Blank Geico Claim Report PDF Template

When an accident occurs, navigating the aftermath can seem daunting, especially when it involves dealing with insurance claims. The Geico Claim Report form plays a crucial role in this process, providing a structured way for individuals to document the specifics of the incident for the insurance provider. Designed with meticulous detail, this form covers a variety of aspects essential for thorough documentation and swift processing of claims. Key sections require information about the insured, such as their name, age, occupation, marital status, and contact details, alongside specific details about the vehicle involved—including make, year, model, and license number. The form also asks whether the vehicle has medical coverage for medical expenses, an important detail for addressing potential injuries. Accurate information about the accident itself is pivotal, including the date, time, place, and full description of how the incidents unfolded. Individuals must also specify the extent of their injuries, if any, the use of seat belts, weather and road conditions at the time, and any witnesses or additional damages. Completing the form culminates in a declaration against fraud, reminding filers of the legal implications of dishonesty. This comprehensive approach ensures that all necessary information is captured to assist Geico in efficiently processing the insurance claim.

Preview - Geico Claim Report Form

Instructions

The Accident Report is for you to document what happened. Please include the name of GEICO insured, your claim number, and complete details related to the accident, then sign and date the form.

(Form Below)

GOVERNMENT EMPLOYEES INSURANCE COMPANIES |

|

|

|

|

GEICO INSURED |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

REPORT OF ACCIDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

GEICO CLAIM # |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR NAME |

|

|

|

|

|

|

|

|

|

AGE |

|

|

|

|

|

|

OCCUPATION |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

(NUMBER) |

|

(STREET) |

(CITY) |

(STATE) (ZIP) |

|

PHONE NO. |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOME |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME AND ADDRESS OF EMPLOYER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ARE YOU MARRIED? IF YES, G I V E FULL NAME OF SPOUSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

MAKE OF OUR INSURED”S |

|

YEAR |

|

|

MODEL |

|

|

|

LIC NO |

|

|

STATE |

|

|||||||||||||||

AUTO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF OUR INSURED DRIVER |

|

|

|

|

|

|

|

|

|

|

|

DRIVER”S LICENSE # |

|

|

|

|

AGE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

WHAT COMPANY(S) INSURES |

|

NAME OF COMPANY (S) |

|

|

POLICY NO. |

|

DOES THE POLICY CONTAIN |

|||||||||||||||||||||

YOUR AUTOMOBILE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICAL COVERAGE FOR |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICAL EXPENSES? |

|

||||

|

|

|

|

|

|

PHONE # |

|

|

|

|

|

CLAIM # |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

||

DATE OF |

|

|

|

|

TIME |

PLACE OF ACCIDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ACCIDENT |

|

|

|

|

M. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAKE OF YOUR AUTO |

|

|

|

YEAR |

|

MODEL |

|

|

|

LIC. NO. |

|

|

|

|

|

|

|

|

|

STATE |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OF REGISTERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF DRIVER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DRIVER'S LICENSE # |

|

AGE |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

WAS DRIVER ON |

|

|

|

|

|

IF YES, FOR WHAT PURPOSE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ERRAND FOR OWNER? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

NAME, ADDRESS, AND TELEPHONE NUMBER OF OCCUPANTS OF YOUR AUTOMOBILE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

NAME |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE NO. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WERE YOU HURT? YES |

|

NO |

WAS ANYONE HURT? YES |

NO IF SO, G I V E NAME, ADDRESS AND TEL. NO. OF OTHER PERSONS INJURED: |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEAT BELTS |

|||

|

NAME |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

TEL. NO. |

|

|

|

IN USE? |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATURE OF YOUR INJURIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

NAME AND ADDRESS OF DOCTOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

NAMES AND ADDRESSES OF ALL WITNESSES (OTHER THAN OCCUPANTS OF YOUR CAR): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

IF AFTER DARK, WERE ALL VEHICLES LIGHTED? |

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

CONDITION OF ROAD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEATHER CONDITONS |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PLEASE COMPLETE OTHER SIDE)

STATE FULL DETAILS OF HOW THE ACCIDENT HAPPENED:

WHERE CAN CAR BE SEEN DURING THE DAY?

