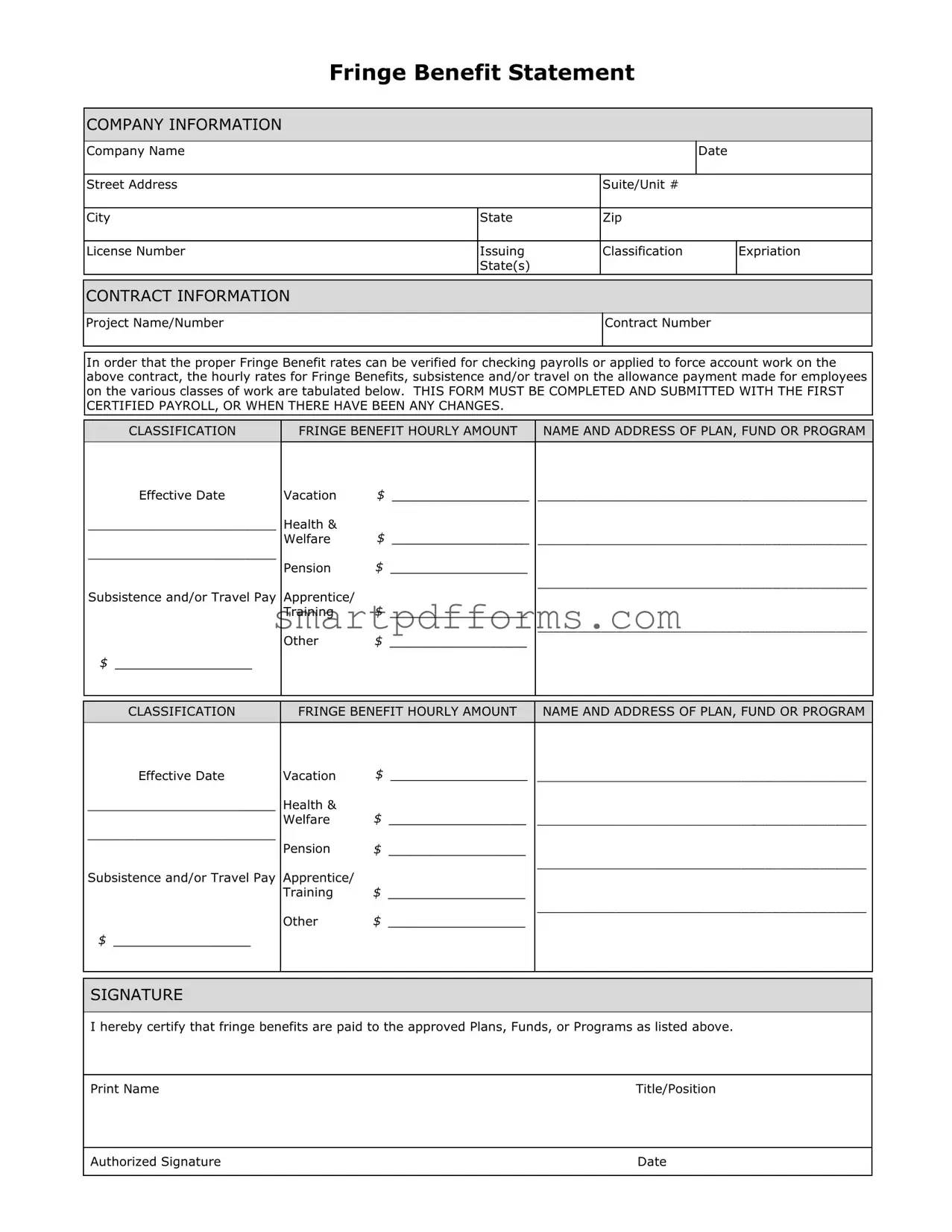

Blank Fringe Benefit PDF Template

When navigating the complexities of employment compensation, understanding the nuances of the Fringe Benefit form becomes crucial. This document plays an essential role in outlining additional compensation beyond regular salary or wages, encompassing elements such as health insurance, retirement plans, and paid time off, among others. Given its significance, both employers and employees must approach this form with thorough attention to detail, ensuring that all provided benefits are accurately documented and in compliance with applicable tax regulations. The task involves not just a meticulous documentation of benefits but also a clear understanding of which perks are considered taxable and how they impact overall compensation. With the potential to influence employee satisfaction and financial well-being significantly, the preparative process involves a careful review of all benefits, a keen understanding of legal requirements, and an ongoing commitment to transparency and fairness in compensation practices. By spotlighting these major aspects, individuals and organizations can navigate the intricacies of fringe benefits more effectively, fostering a more supportive and equitable work environment.

