Blank Freddie Mac 65 PDF Template

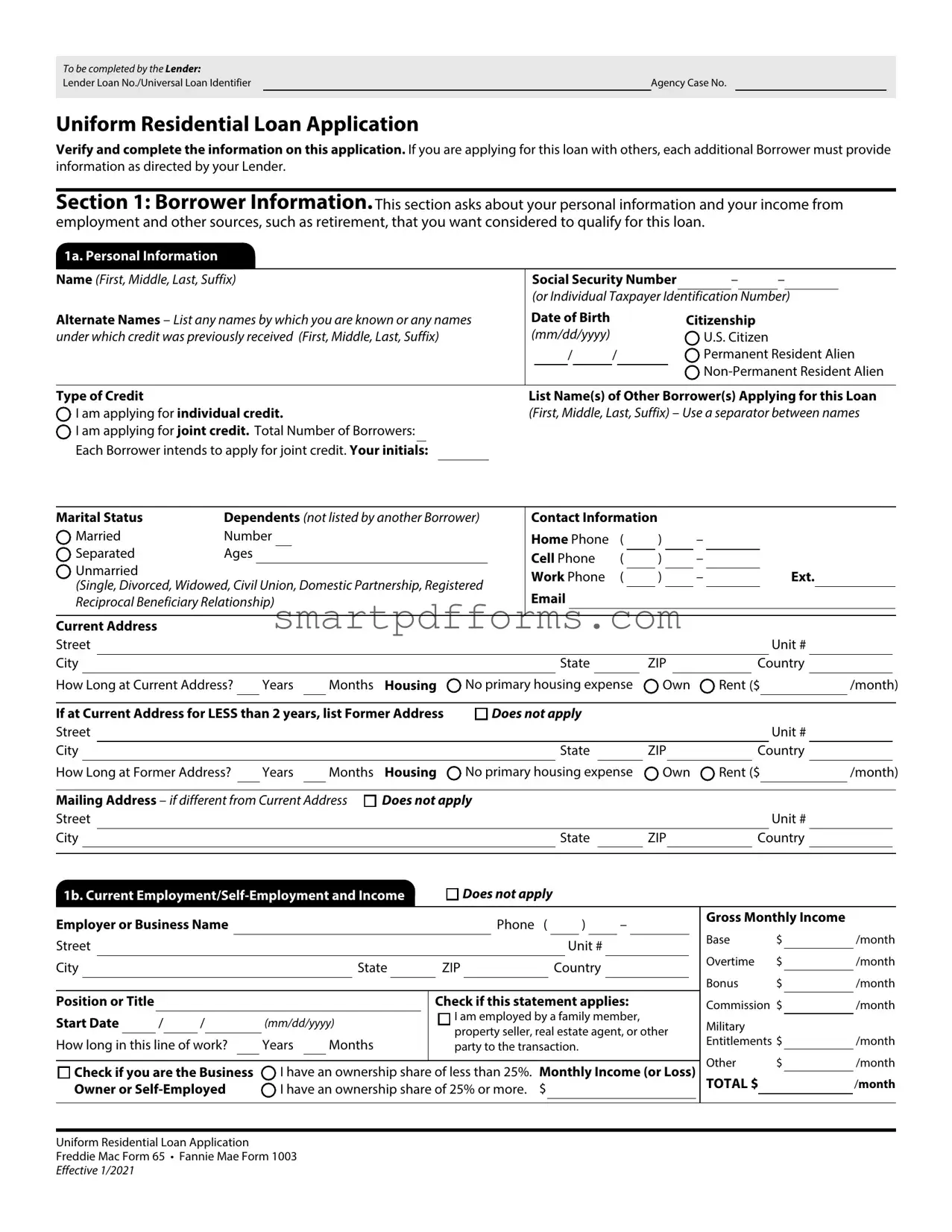

Navigating the process of applying for a mortgage can often seem daunting, especially with the myriad forms and documents that are required. Among these, the Freddie Mac Form 65, also known as the Uniform Residential Loan Application, stands out as a critical piece of documentation. This extensive form is designed to collect detailed information from individuals seeking to secure a loan for residential real estate. It covers a wide range of areas, from personal and employment information to financial data, assets, liabilities, and details about the property in question. Importantly, it seeks to understand the applicant's income sources, not just from employment but also from other areas such as retirement funds or alimony, which could influence the ability to qualify for the loan. Additionally, it delves into the financial obligations of the applicant, including current housing expenses and any debts, which play a significant role in determining the loan eligibility. The form further expands to cover the specifics of the loan and property, including the purpose of the loan and detailed information about the property being purchased or refinanced. Through its comprehensive nature, the Freddie Mac 65 form serves as a foundational document that lenders use to assess an applicant's loan qualification, embodying the meticulous scrutiny involved in the mortgage application process.

Preview - Freddie Mac 65 Form

To be completed by the Lender: |

|

Lender Loan No./Universal Loan Identifier |

Agency Case No. |

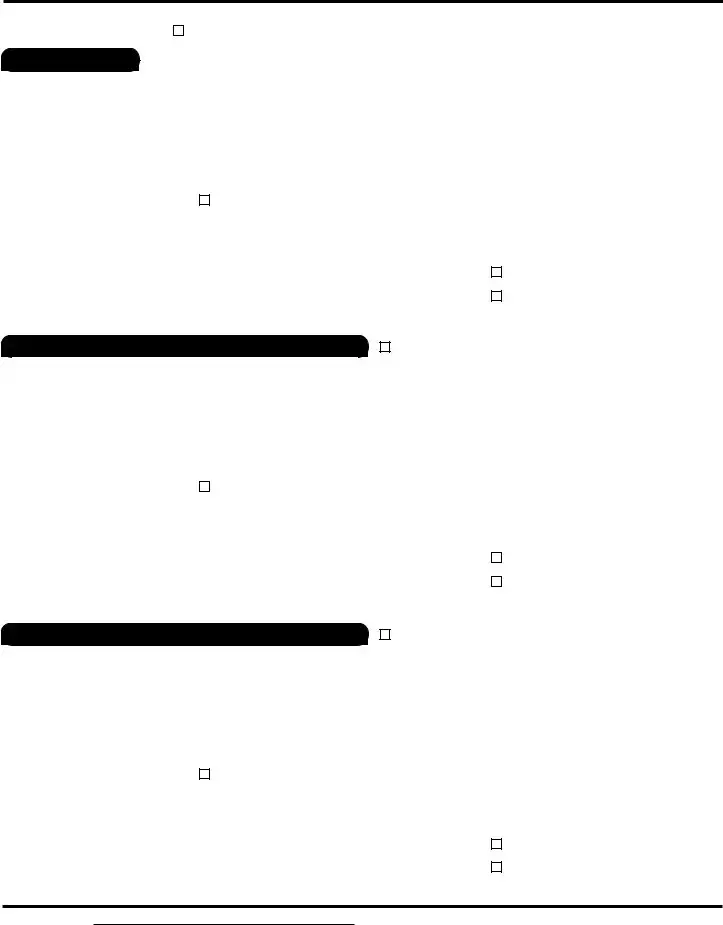

Uniform Residential Loan Application

Verify and complete the information on this application. If you are applying for this loan with others, each additional Borrower must provide information as directed by your Lender.

