Blank Georgia St 5 PDF Template

In the diverse landscape of tax regulations within the United States, the Georgia ST-5 form emerges as a critical document for entities looking to navigate the complexities of sales and use tax exemptions. Officially titled the "Sales Tax Certificate of Exemption," this form is issued by the State of Georgia Department of Revenue and serves as a declaration by purchasers that their acquisitions—ranging from tangible personal property to specific services—are intended for uses that qualify for tax-exempt status under various provisions of the Georgia Code (O.C.G.A.). Such exemptions encompass a broad spectrum of scenarios, including purchases for resale, items bought by or for certain government and educational institutions, materials meant for packaging goods for sale or shipment, and even transportation equipment manufactured within the state for exclusive use outside its borders. Additional exemptions apply to transactions involving the Federal Reserve Bank, federally chartered credit unions, or those credit unions organized under state laws, highlighting the form's significance across multiple sectors. Aside from declaring the nature of the exempt purchase, this document mandates the disclosure of the purchaser’s information, solidifying its role in maintaining transactional transparency and legal compliance. By submitting the ST-5 form, purchasers affirm under the penalties of perjury that they are entitled to the claimed exemptions, acknowledging the potential tax implications should the items be used in a manner inconsistent with the declared purposes. This document not only facilitates tax-exempt transactions but also underscores the purchaser's responsibility to adhere to the specified tax laws and regulations of Georgia, ensuring a balance between legal compliance and fiscal responsibility.

