Blank Forethought Life Insurance Claim PDF Template

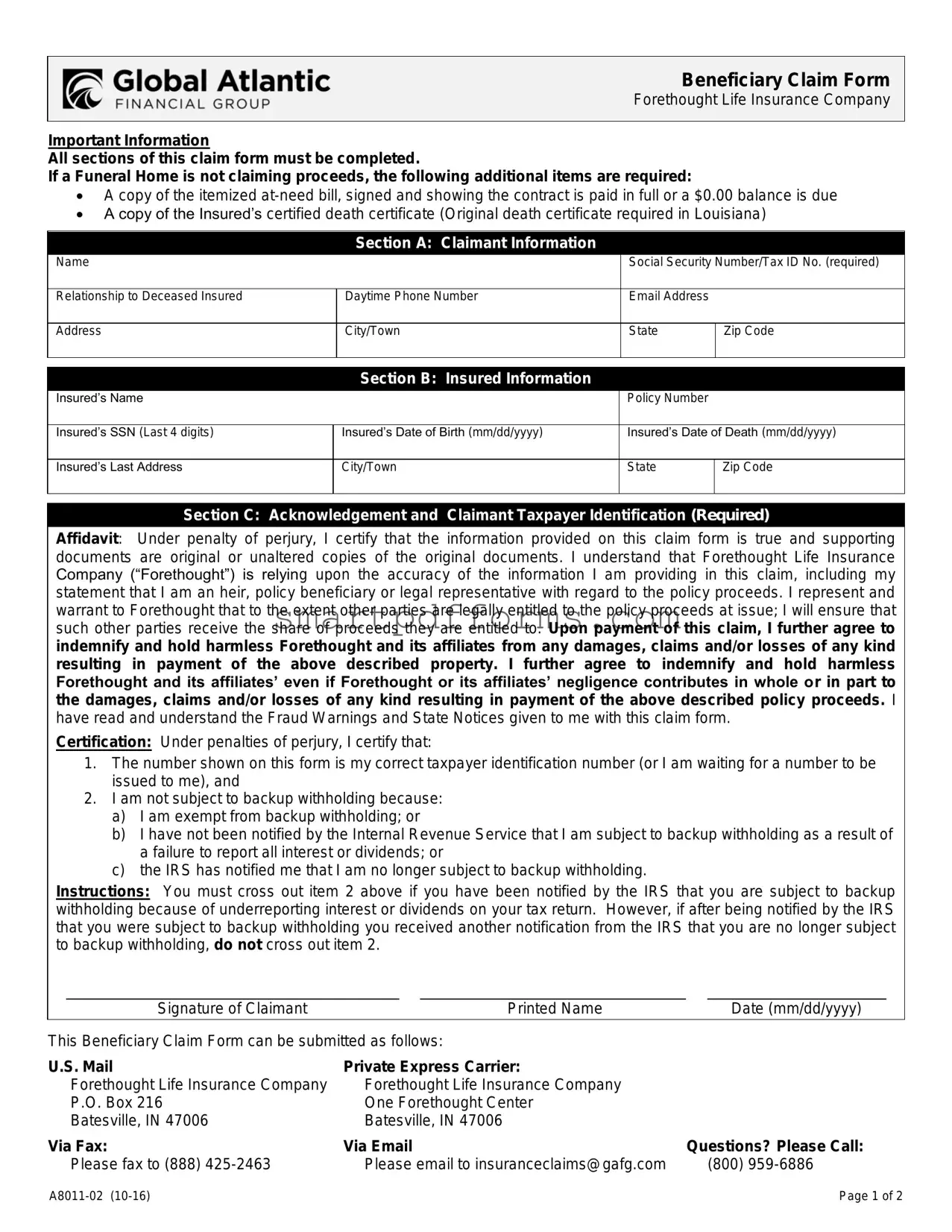

Submitting a claim to Forethought Life Insurance Company requires a comprehensive understanding of the Beneficiary Claim Form, a crucial step for beneficiaries to navigate during an undoubtedly challenging time. This form meticulously outlines the process for claiming life insurance proceeds, specifying that all sections must be filled for a claim to be considered. It emphasizes the importance of providing the deceased insured’s detailed information, including a certified death certificate and, if applicable, a fully paid at-need bill from the funeral home. The form also demands claimant information, including the claimant's relationship to the deceased, ensuring legitimate claims. Attention to detail is paramount, as claimants must certify the accuracy of information provided under penalty of perjury. Additionally, it houses an affidavit acknowledging the claimant's understanding of their responsibilities and the indemnity agreement should issues arise post-payment. The form also contains a section for taxpayer identification, highlighting tax compliance aspects that claimants must adhere to, along with a necessity to understand the implications of backup withholding. Accompanied by fraud warnings and state notices, it alerts claimants to the legal consequences of submitting false information, varying significantly across jurisdictions. This comprehensive approach underscores the importance of accuracy, honesty, and thoroughness when completing the Beneficiary Claim Form, reflecting Forethought Life Insurance Company's commitment to integrity and legal compliance in the claim process.

Preview - Forethought Life Insurance Claim Form

Beneficiary Claim Form

Forethought Life Insurance Company

Important Information

All sections of this claim form must be completed.

If a Funeral Home is not claiming proceeds, the following additional items are required:

A copy of the itemized

A copy of the Insured’s certified death certificate (Original death certificate required in Louisiana)

Section A: Claimant Information

Name |

|

Social Security Number/Tax ID No. (required) |

|

|

|

|

|

Relationship to Deceased Insured |

Daytime Phone Number |

Email Address |

|

|

|

|

|

Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section B: Insured Information

Insured’s Name |

|

Policy Number |

|

|

|

|

|

Insured’s SSN (Last 4 digits) |

Insured’s Date of Birth (mm/dd/yyyy) |

Insured’s Date of Death (mm/dd/yyyy) |

|

|

|

|

|

Insured’s Last Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section C: Acknowledgement and Claimant Taxpayer Identification (Required)

