Blank For Goodwill Donated Goods PDF Template

The For Goodwill Donated Goods form serves as a pivotal bridge between donors and the commendable mission that Goodwill drives forward. It's not merely a receipt but a testimonial of an individual's contribution toward a sustainable future and social empowerment. As donors list their items, from bags of clothing to intricate computer items, they partake in a cycle of giving that extends far beyond the tangible. This simple yet significant document underscores the essence of donation - supporting Goodwill's endeavor to empower individuals facing disadvantages and diversities through tailored programs and services aimed at securing employment. The form details necessary information including the donor's name and contact, with an emphasis on the tax-deductibility of these donations, clearly noting that no goods or services were exchanged. This reminder serves a dual purpose: reinforcing the altruistic nature of the donation while ensuring donors are aware of the benefits come tax season. It is through this transparent and structured approach that Goodwill not only advocates for environmental sustainability by keeping items out of landfills but also champions economic sustainability by channeling 90 cents of every dollar back into programs and services for local job seekers. This comprehensive strategy, detailed within the document, illustrates a model where donations are not the end but the beginning of a cycle of opportunity, underlined by the simple act of filling out the For Goodwill Donated Goods form.

Preview - For Goodwill Donated Goods Form

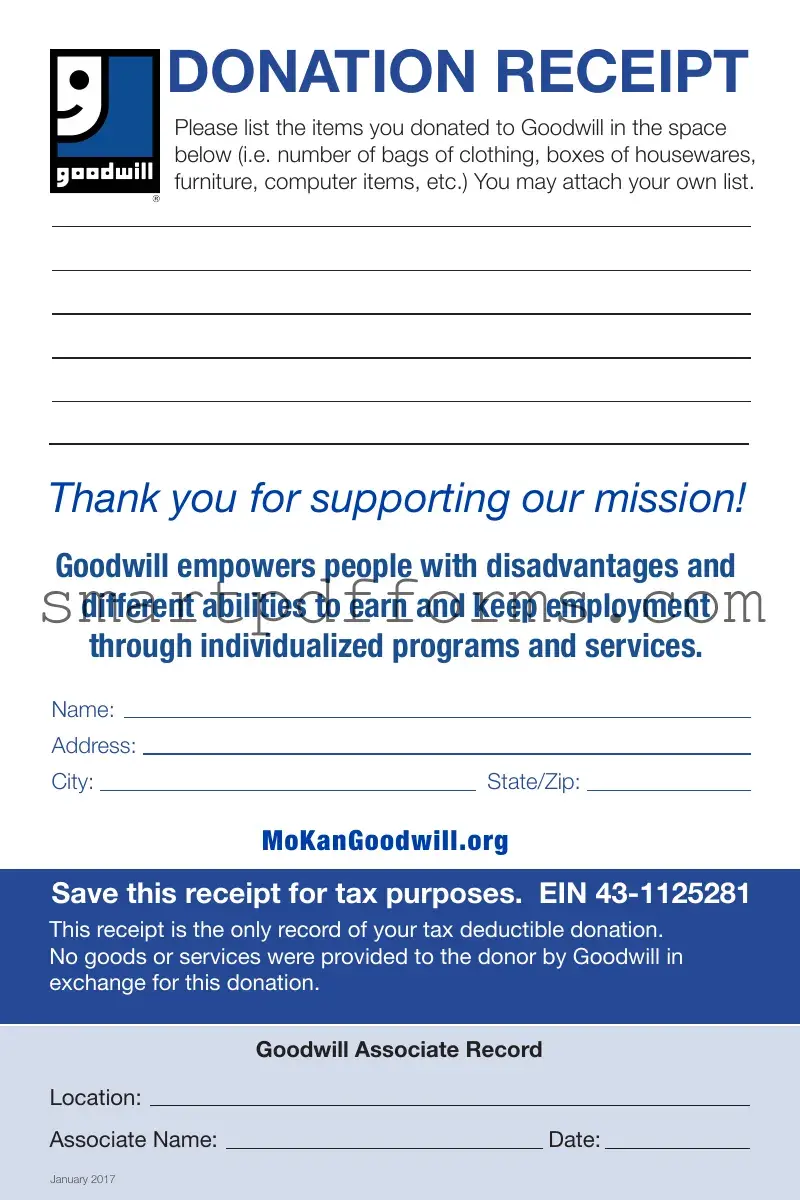

DONATION RECEIPT

Please list the items you donated to Goodwill in the space below (i.e. number of bags of clothing, boxes of housewares, furniture, computer items, etc.) You may attach your own list.

