Blank Il 941 X PDF Template

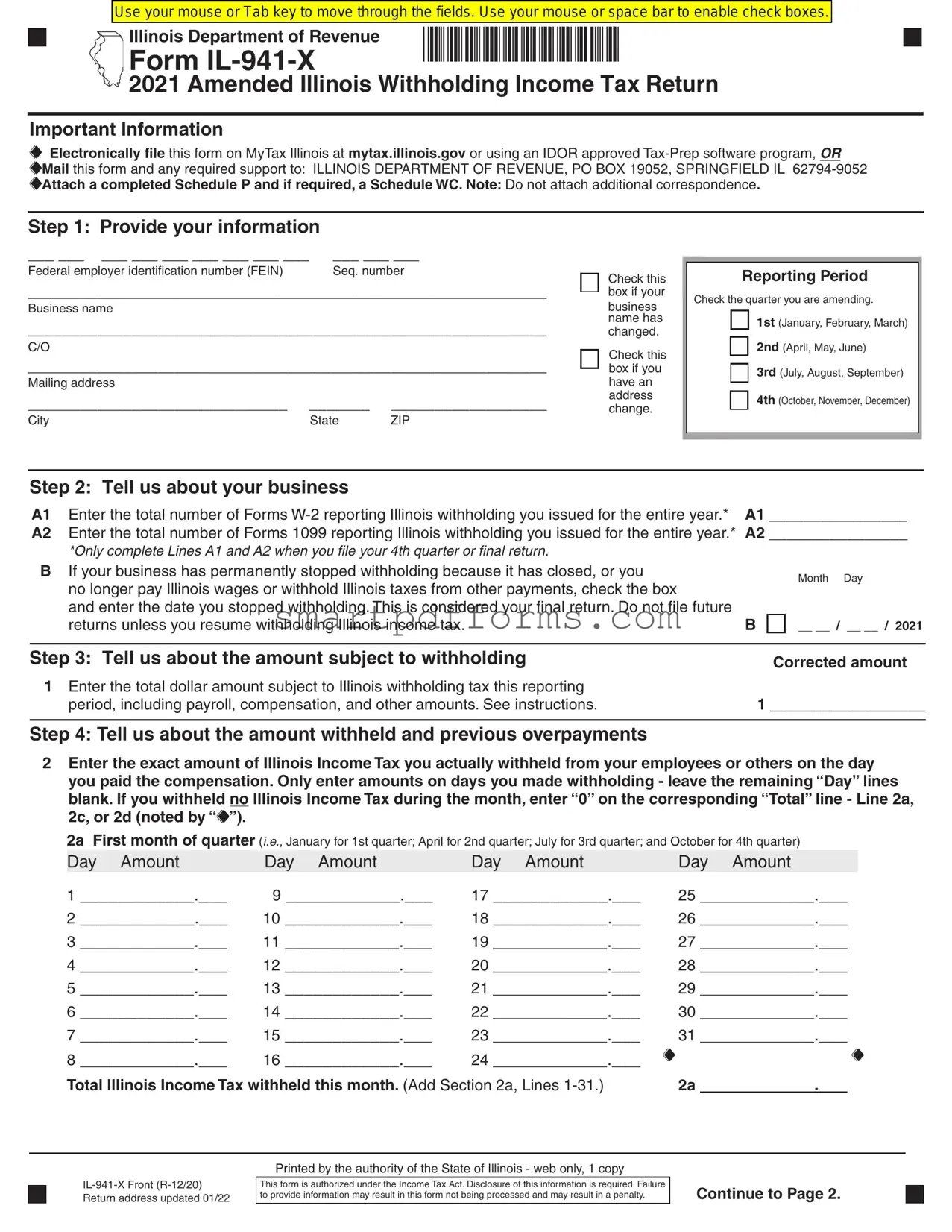

In the ever-evolving landscape of tax administration, the Illinois Department of Revenue introduces the IL-941-X form, a revised necessity for businesses navigating the complexities of amended Illinois withholding income tax returns for the year 2021. This form serves as a vital tool for entities that need to correct previously filed IL-941 forms, ensuring the accuracy of reported withholding taxes. Businesses are provided with a streamlined approach to report adjustments, whether they pertain to increases or decreases in the total amount subjected to Illinois withholding tax. The IL-941-X form empowers entities to precisely adjust the figures of taxes withheld from employees or other compensations, fostering compliance and integrity in tax reporting. Moreover, it accommodates adjustments for both the total number of Forms W-2 and 1099 reporting Illinois withholding previously issued. Designed for electronic filing through MyTax Illinois or through an IDOR-approved tax-prep software, it also offers a traditional mail-in option for those who prefer or require it. Alongside, it mandates the attachment of completed Schedule P and, if necessary, a Schedule WC, without encouraging additional correspondence, highlighting its focus on efficiency and specificity. The form also cleverly integrates sections for entities to indicate changes in business names or addresses, thereby consolidating various reporting requirements into a single, manageable process. With its introduction, the IL-941-X form underscores the Illinois Department of Revenue's commitment to facilitating a user-friendly, accurate tax amendment process, reflecting broader efforts to enhance tax administration fidelity and ease for businesses across the state.

Preview - Il 941 X Form

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

|

Illinois Department of Revenue |

*70712211W* |

|

|

|

||

|

Form |

|

|

|

|

|

|

|

2021 Amended Illinois Withholding Income Tax Return |

|

|

Important Information

Electronically file this form on MyTax Illinois at mytax.illinois.gov or using an IDOR approved

Electronically file this form on MyTax Illinois at mytax.illinois.gov or using an IDOR approved  Mail this form and any required support to: ILLINOIS DEPARTMENT OF REVENUE, PO BOX 19052, SPRINGFIELD IL

Mail this form and any required support to: ILLINOIS DEPARTMENT OF REVENUE, PO BOX 19052, SPRINGFIELD IL

Attach a completed Schedule P and if required, a Schedule WC. Note: Do not attach additional correspondence.

Attach a completed Schedule P and if required, a Schedule WC. Note: Do not attach additional correspondence.

Step 1: Provide your information

___ ___ ___ ___ ___ ___ ___ ___ ___ |

___ ___ ___ |

Federal employer identification number (FEIN) |

Seq. number |

____________________________________________________________

Business name

____________________________________________________________

C/O

____________________________________________________________

Mailing address

