Blank Gift Of Equity Letter PDF Template

When family members or close friends decide to help each other out in achieving homeownership, the Gift of Equity Letter form plays a crucial role in facilitating this process. It is a document that officially records the generosity of a property owner, often referred to as the donor, towards a recipient, who is usually a relative or a very close friend, known formally in the document as the borrower. This letter states that a certain amount of the property's equity is being given as a gift to the borrower to assist in the purchase of a home. Importantly, it emphasizes that this act of kindness is not a loan; there is no expectation of repayment, whether in monetary terms or through services. The form includes essential details such as the names of the donor and borrower, their relationship, the amount of equity being gifted, and the address of the property involved. Both the donor and borrower are required to sign the document, cementing the agreement's validity. This step is not just a formality but a necessary part of the home buying process, ensuring transparency and legality in transactions that could otherwise be misunderstood by lenders or taxing authorities.

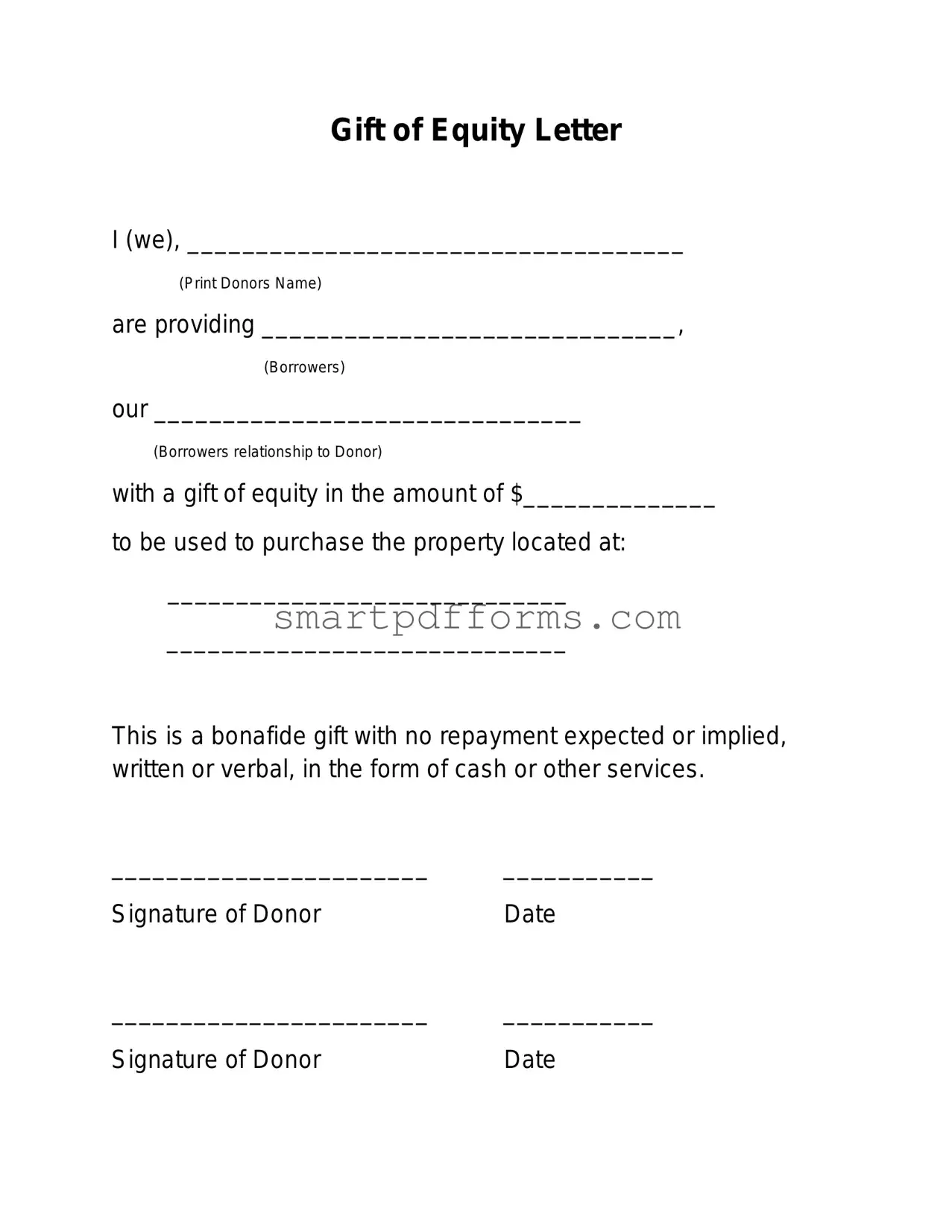

Preview - Gift Of Equity Letter Form

Gift of Equity Letter

I (we), ____________________________________

(Print Donors Name)