Section 1: Borrower Information.This section asks about your personal information and your income from employment and other sources, such as retirement, that you want considered to qualify for this loan.

1a. Personal Information

Name (First, Middle, Last, Suffix)

Alternate Names – List any names by which you are known or any names under which credit was previously received (First, Middle, Last, Suffix)

Social Security Number |

|

– |

– |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(or Individual Taxpayer Identification Number) |

||||||||||||

Date of Birth |

|

|

|

Citizenship |

|

|

|

|||||

(mm/dd/yyyy) |

|

|

|

U.S. Citizen |

|

|

|

|||||

/ |

|

/ |

|

|

Permanent Resident Alien |

|||||||

|

|

|

|

|

|

|

||||||

Type of Credit

I am applying for individual credit.

I am applying for individual credit.

I am applying for joint credit. Total Number of Borrowers: Each Borrower intends to apply for joint credit. Your initials:

I am applying for joint credit. Total Number of Borrowers: Each Borrower intends to apply for joint credit. Your initials:

List Name(s) of Other Borrower(s) Applying for this Loan (First, Middle, Last, Suffix) – Use a separator between names

Marital Status |

Dependents (not listed by another Borrower) |

|

Contact Information |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Married |

Number |

|

|

|

|

|

|

Home Phone |

( |

|

) |

|

|

|

– |

|

|

|

|

|

|

|

|||||||||||||||||

Separated |

Ages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Cell Phone |

( |

|

) |

|

|

|

– |

|

|

|

|

|

|

|

||||||||||||||||

Unmarried |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Phone |

( |

|

) |

|

|

|

– |

Ext. |

||||||||||||||||||

(Single, Divorced, Widowed, Civil Union, Domestic Partnership, Registered |

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Reciprocal Beneficiary Relationship) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

|||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

ZIP |

|

|

|

Country |

|

|

||||||||||||

How Long at Current Address? |

|

Years |

|

|

Months |

Housing |

No primary housing expense |

|

|

Own |

|

Rent ($ |

|

|

|

/month) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

If at Current Address for LESS than 2 years, list Former Address |

|

Does not apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

|||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

ZIP |

|

|

|

Country |

|

|

||||||||||||

How Long at Former Address? |

|

Years |

|

|

Months |

Housing |

No primary housing expense |

|

|

Own |

|

Rent ($ |

|

|

|

/month) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Mailing Address – if different from Current Address |

Does not apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

ZIP |

|

|

Country |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

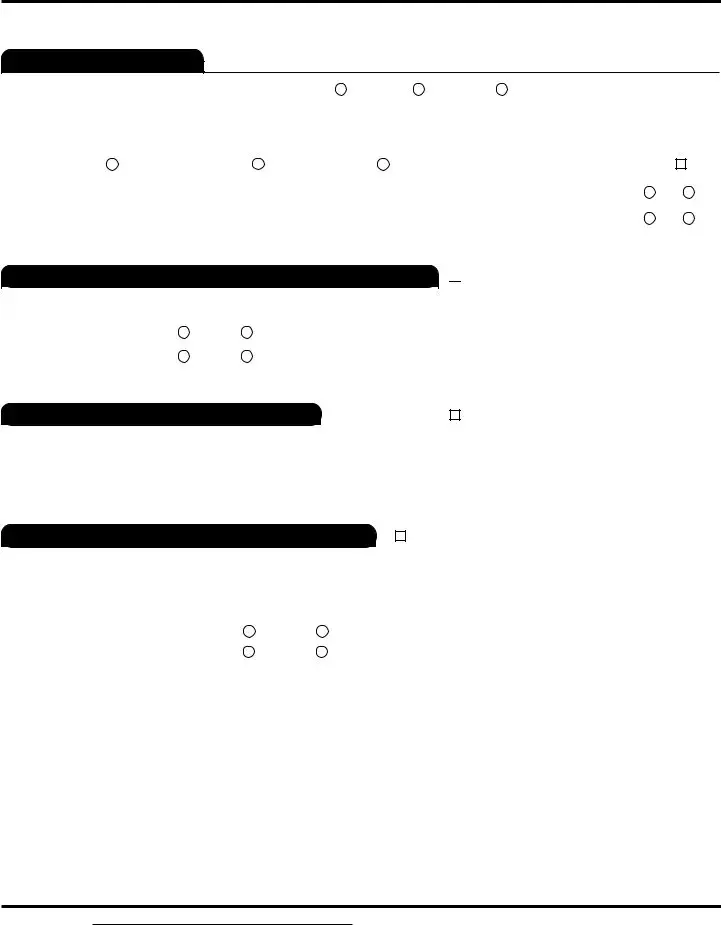

1b. Current

Does not apply

Does not apply

Employer or Business Name |

|

|

|

|

|

|

|

|

|

|

Phone |

( |

|

|

) |

|

|

– |

|

|

|||||||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP |

|

|

|

Country |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if this statement applies: |

||||||||||||||||||

Start Date |

|

|

/ |

|

/ |

|

|

|

|

(mm/dd/yyyy) |

|

I am employed by a family member, |

|||||||||||||||||||||

|

|

|

|

|

property seller, real estate agent, or other |

||||||||||||||||||||||||||||

How long in this line of work? |

Years |

|

Months |

|

|||||||||||||||||||||||||||||

|

|

party to the transaction. |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you are the Business |

