Blank Ga Tax Wage Report PDF Template

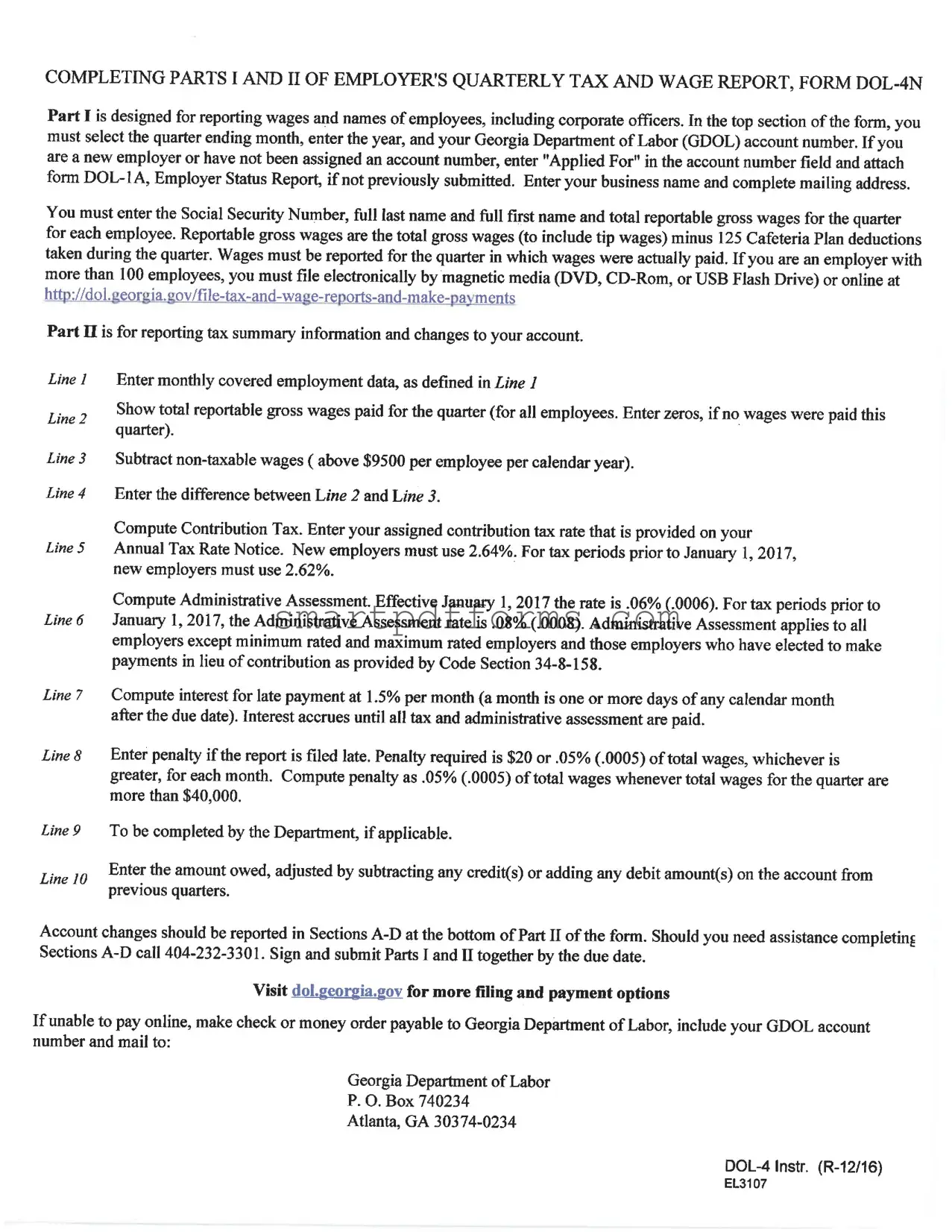

Every quarter, businesses operating in Georgia face the task of reporting wages and taxes to the state—a crucial step that involves the Georgia Tax Wage Report form, formally known as Form DOL-4N. This document, essential for maintaining compliance with state labor regulations, is divided into two main parts. In Part I, employers report individual employee wages, including those of corporate officers, requiring meticulous entry of Social Security numbers, full names, and total gross wages after specific deductions, for the respective quarter. This part aids in tracking and ensuring that the wages are accurately reported to the Georgia Department of Labor (GDOL). On the flip side, Part II focuses on summarizing the tax information, where employers detail their monthly employment data, total gross wages, and compute contributions based on their assigned tax rates. The form also guides employers through subtracting non-taxable wages, computing various assessments, and adding any due interest or penalties for late submissions. For businesses with a workforce