Blank H1857 PDF Template

In an era where the verification of tenant information becomes increasingly crucial for accurate support and services, the H1857 form stands as a vital document that facilitates this verification process. Designed to be completed by landlords or their representatives, this form plays an essential role in assessing the living situations of individuals and families seeking assistance. It encompasses important data points such as the tenant move date, the number of occupants, their employment status, details about rent payments, and utility responsibilities. By requiring landlords to provide a breakdown of the rent, frequency of payments, current rent status, and information on utility payments, the H1857 brings clarity and accountability to the financial aspects of tenancy. Moreover, the inclusion of tenant consent on the form underscores the importance of privacy and voluntary information sharing in the process. As the form must be returned promptly, often within a specified deadline, it further underscores the urgency and significance attached to gathering this information accurately and efficiently. Offering a postage-paid envelope for this purpose reflects an understanding of and accommodation for the practicalities involved in submitting such documentation. Through its comprehensive approach to collecting tenant information, the H1857 form embodies a key administrative tool in the evaluation of household situations, ensuring that assistance is tailored accurately to meet the needs of individuals and families.

Preview - H1857 Form

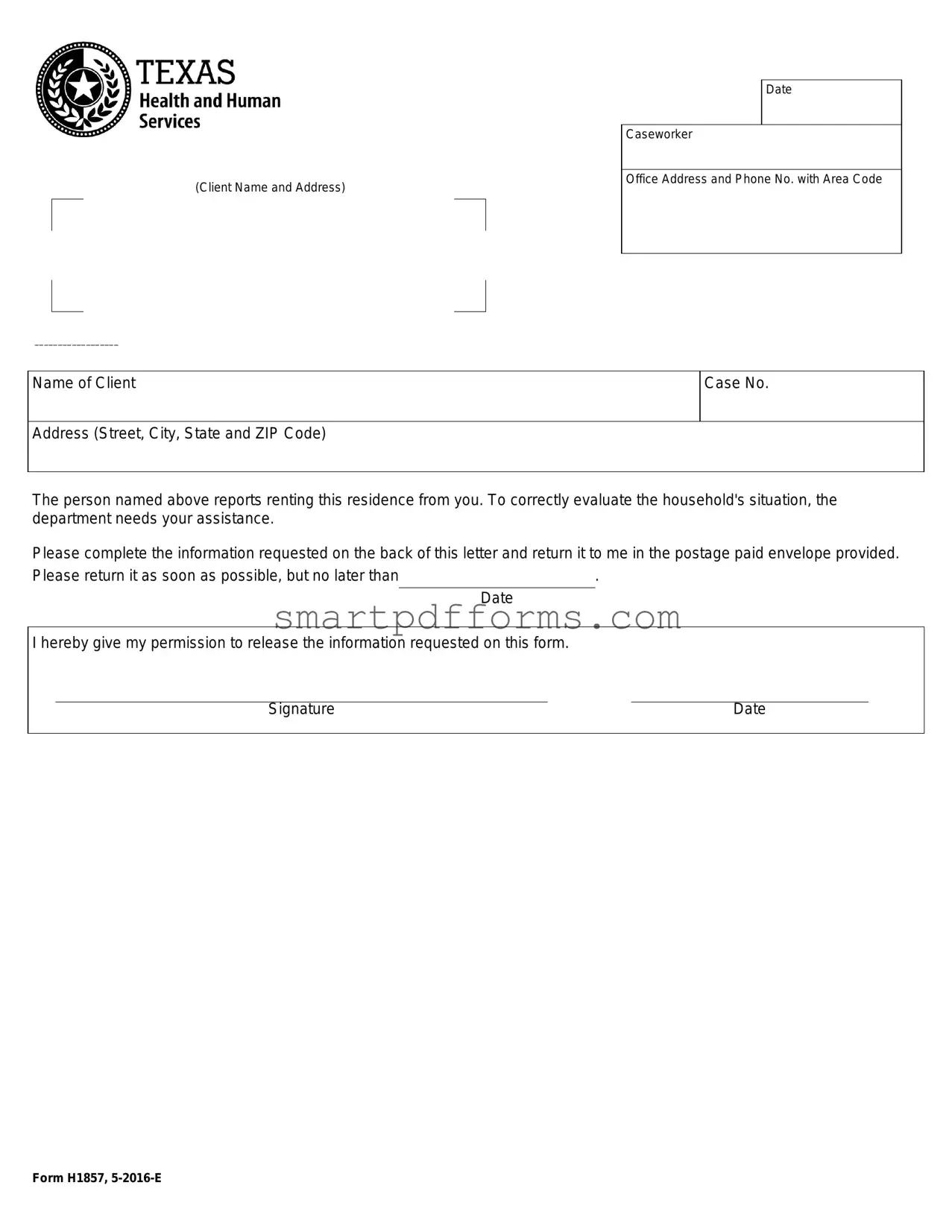

(Client Name and Address)

Date

Caseworker

Office Address and Phone No. with Area Code

Name of Client

Case No.

Address (Street, City, State and ZIP Code)

The person named above reports renting this residence from you. To correctly evaluate the household's situation, the department needs your assistance.

Please complete the information requested on the back of this letter and return it to me in the postage paid envelope provided.

Please return it as soon as possible, but no later than |

. |

||

|

|

Date |

|

I hereby give my permission to release the information requested on this form.

Signature |

Date |

Form H1857,

Landlord Verification

Form H1857

May

(This form must be completed by the client's landlord or a representative.)

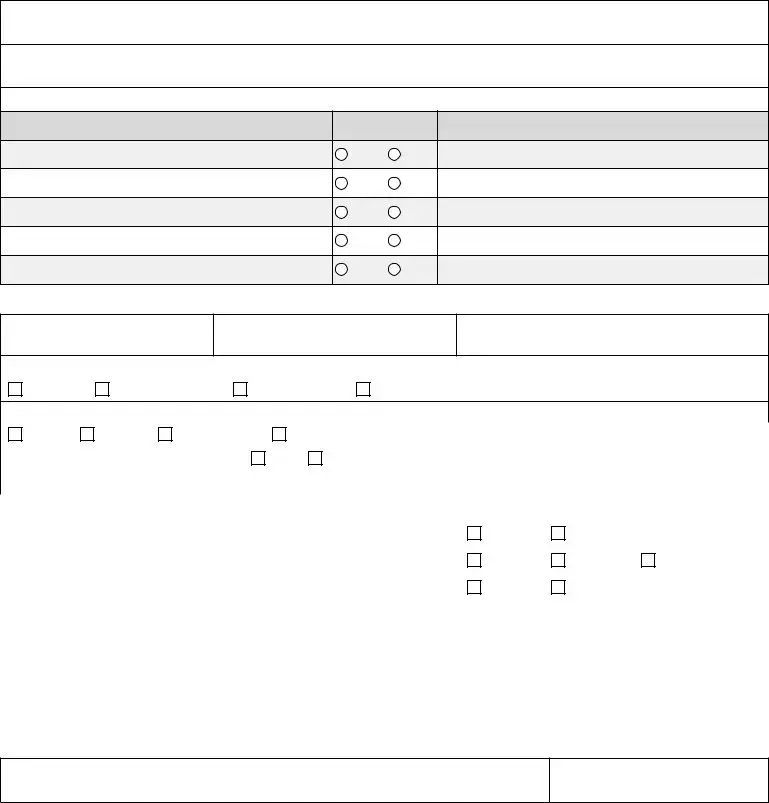

1.Tenant Move Date:

2.How many people live in the house or apartment?

3.List the names of all people who live in the house or apartment. List their employer, if known:

Name of Person |

Working? |

Employer |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

4. Questions about the rent payment:

Amount of RentTenant's Portion of RentPerson making payment?

How often paid?

Weekly

Every Two Weeks

Twice a Month

Monthly

Method of payment?