I have an ownership share of less than 25%. |

Monthly Income (or Loss) |

|||||||||||||||||||||||||||||||

Owner or |

I have an ownership share of 25% or more. |

$ |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Monthly Income

Base |

$ |

|

/month |

Overtime |

$ |

|

/month |

Bonus |

$ |

|

/month |

Commission $ |

|

/month |

|

Military |

|

|

|

Entitlements $ |

|

/month |

|

Other |

$ |

|

/month |

TOTAL $ |

|

|

/month |

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

|

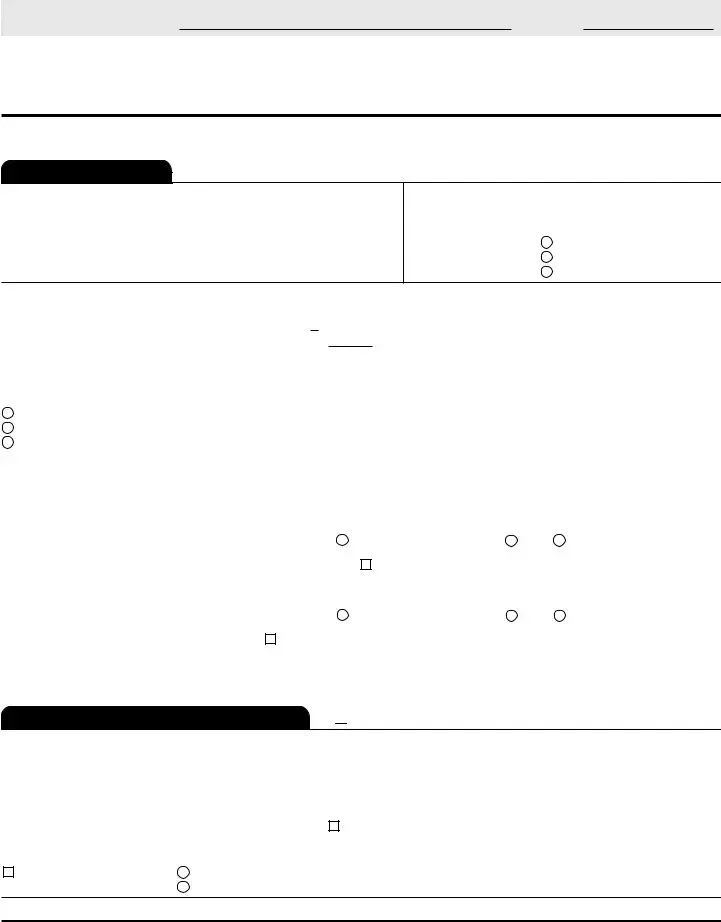

1c. IF APPLICABLE, Complete Information for Additional |

|

Does not apply |

|

||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or Business Name |

|

|

|

|

|

|

|

|

|

|

Phone ( |

|

) |

|

|

– |

|

|

Gross Monthly Income |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

|

|

|

Base |

$ |

|

/month |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overtime |

$ |

|

/month |

|||||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP |

|

|

|

Country |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonus |

$ |

|

/month |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Position or Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if this statement applies: |

Commission $ |

/month |

|||||||||||||||||||||||

Start Date |

|

|

/ |

|

/ |

|

|

|

|

(mm/dd/yyyy) |

|

I am employed by a family member, |

Military |

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

property seller, real estate agent, or other |

|

|

|

||||||||||||||||||||||||||||||||

How long in this line of work? |

Years |

|

Months |

|

Entitlements $ |

/month |

||||||||||||||||||||||||||||||||||

|

|

party to the transaction. |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Other |

$ |

|

/month |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Check if you are the Business |

I have an ownership share of less than 25%. |

Monthly Income (or Loss) |

|||||||||||||||||||||||||||||||||||||

|

TOTAL $ |

|

|

/month |

||||||||||||||||||||||||||||||||||||

|

Owner or |

I have an ownership share of 25% or more. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1d. IF APPLICABLE, Complete Information for Previous |

|

Does not apply |

|

|

||

|

|

|

|

Provide at least 2 years of current and previous employment and income.

Employer or Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

||

City |

|

|

|

|

|

|

|

State |

|

ZIP |

|

Country |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you were the Business |

|||||

Start Date |

/ |

/ |

|

|

(mm/dd/yyyy) |

|

||||||||||||||

|

|

|

Owner or |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

End Date |

/ |

/ |

|

|

(mm/dd/yyyy) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous Gross Monthly

Income $ |

|

/month |

1e. Income from Other Sources

Does not apply

Does not apply

Include income from other sources below. Under Income Source, choose from the sources listed here:

• Alimony |

• Child Support |

• Interest and Dividends |

• Notes Receivable |

• Royalty Payments |

• Unemployment |

• Automobile Allowance |

• Disability |

• Mortgage Credit Certificate |

• Public Assistance |

• Separate Maintenance |

Benefits |

• Boarder Income |

• Foster Care |

• Mortgage Differential |

• Retirement |

• Social Security |

• VA Compensation |

• Capital Gains |

• Housing or Parsonage |

Payments |

(e.g., Pension, IRA) |

• Trust |

• Other |

NOTE: Reveal alimony, child support, separate maintenance, or other income ONLY IF you want it considered in determining your qualification for this loan.

Income Source – use list above |

Monthly Income |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Provide TOTAL Amount Here |

