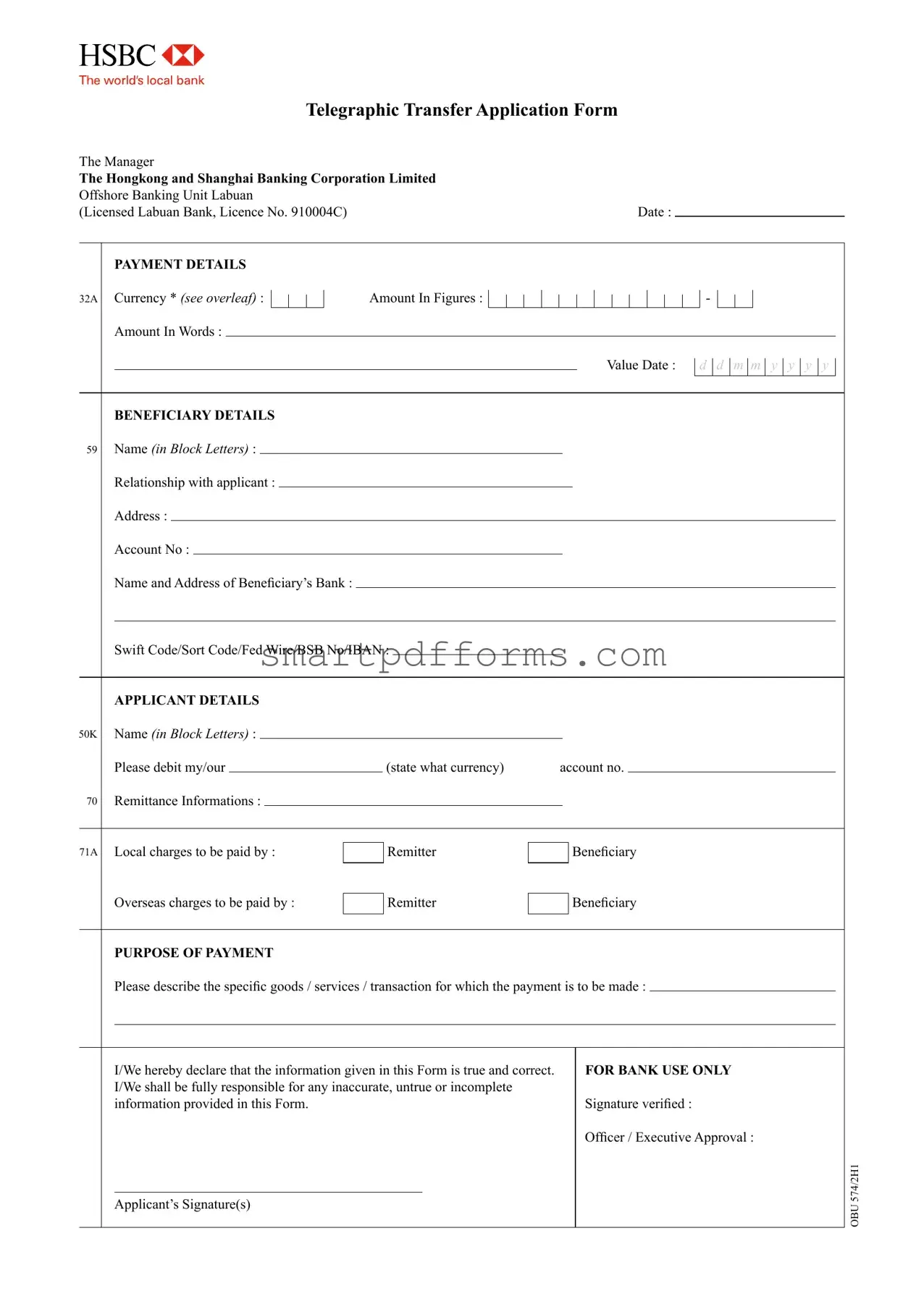

Blank Hsbc Telegraphic Transfer Slip PDF Template

The HSBC Telegraphic Transfer Slip is a vital document for customers desiring to send money abroad through the Hongkong and Shanghai Banking Corporation Limited, specifically from their Offshore Banking Unit in Labuan. This form encompasses various sections that require detailed attention, including payment details like currency, amount, and value date, along with beneficiary information such as their name, address, and bank details. Additionally, it covers the applicant's details, including their account number from which the charges are to be debited. The form also includes provisions for remittance information, specifying whether local or overseas charges are to be borne by the remitter or the beneficiary, and a section dedicated to the purpose of the payment. Completion and submission of this form serve as an agreement to the associated terms and conditions, including tariffs and charges. Furthermore, the form underscores the commitment to processing remittances within specified cut-off times and outlines the bank’s limited liability regarding delays or errors in the transmission of funds. Each section plays a crucial role in ensuring the accurate and secure transfer of funds across borders, highlighting the importance of the form in international transactions.

Preview - Hsbc Telegraphic Transfer Slip Form

Telegraphic Transfer Application Form

The Manager

The Hongkong and Shanghai Banking Corporation Limited

Offshore Banking Unit Labuan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

(Licensed Labuan Bank, Licence No. 910004C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

PAYMENT DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

32A |

Currency * (see overleaf) : |

|

|

|

|

|

|

Amount In Figures : |

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Amount In Words : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value Date : |

d |

d |

m |

m |

y |

y |

y |

y |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

BENEFICIARY DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

59 |

Name (in Block Letters) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Relationship with applicant : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Address : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Account No : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Name and Address of Beneiciary’s Bank : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Swift Code/Sort Code/Fed Wire/BSB No/IBAN : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

APPLICANT DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

50K |

Name (in Block Letters) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Please debit my/our |

|

|

|

|

|

|

|

|

(state what currency) |

account no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

70 |

Remittance Informations : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

71A |

Local charges to be paid by : |

|

|

Remitter |

|

|

|

|

Beneiciary |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneiciary |

|

||||||||||||||||||||||||||||||||||||

|

Overseas charges to be paid by : |

|

|