are providing ______________________________,

(Borrowers)

our _______________________________

(Borrowers relationship to Donor)

with a gift of equity in the amount of $______________

to be used to purchase the property located at:

_____________________________

_____________________________

This is a bonafide gift with no repayment expected or implied, written or verbal, in the form of cash or other services.

_______________________ |

___________ |

Signature of Donor |

Date |

_______________________ |

___________ |

Signature of Donor |

Date |

Form Data

| Fact | Description |

|---|---|

| Definition | A Gift of Equity Letter is a document where a property owner gifts a portion of their home’s equity to a buyer, usually a family member, to help them purchase the home. |

| Key Components | The form includes donor's name, borrower’s name and relationship to the donor, amount of equity gifted, property address, and a statement of no repayment expected. |

| Repayment Clause | It clearly states that the gift is bona fide with no repayment expected or implied, either in cash or other services. |

| Signatures | The form requires signatures from the donor(s) to validate the gift, along with the date the letter is signed. |

| Purpose | It is used to provide proof to lending institutions that funds for a portion of the home purchase come from a gift of equity, not a loan. |

| Benefit to Borrower | Allows the borrower to use the equity as part of their down payment, potentially avoiding private mortgage insurance (PMI) and reducing loan amount. |

| Governing Laws | While specific requirements can vary, the form generally must comply with federal tax laws and lending regulations. State laws may also apply depending on the property location. |

| Documentation for Lenders | Lenders may require the Gift of Equity Letter during the loan application process to ensure the legality and legitimacy of the gift. |

Instructions on Utilizing Gift Of Equity Letter

Filling out a Gift of Equity Letter is an important step in the process of purchasing a home, especially when the transaction involves family members or close acquaintances. This document officially records the generosity of a homeowner (the donor) towards the homebuyer (the borrower) in the form of equity, which serves as part of the buyer's down payment. Completing this letter accurately ensures that the gift of equity is properly recognized and accepted by lenders, thereby facilitating a smoother transaction for both parties involved. The following steps will guide you through the process of filling out a Gift of Equity Letter.

- Start by printing the donor's name(s) in the space provided, ensuring that it matches the name(s) as listed on official documents.

- Next, fill in the borrower's name in the designated space. This is the person receiving the gift of equity.

- Identify and record the borrower's relationship to the donor in the provided blank. This clarifies the connection between the two parties involved.

- Write the amount of equity being gifted in dollars in the specified area. This amount will be deducted from the home's purchase price to benefit the borrower.

- Enter the address of the property that the equity gift will be applied towards. Make sure to include both the street address and any additional identifying information to ensure accuracy.

- The statement in the form reiterates that this gift comes with no expectation of repayment, either in physical cash or through other services. Review this statement to understand its implications fully.

- Both of the donors (if applicable) must sign their names in the designated spaces to validate the gift. Ensure that these signatures are provided.

- Date the document next to each signature, indicating the day the gift was officially offered and documented.

With the Gift of Equity Letter properly filled out, the next step involves ensuring that this documentation is submitted alongside other necessary paperwork to the relevant financial institutions or attorneys involved in the home purchase process. This document acts as a clear record of the gift, assisting in the smooth execution of the transaction and helping to clarify matters for tax or legal purposes down the line.

Obtain Answers on Gift Of Equity Letter

What is a Gift of Equity Letter?

A Gift of Equity Letter is a formal document used when a property owner wants to provide a portion of their home's equity as a gift to a buyer, typically a family member, to be used towards the purchase of the property. This letter states the amount of equity being gifted and confirms that it is a genuine gift with no expectation of repayment.

Who needs to provide a Gift of Equity Letter?