Affidavit: Under penalty of perjury, I certify that the information provided on this claim form is true and supporting documents are original or unaltered copies of the original documents. I understand that Forethought Life Insurance Company (“Forethought”) is relying upon the accuracy of the information I am providing in this claim, including my statement that I am an heir, policy beneficiary or legal representative with regard to the policy proceeds. I represent and warrant to Forethought that to the extent other parties are legally entitled to the policy proceeds at issue; I will ensure that such other parties receive the share of proceeds they are entitled to. Upon payment of this claim, I further agree to indemnify and hold harmless Forethought and its affiliates from any damages, claims and/or losses of any kind resulting in payment of the above described property. I further agree to indemnify and hold harmless Forethought and its affiliates’ even if Forethought or its affiliates’ negligence contributes in whole or in part to the damages, claims and/or losses of any kind resulting in payment of the above described policy proceeds. I have read and understand the Fraud Warnings and State Notices given to me with this claim form.

Certification: Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because:

a)I am exempt from backup withholding; or

b)I have not been notified by the Internal Revenue Service that I am subject to backup withholding as a result of a failure to report all interest or dividends; or

c)the IRS has notified me that I am no longer subject to backup withholding.

Instructions: You must cross out item 2 above if you have been notified by the IRS that you are subject to backup withholding because of underreporting interest or dividends on your tax return. However, if after being notified by the IRS that you were subject to backup withholding you received another notification from the IRS that you are no longer subject to backup withholding, do not cross out item 2.

Signature of Claimant |

|

Printed Name |

|

Date (mm/dd/yyyy) |

This Beneficiary Claim Form can be submitted as follows:

U.S. Mail |

Private Express Carrier: |

Forethought Life Insurance Company |

Forethought Life Insurance Company |

P.O. Box 216 |

One Forethought Center |

Batesville, IN 47006 |

Batesville, IN 47006 |

Via Fax: |

Via Email |

Questions? Please Call: |

Please fax to (888) |

Please email to insuranceclaims@gafg.com |

(800) |

Page 1 of 2 |

Beneficiary Claim Form

Forethought Life Insurance Company

Fraud Warnings & State Notices

California Residents – Reg. 789.8

The sale or liquidation of any asset in order to buy insurance, either life insurance or an annuity contract, may have tax consequences. Terminating any life insurance policy or annuity contract may have early withdrawal penalties or other costs or penalties, as well as tax consequences. You may wish to consult independent legal or financial advice before the sale or liquidation of any asset and before the purchase of any life insurance or annuity contract.

Colorado Residents

It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of any insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Department of Regulatory Agencies.

