Blank Hr Block Drop Off Checklist PDF Template

When it comes to preparing your taxes, efficiency and thoroughness are key. That's where the H&R Block Drop Off Checklist form steps in, offering a structured approach to make sure you provide all the necessary information and documents to your tax professional. Designed to ensure a smooth process from start to finish, this form guides clients through providing essential personal and financial details, from basic information like names and Social Security numbers to more detailed data regarding income, expenses, credits, and deductions. With sections clearly marking what documents to include, whether it's W-2s from employers, 1099s for various income sources, or records of deductible expenses, the checklist is exhaustive. The form is not just about listing what you earned and spent; it also includes provisions for noting down dependents, your marital status, and even asks if you'd like to contribute to the presidential campaign fund. Tailored to simplify the tax preparation process, it ensures that no stone is left unturned, whether you're a returning client with a preferred tax professional or someone newly seeking H&R Block's services. It navigates clients through choosing how to engage with the service—be it dropping off documents for a hands-off approach or opting for an in-depth discussion—and how they prefer to finalize their return. For both clients and tax professionals, the form serves as a pivotal tool in organizing and expediting tax preparation, embodying H&R Block's commitment to meeting clients' tax preparation expectations with precision and care.

Preview - Hr Block Drop Off Checklist Form

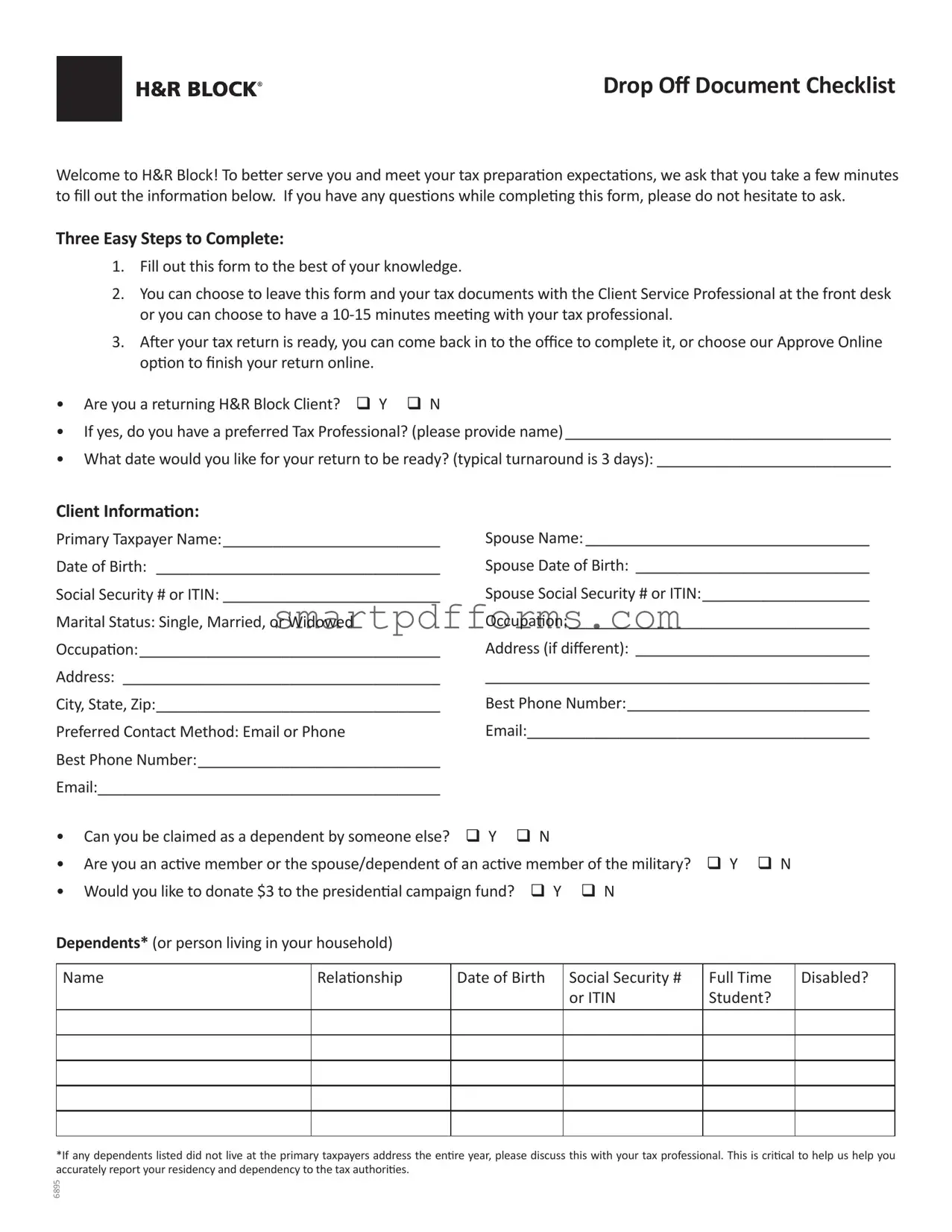

Drop Of Document Checklist

Welcome to H&R Block! To beter serve you and meet youR tax preparaion expectaions, we ask that you take a few minutes to ill out the informaion below. If you have any quesions while compleing this form, please do not hesitate to ask.

Three Easy Steps to Complete:

1.Fill out this form to the best of your knowledge.

2.You can choose to leave this form and your tax documents with the Client Service Professional at the front desk or you can choose to have a

3.Ater your tax return is ready, you can come back in to the oice to complete it, or choose our Approve Online opion to inish your return online.

• Are you a returning H&R Block Client? Y N

•If yes, do you have a preferred Tax Professional? (please provide name) _______________________________________

•What date would you like for your return to be ready? (typical turnaround is 3 days): ____________________________

Client Informaion:

Primary Taxpayer Name:__________________________ |

Spouse Name: __________________________________ |

Date of Birth: __________________________________ |

Spouse Date of Birth: ____________________________ |

