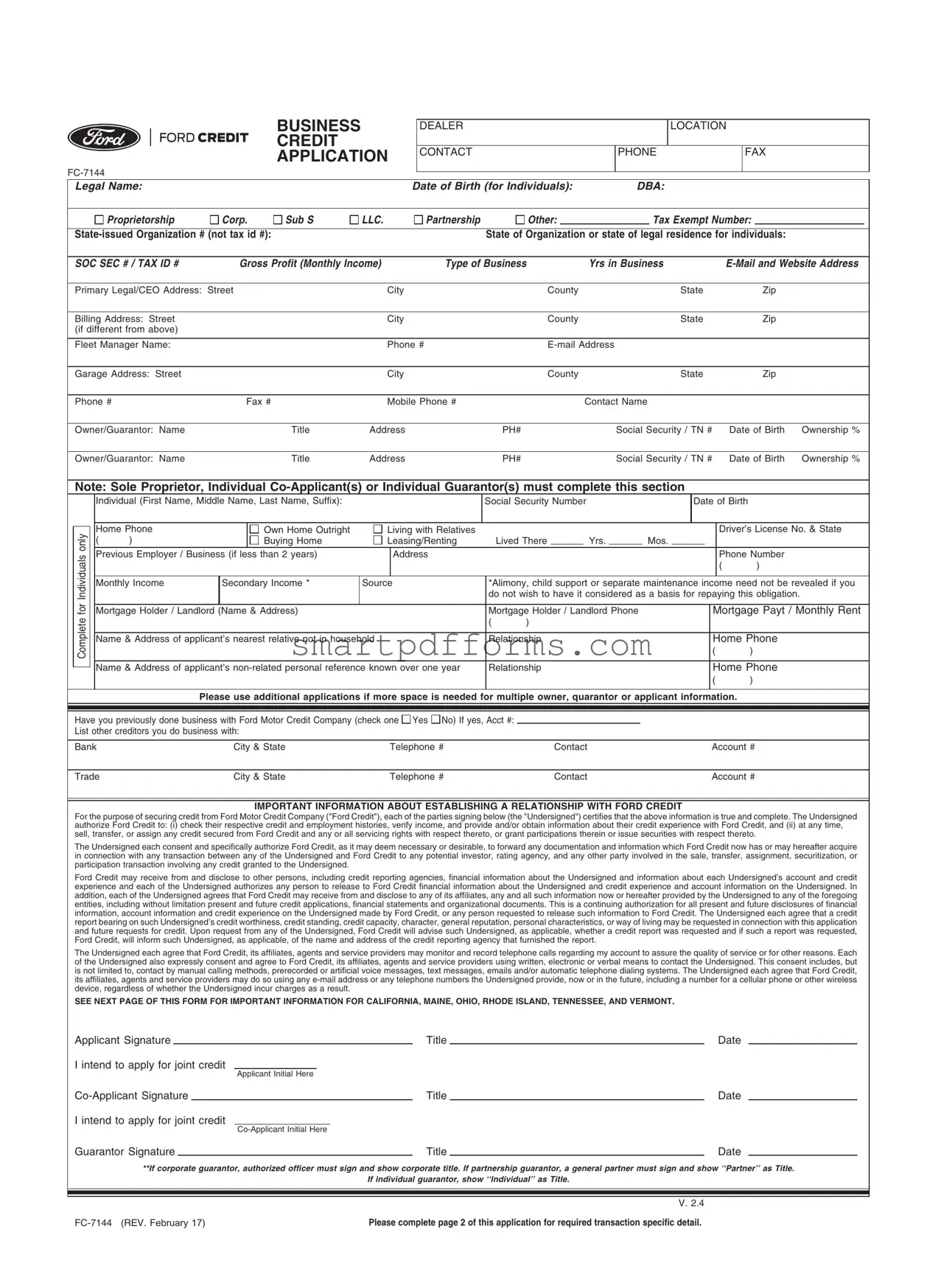

Blank Ford Business Credit Application PDF Template

In the realm of automotive and commercial financing, the Ford Business Credit Application form plays a crucial role by setting the groundwork for businesses to access credit for vehicle purchases through Ford Motor Credit Company. This detailed form, designated as FC-7144, encompasses several key sections aimed at gathering comprehensive information about the applicant business or individual. It starts with basic identification details such as legal name, the structure of the organization (whether it's a Proprietorship, Corporation, LLC, etc.), and essential tax information. Crucial financial data including monthly gross profit and type of business alongside operational duration are solicited to evaluate the creditworthiness of the business. Furthermore, it delves into the specifics about primary and billing addresses, contact details for the fleet manager, and garage locations, ensuring all pertinent logistical channels are covered. Identifying information about owners or guarantors, alongside their stakes in the business, personal details, and financial information, are mandated for a thorough credit risk assessment. The form also seeks information regarding previous engagements with Ford Credit and discloses authorization for Ford Credit to perform comprehensive credit checks and share information with relevant stakeholders. Moreover, detailed requirements concerning vehicle specifics, trade details, and insurance stipulations are listed to tailor the agreement to the prospective borrower's needs. The nuances of the application process, including consents related to credit checks and the use of provided information, are elucidated with an emphasis on compliance with state-specific disclosures, underscoring the importance of transparency and legal adherence in the credit application process.

Preview - Ford Business Credit Application Form

BUSINESS

CREDIT

APPLICATION

DEALER

CONTACT

LOCATION

PHONE |

FAX |

|

|

|

Legal Name: |

|

|

|

|

|

Date of Birth (for Individuals): |

|

DBA: |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Proprietorship |

|

Corp. |

Sub S |

LLC. |

Partnership |

|

|

|

Other: |

|

|

|

|

|

|

Tax Exempt Number: |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Organization or state of legal residence for individuals: |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

SOC SEC # / TAX ID # |

|

Gross Profit (Monthly Income) |

Type of Business |

Yrs in Business |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Primary Legal/CEO Address: Street |

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Billing Address: Street |

|

|

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||

|

(if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Fleet Manager Name: |

|

|

|

Phone # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Garage Address: Street |

|

|

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Phone # |

|

Fax # |

Mobile Phone # |

|

|

|

|

|

|

Contact Name |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Owner/Guarantor: Name |

|

|

Title |

Address |

|

|

|

PH# |

|

Social Security / TN # |

Date of Birth |