District of Columbia Residents

Warning: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

Hawaii, North Dakota, Pennsylvania Residents

Any person who knowingly and with intent to injure, defraud or deceive any insurance company, submits an application for insurance containing any materially false, incomplete, or misleading information, or conceals for the purpose of misleading, any material fact, is guilty of insurance fraud, which is a crime and in certain states, a felony. Penalties may include imprisonment, fine, denial of benefits, or civil damages.

Kansas Residents

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance may be guilty of insurance fraud as determined by a court of law and may be subject to fines and confinement in prison

Kentucky Residents

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maine and Tennessee Residents

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Massachusetts, New Mexico, Louisiana and Rhode Island Residents

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

New Jersey Residents

Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Virginia Residents

Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated the state law.

All Other States

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Page 2 of 2 |

Form Data

| Fact Name | Detail |

|---|---|

| Completion Requirement | All sections of the claim form must be completed for processing. |

| Additional Items for Non-Funeral Home Claims | If a Funeral Home is not claiming proceeds, an itemized at-need bill and a certified death certificate are required. |

| Original Death Certificate Requirement | Original death certificate is required in Louisiana. |

| Claimant Information Section | Includes name, Social Security Number/Tax ID, relationship to deceased, contact information, and address. |

| Insured Information Section | Details about the insured including name, policy number, last 4 digits of SSN, date of birth, date of death, and last address. |

| Acknowledgement and Claimant Taxpayer Identification | Claimant must certify information accuracy under penalty of perjury and acknowledge understanding of fraud warnings. |

| Submission Methods | Form can be submitted via U.S. Mail, Private Express Carrier, Fax, or Email. |

| Fraud Warnings & State Notices | Specific fraud warnings and notices vary by state, detailing consequences for providing false information. |

| Governing Law(s) | Variable based on the claimant's or policy holder's state of residence, with applicable state-specific notices included. |

Instructions on Utilizing Forethought Life Insurance Claim

Losing a loved one can be an incredibly difficult time, and dealing with paperwork can add to the stress. Filling out a Forethought Life Insurance Claim form is one of the necessary steps to manage the practicalities following a loss. The form is designed to simplify the claim process, ensuring the beneficiary can access the benefits with ease. Here’s a clear, step-by-step guide to completing the claim form correctly.

- Start with Section A: Claimant Information. Fill in your full name as the person making the claim.

- Enter your Social Security Number or Tax ID number, as this is required.

- Specify your relationship to the deceased insured person.

- Provide your daytime phone number and email address for contact purposes.

- Include your full mailing address: street, city/town, state, and zip code.

- Move on to Section B: Insured Information. Enter the full name of the insured individual who passed away.

- Fill in the policy number associated with the deceased’s life insurance policy.

- Enter the last four digits of the insured’s Social Security Number.

- Provide the insured’s date of birth and date of death, formatted as mm/dd/yyyy.

- Include the last known address of the insured: street, city/town, state, and zip code.

- In Section C: Acknowledgement and Claimant Taxpayer Identification (Required), read the affidavit carefully.

- Sign to certify that all the provided information is accurate and that you have read and understood the fraud warnings and state notices. If you're subject to backup withholding by the IRS, cross out item 2 under the Certification section. If not, leave it as is.

- Print your name, put the date (mm/dd/yyyy), and sign at the bottom of the form to acknowledge the affidavit and certify your taxpayer identification number.

After you complete the form, ensure you have attached all required documents. These may include a certified copy of the death certificate (original required in Louisiana) and, if applicable, an itemized at-need bill from the funeral home. Once everything is in order, you can submit the form and all attachments via U.S. Mail, private express carrier, fax, or email as provided on the claim form. Submitting this claim is the initial step towards finalizing the deceased’s affairs and securing the policy benefits. It’s crucial to provide accurate and honest information throughout the form to avoid any delays in processing the claim.

Obtain Answers on Forethought Life Insurance Claim

- What items are required when submitting a Forethought Life Insurance Claim form?

- How can I submit the Beneficiary Claim Form to Forethought Life Insurance Company?

- What is required in Section C: Acknowledgement and Claimant Taxpayer Identification?

- What happens if I provide false or misleading information on my claim?

- Are there specific fraud warnings for residents of different states?

- Can I submit the claim form if I'm waiting for a Tax ID number to be issued to me?

- What should I do if I have been notified by the IRS that I am subject to backup withholding?

- Who can I contact if I have questions about filling out the Forethought Life Insurance Claim form?

- Is the claimant required to indemnify Forethought Life Insurance Company?