exceeding 100 employees, electronic filing becomes a necessity, whereas smaller entities might opt for more traditional methods. Amidst these technicalities, the form also allows for reporting any changes to the employer's account, ensuring the GDOL has the most current information. Whether newly navigating the complexities of state labor laws or a seasoned filer, understanding the nuances of the Ga Tax Wage Report form is key to a business's operational harmony and compliance.

Preview - Ga Tax Wage Report Form

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The Employer’s Quarterly Tax and Wage Report, Form DOL-4N, is designed for reporting employees' wages, including corporate officers, and tax summary information. |

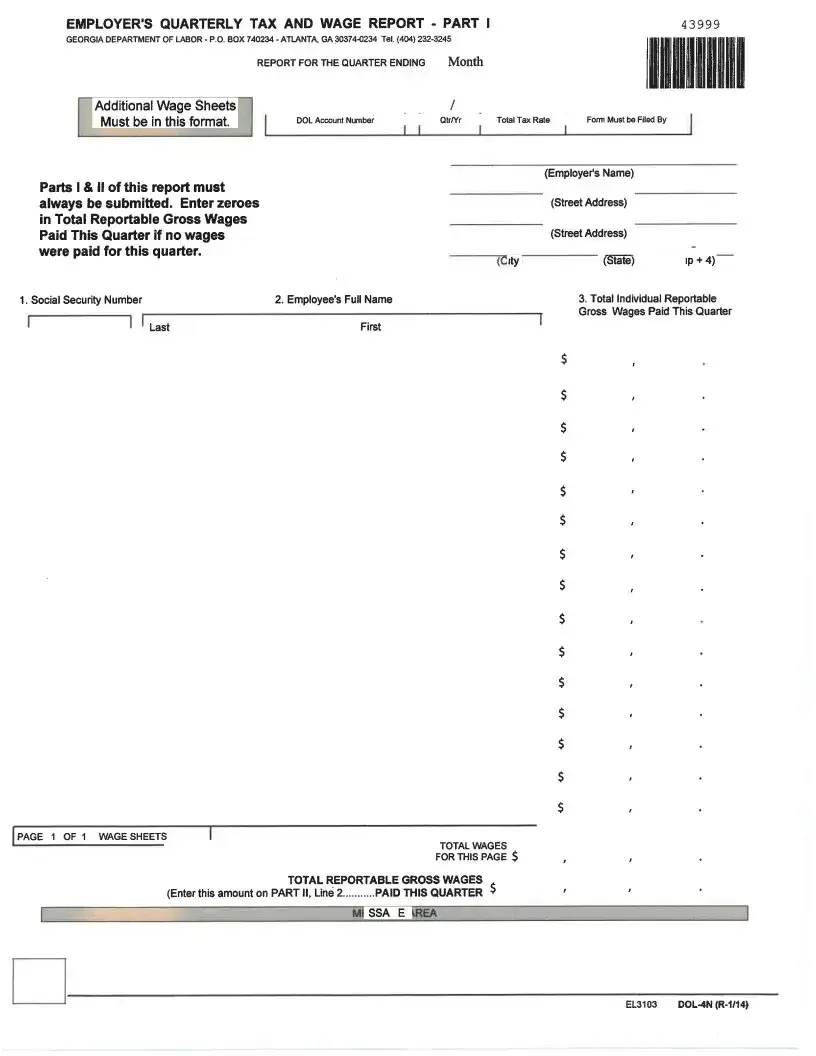

| Part I - Employee Information | Part I collects detailed employee information such as Social Security Number, full name, and total reportable gross wages for the quarter. |

| Electronic Filing Requirement | Employers with more than 100 employees are required to file the form electronically, either via magnetic media or online at the Georgia Department of Labor website. |

