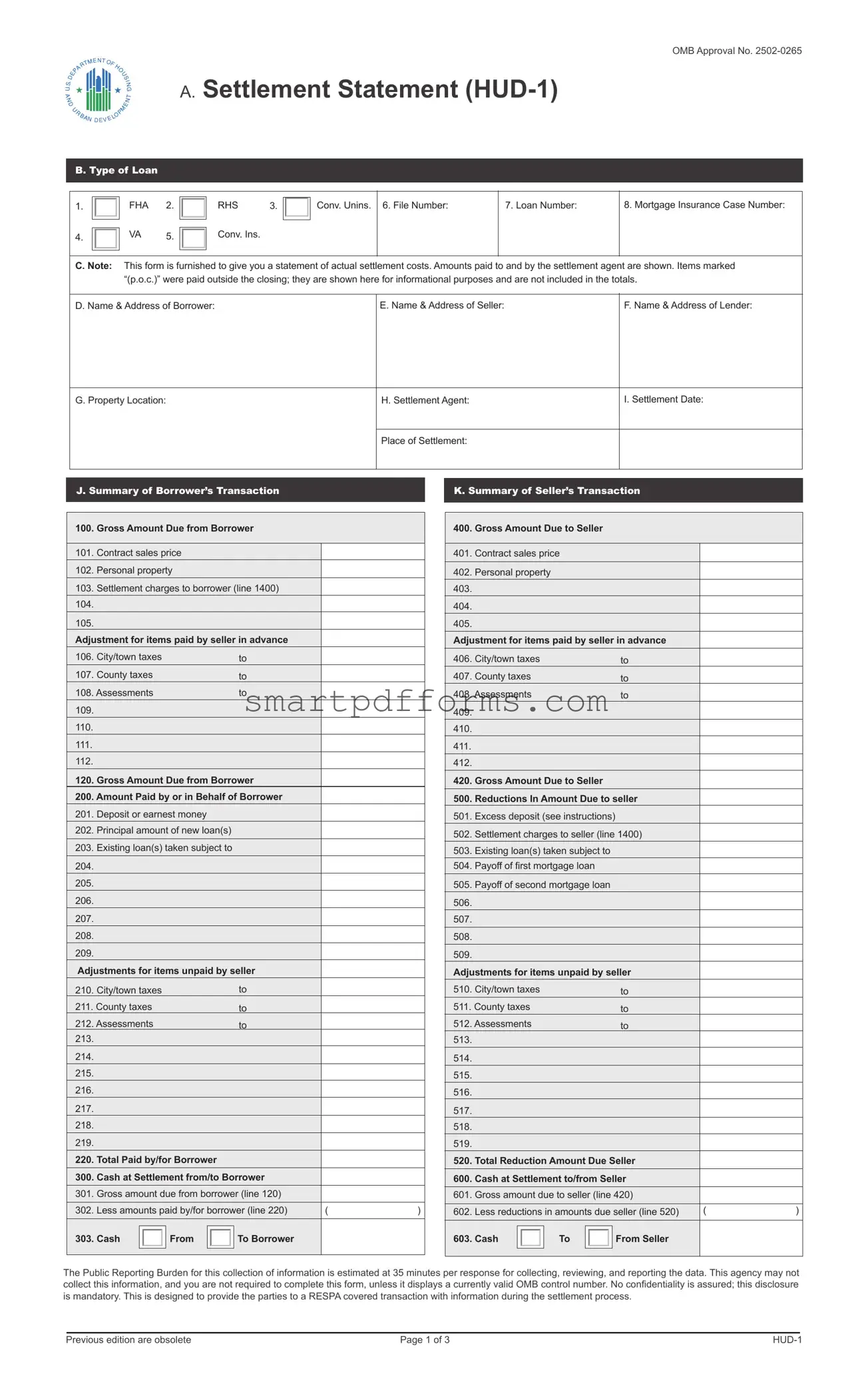

Blank HUD-1 Settlement Statement PDF Template

At the heart of every real estate transaction, the HUD-1 Settlement Statement form emerges as a critical document, encapsulating the financial intricacies of buying or selling property. Designed to provide a comprehensive summary of the transaction costs, this form plays a pivotal role in ensuring transparency between the buyer and seller, as well as with lenders and any involved real estate professionals. Throughout its pages, the HUD-1 delineates fees, charges, and adjustments, offering a clear breakdown of who owes what and to whom at the closure of the sale. It meticulously records the financial obligations of both parties, including but not limited to, the sales price, loan amounts, closing costs, and any prepaid amounts. This detailed accounting is not only a requirement for most real estate transactions but also serves as a valuable tool for parties to verify the accuracy of all charges before finalizing the deal. As such, the HUD-1 Settlement Statement stands as a cornerstone in the landscape of real estate transactions, underpinning the financial clarity and accuracy essential for a smooth transfer of property ownership.

Preview - HUD-1 Settlement Statement Form

OMB Approval No.

