Blank I 765Ws PDF Template

The process of applying for employment authorization in the United States incorporates various forms, among which the Form I-765WS plays a crucial role for specific categories of applicants. This form, designed by the U.S. Citizenship and Immigration Services (USCIS), a component of the Department of Homeland Security, is a worksheet that aids in determining an applicant's economic necessity for work. Specifically, it targets individuals seeking employment authorization under categories (c)(14), Deferred Action, and (c)(33), Consideration of Deferred Action for Childhood Arrivals (DACA). The Form I-765WS requires applicants to furnish details about their current annual income, expenses, and the total value of their assets. Although providing supporting evidence for these claims is not obligatory, the USCIS welcomes and reviews any documentation submitted to substantiate an applicant's economic need. Importantly, the form emphasizes that applicants need not include financial information pertaining to other household members to establish their own economic necessity. Additionally, it offers space for individuals to explain their current financial situation or elaborate on their need for employment authorization further. As a nuanced component of the employment authorization application process, the I-765WS captures financial snapshots of applicants to ensure that work permits are granted to those who demonstrate a significant economic need.

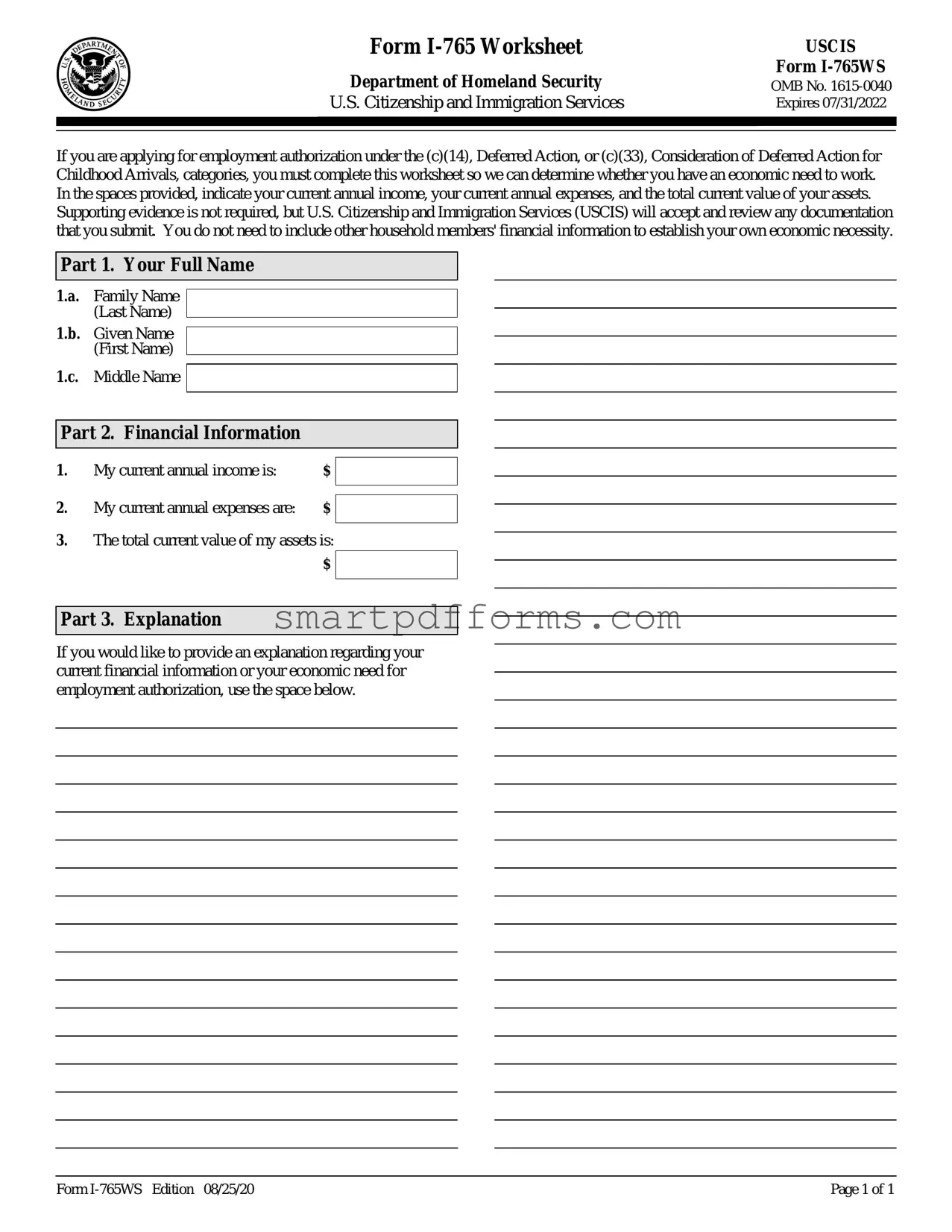

Preview - I 765Ws Form

Form |

USCIS |

Department of Homeland Security |

Form |

OMB No. |

|

U.S. Citizenship and Immigration Services |

Expires 07/31/2022 |

If you are applying for employment authorization under the (c)(14), Deferred Action, or (c)(33), Consideration of Deferred Action for Childhood Arrivals, categories, you must complete this worksheet so we can determine whether you have an economic need to work. In the spaces provided, indicate your current annual income, your current annual expenses, and the total current value of your assets.

Supporting evidence is not required, but U.S. Citizenship and Immigration Services (USCIS) will accept and review any documentation that you submit. You do not need to include other household members' financial information to establish your own economic necessity.

Part 1. Your Full Name

1.a. Family Name

(Last Name)

1.b. Given Name

(First Name)

1.c. Middle Name

Part 2. Financial Information

1. |

My current annual income is: |

$ |

|

2. |

My current annual expenses are: |

$ |

|

|

|||

|

|||

3. |

The total current value of my assets is: |

|

|

|

|||

|

|

$ |

|

|

|

|

|

Part 3. Explanation

If you would like to provide an explanation regarding your current financial information or your economic need for employment authorization, use the space below.

Form |

Page 1 of 1 |

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The Form I-765WS is issued by the U.S. Citizenship and Immigration Services (USCIS), which is part of the Department of Homeland Security. |