______________________________ |

_______ |

__________________ |

City |

State |

ZIP |

Check this box if your

business name has changed.

Check this box if you have an address change.

Reporting Period

Check the quarter you are amending.

1st (January, February, March)

2nd (April, May, June)

3rd (July, August, September)

4th (October, November, December)

Step 2: Tell us about your business

A1 |

Enter the total number of Forms |

A1 ________________ |

|

A2 |

Enter the total number of Forms 1099 reporting Illinois withholding you issued for the entire year.* |

A2 ________________ |

|

|

*Only complete Lines A1 and A2 when you file your 4th quarter or final return. |

|

|

B |

If your business has permanently stopped withholding because it has closed, or you |

|

Month Day |

|

no longer pay Illinois wages or withhold Illinois taxes from other payments, check the box |

|

|

|

|

|

|

|

and enter the date you stopped withholding. This is considered your final return. Do not file future |

B |

|

|

returns unless you resume withholding Illinois income tax. |

__ __ / __ __ / 2021 |

|

Step 3: Tell us about the amount subject to withholding |

Corrected amount |

1 Enter the total dollar amount subject to Illinois withholding tax this reporting |

1 __________________ |

period, including payroll, compensation, and other amounts. See instructions. |

Step 4: Tell us about the amount withheld and previous overpayments

2Enter the exact amount of Illinois Income Tax you actually withheld from your employees or others on the day you paid the compensation. Only enter amounts on days you made withholding - leave the remaining “Day” lines blank. If you withheld no Illinois Income Tax during the month, enter “0” on the corresponding “Total” line - Line 2a, 2c, or 2d (noted by “ ”).

”).

2a First month of quarter (i.e., January for 1st quarter; April for 2nd quarter; July for 3rd quarter; and October for 4th quarter)

Day Amount |

Day Amount |

Day Amount |

Day Amount |

1 ____________.___ |

9 ____________.___ |

17 ____________.___ |

25 ____________.___ |

2 ____________.___ |

10 ____________.___ |

18 ____________.___ |

26 ____________.___ |

3 ____________.___ |

11 ____________.___ |

19 ____________.___ |

27 ____________.___ |

4 ____________.___ |

12 ____________.___ |

20 ____________.___ |

28 ____________.___ |

5 ____________.___ |

13 ____________.___ |

21 ____________.___ |

29 ____________.___ |

6 ____________.___ |

14 ____________.___ |

22 ____________.___ |

30 ____________.___ |

7 ____________.___ |

15 ____________.___ |

23 ____________.___ |

31 ____________.___ |

8 ____________.___ |

16 ____________.___ |

24 ____________.___ |

|

Total Illinois Income Tax withheld this month. (Add Section 2a, Lines |

2a ____________.___ |

||

Printed by the authority of the State of Illinois - web only, 1 copy

This form is authorized under the Income Tax Act. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Continue to Page 2.