- What do I need to do if there are other parties legally entitled to the policy proceeds?

When you submit a Forethought Life Insurance Claim form, it's important to complete all sections. If a Funeral Home is not claiming the proceeds, you will need to provide additional documents including a copy of the itemized at-need bill that is signed and shows the contract is paid in full or that a $0.00 balance is due, and a copy of the insured’s certified death certificate. Note that in Louisiana, an original death certificate is required.

The Beneficiary Claim Form can be submitted through several means. You can send it via U.S. Mail to Forethought Life Insurance Company, P.O. Box 216, Batesville, IN 47006 or through Private Express Carrier to One Forethought Center, Batesville, IN 47006. Alternatively, you can fax it to (888) 425-2463 or email it to insuranceclaims@gafg.com.

In Section C, the claimant must certify under penalty of perjury that all provided information and supporting documents are true, correct, and unaltered. The claimant must also attest to being an heir, policy beneficiary, or legal representative authorized to claim the policy proceeds. Additionally, the claimant agrees to indemnify Forethought against damages, claims, and/or losses stemming from the payment of the claim, including those resulting from negligence. Lastly, the claimant needs to certify their taxpayer identification number and their status regarding backup withholding.

Providing false or misleading information with the intent to defraud is illegal and is treated as insurance fraud. Depending on your state, penalties for such actions may include imprisonment, fines, denial of insurance benefits, and civil damages. Each state has specific warnings and potential penalties listed on the claim form, reflecting the seriousness of submitting fraudulent claims.

Yes, the Forethought Life Insurance Claim form includes specific fraud warnings tailored to residents of certain states. These warnings address the illegality of providing false information with the intent to defraud insurance companies. The form specifies potential consequences such as imprisonment, fines, denial of insurance, and civil damages, which vary by state.

Yes, you can submit the claim form even if you're waiting for a Tax ID number to be issued. When certifying under penalties of perjury in Section C, you have the option to indicate that you are waiting for a number to be issued to you. It’s important to provide this number to Forethought as soon as you receive it to avoid any delays in processing your claim.

If you’ve been notified by the IRS that you’re subject to backup withholding due to underreporting interest or dividends on your tax return, you must cross out item 2 in Section C of the form. However, if you’ve been notified by the IRS that you are no longer subject to backup withholding, you should leave item 2 as is and not cross it out.

If you have any questions about filling out the claim form or require assistance, you can contact Forethought Life Insurance Company directly at (800) 959-6886. Their team can provide guidance and help ensure that you properly complete and submit your claim.

Yes, by signing the claim form, the claimant agrees to indemnify and hold harmless Forethought Life Insurance Company and its affiliates from any damages, claims, and/or losses of any kind that may result from the payment of the claim. This includes damages resulting from Forethought's negligence.

In the event there are other parties legally entitled to a share of the policy proceeds, as the claiming party, you are responsible for ensuring that these individuals or entities receive their entitled share. The claim form requires acknowledgment that to the extent other parties are legally entitled to the policy proceeds, you will ensure they receive their share.

Common mistakes

When individuals file a claim with Forethought Life Insurance, they often aim to do so with accuracy and diligence. However, some common mistakes can complicate the process, delay claims, or even result in denials. Recognizing and avoiding these errors is crucial for a smooth claims process.

- Not completing all sections of the claim form correctly is a common mistake. Forethought Life Insurance requires that every part of the claim form be filled out. Incomplete information can cause delays.

- Forgetting to include a copy of the itemized at-need bill from the funeral home, if applicable, signed and indicating that the contract is paid in full, or a balance of $0.00, is another oversight. This document is necessary unless the claim is being made by a funeral home directly.

- Omitting a copy of the insured’s certified death certificate, which is mandatory for processing the claim. In Louisiana, the original death certificate is required.

- Entering incorrect information in Section A, which pertains to the claimant. The Social Security Number/Tax ID No., relationship to the deceased, and contact details must be accurate.

- In Section B, related to the insured’s information, it’s vital to ensure that the provided details, especially the policy number and the insured’s SSN, are correct. Mistakes here can lead to significant delays.

- A mistake often made in Section C is failing to accurately complete the affidavit and certification. Not only must claimants ensure that the information they provide is true, but they must also understand the penalties for perjury and the importance of indemnifying Forethought in case of disputes.