Remitter |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

PURPOSE OF PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Please describe the speciic goods / services / transaction for which the payment is to be made : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

I/We hereby declare that the information given in this Form is true and correct. |

|

|

|

|

|

FOR BANK USE ONLY |

|

||||||||||||||||||||||||||||||||||||||||||||

|

I/We shall be fully responsible for any inaccurate, untrue or incomplete |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

information provided in this Form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature veriied : |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oficer / Executive Approval : |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

574/2H1 |

|

Applicant’s Signature(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OBU |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TERMS & CONDITIONS

1.The applicant agrees to be bound by The Hongkong and Shanghai Banking Corporation Limited, Offshore Banking Unit Labuan’s

(“the Bank”) Tariff and Charges (available at www.hsbc.com.my/1/2/offshore) (as updated from time to time).

2.Apart from these Terms and Conditions, the Bank's Generic Terms and Conditions also applies.

3.All applications for remittances, are subject to daily

remittances received after the respective

4.All charges incurred for remittances are to be debited from the relevant account. The Bank shall not be liable for any loss or delay which may occur in the transfer, transmission and/or application of funds or, in the case of remittance by Telegraphic Transfer (whether instructed by the Customer or whenever the Bank deems necessary) for any error, omission or mutilation which may occur in the transmission of the message (either literally or in cipher) or for its misinterpretation by the receiving party when received, and the Customer agrees to indemnify the Bank against any actions, proceedings, claims and/or demands that may arise in connection with such loss, delay, error, omission, mutilation and/or misinterpretation.

5.All payment instructions, once transmitted, shall be deemed inalised. Any request for cancellation / recall of a payment instruction must be made in writing and shall only be cancelled / recalled at the Bank's sole option and discretion and provided that such payment instruction has not yet been transmitted by the Bank.

6.In the absence of any speciic instructions to the contrary the Telegrahic Transfer will be effected in the currency in which payment is to be made.

7.The Bank reserves the rights to draw this Telegrahic Transfer on a different place from that speciied by the remitter if operational circumstances so require.

8.Telegrahic Transfer is to be despatched entirely at the remitter's own risk.

9.Where the Bank is unable to provide a irm exchange rate quotation, the Bank shall effect the remittance on the basis of a provisional exchange rate which shall be subject to adjustment when the actual exchange rate is ascertained. Any difference between the provisional rate and the actual rate shall be debited/credited (as the case may be) from/to the Applicant account.