Ownership % |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Owner/Guarantor: Name |

|

|

Title |

Address |

|

|

|

PH# |

|

Social Security / TN # |

Date of Birth |

Ownership % |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Note: Sole Proprietor, Individual |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

Individual (First Name, Middle Name, Last Name, Suffix): |

|

|

|

Social Security Number |

|

|

|

|

|

|

|

Date of Birth |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

only |

|

Home Phone |

|

|

Own Home Outright |

Living with Relatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver’s License No. & State |

|||||||

|

|

( |

) |

|

|

Buying Home |

Leasing/Renting |

|

|

Lived There |

|

|

|

Yrs. |

|

|

|

Mos. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Individuals |

|

Previous Employer / Business (if less than 2 years) |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

do not wish to have it considered as a basis for repaying this obligation. |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|||||||

|

|

|

Monthly Income |

|

Secondary Income * |

Source |

|

|

*Alimony, child support or separate maintenance income need not be revealed if you |

|||||||||||||||||||||||

|

for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Mortgage Holder / Landlord (Name & Address) |

|

|

|

|

Mortgage Holder / Landlord Phone |

|

|

|

|

|

Mortgage Payt / Monthly Rent |

|||||||||||||||||||

|

Complete |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name & Address of applicant’s nearest relative not in household |

|

|

Relationship |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Name & Address of applicant’s |

|

Relationship |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

Please use additional applications if more space is needed for multiple owner, quarantor or applicant information. |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you previously done business with Ford Motor Credit Company (check one |

Yes No) If yes, Acct #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

List other creditors you do business with: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Bank |

|

|

City & State |

|

Telephone # |

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

|

Account # |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Trade |

|

|

City & State |

|

Telephone # |

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

|

Account # |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

IMPORTANT INFORMATION ABOUT ESTABLISHING A RELATIONSHIP WITH FORD CREDIT |

|

|

|

|

|||||||||||||||||||||

For the purpose of securing credit from Ford Motor Credit Company ("Ford Credit"), each of the parties signing below (the "Undersigned") certifies that the above information is true and complete. The Undersigned authorize Ford Credit to: (i) check their respective credit and employment histories, verify income, and provide and/or obtain information about their credit experience with Ford Credit, and (ii) at any time, sell, transfer, or assign any credit secured from Ford Credit and any or all servicing rights with respect thereto, or grant participations therein or issue securities with respect thereto.