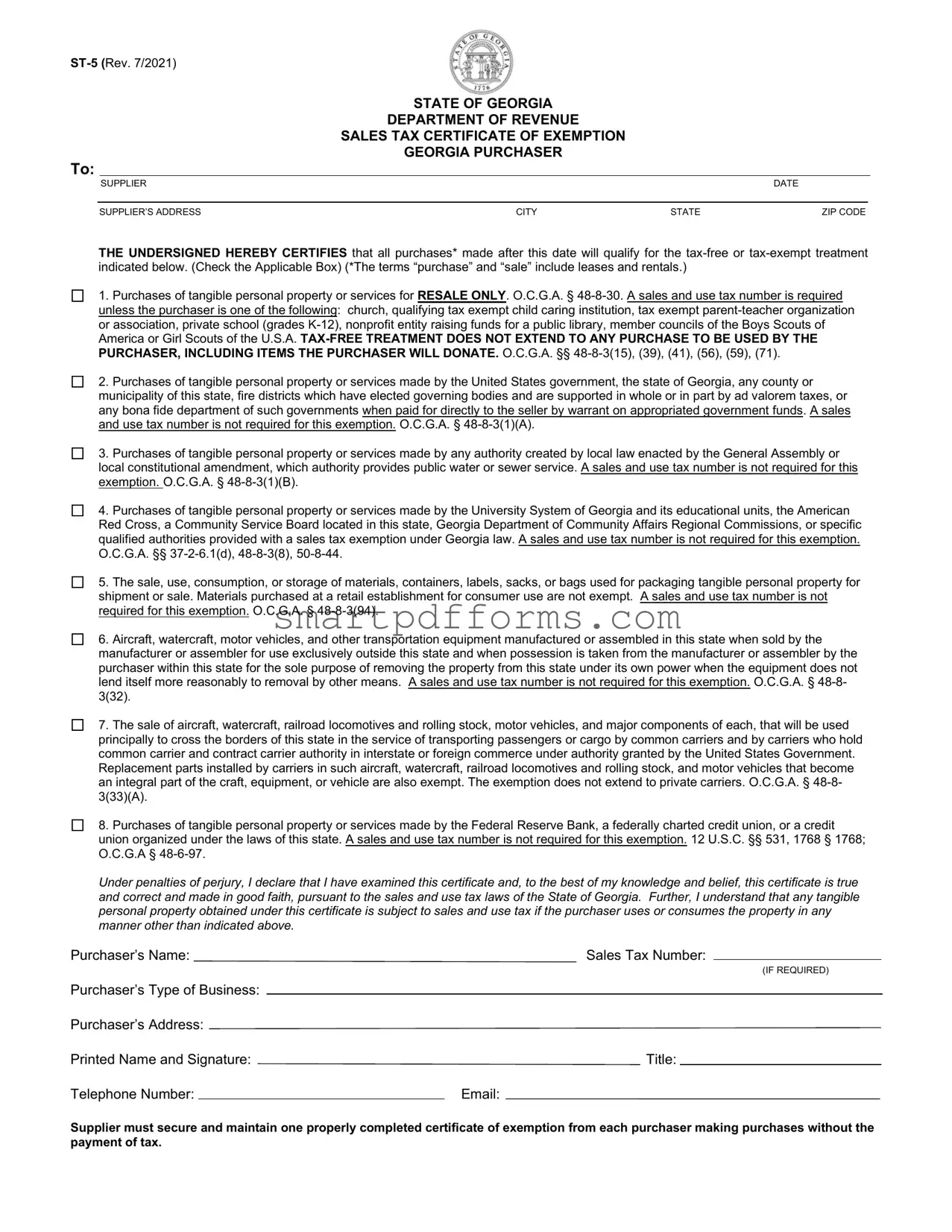

Preview - Georgia St 5 Form

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES TAX CERTIFICATE OF EXEMPTION

GEORGIA PURCHASER

To:

|

SUPPLIER |

|

|

DATE |

|

|

|

|

|

|

|

SUPPLIER’S ADDRESS |

CITY |

STATE |

ZIP CODE |

||

THE UNDERSIGNED HEREBY CERTIFIES that all purchases* made after this date will qualify for the

1. Purchases of tangible personal property or services for RESALE ONLY. O.C.G.A. §

2. Purchases of tangible personal property or services made by the United States government, the state of Georgia, any county or municipality of this state, fire districts which have elected governing bodies and are supported in whole or in part by ad valorem taxes, or any bona fide department of such governments when paid for directly to the seller by warrant on appropriated government funds. A sales and use tax number is not required for this exemption. O.C.G.A. §

3. Purchases of tangible personal property or services made by any authority created by local law enacted by the General Assembly or local constitutional amendment, which authority provides public water or sewer service. A sales and use tax number is not required for this exemption. O.C.G.A. §

4. Purchases of tangible personal property or services made by the University System of Georgia and its educational units, the American Red Cross, a Community Service Board located in this state, Georgia Department of Community Affairs Regional Commissions, or specific qualified authorities provided with a sales tax exemption under Georgia law. A sales and use tax number is not required for this exemption. O.C.G.A. §§

5. The sale, use, consumption, or storage of materials, containers, labels, sacks, or bags used for packaging tangible personal property for shipment or sale. Materials purchased at a retail establishment for consumer use are not exempt. A sales and use tax number is not required for this exemption. O.C.G.A. §

6. Aircraft, watercraft, motor vehicles, and other transportation equipment manufactured or assembled in this state when sold by the manufacturer or assembler for use exclusively outside this state and when possession is taken from the manufacturer or assembler by the purchaser within this state for the sole purpose of removing the property from this state under its own power when the equipment does not lend itself more reasonably to removal by other means. A sales and use tax number is not required for this exemption. O.C.G.A. §

7. The sale of aircraft, watercraft, railroad locomotives and rolling stock, motor vehicles, and major components of each, that will be used principally to cross the borders of this state in the service of transporting passengers or cargo by common carriers and by carriers who hold common carrier and contract carrier authority in interstate or foreign commerce under authority granted by the United States Government. Replacement parts installed by carriers in such aircraft, watercraft, railroad locomotives and rolling stock, and motor vehicles that become an integral part of the craft, equipment, or vehicle are also exempt. The exemption does not extend to private carriers. O.C.G.A. §

8. Purchases of tangible personal property or services made by the Federal Reserve Bank, a federally charted credit union, or a credit union organized under the laws of this state. A sales and use tax number is not required for this exemption. 12 U.S.C. §§ 531, 1768 § 1768; O.C.G.A §

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, this certificate is true and correct and made in good faith, pursuant to the sales and use tax laws of the State of Georgia. Further, I understand that any tangible personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any manner other than indicated above.

Purchaser’s Name: |

Sales Tax Number: |

|

|||

|

|

|

|

|

(IF REQUIRED) |

Purchaser’s Type of Business: |

|

|

|

|

|

|

|

|

|

||

Purchaser’s Address: |

|

|

|

||

Printed Name and Signature: |

Title: |

|

|||

Telephone Number: |

|

|

Email: |

||

Supplier must secure and maintain one properly completed certificate of exemption from each purchaser making purchases without the payment of tax.