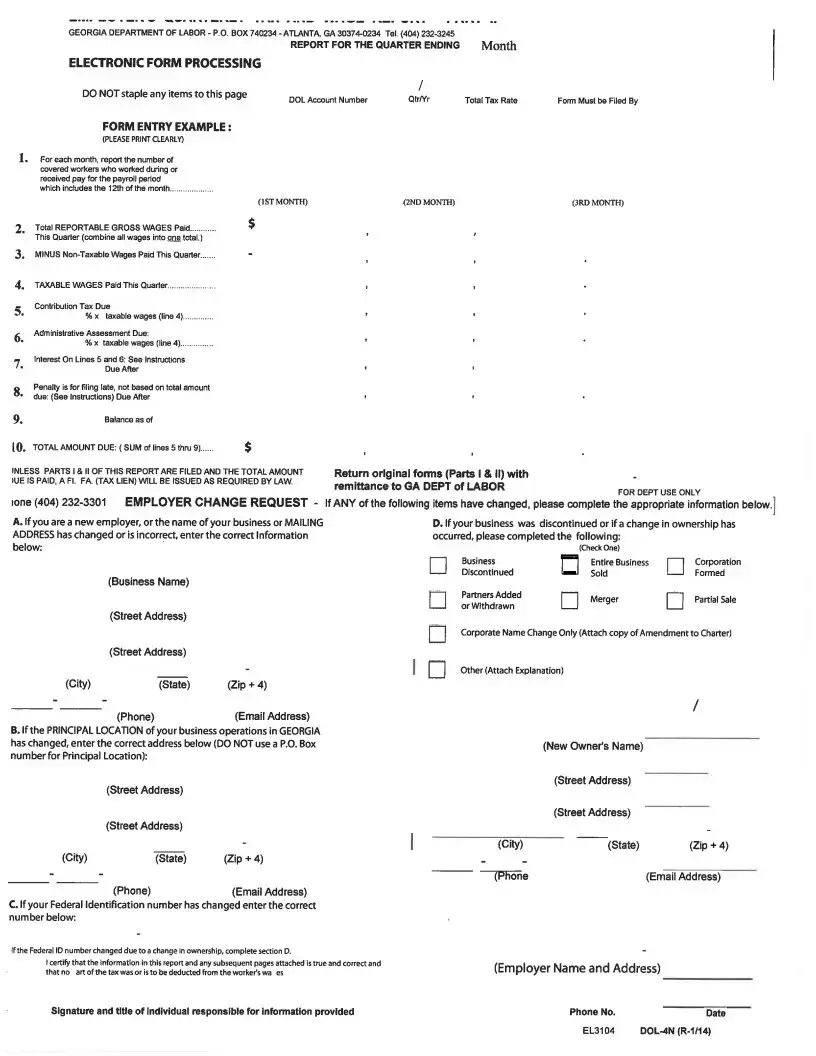

| Part II - Tax and Account Changes | Part II focuses on reporting tax summary information, changes to the employer’s account, and calculation of taxes and penalties due. |

| Governing Law | The form is governed by Georgia Code Section 34-8-158 among others, regarding unemployment insurance payment in lieu of contributions and administrative assessments. |

Instructions on Utilizing Ga Tax Wage Report

Filing the Georgia Tax Wage Report form is an important task that requires your attention to detail. This form is divided into two key parts: the first involves reporting wages and employee information, while the second focuses on summarizing tax information and noting any account changes. Accurate completion of this document is crucial for compliance with Georgia Department of Labor regulations. Utilizing a step-by-step approach will help ensure that all necessary information is correctly reported, and you can remain focused, reducing the chances of errors. Let's walk through how to fill out this form efficiently and accurately.

- Part I:

- Select the quarter ending month at the top of the form.

- Enter the corresponding year next to the quarter ending month.

- Provide your Georgia Department of Labor (GDOL) account number. If you're a new employer or don't have an account number yet, write "Applied For" and attach form DOL-1A, Employer Status Report, if you haven't submitted it already.

- Write down your business name and complete mailing address in the designated spaces.