The Undersigned each consent and specifically authorize Ford Credit, as it may deem necessary or desirable, to forward any documentation and information which Ford Credit now has or may hereafter acquire in connection with any transaction between any of the Undersigned and Ford Credit to any potential investor, rating agency, and any other party involved in the sale, transfer, assignment, securitization, or participation transaction involving any credit granted to the Undersigned.

Ford Credit may receive from and disclose to other persons, including credit reporting agencies, financial information about the Undersigned and information about each Undersigned’s account and credit experience and each of the Undersigned authorizes any person to release to Ford Credit financial information about the Undersigned and credit experience and account information on the Undersigned. In addition, each of the Undersigned agrees that Ford Credit may receive from and disclose to any of its affiliates, any and all such information now or hereafter provided by the Undersigned to any of the foregoing entities, including without limitation present and future credit applications, financial statements and organizational documents. This is a continuing authorization for all present and future disclosures of financial information, account information and credit experience on the Undersigned made by Ford Credit, or any person requested to release such information to Ford Credit. The Undersigned each agree that a credit report bearing on such Undersigned’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or way of living may be requested in connection with this application and future requests for credit. Upon request from any of the Undersigned, Ford Credit will advise such Undersigned, as applicable, whether a credit report was requested and if such a report was requested, Ford Credit, will inform such Undersigned, as applicable, of the name and address of the credit reporting agency that furnished the report.

The Undersigned each agree that Ford Credit, its affiliates, agents and service providers may monitor and record telephone calls regarding my account to assure the quality of service or for other reasons. Each of the Undersigned also expressly consent and agree to Ford Credit, its affiliates, agents and service providers using written, electronic or verbal means to contact the Undersigned. This consent includes, but is not limited to, contact by manual calling methods, prerecorded or artificial voice messages, text messages, emails and/or automatic telephone dialing systems. The Undersigned each agree that Ford Credit, its affiliates, agents and service providers may do so using any

SEE NEXT PAGE OF THIS FORM FOR IMPORTANT INFORMATION FOR CALIFORNIA, MAINE, OHIO, RHODE ISLAND, TENNESSEE, AND VERMONT.

Applicant Signature |

|

|

|

|

|

|

Title |

|

Date |

|

|

I intend to apply for joint credit |

|

|

|

|

|

|

|

|

|||

|

|

|

|

Applicant Initial Here |

|

|

|

||||

|

|

|

|

Title |

|

Date |

|

|

|||

I intend to apply for joint credit |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

Guarantor Signature |

|

|

|

|

Title |

|

Date |

|

|

||

**If corporate guarantor, authorized officer must sign and show corporate title. If partnership guarantor, a general partner must sign and show ‘‘Partner’’ as Title. |

|

||||||||||

|

|

|

|

|

|

If individual guarantor, show ‘‘Individual’’ as Title. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. 2.4 |

|

|

|

|

|

Please complete page 2 of this application for required transaction specific detail. |

|

|

|

||||||

BUSINESS CREDIT APPLICATION - PAGE 2

VEHICLE INFORMATION - (All of the below information is tentative and subject to the terms and conditions of the applicable approval letter. Use additional application for multiple vehicles.)

Qty |

N/U |

Year |

Make / Model |

|

GVW |

|

Serial / VIN # |

|

Total CAP Cost |

|

Residual % |

|

|

Est. Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installed equipment, body uplifts or |

|

|

|

|

Total cost of body uplifts / |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qty |

N/U |

Year |

Make / Model |

|

GVW |

|

Serial / VIN # |

|

Total CAP Cost |

|

Residual % |

|

|

Est. Payment |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installed equipment, body uplifts or |

|

|

|

|

Total cost of body uplifts / |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

Trade Detail: QTY: |

Year |

Make / Model |

|

VIN # |

Dealer Allowance |

Leinholder |

Payoff Amount |

||||||||

Will the vehicles be:

Used in Hazardous Material Transportation: |

Yes |

No |

Used in People Moving Services: |

Yes |

No |

Used in |

Yes |

No |

Part of a |

Yes |

No |

NOTE SPECIFIC PROGRAM OR OTHER DETAIL:

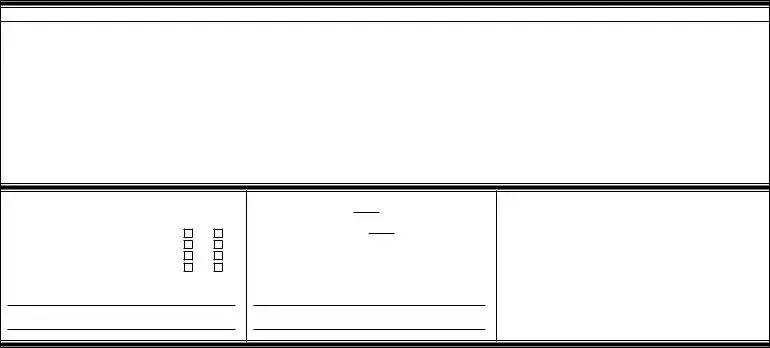

Terms:

#of Months

#of Adv. Pmts.

Circle Skip Months:

J F M A M J J A S O N D

Other:

Cash Price |

$ |

Net Trade |

- |

|

|

Cash Down |

- |

|

|

FET |

+ |

Other Up Front Tax |

+ |

|

|

Tags & Title |

+ |

Cap Cost |

$ |

|

|

Est. Payment |

$ |

California Disclosure

Applicant, if married, may apply for a separate account.

Maine Resident

If your credit application is approved and you finance the purchase of your motor vehicle through Creditor, you will be required to insure the vehicle against loss or damage. Creditor requires collision coverage and comprehensive coverage or fire and theft coverage. In addition, if this application is for a lease, Creditor will also require you to obtain liability insurance.

You have the option to select an agent or broker of your choice, whether or not affiliated with Creditor. Obtaining insurance from a particular agent or broker does not affect credit decisions by Creditor, unless the insurance product selected violates the terms of your contract for the purchase or lease of the motor vehicle.

Ohio Disclosure

The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Rhode Island Resident

A Credit Report may be requested in connection with this application for credit. Vehicle insurance may be obtained from a person of your choice.

Tennessee Resident

You must maintain insurance during the term of the contract. You must give the Creditor evidence of this insurance. The amount and type of insurance must be acceptable to the Creditor. YOU MAY CHOOSE THE PERSON THROUGH WHOM ANY INSURANCE IS OBTAINED.

Vermont Resident

By signing this credit application, Applicant consents to your obtaining a credit report for the purposes of evaluating this application and to obtain subsequent credit reports, in connection with this transaction, for the purpose of reviewing the account, taking collection action on the account or for any other legitimate purpose associated with the account.

Form Data

| Fact Name | Description |

|---|---|

| Application Identification | The document is identified as the Ford Business Credit Application, form number FC-7144. |

| Content of the Form | The form includes sections for dealer information, business and personal information, financial details, vehicle information, and state-specific disclosures. |

| Governing Laws for State-Specific Provisions | The form includes specific disclosures and requirements for California, Maine, Ohio, Rhode Island, Tennessee, and Vermont, indicating differing state laws that govern the credit application process. |

| Privacy and Information Sharing | Applicants agree to allow Ford Credit to obtain and share credit and financial information with affiliates, credit reporting agencies, and other third parties as deemed necessary for the credit application and maintenance processes. |

Instructions on Utilizing Ford Business Credit Application

Filling out a Ford Business Credit Application requires providing detailed information about your business, as well as personal details for any owners or guarantors. This application process is designed to assess your business's creditworthiness for obtaining credit with Ford Motor Credit Company. Follow these steps to complete the application accurately:

- Enter the Dealer Contact Information, including the dealer name, location, phone, and fax.

- Fill in your business's Legal Name and, if applicable, the Date of Birth (for Individuals).

- Specify the type of business entity you operate under (e.g., Proprietorship, Corp, Sub S, LLC, or Partnership) in the provided field.