$ |

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

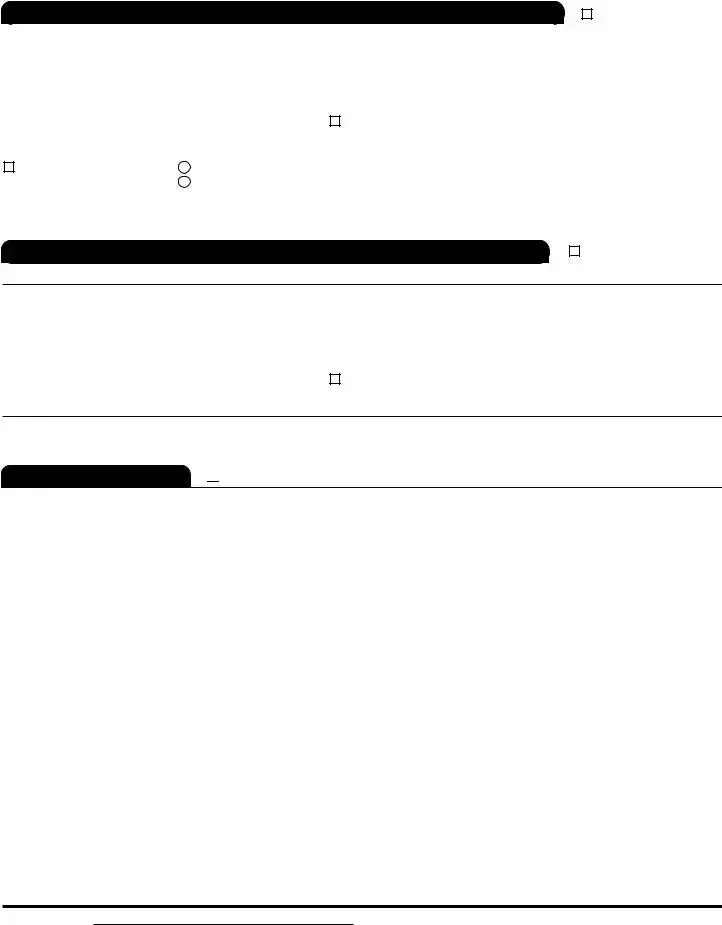

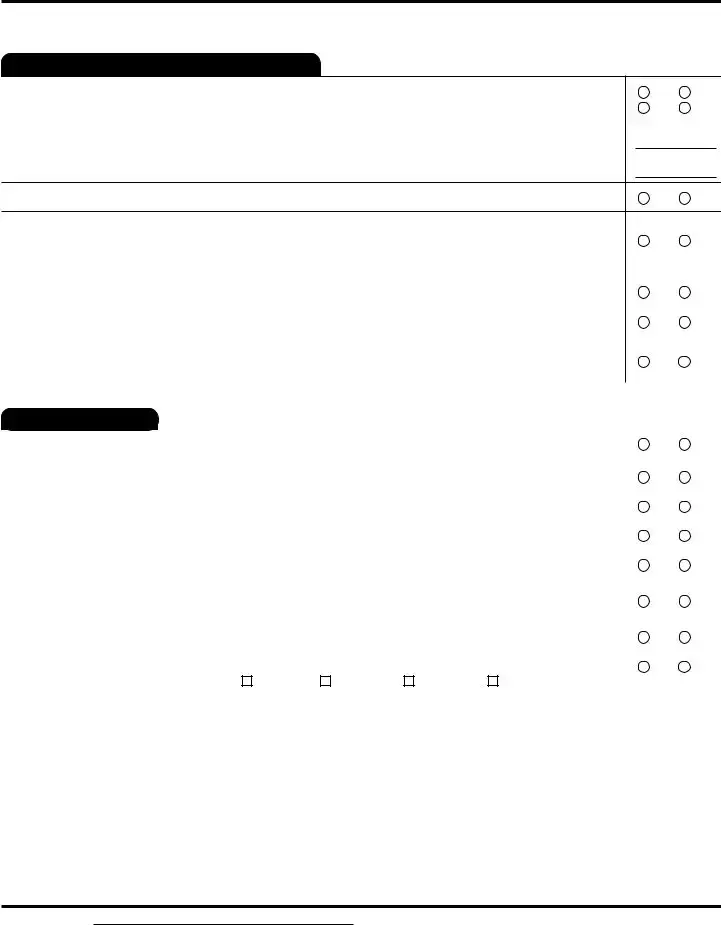

Section 2: Financial Information — Assets and Liabilities.This section asks about things you own that

are worth money and that you want considered to qualify for this loan. It then asks about your liabilities (or debts) that you pay each month, such as credit cards, alimony, or other expenses.

2a. Assets – Bank Accounts, Retirement, and Other Accounts You Have

Include all accounts below. Under Account Type, choose from the types listed here:

|

• Checking |

• Certificate of Deposit |

• Stock Options |

|

|

|

• Bridge Loan Proceeds |

|

• Trust Account |

|

|||||

|

• Savings |

• Mutual Fund |

• Bonds |

|

|

|

• Individual Development |

• Cash Value of Life Insurance |

|||||||

|

• Money Market |

• Stocks |

|

|

• Retirement (e.g., 401k, IRA) |

Account |

|

(used for the transaction) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Account Type – use list above |

Financial Institution |

|

|

Account Number |

|

|

|

Cash or Market Value |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Provide TOTAL Amount Here |

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2b. Other Assets and Credits You Have |

|

Does not apply |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Include all other assets and credits below. Under Asset or Credit Type, choose from the types listed here: |

|

|

|

|

|

||||||||||

|

Assets |

|

|

|

|

|

|

|

Credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

• Proceeds from Real Estate |

• Proceeds from Sale of |

• Unsecured Borrowed Funds |

• Earnest Money |

• Relocation Funds |

• Sweat Equity |

|||||||||

|

Property to be sold on or |

• Other |

|

|

|

• Employer Assistance |

• Rent Credit |

|

|

• Trade Equity |

|||||

|

before closing |

• Secured Borrowed Funds |

|

|

|

• Lot Equity |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset or Credit Type – use list above |

|

|

|

|

|

|

|

|

|

|

|

Cash or Market Value |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Provide TOTAL Amount Here |

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

2c. Liabilities – Credit Cards, Other Debts, and Leases that You Owe |

|

|

Does not apply |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List all liabilities below (except real estate) and include deferred payments. Under Account Type, choose from the types listed here:

• Revolving (e.g., credit cards) |

• Installment (e.g., car, student, personal loans) |

• Open |

||||

|

|

|

|

|

|

|

Account Type – |

|

|

|

|

To be paid off at |

|

use list above |

Company Name |

Account Number |

Unpaid Balance |

or before closing |

Monthly Payment |

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

2d. Other Liabilities and Expenses

Does not apply

Include all other liabilities and expenses below. Choose from the types listed here:

• Alimony |

• Child Support • Separate Maintenance • Job Related Expenses |

• Other |

Monthly Payment |

$

$

$

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

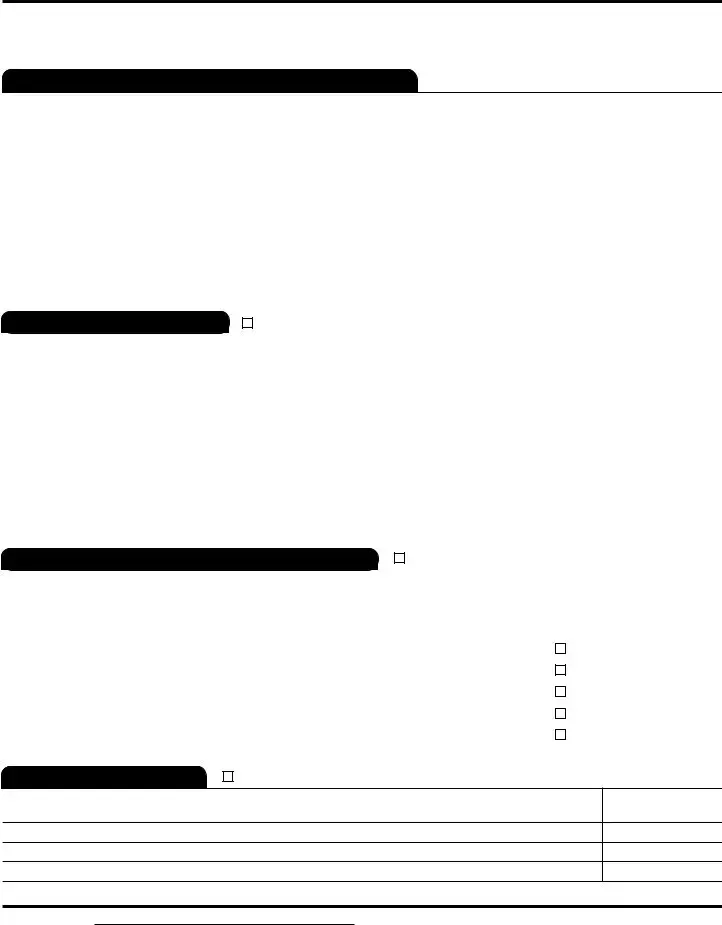

Section 3: Financial Information — Real Estate. This section asks you to list all properties you currently own

|

and what you owe on them. |

I do not own any real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3a. Property You Own |

|

If you are refinancing, list the property you are refinancing FIRST. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|

|

||||

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP |

|

|

|

Country |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status: Sold, |

Intended Occupancy: |

Monthly Insurance,Taxes, |

|

For |

||||||||||||||||||||

|

|

|

|

|

Investment, Primary |

Association Dues, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Pending Sale, |

|

Monthly Rental |

|

For LENDER to calculate: |

||||||||||||||||||||

|

|

|

|

|

Residence, Second |

if not included in Monthly |

|

|

|||||||||||||||||||||

|

Property Value |

or Retained |

|

Income |

|

Net Monthly Rental Income |

|||||||||||||||||||||||

|

Home, Other |

|

Mortgage Payment |

|

|

||||||||||||||||||||||||

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Mortgage Loans on this Property |

Does not apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

|

|

Type: FHA, VA, |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Mortgage |

|

|

|

To be paid off at |

|

Conventional, |

Credit Limit |

|||||||||||||

Creditor Name |

|

Account Number |

Payment |

Unpaid Balance |

or before closing |

|

(if applicable) |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

3b. IF APPLICABLE, Complete Information for Additional Property |

|

Does not apply |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP |

|

|

|

Country |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status: Sold, |

Intended Occupancy: |

Monthly Insurance, Taxes, |

|

For |

||||||||||||||||||||

|

|

|

|

|

Investment, Primary |

Association Dues, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Pending Sale, |

|

Monthly Rental |

|

For LENDER to calculate: |

||||||||||||||||||||

|

|

|

|

|

Residence, Second |

if not included in Monthly |

|

|

|||||||||||||||||||||

|

Property Value |

or Retained |

|

Income |

|

Net Monthly Rental Income |

|||||||||||||||||||||||

|

Home, Other |

|

Mortgage Payment |

|

|

||||||||||||||||||||||||

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mortgage Loans on this Property |

Does not apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

|

|

Type: FHA, VA, |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Mortgage |

|

|

|

To be paid off at |

|

Conventional, |

Credit Limit |

|||||||||||||

Creditor Name |

|

Account Number |

Payment |

Unpaid Balance |

or before closing |

|

(if applicable) |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3c. IF APPLICABLE, Complete Information for Additional Property |

|

Does not apply |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address |

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit # |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP |

|

|

|

Country |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status: Sold, |

Intended Occupancy: |

Monthly Insurance, Taxes, |

|

For |

||||||||||||||||||||

|

|

|

|

|

Investment, Primary |

Association Dues, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Pending Sale, |

|

Monthly Rental |

|

For LENDER to calculate: |

||||||||||||||||||||

|

Property Value |

Residence, Second |

if not included in Monthly |

|

|

||||||||||||||||||||||||

|

or Retained |

Home, Other |

|

Mortgage Payment |

|

Income |

|

Net Monthly Rental Income |

|||||||||||||||||||||

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Mortgage Loans on this Property |

Does not apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

|

|

Type: FHA, VA, |

|

|

|

|

|

|||||

|

|

|

|

|

|

Account Number |

Mortgage |

|

|

|

To be paid off at |

|

Conventional, |

Credit Limit |

|||||||||||||||

Creditor Name |

|

Payment |

Unpaid Balance |

or before closing |

|

(if applicable) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

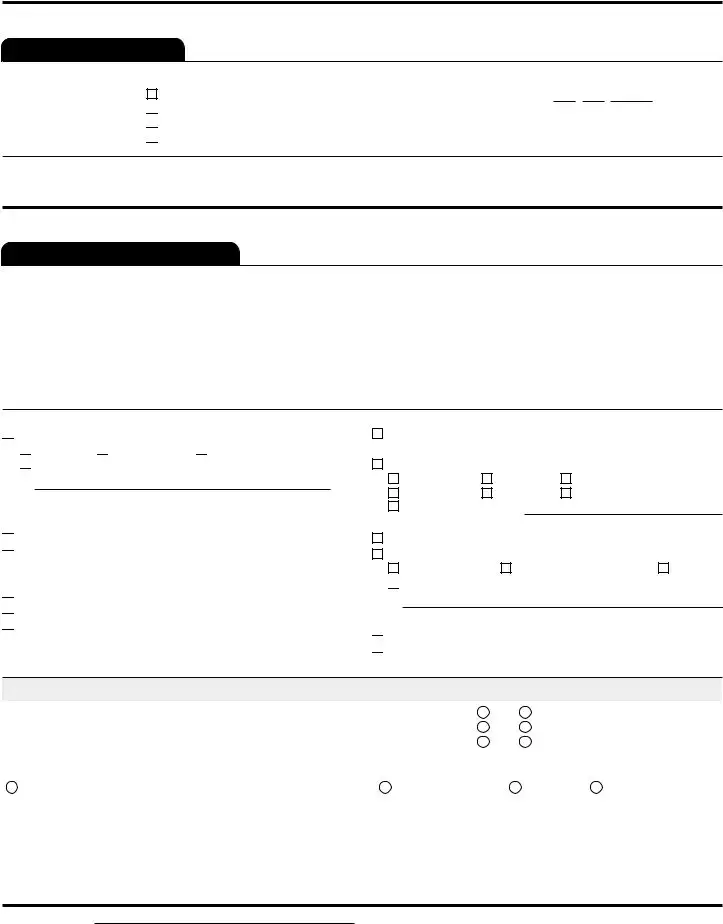

Section 4: Loan and Property Information. This section asks about the loan’s purpose and the property you want to purchase or refinance.