A. Settlement Statement

B. Type of Loan

1. |

|

FHA |

2. |

|

|

RHS |

3. |

|

Conv. Unins. |

6. File Number: |

|

7. Loan Number: |

8. Mortgage Insurance Case Number: |

|

|

|

|

|

|||||||||

4. |

|

VA |

5. |

|

|

Conv. Ins. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Note: |

This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked |

||||||||||||

|

|

“(p.o.c.)” were paid outside the closing; they are shown here for informational purposes and are not included in the totals. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Name & Address of Borrower: |

|

|

|

|

E. Name & Address of Seller: |

|

F. Name & Address of Lender: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. Property Location: |

|

|

|

|

|

|

|

H. Settlement Agent: |

|

I. Settlement Date: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place of Settlement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. Summary of Borrower’s Transaction

K. Summary of Seller’s Transaction

100.Gross Amount Due from Borrower

101.Contract sales price

102. |

Personal property |

|

|

|

|||

103. |

Settlement charges to borrower (line 1400) |

|

|

||||

104. |

|

|

|

|

|

|

|

105. |

|

|

|

|

|

|

|

Adjustment for items paid by seller in advance |

|

|

|||||

106. |

City/town taxes |

|

|

to |

|

|

|

107. |

County taxes |

|

|

to |

|

|

|

108. Assessments |

|

|

to |

|

|

||

109. |

|

|

|

|

|

|

|

110. |

|

|

|

|

|

|

|

111. |

|

|

|

|

|

|

|

112. |

|

|

|

|

|

|

|

120. Gross Amount Due from Borrower |

|

|

|||||

200. Amount Paid by or in Behalf of Borrower |

|

|

|||||

201. |

Deposit or earnest money |

|

|

|

|||

202. |

Principal amount of new loan(s) |

|

|

|

|||

|

|

|

|

|

|

|

|

203. |

Existing loan(s) taken subject to |

|

|

|

|||

204. |

|

|

|

|

|

|

|

205. |

|

|

|

|

|

|

|

206. |

|

|

|

|

|

|

|

207. |

|

|

|

|

|

|

|

208. |

|

|

|

|

|

|

|

209. |

|

|

|

|

|

|

|

Adjustments for items unpaid by seller |

|

|

|||||

210. |

City/town taxes |

|

|

to |

|

|

|

211. County taxes |

|

|

to |

|

|

||

212. Assessments |

|

|

to |

|

|

||

213. |

|

|

|

|

|

|

|

214. |

|

|

|

|

|

|

|

215. |

|

|

|

|

|

|

|

216. |

|

|

|

|

|

|

|

217. |

|

|

|

|

|

|

|

218. |

|

|

|

|

|

|

|

219. |

|

|

|

|

|

|

|

220. |

Total Paid by/for Borrower |

|

|

|

|||

300. |

Cash at Settlement from/to Borrower |

|

|

||||

301. |

Gross amount due from borrower (line 120) |

|

|

||||

|

|

|

|

|

|

|

|

302. |

Less amounts paid by/for borrower (line 220) |

( |

) |

||||

|

|

|

|

|

|

|

|

303. Cash |

|

From |

|

To Borrower |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

400.Gross Amount Due to Seller

401.Contract sales price

402. |

Personal property |

|

|

|

|

|

|

||

403. |

|

|

|

|

|

|

|

|

|

404. |

|

|

|

|

|

|

|

|

|

405. |

|

|

|

|

|

|

|

|

|

Adjustment for items paid by seller in advance |

|

|

|||||||

406. |

City/town taxes |

|

|

|

to |

|

|

||

407. |

County taxes |

|

|

|

to |

|

|

||

408. Assessments |

|

|

|

to |

|

|

|||

409. |

|

|

|

|

|

|

|

|

|

410. |

|

|

|

|

|

|

|

|

|

411. |

|

|

|

|

|

|

|

|

|

412. |

|

|

|

|

|

|

|

|

|

420. Gross Amount Due to Seller |

|

|

|

||||||

500. |

Reductions In Amount Due to seller |

|

|

||||||

501. |

Excess deposit (see instructions) |

|

|

|

|||||

502. |

Settlement charges to seller (line 1400) |

|

|

||||||

503. |

Existing loan(s) taken subject to |

|

|

|

|||||

504. |

Payoff of first mortgage loan |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