- For each employee, include their Social Security Number, full last name, full first name, and total reportable gross wages for the quarter. Remember, reportable gross wages include total gross wages (including tip wages) minus any Cafeteria Plan deductions taken during the quarter.

- If you have more than 100 employees, remember you must file electronically, either by magnetic media (DVD, CD-ROM, or USB Flash Drive) or online.

- Part II:

- Enter the monthly covered employment data as defined in Line 1 of Part II.

- Show the total reportable gross wages paid for the quarter for all employees. Enter zeros if no wages were paid this quarter.

- Subtract non-taxable wages (above $9,500 per employee per calendar year).

- Enter the difference between the total reportable gross wages and the non-taxable wages.

- Compute the Contribution Tax using your assigned tax rate (new employers use 2.64% or 2.62% for tax periods prior to January 1, 2017).

- Calculate the Administrative Assessment, which is .06% (or .08% for periods before January 1, 2017).

- For any late payments, compute interest at 1.5% per month.

- If your report is filed late, enter the penalty, calculated as .05% of total wages whenever the total wages for the quarter are more than $40,000.

- Line 9 will be filled out by the Department, if applicable.

- Enter the total amount owed, adjusting for any credits or debits from previous quarters in your account.

- Should there be any changes to your account, report these in Sections A-D at the bottom of Part II. For assistance, call 404-232-3301.

- Sign the form and submit Parts I and II together by the due date. If you're unable to pay online, checks or money orders should be made payable to the Georgia Department of Labor and mailed to their provided address.

By following these steps, you can ensure that the Georgia Tax Wage Report form is filled out correctly. This detailed approach helps in maintaining accurate records, which is essential for both compliance and the effective management of your business's payroll and tax obligations. Remember, keeping up-to-date with state regulations and requirements is key to avoiding any unnecessary complications or penalties.

Obtain Answers on Ga Tax Wage Report

What is the purpose of the Employer’s Quarterly Tax and Wage Report, Form DOL-4N?

The Employer's Quarterly Tax and Wage Report, Form DOL-4N, is used to report wages paid to employees, including corporate officers, and the corresponding taxes due for each quarter. It serves as the primary document through which employers report individual employee earnings and tax information to the Georgia Department of Labor (GDOL).

How do I determine which quarter and year to report on the form?

At the top section of Form DOL-4N, you are required to select the quarter ending month (March, June, September, or December) and enter the corresponding year. This should reflect the period for which you are reporting wages paid and taxes owed.

If I am a new employer or lack a GDOL account number, what should I do?

New employers or those not assigned an account number should enter "Applied For" in the account number field. Additionally, attach Form DOL-1A, the Employer Status Report, if it has not been previously submitted, to ensure your account is properly set up with the Georgia Department of Labor.

What constitutes reportable gross wages?

Reportable gross wages include the total gross wages paid to an employee, minus any Section 125 Cafeteria Plan deductions, within the reporting quarter. This encompasses all forms of compensation, such as salaries and tip wages.

How should wages be reported for employees?

For each employee, including corporate officers, employers must enter their Social Security Number, full last name, full first name, and the total reportable gross wages for the quarter. It is important to note that wages must be reported in the quarter they were actually paid.

Is electronic filing required for employers with a large number of employees?

Yes, employers with more than 100 employees are mandated to file the form electronically, either through magnetic media (DVD, CD-Rom, or USB Flash Drive) or online. This streamlines the process and ensures accuracy in the submission of a large volume of employee data.

What information is required in Part II of the form?

In Part II, employers report tax summary information, including monthly covered employment data, total reportable gross wages, taxable wages after subtracting non-taxable wages, and the computation of contribution tax, administrative assessment, interest for late payment, and penalties if applicable. Account changes should also be reported in this section.

How is the interest for late payment calculated?

Interest for late payment of taxes and assessments is calculated at a rate of 1.5% per month. This accrues for any part of a month following the due date until all taxes and administrative assessments are fully paid.

What penalties apply if the report is filed late?

Should the report be filed after the due date, a penalty is imposed. The penalty is either $20 or 0.05% of total wages, whichever is greater, for each month or part of a month that the report is late. When total wages for the quarter exceed $40,000, the 0.05% rate is applied to compute the penalty.