4a. Loan and Property Information

Loan Amount $ |

|

|

Loan Purpose |

Purchase |

Refinance |

Other (specify) |

|

|

|

|

|

|||||||

Property Address Street |

|

|

|

|

|

|

|

|

|

|

|

Unit # |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

ZIP |

|

|

County |

|

|

||||

|

Number of Units |

|

Property Value $ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Occupancy |

Primary Residence |

Second Home |

Investment Property |

FHA Secondary Residence |

|

|

|

|

|

||||

1. |

NO |

YES |

||||

your own business? (e.g., daycare facility, medical office, beauty/barber shop) |

|

|

||||

|

|

|

|

|||

2. Manufactured Home. Is the property a manufactured home? (e.g., a factory built dwelling built on a permanent chassis) |

NO |

YES |

||||

|

|

|

|

|

|

|

4b. Other New Mortgage Loans on the Property You are Buying or Refinancing

Does not apply

Does not apply

|

|

|

|

|

|

|

|

|

|

|

Loan Amount/ |

Credit Limit |

|

|

Creditor Name |

|

Lien Type |

|

|

|

Monthly Payment |

|

Amount to be Drawn |

(if applicable) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Lien |

Subordinate Lien |

$ |

|

|

|

$ |

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Lien |

Subordinate Lien |

$ |

|

|

|

$ |

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c. Rental Income on the Property You Want to Purchase |

|

For Purchase Only |

Does not apply |

|

|

|||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

Complete if the property is a |

|

|

Amount |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Expected Monthly Rental Income |

|

|

|

|

|

|

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

For LENDER to calculate: Expected Net Monthly Rental Income |

|

|

|

|

|

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|||||

|

4d. Gifts or Grants You Have Been Given or Will Receive for this Loan |

|

Does not apply |

|

|

||||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||

Include all gifts and grants below. Under Source, choose from the sources listed here: |

|

|

|

|

|||||||||

|

• Community Nonprofit |

• Federal Agency |

• Relative |

|

|

|

• State Agency |

|

• Lender |

|

|

||

|

• Employer |

• Local Agency |

• Religious Nonprofit |

|

• Unmarried Partner |

• Other |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

Asset Type: Cash Gift, Gift of Equity, Grant |

Deposited/Not Deposited |

Source – use list above |

Cash or Market Value |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposited |

|

Not Deposited |

|

|

|

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposited |

|

Not Deposited |

|

|

|

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

Section 5: Declarations. This section asks you specific questions about the property, your funding, and your past financial history.

5a. About this Property and Your Money for this Loan

A. Will you occupy the property as your primary residence? |

NO |

YES |

If YES, have you had an ownership interest in another property in the last three years? |

NO |

YES |

If YES, complete (1) and (2) below: |

|

|

(1)What type of property did you own: primary residence (PR), FHA secondary residence (SR), second home (SH), or investment property (IP)?

(2)How did you hold title to the property: by yourself (S), jointly with your spouse (SP), or jointly with another person (O)?

B. If this is a Purchase Transaction: Do you have a family relationship or business affiliation with the seller of the property? |

NO |

YES |

C.Are you borrowing any money for this real estate transaction (e.g., money for your closing costs or down payment) or

|

|

obtaining any money from another party, such as the seller or realtor, that you have not disclosed on this loan application? |

|

NO |

YES |

||||||

|

|

If YES, what is the amount of this money? |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. 1. Have you or will you be applying for a mortgage loan on another property (not the property securing this loan) on or |

|

NO |

YES |

||||||||

|

|

before closing this transaction that is not disclosed on this loan application? |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

2. Have you or will you be applying for any new credit (e.g., installment loan, credit card, etc.) on or before closing this loan that |

|

NO |

YES |

||||||

|

|

is not disclosed on this application? |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

E. |

Will this property be subject to a lien that could take priority over the first mortgage lien, such as a clean energy lien paid |

|

NO |

YES |

|||||||

|

|

through your property taxes (e.g., the Property Assessed Clean Energy Program)? |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

5b. About Your Finances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

F. |

Are you a |

|

|

NO |

YES |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

G. |

Are there any outstanding judgments against you? |

|

|

|

|

NO |

YES |

||||

|

|

|

|

|

|

|

|

|

|

|

|

H. |

Are you currently delinquent or in default on a Federal debt? |

|

|

|

|

NO |

YES |

||||

|

|

|

|

|

|

|

|

|

|||

I. |

Are you a party to a lawsuit in which you potentially have any personal financial liability? |

|

|

NO |

YES |

||||||

|

|

|

|

|

|

|

|

|

|||

J. |

Have you conveyed title to any property in lieu of foreclosure in the past 7 years? |

|

|

NO |

YES |

||||||

|

|

|

|

|

|

|

|||||

K. Within the past 7 years, have you completed a |

|

NO |

YES |

||||||||

|

|

third party and the Lender agreed to accept less than the outstanding mortgage balance due? |

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

L. |

Have you had property foreclosed upon in the last 7 years? |

|

|

|

|

NO |

YES |

||||

|

|

|

|

|

|

|

|

|

|

||

M. Have you declared bankruptcy within the past 7 years? |

|

|

|

|

NO |

YES |

|||||

|

|

If YES, identify the type(s) of bankruptcy: |

Chapter 7 |

Chapter 11 |

Chapter 12 |

Chapter 13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

Section 6: Acknowledgments and Agreements. This section tells you about your legal obligations when you sign this application.