|

|

*70712212W* |

|

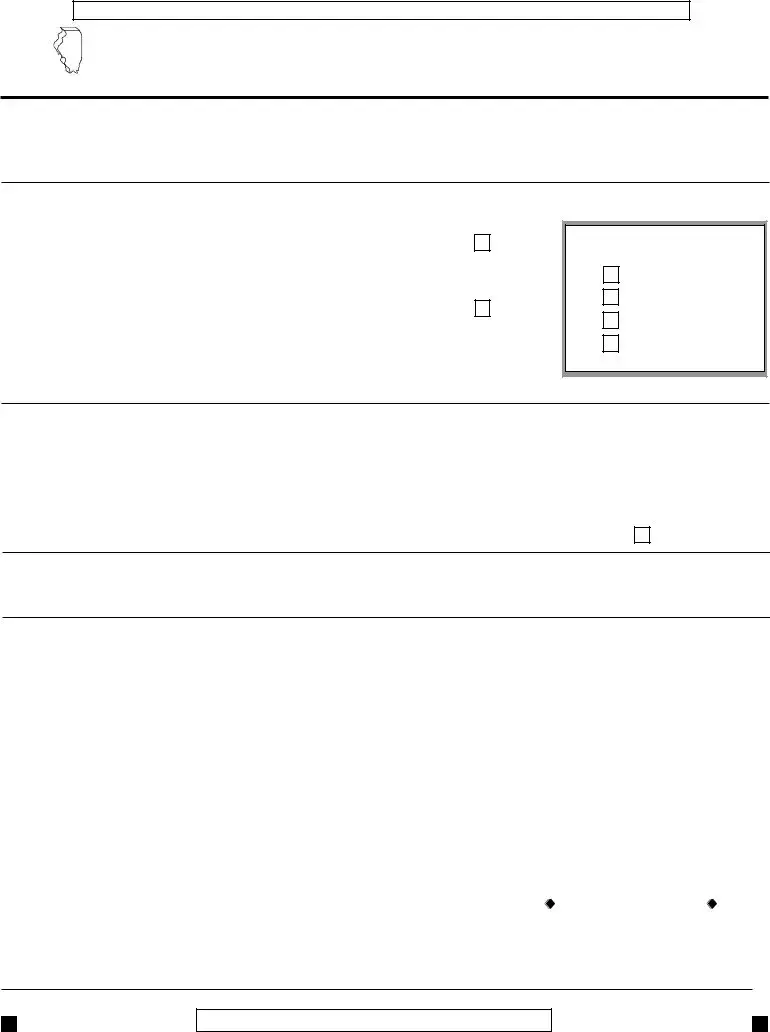

Step 4: Continued |

|

||

|

|

||

2b Enter the amount from Page 1, Step 4, Line 2a.

2c Second month of quarter (i.e., February for 1st quarter; May for 2nd quarter; August for 3rd quarter; and November for 4th quarter)

Day Amount |

Day Amount |

Day Amount |

Day Amount |

1 ____________.___ |

9 ____________.___ |

17 ____________.___ |

25 ____________.___ |

2 ____________.___ |

10 ____________.___ |

18 ____________.___ |

26 ____________.___ |

3 ____________.___ |

11 ____________.___ |

19 ____________.___ |

27 ____________.___ |

4 ____________.___ |

12 ____________.___ |

20 ____________.___ |

28 ____________.___ |

5 ____________.___ |

13 ____________.___ |

21 ____________.___ |

29 ____________.___ |

6 ____________.___ |

14 ____________.___ |

22 ____________.___ |

30 ____________.___ |

7 ____________.___ |

15 ____________.___ |

23 ____________.___ |

31 ____________.___ |

8 ____________.___ |

16 ____________.___ |

24 ____________.___ |

|

Total Illinois Income Tax withheld this month. (Add Section 2c, Lines |

2c ____________.___ |

||

2d Third month of quarter (i.e., March for 1st quarter; June for 2nd quarter; September for 3rd quarter; and December for 4th quarter)