- Include your business's DBA (Doing Business As) name if different from the legal name.

- Enter the Tax Exempt Number, if applicable, and the State-issued Organization Number (not the tax ID number).

- Specify the State of Organization or state of legal residence (for individuals).

- Provide the Social Security Number or Tax ID Number, along with the Gross Profit (Monthly Income).

- Detail the primary type of business, including the years in business, email, and website address.

- Fill in the Primary Legal/CEO Address and, if applicable, a different Billing Address.

- List the Fleet Manager Name, contact phone number, and email address.

- Provide the Garage Address where the vehicles will be kept, along with contact phone and fax numbers.

- For each Owner/Guarantor, enter their name, title, address, phone number, social security/tax number, date of birth, and ownership percentage.

- If applicable, complete the section for Sole Proprietor, Individual Co-Applicant(s), or Individual Guarantor(s) with detailed personal information and financial details.

- Indicate if you have previously done business with Ford Motor Credit Company and list other creditors you work with.

- Read the important disclosure information carefully and provide signatures from the applicant, co-applicant (if applicable), and guarantor at the bottom of the form.

Upon completing the initial form, proceed to page 2 which requires detailed information about the vehicle(s) in question, including make, model, year, VIN number, cost, and any additional equipment or customization. This section also asks about the intended use of the vehicles, trade details, and specific terms and conditions related to the financing arrangement. Lastly, special state-specific disclosures are provided for applicants based in California, Maine, Ohio, Rhode Island, Tennessee, and Vermont, with instructions relevant to each jurisdiction's regulatory requirements. Ensure all information provided is accurate and complete before submission to facilitate a smooth credit approval process.

Obtain Answers on Ford Business Credit Application

-

What is the purpose of the Ford Business Credit Application form?

The Ford Business Credit Application form is designed to assess and process credit requests for businesses interested in financing vehicles through Ford Motor Credit Company. This form is used to evaluate the creditworthiness of a business based on financial information, business details, and personal information of owners or guarantors.

-

Who needs to fill out the Ford Business Credit Application form?

Any business entity, including a sole proprietorship, corporation, partnership, or LLC, seeking to obtain credit for the purchase or lease of Ford vehicles through Ford Motor Credit Company should complete this form. Additionally, individual co-applicants or guarantors associated with the business financing must provide their personal information on the form.

-

What information do you need to provide in the application?

Applicants are required to provide comprehensive business information, including but not limited to:

- Legal name and type of business entity

- Years in business and gross monthly income

- State of organization or residence

- Contact information for the business and fleet manager

- Ownership details and percentages

- Financial information including bank and trade creditors

- Vehicle information for the financing request

Personal information of individual owners, co-applicants, or guarantors, including social security numbers and date of birth, is also required.

-

How is personal information from applicants used and protected?

Ford Credit uses personal and financial information provided by applicants to check credit and employment histories, verify income, and obtain or provide information about credit experiences with Ford Credit or other entities. Applicant consent is obtained for sharing this information within Ford Credit, its affiliates, and potential investors or rating agencies as part of the credit assessment and approval process. Ford Credit outlines the use of personal information and guarantees confidentiality and security, adhering to legal standards for protecting applicant data.

-

Can I apply for joint credit using this application?

Yes, applicants can apply for joint credit using the Ford Business Credit Application form. Parts of the form specifically ask whether the applicant intends to apply for joint credit and provides space for co-applicant signatures and information. This enables businesses and individuals associated with the business to apply for credit together.

Common mistakes

Completing the Ford Business Credit Application form accurately is crucial for businesses seeking credit. However, common mistakes can impact the processing time or even the outcome of the application. Here are nine common errors to avoid:

Failing to provide the legal name as well as any DBA (Doing Business As) names can lead to confusion and delays in verifying the business identity.

Omitting the tax-exempt number or state-issued organization number, when applicable, can complicate tax status and organizational verification processes.

Not specifying the type of business entity correctly (e.g., Proprietorship, Corporation, LLC, etc.) can affect how the credit application is assessed and processed.

Overlooking the gross profit (monthly income) and not including it or inaccurately reporting it can lead to a misjudgment of the business's financial stability.

Providing incomplete or outdated contact information, including email and website addresses, can hinder communication between the applicant and Ford Credit.