Acknowledgments and Agreements

Definitions: |

• If this application is created as (or converted into) an “electronic |

|

• "Lender" includes the Lender’s agents, service providers, and any of |

application”, I consent to the use of “electronic records” and |

|

their successors and assigns. |

“electronic signatures” as the terms are defined in and governed by |

|

• "Other Loan Participants" includes (i) any actual or potential owners of |

applicable Federal and/or state electronic transactions laws. |

|

a loan resulting from this application (the “Loan”), (ii) acquirers of |

• I intend to sign and have signed this application either using my: |

|

any beneficial or other interest in the Loan, (iii) any mortgage insurer, |

(a) electronic signature; or |

|

(iv) any guarantor, (v) any servicer of the Loan, and (vi) any of these |

(b) a written signature and agree that if a paper version of this |

|

parties' service providers, successors or assigns. |

application is converted into an electronic application, the |

|

I agree to, acknowledge, and represent the following: |

application will be an electronic record, and the representation |

|

of my written signature on this application will be my binding |

||

(1) The Complete Information for this Application |

||

electronic signature. |

||

• The information I have provided in this application is true, accurate, |

• I agree that the application, if delivered or transmitted to the Lender |

|

and complete as of the date I signed this application. |

||

or Other Loan Participants as an electronic record with my electronic |

||

• If the information I submitted changes or I have new information |

||

signature, will be as effective and enforceable as a paper application |

||

before closing of the Loan, I must change and supplement this |

||

signed by me in writing. |

||

application, including providing any updated/supplemented real |

||

(5) Delinquency |

||

estate sales contract. |

||

• The Lender and Other Loan Participants may report information about |

||

• For purchase transactions: The terms and conditions of any real |

||

my account to credit bureaus. Late payments, missed payments, or |

||

estate sales contract signed by me in connection with this application |

||

other defaults on my account may be reflected in my credit report and |

||

are true, accurate, and complete to the best of my knowledge and |

||

will likely affect my credit score. |

||

belief. I have not entered into any other agreement, written or oral, in |

||

• If I have trouble making my payments I understand that I may contact |

||

connection with this real estate transaction. |

||

a |

||

• The Lender and Other Loan Participants may rely on the information |

||

actions I can take to meet my mortgage obligations. |

||

contained in the application before and after closing of the Loan. |

||

|

||

• Any intentional or negligent misrepresentation of information may |

(6) Authorization for Use and Sharing of Information |

|

result in the imposition of: |

By signing below, in addition to the representations and agreements |

|

(a) civil liability on me, including monetary damages, if a |

made above, I expressly authorize the Lender and Other Loan |

|

person suffers any loss because the person relied on any |

Participants to obtain, use, and share with each other (i) the loan |

|

misrepresentation that I have made on this application, and/or |

application and related loan information and documentation, (ii) a |

|

(b) criminal penalties on me including, but not limited to, fine or |

consumer credit report on me, and (iii) my tax return information, as |

|

imprisonment or both under the provisions of Federal law |

necessary to perform the actions listed below, for so long as they have |

|

(18 U.S.C. §§ 1001 et seq.). |

an interest in my loan or its servicing: |

|

(2) The Property’s Security |

(a) process and underwrite my loan; |

|

(b) verify any data contained in my consumer credit report, my |

||

The Loan I have applied for in this application will be secured by |

||

loan application and other information supporting my loan |

||

a mortgage or deed of trust which provides the Lender a security |

||

application; |

||

interest in the property described in this application. |

||

(c) inform credit and investment decisions by the Lender |

||

(3) The Property’s Appraisal, Value, and Condition |

||

and Other Loan Participants; |

||

• Any appraisal or value of the property obtained by the Lender is |

(d) perform audit, quality control, and legal compliance analysis |

|

for use by the Lender and Other Loan Participants. |

||

and reviews; |

||

• The Lender and Other Loan Participants have not made any |

||

(e) perform analysis and modeling for risk assessments; |

||

representation or warranty, express or implied, to me about the |

||

(f) monitor the account for this loan for potential delinquencies and |

||

property, its condition, or its value. |

||

determine any assistance that may be available to me; and |

||

|

||

(4) Electronic Records and Signatures |

(g) other actions permissible under applicable law. |

|

• The Lender and Other Loan Participants may keep any paper record |

|

|

and/or electronic record of this application, whether or not the Loan |

|

|

is approved. |

|

Borrower Signature |

|

Date (mm/dd/yyyy) |

/ |

/ |

||

|

|

|

|

|

|

|

Additional Borrower Signature |

|

Date (mm/dd/yyyy) |

/ |

/ |

||

|

|

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

Section 7: Military Service. This section asks questions about your (or your deceased spouse's) military service.

Military Service of Borrower

Military Service – Did you (or your deceased spouse) ever serve, or are you currently serving, in the United States Armed Forces?  NO

NO  YES

YES

If YES, check all that apply: |

Currently serving on active duty with projected expiration date of service/tour |

/ |

/ |

(mm/dd/yyyy) |

Currently retired, discharged, or separated from service

Currently retired, discharged, or separated from service

Only period of service was as a

Only period of service was as a

Surviving spouse

Surviving spouse

Section 8: Demographic Information. This section asks about your ethnicity, sex, and race.

Demographic Information of Borrower

The purpose of collecting this information is to help ensure that all applicants are treated fairly and that the housing needs of communities and neighborhoods are being fulfilled. For residential mortgage lending, Federal law requires that we ask applicants for their demographic information (ethnicity, sex, and race) in order to monitor our compliance with equal credit opportunity, fair housing, and home mortgage disclosure laws. You are not required to provide this information, but are encouraged to do so. You may select one or more designations for "Ethnicity" and one or more designations for "Race." The law provides that we may not discriminate on the basis of this information, or on whether you choose to provide it. However, if you choose not to provide the information and you have made this application in person, Federal regulations require us to note your ethnicity, sex, and race on the basis of visual observation or surname. The law also provides that we may not discriminate on the basis of age or marital status information you provide in this application. If you do not wish to provide some or all of this information, please check below.

Ethnicity: Check one or more

Hispanic or Latino

Hispanic or Latino

Mexican

Mexican

Puerto Rican

Puerto Rican

Cuban

Cuban

Other Hispanic or Latino – Print origin:

Other Hispanic or Latino – Print origin:

For example: Argentinean, Colombian, Dominican, Nicaraguan, Salvadoran, Spaniard, and so on.