505. |

Payoff of second mortgage loan |

|

|

|

|||||

506. |

|

|

|

|

|

|

|

|

|

507. |

|

|

|

|

|

|

|

|

|

508. |

|

|

|

|

|

|

|

|

|

509. |

|

|

|

|

|

|

|

|

|

Adjustments for items unpaid by seller |

|

|

|||||||

510. |

City/town taxes |

|

|

|

to |

|

|

||

511. County taxes |

|

|

|

to |

|

|

|||

512. Assessments |

|

|

|

to |

|

|

|||

513. |

|

|

|

|

|

|

|

|

|

514. |

|

|

|

|

|

|

|

|

|

515. |

|

|

|

|

|

|

|

|

|

516. |

|

|

|

|

|

|

|

|

|

517. |

|

|

|

|

|

|

|

|

|

518. |

|

|

|

|

|

|

|

|

|

519. |

|

|

|

|

|

|

|

|

|

520. |

Total Reduction Amount Due Seller |

|

|

||||||

600. |

Cash at Settlement to/from Seller |

|

|

||||||

601. |

Gross amount due to seller (line 420) |

|

|

||||||

|

|

|

|

|

|

|

|

||

602. |

Less reductions in amounts due seller (line 520) |

( |

) |

||||||

603. Cash |

|

|

To |

|

|

From Seller |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

The Public Reporting Burden for this collection of information is estimated at 35 minutes per response for collecting, reviewing, and reporting the data. This agency may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number. No confidentiality is assured; this disclosure is mandatory. This is designed to provide the parties to a RESPA covered transaction with information during the settlement process.

|

|

|

|

Previous edition are obsolete |

Page 1 of 3 |

||

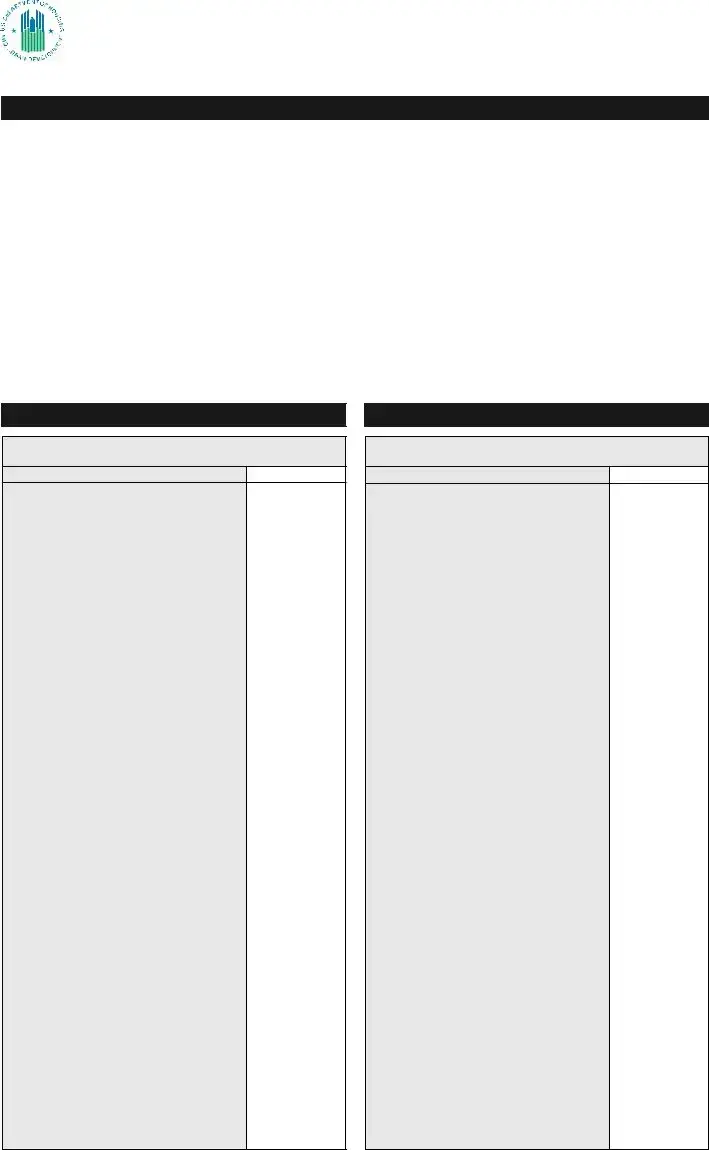

L. Settlement Charges

700. |

Total Real Estate Broker Fees |

Paid From |

Paid From |

|

|

Division of commission (line 700) as follows : |

Borrower’s |

Seller’s |

|

701. |

$ |

to |

Funds at |

Funds at |

Settlement |

Settlement |

|||

702. |

$ |

to |

|

|

703. |

Commission paid at settlement |

|

|

|

704. |

|

|

|

|

|

|

|

|

|

800. |

Items Payable in Connection with Loan |

|

|

|

|

|

|

|

801. |

Our origination charge |

|

|

|

$ |

(from GFE #1) |

|

|

802. |

Your credit or charge (points) for the specific interest rate chosen |

|

$ |

(from GFE #2) |

|

|

||

803. |

Your adjusted origination charges |

|

|

|

|

(from GFE #A) |

|

|

804. Appraisal fee to |

|

|

|

|

(from GFE #3) |

|

|

|

805. |

Credit report to |

|

|

|

|

(from GFE #3) |

|

|

806. |

Tax service to |

|

|

|

|

(from GFE #3) |

|

|

807. |

Flood certification to |

|

|

|

|

(from GFE #3) |

|

|

808. |

|

|

|

|

|

|

|

|

809. |

|

|

|

|

|

|

|

|

810. |

|

|

|

|

|

|

|

|

811. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

900. Items Required by Lender to be Paid in Advance |

|

|

|

|

|

|||

901. |

Daily interest charges from |

to |

@ $ |

/day |

|

(from GFE #10) |

|

|

902. |

Mortgage insurance premium for |

|

months to |

|

|

(from GFE #3) |

|

|

903. |

Homeowner’s insurance for |

|

years to |

|

|

(from GFE #11) |

|

|

904. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1000. |

Reserves Deposited with Lender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1001. |