| 2 | This form is specifically designed for individuals applying for employment authorization under categories (c)(14), Deferred Action, and (c)(33), Consideration of Deferred Action for Childhood Arrivals (DACA). |

| 3 | Applicants are required to complete this worksheet to demonstrate their economic need for work. |

| 4 | The form requests details on the applicant's current annual income, annual expenses, and the total current value of their assets. |

| 5 | Though supporting evidence of financial information is not mandatory, USCIS will review any documentation provided with the form. |

| 6 | To establish economic necessity, applicants do not need to include financial information of other household members. |

| 7 | There is a dedicated section for explanations concerning the applicant's financial situation or the need for employment authorization. |

| 8 | The form's OMB Control Number is 1615-0040, and it was last updated on August 25, 2020. |

| 9 | The latest edition of the Form I-765WS was set to expire on July 31, 2022. |

| 10 | While the Form I-765WS itself does not cite specific governing laws, its requirement stems from federal immigration regulations concerning employment authorization for certain non-citizens. |

Instructions on Utilizing I 765Ws

Upon completing an application for employment authorization under specific categories, the I-765WS form plays a crucial function. This worksheet helps the U.S. Citizenship and Immigration Services (USCIS) determine an applicant's economic need for employment. It entails providing details about an individual's income, expenses, and assets. Although supporting documents are not mandatory, they are reviewed if submitted, aiding in the establishment of economic necessity without the need to include financial information of other household members.

- Collect the required information: Before starting the form, gather your financial details, including your annual income, expenses, and total assets. This preparation will help streamline the process.

- Start with your full name:

- Enter your Family Name (Last Name) in the space marked 1.a.

- Provide your Given Name (First Name) in the space labeled 1.b.

- If applicable, insert your Middle Name in the space designated 1.c.

- Fill in your financial information in Part 2:

- In the space provided for current annual income, enter the total amount you earn in a year before taxes.

- For current annual expenses, list the total amount you spend annually on necessities like housing, food, healthcare, education, etc.

- In the field for the total current value of your assets, state the combined value of your financial assets such as savings, real estate, investments, etc.

- Write down an explanation (Optional): Part 3 offers space to include any additional information regarding your financial state or to justify your economic need for employment. While this part is optional, providing a detailed explanation can be beneficial.

- Review your information: Ensure that all the details entered are accurate and truthful. Remember, while supporting evidence is not obligatory, submitting relevant documentation can strengthen your case.

