Blank Ftb 3552 PDF Template

In the age of increasing digital transactions and records, the menace of identity theft looms larger than ever, posing significant challenges and risks to taxpayers' financial and personal integrity. The State of California, recognizing the gravity of this issue, provides a crucial tool through the Ftb 3552 form, designed specifically for both actual and potential victims of identity theft seeking to safeguard their tax account against fraudulent activities. This form serves an essential purpose by notifying the Franchise Tax Board (FTB) about the incident, thereby triggering a process to monitor and protect the taxpayer’s account from unauthorized access and misuse. Individuals are required to check one of the specified boxes to describe their situation, whether they have already been victimized by identity theft and perceive an imminent threat to their tax account or anticipate potential risk due to circumstances like a lost or stolen wallet. Moreover, the form requests information about the tax year(s) affected, details of the incident, and personal identification to ensure thorough processing. Submission of the form, accompanied by verifying documents such as a driver's license or police report, is facilitated through specified mail or fax instructions, preferably with a copy of any notice received from the FTB. This proactive measure underscores the importance of maintaining vigilance and immediate reporting to mitigate the impacts of identity theft on one’s fiscal responsibilities and records. It embodies the FTB's commitment to providing a responsive and supportive resource for taxpayers navigating the complexities of identity theft.

Preview - Ftb 3552 Form

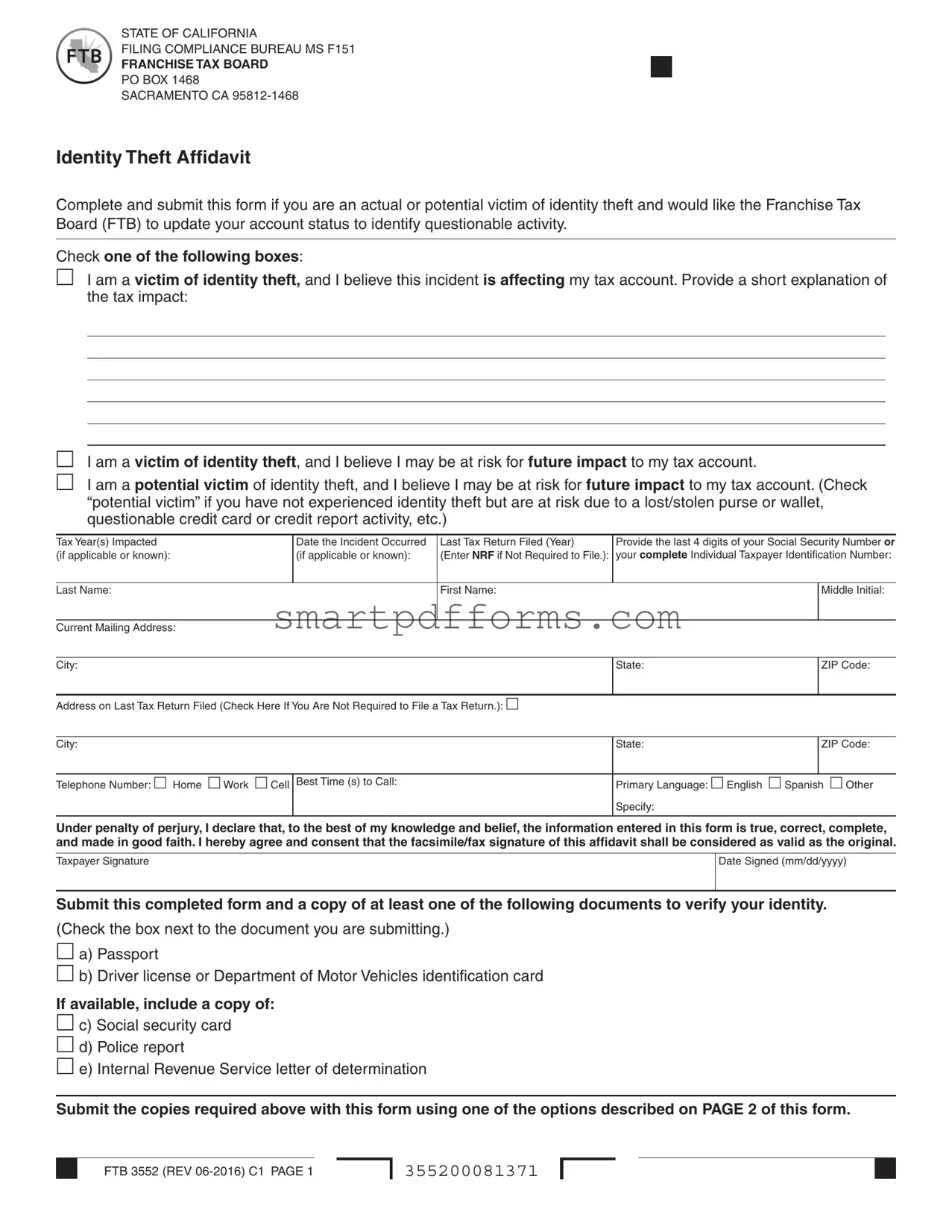

STATE OF CALIFORNIA

FILING COMPLIANCE BUREAU MS F151

FRANCHISE TAX BOARD

PO BOX 1468

SACRAMENTO CA

Identity Theft Affidavit

Complete and submit this form if you are an actual or potential victim of identity theft and would like the Franchise Tax Board (FTB) to update your account status to identify questionable activity.

Check one of the following boxes:

I am a victim of identity theft, and I believe this incident is affecting my tax account. Provide a short explanation of the tax impact:

I am a victim of identity theft, and I believe I may be at risk for future impact to my tax account.

I am a potential victim of identity theft, and I believe I may be at risk for future impact to my tax account. (Check “potential victim” if you have not experienced identity theft but are at risk due to a lost/stolen purse or wallet, questionable credit card or credit report activity, etc.)

Tax Year(s) Impacted |

Date the Incident Occurred |

Last Tax Return Filed (Year) |

Provide the last 4 digits of your Social Security Number or |

|

(if applicable or known): |

(if applicable or known): |

(Enter NRF if Not Required to File.): |

your complete Individual Taxpayer Identification Number: |

|

|

|

|

|

|

Last Name: |

|

First Name: |

|

Middle Initial: |

|

|

|

|

|

Current Mailing Address: |

|

|

|

|

City: |

State: |

|

|

Address on Last Tax Return Filed (Check Here If You Are Not Required to File a Tax Return.):

ZIP Code:

City: |

State: |

ZIP Code: |

|

|

|

|

|

Telephone Number: Home Work Cell |

Best Time (s) to Call: |

Primary Language: English Spanish Other |

|

|

|

Specify: |

|

|

|

|

|

Under penalty of perjury, I declare that, to the best of my knowledge and belief, the information entered in this form is true, correct, complete, and made in good faith. I hereby agree and consent that the facsimile/fax signature of this affidavit shall be considered as valid as the original.

Taxpayer Signature

Date Signed (mm/dd/yyyy)

Submit this completed form and a copy of at least one of the following documents to verify your identity.

(Check the box next to the document you are submitting.)

a) Passport

b) Driver license or Department of Motor Vehicles identification card

If available, include a copy of:

c) Social security card

d) Police report

e) Internal Revenue Service letter of determination

Submit the copies required above with this form using one of the options described on PAGE 2 of this form.

FTB 3552 (REV

355200081371

Submit the copies required above with this form using one of the options described on PAGE 2 of this form.