Form Data

| Fact | Detail |

|---|---|

| Document Title | Georgia State Form ST-5, Sales Tax Certificate of Exemption |

| Revision Date | July 2021 |

| Primary Purpose | To certify tax-exempt purchases made by qualified entities in Georgia. |

| Governing Law | O.C.G.A. §§ 48-8-30, 48-8-3, 37-2-6.1(d), 50-8-44, 12 U.S.C. §§ 531, 1768 |

| Applicable Exemptions Include | Resale items, purchases by government and certain non-profit organizations, materials for packaging, transportation equipment for use outside Georgia, and purchases by financial institutions. |

Instructions on Utilizing Georgia St 5

Filling out the Georgia ST-5 form is a crucial step for purchasers seeking tax-exempt status on certain purchases within the state. This document serves as a confirmation that purchases made meet the qualifications for tax exemptions as outlined by Georgia law. It is vital for both the purchaser and the supplying parties to accurately complete this form to ensure compliance and avoid any potential taxation issues.

- Begin by identifying the type of exemption that applies to your purchase from the options listed on the form. Check the appropriate box indicating the reason for the exemption, such as purchases for resale, purchases made by government entities, or specific exempt organizations.

- Input the date at the top of the form. This indicates the effective date from which the tax exemption is claimed.

- Fill in the supplier's information, including the supplier's full name, address, city, state, and ZIP code. This information should be accurate to ensure the supplier can verify the exemption.

- Under "Purchaser’s Name," provide the legal name of the entity claiming the tax exemption.

- If required for your exemption category, provide the Sales Tax Number. Certain exemptions do not require this number; check the specific exemption criteria listed on the form.

- Specify the "Purchaser’s Type of Business" to give context to the supplier and authorities about the nature of the exempt purchases.

- Enter the "Purchaser’s Address," ensuring it matches the legal address associated with the entity or individual claiming the exemption.

- Print your name in the designated area, then sign your signature to validate the form. The signature attests that the information provided is accurate and in compliance with Georgia's sales and use tax laws.

- Indicate your title next to your signature, such as Owner, Manager, or Authorized Representative, to clarify your relationship to the purchaser entity.

- Provide a telephone number and email address for contact purposes. This information is used if clarification or additional information is required regarding the exemption claim.

After completing the form, it's important to provide a copy to the supplier and keep a copy for your records. The supplier is required to retain the certificate of exemption to substantiate the tax-free transaction. Remember, the integrity of the information provided is crucial as misuse or fraudulent claiming of tax exemptions can lead to penalties under Georgia law.

Obtain Answers on Georgia St 5

What is the Georgia ST-5 form?

The Georgia ST-5 form, officially known as the Sales Tax Certificate of Exemption, is a document that allows qualified purchasers to buy goods or services tax-free, under specific conditions outlined by the State of Georgia Department of Revenue. This form serves as a declaration that the purchases made by the holder will qualify for exemption from sales and use tax, based on the criteria stipulated by Georgian law.

Who can use the ST-5 form in Georgia?

Entities eligible to use the ST-5 form include, but are not limited to, certain nonprofits like churches and parent-teacher organizations, educational institutions, government agencies, authorities providing public water or sewer services, the University System of Georgia, the American Red Cross, and businesses involved in the resale of tangible personal property or services. Specific conditions apply to each category, ensuring that these entities strictly use the acquired goods or services in a manner that aligns with their tax-exempt status.

Is a sales tax number always required to use the ST-5 form?

No, a sales tax number is not always required to utilize the ST-5 form. While businesses purchasing goods for resale must provide a sales tax number, several exempted entities—such as government bodies, nonprofit organizations, and specific institutions outlined in the form—do not need to present a sales tax number to qualify for the exemption.

What purchases are covered under the ST-5 form?

Purchases that can be exempted using the ST-5 form include tangible personal property or services intended for resale, goods or services bought by eligible government and educational institutions, materials for packaging products for sale or shipment, certain transportation equipment and vehicles if used exclusively outside Georgia, and purchases made by the Federal Reserve Bank, among others. It's imperative that these purchases adhere to the exemption criteria as misuse may subject the property to standard sales and use tax rules.

Can the ST-5 form be used for personal purchases?