Initial deposit for your escrow account |

|

|

(from GFE #9) |

|

|

|

1002. |

Homeowner’s insurance |

|

months @ $ |

per month |

$ |

|

|

1003. |

Mortgage insurance |

|

months @ $ |

per month |

$ |

|

|

|

|

|

|

|

|

|

|

1004. |

Property Taxes |

|

months @ $ |

per month |

$ |

|

|

1005. |

|

|

months @ $ |

per month |

$ |

|

|

1006. |

|

|

months @ $ |

per month |

$ |

|

|

|

|

|

|

|

|

|

|

1007. Aggregate Adjustment |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1100. Title Charges |

|

|

|

|

|

|

|

1101. Title services and lender’s title insurance |

|

|

(from GFE #4) |

|

|

||

1102. Settlement or closing fee |

|

|

|

$ |

|

|

|

1103. Owner’s title insurance |

|

|

|

(from GFE #5) |

|

|

|

1104. Lender’s title insurance |

|

|

|

$ |

|

|

|

1105. Lender’s title policy limit $ |

|

|

|

|

|

|

|

1106. Owner’s title policy limit $ |

|

|

|

|

|

|

|

1107. Agent’s portion of the total title insurance premium to |

|

$ |

|

|

|||

1108. Underwriter’s portion of the total title insurance premium to |

|

$ |

|

|

|||

1109. |

|

|

|

|

|

|

|

1110. |

|

|

|

|

|

|

|

1111. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

1200. Government Recording and Transfer Charges |

|

|

|

|

|||

1201. |

Government recording charges |

|

|

(from GFE #7) |

|

|

|

1202. |

Deed $ |

Mortgage $ |

|

Release $ |

|

|

|

1203. Transfer taxes |

|

|

|

(from GFE #8) |

|

|

|

1204. |

City/County tax/stamps |

Deed $ |

Mortgage $ |

|

|

|

|

1205. |

State tax/stamps |

Deed $ |

Mortgage $ |

|

|

|

|

1206. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1300. Additional Settlement Charges |

|

|

|

|

|

||

1301. |

Required services that you can shop for |

|

|

(from GFE #6) |

|

|

|

1302. |

|

|

|

$ |

|

|

|

1303. |

|

|

|

$ |

|

|

|

1304. |

|

|

|

|

|

|

|

1305. |

|

|

|

|

|

|

|

1400. Total Settlement Charges (enter on lines 103, Section J and 502, Section K)

|

|

|

|

Previous edition are obsolete |

Page 2 of 3 |

||

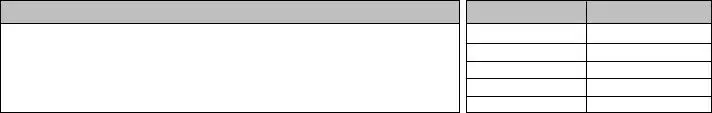

Comparison of Good Faith Estimate (GFE) and

Charges That Cannot Increase |

|

Our origination charge |

# 801 |

Your credit or charge (points) for the specific interest rate chosen |

# 802 |

Your adjusted origination charges |

# 803 |

Transfer taxes |

# 1203 |

|

|

Good Faith Estimate

Charges That In Total Cannot Increase More Than 10% |

|

|

|

|

|

|

|

Good Faith Estimate |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government recording charges |

|

|

# 1201 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

Increase between GFE and |

|

$ |

|

|

or |

% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charges That Can Change |

|

|

|

|

|

|

|

|

|

Good Faith Estimate |

|

|

||||

Initial deposit for your escrow account |

|

# 1001 |

|

|

|

|

|

|

|

|

|

|

||||

Daily interest charges |

$ |

/day |

# 901 |

|

|

|

|

|

|

|

|

|

|

|||

Homeowner’s insurance |

|

|

# 903 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

|

|

|

|

|

|

|

|

|

|

|

|

Loan Terms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your initial loan amount is |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

||

Your loan term is |

|

|

|

|

|

years |

|

|

|

|

|

|

|

|

||

Your initial interest rate is |

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

||

Your initial monthly amount owed for principal, interest, and any |

$ |

|

|

includes |

|

|

|

|

|

|

|

|

||||

mortgage insurance is |

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Mortgage Insurance |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Can your interest rate rise? |

|

|

|

|

No |

|

Yes, it can rise to a maximum of |

%. The first change will be on |

||||||||

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

and can change again every |

|

|

after |

|

. Every change date, your |

||||||

|

|

|

|

|

interest rate can increase or decrease by |

|

%. Over the life of the loan, your interest rate is |

|||||||||

|

|

|

|

|

guaranteed to never be lower than |

% or higher than |

%. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Even if you make payments on time, can your loan balance rise? |