Cash |

Check |

Money Order |

|

Other (explain): |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Is the tenant current in paying the rent? |

Yes |

No If "No," when was the last month rent was paid? |

|

|

|

|

|||||||||||||

What is the total amount of past due rent? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Questions about the utilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Are all utilities included in rent? |

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Utilities the tenant is responsible for paying (check all that apply): |

|

|

|

Gas |

|

|

Electric |

|

|

|

Telephone |

|

|||||||

|

|

|

|

|

|

|

|

||||||||||||

Utility bills are paid directly to: |

|

|

|

|

|

|

|

|

Landlord |

|

|

Utility Company |

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please provide the tenant's complete residential address: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Street Address |

|

|

|

|

Apt. No. |

|

|

|

City |

|

|

|

|

ZIP Code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Landlord or Representative Name (printed) |

|

Signature – Landlord or Representative |

|

Date |

Business Address or Residential Address

Telephone No. with Area Code

Form Data

| Fact | Description |

|---|---|

| Purpose | The H1857 form is designed to verify the housing situation of a client by seeking information directly from the landlord. It assists in evaluating the household's needs accurately. |

| Content | This form requires the landlord to provide details such as the tenant move date, the number and names of people living in the residence, rent payment specifics, and utility responsibility. |

| Signatory Requirement | Both the client and the landlord (or the landlord's representative) are required to sign the form, thereby authorizing the release of the specified information. |

| Submission Guidance | Landlords are urged to complete and return the form as promptly as possible, using a postage-paid envelope provided for their convenience, emphasizing the importance of timely submission for the department's evaluation process. |

| Governing Law | The form indicates it was updated in May 2016 (noted as "5-2016-E"), suggesting its compliance with regulations effective at that time. Since it is a form used for state-specific purposes, its usage and relevance are subject to the statutes and administrative codes of the specific state in question, which govern landlord-tenant relationships and information disclosure requirements. |

Instructions on Utilizing H1857

After filling out the H1857 form, you are aiding in a crucial step for assessing the individual's or family's living conditions and financial responsibilities. This form gathers essential information regarding rent, the number of occupants, and utility payment responsibilities from a landlord's perspective. Although the form appears straightforward, ensuring all sections are accurately completed is key to providing the necessary assistance to the client. Here are the steps to fill it out correctly:

- Filling in the tenant's information at the top section (Client Name and Address, Date, Caseworker Office Address and Phone Number).

- On the reverse side, start with the Tenant Move Date, detailing when the tenant began occupying the premises.

- Enter the total number of people living in the house/apartment.

- List all individuals residing in the property, mentioning their employment status and employers if known.

- Detail the rent information including the full rent amount, the portion paid by the tenant, who usually makes the payment, payment frequency (weekly, every two weeks, twice a month, monthly), and the payment method (cash, check, money order, or other).

- Confirm whether the tenant is current with their rent payments. If not, you must specify the last month rent was paid and the total amount of overdue rent.

- Answer questions about utilities, indicating whether they are included in the rent. If not, check which utilities the tenant is responsible for and whether these are paid to the landlord or directly to the utility company.

- Provide the tenant's complete address, ensuring clarity on the street address, apartment number, city, and ZIP code.

- Complete the section with the landlord or representative's printed name, signature, date, business or residential address, and telephone number with area code.

Once the H1857 form is filled out and signed, it should be returned using the postage-paid envelope provided. This timely action ensures that the caseworker can complete their evaluation and proceed with any necessary assistance efficiently. Your cooperation is not only beneficial but also vital to supporting individuals and families in need of housing assistance.

Obtain Answers on H1857

When navigating the intricacies of form H1857, questions often arise concerning its purpose, the required information, and the overall process for landlords and tenants alike. To shed light on some of these common inquiries, a detailed FAQ section is provided below.

- What is the purpose of form H1857?

- What information must be supplied on form H1857?

- The date the tenant moved into the property.

- Details regarding the occupants of the residence, including names and possibly their employment status.

- Comprehensive information on the rent arrangement, such as the total rent amount, the tenant's portion of the rent, who makes the rent payments, the frequency of payment, and the method of payment. Additionally, it inquires about the current rent payment status and any past due amounts.