Preview - Fringe Benefit Form

|

|

|||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

!" |

# |

&'! |

|

() |

|

$% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*!"

!"

22#,'!"/''!2!7#&&&'!!!872

"/!!.22&'#,'."!/&2&&8!'&

|

|

|

|

(( .+ |

|||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

(''!/ |

1! |

000000000000000000000000000000000000000000 |

||||||||||||||

000000000000000000000000 |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

000000000000000000000000000000000000000000 |

||||||||||||||||||

|

|

|

|

4&' |

|||||||||||||||

000000000000000000000000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

||||||||||||||||||

|

|

|

|

|

|

||||||||||||||

"!/& |

! |

|

|

|

|

|

|

|

|

|

|

000000000000000000000000000000000000000000 |

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|||||||||||||||

|

|

|

|

# |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000000000000000000000000000000000000000000 |

|

|

|

|

2 |

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

(( .+ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

(''!/ |

1! |

|

000000000000000000000000000000000000000000 |

|||||||||||||

000000000000000000000000 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

000000000000000000000000000000000000000000 |

|||||||||||||

|

|

|

|

4&' |

|

||||||||||||||

000000000000000000000000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

||||||||||||||

"!/& |

! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000000000000000000000000000000000000000000 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

# |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000000000000000000000000000000000000000000 |

|

|

|

|

2 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+(

2"!'2'#"'2/&..#&"/5

&

26#

Form Data

| Fact Name | Description |

|---|---|

| Purpose | This form is used to report the value of certain fringe benefits provided to employees and may include benefits like health insurance, educational assistance, or the use of a company car. |

| Reporting Requirement | Employers must annually report the value of the provided fringe benefits to ensure compliance with tax regulations. |

| State-Specific Variations | Some states have their own requirements or forms for reporting fringe benefits. These are governed by individual state laws and regulations. |

| Impact on Employees | Employees may see an impact on their taxable income, depending on the type and value of fringe benefits reported. |

Instructions on Utilizing Fringe Benefit

Filling out the Fringe Benefit form is an essential step for accurately reporting and managing employment benefits. This documentation is necessary for maintaining clear records and ensuring that all provided benefits are correctly accounted for. The process might seem complicated at first glance, but by following these steps, the task will be completed efficiently and accurately.

- Start by reading through the entire form to familiarize yourself with the required information.

- Enter the employee's identification details in the specified areas. This includes their full name, employee number, and department.

- Review the list of fringe benefits provided by your organization to ensure you report accurately. These may include health insurance, retirement plans, or company cars.

- For each benefit, enter the corresponding code from the form's code list into the designated field next to the employee's information.

- Specify the monetary value of each fringe benefit in the respective columns. If a benefit does not have a direct monetary value, use the guidelines provided with the form to estimate its value correctly.

- After filling out the details for all relevant fringe benefits, double-check each field for accuracy. Mistakes or inaccuracies can lead to reporting issues or discrepancies.

- If the form provides a section for comments or additional notes, use this space to clarify any unusual circumstances or to provide further details about certain entries.

- Before submitting the form, ensure it is signed and dated in the appropriate section. This may require the employee's signature, a supervisor's, or both, depending on your organization's policies.

- Follow your organization's procedure for submitting the completed form. This might involve sending it to your human resources department, a financial officer, or uploading it to a digital record-keeping system.

After the form is submitted, it will be reviewed for completeness and accuracy. The information provided helps in managing and reporting the costs associated with employment beyond salaries. Correctly documented fringe benefits are crucial for both tax reporting and for employees to understand the full value of their compensation package.

Obtain Answers on Fringe Benefit

-

What is a Fringe Benefit form?

A Fringe Benefit form is a document used by employers to report the value of certain benefits provided to employees beyond their salaries. These benefits can include health insurance, retirement plans, educational assistance, and more. This form helps in ensuring these benefits are accounted for properly in tax filings and internal records.

-

Who needs to fill out a Fringe Benefit form?

Employers who offer fringe benefits as part of their compensation package to employees are required to fill out this form. It's crucial for accurately reporting the value of non-cash benefits to tax authorities and for employee records. It's not typically the responsibility of the employee to fill out this form, but they might need to provide certain information to their employer to complete it.

-

What kinds of benefits are reported on this form?

The Fringe Benefit form records various types of non-wage compensation. Common examples include:

- Health insurance premiums paid by the employer

- Contributions to retirement savings plans

- Tuition reimbursement

- Life insurance

- Use of a company car for personal purposes

These benefits contribute to the total compensation an employee receives and are important for both financial planning and compliance reasons.

-

When should the Fringe Benefit form be submitted?