No, the ST-5 form cannot be used for personal purchases. The form clearly states that tax-exempt treatment does not extend to items to be used by the purchaser for personal use, including items that the purchaser intends to donate. Its use is strictly limited to purchases made within the parameters of the entity’s exempt status, mainly for resale or for direct use in the operation of the exempt organization or business.

How long is the ST-5 form valid?

The document does not provide a specific expiration date for the ST-5 form's validity. However, it implies a continuing assurance that all future purchases made after the issuance of this certificate are for qualifying tax-exempt purposes. Entities should be prepared to renew or update their information to reflect any significant changes in their operations or tax exemption status that might affect their eligibility.

What consequences could follow if an entity misuses the ST-5 form?

Misuse of the ST-5 form, such as making personal purchases or acquiring goods not covered by the exemption, can lead to the revocation of tax-exempt status. Furthermore, the entity may be subject to pay the sales and use tax retrospectively, along with potential penalties and interest, as per Georgia’s tax laws.

Does the supplier retain a copy of the ST-5 form?

Yes, it is compulsory for the supplier to secure and maintain a properly completed ST-5 certificate from each purchaser claiming exemption from the payment of sales tax. This is crucial for audit purposes and ensures that suppliers can verify the validity of tax-exempt transactions.

Where can one obtain an ST-5 form?

The ST-5 form can be obtained directly from the State of Georgia Department of Revenue’s official website or by contacting their office. It's important for entities to use the most current version of the form, as revisions are made to reflect changes in tax legislation.

Is the ST-5 form applicable only in Georgia?

Yes, the ST-5 form is specific to the State of Georgia and applies to transactions within this state. Other states may have similar forms but with different requirements and guidelines for tax-exempt purchases.

Common mistakes

-

Not providing a sales and use tax number when required is a common mistake. For most exemptions under the Georgia ST-5 form, organizations such as businesses, certain non-profits, and other entities must include their sales and use tax number. Failing to do so can invalidate the form, making the purchase subject to sales tax.

-

Incorrectly checking the applicable exemption box leads to issues in determining the correct tax status of a purchase. Each box corresponds to a specific situation or type of purchase that qualifies for exemption. Accuracy here ensures the transaction is processed correctly and benefits from the intended tax exemption.

-

Overlooking the necessity to update the form for every new purchase is a frequent oversight. The ST-5 form stipulates that all purchases made after the date on the form are qualified for the tax exemption. Not updating this can lead to complications or the potential for buyers to inadvertently not comply with current tax laws.

-

Incomplete purchaser information, such as leaving the purchaser's type of business, address, or contact information sections blank, can lead to the form being rejected. This information is vital for verifying the eligibility of the purchaser for tax-exempt status.

-

Signature related errors, either by the purchaser not signing the form or the signature being illegible, can invalidate the document. A properly completed certificate must include a clear printed name and signature to verify the authenticity and commitment of the purchaser to the declarations made on the form.

-

Misunderstanding the scope of the exemption selected, particularly regarding items intended for use rather than resale or items not directly linked to the types of exempt purchases specified. This misunderstanding can lead to purchasing items under the assumption they are tax-exempt when, in fact, they are not.

Documents used along the form

In managing business transactions in Georgia, the ST-5 Sales Tax Certificate of Exemption is crucial for those qualifying for tax-exempt purchases. However, navigating through these transactions often requires additional forms and documentation to ensure full compliance and benefit from available exemptions. Below is a selection of documents frequently used alongside the Georgia ST-5 form, each serving its unique purpose in the broader scope of tax exemption and financial reporting.

- ST-4 Certificate of Exemption: Used for purchases of tangible personal property for resale which will be paid for directly by warrant on appropriated government funds. This document is specifically for government-related purchases.

- GTC-APP Application for Sales Tax Certificate of Registration: Necessary for businesses to apply for a sales tax number, enabling them to collect and remit sales tax, a prerequisite for certain types of ST-5 exemptions.

- ST-12 Sales and Use Tax Return: Filed by businesses to report and pay the sales and use tax collected from customers, an essential step in maintaining tax compliance.

- Form ST-5C Multistate Taxpayer Form: Allows businesses operating in multiple states to claim exemptions or report tax liabilities across state lines, applicable when purchases involve interstate transactions.