Skipping details about the primary legal/CEO address, or providing a non-current address, can delay or impede background and credit checks.

Neglecting to list all owners/guarantors, their ownership percentages, or incorrectly filling out their personal details can cause issues in assessing personal guarantees and responsibilities.

Forgetting to indicate previous business dealings with Ford Motor Credit Company or not listing other creditors can lead to an incomplete credit profile.

Incorrectly completing the vehicle information section, such as not specifying the number of vehicles or omitting details about intended use, can affect the terms of credit offered.

Being diligent in filling out each section of the form, ensuring accuracy and completeness, can facilitate a smoother credit application process with Ford Credit.

Documents used along the form

When businesses apply for credit with the Ford Business Credit Application form, several other forms and documents are commonly required to support the application. The list below outlines documents frequently used alongside the Ford Business Credit Application to ensure a comprehensive and complete evaluation of creditworthiness.

- Proof of Business Identity: This document can include a business license, articles of incorporation, or other legal documents establishing the business's legal name and structure. It confirms the business's legal existence and operational status.

- Business Financial Statements: Recent financial statements—balance sheets, income statements, and cash flow statements—provide a snapshot of the business's financial health. These documents help in assessing the business's ability to meet financial obligations.

- Bank Statements: Typically, the last three to six months of bank statements are requested to understand the business's cash flow and operations better. Analysis of these statements can indicate the stability and liquidity of the business.

- Business Tax Returns: The last two or three years of tax returns furnish insights into the business's earnings and compliance with tax obligations. This history is crucial for evaluating the financial consistency and integrity of the business.

- Personal Guarantor Information: For businesses that may not have a long credit history or those asked to provide a personal guarantee, documents relating to the guarantor's financial status (such as personal tax returns, bank statements, and a personal credit score) may be requested. This information supports the credit application by providing an additional layer of financial assurance.

Each of these documents plays a vital role in the credit application process with Ford Motor Credit Company. By providing comprehensive details about the business's financial stability and history, these forms and documents help in building a solid case for credit approval. It's important for businesses to prepare these documents in advance to ensure a smooth and efficient credit application process.

Similar forms

Personal Loan Application: Similar to the Ford Business Credit Application, a personal loan application collects detailed personal information, including income, employment history, and existing debts. Both forms require the applicant to provide financial details that help the lender assess creditworthiness.

Mortgage Application: Just like the business credit application, mortgage applications require comprehensive financial information from the applicant, including monthly income, current debts, and assets. They also assess the applicant's credit history to determine eligibility for the loan.

Lease Agreement Application: This form is akin to the Ford Business Credit Application in that both require detailed personal and financial information to evaluate the applicant’s capacity to meet the payment obligations under the lease or credit arrangement.

Business Loan Application from Other Financial Institutions: Similar in structure and purpose, these applications gather detailed business and personal financial information, including years in business, type of business, and ownership details to evaluate the credit risk and financial health of the business applying for credit.

Credit Card Application: Credit card applications also request personal financial information, employment history, income, and existing credit obligations, mirroring the way the Ford Business Credit Application gathers information to assess creditworthiness.

Equipment Financing Application: These applications are comparable owing to their focus on businesses seeking to finance the purchase of equipment. Both forms evaluate the business’s financial stability, type of business, and ability to repay the financial obligation.

Small Business Administration (SBA) Loan Application: Both the Ford Business Credit Application and the SBA loan application demand rigorous documentation of business financials, personal financials of the guarantors, and an assessment of the business’s viability and credit risk.

Commercial Real Estate Loan Application: These applications are similar in the depth of financial and operational information required about the business, including the financial health of the company, the purpose of the loan, and details about the guarantors or key stakeholders, to evaluate the potential for successful repayment.

Dos and Don'ts

Filling out the Ford Business Credit Application is an important step in securing financing for your business vehicles. Here are some tips to ensure the process goes smoothly:

Do:

- Double-check all provided information for accuracy. Before you submit your application, make sure every detail you've provided is correct. This includes checking numbers and spelling to avoid any delays in processing.

- Include all required documents. Make sure you attach any necessary documents that are requested in the application form. This could include financial statements or proof of business registration.