The submission deadlines for the Fringe Benefit form can vary depending on tax laws and the individual policies of the business or organization. Generally, this form must be completed and submitted at the end of the fiscal or calendar year, in time for tax filing season. Employers should consult their tax advisors or the IRS guidelines for specific deadlines relevant to their situation.

-

How does the information on this form affect an employee's taxes?

The value of fringe benefits is typically considered taxable income and can affect an employee's tax liabilities. Reporting these benefits accurately ensures that employees' income information is correct for tax purposes, preventing potential issues with underreported income. In some cases, certain benefits may be exempt from taxes, depending on the type and amount of benefit, as well as IRS rules.

Common mistakes

When filling out the Fringe Benefit form, some common mistakes can lead to delays or issues. Here's a rundown to help ensure everything goes smoothly:

Not double-checking the information for accuracy. It's crucial to review every section to avoid errors that can complicate processing.

Skipping sections that are applicable. Sometimes, people rush through the form and miss sections relevant to their situation.

Failing to update personal information. If any personal details have changed since the last submission, they need to be corrected.

Using incorrect identifiers or codes. Each benefit has specific codes associated with it, and using the wrong ones can lead to misprocessing.

Forgetting to include necessary documentation. Some benefits require additional documents for verification; not including these can halt the process.

Entering information in the wrong section. This can confuse the form processors and delay benefit allocation.

Omitting the signature and date. Without these, the form is considered incomplete and won't be processed.

Not retaining a copy for personal records. It's always wise to keep a copy of submitted forms in case questions or issues arise later.

Here are a few tips to avoid these mistakes:

Take your time when filling out the form to ensure all information is complete and accurate.

Use the latest form version to ensure compliance with current guidelines.

Review instructions carefully to understand what information goes where and which documents need to be included.

Finally, ask for help if you're unsure about any part of the form. It’s better to ask than to make an error that could have been avoided.

Documents used along the form

When managing employee benefits and compensation, businesses often use a variety of forms and documents to ensure that all aspects are properly documented and in compliance with federal and state regulations. The Fringe Benefit form is just one essential piece of documentation among many that businesses may need. This form is used to record any additional benefits employees receive beyond their usual wages, such as health insurance, retirement contributions, or transportation subsidies, providing a clear record for both the employer and the employee. Alongside the Fringe Benefit form, there are several other important documents that play a critical role in employee benefits administration.

- W-4 Form: This document is filled out by employees to indicate their tax withholding preferences. It helps employers withhold the correct federal income tax from employees' paychecks.

- I-9 Form: Required by the U.S. Citizenship and Immigration Services, this form verifies an employee's eligibility to work in the United States. Both the employee and the employer need to complete it.

- Employee Handbook Acknowledgement Receipt: This form is a confirmation that the employee has received, read, and understood the company's handbook, which often includes information on employee benefits, company policies, and procedures.

- Health Insurance Enrollment Form: Used by employees to enroll in company-provided health insurance plans, this document captures personal information, dependents, and selected coverage options.

- Retirement Plan Enrollment Form: For employees who wish to participate in company-offered retirement plans, such as 401(k)s, this form captures participation consent and investment selections.

Together, these forms ensure that the necessary information is captured and tracked effectively, helping employers provide accurate benefits and comply with legal requirements. Proper documentation supports transparency and good governance within the workplace, creating a structured and supportive environment for both employees and employers. Regularly reviewing and updating these documents is critical to reflect any changes in employees' status, benefits modifications, or updates in legal guidelines.

Similar forms

The W-2 Form shares similarities with the Fringe Benefit form because it provides information on an employee's annual wages and tax deductions. Both forms are essential for tax preparation by detailing compensation received by the employee.

The 1099-MISC Form is akin to the Fringe Benefit form since it reports payments made to independent contractors or freelancers, including non-employee compensation, which may resemble certain fringe benefits for tax purposes.

Comparable to the Fringe Benefit form, the W-4 Form involves the employee's financial information by allowing employees to specify their tax withholdings. This directly affects how fringe benefits are taxed.

The Expense Reimbursement Form is similar because it involves the reporting of expenses paid by employees that are subsequently reimbursed by the employer, which can be considered a type of fringe benefit.

A Health Insurance Enrollment Form is related as it details an employee's selections for health insurance benefits offered by their employer, illustrating another form of a fringe benefit.

Like the Fringe Benefit form, the 401(k) Contribution Form captures decisions made by the employee regarding retirement savings contributions, which is a voluntary fringe benefit provided by many employers.

The Employee Stock Option Agreement bears resemblance in that it details an unconventional compensation method, offering employees the right to buy company stock at a future date and price, mirroring the nature of certain fringe benefits.

The Time Off Request Form relates to the setup of fringe benefits, specifically paid time off, where employees submit their requests for employer-approved leave.