Thank you for supporting our mission!

Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services.

Name:

Address:

City:State/Zip:

MoKanGoodwill.org

Save this receipt for tax purposes. EIN

This receipt is the only record of your tax deductible donation. No goods or services were provided to the donor by Goodwill in exchange for this donation.

|

Goodwill Associate Record |

Location: |

|

Associate Name: |

Date: |

January 2017

Goodwill spends 90¢ of every dollar on programs & services for local job seekers.

When you donate to Goodwill, your stuff gets a second chance in another person’s life instead of laying in a landfill.

High quality & unique items sell in our thrift stores & online at mokangoodwill.org/shoponline.

Unsold items get one last chance at the Goodwill Outlet in Kansas City. Here, amazing deals are purchased by the pound.

What remains is recycled or salvaged. This gets the most value out of every donation – and keeps items out of landfills.

Your donation funds programs and services for local job seekers to get the skills and confidence they need to find competitive employment.

Employment is more than a paycheck. It’s a resounding victory for the individual, for their family and for the community. When jobs thrive,

communities thrive.

MoKanGoodwill.org

Form Data

| Fact Name | Description |

|---|---|

| Donation Purpose | Supports Goodwill's mission to empower individuals with disadvantages and different abilities through employment programs and services. |

| Donation Receipt Requirement | Donors are urged to detail their donated items on the receipt or attach a list for tax purposes. |

| Organization's EIN | The Tax Identification Number for Goodwill is 43-1125281, necessary for tax deduction purposes. |

| No Exchange Policy | No goods or services were provided to the donor by Goodwill in exchange for the donation. |

| Funds Use | 90 cents of every dollar donated to Goodwill are allocated towards programs and services for local job seekers. |

| Environmental Impact | Donated items are resold, recycled, or salvaged, minimizing waste and preventing landfill accumulation. |

| Second Chance for Goods | Donations get a second life by either retailing in thrift stores, online, or being sold by weight at the Goodwill Outlet. |

| Community Benefit | Donations support local job seekers in gaining employment, fostering community prosperity. |

| Governing Law | Missouri and Kansas laws govern the receipt and processing of donated goods to MoKanGoodwill, as indicated by the organization's website. |

Instructions on Utilizing For Goodwill Donated Goods

Filling out the For Goodwill Donated Goods form is a straightforward process that helps track your contributions to a cause aimed at empowering individuals and supporting employment through donation-driven programs. This task not only provides you with a record for tax purposes but also partakes in a larger mission of environmental sustainability and community enhancement. Below, find the steps detailed to complete this form, ensuring that your generous donations are documented and recognized appropriately.

- Start by listing the items you donated in the space provided. Specify the number of bags or boxes, types of items (such as clothing, housewares, furniture, computer items), and any other relevant details. If the space is insufficient, attach an additional list.

- Fill in your Name in the designated area, ensuring it matches the name used for tax records to avoid any discrepancies.

- Enter your Address, including apartment or suite numbers if applicable. This information is crucial for keeping your donation records accurate.

- Write down the City, followed by the State and Zip code in the designated fields. Accurate entry here is vital for regional data analysis and for sending you acknowledgment letters or future donation solicitations.

- Visit MoKanGoodwill.org if you need additional information about the donation process, to explore Goodwill services, or to shop online. This step, while not part of filling out the form, is a valuable resource for understanding the impact of your donation.

- Save the receipt provided by Goodwill, as it serves as the sole record of your tax-deductible donation. The receipt includes Goodwill's EIN (43-1125281), which you will need for tax filing purposes.

- Be sure to note the Associate Record section completed by a Goodwill employee, which will include the location, associate name, and the date of the donation. This section is crucial for internal tracking and verification purposes.

After completing the form, you've not only contributed tangibly to a meaningful cause but have also taken steps to ensure your contributions are recognized for tax purposes. Your donations support vital programs that drive employment, uplift individuals, and foster stronger communities, all while promoting environmental sustainability by giving items a second life and diverting them from landfills. Keep the saved receipt in a safe place for your tax records, and consider staying engaged with Goodwill's mission through volunteering, further donations, or simply spreading the word.