- Failing to read and understand the Fraud Warnings and State Notices can be a critical error. These notices contain important information about the legal implications of providing false information.

- Ignoring the instruction to cross out item 2 if you’ve been notified by the IRS that you are subject to backup withholding can result in processing issues. This step is crucial for those who have been notified of such withholding because of underreporting interest or dividends.

- Lastly, submitting the claim form without the claimant’s signature, printed name, and date will render it incomplete. A signed form is a basic requirement for processing any insurance claim.

Understanding and avoiding these common mistakes can lead to a more streamlined and efficient claims process with Forethought Life Insurance. It’s also beneficial to closely follow all included instructions and seek clarification when needed.

Documents used along the form

When filing a Forethought Life Insurance Claim, claimants are usually required to submit specific forms and documents to process their claims effectively. These required submissions help ensure that the insurance company can verify the claim and expedite the process, offering timely assistance to the beneficiaries or claimants during a challenging period. Below is a summary of four other forms and documents often used alongside the Forethought Life Insurance Claim form.

- Certified Death Certificate: An essential document, the certified death certificate confirms the insured's passing. It is a required document for all claims, serving as official proof of death to the insurance company.

- Copy of the Itemized at-need Bill: If the funeral home is not claiming the proceeds, a copy of the itemized at-need bill, showing that it has been paid in full or that there is a $0.00 balance due, is necessary. This document ensures that the funeral expenses are accounted for, and it helps in the verification process for the appropriate distribution of funds.

- Claimant's Identification Proof: A valid form of identification for the claimant, such as a driver's license or passport, is often required. This helps in verifying the claimant's identity, ensuring that the proceeds go to the rightful person.

- Affidavit of Heirship: In cases where the policy does not list a beneficiary, or the beneficiary is deceased with no contingent beneficiary designated, an affidavit of heirship might be needed. This legal document helps to establish the rightful heirs to the insurance proceeds in the absence of a named beneficiary.

Understanding the significance and requirements of each document can significantly streamline the process of filing a life insurance claim. The use of these documents, along with the Forethought Life Insurance Claim form, ensures a smoother transaction for the claimant, providing much-needed support during times of loss. These documentations play a crucial role in the validation of claims, reinforcing the integrity of the claims process.

Similar forms

The beneficiary designation form for a retirement account or pension plan is similar to the Forethought Life Insurance Claim form. Both require personal information about the claimant and deceased, details about the policy or account, and an acknowledgement or certification statement from the claimant verifying the truthfulness of the information provided.

A death benefit claim form for a government program such as Social Security or Veterans Affairs benefits mirrors the structure of the Forethought form. In these forms, claimants must also provide documentation such as a death certificate, detailed personal information, and sometimes proof of relationship to the deceased.

The claim form for an accidental death and dismemberment (AD&D) insurance policy has parallels with the Forethought form, requiring detailed information on the insured, a certification of truth by the claimant, and supporting documentation proving the cause of death aligns with the policy terms.

The application for death benefits under a life settlement contract shows similarities by requiring the beneficiary to provide detailed information about the deceased, proof of death, and a claimant's tax identification number, akin to the Forethought Life Insurance Claim form.

A probate claim form filed in court to claim an estate asset follows a similar procedural requirement. It requires detailed information about the deceased and the claimant, supporting documents to verify the claim, and a signed affidavit or declaration asserting the claim's legitimacy.

The health insurance claim form for a deceased insured's medical expenses also mirrors this form. Such forms typically request extensive information about the insured and the claimant, detailed billing information from healthcare providers, and a certification of truthfulness and accuracy from the claimant.

Dos and Don'ts

Filling out a Forethought Life Insurance Claim form is a critical step in the claims process, requiring attention to detail and accuracy. It's important to carefully navigate this task to ensure a smooth and successful claim submission. Here are six dos and don'ts to keep in mind:

- Do thoroughly review every section of the claim form to ensure a complete understanding of what is required.

- Do provide accurate and truthful information when completing the form. Misinformation can lead to delays or denial of the claim.

- Do attach all additional required documents, such as the insured’s certified death certificate and the itemized at-need bill, if applicable. Make sure these documents are unaltered and clearly legible.

- Don't leave any section incomplete. If a question does not apply to your situation, it's better to write "N/A" (not applicable) instead of leaving it blank.

- Don't forget to sign and date the form. An unsigned or undated claim form can be grounds for immediate rejection.