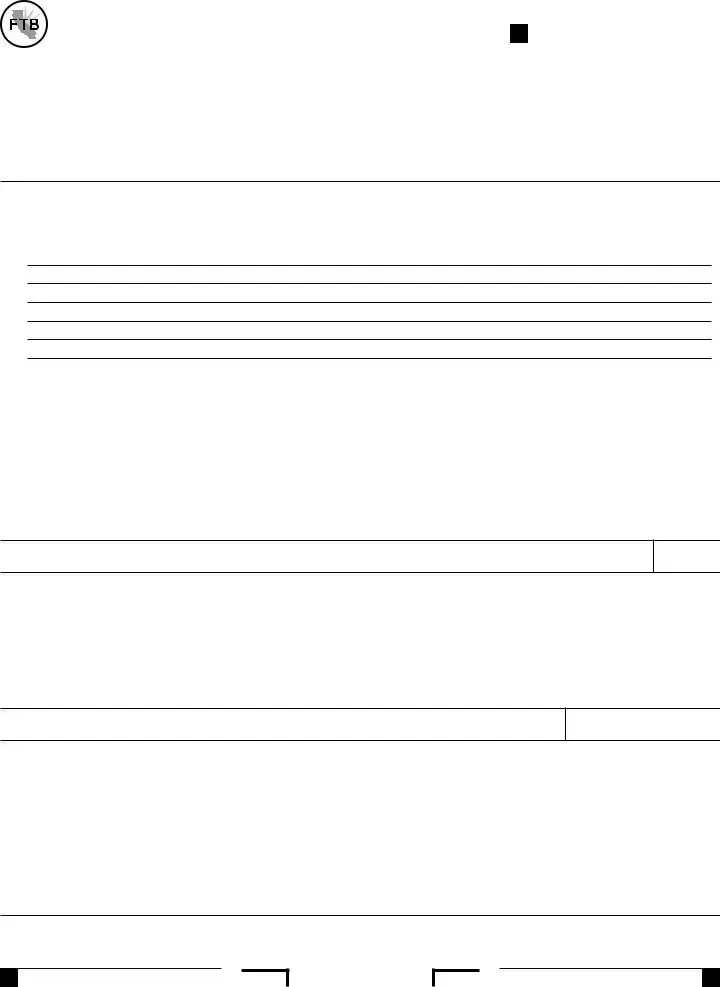

By Mail: |

By Fax: |

|

|

If you received a notice from FTB, return this |

If you received a notice in the mail from FTB and a fax |

form with a copy of the notice to the address |

number is shown, fax this completed form with a copy of |

contained in the notice. |

the notice to that number. Include a cover sheet marked |

|

“Confidential.” If no fax number is shown, follow the mailing |

If you have not received an FTB notice and are |

instructions. |

|

|

your tax account, mail this form to: |

FTB does not initiate contact with taxpayers by email or fax. |

FILING COMPLIANCE BUREAU MS F151 |

If you have not received an FTB notice and are |

FRANCHISE TAX BOARD |

potential risk for future impact to your tax account, fax this form |

PO BOX 1468 |

to: |

SACRAMENTO CA |

|

|

916.843.0561 |

|

|

Go to oag.ca.gov and search for identity theft for additional resources and information regarding identity theft.

For privacy information, go to ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.338.0505 and enter form code 948 when instructed.

Connect With Us

Web: ftb.ca.gov |

Phone: |

916.845.7088 |

|

7 a.m. to 5 p.m. weekdays, except state holidays |

|

|

916.845.6500 |

|

from outside the United States |

|

|

|

TTY/TDD: 800.822.6268

for persons with hearing or speech impairments

FTB 3552 (REV

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form FTB 3552 | Designed for victims or potential victims of identity theft to alert the Franchise Tax Board (FTB) to questionable activity on their tax account. |

| Required Identification Documents | Victims must submit a copy of their passport, driver license, or DMV identification card along with the form, and if available, a social security card, police report, or IRS letter of determination. |

| Submission Methods | The form can be submitted by mail or fax, with specific instructions provided for cases with or without a notice from the FTB. |

| Governing Law | This process falls under California state law, specifically administrated by the Franchise Tax Board, a California state agency responsible for tax collection and compliance. |

Instructions on Utilizing Ftb 3552

Filling out the FTB 3552 form is a crucial step for individuals who have either fallen victim to identity theft or believe they are at risk of such an event impacting their tax account. Proceeding with precision can ensure that the Franchise Tax Board (FTB) receives the necessary information to protect the account and identify any questionable activity efficiently. The process involves checking specific boxes that apply to one's situation, providing personal and situation-specific information, and submitting proof of identity among other details.