Where can I get assistance if I have difficulties completing the form?

If you encounter difficulties or have questions while completing the form, assistance is available. You can call the Georgia Department of Labor at 404-232-3301 for support. Additionally, the GDOL website provides further filing and payment options and information.

Common mistakes

Filling out the Georgia Tax Wage Report form, designated as form DOL-4N, requires close attention to detail. Common mistakes can lead to inaccuracies that complicate tax and wage reporting. To ensure compliance and accuracy, here are five common errors that should be avoided:

Incorrectly entering the quarter ending month, year, and Georgia Department of Labor (GDOL) account number in Part I. Employers must carefully select the correct quarter ending month and enter the appropriate year along with their GDOL account number. If an employer is new or doesn't have an account number, they should enter 'Applied For' and attach the DOL-1 A, Employer Status Report.

Omitting or inaccurately reporting employee information such as Social Security Number, full last name, full first name, and total reportable gross wages for the quarter. Each employee's details must be meticulously entered, including their earnings minus any 125 Cafeteria Plan deductions taken during the quarter, in the top section of Part I.

Failure to report gross wages in the quarter they were actually paid. It is crucial to report wages for the specific quarter in which they were paid to employees, not when they were earned, to avoid discrepancies in wage reporting.

Miscalculating total reportable gross wages paid for the quarter and taxable wages after subtracting non-taxable wages in Part II. Employers must correctly show the total reportable gross wages paid for all employees in Line 2 and then accurately subtract non-taxable wages (above $9,500 per employee per calendar year) in Line 3 to determine taxable wages.

Incorrectly computing the contribution tax due and the administrative assessment, along with failing to report any account changes in Sections A-D at the bottom of Part II. The contribution tax rate, provided on the Annual Tax Rate Notice, must be accurately applied, and the administrative assessment should be computed based on the current rate. Additionally, any changes to the employer's account should be accurately reported in the specified sections for the report to be processed correctly.

Avoiding these common mistakes can help ensure the accurate and timely submission of the Georgia Tax Wage Report form, thereby maintaining compliance with state labor laws. Employers are encouraged to double-check their entries and calculations before submitting the form to the Georgia Department of Labor.

Documents used along the form

When filling out the Georgia Tax Wage Report form, it's not just about completing and submitting this singular document. Often, businesses need to incorporate additional forms and documents to ensure compliance with Georgia's Department of Labor regulations. Understanding these additional forms can help streamline the payroll reporting process and minimize errors.

- DOL-1A, Employer Status Report: A crucial document for new employers or businesses that haven’t yet been assigned an account number by the Georgia Department of Labor. It gathers general information about the business to establish its tax liability status.

- Quarterly Contribution and Wage Report Continuation Sheet: This is used when an employer has more employees than can be reported on the main Tax and Wage Report form. It helps in listing additional employees and their wages.

- Power of Attorney (POA): This form authorizes another individual or entity to act on behalf of the employer in matters related to the filing of the Tax Wage Report and other associated legal and financial responsibilities.

- Amendment to Employer’s Quarterly Tax and Wage Report: If there are mistakes or omissions in a previously submitted Tax and Wage Report, this form allows corrections to be made to ensure accurate reporting.

- Electronic Filing Requirement Waiver Request: Employers mandated to file electronically due to having over a certain number of employees can request a waiver for paper filing through this document under specific conditions.

- Employer Change Request: This form is for reporting any changes to the business’s name, address, ownership, or Federal ID number. It ensures that the Georgia Department of Labor has the most current and accurate information.

- Payment Coupon: This document accompanies payments when employers are not paying online. Including the correct payment coupon ensures that payments are processed efficiently and credited to the correct account.

The process of managing payroll taxes and wages in Georgia exemplifies the intersection of accurate data gathering and statutory compliance. By familiarizing oneself with these additional forms, employers can more effectively navigate their responsibilities and maintain good standing with the Georgia Department of Labor. This holistic approach to payroll administration not only simplifies procedural requirements but also reinforces the importance of thoroughness in every aspect of business reporting.

Similar forms

The IRS Form W-2, Wage and Tax Statement, is quite similar to the GA Tax Wage Report form. Both documents require employers to report wages paid to employees, including specific details like Social Security numbers and total gross wages. The primary focus is on reporting earnings to government agencies for tax purposes.

The IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, shares similarities in that it involves reporting wages to determine tax liability. However, while the GA form is quarterly and state-focused, Form 940 is annual and focused on federal unemployment contributions.

Quarterly Federal Tax Return Form 941 is another document with a strong resemblance. This form is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks, aligning with the GA Tax Wage Report's objective to report wages for tax calculation purposes.

The State Unemployment Tax Act (SUTA) reports bear a resemblance as well, with each state having its version similar to Georgia's. These reports require detailed employee wage information for the calculation of state unemployment insurance taxes, making them quite similar in purpose and content.

Form W-3, Transmittal of Wage and Tax Statements, serves as a summary page for all W-2 forms sent to the federal government. It aligns with the GA Tax Wage Report in its aggregation and reporting of employee wage data, albeit on an annual rather than quarterly basis.

The New Hire Reporting forms, which employers must submit to state agencies to report newly hired employees, share the purpose of providing employee information to governmental bodies, much like the GA form's requirement to report employee wages and details.

Form W-4, Employee's Withholding Certificate, while primarily used by employees to determine tax withholdings, indirectly relates to the GA Tax Wage Report as it influences the total taxable wages reported by the employer each quarter.

The Local Earned Income Tax Residency Certification Form, used in some states to report local tax withholdings, is similar in its function of reporting wages for tax purposes, though its scope is more localized compared to the statewide nature of the GA Tax Wage Report.

Annual Wage and Tax Statement reports for state income taxes, such as those required in states with state income tax, parallel the GA form in their need for detailed employee wage information to calculate tax obligations.

Dos and Don'ts

When filling out the Georgia Tax Wage Report Form (Form DOL-4N), there are several things you should and shouldn't do to ensure accurate and timely submission. Below are the guidelines to follow:

Things You Should Do:

- Ensure you have selected the correct quarter ending month and entered the corresponding year accurately at the top of the form.

- If you are a new employer without a Georgia Department of Labor (GDOL) account number, enter “Applied For” in the respective field and attach the DOL-1 A, Employer Status Report.

- Provide your business name and complete mailing address in the designated areas.

- Accurately enter each employee's Social Security Number, full first name, and last name, alongside the total reportable gross wages for the quarter.

- Understand that reportable gross wages include total gross wages minus any section 125 Cafeteria Plan deductions taken during the quarter.

- File electronically if you have more than 100 employees, utilizing either magnetic media (DVD, CD-ROM, USB Flash Drive) or online services provided by GDOL.

- Accurately compute and report tax summary information in Part II, including contribution tax rate, non-taxable wages deduction, and any interest or penalties due to late payment.

- Sign and submit both Parts I and II together by the due date to avoid penalties or interest for late submission.

- Make a check or money order payable to the Georgia Department of Labor if you cannot pay online, including your GDOL account number on your payment.

- For any changes to your account or if you need assistance with completing sections A-D of Part II, call the provided GDOL contact number.

Things You Shouldn't Do:

- Do not leave the quarter ending month and year fields blank at the top of the form.

- Avoid entering incorrect or incomplete employee information, such as omitting Social Security Numbers or names.

- Don't forget to deduct section 125 Cafeteria Plan amounts from the total gross wages when calculating reportable gross wages.

- Do not attempt to file electronically if you have fewer than 100 employees without checking if you're eligible or required to do so.

- Avoid inaccurately calculating your taxes owed in Part II, as this can lead to underpayment or overpayment and potential penalties.

- Do not file only one part of the form; both Parts I and II must be submitted together.

- Avoid making out payments to an incorrect entity; ensure checks or money orders are made payable to the Georgia Department of Labor.

- Do not attach anything, including payment or additional documentation, to the form with staples as instructed for electronic form processing.

- Refrain from guessing or estimating information needed for the form; verify all details for accuracy before submitting.

- Do not disregard the need to report any changes in your business, such as change in ownership or business address, as specified in the form’s instructions.

