Blank Fs1522 PDF Template

The FS Form 1522 serves as a crucial document for individuals seeking payment for United States Savings and Retirement Securities when a detached request is authorized. This meticulously revised form, updated as of November 2021, ensures a streamlined process for claims on savings bonds, savings notes, retirement plan bonds, and individual retirement bonds under specific circumstances. The form requires detailed information regarding the bonds in question, including their registration details and serial numbers, and mandates that payees provide either a Social Security Number or an Employer Identification Number for direct deposit payments. Notably, the form also emphasizes the imperative to follow instructions carefully to avoid making false, fictitious, or fraudulent claims, which are prosecutable offenses in the United States. The sections within the form guide the payee through the process of describing the bonds, setting up direct deposit payments, and affirming their identity and eligibility under penalties of perjury. For bonds with a current redemption value exceeding $1,000, additional verification through a notary or certifying officer is required, reflecting the Treasury's commitment to security and authentication. This document underscores the procedural and legal steps necessary for individuals to rightfully claim payments, thereby facilitating an important aspect of managing personal finance with respect to government-issued securities.

Preview - Fs1522 Form

|

|

|

RESET |

|

|

|

|

For official use only: |

Customer Name |

Case or SR# |

Customer No |

|

|

|

|

FS Form 1522 (Revised November 2021) |

|

|

OMB No. |

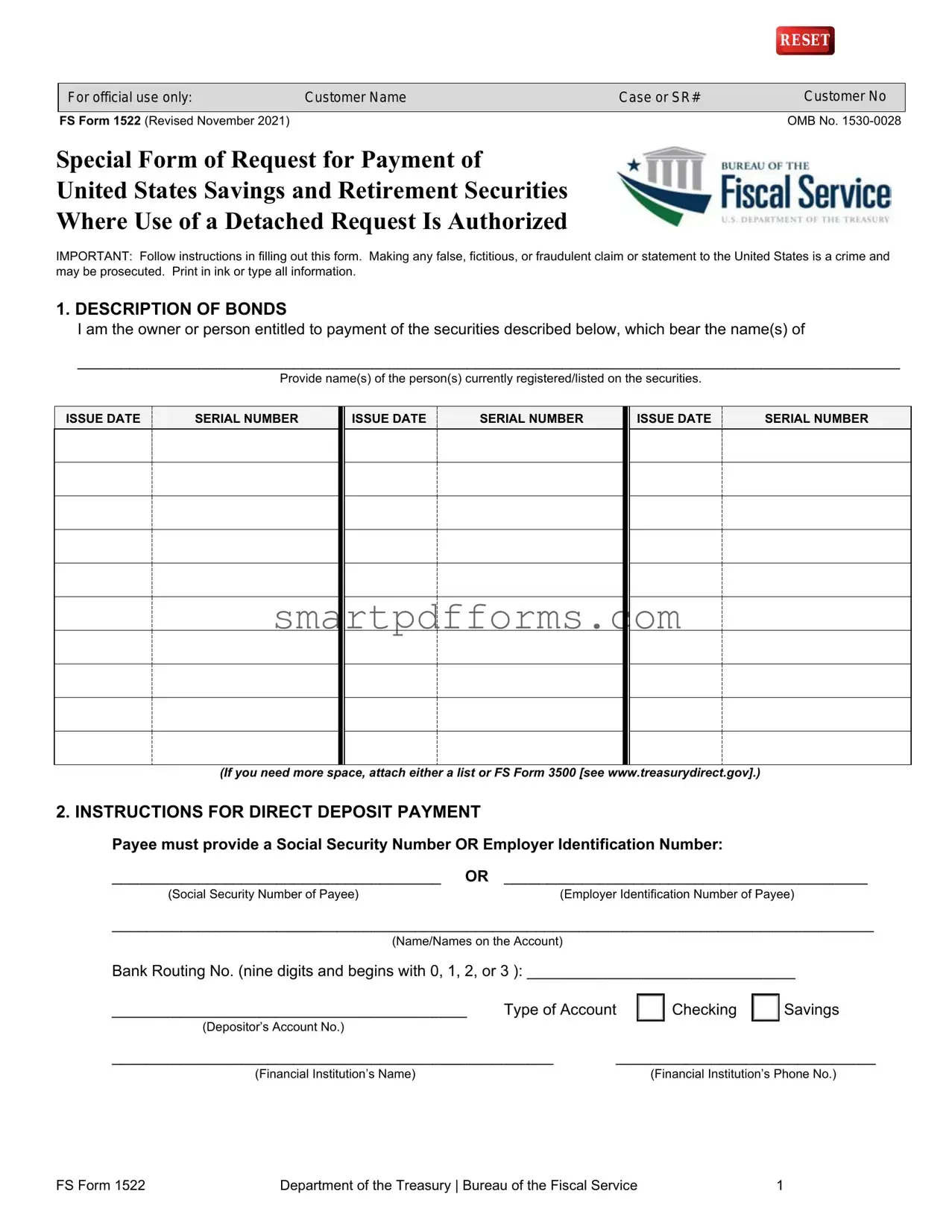

Special Form of Request for Payment of

United States Savings and Retirement Securities

Where Use of a Detached Request Is Authorized

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

1. DESCRIPTION OF BONDS