10.* Please use standard currency abbreviation e.g. USD for United States Dollars, GBP for Pound Sterling, AUD for Australian Dollar,

SGD for Singaporean Dollar, JPY for Japanese Yen, EUR for Euro Unit, etc

11.The Bank is hereby irrevocably authorised to disclose any information deemed necessary by the Bank, including but not limited to the applicant's name, account number and address (or in lieu of the address, to disclose the applicant's national identiicatio or passport number, or date and place of birth) in all outgoing foreign currency telegraphic transfers.

Form Data

| Fact 1 | Form is an application for Telegraphic Transfer |

| Fact 2 | Issued by The Hongkong and Shanghai Banking Corporation Limited, Offshore Banking Unit Labuan |

| Fact 3 | Requires detailed payment and beneficiary information |

| Fact 4 | Applicants must declare the information provided is true |

| Fact 5 | Subject to the Bank's Tariff and Charges |

| Fact 6 | Applications are processed based on daily cut-off times |

| Fact 7 | All charges for remittances are to be debited from the relevant account |

| Fact 8 | Telegraphic Transfers are at the remitter's own risk |

| Fact 9 | The Bank may disclose necessary information in all outgoing foreign currency telegraphic transfers |

Instructions on Utilizing Hsbc Telegraphic Transfer Slip

Completing the HSBC Telegraphic Transfer Slip form requires attention to detail and accuracy to ensure the successful processing of your transaction. This form is a crucial document for sending funds overseas through HSBC, and it requires the submission of specific information concerning the payment details, beneficiary details, and the applicant’s details. Here are the steps you need to follow carefully to fill out the form correctly.

- Date: Enter the current date in the format of day, month, and year.

- Payment Details:

- Specify the currency in standard abbreviation under "Currency".

- Enter the amount of the transfer in figures and then, for clarity, again in words.

- Provide the value date, using the same date format as before.

- Beneficiary Details:

- Write the name of the beneficiary in block letters.

- Detail the relationship between the applicant and the beneficiary.

- Provide the full address of the beneficiary.

- Enter the beneficiary's account number.

- Include the name and address of the beneficiary’s bank.

- Specify the bank's Swift Code/Sort Code/Fed Wire/BSB No/IBAN as applicable.

- Applicant Details:

- State the name of the applicant in block letters.

- Indicate the currency and provide the applicant's account number to be debited.

- Detail any remittance information that clarifies the payment’s purpose.

- Specify who will bear the local charges (Remitter or Beneficiary) and who will bear any overseas charges accordingly.

- Describe the purpose of the payment, specifying the goods, services, or transactions involved.

- Read the terms and conditions outlined on the form. It's essential to understand the responsibilities and agreements before proceeding.

- Sign the form to confirm that the information provided is accurate and complete. The signature also indicates agreement to the terms and conditions.

After the form is filled out, it should be reviewed to ensure all details are accurate and complete. This step minimizes the potential for delays or issues in the processing of the telegraphic transfer. Once satisfied, the completed form should be submitted to HSBC for processing. The bank will then handle the transaction, adhering to the instructions provided, and ensure the transfer of funds to the designated beneficiary. It's important to keep a copy of the filled form for your records.

Obtain Answers on Hsbc Telegraphic Transfer Slip

Frequently Asked Questions about the HSBC Telegraphic Transfer Slip Form

What is a Telegraphic Transfer Application Form?

This form is used for initiating a telegraphic transfer of funds through The Hongkong and Shanghai Banking Corporation Limited, Offshore Banking Unit Labuan. It involves transferring money electronically from one account to another, domestically or internationally.

How do I fill out the Payment Details section?

In the Payment Details section, you are required to specify the currency using the standard currency abbreviation, the amount in figures and words, and the value date (the date you wish the transfer to be effective).

What information is needed for the Beneficiary Details?

For the Beneficiary Details, provide the full name (in block letters), relationship with the applicant, address, account number, and the name and address of the beneficiary’s bank. Additionally, details like Swift Code/Sort Code/Fed Wire/BSB No/IBAN are required for international transactions.

What are the Applicant Details required on the form?