LIST THE AREAS OF YOUR CAR WHICH WERE DAMAGED IN THE ACCIDENT:

DESCRIBE DAMAGED PROPERTY OTHER THAN YOUR AUTO

ARE YOU MAKING A CLAIM? |

AGAINST WHOM? |

|

|

|

|

|

FOR WHAT AMOUNT? |

|||||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

DID YOU REPORT THE ACCIDENT TO |

WHERE? (DEPT. ADDRESS) |

|

|

|

|

|

|

|||||

POLICE? |

|

|

|

|

|

|

|

|

|

|

||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

WAS ANYONE CHARGED? |

WHO |

|

|

|

|

CHARGES |

||||||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

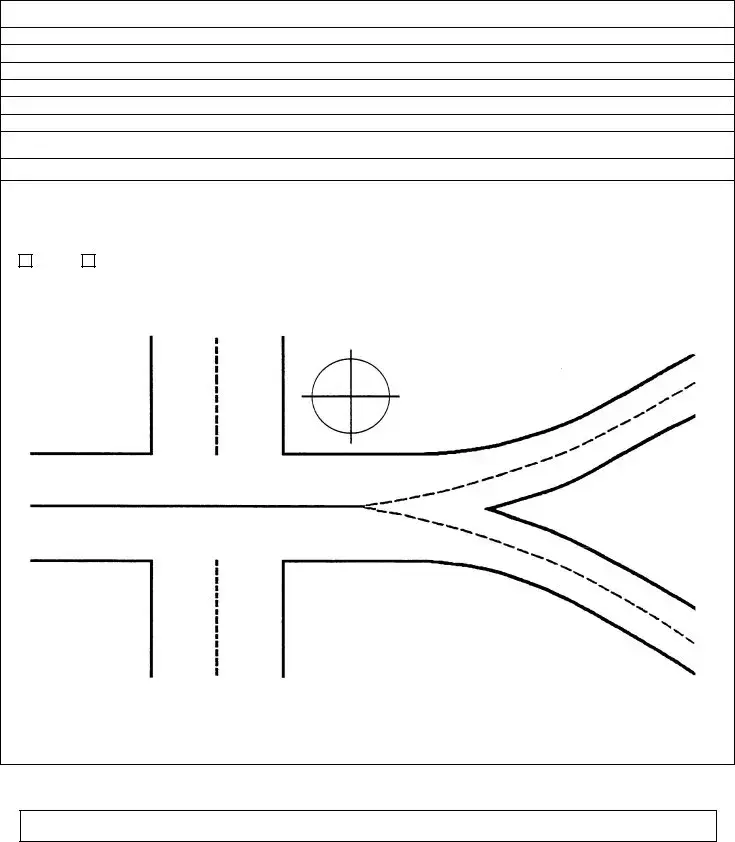

DRAW A SKETCH OF THE ACCIDENT USING THIS DIAGRAM: |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Show by arrow in this |

|

|

||

|

|

|

|

|

|

|

|

circle which way is |

|

|||

|

|

|

|

|

|

|

|

North. |

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Please label autos, stop |

|

|

|

|

|

|

|

|

|

|

|

|

signs, traffic signals, |

|

||||

|

|

|

|

|

|

|

objects, street names, etc. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

DATE |

|

|

|

|

|

|

|

|

|

|

||

Any person who knowingly and with intent to defraud or solicit another to defraud an insurer: (1) by submitting an application, or (2) by filing a claim containing a false statement as to any material fact, may be violating state law