I am the owner or person entitled to payment of the securities described below, which bear the name(s) of

_______________________________________________________________________________________________

Provide name(s) of the person(s) currently registered/listed on the securities.

ISSUE DATE |

SERIAL NUMBER |

ISSUE DATE |

SERIAL NUMBER |

|

|

|

|

ISSUE DATE |

SERIAL NUMBER |

(If you need more space, attach either a list or FS Form 3500 [see www.treasurydirect.gov].)

2. INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

Payee must provide a Social Security Number OR Employer Identification Number:

______________________________________ |

OR __________________________________________ |

(Social Security Number of Payee) |

(Employer Identification Number of Payee) |

________________________________________________________________________________________

(Name/Names on the Account)

Bank Routing No. (nine digits and begins with 0, 1, 2, or 3 ): _______________________________

_________________________________________ |

Type of Account |

(Depositor’s Account No.)

Checking

Savings

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

(Financial Institution’s Phone No.) |

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

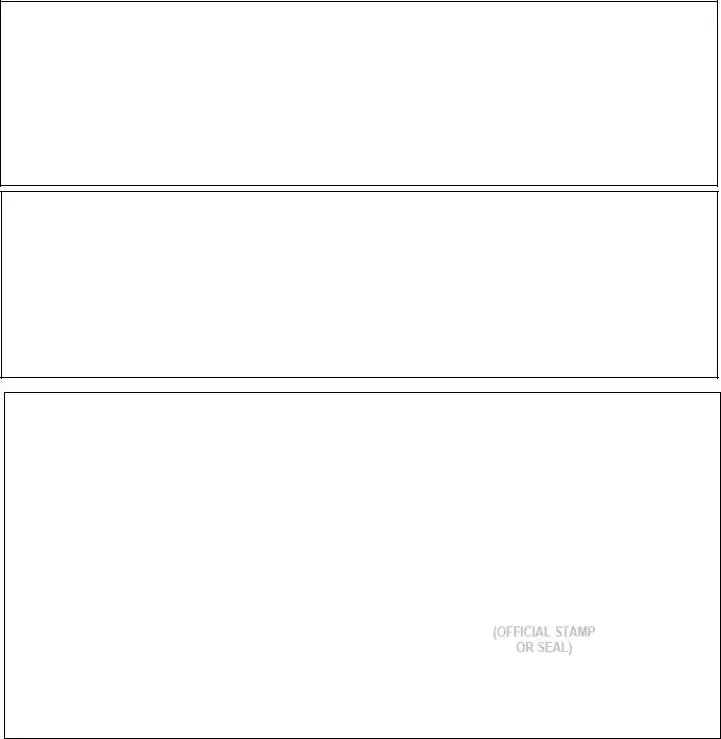

3. SIGNATURE

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U.S. person (including a U.S. resident alien).

NOTE: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

Certification. If the current redemption value (see Instructions) of your bonds totals $1,000 or less, your signature need not be certified; you may simply sign the form and enclose a current copy of your driver’s license, passport, state ID, or military ID. If the current redemption value of your bonds totals more than $1,000, sign this form in the presence of a notary or certifying officer.

Complete in ink. If required (see “Certification” above), sign in the presence of a notary or certifying officer.