Obtain Answers on For Goodwill Donated Goods

Frequently Asked Questions About the For Goodwill Donated Goods Form

What should I list on the donation receipt?

You should list the items you have donated, such as the number of bags of clothing, boxes of housewares, pieces of furniture, computer items, etc. If your list is long, you may attach your own detailed list to the receipt.

Why should I save this receipt?

Saving this receipt is important for tax purposes. The receipt serves as the sole record of your tax-deductible donation. The Internal Revenue Service (IRS) may require this document to support your donation claim when you file your taxes.

Were any goods or services provided to me in return for my donation?

No, Goodwill did not provide any goods or services to you in exchange for your donation. The statement on the receipt clarifies that your contribution was purely charitable.

What happens to the items I donate to Goodwill?

Your donated items get a second chance at another person's life. High-quality and unique items are sold in Goodwill thrift stores and online. Unsold items are then moved to the Goodwill Outlet in Kansas City for one last chance at sale, where they are sold by the pound. Whatever remains is recycled or salvaged, ensuring the most value is extracted from every donation and keeping items out of landfills.

How does my donation help local job seekers?

Your donations fund programs and services designed to assist local job seekers in acquiring the skills and confidence needed to secure competitive employment. This support leads to a resounding victory not just for the individual, but also for their family and the community at large. Contributions like yours help keep communities thriving by fostering employment opportunities.

How much of my donation goes to Goodwill programs and services?

Goodwill allocates 90 cents of every dollar received from donated goods to support its programs and services focused on helping local job seekers.

What is the tax identification number for Goodwill?

The tax identification number (EIN) for Goodwill is 43-1125281. This number is needed when itemizing your charitable contributions on your tax return.

Common mistakes

Filling out a donation form, like the one for Goodwill, might seem straightforward, but it's easy to make mistakes that can affect the benefit you get from your generosity and, in some cases, how much help your donation provides to others. Here are seven common mistakes people make when filling out the Goodwill Donated Goods form:

Not listing items in detail: Simply writing "bags of clothes" lacks the specificity needed for Goodwill to properly assess the value of your donation. Specific details help Goodwill, and the IRS should you be audited.

Forgetting to specify quantities: The number of items or boxes donated is essential for record-keeping and tax deduction purposes. It provides a clearer picture of the donation's scope.

Omitting the condition of donated goods: The condition of the items—whether new, gently used, or something else—can significantly impact their value and how they're processed by Goodwill.

Not attaching a detailed list if needed: For larger donations, attaching your detailed list can ensure accuracy and might be useful for tax records.

Misplacing the receipt: This receipt is the only proof of your tax-deductible donation. Losing it means you might miss out on a potential deduction come tax time.

Overlooking the associate details: Not ensuring the Goodwill associate fills in their section might lead to questions about the donation’s authenticity.

Ignoring the environmental and social impact: Understanding how Goodwill uses donations can motivate more thoughtful and generous giving. Not realizing the broader impact of your donation might mean you undervalue what you’re giving.

Donating to Goodwill is more than just decluttering; it's an opportunity to help others and make a positive environmental impact. Being mindful of these common mistakes ensures your kindness goes as far as possible.

Documents used along the form

When individuals generously donate goods to organizations like Goodwill, it's not only an act of kindness but also an opportunity to support local communities and reduce waste. Alongside the For Goodwill Donated Goods form, there are several other forms and documents that donors might consider completing or retaining to ensure the process is smooth, compliant with tax regulations, and effectively supports their intentions of contributing to the charity. These documents serve various purposes, from detailing the donated items to understanding the potential tax deductions.

- Itemized Donation List: This document supplements the donation receipt by providing a detailed account of the items donated. It might include descriptions, quantities, and estimated value of each item. This ensures transparency and helps in keeping a record for personal tracking and tax purposes.

- IRS Form 8283: For non-cash donations exceeding $500 in value, this form is necessary. It’s used to report such donations on your tax returns. The form requires information on the type and value of the donated goods, and how the valuation was determined, among other details.

- Appraisal Documentation: In cases where donated items are of significant value, an appraisal may be required to substantiate the claimed value for tax purposes. This document should be prepared by a qualified appraiser. It becomes crucial for high-value donations, especially if they exceed $5,000.