Both the donor (the person providing the equity) and the borrower (the person receiving the equity) are involved in the Gift of Equity process. The donor must fill out the letter, stating their name and the relationship to the borrower, the amount of equity being gifted, and the address of the property. This document is then usually required by mortgage lenders when the transaction involves a gift of equity.

What information should be included in a Gift of Equity Letter?

The letter should include:

- The full names of both the donor(s) and the borrower(s).

- The relationship between the donor(s) and borrower(s).

- The specific dollar amount of the equity being given as a gift.

- The address of the property involved in the transaction.

- A declaration that the gift is genuine and no repayment is expected or implied.

- The signatures of all donors and the date(s) signed.

Is repayment expected for a gift of equity?

No, a true gift of equity involves no repayment. The letter explicitly states that the equity is offered as a bona fide gift, implying that there's no expectation or implication of any repayment, whether in cash or any other forms of service, from the borrower to the donor.

Can a Gift of Equity be used for properties other than houses?

While the concept of a gift of equity is most commonly used in residential real estate transactions, the fundamental idea can apply to any property with equity value. However, it's crucial to consult with legal or financial professionals to understand the implications and logistics for properties other than houses, as regulations and lender requirements may vary.

What are the tax implications of gifting equity?

When gifting equity, there might be tax implications for both the donor and the recipient. These can vary depending on the amount of equity gifted and current tax laws. Generally, if the gift exceeds the annual exclusion limit set by the IRS, the donor may have to file a gift tax return. Recipients typically aren't subject to taxes on the gift received. However, it's advisable to consult with a tax professional for guidance specific to your situation.

How does a Gift of Equity affect the buying process?

Using a Gift of Equity can significantly impact the home buying process, primarily by providing the borrower with instant equity in the home and potentially allowing them to qualify for better mortgage terms. It might also influence the down payment requirement and closing costs. However, borrowers should be prepared to provide mortgage lenders with the Gift of Equity Letter, as lenders will likely require it to confirm the transaction's legitimacy and conditions.

Common mistakes

When filling out the Gift of Equity Letter form, attention to detail matters a lot. Below are common mistakes to avoid to ensure the process goes smoothly.

- Not printing the donor's name clearly. This name should be legible and match the name as it appears on related legal documents.

- Leaving out the borrower's relationship to the donor. It's critical to specify the relationship clearly, such as “son,” “daughter,” or “niece,” to comply with lender requirements.

- Forgetting to include the exact amount of the equity gift. The amount should be in dollars and should be precise to avoid any confusion or delays.

- Skipping the property address. The property being purchased must be identified clearly with a complete address, including any relevant unit numbers or identifiers.

- Omitting the assurance statement that the gift does not need to be repaid. It’s essential to affirm that the gift is truly a gift, with no repayment expected.

- Leaving signature lines blank. Both donors must sign the form. If there's only one donor, ensure the appropriate line is signed.

- Misdating the form, or not dating it at all. The date next to the signatures should accurately reflect when the form was signed.

- Not matching names and addresses to official documents. Any discrepancies between the gift letter and documents such as the title or loan application could cause issues.

- Assuming one size fits all. Different lenders may have specific requirements for gift letters, so it's wise to check if additional information is needed.

To sum up, the key to successfully completing the Gift of Equity Letter form lies in detailed attention and ensuring that all provided information is accurate and matches official documents. Avoiding these common mistakes can help streamline the home purchasing process for everyone involved.

Documents used along the form

The Gift of Equity Letter is a crucial document in real estate transactions where a portion of a home's equity is given as a gift, typically from a family member to the buyer. This form serves to officially state that an amount of the property's value is being transferred as a gift, without any obligation or intention of repayment. The legal recognition of this letter is vital for the proper processing of the property's purchase and the financial arrangements entailing mortgages. However, to ensure a smooth and compliant transaction, various other forms and documents are often required in conjunction with the Gift of Equity Letter.

- Promissory Note - This is a written promise to pay a specified sum of money to another party, often used in transactions not involving gifts, but crucial in documenting loans with clear repayment terms.

- Mortgage or Trust Deed - A secured loan agreement that spells out the specifics of the mortgage loan and the property being used as security. It is recorded to establish the lending institution's interest in the property.