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | The Geico Claim Report form is designed for individuals to document details of an accident involving a Geico insured vehicle. |

| Required Information | Individuals must provide their name, age, occupation, address, contact information, vehicle details, and specifics of the accident, including the date, time, and location. |

| Additional Details | The form requests information about the insured’s and claimant’s vehicles, the drivers, occupants, any injuries, and witnesses. |

| Medical Coverage Inquiry | Claimants are asked whether their policy contains medical coverage for medical expenses resulting from the accident. |

| Incident Description | Claimants must state full details of how the accident occurred, providing a comprehensive account of the event. |

| Damage and Claim Details | Individuals must list damages to their vehicle, describe any other damaged property, and indicate whether they are making a claim and if so, against whom and for what amount. |

| Legal Warning | The form includes a warning that knowingly providing false information with the intent to defraud is against the law. |

| Governing Law | The form specifies that it may be governed by specific state laws, using the code C-22-OR 02-06) NS to indicate form version or applicability, potentially referring to Oregon statutes. |

Instructions on Utilizing Geico Claim Report

Filing a claim with GEICO after an accident involves completing their specific Claims Report form. It's important to gather all relevant information about the incident before beginning the form to ensure accuracy. Information needed includes personal details, specifics about the vehicle(s) involved, the accident's circumstances, and any damages sustained. Following the completion of this form, it will be submitted to GEICO for review. A claims adjuster will likely get in touch to discuss the next steps, which may include an evaluation of the vehicle damage, medical expenses (if any), and determining the settlement.

- Start by entering the GEICO insured’s name, your claim number at the top of the form to ensure it is correctly associated with your case.

- Provide your personal information including your name, age, occupation, and full address (number, street, city, state, zip), and home phone number.

- Indicate your employment details, including the name and address of your employer. If applicable, denote whether you are married and provide the full name of your spouse.

- Enter the details about the insured vehicle, such as the year, make, model, license number, and the state it’s registered in. Include the name and address of the insured driver, their driver's license number, and age.

- Specify information regarding the insurance policy that covers the vehicle involved in the accident. This includes the name of the insurance company(s), the policy number, and if the policy includes medical coverage for medical expenses.

- Document the accident's specifics: date, time, place, and a full description of how the accident happened.

- Enter details about your vehicle (if different from the insured vehicle): make, year, model, license number, state, and the registered owner and driver’s name, address, and age.

- Include the names, addresses, and telephone numbers of all occupants in your automobile and specify if anyone was injured, including the use of seat belts at the time of the accident.

- List the nature of your injuries, the name, and address of your doctor, as well as names and addresses of witnesses other than the occupants of your car.

- Detail the vehicle damage, describing the condition of the road, weather conditions, and whether all vehicles were lighted after dark.

- Indicate where the car can be seen during the day, and list the areas of your car that were damaged in the accident.

- Describe any damaged property other than your auto and state whether you are making a claim, against whom, and for what amount.

- Report if the accident was reported to the police, including the department and address, and if anyone was charged.

- Draw a sketch of the accident in the provided diagram, showing the direction with an arrow indicating north and labeling significant elements like autos, stop signs, traffic signals, and names of streets.

- Review the form for accuracy, then sign and date the document at the bottom. Be mindful of the legal notice regarding the submission of fraudulent information.

Once submitted, the claim will undergo a review process, during which additional information or clarifications might be requested. It's crucial to provide accurate and comprehensive information to ensure a smooth claims process.

Obtain Answers on Geico Claim Report

When filing a claim with GEICO following an accident, it's essential to have a clear understanding of the claim report form and the process itself. The form serves as your medium to narrate the incident comprehensively. Here, we address some commonly asked questions that could help demystify the process for you.

What information do I need to fill out on the GEICO Claim Report form?

You'll need to provide detailed information that includes the name of the GEICO insured, your claim number, and a thorough account of the accident. Specific details such as your personal information (name, age, occupation, etc.), information about the insured vehicle, the accident (date, time, location), and details of any other parties involved (other drivers, occupants of your vehicle) are also required. Ensure to document the extent of injuries, if any, and witness information as well.

How can the accident report form affect my claim?