- Charitable Contribution Deduction Records: Maintaining a personal record of any donations made throughout the year is beneficial. These records might include a list of donated items, their condition at the time of donation, the recipient charity's acknowledgement letters, and copies of filled forms, such as the For Goodwill Donated Goods form and IRS Form 8283.

Having these documents in order effectively supports the donation process, making it easier for donors to keep track of their contributions and benefit from potential tax deductions. It's essential for donors to understand not just the impact of their generosity but also the practical steps they can take to ensure their donations fulfill their intended purpose. Organizations like Goodwill provide valuable services to the community, powered by the goodwill of their donors, and supported by a clear and organized documentation process.

Similar forms

Charitable Contribution Deduction Receipt: Similar to the For Goodwill Donated Goods form, this receipt is issued by non-profit organizations to acknowledge the receipt of a charitable donation. Both documents serve to provide the donor with proof of their contribution for tax deduction purposes, listing the donated items or monetary value and indicating that no goods or services were provided in exchange for the donation.

Thrift Store Donation Receipt: This document, issued by thrift stores when individuals donate items, closely mirrors the Goodwill donation form. It typically includes a description of the donated goods, the date of donation, and sometimes the estimated value of the items. Both forms play a crucial role in managing and recording inventory received through donations, supporting the stores' mission.

Non-profit Fundraising Event Donation Receipt: Organizations that hold fundraising events issue this type of receipt to donors who contribute items for auctions or as gifts. Like the For Goodwill Donated Goods form, it acknowledges the donation, listing the items or services donated, and confirms that the contribution will support the organization's mission. It also serves as documentation for tax purposes.

Tax-Deductible Donation Record: Similar in purpose to the For Goodwill Donated Goods form, this document is designed to keep a record of any donation made to a non-profit that can be deducted from the donor's income tax. It generally includes the donor’s name, a description of the donation, and states the non-profit's tax-exemption status, serving as a critical record for both parties during tax season.

Corporate Gift Receipt: When a business donates to a non-profit, the organization issues a receipt acknowledging the contribution, which can include goods, services, or monetary support. This receipt is akin to the For Goodwill Donated Goods form, noting the contribution's specifics and stating that no goods or services were provided in return, which is vital for the corporate donor’s tax records.

Volunteer Mileage and Expenses Log: While not a receipt for physical goods, this document is similar to the For Goodwill Donated Goods form in that it tracks contributions to non-profit organizations—this time, in the form of logged miles or expenses incurred by volunteers. It supports tax deductions much like the goods donation receipt, providing essential documentation of the volunteer’s contribution to the organization's mission.

Dos and Don'ts

When you fill out the For Goodwill Donated Goods form, making sure you're doing it correctly can help both you and Goodwill maximize the benefit from your donation. Here are some dos and don’ts to keep in mind.

Do:

- Be precise: Clearly describe each item you're donating. For example, specify "3 bags of adult clothing" or "1 box of assorted kitchenware."

- Attach a list if you have many items to donate. A detailed, itemized list can make it easier for both you and Goodwill.

- Keep your receipt: This receipt is your only record of the donation and will be necessary for tax deduction purposes.

- Understand the impact: Remember, your donation supports Goodwill’s mission to empower individuals through employment. This makes your contribution significant beyond the tax deduction.

- Check the value: Although the form doesn't directly require this, researching and noting the fair market value of your donations can be helpful when you file your taxes.

Don't:

- Estimate your donation too broadly: Ambiguous descriptions like "various items" or "miscellaneous goods" won't give a clear account of your contribution.

- Forget to list quantities: Always mention how many of each item or type of bag/box you are donating.

- Dismiss the form's importance: This form serves as a legal document for your charitable contribution. Treat it with care.

- Expect a valuation from Goodwill: The responsibility to estimate the value of your donation rests with you, not with Goodwill.

- Lose track of your donation: Once you donate, especially large or valuable items, it's wise to take photographs or keep a personal record in addition to the receipt.

Misconceptions

There are several misconceptions surrounding the "For Goodwill Donated Goods" form that may confuse or mislead donors. It's essential to clarify these misunderstandings to ensure that the process of donating goods is as smooth and beneficial as possible for both the donor and the recipient organization.

- Donations are not tax-deductible: A common misconception is that goods donated to Goodwill are not eligible for a tax deduction. In reality, Goodwill provides a donation receipt that can be used to claim a deduction on your tax return, provided you itemize your deductions.