|

|

No |

|

Yes, it can rise to a maximum of $ |

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Even if you make payments on time, can your monthly |

|

|

No |

|

Yes, the first increase can be on |

and the monthly amount |

||||||||||

|

|

|

||||||||||||||

amount owed for principal, interest, and mortgage insurance rise? |

|

owed can rise to $ |

. The maximum it can ever rise to is $ |

. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Does your loan have a prepayment penalty? |

|

|

|

No |

|

Yes, your maximum prepayment penalty is $ |

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does your loan have a balloon payment? |

|

|

|

No |

|

Yes, you have a balloon payment of $ |

|

due in |

years |

|||||||

|

|

|

|

|

||||||||||||

|

|

|

|

|

on |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Total monthly amount owed including escrow account payments |

|

|

You do not have a monthly escrow payment for items, such as property taxes and |

|||||||||||||

|

|

|||||||||||||||

|

|

|

|

|

|

homeowner’s insurance. You must pay these items directly yourself. |

|

|||||||||

|

|

|

|

|

|

You have an additional monthly escrow payment of $ |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

that results in a total initial monthly amount owed of $ |

|

. This includes |

||||||||

|

|

|

|

|

|

principal, interest, any mortagage insurance and any items checked below: |

|

|||||||||

|

|

|

|

|

|

Property taxes |

|

|

|

|

Homeowner’s insurance |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Flood insurance |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If you have any questions about the Settlement Charges and Loan Terms listed on this form, please contact your lender.

|

|

|

|

Previous edition are obsolete |

Page 3 of 3 |

||

Form Data

| Fact Number | Description |

|---|---|

| 1 | The HUD-1 Settlement Statement is a standardized mortgage form used in the United States that itemizes all charges imposed on borrowers and sellers in real estate transactions. |

| 2 | Previously required under the Real Estate Settlement Procedures Act (RESPA) for all transactions involving federally related mortgage loans, it was replaced by the Closing Disclosure form for most residential real estate transactions after October 3, 2015, due to the TILA-RESPA Integrated Disclosure rule. |

| 3 | It details the buyer's and seller's closing costs separately, providing transparency to the process and helping parties understand how the total closing costs were calculated. |

| 4 | The form provides a detailed account of the transaction, including the sales price, loan amount, loan charges, and adjustments between the buyer and seller, amongst other fees related to the transaction. |

| 5 | While the HUD-1 Form is federally mandated for certain loans, states may have their own specific forms and laws governing real estate transactions. For instance, in California, real estate transactions are subject to the California Civil Code. |

Instructions on Utilizing HUD-1 Settlement Statement

The HUD-1 Settlement Statement is an important document in the real estate transaction process. It itemizes all the charges and credits to the buyer and the seller in a mortgage loan transaction. This statement is usually prepared by the closing agent and must be provided to all parties involved in the transaction. The focus now shifts towards accurately filling out this form to ensure a transparent and lawful transfer of property ownership. This process can be meticulous, but accuracy is key to preventing legal issues down the road.

Steps to Fill Out the HUD-1 Settlement Statement Form:

- Begin with the basic information section at the top of the form. Fill in the type of loan, loan number, mortgage insurance case number, and the property's address. Ensure that the names of the buyer and seller are correctly entered alongside the property's address.

- Enter the date of settlement. This is critical as it affects certain financial calculations on the form.

- Proceed to the sections labeled “Summary of Borrower’s Transaction” and “Summary of Seller’s Transaction”. Here, record the gross amount due from the borrower and to the seller, including the purchase price and any adjustments for items paid by the seller in advance.

- Detail the settlement charges in the respective section. These are divided into items payable in connection with the loan and items required by the lender to be paid in advance. Include loan origination fees, title insurance, and any inspection fees here.

- Itemize any reserves deposited with the lender. These might include insurance and taxes.

- Fill in the sections related to title charges, government recording and transfer charges, and additional settlement charges. Each charge should be clearly described and entered in the appropriate column for the buyer or seller.

- Complete the loan terms section, including the interest rate, loan term, and any initial deposit amount. Also, specify whether the interest rate is fixed or adjustable.

- For the section dedicated to comparison of Good Faith Estimate (GFE) charges to actual charges, document the charges from the GFE provided to you at the beginning of the loan application process and compare these to the final actual charges. Highlight any significant variances.

- In the "Loan Terms" section, confirm details like whether your loan has a prepayment penalty or if there is a balloon payment associated.

- Finally, review the entire document for accuracy. Double-check the calculations to ensure they comply with the listed fees and totals. Once confident in the information's accuracy, the settlement agent, buyer, and seller should sign and date the form accordingly.

Completing the HUD-1 Settlement Statement with diligence is crucial for a successful real estate transaction. By following these steps, parties involved can confidently navigate the complexities of settlement procedures. With each party's interest plainly laid out, this form plays a pivotal role in promoting transparency and understanding, paving the way for a smoother property transfer process.