- Closing Disclosure - A form that outlines the final details of a mortgage loan, including the loan terms, projected monthly payments, and how much the borrower will pay in fees and other costs to get the mortgage.

- HUD-1 Settlement Statement - Although less common since the introduction of the Closing Disclosure, this document itemizes all charges and credits to the buyer and seller in a real estate settlement, or all the charges in a mortgage refinance.

- Appraisal Report - A professional appraiser’s estimate of the market value of the property being purchased. This is essential for lenders to determine the loan-to-value ratio, a key factor in loan approval decisions.

- Title Insurance Policy - Provides protection against financial loss due to defects in title to real property and from the invalidity or unenforceability of mortgage loans.

- Home Inspection Report - A detailed assessment of the physical condition of a property, often required by lenders to ensure the property does not have significant defects that could affect its value as collateral.

- Proof of Homeowners Insurance - This document confirms that the property has homeowners insurance, which is required by lenders to protect the property against damage or loss from a variety of causes.

In the intricate process of purchasing a home, these documents play vital roles, complementing the Gift of Equity Letter to ensure that all aspects of the transaction adhere to legal, financial, and regulatory requirements. While the Gift of Equity Letter signifies the generous transfer of property value, the accompanying forms and documents provide a comprehensive framework to navigate the complexities of home buying, securing the interests of all parties involved. Understanding the purpose and necessity of each document helps all participants in the transaction move through the process with clarity and confidence.

Similar forms

Promissory Note: Similar to a Gift of Equity Letter, a Promissory Note outlines the intention to transfer money, though it's a loan that requires repayment. Both documents detail the amount and have signatures for validation.

Mortgage Agreement: Like the Gift of Equity Letter, this agreement involves property transactions. It specifies the terms under which a lender provides money to the borrower to purchase a home, indicating the relationship between the parties and the property details.

Deed of Trust: This document also relates to property transactions, involving a third party that holds the legal title until the debt is paid off. It shares similarities in detailing property information and involving a conditional transfer of property.

Quitclaim Deed: This deed transfers any ownership interest in property without making any guarantees about the title, similar to a Gift of Equity where an interest in property is given without expectation of repayment.

Down Payment Gift Letter: Very similar to a Gift of Equity Letter, this outlines a gift of money rather than equity, to help with the purchase of a home. Both confirm the gift is without expected repayment and include relevant party information.

Affidavit of Title: This document confirms the seller’s right to transfer property and discloses any encumbrances. Like the Gift of Equity Letter, it's crucial for property transactions and ensures clarity about the property’s status and ownership.

Sale Agreement: A Sale Agreement documents the terms and conditions of a sale of goods or property. It's similar to a Gift of Equity Letter as it details the property involved and includes identification of the parties, though it's for sales, not gifts.

Power of Attorney: This document authorizes someone to act on another's behalf in private affairs, including property transactions. It can facilitate gifts of equity by granting the authority to sign documents related to the transfer.

Letter of Intent: Often used in real estate to express interest in buying a property, it resembles the Gift of Equity Letter in its preliminary nature, setting the stage for the transaction before formal agreements are made.

Loan Agreement: Although primarily for loans rather than gifts, a Loan Agreement shares similarities with a Gift of Equity Letter by detailing money's movement from one party to another, including the terms and parties involved.

Dos and Don'ts

Filling out a Gift of Equity Letter form requires attention to detail and an understanding of the process. Here are some important do's and don'ts to keep in mind:

Do:- Ensure that all names are spelled correctly. Incorrect spelling can cause significant delays.

- Clearly specify the relationship between the donor(s) and the borrower(s) to avoid any confusion.

- Include the exact dollar amount of the equity gift. Precision is crucial for legal and tax purposes.

- Provide the complete address of the property involved in the transaction. Omitting any part of it can lead to misunderstandings.

- Sign and date the form in the presence of a notary public if required. This step can add an extra layer of legal validity.

- Keep a copy of the signed form for your records. It's important for both parties to have this documentation.

- Consult with a real estate or tax professional before completing the form. Professional advice can prevent future legal or financial issues.

- Leave any fields blank. Incomplete forms may be considered invalid.

- Assume that a verbal agreement is sufficient. The Gift of Equity Letter must be in writing to be legally binding.