In the Applicant Details section, your full name in block letters should be included. Also, specify the currency and account number from which the funds should be debited. The section also asks for remittance information and who will bear the local and overseas charges.

How should I describe the Purpose of Payment?

The Purpose of Payment section requires a clear description of the goods, services, or transaction for which the payment is being made. This helps in ensuring the accuracy and legitimacy of the funds' transfer.

What are the terms and conditions I should be aware of?

You agree to comply with the Bank's Tariff and Charges, Generic Terms and Conditions, acknowledge the daily cut-off times for processing, and accept the risks and charges associated with telegraphic transfers. The form makes clear that all transactions are final once transmitted, with cancellation or recall being at the Bank's discretion and subject to specific conditions.

How do I submit the form, and what follows?

After thoroughly completing and signing the form, submit it to the designated bank official for verification and executive approval. Processing follows the Bank's prescribed cut-off times, and transactions may take additional time depending on the beneficiary's bank and location.

Is there anything special about the currency section marked with an asterisk (*)?

The Currency section mandates the use of standard currency abbreviations for the transaction. This ensures clarity and reduces the risk of errors in the transfer process, particularly for international transfers.

Common mistakes

When filling out an HSBC Telegraphic Transfer Slip form, there are common mistakes that can lead to delays in processing or even rejection of the transfer request. Recognizing and avoiding these mistakes can ensure a smoother transaction. Here are nine common errors:

- Incorrect currency abbreviation: Using wrong or non-standard currency abbreviations instead of those recognized internationally (e.g., writing "dollars" instead of "USD" for United States Dollars).

- Incomplete beneficiary information: Leaving out details such as the beneficiary's full name, address, or account number, which are critical for the successful completion of the transfer.

- Missing bank details: Not providing complete and accurate name, address of the beneficiary’s bank, or the necessary bank identifiers like Swift Code, Sort Code, Fed Wire, BSB No, or IBAN.

- Amount discrepancies: Writing different amounts in figures and words, or incorrectly converting currencies, leading to confusion about the intended amount to be transferred.

- Failing to specify charges: Not clarifying who will bear the transaction charges ("Local charges to be paid by" and "Overseas charges to be paid by" fields left blank or incorrectly filled).

- Vague purpose of payment: Not clearly describing the goods, services, or transaction purpose for which the payment is made can raise compliance issues.

- Omitting applicant details: Neglecting to fill in the applicant's name or account number from which the funds should be debited, resulting in delays to identify the originator of the transfer.

- Ignoring cut-off times and operational circumstances: Submitting applications without consideration of daily cut-off times or without acknowledging that operational conditions may lead to adjustments in the transfer process.

- Signature mismatches or omissions: Forgetting to sign the form or having a signature that doesn’t match the one on file with the bank can cause security flags, leading to a hold or inquiry on the transaction.

Making sure to review the form thoroughly before submission and keeping these common pitfalls in mind can help avoid unnecessary complications. Ensuring all information provided is complete, accurate, and clearly specified supports a timely and successful telegraphic transfer.

Documents used along the form

When executing international transactions, particularly those involving the use of an HSBC Telegraphic Transfer Slip, various accompanying documents and forms often come into play to ensure the process adheres to legal and institutional requirements. These forms and documents are pivotal, functioning not only as compliance measures but also as tools to facilitate the transparent, accurate conveyance of funds across borders. Below, a curated list explores several of these documents that are commonly used alongside the aforementioned Telegraphic Transfer Slip, shedding light on their purpose and the role they play in the seamless execution of international financial transactions.

- Customer Identification Form: This document is vital for verifying the identity of the individual or entity initiating the transfer. It typically requires personal or business identification details to comply with anti-money laundering (AML) regulations.

- Bank Account Verification Letter: Often required to prove the existence of the account from which funds are being transferred, this letter serves as a confirmation from the bank acknowledging the account details and its standing.

- Foreign Exchange Transaction Form: For transfers involving currency exchange, this form records the details of the exchange rate agreed upon and the equivalent amount in the foreign currency, ensuring transparency in the transaction.

- Source of Funds Declaration: This document is requested to declare the origin of the funds being transferred, in adherence to AML policies. It requires the remitter to explain the lawful source of the funds, such as income, sale of assets, or a loan.