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

2 |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

INSTRUCTIONS

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

WHO MAY COMPLETE – This form may be completed by the owner, coowner, surviving beneficiary, or legal representative of the estate of a deceased or incompetent owner, persons entitled to the estate of a deceased registrant, or such other persons who may be entitled to payment under the regulations governing United States Savings Bonds. A minor may sign this form if, in the opinion of the notary or certifying officer, he or she is of sufficient competency to understand the nature of the transaction. An incompetent person may not sign this form.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1.DESCRIPTION OF BONDS – Provide the name(s) of the person(s) shown in the inscription of the bonds for which payment is requested. Describe the bonds by issue date and serial number.

ITEM 2.INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

The payee's Taxpayer Identification Number must be provided. Furnish the Social Security Number if the payee is an individual. If an estate, trust, or other entity is involved and IRS has assigned an Employer Identification Number, provide that number. Furnish the name(s) on the account, the account number, the type of account, and the financial institution's name, the routing/transit number which identifies the institution, and the institution's phone number. You may need to contact the financial institution to obtain the routing number.

Please verify account information for accuracy and legibility to avoid a delay in deposit.

ITEM 3. SIGNATURE

The person(s) requesting payment of the bonds must sign the form in ink, print his or her name, and provide his or her address, daytime telephone number, and if applicable,

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

CERTIFICATION – To find the current redemption value of savings bonds of Series EE, Series E, or Series I, or of savings notes, use the Savings Bond Calculator at TreasuryDirect.gov.

If the current redemption value of your bonds totals $1,000 or less, your signature need not be certified. Rather, when you sign the form, you may verify your identity by enclosing a current copy of your driver’s license, passport, state ID, or military ID.

If the current redemption value of your bonds totals more than $1,000, each person whose signature is required must appear before and establish identification to the satisfaction of a notary or authorized certifying officer. The signatures to the form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. Examples of acceptable seals and stamps:

•The seal or stamp of a notary

•A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and

•The seal or stamp of

WHERE TO SEND – Unless otherwise instructed, send this form and the bonds, as well as any other appropriate forms, evidence, or identification records, to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN

(Phone:

NOTICE UNDER THE PRIVACY AND PAPERWORK REDUCTION ACTS

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 15 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV

address; send to the address shown in "WHERE TO SEND" above.

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |

Form Data

| Fact | Description |

|---|---|

| Form Number | FS Form 1522 |

| Issuing Authority | Department of the Treasury | Bureau of the Fiscal Service |

| Revision Date | November 2021 |

| Purpose | Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized |

| OMB Number | 1530-0028 |

Instructions on Utilizing Fs1522

Upon completing the FS Form 1522, your request for payment of United States Savings and Retirement Securities will be processed efficiently. This form is vital for individuals seeking to receive payment for their bonds where a detached request is authorized. It's important to provide accurate and complete information to avoid potential delays in your request. Here's a step-by-step guide on how to fill it out.

- Start by locating the section labeled DESCRIPTION OF BONDS. Here, input the name(s) as they appear on the securities. Ensure every detail, such as issue date and serial number for each bond, is included. If additional space is required, attach a separate list or the FS Form 3500.

- Move to the section officially termed as INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT. First, supply either the Social Security Number or Employer Identification Number of the payee. Next, accurately provide the required banking information: name(s) on the account, bank routing number (nine digits), account number, and type of account (checking or savings). Furthermore, include the financial institution’s name and phone number.

- In the part labeled SIGNATURE, the person requesting payment must sign, ensuring to print their name beneath the signature. Also, include your home address, daytime telephone number, city, state, ZIP Code, and if available, an email address. If your bonds have a current redemption value of more than $1,000, this signature must be witnessed and certified by a notary or certifying officer. In such cases, make sure this section is completed in their presence.

- For the certification process, if applicable, verify that the notary or certifying officer fulfills their section correctly, including the date of appearance and their signature/stamp details. Remember, a certified signature is only necessary if the total current redemption value exceeds $1,000, or you may simply include a copy of an appropriate ID as specified.

- Finally, double-check all the information for accuracy and completeness before sending the form along with any necessary attachments to Treasury Retail Securities Services at the address provided. Doing so ensures your request is processed without unnecessary delays.

Rigorously following these steps ensures a smooth process for requesting payments on United States Savings and Retirement Securities. Remember to verify each filled section for accuracy and clarity, and ensure all necessary documentation accompanies your form when submitting it.

Obtain Answers on Fs1522

-

What is the purpose of FS Form 1522?

