/lienholders, which can affect the settlement of claims.

- Forgetting to mention other policies of insurance which may cover the loss, potentially resulting in a missed opportunity for additional coverage.

- Failing to describe changes in title or occupancy during the policy term, which may be relevant to the claim.

- Incorrectly calculating or not accurately reporting the total insurance, the actual cash value of the property at the time of loss, or the total loss and damage. This includes the whole loss total, deductible, or the whole amount claimed minus deductible.

Additionally, there are common missteps related to documentation and verification:

- Not attaching necessary documentation such as specifications of damaged buildings or contents, and ALE or rental loss receipts where applicable. This oversight can lead to underpayments or denials.

- Forgetting to sign the form or having inconsistencies in the signature with prior documents submitted to the insurance company.

- Not properly completing the notarization section, either by omitting required information or not having it witnessed by a Notary Public as required.

- Attempting to conceal information or intentionally providing false information, which is not only unethical but also a criminal offense that can lead to felony charges.

- Failing to print names clearly, which could raise questions about the identity of the insured and potentially delay the claim.

It's imperative for individuals to review their forms meticulously and ensure all information is complete, accurate, and truthful to facilitate a smooth claims process.

Documents used along the form

When handling insurance claims, especially in the context of the Florida Proof of Loss form, it's important for policyholders to be aware of other forms and documents that often play a crucial role in supporting their claim. Understanding these documents not only assists in accurately completing your claim but also ensures compliance with the requirements set forth by insurance providers for a seamless claim process.

- Insurance Policy Declaration Page: This is essentially the summary of your insurance policy. It outlines your coverage, including the maximum amounts the insurance company will pay for specific losses under the terms of your policy. It’s vital for cross-referencing the amounts claimed on the Proof of Loss form.

- Photographic or Video Evidence of Damage: Visual documentation of the damage can significantly support your claim. These images or videos should be detailed and cover all areas of damage to provide clear evidence that supports the descriptions and valuations of loss stated in the Proof of Loss form.

- Repair Estimates: Obtained from licensed contractors or repair companies, these estimates outline the expected costs of repairing the damaged property. They should be detailed, including the costs of materials and labor, to justify the amounts listed on the Proof of Loss form.

- Inventory of Damaged or Lost Property: A comprehensive list detailing each item damaged or lost, including their descriptions, ages, and the cost to replace or repair. This document complements the Proof of Loss by providing itemized evidence of the claimed damages or losses.

- Receipts for Additional Living Expenses (ALE): If your claim involves costs incurred for living expenses due to being displaced from your home, keeping and submitting all related receipts is crucial. These might include hotel stays, meals, and other necessary expenses resulting from the loss.

- Correspondence with the Insurance Company: Keeping a detailed record of all communications with your insurance provider is important, especially letters, emails, or notes from phone calls. This documentation can provide a timeline and proof of the claim process, including any instructions or requests from the insurance company.

Together, these documents work in conjunction with the Florida Proof of Loss form to provide a comprehensive view of the claim, from the initial loss through to the detailed estimates for repair or replacement. They are essential for substantiating your claim, leading to a fair evaluation and timely settlement. By gathering and organizing these documents early in the claim process, policyholders can navigate their claims more efficiently and with greater peace of mind.

Similar forms

Insurance Claim Form: Similar to the Florida Proof of Loss form, an insurance claim form is used by policyholders to file a claim for compensation due to loss or damage. Both documents require detailed information about the policy, the claimant, and the nature of the loss or damage.

Property Damage Report: This report is filled out when there is property damage, detailing the extent and cause of the damage. Like the Proof of Loss form, it includes descriptions of the damage, albeit typically for reporting purposes rather than direct insurance claim filing.

Auto Accident Claim Form: Similarly, this form is used after a vehicle accident to detail the incident to an insurance company. Both forms require information about the incident, including date, time, and cause, as well as the resulting damage.

Health Insurance Claim Form: Used to request reimbursement or direct payment for medical services under a health insurance policy, it gathers specific details about the treatment, similar to how the Proof of Loss form collects data relevant to the property loss.

Sworn Affidavit for Loss: This legal document allows an individual to make a formal statement regarding the loss of an item, similar to the Proof of Loss, which is a sworn statement detailing the loss claimed under an insurance policy.

Police Report: Filed following incidents like theft, accidents, or vandalism, a police report provides an official account of events, paralleling the Proof of Loss form's function to officially document incidents for insurance purposes.

Fire Incident Report: After a fire, this report details the incident, including potential causes of the fire and the extent of the damage, akin to the information required in the Florida Proof of Loss form for insurance claims related to fire damage.

Marine Cargo Claim Form: For loss or damage to goods during shipment, this form details the incident, paralleling the Proof of Loss form’s role in documenting the specifics of an insured loss, but in the context of maritime shipping.

Homeowner’s Warranty Claim: Used to detail issues to be addressed under a home warranty policy, it requires information about the claimed defect or failure, likened to the Proof of Loss form’s documentation of insured property's damages.

Travel Insurance Claim Form: Similar to the Proof of Loss, travelers use this form to document and claim unexpected expenses or losses incurred during travel, requiring detailed documentation of the event and resulting losses.

Dos and Don'ts

Filling out the Florida Proof of Loss form is a critical step in the claims process after experiencing loss or damage to your property. As it is a legal document, it is essential to approach this task with care and diligence. Below are guidelines to help ensure the form is completed correctly and effectively.