Day Amount |

Day Amount |

Day Amount |

Day Amount |

|

1 ____________.___ |

9 ____________.___ |

17 ____________.___ |

25 ____________.___ |

|

2 ____________.___ |

10 ____________.___ |

18 ____________.___ |

26 ____________.___ |

|

3 ____________.___ |

11 ____________.___ |

19 ____________.___ |

27 ____________.___ |

|

4 ____________.___ |

12 ____________.___ |

20 ____________.___ |

28 ____________.___ |

|

5 ____________.___ |

13 ____________.___ |

21 ____________.___ |

29 ____________.___ |

|

6 ____________.___ |

14 ____________.___ |

22 ____________.___ |

30 ____________.___ |

|

7 ____________.___ |

15 ____________.___ |

23 ____________.___ |

31 ____________.___ |

|

8 ____________.___ |

16 ____________.___ |

24 ____________.___ |

|

|

Total Illinois Income Tax withheld this month. (Add Section 2d, Lines |

2d ____________.___ |

|||

Add Lines 2b, 2c, and 2d and enter the total amount here. This is the total dollar amount of |

||||

Illinois Income Tax actually withheld from your employees or others for this quarter. |

|

|

||

Note: If you are reducing your tax based on Form |

2 _________________ |

|||

3If your original return or previously filed

have already received, please enter this amount. See instructions. |

3 _________________ |

4 Add Lines 2 and 3 and enter the total amount here. |

4 _________________ |

Step 5: Tell us about your payments and credits

5 Enter the amount of credit from the Schedule WC you are using this period. See instructions. |

5 _________________ |

6Enter the total dollar amount of withholding payments you made to the Illinois Department of

Revenue (IDOR) for this period. This includes all |

|

coupons). Do not estimate this amount. |

6 _________________ |

7 Add Lines 5 and 6 and enter the total amount here. |

7 _________________ |

Step 6: Figure your balance

8If Line 4 is greater than Line 7, subtract Line 7 from Line 4. This is your remaining balance due. Make your payment electronically or make your remittance payable to “Illinois Department of

Revenue.” |

8 _________________ |

9 If Line 7 is greater than Line 4, subtract Line 4 from Line 7. This amount is your overpayment. |

9 _________________ |

Step 7: Sign here Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete.

Sign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if the Department |

||

|

|

|

|

|

|

|||

Here |

|

( |

) |

|

|

|

||

|

|

may discuss this return with the |

||||||

|

Signature |

Date (mm/dd/yyyy) Title |

Phone |

|

paid preparer shown in this step. |

|||

Paid |

|

|

|

|

Check if |

|

||

Paid preparer’s name |

Paid preparer’s signature |

Date (mm/dd/yyyy) |

Paid Preparer’s PTIN |

|||||

Preparer |

||||||||

Use Only |

Firm’s name |

|

|

Firm’s FEIN |

( |

) |

||

|

Firm’s address |

|

|

Firm’s phone |

||||

|

NS |

IR |

DR |

|

|

|||

|

|

|

Reset |

|

|

|

||

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The IL-941-X form is used for amending previously filed Illinois Withholding Income Tax Returns. |

| Filing Options | This form can be filed electronically through MyTax Illinois, using an IDOR approved Tax-Prep software program, or mailed to the Illinois Department of Revenue. |

| Required Attachments | A completed Schedule P and, if required, a Schedule WC must be attached. Additional correspondence should not be attached. |

| Governing Law | The submission and processing of this form are authorized under the Income Tax Act of Illinois. |

Instructions on Utilizing Il 941 X

When the need arises to amend an Illinois Withholding Income Tax Return, the IL-941-X form is the document required. Ensuring accurate and timely submission of this form is crucial for correcting any previously reported information. Whether updating amounts subject to withholding, adjusting the tax withheld, or making other necessary corrections, the steps below are designed to guide you through the process. It is important to note that the form allows for adjustments to be made for a specific reporting period, requiring you to indicate the relevant quarter being amended. Below are the steps to complete the IL-941-X form.

- Provide your information, including:

- Federal Employer Identification Number (FEIN)

- Business name (and check the box if it has changed)

- Sequence number

- C/O (Care Of) if applicable

- Mailing address, city, state, and ZIP code (and check the box if it has changed)

- Check the quarter you are amending under "Reporting Period."