FS Form 1522 is designed for requesting payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds when a detached request is authorized. It must be filled out by the bond’s owner or a person entitled to the payment. This includes surviving beneficiaries, legal representatives of the owner's estate, and others entitled under relevant regulations.

-

Who can complete FS Form 1522?

The form can be completed by the savings bond’s owner, co-owner, a surviving beneficiary, a legal representative of a deceased or incompetent owner’s estate, or others entitled under the regulations governing U.S. Savings Bonds. Minors capable of understanding the transaction can sign the form, but an incompetent person cannot.

-

How should FS Form 1522 be filled out?

All requested information should be printed in ink or typed. For the description of bonds, provide the name(s) of the person(s) listed on the securities and detail the bonds by issue date and serial number. When instructing direct deposit payments, include the payee’s Taxpayer Identification Number, the account details, and the financial institution's contact information. Ensure all information is accurate and legible to prevent delays.

-

What is required for the Certification section in FS Form 1522?

If the current redemption value of the bonds totals $1,000 or less, a certified signature is not necessary; however, the form must be signed, and a current ID (driver's license, passport, state ID, or military ID) must be enclosed. For bonds valued over $1,000, each signatory must sign in the presence of a notary or certified officer and provide acceptable identification. The officer must affix a seal or stamp, including but not limited to a notary seal, Signature Guaranteed, or Endorsement Guaranteed seals.

-

Where should FS Form 1522 be sent?

Send the completed FS Form 1522, along with the bonds and any other necessary forms, evidence, or identification records, to Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150. Legal documentation submitted with this form cannot be returned. For assistance, contact the toll-free number provided in the form’s instructions.

Common mistakes

Not fully completing the description of bonds. Individuals often overlook or incorrectly fill in the names registered on the securities, along with the issue dates and serial numbers, which are crucial for identifying the bonds in question.

Failing to provide the correct Taxpayer Identification Number (TIN). Whether it's a Social Security Number for individuals or an Employer Identification Number for entities, providing the wrong number can delay processing.

Incorrect or unclear bank account details. The routing number, account number, and the type of account (checking or savings) must be accurate and legible. Mistakes here can prevent direct deposit payments.

Omitting the financial institution’s phone number. Although it might seem minor, omitting this can complicate verification processes and delay the transaction.

Signature related errors. Individuals either forget to sign the form, which is mandatory, or their signature does not match the name listed on the bonds, creating authentication issues.

Not adhering to the certification requirements. For bonds over $1,000 in current redemption value, a notary or certifying officer must witness the signature, but people often overlook this stipulation.

Neglecting to include identification for certification. When the current redemption value of the bonds is $1,000 or less, a current copy of identification (e.g., driver's license, passport) must be enclosed, which is frequently forgotten.

Incorrectly reporting or updating name changes. If the name of the requester has changed due to marriage or other legal reasons, both names and the reason for the change must be clearly indicated.

Illegible writing or typos in filling out the form. Since all information must be printed in ink or typed, any illegibility or typing error can lead to misinterpretation and processing delays.

Failure to send the completed form to the correct address. The form, along with any additional required documentation, must be sent to Treasury Retail Securities Services, yet it's common for people to send their paperwork to the wrong location.

These errors can lead to significant delays in the processing of requests for payment of United States Savings and Retirement Securities. Ensuring accuracy and completeness when filling out the FS Form 1522 is crucial for a smooth and efficient transaction.

Documents used along the form

When dealing with the redemption of United States Savings and Retirement Securities, the FS Form 1522 offers a streamlined way to request payment. However, this form does not stand alone. In many cases, other documents are required to complete the processing of securities or to accommodate special circumstances. Here’s a brief overview of related forms and documents often used alongside FS Form 1522 to ensure a smooth transaction.

- FS Form 3500: Known as the "Certification of Identity Form," it is used when further identity verification is required for the owner or beneficiary claiming the securities.

- FS Form 1048: This "Claim for Lost, Stolen, or Destroyed United States Savings Bonds" form is pivotal when the physical securities are missing, and the owner needs to establish entitlement to replace or redeem them.

- FS Form 5396: This form is required for the reissue of Treasury securities. It's particularly useful if the securities are to be reissued to a trust or if there’s a change in ownership due to reasons like marriage or divorce.