Social Security # or ITIN: __________________________ |

Spouse Social Security # or ITIN:____________________ |

Marital Status: Single, Married, or Widowed |

Occupaion:____________________________________ |

Occupaion:____________________________________ |

Address (if diferent): ____________________________ |

Address: ______________________________________ |

______________________________________________ |

City, State, Zip:__________________________________ |

Best Phone Number:_____________________________ |

Preferred Contact Method: Email or Phone |

Email:_________________________________________ |

Best Phone Number:_____________________________

Email:_________________________________________

• |

Can you be claimed as a dependent by someone else? Y |

N |

• |

Are you an acive member or the spouse/dependent of an acive member of the military? Y N |

|

• |

Would you like to donate $3 to the presidenial campaign fund? |

Y N |

Dependents* (or person living in your household)

Name

Relaionship

Date of Birth

Social Security # or ITIN

Full Time Student?

Disabled?

*If any dependents listed did not live at the primary taxpayers address the enire year, please discuss this with your tax professional. This is criical to help us help you accurately report your residency and dependency to the tax authoriies.

6895

Drop Of Document Checklist

Document Checklist

Income: Check all that apply and include requested documents, if available

Income From: |

Yes |

|

Yes |

Employer |

|

|

|

|

|

|

|

Interest |

|

Social Security/Reirement |

|

|

|

|

|

Dividends |

|

Rental Property* |

|

Stock or Mutual Fund sale |

|

Unemployment |

|

|

|

|

|

Expenses: Check all that apply and include requested documents, if available |

|||

|

|

|

|

Expenses From: |

Yes |

|

Yes |

|

|

|

|

Self Employment* |

|

|

|

Educaion |

|

Rental Property* |

|

|

|

|

|

Medical/Dental care |

|

Union Dues |

|

|

|

|

|

Credits and Deducions: Check all that apply and include requested documents, if available |

|||

Did you or your spouse: |

Yes |

|

Yes |

|

|

|

|

Donate cash or goods to a charity? |

|

Pay Student Loan interest? |

|

|

|

|

|

Pay Child/Dependent Care expense? |

|

Have a Mortgage Payment? (1098) |

|

|

|

|

|

Make an IRA Contribuion |

|

Make a major taxable purchase? |

|

|

|

|

|

Pay Property Taxes? |

|

|

|

|

|

|

|

Miscellaneous*: Check all that apply |

|

|

|

|

|

|

|

Did you or your spouse: |

Yes |

|

Yes |

|

|

|

|

Sell a home? |

|

Take an IRA or 401(k) distribuion? |

|

|

|

|

|

Pay/Receive alimony? |

|

Adopt a child? |

|

|

|

|

|

Sufer catastrophic loss? |

|

Have gambling winnings/losses? |

|

|

|

|

|

*If this applies, we recommend you meet with your tax professional to discuss your tax situaion before dropping of your informaion.