Obtain Answers on HUD-1 Settlement Statement

-

What is a HUD-1 Settlement Statement?

A HUD-1 Settlement Statement is a standard government form that was previously used to itemize all charges imposed upon a borrower and seller for a real estate transaction. It provides a detailed account of all incoming and outgoing funds in transactions that are typically related to real estate. Although it was replaced by the Closing Disclosure form for most residential real estate transactions as of October 3, 2015, under the TRID rule, it is still used for reverse mortgages and mortgage transactions not covered by the TRID rule.

-

Who needs to use the HUD-1 Settlement Statement?

Prior to being replaced by the Closing Disclosure form, the HUD-1 Settlement Statement was mandatory for all real estate transactions involving federally related mortgage loans. Today, it is primarily used in reverse mortgage transactions and certain other mortgage types not covered by the TRID rule, such as loans made by creditors that do not originate more than five mortgages in a year.

-

When is the HUD-1 Settlement Statement provided?

For those transactions that still require the HUD-1 Settlement Statement, it must be provided to the borrower, lender, and seller (if applicable) at least one day prior to settlement. This timeframe allows all parties to review the statement and clarify any concerns before the closing of the transaction.

-

What kind of information can you find on the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement includes comprehensive details regarding the financial aspects of a real estate transaction. This includes, but is not limited to, the sales price, loan amounts, closing costs, loan origination fees, interest rates, escrow amounts, and any adjustments between the seller and buyer. Furthermore, it itemizes credits and debits for both the buyer and seller, providing a clear picture of the final amounts due from or to each party.

-

Why is the HUD-1 Settlement Statement important?

This form plays a critical role in real estate transactions because it provides transparency and a detailed account of all financial aspects involved. For buyers and sellers, it serves as a final statement of their financial obligations and rights related to the transaction. It also helps to ensure that lenders are disclosing all costs accurately and are in compliance with relevant lending laws.

-

How does the HUD-1 Settlement Statement differ from the Closing Disclosure?

The HUD-1 Settlement Statement and the Closing Disclosure are similar in their purpose of detailed financial accounting for real estate transactions. However, the Closing Disclosure incorporates additional consumer protection elements brought about by the TRID rule, providing clearer explanations of terms, more transparent breakdowns of costs, and a different layout designed to be more understandable to consumers. Most notably, the Closing Disclosure is required to be delivered to consumers three days before closing, providing more time to review than the HUD-1 Settlement Statement.

-

What should you do if you find an error on your HUD-1 Settlement Statement?

If an error is found on the HUD-1 Settlement Statement, it's important to contact the closing agent or the title company immediately to have the error corrected. This should be done as soon as possible, ideally before the closing of the transaction. The closing agent is responsible for preparing the document and can make any necessary revisions. Ensuring accuracy is crucial for all parties involved.

-

Can the HUD-1 Settlement Statement have entries that are hard to understand?

Yes, the HUD-1 Settlement Statement can include terms and entries that may not be immediately clear to all parties. It often contains technical real estate and financial terminology. If you encounter terms or charges you don't understand, it's essential to ask the closing agent, lender, or your legal advisor for clarification. Fully understanding each entry is important for verifying the accuracy of the document and ensuring that all charges and credits are appropriate and agreed upon.

Common mistakes

The HUD-1 Settlement Statement is a critical document used in real estate transactions in the United States, particularly those involving a mortgage. It provides a detailed account of the financial transactions that occur between the buyer, seller, and other parties involved in the sale of property. However, due to its complexity, it is not uncommon for people to make mistakes when filling it out. Here are four common errors:

Not Checking for Accuracy in Personal Information: One of the most basic yet often overlooked details is ensuring personal information is accurate. This includes names, addresses, and social security numbers of the parties involved. Erroneous information can lead to significant delays or issues with the title transfer process.

Incorrect Figures: Another frequent error involves inaccurately entered figures, whether it’s the sale price, loan amount, or closing costs. These numbers are foundational to the transaction, and mistakes can not only delay the closing but also result in financial discrepancies that could be costly to rectify.

Omitting Fees or Costs: It's crucial not to skip any fees or costs, intentional or otherwise. Every charge, fee, or settlement cost must be documented accurately on the HUD-1. Missing entries can lead to disputes between parties and might even cause legal issues post-closure.

Failure to Verify with Other Documents: The HUD-1 Settlement Statement should be consistent with other transaction documents, such as the Good Faith Estimate (GFE) provided by lenders to borrowers early in the loan process. Failing to cross-check these documents for consistency can lead to unexpected discrepancies in final costs or loan terms.

By paying close attention to these areas when filling out the HUD-1 Settlement Statement, parties involved can help ensure a smoother, more reliable closing process. Accurate and thorough completion of this form not only helps avoid delays but also establishes a clear and accurate financial record of the real estate transaction.