- Death Certificate: In scenarios where the securities owner is deceased, a certified copy of the death certificate is necessary to process the redemption for the beneficiaries or estate representatives.

- Power of Attorney (POA): A POA document may be needed if someone other than the owner is conducting transactions on behalf of the owner, including redemption requests.

- Letter of Instruction: Accompanying the FS 1522, a letter of instruction from the owner or estate executor can clarify the desired action on the securities, allocation, or special handling instructions.

- Court Documents: In the case of an estate or trust, legal documents such as the will, trust agreement, or court orders may be required to establish the executor’s or trustee’s authority to redeem securities.

Each of these documents serves a unique purpose, assisting individuals in navigating the specifics of their situation. Whether it's establishing identity, replacing lost securities, changing ownership details, or acting on behalf of an estate, it’s important to familiarize oneself with the necessary paperwork. Taking the time to gather and complete these documents properly ensures your transactions are processed efficiently and accurately, safeguarding your investments and honoring the intentions of all parties involved.

Similar forms

FS Form 3500 - Claim for Lost, Stolen, or Destroyed United States Savings Bonds: Similar to FS Form 1522, FS Form 3500 is also used in connection with U.S. savings bonds. However, FS Form 3500 is specifically for bonds that are lost, stolen, or destroyed, requiring detailed information about the bonds and proof of ownership. Both forms require the owner’s personal details, bond information, and a certification process, though FS Form 1522 focuses on the payment request of bonds in possession.

IRS Form W-9, Request for Taxpayer Identification Number and Certification: FS Form 1522 shares similarities with IRS Form W-9 as both require the taxpayer identification number (Social Security Number or Employer Identification Number) and include a perjury statement regarding the information provided. While FS Form 1522 pertains to the redemption of savings bonds, Form W-9 is generally used to provide financial information to entities that will pay interest, dividends, or issue other forms of income.

Form PD F 4000, Request To Reissue United States Savings Bonds: Like FS Form 1522, Form PD F 4000 is used in activities related to U.S. savings bonds, specifically for reissuing bonds to correct names, change ownership, or update beneficiary information. Both forms necessitate detailed bond descriptions, owner information, and official certifications for authentication purposes, although their primary uses differ.

Direct Deposit Sign-Up Form (SF 1199A) for Federal Payments: FS Form 1522 and the Direct Deposit Sign-Up Form SF 1199A both facilitate direct deposit payments into bank accounts. Each form requires the recipient's bank account details, including routing number and account type. However, FS Form 1522 is specific to the payment of U.S. savings and retirement securities, while SF 1199A is used for a variety of federal payments, like social security benefits and tax refunds.

IRS Form 1040, U.S. Individual Income Tax Return: While primarily for annual income tax return filing, IRS Form 1040 and FS Form 1522 overlap in that both require taxpayer identification numbers and can involve topics related to savings bonds, albeit in different contexts. FS Form 1522 directly relates to the redemption of savings bonds, whereas savings bonds interest might be reported on Form 1040. Moreover, both forms include certifications to avoid penalties of perjury regarding the truthfulness of the provided information.

Dos and Don'ts

Filling out the FS1522 form is an important step in requesting payment of United States Savings and Retirement Securities. To ensure a smooth process, there are certain dos and don'ts to keep in mind:

Do:- Double-check the information: Before submitting, verify all your entries to ensure accuracy. Make sure names, social security numbers, account numbers, and routing numbers are correct.

- Use ink or type: All information on the FS1522 form should be printed in ink or typed. This enhances legibility and prevents processing errors.

- Include proper identification: Depending on the value of your bonds, include the necessary identification as outlined in the "Certification" section. For bonds over $1,000, ensure your signature is certified; for bonds $1,000 or less, enclosing a valid form of ID may suffice.

- Follow direct deposit instructions carefully: The instructions for direct deposit payment require meticulous attention. Provide all the requested details such as taxpayer identification number, account type, and bank routing number to prevent any delay in your transaction.

- Sign before completin: Do not sign the form until all other information has been filled out. Your signature may need to be witnessed or notarized if the redemption value of your bonds exceeds $1,000.

- Ignore certification requirements: If your bonds exceed the $1,000 threshold, not adhering to the certification requirements can result in processing delays. Ensure a notary or certifying officer's presence if necessary.