- Don't ignore any specific instructions or fraud warnings that accompany the form. Compliance with these instructions is crucial for the legal and timely processing of your claim.

By adhering to these guidelines, you can streamline the claim process and avoid common pitfalls that could potentially complicate or delay the processing of your claim. Remember, the goal is to ensure that the insurance company has all the information they need to process your claim efficiently and effectively.

Misconceptions

Life insurance claim forms, such as those provided by Forethought Life Insurance Company, are fundamental documents for beneficiaries to process their claims. Yet, several misconceptions surround these forms. Understanding these misconceptions is crucial to navigating the complexities of filing a claim effectively.

Every section must be completed by the claimant themselves. This belief misinterprets the necessity for accuracy and completeness. Assistance in filling out the form, especially from legal or financial advisors, is permissible and often beneficial, as long as the information is true and submitted by the claimant or their legal representative.

Only a certified death certificate is required for the claim. While a certified death certificate is essential, the claim form highlights specific situations where additional documentation is needed. For example, a funeral home not claiming proceeds must also submit an itemized at-need bill.

Fraud warnings and state notices are generic and not important. These warnings are tailored to the legal requirements of each state, reflecting the serious legal implications of submitting fraudulent information. They serve as a critical reminder of the legal responsibilities and consequences when filing a claim.

The claimant’s Social Security Number (SSN) or Tax ID is optional. The form explicitly requires this information for processing the claim, emphasizing its importance in identifying the claimant and ensuring proper tax reporting and compliance.

Email and fax are less preferred submission methods. Contrary to this belief, Forethought Life Insurance Company accommodates various submission methods including U.S. Mail, email, and fax, providing flexibility and convenience based on the claimant's preference or situation.

The affidavit section is a standard formality with no legal weight. The affidavit is a solemn declaration under the penalties of perjury, making it a powerful legal statement. It attests to the truthfulness of the information provided and the claimant's understanding of their indemnification duties.

There is no need to cross out the section regarding backup withholding if it doesn’t apply. Instructions on the form specifically state that certain declarations regarding backup withholding must be crossed out if they do not apply to the claimant’s situation, highlighting the uniqueness of each claimant's tax status.

The certification about backup withholding is merely procedural. This certification is a federal requirement to ensure that individuals are reporting their income accurately to the Internal Revenue Service (IRS) and are not subject to backup withholding. It’s a crucial part of the compliance process with tax laws.

Clearing up these misconceptions is fundamental to ensuring that the claims process is navigated accurately and efficiently, underlining the importance of careful, informed completion of the Forethought Life Insurance Claim form.

Key takeaways

Filling out and using the Forethought Life Insurance Claim Form correctly is vital for the timely processing of your claim. It’s important to pay attention to the details and ensure all required information and documents are provided. Here are five key takeaways:

- Ensure that all sections of the claim form are fully completed. Incomplete forms may lead to delays in the processing of your claim.

- If a Funeral Home is not claiming the proceeds, you must include a copy of the itemized at-need bill that is signed and shows the contract is paid in full or that a $0.00 balance is due. Additionally, a copy of the insured’s certified death certificate is required, and note that for residents of Louisiana, an original death certificate is mandatory.

- The claimant must provide their Taxpayer Identification Number (TIN) and certify under penalty of perjury that the information they have provided is accurate. This includes certifying that they are not subject to backup withholding taxes by the IRS, or if they are, that they have been formally advised that this no longer applies.

- The affidavit and certification section of the form requires the claimant to acknowledge their responsibility to ensure the rightful parties receive any proceeds they are legally entitled to and to indemnify Forethought Life Insurance Company against any claims or damages arising from the payment of the proceeds.

- Read and understand the Fraud Warnings and State Notices provided with the claim form. It's crucial to recognize that knowingly providing false or misleading information in the application can lead to severe penalties, including imprisonment, fines, denial of insurance benefits, and civil damages, depending on your state of residence.

It’s recommended to consult the specific regulations and warnings applicable in your state, as outlined in the Fraud Warnings & State Notices section of the form, to understand the implications of providing false information or attempting to defraud the insurance company.

Popular PDF Forms

Permission Slip Lds - Comprehensive form addressing dietary restrictions, allergies, and medications, tailored for LDS event participation.

How Much Does It Cost to Get a Salvage Title - Ensuring all parts and work are accounted for, the form helps in mitigating fraud in the vehicle rebuild industry.