- Form 600 - Corporation Tax Return: Required from corporations operating in Georgia, reporting income and calculating state tax liabilities, relevant for businesses utilizing ST-5 exemptions for financial reporting.

- Non-profit Organization Tax Exemption Letter: Issued by the Georgia Department of Revenue or the IRS, certifying a non-profit's tax-exempt status. This letter supports ST-5 exemption claims for qualifying organizations.

- ST-8 Certificate of Exemption for Federal Government Purchases: Employed when the United States government makes direct purchases, exempting such transactions from sales tax.

- Annual Resale Certificate for Sales Tax: Used by retailers and wholesalers to purchase goods for resale without paying sales tax at the time of purchase. This certificate must be renewed annually and complements the ST-5 for resellers.

Understanding and properly utilizing these documents in conjunction with the Georgia ST-5 form can streamline tax exemption processes, ensuring businesses and organizations maximize their benefits while adhering to state tax laws. Navigating these requirements can be complex, highlighting the importance of thorough documentation and compliance to facilitate smooth and efficient tax-exempt transactions.

Similar forms

The Georgia ST-5 Sales Tax Certificate of Exemption is specifically designed to facilitate tax-exempt purchases for eligible entities within Georgia. This document is central to ensuring that sales tax is accurately applied or exempted in accordance with state laws. Below are five documents that share similarities with the Georgia ST-5 form in various jurisdictions and contexts:

- Florida Annual Resale Certificate for Sales Tax: Much like the Georgia ST-5, the Florida Annual Resale Certificate allows businesses to purchase goods tax-free that will be resold or rented. Both certificates require the purchaser to provide evidence of their eligibility for the exemption and stress the consequences of misuse of the certificate.

- California Resale Certificate: Similar to the ST-5, this certificate is used by businesses in California to buy or lease property tax-free that will be resold or leased in the ordinary course of operations. The certificates both necessitate that the purchaser's eligibility is thoroughly documented and likewise emphasize that property obtained under the certificate is subject to tax if used in a way that doesn't comply with the stated purpose.

- Texas Sales and Use Tax Resale Certificate: Texas businesses utilize this form under circumstances akin to the Georgia ST-5, specifically for purchasing goods without paying state sales tax when the intention is to resell those goods. Both forms require accurate representation of the purchaser's eligibility and caution against any misuse of the exemption status.

- New York State Sales Tax Exemption Certificate: This document serves a similar function for tax-exempt purchases in New York. Like the ST-5, it covers various categories of purchases and emphasizes the importance of correct application to avoid penalties. Both certificates are pivotal for eligible organizations to make tax-exempt purchases according to respective state laws.

- Illinois Certificate of Resale: Similar to the Georgia ST-5 form, this certificate enables businesses in Illinois to purchase goods tax-free if those goods are intended for resale. Both documents underscore the necessity for purchasers to provide comprehensive and accurate information to substantiate their tax exemption eligibility.

Each of these documents, though tailored to the specific requirements and tax laws of their respective states, shares a fundamental purpose with the Georgia ST-5 form – to document and enable tax-exempt purchases for eligible entities under certain conditions. They play an essential role in maintaining compliance with state tax regulations, and misuse of these documents can lead to legal consequences. Understanding and properly utilizing these forms is key for businesses seeking to leverage tax exemptions within their operations.

Dos and Don'ts

Filling out the Georgia ST-5 Sales Tax Certificate of Exemption form correctly is crucial for ensuring that eligible purchases are not unnecessarily taxed. Here are essential dos and don'ts to consider:

- Do ensure that all information provided is accurate and up-to-date. This includes the purchaser’s name, sales tax number (if required), type of business, address, and contact details.

- Do check the applicable box that accurately describes the nature of the exemption you are claiming. Understanding the specific criteria for each exemption category is vital to ensure compliance.

- Do provide a valid sales tax number if your purchase falls under categories that require one, unless your organization is specifically exempt from this requirement.

- Do sign and date the form to certify that the information is correct and that you are aware of the conditions under which the exemption is granted.

- Don’t leave any required fields blank. Incomplete forms may be considered invalid, potentially leading to the denial of the tax exemption.

- Don’t claim an exemption that does not apply to your purchase. Misrepresenting information for the purpose of tax evasion can result in penalties.

- Don’t use the form for purchases that will be used by the purchaser in a manner other than that indicated by the applicable exemption category, including items that will be donated.