- Tell us about your business:

- Enter the total number of Forms W-2 and Forms 1099 reporting Illinois withholding you issued for the whole year in Lines A1 and A2, respectively. This is only completed when filing for the 4th quarter or final return.

- If your business has permanently stopped withholding, check the box in section B and enter the date you stopped withholding. This is considered your final return.

- Tell us about the amount subject to withholding:

- Enter the corrected total dollar amount subject to Illinois withholding tax this reporting period in Line 1.

- Tell us about the amount withheld and previous overpayments:

- For each month of the quarter (Sections 2a, 2b, and 2d), enter the day-to-day amounts withheld.

- Add the totals from each month and document the cumulative amount withheld for the quarter in Line 2.

- Enter any previously allowed credit, IDOR-approved credit for the period, or a refund you have already received in Line 3.

- Add Lines 2 and 3 and enter the total amount in Line 4.

- Tell us about your payments and credits:

- Enter the amount of credit from the Schedule WC you are using this period in Line 5.

- Document the total dollar amount of withholding payments made to the Illinois Department of Revenue (IDOR) for this period in Line 6.

- Add Lines 5 and 6 and enter the total amount in Line 7.

- Figure your balance:

- If Line 4 is greater than Line 7, subtract Line 7 from Line 4 to find your remaining balance due and enter it in Line 8.

- If Line 7 is greater than Line 4, subtract Line 4 from Line 7 to determine your overpayment and enter it in Line 9.

- Sign the form:

- Provide a signature, the date, and your title.

- If applicable, a paid preparer should also sign and provide their information.

After carefully filling out each section of the IL-941-X form, double-check for accuracy before submitting. The form can be filed either online through MyTax Illinois or mailed to the address provided on the form, depending on your preference or requirement. Including a completed Schedule P and, if required, a Schedule WC with your submission, but refrain from attaching any additional correspondence to ensure a smooth processing of your amended return.

Obtain Answers on Il 941 X

How do I file an amended Illinois Withholding Income Tax Return using Form IL-941-X?

To file an amended Illinois Withholding Income Tax Return, you can do so electronically through MyTax Illinois at mytax.illinois.gov or by using an Illinois Department of Revenue (IDOR) approved Tax-Prep software program. Alternatively, you can mail the form along with any required support, such as a completed Schedule P and, if necessary, a Schedule WC. Remember, additional correspondence should not be attached. Ensure you provide all requested information, such as your Federal Employer Identification Number (FEIN), business name, and address changes if applicable. Also, accurately report the quarter being amended and the details of your business and withholding amounts.

What should I do if my business name or address has changed?

If there has been a change in your business name or address, you must mark the appropriate checkboxes on the IL-941-X form to indicate these changes. Provide the new business name or address in the provided fields. It's essential to keep this information updated to ensure that all correspondence and records are accurately maintained.

How do I indicate the quarter I am amending on the IL-941-X form?

To indicate the quarter you are amending, simply check the appropriate box corresponding to the quarter being amended: 1st (January, February, March), 2nd (April, May, June), 3rd (July, August, September), or 4th (October, November, December). This step is crucial for accurately processing your amended return and adjusting your records accordingly.

What are the steps involved in calculating and reporting the amended amounts?

The IL-941-X form requires you to enter corrected amounts for the total dollar amount subject to Illinois withholding tax, the actual amount of Illinois Income Tax you withheld from employees or other compensations, and any previous overpayments or credits. Start by entering the corrected total subject to withholding in the reporting period. Next, detail the exact amount withheld for each month of the quarter. If you're adjusting your tax due because of corrected W-2 forms, follow the specific instructions on the form. Lastly, calculate your balance, considering any credits or payments made during the period. Ensuring accuracy in these steps is vital for the corrected return to reflect the true amounts for your business's withholding responsibilities.

Common mistakes

When filling out the Illinois Form IL-941-X, which is the Amended Illinois Withholding Income Tax Return, individuals commonly make several mistakes. These errors can lead to delays in processing and potential issues with the Illinois Department of Revenue (IDOR). Here is an expanded list of six common mistakes:

Failing to accurately report changes to the business name or address: It is crucial to check the appropriate box if there has been a change to the business name or address to ensure the IDOR has the most current information.

Incorrectly entering the number of Forms W-2 and 1099: Accurately reporting the total number of Forms W-2 and 1099 that include Illinois withholding for the entire year is essential. This information is only required when filing your 4th quarter or final return.