Tax Professional or Client Service Professional Complete the secion below:

Legal Disclaimers

Client received Privacy Policy, Consent to Use and Consent to Disclose Service Provider documents, and the documents were explained and executed as applicable. Y N

Did the client review and sign the Client Service Agreement? Y N

Follow Up

How would the client like to review and approve their tax return?

•H&R Block Tax Oice – Appointment ime and date: ________________________________

•Approve Online: (Refund Anicipaion Loans and Emerald Card not available with this opion)

Tax Pro: If Approve Online is selected, you must verify Taxpayer and Spouse (if applicable) Ideniicaion

Taxpayer ID Type:_______________Exp. Date: __________

Place of Issuance, if any ____________________________

Date of Issuance, if any _____________________________

6895

Spouse ID Type:_________________Exp. Date: _________

Place of Issuance, if any ____________________________

Date of Issuance, if any _____________________________

DOP12006

Form Data

| Fact Name | Fact Detail |

|---|---|

| Client Preparation Steps | Clients must fill out the form, decide on the mode of submission and tax professional interaction, and choose a return completion method. |

| Client Information Required | Includes primary taxpayer and spouse's name, DOB, SSN or ITIN, marital status, occupation, address, contact information, and dependency status. |

| Documentation for Income and Expenses | Checklists for income sources and expenses, including employer income, self-employment, interest, dividends, rental property, and more, plus expenses and deductions for accurate tax return preparation. |

| Professional Assistance and Legal Disclaimers | Sections for tax professional notes, legal disclaimers on privacy and services, and client agreements on service terms. |

Instructions on Utilizing Hr Block Drop Off Checklist

Once you've decided to utilize the services of H&R Block for your tax preparation needs, filling out the Drop Off Document Checklist form is your first step toward a smoother tax filing process. This form helps in organizing your documents and ensures that all necessary information is available for the tax professionals. It's designed to streamline the interaction, allowing you to communicate your needs and preferences clearly from the outset. For a successful completion, follow these straightforward steps:

- Under the section titled "Three Easy Steps to Complete":

- Begin by filling out the form with your best knowledge.

- Decide whether you will leave your tax documents with the Client Service Professional at the front desk or prefer to have a brief meeting with your tax professional.

- Choose how you'd like to finalize your tax return once it's prepared - by returning to the office or through the online approval option.

- Check the appropriate box to indicate if you are a returning client to H&R Block and if you have a preferred tax professional, providing their name if applicable.

- Provide the date by which you would like your tax return to be ready.

- In the "Client Information" section, fill in the primary taxpayer's name, spouse's name (if applicable), dates of birth, Social Security Numbers or ITINs, marital status, occupations, and contact information as requested.

- Indicate your preferred method of contact - Email or Phone.

- Check the boxes that apply regarding dependency, military status, and whether you'd like to donate to the presidential campaign fund.

- For dependents or persons living in your household, list their names, relationship to you, dates of birth, Social Security Numbers or ITINs, and specify if any are full-time students or disabled. Discuss with your tax professional if any lived away from the primary taxpayer's address for part of the year.

- In the "Document Checklist" section, check all the income sources that apply to you and include any relevant documents. Do the same for the expense categories, credits, deductions, and miscellaneous items as applicable.

- If you have situations that are complicated or unusual, such as self-employment or rental property income, it is recommended to discuss these with your tax professional.

- At the bottom of the form, the Client Service Professional or Tax Professional will complete the legal disclaimer section, where it must be indicated if you received and signed the Privacy Policy, Consent to Use, Consent to Disclose Service Provider documents, and the Client Service Agreement.