- Beneficiary Consent Form: In certain transactions, especially those involving large amounts, a consent form from the beneficiary may be required to confirm their agreement to receive the funds and to verify their account details.

- Compliance Declaration Form: This form is an affirmation by the remitter that the transaction complies with the regulations of both the originating and receiving countries, including sanctions laws and AML requirements.

- Transaction Purpose Declaration: Similar to the purpose statement in the Telegraphic Transfer Slip, this more detailed declaration explains the rationale behind the transaction, providing specific details about the goods or services being paid for.

- Invoice or Purchase Order: For transactions related to trade or the purchase of services, the original invoice or purchase order is often attached to substantiate the details of the transaction, such as the cost, description of goods or services, and agreed terms.

Each document serves as a cog in the intricate machinery of international finance, ensuring that every transaction is executed with the utmost integrity and in compliance with global financial regulations. The complexity of these transactions necessitates a thorough documentation process, safeguarding all parties involved while promoting a transparent and secure global financial environment. Understanding the function and importance of these documents is essential for any entity engaging in international money transfers.

Similar forms

The HSBC Telegraphic Transfer Slip form is a financial document used for the international transfer of funds. Various aspects of this form align with the functions and objectives of several other financial documents. Each one facilitates certain transactions, provides essential details for processing payments, or records financial agreements between parties. Below are documents similar to the HSBC Telegraphic Transfer Slip form, highlighting their specific similarities.

- Wire Transfer Request Form: Like the Telegraphic Transfer Slip, this type of document is used to initiate a transfer of funds between banks, often across international borders. It requires the sender's account information, beneficiary's banking details, and the amount to be transferred.

- ACH Payment Authorization Form: This document authorizes payments via the Automated Clearing House (ACH) network. Similar to the Telegraphic Transfer application, it collects detailed information about the payer, payee, and the specific transaction. Though used for domestic transfers, its focus on detailed information aligns with the international focus of the Telegraphic Transfer Slip.

- Bank Draft Request Form: Used to request a bank draft, this form gathers comprehensive payment details, comparable to those on the Telegraphic Transfer Slip. Both forms ensure funds are transferred securely, although the methods of transfer differ.

- Foreign Exchange Transaction Form: This document is involved in currency exchanges, detailing the currencies involved and the equivalent amounts, much like the currency and amount fields in the Telegraphic Transfer Slip.

- Standing Order Mandate Form: Similar in its purpose of arranging payments, this document specifically sets up regular, automatic transfers from one account to another, capturing detailed information about the accounts and transaction terms akin to the Telegraphic Transfer Slip.

- International Trade Payment Form: This form is integral to the process of making payments in international trade, detailing goods or services, payment terms, and banking details, reflecting the detail and purpose observed in the Telegraphic Transfer Slip.

- Swift Message Request Form: Swift messages facilitate international bank transactions. This form, like the Telegraphic Transfer Slip, includes detailed beneficiary, sender, and transaction data required for Swift transactions.

- Credit Facility Application Form: Although focusing on credit rather than immediate transfers, this document collects detailed financial and personal information from applicants for setting up a line of credit, notably similar to the data collection aspect of the Telegraphic Transfer Slip.

Each of these documents, while serving distinct purposes within financial operations, shares a common necessity for detailed, accurate information regarding participants and transaction specifics, akin to the structure and requirements of the HSBC Telegraphic Transfer Slip form.

Dos and Don'ts

When filling out the HSBC Telegraphic Transfer Slip form, it is important to pay close attention to detail and understand the implications of the information you provide. Here are some dos and don'ts to help ensure the process is completed accurately and efficiently.

- Do ensure that you use the correct and standard currency abbreviation in section 32A, as per the instruction *. This includes USD for United States Dollars, GBP for Pound Sterling, and so on.

- Do verify all beneficiary details, including the name, address, account number, and the bank’s information like Swift Code/Sort Code/Fed Wire/BSB No/IBAN, to prevent any delays or errors in processing your transfer.

- Do clearly describe the purpose of the payment in the required section to avoid any confusion or processing delays. This helps in the precise and timely execution of your transaction.

- Don't overlook the declaration statement before signing the form. By signing, you acknowledge that the information provided is accurate and complete, and you accept responsibility for any inaccuracies.