Misconceptions

When it comes to the Georgia Tax Wage Report form, also known as the DOL-4N, there are several misconceptions that employers, especially those who are new to the process, might have. Understanding these misconceptions can help ensure accurate and timely reporting, compliance with state labor laws, and avoidance of unnecessary penalties.

Electronic filing is only for large corporations: While the requirement to file electronically by magnetic media or online applies to employers with more than 100 employees, smaller employers can also opt for these methods. Online filing is encouraged for its convenience and efficiency, making it a viable option for businesses of all sizes.

Reporting wages means only cash payments are included: The form requires the reporting of total reportable gross wages, which include not just cash wages but also other forms of compensation such as tips. Moreover, certain pre-tax deductions, like those under a 125 Cafeteria Plan, are subtracted from the gross wages for the quarter.

Tax and wage reports are filed annually: The name, Employer's Quarterly Tax and Wage Report, highlights the necessity to file this form quarterly, not annually. Employers must submit this report every three months to accurately report wages paid and taxes due for that quarter.

Zero wages mean no report is necessary: Even if no wages were paid during a quarter, employers are still required to submit Parts I and II of the DOL-4N form. Entering zeros in the Total Reportable Gross Wages Paid This Quarter section is necessary to maintain compliance with reporting requirements.

New employers must use the standard contribution tax rate: While there is a set contribution tax rate for new employers, it has changed over time. For instance, the rate was 2.64% for tax periods starting January 1, 2017, slightly higher than the previous rate of 2.62%. Understanding the correct rate applicable to the reporting period is crucial for accurate calculation of taxes owed.

Interest and penalties only apply if you don't pay the taxes: Late filing of the form itself can result in penalties, regardless of whether the tax due is paid on time. A penalty is imposed for late filing, calculated as either $20 or .05% of total wages, whichever is greater, for each month past the due date. Additionally, interest accrues on late payments at the rate of 1.5% per month until the tax and administrative assessment are fully paid.

By addressing these misconceptions, employers can ensure they meet all requirements for the Georgia Tax Wage Report form, avoiding penalties and keeping in good standing with the Georgia Department of Labor.

Key takeaways

Filling out and submitting the Georgia Tax Wage Report Form, known as Form DOL-4N, is a necessary quarterly task for employers operating within the state. This document serves a critical role in ensuring accurate tax and wage reporting to the Georgia Department of Labor (GDOL).

- It's essential to select the correct quarter ending month, enter the relevant year, and provide your GDOL account number right at the top section of Part I. If you haven't been assigned an account number yet, write “Applied For” and remember to attach Form DOL-1A (Employer Status Report).

- In the form, report each employee's Social Security Number, full name, and total reportable gross wages for the quarter. This includes all wages paid, plus any tip wages, minus deductions allowed under a 125 Cafeteria Plan.

- For employers with more than 100 employees, electronic filing is mandatory. This can be done via magnetic media such as DVD, CD-ROM, or USB Flash Drive, or online through the official platform.

- Part II is reserved for tax summary information and any account changes. This includes monthly employment data, reportable gross wages, non-taxable wages exclusions, and calculation of various taxes and assessments due. Accurate completion helps prevent errors in tax liability.

- Penalties and interest calculations for late payments are included in Part II. Understanding how these are computed is crucial for avoiding unexpected costs. The specific deadlines and rates are provided to ensure timely and accurate submissions.

- If changes to your account occur, such as a change in business name, principal location, or Federal Identification number, these can be reported in Sections A through D at the bottom of Part II, ensuring your account information remains up to date.

For assistance in filling out Sections A-D or for any related queries, employers are encouraged to contact the GDOL directly. Keeping accurate and timely records, alongside prompt report submissions, aids in maintaining compliant with Georgia labor laws and contributes to the smooth operation of the state's employment system. Additionally, various filing and payment options are accessible through the GDOL website, offering convenience to employers. Should online payment not be possible, checks or money orders can be mailed to the specified GDOL address, ensuring the inclusion of the GDOL account number for accurate processing.

Popular PDF Forms

Business Hours Sign Template Free - A tool for businesses to communicate their weekly schedule, including the days they are open and the specific hours of operation.

Secondary Leaving Certificate - Embodies the essence of Jackson Henry Agarwal's school life, encapsulating both his personal growth and academic progress.