Completing the accident report form with accurate and detailed information provides a foundation for your claim. This documentation is crucial as it determines the validity and extent of your claim. Inaccurate or incomplete forms can lead to delays or denials in your claim process. Therefore, taking the time to fill out the form thoroughly is in your best interest.

Is it necessary to fill out every section of the form?

Yes, you should fill out every section of the form to the best of your ability. Each section collects essential information necessary for processing your claim efficiently. If a section does not apply to you, it's advisable to mark it as "N/A" (Not Applicable) rather than leaving it blank.

What if I don’t know the answer to a question on the form?

If you encounter a question to which you do not have an answer, it is better to note that the information is currently unknown instead of skipping the question or providing a speculative answer. You can update your claim representative as soon as the information becomes available.

Can I file the report if I don’t have all the required information immediately after the accident?

Yes, you can and should file the report even if some details are missing, ensuring that you highlight the incomplete sections. It's crucial to initiate the claim process as promptly as possible, and you can always provide additional information or amendments later on.

How do I submit the accident report form to GEICO?

Once completed, you can submit the accident report form to GEICO in several ways, including through the GEICO mobile app, by email, or by mail. It is advisable to check the most current submission processes directly with GEICO, as methods and requirements may change.

What happens after I submit the report?

After submitting the report, a GEICO claims adjuster will review the information provided. They may contact you for additional information or clarification. The adjuster will then assess fault, damages, and coverage to determine the compensation amount. Keep all medical records, repair receipts, and any other documents related to your claim for reference.

Who can I contact if I have questions while filling out the form?

If you have any questions or require assistance while completing the form, GEICO provides resources including customer service representatives, claims adjusters, and a comprehensive FAQ section on their website. Don't hesitate to reach out for help to ensure your form is filled out correctly and comprehensively.

Navigating the aftermath of an accident can be stressful, but understanding how to properly complete the GEICO Claim Report form can help ensure your claim process is as smooth as possible. Remember, accurate and complete information is key to a favorable outcome in your claim.

Common mistakes

When filling out the Geico Claim Report form, it's important to pay close attention to detail and provide accurate information. However, people often make mistakes during this process. Here are nine common errors:

- Not including the Geico insured name or forgetting to add the claim number. Both pieces of information are crucial for processing your claim efficiently.

- Failing to provide complete details related to the accident. Vague descriptions can delay the evaluation process.

- Omitting contact information, such as a current phone number or address. This can hinder communication between you and Geico.

- Incorrectly stating the insurance coverage details, including whether there is medical coverage for medical expenses. This affects how your claim is processed.

- Forgetting to mention if seat belts were in use at the time of the accident. This detail is important for assessing claim details.

- Leaving out the condition of the road and weather conditions. These factors can impact the assessment of the accident's circumstances.

- Not fully describing how the accident happened. A clear, detailed account is necessary for a thorough investigation.

- Failing to list injuries or damages properly, or not making it clear whether you are making a claim for these damages.

- Forgetting to sign and date the form. Without a signature, your claim report is considered incomplete and cannot be processed.

Mistakes like these can slow down the claim process considerably. It's imperative to review your form carefully and ensure all necessary information is complete and accurate to avoid delays.

Documents used along the form

When dealing with the aftermath of a vehicle accident, submitting a claim through your insurance provider is a crucial step towards resolution. The GEICO Claim Report form is a comprehensive document designed to encapsulate all the necessary details pertaining to the accident. This form thoroughly guides the claimant through the process of documenting the incident, including information about the insured, the vehicle(s) involved, the accident's specifics, and any damages or injuries incurred. However, to ensure a smooth and supportive claim process, several other documents and forms are often utilized alongside the GEICO Claim Report form. Here is a brief overview of five such documents.

- Police Report: A detailed report compiled by the responding law enforcement officer, providing an objective overview of the incident, including any findings or citations issued. This document plays a critical role in establishing the facts surrounding the accident.

- Medical Records: In the event of injuries, comprehensive medical records and bills related to the accident are crucial. They offer a precise account of the injuries suffered, treatment received, and the associated costs, helping to substantiate any claims for medical expenses.