- Submit the form: After completing the worksheet, attach it to your Form I-765 application for employment authorization. Follow the submission instructions provided by USCIS closely to ensure your application is processed without delays.

Accurately completing the I-765WS worksheet is key to demonstrating your economic need for employment. While it might seem straightforward, taking the time to precisely fill out each section ensures your application is well-supported, enhancing the likelihood of approval.

Obtain Answers on I 765Ws

-

What is Form I-765WS?

Form I-765WS, part of the I-765 Application for Employment Authorization, serves individuals applying under specific categories related to deferred action. If applying under the (c)(14), Deferred Action, or (c)(33), Consideration of Deferred Action for Childhood Arrivals (DACA) categories, this form is required. It helps the U.S. Citizenship and Immigration Services (USCIS) assess an applicant's economic need to work by requesting details on annual income, expenses, and total asset value.

-

Who needs to complete Form I-765WS?

Those seeking employment authorization under the categories of (c)(14), Deferred Action, or (c)(33), Deferred Action for Childhood Arrivals (DACA), are required to complete Form I-765WS. Its purpose is to demonstrate the applicant's financial need for employment.

-

Do I need to provide supporting evidence with Form I-765WS?

While it is not mandatory to submit supporting evidence of your financial situation with Form I-765WS, USCIS will review any documents provided. Applicants have the option to submit evidence to substantiate their annual income, expenses, and assets, but it's not a requirement for the form's acceptance.

-

Should I include my household members' financial information?

No, the I-765WS form focuses solely on the applicant’s financial information. It is not necessary to include the financial details of other household members when demonstrating economic necessity for work authorization. The form seeks to understand the applicant's personal financial needs and does not require information on household members' finances.

-

What information do I need to provide on Form I-765WS?

- Your current annual income

- Your current annual expenses

- The total current value of your assets

Additionally, there's space to include an explanation about your financial situation or your need for employment authorization. This section is optional and can be used to provide additional context or clarification.

-

How does USCIS use the information provided on Form I-765WS?

USCIS uses the details provided on Form I-765WS to assess whether an applicant has an economic need to work. The information about your annual income, expenses, and assets helps determine your financial situation and the necessity for employment authorization. Accurately completing this form and providing any optional supporting documentation can aid in the approval process of your work authorization under Deferred Action categories.

Common mistakes

When filling out the I-765WS form, which is essential for individuals applying for employment authorization under specific categories such as Deferred Action for Childhood Arrivals (DACA), several common mistakes can affect the outcome of the application. It's crucial to complete the form accurately to establish the economic need to work. Here are eight common mistakes to avoid:

- Failing to provide complete names: Applicants sometimes neglect to fill out their full legal name, including their family name, given name, and middle name if applicable. This can cause delays or complications in processing the form.

- Incorrectly reporting annual income: It's important to accurately calculate and report your current annual income. Overestimating or underestimating this figure might impact the assessment of your economic need.

- Underreporting or overreporting expenses: Much like income, accurately reporting your current annual expenses is crucial. This includes all significant expenses such as rent, utilities, education, and healthcare. Misreporting can lead to an inaccurate assessment of your financial situation.

- Omitting asset values: Some applicants forget to include the total current value of their assets, or they report this inaccurately. Assets play a key role in determining your economic necessity and should be carefully evaluated.

- Not providing an explanation when necessary: The form offers space for explanations regarding your financial information or your need to work. Neglecting this opportunity to provide context or clarify aspects of your financial situation can be a missed chance to strengthen your case.

- Forgetting to check for updated forms: USCIS periodically updates its forms. Using an outdated form, such as one that has expired, can lead to the rejection of your application. Always check for the most current form available on the USCIS website.

- Not reviewing the form for errors: Simple mistakes such as typos, incorrect dates, or miscalculations can delay the processing of your application. It's essential to thoroughly review your form before submission.

- Overlooking the need for supporting documents: Though the I-765 Worksheet states that supporting evidence is not required, providing documentation that supports your economic need can be beneficial. Failing to include any supportive documents may result in a missed opportunity to substantiate your claim.

Avoiding these mistakes can help ensure that your I-765WS form is accurately completed and positively considered by USCIS. It's always recommended to double-check the form and possibly consult with a legal expert to ensure that all information is presented correctly and comprehensively.