- Check the appropriate box at the beginning of the form to indicate if you are a victim of identity theft affecting your tax account, a victim believing you might be at risk of future tax account impact, or a potential victim at risk of future impact due to a specific incident.

- Fill in the "Tax Year(s) Impacted" and "Date the Incident Occurred" fields with the relevant details. If you do not know the specific dates or tax years, provide an estimation.

- If applicable, indicate the last tax return you filed by specifying the year in the "Last Tax Return Filed (Year)" box. Enter "NRF" if you were not required to file a return for the mentioned years.

- Provide the last four digits of your Social Security Number (SSN) or your full Individual Taxpayer Identification Number (ITIN) in the provided space.

- Complete the section with your name (last, first, and middle initial) and your current mailing address, including city, state, and ZIP code. If your current address differs from the one on your last tax return, fill in the "Address on Last Tax Return Filed" section and check the indicated box if you are not required to file a tax return.

- Indicate your best contact number and select whether it is your home, work, or cell. Provide the best times to call and choose your primary language.

- Sign and date the form under penalty of perjury, affirming that the information provided is true, correct, complete, and made in good faith. Remember, the form considers a faxed signature as valid as the original.

- Select and check the box next to the type of document you are submitting to verify your identity, such as a passport or driver license. If available, include a social security card, police report, or IRS letter of determination as additional documentation.

- Review the instructions on PAGE 2 for submitting the form and required copies. You can choose to submit by mail or by fax, depending on whether you have received a notice from the FTB and the instructions contained within.

Upon completion, ensure you have attached a copy of the required identity verification document and any additional supporting materials. Choose the submission method that best suits your situation, whether returning the form in response to a received notice or self-reporting a potential risk. Proper submission will commence the process of updating your account status with the FTB to safeguard against and address any questionable activity related to identity theft.

Obtain Answers on Ftb 3552

Welcome to our FAQ section where we'll dive into some commonly asked questions about the FTB 3552 form, an Identity Theft Affidavit provided by the Franchise Tax Board (FTB) of California.

- What is the purpose of the FTB 3552 form?

- Who should fill out the FTB 3552 form?

- Victims of identity theft who believe the incident has impacted their tax account.

- Victims of identity theft who are concerned about future impacts on their tax account.

- Individuals who have not yet been victims but are at potential risk due to circumstances like a lost or stolen purse, suspicious credit card activities, or unauthorized entries on their credit report.

- What information do I need to provide on the form?

- Brief explanation of the tax impact or potential risk.

- Specific tax years impacted.

- Date of the incident, if known.

- The last tax return filed or indicate if not required to file (NRF).

- Personal details such as your social security number (or Individual Taxpayer Identification Number), name, current, and last known addresses, contact information, and preferred language.

- Verification through a valid identification document, such as a passport, driver’s license, social security card, and optionally a police report or IRS letter of determination.

- How do I submit the FTB 3552 form?

- What should I do if I need help filling out the form or have questions?

The FTB 3552 form is specifically designed for individuals who have either fallen victim to identity theft or are at a potential risk of identity theft affecting their tax accounts. By completing and submitting this form, individuals can inform the California Franchise Tax Board about the incident, which enables the FTB to mark their account for questionable activity and take necessary precautions.

There are three categories of people who should consider filling out the FTB 3552 form:

To successfully complete the form, you must provide:

The form can be submitted either by mail or fax. The method of submission may vary depending on whether you have received a notice from the FTB or are self-reporting. Specific addresses and fax numbers are provided on the form for both scenarios. It's crucial to remember that the FTB does not initiate contact via email or fax for the submission of this form.

For assistance, the Franchise Tax Board provides several resources. You can connect with them through their website, by phone, or for those with hearing or speech impairments, TTY/TDD service is available. Additionally, seeking further information on identity theft, including prevention and response strategies, is recommended through the Office of the Attorney General's website and other provided resources.

Understanding the importance and proper use of the FTB 3552 form is a critical step in protecting your financial and personal information from the impacts of identity theft. It's a valuable tool in communicating with the California Franchise Tax Board to ensure the safety and integrity of your tax account.