- Photographs of the Accident Scene and Damages: Visual evidence can significantly bolster a claim by illustrating both the extent of damage to the vehicles involved and any relevant conditions at the accident scene. Clear, well-taken photos can provide invaluable context and detail.

- Witness Statements: Written accounts from individuals who witnessed the accident can offer additional perspectives on how the incident occurred. These statements can support the claimant's version of events and provide further evidence to insurance adjusters.

- Repair Estimates: Documentation of professional estimates for repairing the damages to the vehicle(s) involved. These estimates help the insurance company gauge the financial extent of the damages and are essential for processing the claim.

Together, these documents complement the GEICO Claim Report form, creating a comprehensive package that aids the claimant and the insurance company in understanding the incident in its entirety. Each document contributes valuable information, facilitating a thorough evaluation of the claim and ensuring a fair and timely resolution for all parties involved. Remember, the accuracy and completeness of the information provided across all these documents are pivotal in navigating the claims process successfully.

Similar forms

The Auto Insurance Application Form shares similarities with the Geico Claim Report form in its collection of personal information such as name, age, address, occupation, and marital status. Both forms require detailed vehicle information, including make, model, and license number. They are essential for initiating the process, whether it be for filing a claim or obtaining insurance coverage.

The Property Damage Claim Form is another document that bears resemblance to the Geico Claim Report form. This form also asks for detailed information on damaged property, the circumstances leading to the damage, and requests an estimation of the repair costs. Documentation of property damage and relevant personal information are crucial parts in both types of forms.

Medical Claim Forms are used to request reimbursement or direct payment for medical services received. They are similar to the Geico Claim Report concerning the part that deals with injuries, listing of doctors, and potentially medical expenses. Both types of documents require detailed incident descriptions to support the claims.

The Workers' Compensation Claim Form comes close too, especially in sections asking about the employer and the nature of employment. While focused on workplace injuries, this form, like the Geico report, gathers detailed information on the incident, including injuries sustained and parties involved.

Police Accident Reports are official accounts of an incident, prepared by law enforcement. Like the Geico Claim Report, they document accident details, involved parties, and witness statements. Both are used to assess responsibility and support claims processing.

Structured similarly to the Geico form, Renters’ Insurance Claim Forms request information on personal belongings, detailed descriptions of lost or damaged items, and circumstances of the incident. Both types of documents are crucial for substantiating claims related to losses.

The Homeowners Insurance Claim Form parallels the Geico Claim Report when it involves property damage or loss, requiring similar detailed descriptions of the incident, damaged areas, and listing of personal information. Both documents are fundamental in initiating the claims process for recovery purposes.

Product Warranty Claim Forms require specific information about the product, purchase details, and a description of the fault. Like the Geico Claim Report, these forms include a description of the issue (akin to the accident description) and personal contact information for follow-up.

Like the Geico Claim Report, Third-Party Liability Claim Forms ask for detailed descriptions of incidents leading to personal injury or property damage, pertinent personal information, and specifics about the damages or injuries incurred. Both are key in legal proceedings and insurance claims involving third parties.

Dos and Don'ts

When filling out the Geico Claim Report form, there are essential steps to follow and mistakes to avoid ensuring your claim is processed effectively and accurately. Here’s a guide to help you through the process:

- Do provide complete details related to the accident. Include all the specifics such as how, when, and where the accident occurred.

- Don't omit the claim number and the name of the Geico insured. These are crucial for identifying your case.

- Do ensure the information about your automobile and the Geico insured’s automobile is accurate. This includes the year, make, model, and license number.

- Don't forget to document all individuals involved. Include names and contact information of any passengers, other drivers, and witnesses.

- Do accurately describe the damage to your vehicle and any other property. This helps in assessing the claim properly.

- Don't leave out information about injuries. Whether it’s you or others who were hurt, include the nature of the injuries and medical provider details.

- Do check if all vehicles were lighted after dark and describe weather and road conditions. Environmental factors can influence the processing of your claim.