- Know your business details. Be clear about your type of business, years in operation, and other specific details like your Tax Exempt Number and State-issued Organization Number. Accurate information speeds up the verification process.

- Review the terms and conditions. Before signing, understand the obligations and rights you're agreeing to. This includes understanding how your information will be used and your consent on credit checks.

Don't:

- Leave sections incomplete. If a section doesn’t apply to your business, fill it with 'N/A' or 'Not Applicable' instead of leaving it blank. This shows you've reviewed every part of the application.

- Forget to list a contact for communications. Make sure to provide up-to-date contact information, including an e-mail address and phone number, to avoid any communication gaps.

- Overlook the authorization sections. Pay close attention to the sections where you're required to give consent or authorization, particularly concerning credit checks and sharing of your information with Ford Credit's partners.

- Submit without reviewing for errors. A simple mistake can cause unnecessary delays. Review your application thoroughly or have someone else check it to catch any errors you might have missed.

Misconceptions

Understanding the paperwork involved when applying for business credit can be complex, and the Ford Business Credit Application is no exception. Common misconceptions often arise, potentially complicating the process. Here are eight common misunderstandings and the reality behind each.

It's only for companies purchasing fleets of vehicles: While the form can be used by businesses buying fleets, it's also applicable for single vehicle purchases or leases by businesses of any size.

Personal information is irrelevant: Even though it's a business application, personal information related to the business owners or guarantors, such as Social Security Numbers and dates of birth, is crucial for credit assessment purposes.

Tax Exempt Number is always required: This field is only necessary for organizations that are officially exempt from paying taxes. Not all businesses will have such a number.

Only total monthly income is considered: The application asks for gross profit rather than simply monthly income, which accounts for revenues after the cost of goods sold has been deducted.

Ownership percentage isn't important: Ownership percentage is critical, especially for businesses with multiple owners, as it helps Ford Credit understand the distribution of equity and potential liability.

Email and website information are optional: In today's digital age, providing an email and website address can enhance credibility and provide necessary contact information for communication.

You can only apply as an individual or a business: The application allows for individual, joint, and guarantor applications, offering flexibility based on the applicant's situation.

Previous business with Ford Credit doesn't matter: Indicating past relations with Ford Motor Credit Company can be beneficial as it may impact the credit decision based on prior account conduct.

Correcting these misconceptions is paramount in ensuring a smooth application process. Detailed attention to the application's requirements and clarity regarding what is expected can help in successfully obtaining business credit from Ford Credit.

Key takeaways

Filling out a Ford Business Credit Application is an important step for businesses looking to finance or lease Ford vehicles. Here are key takeaways to ensure that the process is as smooth as possible:

- Ensure the application is completely filled out with accurate information, including the legal name of the business, type of business entity (e.g. LLC, Corporation, Partnership), and state of organization. Incomplete or inaccurate information can delay the approval process.

- For individuals, including sole proprietors or guarantors, personal information such as date of birth, social security number, and home address must be provided. This helps Ford Credit assess the creditworthiness of the individuals behind the business.

- Financial details, including gross profit (monthly income), need to be disclosed. Be prepared to verify income and provide additional financial documentation if requested. This information is crucial for determining the terms of credit.

- The application includes authorizations for Ford Credit to check credit and employment histories, verify income, and share information with third parties as part of the credit evaluation and approval process. Understanding these consents is important for applicants.

- For specific vehicle information, including make, model, GVW (Gross Vehicle Weight), serial/VIN number, and estimated payment, should be filled out if applicable. This helps in tailoring the financing or lease agreement to the specific needs of the business.

By following these guidelines, businesses can ensure a more streamlined and efficient application process. Additionally, applicants should review the terms and conditions and understand the privacy and information sharing policies of Ford Credit before submitting the application.

Popular PDF Forms

Pds Download - Locking down every crucial detail about a soldier's career and personal life, ensuring nothing is missed in military records.

How Long Is Form 3300 Good for - Nutritional screening evaluates the child's body mass index (BMI) and categorizes it into percentile ranges to identify those who may need further nutritional counseling.

Army Ht Wt Calculator - Soldiers found not in compliance with body fat standards on the DA 5501 are recommended a monthly weight loss target to ensure their return to standards.