Common mistakes

Not checking the correct box to indicate their identity theft status. People often rush through the form and fail to properly indicate whether they are a victim of identity theft affecting their tax account, believe they may be at risk for future tax account impact, or are a potential victim due to circumstances such as a lost or stolen purse. Clearly marking the correct box is crucial for the Franchise Tax Board (FTB) to provide the appropriate assistance and protection.

Omitting or incorrectly providing the last four digits of their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This information is critical for accurately identifying an individual's tax account. Leaving this section incomplete or entering incorrect digits can delay the processing of the form and the resolution of any identity theft issues.

Failing to include the necessary documentation to verify their identity. The form requires at least one of the following documents to be submitted alongside it: a passport, a driver's license or Department of Motor Vehicles identification card, if available, a social security card, a police report, or an Internal Revenue Service letter of determination. Neglecting to attach the required documents can significantly delay the verification and processing of the identity theft affidavit.

Inaccurately reporting the tax year(s) impacted, date of the incident, and the last tax return filed. This information helps the FTB understand the scope and timing of the identity theft issue. Incorrect or missing data in these fields can hinder the FTB's ability to fully assist the taxpayer and protect them against fraudulent activities on their tax account.

Avoiding these common mistakes ensures a smoother process in updating an individual's account status and identification of questionable activity. For those completing the FTB 3552 form, thoroughness and accuracy are key to effectively communicating their situation to the Franchise Tax Board.

Documents used along the form

When handling matters of identity theft, particularly with tax implications, individuals find it necessary to utilize several forms and documents in addition to the FTB 3552, Identity Theft Affidavit. These documents play critical roles in establishing the veracity of an individual's claim, protecting their financial integrity, and ensuring their tax records are corrected. Each document serves as a piece in the puzzle to illustrate the full scope of the incident to the Franchise Tax Board (FTB) and other authorities.

- Passport or Driver License/Department of Motor Vehicles Identification Card: These are primary documents to verify an individual's identity. They establish that the person submitting the FTB 3552 form is indeed who they claim to be, providing a foundation for the investigation into the identity theft claim.

- Social Security Card: It's often requested as a secondary form of identifying information. Since social security numbers are commonly targeted for identity theft, presenting this card helps verify the number belongs to the individual claiming identity theft.

- Police Report: Filing a report with the police and providing a copy to the FTB adds a formal layer of documentation to the claim. It demonstrates that the individual has taken the issue to law enforcement, thereby underlining the seriousness of the matter.

- Internal Revenue Service (IRS) Letter of Determination: If the IRS has been involved and has issued any findings or decisions related to the identity theft, this document can be invaluable in showing that other tax authorities recognize the breach of identity.

- Notice from FTB: For individuals who have been directly contacted by the Franchise Tax Board regarding discrepancies that could be the result of identity theft, any correspondence from the FTB should be included. This could help expedite the process by directly linking the report to any ongoing investigations by the tax agency.

Together, these documents form a comprehensive dossier that supports the claim of identity theft. They not only assist in validating the identity of the claimant but also help in painting a clear picture of how the theft has impacted their tax situation. It's a process that requires diligence and a thorough approach to ensure every angle is covered, supporting a swift resolution and the restoration of financial and personal security for the victim.

Similar forms

The IRS Form 14039 (Identity Theft Affidavit) is quite similar to the FTB 3552 form. Both forms serve individuals who have been victims of identity theft or are at potential risk of identity theft. They provide a mechanism for these individuals to report the issue to the respective tax authority, allowing the agency to mark the account for suspicious activity and help prevent tax-related identity theft. Additionally, both forms require the submission of identification documents to verify the identity of the filer.

The Form I-9 (Employment Eligibility Verification) shares a requirement with the FTB 3552 in that both call for identity verification through documents. Although the I-9 is used for employment verification purposes to prove the eligibility of individuals to work in the United States, the concept of verifying an individual’s identity through specific documents is a key similarity between this and the process involved in submitting the FTB 3552.