- Finally, decide how you wish to review and approve your tax return - either in person at an H&R Block office or online - and provide identification details as required.

After completing the checklist and submission of your documents, the tax professionals at H&R Block will start processing your tax return based on the information provided. Should they need further details or clarifications, they will contact you. Remember, the accuracy of your tax return depends significantly on the completeness and correctness of the information you provide on this checklist. Ensuring you have covered all areas will make the tax preparation process smoother and more efficient.

Obtain Answers on Hr Block Drop Off Checklist

Frequently Asked Questions about the H&R Block Drop Off Checklist Form:

- What is the H&R Block Drop Off Checklist Form?

The H&R Block Drop Off Checklist Form is a document designed to gather all the necessary information from clients to efficiently process their tax returns. It guides clients through what documents to provide, asks for personal and dependent information, and includes sections on income, expenses, credits, deductions, and more.

- How do I complete the Drop Off Checklist Form?

Complete the form by filling in your personal information, including name, social security number, marital status, contact details, and similar information for your spouse if applicable. Moreover, indicate your income sources, expenses, credits, and deductions by checking the applicable boxes and include any relevant documentation.

- Can I choose a preferred Tax Professional?

Yes, if you are a returning H&R Block client, you have the option to indicate your preferred Tax Professional on the form. Just write their name in the space provided under the question about your preferred Tax Professional.

- What if I have dependents?

If you have dependents, you'll need to provide their names, relationship to you, dates of birth, and social security numbers or ITINs. Additionally, indicate whether they're full-time students or disabled. This information is crucial for accurately reporting residency and dependency.

- What should I do if I have income or expenses that are not listed on the form?

In such cases, it's recommended to meet with your tax professional to discuss your tax situation in detail before dropping off your information. They can help ensure that all relevant income and expenses are reported accurately.

- What are the steps after filling out the form?

After completing the form, you can either leave it along with your tax documents with the Client Service Professional at the front desk or opt for a 10-15 minute meeting with your tax professional. Once your tax return is prepared, you can come back to the office to finalize it or choose the Approve Online option to complete your return online.

- What happens if I can't provide all the requested information or documents immediately?

If you're unable to provide all the information or documents requested on the checklist at the time of drop-off, discuss your situation with the Client Service Professional or your Tax Professional. They can guide you on what to do next and how to proceed to ensure your tax return is accurately prepared.

Common mistakes

When filling out the H&R Block Drop Off Checklist form, individuals commonly make several mistakes. Recognizing and avoiding these errors can streamline the tax preparation process and ensure accuracy in filing.

Not filling out the form completely: Failing to provide all the requested information can delay the tax preparation process.

Choosing the wrong tax professional preference: If you are a returning client with a preference for a specific tax professional, not stating your preference can lead you to a less familiar tax professional.

Incorrect dates: Providing incorrect or unrealistic dates for when you want your return completed can cause scheduling issues.

Mismatched information for dependents: Not accurately reporting the residency and dependency of each dependent can lead to errors in your return.

Misreporting marital status or occupation: Your marital status and occupation can significantly impact your tax obligations and opportunities for deductions or credits.

Omitting income sources: Failing to check all applicable boxes in the income section can lead to undeclared income, which might result in penalties.

Overlooking deductible expenses: Not checking all that apply in the expenses section or forgetting to include requested documents can cause you to miss out on significant deductions.

Not clearly indicating the preferred method of review and approval: If you do not clearly state whether you prefer to approve your return online or in the office, it can lead to misunderstandings about how your return will be finalized.

Failing to review and sign legal disclaimers and agreements: Not acknowledging the receipt and understanding of privacy policies and service agreements can complicate the tax preparation process.

To avoid these mistakes, ensure that all sections of the form are filled out with accurate and complete information. Additionally, double-checking your entries against your tax documents can prevent errors and omissions.

Documents used along the form

When preparing your taxes, especially through services like H&R Block, the Drop Off Document Checklist is just the starting point. Several other forms and documents often accompany this checklist to ensure a thorough and accurate tax filing process. Understanding these additional forms can help streamline your tax preparation and ensure you're not missing any vital information.