Documents used along the form

When it comes to real estate transactions, the HUD-1 Settlement Statement form plays a pivotal role in itemizing all charges imposed upon the buyer and the seller. This form, essential as it is, often comes with a suite of other documents and forms, ensuring thorough documentation and adherence to regulations. Each of these documents fulfills a distinct role, collectively ensuring the transaction’s legality, clarity, and fairness for all parties involved.

- Good Faith Estimate (GFE): This document provides an estimate of all costs involved in the mortgage process. It allows buyers to compare costs between lenders and to understand the financial implications of their loan and settlement fees.

- Truth in Lending Act (TILA) Disclosure: This outlines the cost of the loan, the APR (annual percentage rate), finance charges, and other critical loan terms. It's designed to give borrowers a clear understanding of their financial obligations.

- Loan Estimate: This form combines the initial Truth in Lending statement and the Good Faith Estimate. It provides borrowers with a concise overview of the key loan terms, projected loan and closing costs, and whether the figures can change after closing.

- Closing Disclosure: Serving as a final review before closing, this document gives the buyer detailed information about the mortgage loan. It summarizes loan terms, monthly payments, and totals of closing costs and fees.

- Mortgage Note: This legal document binds the borrower to repay the loan under agreed terms. It specifies the loan amount, interest rate, payment dates, and duration.

- Deed of Trust/Mortgage: This document secures the mortgage note and gives the lender a claim against the home if the borrower fails to meet the terms of the mortgage note.

- Title Insurance Policy: Protects the buyer and the lender from potential damages or legal costs arising from disputes over property ownership or defects in the title.

- Homeowners' Insurance Policy: Ensures coverage for damage to the property and possibly its contents, along with liability for accidents that occur within the home or on the property.

- Property Tax Documents: These documents show the property’s assessed value for tax purposes and detail any due property taxes. This is essential for both the buyer's understanding of ongoing costs and the lender's assessment of escrow amounts.

In the intricate process of home buying and selling, these documents collectively support the HUD-1 Settlement Statement in providing a comprehensive legal and financial framework. Ensuring each document is accurately prepared and reviewed is crucial for a smooth and transparent transaction, safeguarding the interests of all parties involved. Understanding the purpose and content of these documents can significantly demystify the closing process, contributing to better-informed decisions and a more positive closing experience for buyers and sellers alike.

Similar forms

Good Faith Estimate (GFE): The Good Faith Estimate, which was required for loans originated prior to October 3, 2015, under the Real Estate Settlement Procedures Act (RESPA), is similar to the HUD-1 Settlement Statement in that it provides an itemized list of expected closing costs. The GFE was designed to give borrowers an estimate of the fees they would be charged upon closing, allowing for comparison and understanding of costs, mirroring the HUD-1’s objective of transparency in real estate transactions.

Loan Estimate: The Loan Estimate replaced the Good Faith Estimate and initial Truth-in-Lending disclosure for most closed-end borrower credit transactions secured by real estate, effective October 3, 2015. Similar to the HUD-1 Settlement Statement, the Loan Estimate provides details about the key features, costs, and risks of the mortgage loan for which the borrower is applying. This document must be provided to borrowers within three business days of submitting a loan application, aiming to help consumers understand and compare the costs of loans effectively.

Closing Disclosure: The Closing Disclosure is closely related to the HUD-1 Settlement Statement in its purpose and content. It outlines the final transaction costs and loan terms, and it’s provided to the borrower at least three business days before loan consummation. The Closing Disclosure replaced the HUD-1 for most real estate transactions as mandated by the TILA-RESPA Integrated Disclosure rule, but it carries forward the mission of the HUD-1 by ensuring consumers receive a detailed and comprehensive accounting of their transaction.

Annual Escrow Statement: While not involved in the initial closing of a real estate transaction, the Annual Escrow Statement shares similarities with the HUD-1 Settlement Statement in terms of providing a detailed account, but this time of escrow activities over the past year. Homeowners receive an annual escrow statement from their mortgage lender detailing the amounts collected and paid out from escrow for taxes, insurance, and other escrowed items, mirroring the HUD-1’s intent to outline transaction specifics for a property buyer or seller.

Dos and Don'ts

The HUD-1 Settlement Statement is an important document for anyone going through the process of buying or refinancing a home. It provides a detailed account of all the transactions and fees involved. When filling out or reviewing this form, accuracy is key. Here are several do's and don'ts to keep in mind:

- Do gather all necessary documents beforehand. This includes your loan estimate, contract, receipts, and any other financial paperwork related to the transaction. Having all pertinent information at your fingertips can help ensure accuracy.

- Do review each section carefully. The HUD-1 is divided into sections that cover the specifics of the loan, the transaction, and additional details related to the settlement. Paying close attention to each section helps prevent mistakes.

- Do double-check numbers for accuracy. Whether it's the selling price, loan amount, or closing cost totals, verifying these figures can prevent discrepancies later on.

- Do make sure names and addresses are correct. A simple mistake in spelling or an incorrect address can cause significant complications in real estate transactions.

- Do consult with a real estate professional or legal advisor if unsure about any terms or figures on the form. Their expertise can provide clarity and assurance.