Documents used along the form

When preparing to submit the Form I-765 Worksheet (I-765WS) for employment authorization under Deferred Action or Consideration of Deferred Action for Childhood Arrivals (DACA) categories, applicants often need to gather additional forms and documents. These documents play a crucial role in supporting the application and providing a comprehensive view of the applicant's identity, background, and need for employment authorization.

- Form I-765, Application for Employment Authorization: This is the primary form applicants must complete to request employment authorization. It requires personal information, eligibility category, and information about prior applications for employment authorization, if any.

- Form I-821D, Consideration of Deferred Action for Childhood Arrivals: This form is used by individuals seeking to request DACA for the first time or by those seeking to renew their DACA. It establishes eligibility for deferred action.

- Form G-1145, E-Notification of Application/Petition Acceptance: Completing this form allows applicants to receive electronic notification when their application has been accepted into the system.

- Form I-485, Application to Register Permanent Residence or Adjust Status: For individuals seeking a change in their status to obtain a Green Card, this form is often submitted in conjunction with applications for employment authorization.

- Passport-style photographs: USCIS requires recent photographs that meet specific requirements for identification purposes. Generally, two photographs must be submitted with the application package.

- Evidence of Identity and Eligibility: Documents such as a copy of a birth certificate, photo identification, and evidence of eligibility under the specific category (like DACA) are critical. This may include school records, medical records, employment records, or other documents that establish identity and eligibility.

Collectively, these documents bolster an applicant's case for employment authorization by providing detailed personal information, proof of eligibility, and, in some cases, the legal basis for a change in status. It’s important to carefully review the requirements for each form and document to ensure a complete and accurate application package is submitted to USCIS.

Similar forms

Form I-765, Application for Employment Authorization: This form is directly related to the I-765WS as it is the main application individuals must complete when seeking employment authorization in the United States. While the I-765WS serves as a worksheet to demonstrate an applicant's economic need for employment, the I-765 form collects comprehensive information about the applicant's eligibility for work authorization. Both forms must be filed together for categories that require evidence of economic necessity, such as Deferred Action for Childhood Arrivals (DACA) recipients.

Form I-131, Application for Travel Document: Similar to the I-765WS, the I-131 form is used by individuals who need to request permission from USCIS for travel reasons, often while an adjustment of status or certain protected statuses are pending. Both forms are ancillary to main immigration petitions or applications and serve specific purposes that support the applicant's main request to USCIS, focusing on additional privileges or rights such as employment and travel.

Form I-134, Affidavit of Support: This form demonstrates financial support for visitors to the U.S. It is similar to the I-765WS in that it requires the sponsor to provide detailed financial information to prove they can support the visitor financially during their stay in the U.S. The I-765WS, in contrast, focuses on the applicant's own financial situation to justify the need for employment authorization.

Form I-589, Application for Asylum and for Withholding of Removal: The similarity with the I-765WS lies in the aspect of including personal circumstances as part of the application process. For Form I-589, applicants detail their reasons for seeking asylum, including past persecution or fear of future persecution. Though it primarily serves a different purpose, it shares the characteristic of providing personal explanations to USCIS, much like how individuals can use the third part of the I-765WS to explain their economic need for employment authorization.

Dos and Don'ts

Filling out the Form I-765WS is a key step for individuals applying for employment authorization under certain categories like Deferred Action or Consideration of Deferred Action for Childhood Arrivals (DACA). To ensure accuracy and improve the chances of approval, it’s essential to follow some best practices and avoid common pitfalls.

Do:

- Ensure you’re eligible for employment authorization under the specific categories (c)(14) or (c)(33) before you start filling out the form.

- Accurately calculate and report your current annual income, including any forms of income you regularly receive.

- Detail your current annual expenses with precision. It's crucial to reflect your financial needs realistically.

- Calculate the total current value of your assets correctly. Assets can include savings, property, investments, and other valuables that can be converted into cash.

- Consider providing an explanation for your economic need for employment authorization in the space provided, especially if your financial situation has complexities.

- Review all information for accuracy and completeness before submitting.

- If available, include supporting documentation for your financial information, even though it's not required.

Don't:

- Do not overlook the instruction that you do not need to include other household members' financial information to establish your own economic necessity.

- Do not guess your financial figures; ensure all reported income, expenses, and asset values are as accurate as possible.