- Clarification on utilities, specifying which are included in the rent and which the tenant is responsible for. It also requires details on how utility bills are paid and to whom.

- How should the form H1857 be submitted?

- Why is it important for the landlord or representative to fill out form H1857 accurately and promptly?

The primary purpose of form H1857, also known as the Landlord Verification Form, is to provide essential information about a tenant's living situation. This form plays a crucial role in helping various departments to accurately assess and evaluate the household's circumstances by confirming details such as the rental agreement, number of occupants, rent payment status, and utility responsibilities. By completing form H1857, landlords or their representatives assist in ensuring that the necessary verification is conducted efficiently and correctly.

The form requires several pieces of important information to be filled out by the landlord or a representative. Key areas of the form include:

The complete residential address of the tenant, as well as contact information for the landlord or representative completing the form, must also be provided.

After completing form H1857 with all the required information, it should be returned to the requesting agency or caseworker as instructed in the cover letter that accompanies the form. The department typically provides a postage-paid envelope to facilitate the return of the form. Landlords or their representatives are encouraged to submit the form as soon as possible but must adhere to the deadline mentioned in the request to avoid any processing delays.

Filling out form H1857 accurately and promptly is crucial for a few reasons. Firstly, the information provided helps various departments to make informed decisions regarding the household's eligibility for certain benefits or assistance programs. Accurate information ensures that the assessment is based on the tenant's actual living conditions and financial responsibilities. Prompt submission is equally important because it prevents unnecessary delays in the processing of the tenant's application for assistance. It reflects a landlord's responsible management and support in maintaining the well-being of their tenants.

Common mistakes

When filling out the H1857 form, commonly known as the Landlord Verification Form, people often encounter errors that can delay or affect the process. Here’s a list of common mistakes:

- Incomplete client information: Failing to provide full details in sections requiring client name, case number, and full address. This includes the street, city, state, and ZIP code. Accurate details are crucial for processing.

- Incorrect tenant move date: Not specifying the exact move-in date of the tenant can lead to complications. This date helps in verifying the rental period.

- Leaving blanks in the tenant occupancy section: Not listing all the people living in the residence, along with their employment status if available, can lead to incomplete evaluation of the household’s situation.

- Errors in rent payment details: Misinformation about the amount of rent, the tenant's portion of the rent, payment frequency, and method can cause misunderstandings about the tenant's financial obligations.

- Omission of rent payment status: Failing to accurately report if the tenant is current with rent payments or if there is any past due rent affects the accuracy of the tenant’s financial assessment.

- Utilities information mistakes: Not correctly indicating which utilities are included in the rent or which ones the tenant is responsible for can affect the evaluation of the tenant's living expenses.

- Inaccurate or incomplete landlord or representative information: The name, signature, business or residential address, telephone number with area code of the landlord or representative must be fully and correctly provided. This information is necessary for communication and verification purposes.

- Delay in submission: Not returning the form within the specified time frame can delay the processing of necessary evaluations or assistance for the tenant.

Addressing each section of the form with accuracy and completeness is essential. This assists in ensuring the evaluation of the tenant’s situation is conducted efficiently and thoroughly.

Documents used along the form

When processing the H1857 form, a Landlord Verification Form, individuals and agencies often require additional documents to comprehensively evaluate a household's eligibility for various programs or assistance. These documents enable a thorough review of the applicant's living situation, income, and need for support. Here's a look at some key forms and documents typically used alongside the H1857 form.

- Income Verification Form: This document is used to verify the income of the client applying for assistance. It requires detailed information about sources of income, including employment, benefits, and any other financial support.

- Rent Receipts: Copies of rent receipts may be requested to provide proof of rent payments. These receipts help establish the payment history and commitment of the tenant towards their rental obligations.

- Lease Agreement: A copy of the current lease provides detailed information about the rental agreement, including the duration, monthly rent amount, and terms and conditions agreed upon by the tenant and the landlord.

- Utility Bills: To assess the utility payments the tenant is responsible for, copies of recent utility bills may be collected. This helps in understanding the additional financial responsibilities of the client.