Remember, securing and maintaining a properly completed certificate of exemption is a responsibility of both the purchaser and the supplier. Adherence to these guidelines not only ensures compliance with Georgia's sales and use tax laws but also helps protect your organization from unnecessary tax liabilities.

Misconceptions

Understanding the Georgia ST-5 form, a Sales Tax Certificate of Exemption, is essential for businesses and organizations purchasing goods or services in Georgia. However, several misconceptions about the form can lead to misuse or confusion. Here are five common misunderstandings:

- Misconception 1: Any business or organization can use the ST-5 form to avoid paying sales tax on purchases.

This is incorrect. The ST-5 form is specifically designed for entities such as governmental bodies, certain exempt organizations, and businesses making purchases for resale, which are legally exempt from sales tax under Georgia law. The eligibility for using this form is strictly defined and does not extend to all purchasers.

- Misconception 2: Once an entity has an ST-5 form, it never has to pay sales tax again.

This understanding is flawed. The exemption applies only to purchases that fit within the exemption's scope, such as tangible personal property or services for resale or use by exempt governmental and nonprofit entities. Purchases made for other purposes, not covered under the exemption parameters, are still subject to sales tax.

- Misconception 3: The ST-5 form grants tax-exempt status to the holder.

This statement is misleading. Holding an ST-5 form does not, in itself, grant an entity tax-exempt status. The form is a certificate that allows eligible entities to make specific tax-exempt purchases under Georgia sales and use tax laws. An entity's tax-exempt status is determined by other criteria and documentation.

- Misconception 4: The purchasing entity does not need to retain records of transactions made using the ST-5 form.

Contrary to this belief, both the purchaser and the supplier are required to keep accurate records of exempt transactions. These records ensure compliance with tax laws and may be needed for audit purposes.

- Misconception 5: A sales and use tax number is always required to use the ST-5 form.

This is not entirely true. While many entities that use the ST-5 form will require a sales and use tax number, there are specific exemptions listed on the form itself where such a number is not necessary. These exceptions often apply to government agencies, certain nonprofit entities, and other specific organizations.

Clearing up these misconceptions can help entities correctly apply the use of the Georgia ST-5 form, ensuring compliance with state tax laws while taking advantage of legitimate tax exemptions.

Key takeaways

The Georgia ST-5 Sales Tax Certificate of Exemption is a crucial document for entities operating within the state that qualify for sales tax exemptions. Understanding the intricacies of this form is essential for businesses and organizations to ensure compliance with state tax laws while taking advantage of available exemptions. Here are several key takeaways regarding filling out and using the ST-5 form effectively.

- The ST-5 form is specifically designed for purchasers in Georgia who are entitled to make tax-exempt purchases. This includes, but is not limited to, purchases for resale, purchases made by government entities, and specific exempt organizations.

- Purchasers must select the applicable exemption category that best describes the nature of the tax-free purchase. Incorrect categorization can lead to compliance issues or denial of exemption benefits.

- A sales and use tax number is required for certain exemptions, specifically for purchases intended for resale. However, certain entities such as churches, non-profit organizations, and governmental agencies are exempt from this requirement.

- The form highlights that the exempt status does not extend to personal use, including items that the purchaser intends to donate. It’s strictly for the categories outlined within the document.

- Direct payment by government warrants qualifies for exemption. This includes purchases made by the state of Georgia, its counties, municipalities, and specific government departments.

- It’s important to note that the form must be filled out accurately and in good faith, with a declaration that the information is true, correct, and made pursuant to Georgia’s sales and use tax laws.

- The supplier is responsible for securing and maintaining a properly completed certificate of exemption from each purchaser claiming exemption from sales tax. This documentation is essential to defend the tax-exempt status of transactions in case of audits.

Correctly applying the stipulations of the Georgia ST-5 form requires attention to detail and an understanding of the specific exemptions allowed under Georgia law. Entities seeking to utilize these exemptions should thoroughly review their eligibility and ensure that all information provided on the form is accurate to prevent misuse and ensure compliance.

Popular PDF Forms

Nj Courts Forms - Includes explicit instructions for defendants about how to navigate the legal process after being served with a summons in New Jersey.

Pregnancy Test - Acts as a pivotal document ensuring that no stone is unturned in discussing and planning for a child's health in their new family.