- Form W-2: Issued by employers, this form reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

- Form 1099-INT: This document is issued by banks and financial institutions to report interest income.

- Form 1099-DIV: Sent by banks or other financial institutions, this form reports dividends and other distributions to investors.

- Form 1099-B: Used to report income from the sale of stocks, bonds, mutual funds, and other securities.

- Schedule C: This form is for self-employed individuals or sole proprietors to report profits or losses from their business.

- Form 1098: Issued by lenders, this document reports the amount of interest and related expenses paid on a mortgage during the tax year.

- Form 8863: Used to claim education credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

Each of these forms serves a specific purpose and caters to different aspects of an individual's financial situation. Whether you're employed, self-employed, investing in the stock market, or paying off a mortgage, these documents collect and report the necessary information to accurately calculate your taxes. Ensuring you have the relevant forms when you drop off your documents can simplify the tax preparation process for both you and your tax professional. Remember, thorough and accurate documentation can lead to potential savings and a smoother tax filing experience.

Similar forms

The IRS 1040 Tax Form: Similar to the H&R Block Drop Off Checklist, the IRS 1040 form collects detailed personal and financial information necessary for calculating and filing annual income taxes. Both documents serve as comprehensive tools for gathering taxpayer data, though the H&R Block checklist includes additional guidance for preparatory steps.

Intake/Interview & Quality Review Sheet: Used by tax preparers, this form resembles the H&R Block checklist in its function to collect preliminary information from clients. It facilitates an organized discussion about the taxpayer's situation, ensuring all relevant information is considered for accurate tax preparation.

Client Organizer: Often provided by tax professionals to their clients, a Client Organizer requests detailed financial information from the year, similar to the Drop Off Checklist. Both aim to streamline the collection of necessary documents and information for tax preparation.

New Patient Form for Medical Offices: Although from a different sector, this form gathers comprehensive personal and health information from new patients, akin to how the H&R Block form collects tax-related data. Both serve as initial steps to establish a client's profile for the service provider's records.

Financial Aid Application Forms: These forms, similar to the Drop Off Checklist, require detailed personal and financial information to determine eligibility for aid. Both documents are essential for assessing the applicant's financial situation and making informed decisions based on the provided information.

Rental Application Forms: Like the H&R Block Drop Off Checklist, rental applications collect detailed personal information, including financial data, to assess eligibility. Both types of documents are used to evaluate whether the individual meets the criteria set by the service provider or landlord.

Loan Application Forms: Loan applications require comprehensive personal and financial information from applicants, mirroring the extent of detail sought by the H&R Block Drop Off Checklist. Both are used to assess the individual’s financial health and eligibility for the service or product.

Employee Onboarding Documents: These documents compile personal and employment-related information from new hires, similar to how the H&R Block checklist gathers tax information from clients. Both sets of documents facilitate a formal introduction process tailored to the service provider's requirements.

Insurance Claim Forms: Required to file claims, these forms collect detailed information about the claimant and the claim itself, akin to the tax information collected by the H&R Block Checklist. Both are crucial for processing and approval within their respective fields.

Dos and Don'ts

When filling out the H&R Block Drop Off Checklist form, it's crucial to be thorough and accurate to ensure a smooth tax preparation process. Below are essential dos and don'ts to follow:

- Do thoroughly review the checklist before starting, to understand what information and documents are required.

- Do fill out the form to the best of your knowledge, providing accurate and current information.

- Do check all boxes that apply to your income and expenses to avoid missing out on potential deductions or credits.

- Do include all requested documents, such as W-2s, 1099s, receipts for deductible expenses, and supporting documents for credits.

- Do clearly indicate your preferred contact method and ensure the contact information provided is correct.

- Do ask questions if you're unsure about any section of the form or what documents to include, to ensure clarity and avoid errors.

- Don't rush through the form without checking the accuracy of your entries and the completeness of your document submissions.

- Don't ignore sections that apply to your tax situation; if unsure, seek clarification from an H&R Block representative.

- Don't forget to sign and date the form, as this is essential for processing your tax return.

- Don't choose to omit information or documents with the intention of adding them later, as this could delay the processing of your return.