An Education Assistance Form parallels the Fringe Benefit form as it outlines the support an employer provides for further education, which is a benefit beyond regular compensation.

Dos and Don'ts

Completing the Fringe Benefit form correctly is essential for ensuring accurate reporting and compliance with tax regulations. Be mindful of the following dos and don'ts to avoid common mistakes:

Do:Read all instructions carefully before starting to fill out the form. This helps in understanding what information is required and where.

Ensure all the information provided is current and accurate, including personal details and the value of fringe benefits.

Use a black or blue pen if filling out the form by hand, as these colors are the most legible and universally accepted.

Keep records of all documents and calculations you used to determine the value of the fringe benefits reported.

Double-check all calculations and the total value of fringe benefits to ensure accuracy.

Consult with a tax professional or the IRS guidelines if you are unsure about how to value a specific fringe benefit.

Submit the form by the deadline to avoid penalties.

Don't overlook any fringe benefits, including those that might seem insignificant. They all need to be reported.

Don't guess the value of any fringe benefits. Use the actual cost or the fair market value.

Don't use correction fluid or tape on the form. If you make a mistake, it is better to start with a fresh form to maintain legibility.

Don't leave any fields blank. If a section does not apply, write "N/A" (not applicable) rather than leaving it empty.

Don't use abbreviations or nicknames. Always provide full names and accurate descriptions as required.

Don't file the form without reviewing it for completeness and accuracy. Missing or incorrect information can lead to processing delays or inquiries.

Don't forget to make a copy of the completed form for your records before submitting it. This will be helpful for future reference or if any questions arise.

Misconceptions

Fringe benefits can often be misunderstood due to their complexity and the unique nature of each benefit. Below are four common misconceptions about the Fringe Benefit form:

- Fringe benefits are taxable income. This is partially true. While some fringe benefits are considered taxable and must be included in an employee's pay, others are not taxable or are only partially taxable. The taxability depends on the type and value of fringe benefits provided.

- All employees receive the same fringe benefits. In reality, the type and amount of fringe benefits an employee might receive can vary greatly depending on their employment agreement, status, and sometimes their negotiation skills. Companies often tailor fringe benefit packages to meet the needs of different employees.

- Fringe Benefit forms are overly complicated and only necessary for large companies. While it’s true that the documentation can be detailed, the purpose behind the Fringe Benefit form is to ensure proper reporting and compliance with tax laws, which applies to businesses of all sizes. Proper documentation benefits both the employee and the employer by providing clear records of all compensation types.

- Only standard benefits like health insurance and retirement plans are included on the Fringe Benefit form. Actually, a wide variety of benefits can be reported on the Fringe Benefit form, including those not typically considered standard benefits, such as employee discounts, the use of a company car, or reimbursement for education expenses. Understanding the full scope of fringe benefits can help employees and employers alike take full advantage of available opportunities.

Key takeaways

When managing fringe benefits for employees, understanding how to properly fill out and use the Fringe Benefit Form is essential. These key takeaways aim to clarify the process, ensuring both compliance and accuracy.

- Ensure accuracy in documentation by carefully entering employee information, as this is crucial for compliance with tax laws and for accurate record-keeping.

- Understand the different categories of fringe benefits provided, such as health insurance, life insurance, education assistance, and transportation benefits, to accurately list them on the form.

- Accurately valuing fringe benefits is essential. This involves interpreting current tax laws to determine the fair market value of each benefit for reporting purposes.

- Be aware of any tax implications for specific benefits. Some fringe benefits are tax-exempt, while others must be included in an employee’s gross income and are subject to taxes.

- Regularly review updates to tax laws and regulations related to fringe benefits to ensure ongoing compliance and to leverage any new tax advantages.

- Keep detailed records of all fringe benefits offered, including documentation on how each benefit’s value was determined and reports of distributed benefits.

- Use the Fringe Benefit Form as part of an in-depth strategy for employee compensation. This not only aids in financial planning but also in crafting competitive benefits packages.

- Communicate clearly with employees about the benefits they receive. Providing detailed explanations can help in understanding the value of their compensation package beyond the salary.

- Consult with a tax professional or legal advisor to review the Fringe Benefit Form before submission, ensuring that it meets all required regulations and laws.

By focusing on these key areas, employers can manage the complexities of fringe benefits more effectively, ensuring that both the business and its employees make the most out of these offerings. Proper use of the Fringe Benefit Form is not only a matter of compliance but is also integral to strategic financial and human resource planning.

Popular PDF Forms

Usa Patriot Act Independent Review - Assists in identifying areas at high risk for money laundering, prompting enhanced scrutiny and preventive measures.

609 Letter to Debt Collector - Helps in bolstering the accuracy of credit information, granting consumers a fair chance at obtaining favorable credit terms.