Not Hispanic or Latino

Not Hispanic or Latino

I do not wish to provide this information

I do not wish to provide this information

Sex

Female

Female

Male

Male

I do not wish to provide this information

I do not wish to provide this information

Race: Check one or more

American Indian or Alaska Native or principal tribe :

Asian |

|

|

Asian Indian |

Chinese |

Filipino |

Japanese |

Korean |

Vietnamese |

Other Asian – Print race: |

|

|

For example: Hmong, Laotian, Thai, Pakistani, Cambodian, and so on.

Black or African American |

|

|

Native Hawaiian or Other Pacific Islander |

|

|

Native Hawaiian |

Guamanian or Chamorro |

Samoan |

Other Pacific Islander – Print race:

Other Pacific Islander – Print race:

For example: Fijian, Tongan, and so on.

White

White

I do not wish to provide this information

I do not wish to provide this information

To Be Completed by Financial Institution (for application taken in person):

Was the ethnicity of the Borrower collected on the basis of visual observation or surname? |

NO |

YES |

|

|

Was the sex of the Borrower collected on the basis of visual observation or surname? |

NO |

YES |

|

|

Was the race of the Borrower collected on the basis of visual observation or surname? |

NO |

YES |

|

|

|

|

|

|

|

The Demographic Information was provided through: |

|

|

|

|

|

|

|

|

|

Telephone Interview |

Fax or Mail |

Email or Internet |

||

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

Section 9: Loan Originator Information. To be completed by your Loan Originator.

Loan Originator Information

Loan Originator Organization Name

Address

Loan Originator Organization NMLSR ID# |

|

State License ID# |

|

|

|

|

|

|

|

||||||

Loan Originator Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loan Originator NMLSR ID# |

|

|

State License ID# |

|

|

|

|

|

|

|

|

||||

|

|

|

Phone ( |

) |

|

|

|

– |

|

||||||

Signature |

|

|

Date (mm/dd/yyyy) |

/ |

|

/ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower Name:

Uniform Residential Loan Application

Freddie Mac Form 65 • Fannie Mae Form 1003

Effective 1/2021

Form Data

| Fact | Detail |

|---|---|

| Form Name and Number | Freddie Mac Form 65, also known as Fannie Mae Form 1003 |

| Effective Date | Effective 1/2021 |

| Purpose | Uniform Residential Loan Application |

| Borrower Information | Asks about personal information, income, employment, and other sources of income to qualify for the loan. |

| Financial Information | Details assets, liabilities, real estate owned, and other debts or expenses. |

| Loan and Property Information | Covers the purpose of the loan, property details, new mortgage loans, rental income, and gifts or grants received. |

Instructions on Utilizing Freddie Mac 65

Filling out the Freddie Mac 65 form, also known as the Uniform Residential Loan Application, is a necessary step in applying for a mortgage. This comprehensive form collects detailed information about the borrower's personal and financial situation, which lenders use to make decisions on lending. It's important to fill out the form accurately and thoroughly to improve your chances of being approved for the loan. The following steps provide guidance on how to complete this form correctly.

- Start with Section 1: Borrower Information. Fill in your full legal name, including any alternate names used previously. Provide your Social Security Number or Individual Taxpayer Identification Number, date of birth, citizenship status, and type of credit you are applying for (individual or joint).

- Enter the total number of borrowers and if applying for joint credit, include the names of other borrowers.

- Detail your marital status and if you have any dependents not listed by another borrower, including their ages.

- Provide your contact information, including home, cell, and work phone numbers, and your email address.

- Fill in your current residential address, how long you have lived there, and your housing situation (own or rent).

- If you have lived at your current address for less than 2 years, provide details of your former address.

- For Section 1b, detail your current employment, including employer name, your position, start date, and your gross monthly income from various sources like base salary, overtime, and bonuses.

- If applicable, complete Section 1c and 1d for additional employment or previous employment, following the same format as Section 1b.

- In Section 1e, list any income from other sources you wish to be considered for this loan, like alimony or child support. Specify the source and monthly income.

- Move to Section 2: Financial Information — Assets and Liabilities. List all bank accounts, retirement accounts, and any other financial assets under 2a. Include the account type, institution, number, and value.

- Under 2b, mention other assets or credits, detailing the type and cash or market value.

- In 2c, list all liabilities excluding real estate. Include type, company name, account number, unpaid balance, and monthly payment.

- Include any additional liabilities and expenses under 2d.

- For homeowners, Section 3: Financial Information — Real Estate requires listing properties owned. Provide details such as address, status, occupancy, monthly costs, mortgage loans, and rental income if applicable.

- In Section 4: Loan and Property Information, describe the loan's purpose, the property address, the expected loan amount, property value, and occupancy details. Highlight if the property is mixed-use or manufactured and any expected rental income.

- Detail any gifts or grants under 4d, specifying the source and amount.

Once all sections are completed accurately, review the information to ensure its correctness. Incorrect or incomplete information can delay the processing of your loan application. Submit the form as directed by your lender.

Obtain Answers on Freddie Mac 65

When navigating the home-buying process, understanding the paperwork is crucial, and the Freddie Mac Form 65, also known as the Uniform Residential Loan Application (URLA), is a key part of this. Here are some common questions that arise about this form:

- What is the purpose of Freddie Mac Form 65?

The Freddie Mac Form 65, or URLA, is designed to collect detailed information from potential borrowers to determine their eligibility for a mortgage. This form gathers personal information, income details, and financial information about assets and liabilities, as well as information about the property being purchased or refinanced. It's a standard form used across the industry to ensure lenders have the necessary information to make informed decisions about loan approvals.

- Who needs to complete the Freddie Mac Form 65?

Anyone applying for a mortgage loan is required to complete the Freddie Mac Form 65. If there are co-borrowers on the loan, such as a spouse or partner, they must also provide their information on the application. This ensures that the lender has a complete picture of the financial situation of all parties involved in the loan.

- What sections are included in the Freddie Mac Form 65?

The form is divided into several sections, each focusing on different aspects of the borrower's information:

- Section 1: Borrower Information - Collects personal details, employment history, and income sources.

- Section 2: Financial Information - Details assets, liabilities, and any other financial obligations or assets.

- Section 3: Real Estate - For listing properties owned by the borrower and related financial details.

- Section 4: Loan and Property Information - Specifics about the loan being applied for and details about the property.

Each section is designed to provide the lender with a comprehensive understanding of the borrower's financial health and the specifics of the loan request.

- Are there any tips for completing the Freddie Mac Form 65?