- Need to estimate the value of donated items: Some donors believe they must provide a monetary value for the items they donate on the form. However, it's the donor's responsibility to estimate the fair market value of their donated goods for tax purposes; Goodwill only requires a list of items donated.

- Goods or services must be provided in exchange for a donation: Another misconception is that Goodwill provides goods or services in return for donations. The form clearly states that no goods or services were given in exchange for the donations, emphasizing that your donation is entirely charitable.

- Only certain items can be donated: People often think that only clothes or furniture can be donated. Goodwill accepts a variety of items, including computer items and housewares, as long as they are in saleable condition.

- All donated items are sold in stores: While many donated items are sold in Goodwill thrift stores or online, not all items go directly to the sales floor. Some unsold items may be sent to the Goodwill Outlet, recycled, or salvaged, ensuring that every donation benefits the organization in some way.

- Goodwill profits primarily fund administrative costs: A significant misunderstanding is that the proceeds from donated goods primarily fund organizational overhead. In fact, Goodwill emphasizes that 90 cents of every dollar spent supports local job seekers through programs and services.

- The form is only for Goodwill’s records: The donation receipt is not just for Goodwill’s administrative purposes; it serves as the donor's record for tax purposes. It is the only proof of donation given and should be saved by the donor.

- Electronic items are not accepted: There is a misconception that electronic items cannot be donated. Goodwill accepts functioning electronic items, including computers, contributing to e-waste reduction and environmental sustainability.

- The form is complicated to fill out: The idea that the donation form is cumbersome and complicated deters some people from donating. The form is straightforward, requiring only basic information about the donor and a list of donated items.

- Donations do not impact the community: Finally, some might think their donations have a minimal impact. The truth is, every donation supports Goodwill's mission to empower individuals facing employment challenges, significantly affecting local communities and the environment.

Understanding these misconceptions can enhance the donation experience, ensuring donors feel confident and informed about the positive impact of their contributions to Goodwill.

Key takeaways

Filling out and using the For Goodwill Donated Goods form is a straightforward process, but it's important to keep a few key takeaways in mind to ensure your donation process is as beneficial as possible for both you and the recipient. Here are the essential points to remember:

- List all the items you've donated clearly. Mention the quantity, such as the number of bags of clothing or boxes of housewares, along with specific items like furniture or computer equipment. This clarity helps Goodwill process and allocate your donation more effectively.

- If you have a detailed list or prefer to keep a more comprehensive record, feel free to attach your own list to the form. This can be helpful for your personal records and for tax purposes.

- Ensure to fill out your personal details accurately, including your name, address, and especially your email, if you wish to receive electronic updates or acknowledgments from Goodwill.

- Remember to save your receipt. It's your only record of the donation for tax deduction purposes. The form indicates that no goods or services were provided in exchange for the donation, an important aspect for tax recording.

- Take a moment to understand the impact of your donation. Goodwill uses 90 cents of every dollar received from selling donated goods to fund programs and services for local job seekers, helping those with disadvantages and differing abilities secure employment.

- Goodwill's commitment to environmental sustainability is notable. Donations that don't sell in the thrift stores or online are given one last chance at the Goodwill Outlet. What can't be sold is recycled or salvaged, emphasizing the importance of donating quality goods.

- Recognize the broader impact of your donation on the community. By contributing, you're helping to fund essential programs that empower individuals to find competitive employment, fostering community growth and sustainability.

- The form also highlights the date and the Goodwill Associate responsible for handling your donation, which can be useful should you have any questions or need to follow up on your donation for any reason.

By keeping these key considerations in mind when filling out the For Goodwill Donated Goods form, you're not only making a donation but also supporting a larger mission of empowerment and environmental sustainability. It's a meaningful way to give your items a second life while contributing to the well-being of your community.

Popular PDF Forms

Ok Tax Commission Forms - Accurate completion of the form supports state efforts to maintain a fair and balanced taxation system for all entities operating within Oklahoma.

City of Plantation Building Department Forms - The application includes an oath section for notary public confirmation, ensuring authenticity of the signatures and information provided.

Total Value Vs Edward Jones Value - Filling out the Edward Jones Account form is a step toward ensuring that your retirement savings are managed according to your wishes.