The DMV Identity Theft Form, specific to various states, is analogous as well. These forms are designed for individuals to report when their identity has been falsely assumed by another in relation to driving and vehicle registration services. Like the FTB 3552, individuals must supply personal information and potentially attach identification documents to support their claims of identity theft.

Consumer Credit Reporting Agencies’ Fraud Alerts Forms, which individuals can use to place an alert on their credit reports, are structurally and functionally comparable to the FTB 3552. These alerts indicate to creditors that the individual might be a victim of identity theft, similar to how the FTB 3552 alerts the tax board to potential fraudulent activity on the filer’s tax account.

The Social Security Administration’s (SSA) Form SS-5 (Application for a Social Security Card) is related in the sense that it may be used in cases where someone needs to correct or update their Social Security records due to identity theft. Though its primary purpose is to apply for a new or replacement Social Security card, it similarly involves the submission of identity-verifying documents under certain circumstances, paralleling the FTB 3552’s document submission requirement.

The Privacy Complaint Form provided by the Federal Trade Commission (FTC) is designed for reporting issues related to privacy, including identity theft. Much like the FTB 3552, it offers a pathway for individuals to officially document their concerns with an authoritative body, helping to mitigate the impact of identity theft on their lives.

The U.S. Department of State’s DS-64 (Statement Regarding a Lost or Stolen Passport) also deals with the aftermath of identity theft, in particular, when a passport has been lost or stolen. By reporting a stolen or lost passport, individuals can prevent misuse of their identity globally, a goal shared by the FTB 3552, which seeks to preempt and address misuse of one’s identity in tax contexts.

Dos and Don'ts

When filling out the FTB 3552 form, there are several best practices to ensure the process is both effective and secure. These recommendations help protect your personal information and improve the likelihood of a smooth experience with the Franchise Tax Board (FTB). Below are lists of things you should do and things you should avoid.

Things You Should Do:

Review the entire form before starting to fill it out, ensuring you understand all the required information.

Provide a detailed explanation of the tax impact if you're a victim of identity theft, including any evidence or documentation that supports your claim.

Check the appropriate box at the beginning of the form to accurately represent your situation (i.e., actual victim or potential victim).

Include the last 4 digits of your Social Security Number or your complete Individual Taxpayer Identification Number, whichever is applicable.

Ensure that your contact information is current, including a reliable telephone number and the best times to call.

Sign the form and enter the current date, acknowledging the declaration made under penalty of perjury.

Things You Shouldn't Do:

Do not leave any required fields blank. If a section does not apply to you, make sure to indicate that clearly.

Avoid sending the form without the necessary supporting documents, such as a photocopy of your passport or driver's license.

Do not ignore the instructions on how to submit the form. Follow the specified method, whether by mail or fax, based on your circumstances.

Refrain from using email or fax for communication if you have not been explicitly given a fax number by FTB, as they do not initiate contact through these channels.

Avoid guessing information. If you're unsure about specific details, such as the tax year impacted, seek clarification before submitting.

Do not submit the form without ensuring your signature and the date are correctly entered, as this certifies your acknowledgement of the information provided.

Adhering to these dos and don'ts can aid in the accurate and efficient processing of your FTB 3552 form, contributing to a smoother resolution of your identity theft issue.

Misconceptions

Many people have misconceptions about the FTB 3552 form, which is an Identity Theft Affidavit used in California. Understanding these misconceptions can help in correct completion and submission of the form, ensuring quicker resolution for victims of identity theft. Here are ten common misconceptions and the truth behind them:

- Only for confirmed identity theft victims: Some think the form is only for individuals who have had their identity stolen. However, it’s also for those at potential risk, such as after losing a wallet or noticing questionable credit activity.

- Requires extensive documentation to file: While you need to submit documentation to verify your identity (passport, driver's license, etc.), the requirements are not as extensive as some might fear. A police report or an IRS letter of determination can further support your claim but are not initially required.

- Submission is complicated: Another misconception is that the form submission process is complicated. The FTB 3552 form instructions detail how to submit by mail or fax clearly, making it relatively straightforward.

- Email submissions are accepted: People often assume they can submit the form via email. The Franchise Tax Board, however, does not initiate contact or accept submissions by email to protect taxpayers' privacy.