- Don't forget to review the terms and conditions laid out by HSBC for Telegraphic Transfers, including the applicable tariffs and charges, to understand your obligations and rights as the remitter.

- Don't ignore cut-off times and operational requirements mentioned for remittance applications. Submitting your application within the prescribed time ensures that your transfer is processed without unnecessary delay.

Remember, accuracy in filling out the form and an understanding of the terms and conditions can significantly influence the efficiency and success of your Telegraphic Transfer with HSBC. Always review your information thoroughly before submission.

Misconceptions

When it comes to understanding the intricate details of the HSBC Telegraphic Transfer Slip form, several misconceptions often arise. Clearing up these misunderstandings can help ensure that the process of sending a telegraphic transfer is as smooth and error-free as possible.

It's only for international transfers: Many believe that the telegraphic transfer slip is exclusively for international transactions. However, it can also be used for domestic transfers, depending on the specific needs of the remitter and the services provided by the bank.

Any currency can be used without specification: There's a misconception that remitters can use any currency without formally specifying it on the form. In reality, the form requires the use of standard currency abbreviations (e.g., USD, GBP) to clearly indicate the currency being transferred.

Beneficiary relationships don’t need to be disclosed: Some applicants believe it’s unnecessary to detail their relationship with the beneficiary. However, accurately stating this relationship is essential for compliance and security measures.

The remittance information section is optional: This section is crucial as it provides additional details regarding the purpose of the payment, which can be important for both banking records and legal compliance.

Telegraphic transfers are processed immediately regardless of the time submitted: All applications are subject to cut-off times, and those received after will only be processed the next banking day. The timing can also depend on the destination's geographical location.

Transfers can be cancelled or recalled easily at any time: Once a payment instruction has been transmitted, cancelling or recalling it is subject to the bank's discretion and may not always be possible.

The bank will only use the specified transfer route: Operational circumstances may lead the bank to choose a different transfer route than initially specified by the remitter, contrary to what some might expect.

Exchange rates provided are final: If the bank is unable to provide a firm exchange rate quotation at the time of the transfer, it will use a provisional rate that is subject to adjustment once the actual rate is ascertained.

Information confidentiality is absolute: There is a duty on the part of the bank to disclose certain information deemed necessary about the remitter for outgoing foreign currency telegraphic transfers, which includes but is not limited to the applicant's name, account number, and address.

Understanding these common misconceptions can help applicants fill out the HSBC Telegraphic Transfer Slip accurately and ensure a smoother transaction process. Always check with your bank for the most current procedures and requirements when completing any financial transaction form.

Key takeaways

When filling out the HSBC Telegraphic Transfer Slip form, it's important to include detailed payment and beneficiary details to ensure the transfer process is smooth and error-free. Here are key takeaways to remember:

- Ensure the currency section is correctly filled using standard currency abbreviations, such as USD for United States Dollars or GBP for Pound Sterling, to avoid any confusion or delay in processing.

- Clearly write the amount both in figures and words to prevent misinterpretation of the payment amount.

- The value date, formatted as day, month, and year, must be specified, indicating when the transfer should be processed.

- Beneficiary details, including their name in block letters, relationship with the applicant, complete address, account number, and the SWIFT/Sort Code/FedWire/BSB No/IBAN of the beneficiary’s bank, are required to direct the funds appropriately.

- Applicant details, including the name in block letters and the account to be debited, need to be provided clearly to identify the source of the funds.

- It is necessary to describe the purpose of the payment in detail, specifying the goods, services, or transaction for which the payment is made.

- Applicants must declare that the information provided is true and correct and take full responsibility for any inaccuracies.

- All telegraphic transfers are subject to HSBC’s terms and conditions, including tariffs and charges, operational cut-off times, and processing by other institutions, which may affect the timing and finalisation of transfers.

Understanding these aspects and accurately completing the HSBC Telegraphic Transfer Slip can help in ensuring that your transfer is executed efficiently and without unnecessary delays.

Popular PDF Forms

Fia-1100a - The FIA1100A form facilitates a connection between employment verification and child care assistance, highlighting work as a contributing factor to assistance eligibility.

Pay Net 30 - Unlock the full potential of your business's financial strategies with the application for our Net 30 Days credit terms.