- Don't rush through the process. Taking your time to carefully fill out or review the HUD-1 can save you from errors and potential financial losses.

- Don't forget to compare the HUD-1 with your Loan Estimate. This comparison can help identify any unexpected charges or discrepancies in the closing costs.

- Don't hesitate to ask questions. If there are charges or terms you don’t understand, it’s crucial to seek clarification before proceeding.

- Don't sign the document without a thorough review. Signing the HUD-1 signifies that you agree with all the information presented, making it crucial to ensure everything is correct and understood.

By following these guidelines, participants in the real estate process can navigate the complexities of the HUD-1 Settlement Statement more effectively, ensuring a smoother and more transparent transaction.

Misconceptions

The HUD-1 Settlement Statement form, a critical document in the home buying process, often becomes a source of confusion for both buyers and sellers. Several misconceptions surround its use, content, and the information it conveys. Below are four common misunderstandings clarified to help individuals navigate their real estate transactions with more certainty.

- Misconception 1: It's Only for Mortgage Lending Transactions. While the HUD-1 Settlement Statement is prominently used in transactions involving a mortgage, its purpose extends to cash transactions as well. It provides a comprehensive breakdown of all costs incurred by the buyer and seller, ensuring transparency, regardless of whether the purchase is financed or paid outright.

- Misconception 2: The Final Costs Should Match Initial Estimates Exactly. Early in the buying process, buyers receive an estimate of closing costs. However, the final figures on the HUD-1 Settlement Statement often differ from initial estimates due to variable factors like escrow account adjustments, prorated property taxes, and other last-minute charges. This variance is standard, reflecting the dynamic nature of real estate transactions.

- Misconception 3: Only Buyers Need to Review It. Although buyers are directly impacted by the contents of the HUD-1 Settlement Statement, sellers should also review it thoroughly. It contains details pertinent to both parties, including the seller’s proceeds from the sale, any adjustments for prior property taxes, and other related expenses. Both parties’ understanding of these figures is crucial for a transparent and equitable transaction.

- Misconception 4: HUD-1 Is No Longer Relevant After Closing. The importance of the HUD-1 Settlement Statement extends beyond the closing date. For both buyer and seller, it is a crucial document for tax preparation, enabling them to report accurate figures for deductions, such as real estate taxes and certain closing costs. Furthermore, discrepancies may arise after closing that necessitate a review of the finalized figures, making the HUD-1 Settlement Statement relevant long after the transaction is completed.

Understanding the HUD-1 Settlement Statement is fundamental for navigating the complexities of real estate transactions smoothly. By debunking these common misconceptions, individuals are better prepared to engage in the process, armed with knowledge and realistic expectations. This orientation towards informed decision-making is beneficial for both buyers and sellers, promoting clarity, transparency, and confidence in the pursuit of property ownership.

Key takeaways

The HUD-1 Settlement Statement form is an essential document in the closing process for residential real estate transactions, particularly when financing is involved. Its correct use ensures transparency and compliance with federal regulations, safeguarding the interests of both buyers and sellers. Below are key takeaways regarding filling out and using this form:

- Accurate Information: It is crucial to provide accurate and complete information on the HUD-1 to prevent legal and financial discrepancies. Errors can lead to closing delays, disputes between parties, and potential legal consequences.

- Review Early: Buyers and sellers are encouraged to review the HUD-1 Settlement Statement closely as soon as it is available and well before the closing date. This allows time to identify and rectify any errors or misunderstandings.

- Legal Requirements: The HUD-1 is a mandatory document for all real estate transactions involving a federally related mortgage loan. It must be used in compliance with the Real Estate Settlement Procedures Act (RESPA).

- Itemized Charges: The form itemizes all charges payable by the borrower and the seller in the transaction. This includes loan fees, property taxes, insurance premiums, and agent commissions, ensuring complete transparency.

- Compare with Good Faith Estimate: Borrowers should compare the final costs on the HUD-1 with the estimates provided in the Good Faith Estimate (GFE) received at the start of the loan application process. Significant discrepancies should be questioned.

- Final Document: The HUD-1 serves as the final statement of actual settlement costs and should be retained for personal records. It is an important document for tax preparation and resolving any post-closing financial issues.

- Avoid Blank Spaces: All sections of the HUD-1 should be filled out completely. If a particular section does not apply, it should be marked with "N/A" (not applicable) or a zero to acknowledge that it has been reviewed but does not apply.

- Professional Advice: Given the complexity of real estate transactions, consulting with a real estate professional or attorney when completing the HUD-1 can ensure that the document is filled out properly and in compliance with all applicable laws.

Popular PDF Forms

Ky Cdl Self-certification Online - It offers a streamlined process for commercial drivers to certify their compliance with both state and federal laws regarding medical fitness for duty.

What Is the Par-q - For thorough communication, provide both daytime and evening contact numbers along with a mobile phone number.

8832 Tax Form - Keeping abreast of updates and changes to the IRS rules regarding entity classification and Form 8832 filings is essential for tax compliance.