- Immediate resolution guaranteed: Filing the form does not guarantee an immediate fix. While it's an important step towards resolving issues related to identity theft, the process can take time, depending on the complexity of the case.

- FTB contacts all victims first: There’s a belief that the FTB will always contact victims of identity theft first. In reality, individuals often need to report the issue to the FTB themselves, especially if they suspect potential risk before any tax account impact is noticed.

- Only for recent tax years: Some think the form is only relevant to identity theft impacting the most recent tax year. Victims and potential victims should report any suspected fraudulent activity, regardless of the tax year it pertains to.

- Personal visit required: A common misconception is that victims must visit an FTB office in person to submit the form. In fact, the form and accompanying documents can be submitted by mail or fax, following the instructions provided on the form.

- Only available in English: Another misunderstanding is that the form is only available in English. The FTB 3552 form provides a section to indicate your primary language for communication, including English and Spanish, accommodating non-English speakers.

- For California residents only: While the form is from the California Franchise Tax Board, it’s not just for current residents. Former residents or individuals who have tax reporting obligations in California may also need to use this form if they are victims of identity theft affecting their California tax account.

Overcoming these misconceptions is crucial for correctly utilizing the FTB 3552 form. Doing so can significantly aid in the swift resolution of identity theft issues, providing peace of mind and security to those affected.

Key takeaways

Filling out the FTB 3552 form is an essential step for individuals in California who have been victims of identity theft or suspect they might become victims. This document allows the Franchise Tax Board (FTB) to safeguard your account by noting it for potential fraudulent activity. Here are nine key takeaways for correctly completing and utilizing the FTB 3552 form:

- Identify Your Status: It's important to check the appropriate box at the top of the form to clarify whether you are a victim of identity theft currently impacting your tax account, at risk of future impact, or a potential victim due to specific circumstances like a lost or stolen wallet.

- Provide Details: Giving a thorough explanation of how the identity theft has affected or might affect your tax account is crucial. This information helps the FTB understand your situation better and take necessary actions.

- Personal Information Accuracy: Ensure that you provide accurate personal information, including the last four digits of your Social Security Number (SSN) or your complete Individual Taxpayer Identification Number (ITIN), your name, and your current and last known addresses.

- Date and Tax Year(s) Impacted: Clearly indicate the tax year(s) impacted by the identity theft and the date the incident occurred. This information is vital for the FTB to locate and flag the correct tax records.

- Verification Documents: Submit a copy of at least one form of identification along with the FTB 3552 form. Acceptable documents include a passport, driver license, or DMV identification card. Optionally, including a copy of your social security card, a police report, or an IRS letter of determination may provide further validation of your identity.

- Form Submission: You have the option to submit the completed form and accompanying documents by mail or fax. Choose the method that is most convenient or reliable for you, ensuring to follow the specific instructions provided for each submission method.

- Privacy and Security: The FTB takes privacy and security seriously, never initiating contact with taxpayers via email or fax for the submission of personal information. This policy helps protect your sensitive information from further unauthorized access.

- Additional Resources: For further assistance, the FTB encourages individuals to visit the Office of Attorney General’s website for additional resources on handling identity theft. Staying informed can help you protect your financial health and tax information.

- Contact Information: Keep the FTB’s contact information handy for any follow-up questions or concerns. The FTB provides specific phone numbers for assistance during business hours, as well as a TTY/TDD number for individuals with hearing or speech impairments.

By carefully following these guidelines when filling out the FTB 3552 form, you can take a proactive step towards securing your tax account and mitigating the impacts of identity theft. Remember, the details you provide help the FTB to better assist you in this challenging time.

Popular PDF Forms

Certificate of Membership Template - Facilitates a transparent understanding among members regarding the importance of their contributions to the LLC.

Contract for Deed Vs Owner Financing - Defines the terms of a property transaction in Texas, including details on payments, property condition, and buyer and seller responsibilities.

Scout Membership Number - Applicants must agree to abide by the Scout Oath, Scout Law, and Scouter Code of Conduct, symbolizing their commitment to scouting principles.