- Photo ID: A government-issued photo identification for the client helps in verifying identity and preventing fraud.

- Proof of Residence: Besides the H1857 form, further proof of residence may be required, such as a driver's license or mail addressed to the client at the reported residence.

- Employment Verification Form: Similar to the income verification form, this document specifically relates to verification of employment. It provides proof of employment status and income.

- Bank Statements: Recent bank statements may be requested to review the client's financial situation, including savings, expenditures, and financial stability.

- Social Security Benefits Statement: For clients receiving Social Security benefits, a copy of the benefits statement can be requested to confirm the amount and type of benefits received.

- Child Support Documentation: If applicable, documentation regarding child support payments, either received or paid, can provide additional insight into the financial obligations and support of the household.

Collectively, when used alongside the H1857 form, these documents offer a holistic view of the client's circumstances, supporting a fair and accurate assessment process. It is important for clients to provide these documents promptly to avoid delays and ensure a smooth evaluation of their situation.

Similar forms

The H1857 form shares similarities with the Employment Verification Form. Both forms require a third party to provide essential information about the applicant, whether it’s for the purpose of verifying residential status or employment status. These forms generally include questions about the tenure of the individual's employment or tenancy, the financial aspects (such as income or rent payments), and other relevant personal details. The underlying goal is to assess the applicant's reliability and authenticity in a particular context.

Another similar document is the Rental Application Form. This type of form also gathers information about prospective tenants, including their residential history and current living situation. Like the H1857 form, it often requests details about the rental unit, monthly rent, and the tenant’s ability to keep up with payments. However, a Rental Application Form additionally might ask for references, employment information, and a credit check to further validate the applicant's trustworthiness and financial stability.

The Income Verification Form is also akin to the H1857, as it seeks to confirm an individual’s financial status, albeit in a different way. While the H1857 form asks about rent payments and utility responsibilities to understand the tenant's financial obligations, the Income Verification Form directly inquires about an individual’s earnings from their employer. This form is crucial for entities requiring proof of income, such as lenders or government assistance programs.

A document that resembles the H1857 is the Property Inspection Report. Though the focus of this report is on the physical condition of a rental property, it similarly involves a third party (typically a landlord or property manager) providing detailed information to another party (usually the tenant or a government agency). The report covers aspects of the living environment that could indirectly affect the tenant's financial obligations, such as necessary repairs that may impact the tenant's use of the property and potentially the rental agreement altogether.

Finally, the Utility Transfer Authorization Form shares some similarities with the H1857. This form is used when a tenant needs to transfer utility services to their name from a former tenant or from the landlord. Like questions about utility responsibilities on the H1857, this form collects information regarding which utilities are required and who will be responsible for them. It underscores the importance of understanding and documenting the utility obligations tied to a specific rental agreement.

Dos and Don'ts

Filling out the H1857 form, which serves as a critical communication tool between landlords and caseworkers, requires careful attention to details and accuracy. Here are some dos and don'ts that can help streamline the process and ensure the information provided is useful and compliant.

Dos:- Double-check the client's information before you start filling out the form to confirm its accuracy. This includes the client's name, address, and case number.

- Give detailed responses to questions regarding the tenant's move date, the number of occupants, and their employment status if known. Accuracy here helps caseworkers evaluate the household's needs effectively.

- List all occupants of the dwelling accurately, along with their employment status and employer's name if available. This detail is crucial for comprehensive assessments.

- Be clear about the financials, including the total amount of rent, the tenant's contribution, who makes the rent payment, and how often it's paid. Details about rent arrears should also be meticulously reported.

- Specify which utilities, if any, are included in the rent and which are the tenant's responsibility. Also, clarify how utility payments are made.

- Sign and date the form both as the landlord or representative. This verifies the authenticity of the information provided.

- Return the form promptly to facilitate a timely assessment. Utilize the postage-paid envelope where provided.

- Don't leave sections blank. If a question does not apply, indicate with "N/A" or "None" to confirm that you saw and considered the question.

- Don't provide incomplete addresses or contact information. Full details are necessary for any follow-up communication that might be required.