- Leave fields blank unnecessarily: If a section of the form does not apply, confirm whether leaving it blank is appropriate. For instance, if your bonds are worth $1,000 or less and you enclose an ID, the space for the notarization may be left blank.

- Forget to attach additional documents: If you're providing additional information on FS Form 3500 or including a list of bonds, ensure these are securely attached to your FS1522 form before submission.

Misconceptions

When it comes to managing United States Savings and Retirement Securities, the FS Form 1522 is a crucial document. However, there are several misconceptions about the form that need clarification:

Every owner needs to certify their signature, regardless of the bond’s value: This is incorrect. If the current redemption value of your bonds totals $1,000 or less, you do not need to have your signature certified. Instead, you may simply sign the form and enclose a current copy of an approved form of identification.

The form is only for the deceased owner’s estate: This is not true. While part of its use can cater to legal representatives of the estate of a deceased or incompetent owner, the FS Form 1522 is also designed for living owners, co-owners, surviving beneficiaries, or others entitled to the payment under the regulations governing United States Savings Bonds.

You can only submit the form by mail: Mailing is a common submission method, but this statement might not always hold. Depending on guidance from the Bureau of the Fiscal Service, there may be alternative submission methods available. Always check the latest instructions or official website for up-to-date information.

Direct deposit payment details are optional: Actually, the instructions for direct deposit payment are a mandatory part of the form if you wish to have your payment deposited directly into a bank account. This includes providing specific information like the bank routing number, account number, and the type of account.

Personal information is routinely shared: The Privacy and Paperwork Reduction Acts ensure that personal information collected is used only for the expressed purposes of issuing securities, processing transactions, making payments, and other related activities. Disclosure outside of these purposes is limited and governed by strict rules.

There’s no need to list all bonds individually: You must provide detailed information for each bond, including issue date and serial number, for which payment is requested. This ensures that your request is processed correctly and efficiently.

The form is complicated to fill out: While it may seem daunting, the FS Form 1522 is designed with clear instructions for each section. Taking it step by step can simplify the process, and the estimated time to complete the form is about 15 minutes.

Any notary can certify signatures: While it's true that notaries can certify signatures, it's important to note that if the bond values exceed $1,000, the certifying officer or notary must follow specific instructions and use the appropriate seal or stamp. Plus, certain financial institutions and other entities have authorized certifying officers who are familiar with these types of documents.

Signature guarantees are the same as notarization: This is a misunderstanding. When the form refers to signature guarantees and notarization, it indicates specific types of verification. A signature guarantee from an acceptable medallion signature guarantee program is not the same as a notary public’s stamp and requires different criteria for acceptance.

Understanding these points about FS Form 1522 can help avoid confusion and ensure a smoother process when requesting payment for United States Savings and Retirement Securities.

Key takeaways

Here are key takeaways about filling out and using the FS Form 1522:

- Correct completion is crucial: Carefully follow the instructions for completing FS Form 1522. Accurate and complete information prevents processing delays.

- Intended purpose: Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds where a detached request is authorized.

- Who may complete: This form can be completed by the owner, co-owner, surviving beneficiary, legal representative of the deceased or incompetent owner, persons entitled to the estate of a deceased registrant, or others entitled under the regulations governing U.S. Savings Bonds.

- Details matter: Provide clear details about the bonds, including the names on the securities, issue dates, and serial numbers. If more space is needed, attach a list or FS Form 3500.

- Direct deposit information: Direct deposit requests require meticulous detail such as the taxpayer identification number, account information, financial institution's name, and routing number to ensure accurate and timely payment.

- Signature requirements: Signatories must certify their Taxpayer Identification Number and status regarding backup withholding under penalties of perjury. Certification by a notary or certifying officer is necessary if the current redemption value of the bonds exceeds $1,000.

- Proof of identity: If the bonds' current redemption value does not surpass $1,000, identity can be verified with a current copy of the signer's driver's license, passport, state ID, or military ID, instead of notary certification.

- Change of name: If an individual's name has changed since the issuance of the bonds, they must sign the form with both names, explaining the reason for the name change (e.g., marriage).

- Submission instructions: After completion, send the FS Form 1522, together with the bonds and any additional required documents, to Treasury Retail Securities Services. It is advised to double-check the submission address and contact information for any updates or changes.

Understanding and correctly following these guidelines will facilitate a smoother transaction process and help avoid unnecessary complications when requesting payments for United States Savings and Retirement Securities.