Things you should do:

- Be thorough and accurate: Ensure that every detail you provide on the form about your loss is complete and accurate. Double-check the dates, amounts, and descriptions against your records and the policy details.

- Gather documentation: Collect all relevant documents, such as photographs, receipts, and records that support your claim. Having these on hand will not only make completing the form easier but will also strengthen your claim.

- Understand your policy: Before filling out the form, review your insurance policy carefully. Understanding your coverage and the terms of your policy will guide you in accurately detailing your loss and ensuring that your claim is valid.

- Seek clarification if needed: If any section of the form is unclear, don't hesitate to contact your insurance agent or a representative for clarification. Misunderstandings can lead to mistakes that might complicate or delay your claim.

Things you shouldn't do:

- Avoid guessing: If you're unsure about specific details, such as the exact date of loss or the cost of an item, look it up. Guessing can lead to inaccuracies that might raise questions about your claim.

- Don’t leave blanks: If a question on the form does not apply to your situation, write “N/A” (not applicable) instead of leaving the space blank. This demonstrates that you didn’t overlook the question but it indeed does not apply to your case.

- Resist exaggerating your claim: It’s crucial to be honest about the extent of the damage and not to inflate the value of your lost or damaged property. Remember, claims are investigated, and discrepancies can lead to a denial of your claim or legal consequences.

- Do not delay: There are usually time limits for submitting a proof of loss form. Failing to submit the form within the designated timeframe can result in the denial of your claim. Start the process as soon as possible to avoid any complications.

By following these dos and don’ts, you'll help ensure that your claim is processed smoothly and efficiently. Remember, the goal of the Florida Proof of Loss form is to provide a clear and truthful account of your loss to your insurer. Accuracy, honesty, and promptness are your best allies in this process.

Misconceptions

When filing a claim with the Florida Proof of Loss form, people often encounter misconceptions that can complicate the process. Understanding these can help in managing expectations and ensuring the claim process goes smoothly.

Only for Natural Disasters: A common misconception is that the Florida Proof of Loss form is only required for natural disaster claims. While it's frequently used in such circumstances, it's actually necessary for a variety of claim types, whenever an insurer requests a detailed statement of the loss experienced. This includes theft, fire, water damage, and more.

Immediate Submission is Mandatory: People often believe they must submit the Proof of Loss form immediately following a loss. While prompt action is important, insurers usually provide a specific timeframe in which to submit this form after the loss occurs. It is critical to review your policy or consult with your insurer for the exact deadline to avoid jeopardizing your claim.

Submission Finalizes the Claim: Another common misconception is that once the Proof of Loss form is submitted, the claim is finalized and can no longer be adjusted. In reality, the submission is a step in the claims process. Adjustments can be made later if additional damage is discovered or if initial estimates need to be revised.

No Legal Consequence for Mistakes: It's mistakenly believed that inaccuracies or mistakes in the Proof of Loss form will simply be corrected by the insurance company with no consequence to the insured. However, the form contains a warning that knowingly providing false, incomplete, or misleading information is a felony offense. Accuracy is paramount, and it’s advisable to seek professional help if necessary to ensure the information is correct.

Approaching the Florida Proof of Loss form with a clear understanding of these aspects helps in fulfilling the legal requirements accurately and aids in the swift processing of your insurance claim.

Key takeaways

When dealing with property damage in Florida, the proper completion and understanding of the Florida Proof of Loss form is crucial. Here are key takeaways to ensure accuracy and compliance:

- Understand the Legal Implications: Filling out the form with any false, incomplete, or misleading information about the claim can lead to felony charges. It's vital to approach this document with honesty and thoroughness.

- Complete Every Section Carefully: Each detail requested, from the amount of the policy at the time of loss to descriptions of damaged contents and buildings, must be provided accurately. Missing or inaccurate information can complicate or delay the claim process.

- Report the Cause of Loss Clearly: Clearly stating the cause and origin of the loss is essential. This information helps the insurance company determine the nature of the event and validates the claim.

- Disclose All Interest and Liens: It's important to list all parties with an interest in the property, such as mortgagees or lienholders. Failure to do so can result in legal complications and affect the settlement of the claim.

- Identify Other Insurance Policies: Revealing any other policies that might cover the loss prevents the risk of fraud and assists in coordinating benefits, if applicable.

- Detail Changes in Property Title or Occupancy: Notifying the insurer about any changes in the title or occupancy of the property during the policy term is crucial since these factors can affect coverage.

- Attach Necessary Documentation: The form requires attachments for detailed specifications of damaged buildings or contents and any applicable Adjusted Living Expenses (ALE) or rental loss receipts. Ensuring these attachments are included and accurate supports the claim.

- Ensure Accuracy in the Claim Amount: The calculation of the total loss, minus the deductible to arrive at the whole amount claimed, must be precise. This figure impacts the resolution and satisfaction of the claim.

In summary, the Florida Proof of Loss form is a key component in the claims process following property damage. Its accurate and honest completion is not only a matter of legal requirement but also a significant step toward a fair and efficient resolution of the claim. Policyholders should approach this task with diligence, understanding its importance in the broader context of insurance recovery.

Popular PDF Forms

Az Repo Affidavit - Addresses legal and procedural requirements for lienholders aiming to recover vehicles from defaulting borrowers in Arizona.

Benefeds Open Season - Incomplete forms or those received outside the three-month submission window will not be considered.

Community Service Hours Log - Enables educators and program administrators to verify and acknowledge students' contributions to community betterment efforts.