- Don’t sign the form without ensuring all information is truthful and accurate. Remember, submitting false information might lead to legal consequences.

- Do sign and date the form. Your signature verifies that you’ve provided truthful information to the best of your knowledge.

Following these guidelines will help in the efficient processing of your Geico Claim Report form. Remember, accuracy and completeness are key.

Misconceptions

When it comes to filling out a Geico Claim Report form after an accident, there are a few misconceptions that can lead to confusion. Here's a look at some of these myths, and the real facts behind them:

- Myth: You need to decide immediately if you're making a claim.

This is not true. While prompt reporting of an accident is crucial for a smooth claims process, you do not need to decide on the spot whether you are making a claim. It's important to report the accident to Geico as soon as possible, but you can take a moment to assess the situation and your insurance policy before officially filing a claim.

- Myth: The form must be filled out in one sitting.

Many people believe that once you start filling out the Geico Claim Report form, you must complete it in one go. However, you can gather information, take a break, and then continue filling out the form. The key is to provide accurate and complete details to the best of your ability and knowledge.

- Myth: All sections apply to every claim.

Not every section of the Geico Claim Report form will apply to your specific situation. For example, if there were no injuries, you wouldn't need to fill out the sections regarding medical coverage or personal injuries. It's important to read through the form carefully and fill out only the parts that are relevant to your accident.

- Myth: The claim process is lengthy and complicated.

While it might seem daunting at first, the claim process with Geico is designed to be as straightforward as possible. The form itself guides you through each step of documenting the accident. Additionally, Geico's customer service is available to assist you if you have questions or need help completing the form.

Understanding these misconceptions can help make the process of filing a claim with Geico less intimidating. Remember, accurate and thorough documentation on your claim report form is key to a smooth claims process.

Key takeaways

Reporting an accident to your insurance company is a critical step after an incident. The Geico Claim Report form serves as a means to document the details of the accident and facilitate the claims process. Understanding how to correctly complete this form is essential for a smooth experience. Below are nine key takeaways to consider when filling out and utilizing the Geico Claim Report form:

- Accurate Information: Ensure you provide accurate and complete information regarding the accident, including the Geico insured's name, your claim number, and a thorough account of the incident.

- Verify Details: Double-check the details you enter, especially your personal information, claim number, and the specifics of the accident, to avoid any discrepancies that could delay the claim process.

- Document Injuries: Clearly state if you or anyone else was hurt in the accident, providing names, addresses, and phone numbers of the injured parties, alongside details of the injuries sustained and medical attention received.

- Provide Vehicle Information: Include complete information about the vehicles involved, such as make, model, year, license number, and the state of registration, both for your car and the Geico insured’s vehicle.

- Accident Details: Offer a detailed description of how the accident happened, including the date, time, and location, ensuring you cover all aspects that lead to and resulted from the incident.

- Contact Information: List the names, addresses, and telephone numbers of all occupants, witnesses, and the doctors who treated injuries related to the accident.

- Insurance Information: Mention any other insurance coverage that may be relevant to the claim, including policy numbers and the company insuring your vehicle, as well as whether your policy covers medical expenses.

- Police Report: Indicate whether the accident was reported to the police, the department address, and if any charges were filed. This can be crucial information for the claims process.

- Signature and Date: Do not forget to sign and date the form. An unsigned form may not be processed, potentially delaying your claim.

Completing the Geico Claim Report form with diligence and attention to detail not only ensures that all necessary information is communicated but also helps in expediting the claims process, allowing for a more efficient resolution to an otherwise stressful situation.

Popular PDF Forms

Va St-10 - A tool for Virginia churches to ensure religious and education-related purchases are tax-exempt under state law.

Uniform Support Declaration - Accuracy and completeness in filling out the Uniform Support Declaration are paramount for fair support evaluations.

How to Get Msds Sheets - Assessment of the product's impact on the environment, including any special concerns for aquatic toxicity and ecological damage.