- Postpone the signing of the document until the last minute. Delays can complicate the closing process.

- Forget to specify that there is no expectation of repayment. This statement is crucial for the gift's legitimacy.

- Ignore the requirement to disclose the gift to the lender. Transparency with the lender is key to the success of the transaction.

- Underestimate the importance of the legal and tax implications of the gift. Misunderstandings can lead to penalties.

- Alter the form without professional advice. Any changes should be reviewed to ensure they don't affect the document's legality.

Taking these steps seriously can greatly smooth the process of transferring equity and help both parties avoid potential obstacles. It's always best to approach such transactions with care and due diligence.

Misconceptions

There are several misconceptions regarding the Gift of Equity Letter form that can lead to confusion for both the donor and the borrower. Understanding these myths can help in navigating this process more smoothly. Here are five common misconceptions:

It must involve a cash transaction. A common misunderstanding is that a gift of equity necessitates a physical exchange of cash between the donor and the borrower. In reality, a gift of equity represents the value of a portion of the property being transferred as a gift, indicating no cash changes hands in relation to the supposed gift amount.

Repayment may be secretly expected. Some people believe that while the letter states there is no expectation of repayment, under-the-table agreements can still exist. However, the gift of equity letter explicitly declares that the gift is bona fide with "no repayment expected or implied, written or verbal, in the form of cash or other services," legally clarifying the donor's intentions.

It's only for immediate family members. Another misconception is that gifts of equity are exclusively available for transactions involving immediate family members. While commonly used among family, there is no legal requirement restricting the gift of equity to family members. The relationship between the donor and borrower can be outside of familial ties, although lender policies on this may vary.

The process is informal. Some assume the process to involve an informal agreement without need for official documentation. In contrast, a formal, written Gift of Equity Letter is required, outlining specific details of the gift, including the donor’s and borrower's names, the relationship, the amount of equity gifted, and a clear statement indicating no expectation of repayment.

It can only be used for certain types of properties. There's a belief that a gift of equity can only be used in the context of purchasing single-family homes. However, a gift of equity can be applied to various types of property transactions, not limited by the property type. The crucial factor is the agreement and understanding between the donor and borrower, and compliance with lender requirements.

Dispelling these misconceptions can help donors and borrowers alike better understand the gift of equity process and its requirements, leading to smoother property transactions.

Key takeaways

When engaging in the process of using a Gift of Equity Letter form, understanding its key components is crucial. This document has significant financial implications for both the donor and the recipient. Here are some vital takeaways to keep in mind:

- Identify the Parties: The form must clearly state the names of the donor(s) and the borrower(s). Precision in detailing the identities ensures clarity about who is giving the equity and who is receiving it.

- Detail the Relationship: It is important to specify the relationship between the donor(s) and the borrower(s). This information contextualizes the gift and may have implications for tax purposes.

- State the Amount: The exact amount of equity being gifted needs to be distinctly mentioned. This figure is vital for the financial institutions involved and for maintaining transparent records.

- Property Details: Accurately providing the address and details of the property involved is crucial. This ensures there is no ambiguity about which property the equity gift pertains to.

- Declaration of Intent: The letter must include a statement clarifying that the gift is genuine and that there is no expectation of repayment. This declaration helps to distinguish the transfer as a gift rather than a loan, which has different financial and legal implications.

- Signatures and Dates: Last but certainly not least, the letter is not legally binding until it is signed and dated by the donor(s). These signatures formally validate the document's content and the parties' agreement to its terms.

Properly completing and understanding the Gift of Equity Letter form is essential for a smooth transaction. This document plays a pivotal role in the home purchasing process, making the equity transfer official and recognized by all parties involved, including any lenders or financial institutions. Paying attention to the details and accurately filling out the form can prevent misunderstandings and ensure that the gift aids in the property acquisition as intended.

Popular PDF Forms

Mc-040 - Procedural advice for efficiently managing the filing and serving of small claims documents, including tips for using certified mail as a service method.

Ngb Form 23 - This addendum empowers buyers to verify property specifics such as lot size and encroachments, fostering due diligence and informed purchasing decisions.

Trailer Inspection Sheet Pdf - Contributes to the optimization of cargo security measures with sections for reviewing tie-down gear.