- Do not leave any sections blank unless they absolutely do not apply to your situation.

- Do not submit the form without double-checking all the data you’ve entered for accuracy.

- Avoid submitting outdated forms; ensure the Form I-765WS is the current version by checking the USCIS website.

- Do not underestimate the importance of providing a clear and concise explanation in Part 3 if your financial situation requires it.

- Do not forget that while supporting evidence is not required, it can be helpful to include relevant financial documents.

Following these guidelines can significantly enhance your form's accuracy and overall appeal, making your case for economic necessity clearer to USCIS officers. Being thorough and genuine in your application process can make a considerable difference in the outcome.

Misconceptions

When filing for employment authorization under specific categories such as Deferred Action or Consideration of Deferred Action for Childhood Arrivals (DACA), a common requirement is the completion of the Form I-765WS. Here are ten common misconceptions about this form:

- Supporting evidence of financial information is required. While the U.S. Citizenship and Immigration Services (USCIS) does not require supporting evidence for the financial information provided, they will review any documentation you choose to submit.

- Household members' financial information must be included. Your financial information is what USCIS is interested in. You do not need to include the financial details of other household members to establish your economic necessity.

- The form is necessary for all employment authorization applications. Form I-765WS is specifically for those applying under the (c)(14), Deferred Action, or (c)(33), Consideration of Deferred Action for Childhood Arrivals, categories. Not all applicants for employment authorization need to complete this form.

- There’s a fee to submit the I-765WS. There is no separate fee for the I-765WS form; however, the primary form I-765 may have associated fees.

- The form is complicated and requires legal assistance to complete. The I-765WS is straightforward. It primarily asks for current annual income, expenses, and the total value of assets to determine economic need. While consulting a legal advisor can be beneficial for peace of mind, many applicants can complete this form on their own.

- You can leave sections blank if they do not apply. It’s important to fill out the form completely. If a section does not apply to you, it’s better to mark it as “N/A” (not applicable) than to leave it blank, to indicate you did not overlook the question.

- Your application will be denied if you have low assets. The purpose of the form is to assess economic need, not to disqualify applicants based on low assets. A lack of significant assets, especially when balanced by income and expenses, does not automatically result in denial.

- Annual expenses do not include personal spending. When reporting annual expenses, all living expenses, including rent, food, utilities, and other personal expenses, should be included to accurately reflect your economic situation.

- Only full-time jobs are considered valid economic needs. The need to work can be part-time or full-time. USCIS recognizes the varying economic needs and challenges individuals face.

- A high annual income will disqualify you. The form aims to understand your economic situation in its entirety, considering your expenses and assets along with your income. Having a higher income does not automatically disqualify you, especially if your expenses justify the need for employment.

By demystifying these misconceptions, applicants can approach the Form I-765WS with confidence and clarity, ensuring they provide the necessary information to demonstrate their economic need for employment authorization.

Key takeaways

Here are four key takeaways regarding the use and completion of the Form I-765WS, an essential document for certain applicants seeking employment authorization in the United States:

- Specific Purpose: The Form I-765 Worksheet is designed for individuals applying under specific categories, namely (c)(14), Deferred Action, and (c)(33), Consideration of Deferred Action for Childhood Arrivals (DACA). Its primary function is to determine the applicant's economic need to engage in employment in the U.S.

- Financial Details Required: Applicants are required to provide detailed personal financial information, including their current annual income, annual expenses, and the total current value of their assets. This information helps establish the necessity for employment authorization based on economic need.

- No Supporting Evidence Requirement: Although the form requests financial information, the applicant is not obligated to furnish supporting documentation. However, the U.S. Citizenship and Immigration Services (USCIS) will review any documents voluntarily submitted by the applicant to support their claim of economic necessity.

- Personal Financial Information Suffices: When filling out the Form I-765WS, applicants need not include financial information pertaining to other household members. The focus is on the applicant's own financial situation to establish their specific need for employment authorization.

Popular PDF Forms

Business License New Mexico - This Albuquerque-specific form is key for business owners looking to ensure their venture is officially recognized and legally sound.

Form Pa 1897 - Streamlines the verification of an employee’s income and work schedule for Early Learning Resource Center evaluators.

Yahtzee Board - By using the score card, players are encouraged to strategize each roll to maximize their points in various categories.