By adhering to these guidelines, you can ensure a smoother tax preparation process with H&R Block, facilitating an accurate and timely completion of your tax return.

Misconceptions

Many people have misconceptions about the H&R Block Drop Off Checklist form. Let's clear up some of these misunderstandings:

It's only for returning clients. This isn't true. The form clearly asks whether you are a returning client or not, making it applicable for both new and returning clients.

You must have a preferred tax professional. While the form asks if you have a preferred tax professional, this question is optional. You can still process your tax return without specifying a preferred professional.

The turnaround time for your return is negotiable. The form suggests a typical turnaround time of 3 days. This timeframe is based on normal operations and may vary, but it's not generally negotiable on a client-by-client basis.

It’s necessary to complete the form in person at the office. You have options. You can leave it with a client service professional or discuss your return directly with a tax professional if you prefer. The form accommodates different levels of engagement according to your comfort and needs.

It asks for too much personal information. Every piece of information requested is pertinent to accurately processing your tax return, including details about dependents, income, and potential deductions. This comprehensive gathering of information helps ensure accuracy and maximizes potential refunds or minimizes liabilities.

You can only approve your tax return in person. The form offers an “Approve Online” option, showing that H&R Block provides flexibility for how you can review and finalize your tax return, not limiting you to in-office visits.

There’s no privacy policy or client agreement involved. At the bottom of the form, it indicates that clients will receive a privacy policy and must review and sign a Client Service Agreement, ensuring clear communication of terms and privacy considerations.

It’s just a formality without real benefits. This checklist is a crucial part of the tax preparation process, ensuring that all necessary information and documents are provided, which can significantly affect the accuracy and efficiency of the service provided.

All income and expenses need to be documented on the form. While it's ideal to check off and include documents for all income and expenses, the form also allows for discussion with a tax professional about items that may not be as straightforward, indicating flexibility in handling different types of tax situations.

The checklist is only a guideline and not necessary for the tax return process. While it might seem like just another piece of paperwork, the checklist ensures a smoother, more organized tax preparation process, and helps prevent missing out on potential deductions or credits.

Understanding the purposes and requirements of the H&R Block Drop Off Checklist form can help ease any concerns about the tax preparation process, making it more efficient and less daunting for everyone involved.

Key takeaways

When preparing to file your taxes with H&R Block, taking advantage of the Drop Off Document Checklist can simplify the process and ensure a more seamless experience. Here are nine key takeaways:

- Completing the form accurately and to the best of your knowledge helps H&R Block serve you better and meet your tax preparation expectations.

- You have the flexibility to choose between leaving your documents with the Client Service Professional at the front desk or scheduling a 10-15 minute meeting with your tax professional.

- For returning clients, indicating a preferred Tax Professional can personalize your service, ensuring that someone familiar with your history handles your taxes.

- Setting a desired date for your return to be ready helps manage your expectations regarding the typical turnaround time, which is about three days.

- Providing detailed client information, including marital status, occupation, and preferred contact method, allows H&R Block to tailor their service to your specific situation.

- Indicating whether you can be claimed as a dependent or if you are an active member or the spouse/dependent of an active member of the military can affect your tax situation and possible benefits.

- The checklist includes a section to fill out regarding income, expenses, credits and deductions, and miscellaneous items. Checking all that apply and including requested documents ensures that no important information is overlooked.

- If certain situations apply to you, such as self-employment or having experienced a catastrophic loss, it is recommended to discuss these directly with your tax professional before dropping off your information.

- Finally, understanding the legal disclaimers and ensuring all applicable documents are reviewed, explained, and executed as necessary provides peace of mind and guarantees that all legal aspects of your tax preparation are adequately addressed.

Remember, the more accurate and complete your information is, the smoother the tax preparation process will be. H&R Block professionals are there to assist you, so don't hesitate to ask questions or seek clarification at any point during the process.

Popular PDF Forms

9168457088 - The FTB 3552 form represents a vital communication link between taxpayers and the tax board to address concerns related to identity fraud effectively.

Nycers F501 - A planning tool for NYCERS members to direct where their death benefits should go.

Uniform Support Declaration - It requires thorough documentation of income sources, childcare expenses, and health insurance premiums, among others.