- Don't guess on specifics regarding the tenant or the payment details. If uncertain, it's better to confirm the information before submitting the form.

- Don't write outside the provided spaces or margins. Keep the form legible and organized to ensure the information is easily accessible to the caseworker.

- Don't ignore the deadline for submission. The requested return date is critical to process the tenant's case in a timely manner.

- Don't alter the form without proper authorization. Any changes or additions to the form should be clearly marked and approved.

By adhering to these guidelines, landlords and representatives can provide caseworkers with the necessary information to accurately assess and assist the household in question. When filled out with diligence and care, the H1857 form facilitates effective communication and swift processing of cases.

Misconceptions

When it comes to understanding the H1857 form, several misconceptions frequently arise. This document plays an essential role in verifying a tenant's living situation for various departmental evaluations. Here we address seven common misconceptions to provide clarity.

- Misconception 1: The H1857 form is only applicable for use within the housing department.

This is not accurate. While primarily used for housing-related verifications, the form's utility can extend to other areas where proof of residence is necessary.

- Misconception 2: Only the original landlord can complete the form.

In truth, either the landlord or a designated representative is authorized to fill out and sign this form. This flexibility helps ensure the form can be completed even if the landlord is unavailable.

- Misconception 3: The tenant's permission is not required to release the information.

This belief is incorrect. A tenant's signed consent, as shown at the bottom of the form instructions, is crucial to comply with privacy laws and regulations.

- Misconception 4: All utilities must be included in the rent for this form to be applicable.

This statement is false. The form accommodates various situations, whether utilities are included in the rent or paid separately by the tenant.

- Misconception 5: The form must be returned by mail only.

While a postage-paid envelope is provided for convenience, this doesn't preclude the form's return by other means, provided it's agreed upon by the requesting department.

- Misconception 6: It's only necessary to list tenants who are legally adults.

The form requires the names of all occupants, regardless of age, to accurately assess the living situation and comply with departmental requirements.

- Misconception 7: Personal information about the landlord or representative is not needed.

Contrary to this belief, including the contact information of the landlord or representative is essential for verification purposes and any follow-up that may be necessary.

Understanding the purpose and requirements of the H1857 form ensures compliance and facilitates the efficient processing of necessary evaluations. Clearing up these misconceptions helps tenants, landlords, and departments navigate the process with more confidence and accuracy.

Key takeaways

Filling out and using the H1857 form is an important process for verifying a tenant's living situation and financial responsibility. Here are six key takeaways to ensure accuracy and compliance:

- Accuracy is crucial: Double-check all the information provided, especially the tenant's move-in date, the number of occupants, and their employment status. Accurate details support a fair assessment of the tenant's situation.

- Understanding rent details is important: Clearly specify the rent amount, how much of it the tenant is responsible for, the payment frequency, and the method of payment. Knowing whether the tenant is current with rent or has outstanding payments helps in evaluating their financial stability.

- Utility responsibility: Indicate which utilities, if any, are included in the rent and which ones the tenant must pay separately. This gives a holistic view of the tenant's monthly obligations beyond just rent.

- Ensure tenant authorization: Before releasing any information, verify that the tenant has signed and dated the form, giving their permission to release the requested information. This step is crucial for compliance with privacy regulations.

- Timeliness: Return the completed form by the specified deadline using the postage-paid envelope provided. Timely submission helps caseworkers make informed decisions without unnecessary delays.

- Clear communication: If there are any concerns or additional information you feel is relevant, include a note or contact the caseworker directly. Open communication ensures that any potential issues are addressed promptly.

By following these guidelines, landlords and representatives can provide essential information that aids in the accurate and fair evaluation of a tenant's circumstances. This not only supports the tenant's case but also fosters a transparent relationship between landlords, tenants, and caseworkers.

Popular PDF Forms

Buyers Order Template - Provides spaces for detailing vehicle trade-in information, including condition and financial status.

How to File Fafsa as Independent - Confirmation that your business has a functional and informed Compliance Officer, as verified in the Independent Review, is vital for an effective AML framework.