Not correctly indicating the reporting period being amended: It's necessary to clearly check the correct quarter you are amending. Overlooking or misclicking can result in processing the amendment for the wrong period.

Misreporting the total dollar amount subject to withholding: The corrected total amount subject to Illinois withholding tax, including payroll and other compensations, must be precisely calculated and entered.

Errors in the withholding amounts and payment calculations: Ensuring the accuracy of the amounts withheld from employees or others as indicated in Steps 4 and 5 is critical. Errors here can significantly impact the total tax liability or credit.

Omitting the signature and date: The form requires a signature and date under penalties of perjury, attesting to the accuracy of the information. Failing to sign and date the form can lead to its rejection.

In addition to these specific errors, pay attention to the completeness of each section, the accuracy of all reported numbers, and adherence to the guidelines for supporting documentation like Schedule P or Schedule WC, if applicable. Avoid attaching additional correspondence unless expressly required, as instructed on the form.

Documents used along the form

When businesses find themselves needing to amend their Illinois withholding income taxes, filing the IL-941-X form is a crucial step. However, this process often requires additional forms and documents to ensure accuracy and compliance with state tax obligations. Understanding these documents and their purposes can help streamline the amendment process, ensuring that businesses satisfy all requirements for correcting their withholding income tax records.

- IL-W-4, Employee’s Illinois Withholding Allowance Certificate: Employers need this form to accurately determine the amount of state income tax to withhold from employees’ paychecks. Completing this correctly is critical for preparing accurate amendments on the IL-941-X form.

- Schedule P, Withholding Schedule: Mandatory for businesses that have made adjustments to the amount of Illinois Income Tax withheld. It provides detailed information about the adjustments, supporting the changes reported on the IL-941-X form.

- Schedule WC, Illinois Withholding Income Tax Credits: This form is essential for businesses that are claiming any withholding income tax credits. It documents the credits being used to offset the tax owed, as outlined in the amended return.

- IL-501, Payment Coupon and Instructions: Businesses may need to use this if they discover additional payments are due after filing the IL-941-X. The IL-501 allows for proper payment to the Illinois Department of Revenue, ensuring accounts are up-to-date.

- Form W-2c, Corrected Wage and Tax Statement: If an employer discovers discrepancies in the wages reported and taxes withheld for an employee, this form is used to correct those errors. It is key when adjustments on the IL-941-X are a result of errors found on the original W-2 forms.

Ensuring these documents and forms are accurately completed and properly submitted alongside the IL-941-X can help avoid delays and further complications with the Illinois Department of Revenue. Each plays a unique role in clarifying and justifying the adjustments being made, creating a smoother process for correcting income tax withholding for both the employer and the state. Attention to detail and thoroughness in this process can save time and reduce the risk of additional errors.

Similar forms

The IRS Form 941-X is quite similar because it's an adjusted employer's quarterly federal tax return or claim for refund. This form allows employers to correct errors on previously filed Form 941s. Much like the IL-941-X, it involves correcting the figures for income tax withholding and other taxable wages after initially reporting them.

IRS Form 940, another analogous form, pertains to the employer's annual federal unemployment (FUTA) tax return. Though it deals with unemployment tax rather than income tax withholding, it similarly requires employers to report annual financial activities and calculate the taxes owed or the refund due.

IRS Form W-2c, the Corrected Wage and Tax Statement, allows employers to correct errors on a previously filed W-2 form. It's related to the IL-941-X in that both forms are used to amend previously reported wages and withholdings.

The IRS Form 1099 series, specifically when corrections are made using Form 1099-MISC or Form 1099-NEC, is used for reporting various types of income other than wages, salaries, and tips. Like the IL-941-X, these forms may need amendments if the originally reported amounts or information were incorrect.

IRS Form W-4, though primarily for employees to indicate their withholding allowances, ties into the need for the IL-941-X. If employees submit updated W-4 forms resulting in the need to adjust withholding after it was already reported, the IL-941-X could correct those amounts.

IRS Form 1040-X, an amended U.S. individual income tax return, shares its purpose with the IL-941-X in allowing taxpayers to correct previously filed returns. While one is for individual income and the other for withheld income taxes from employees, both serve the function of making corrections to ensure accurate tax reporting and payments.

Lastly, the IRS Form 1120-X, used for amending U.S. corporation income tax returns, is similar in its core functionality to the IL-941-X. It gives corporations the avenue to correct any part of a previously filed Form 1120 series return, akin to how the IL-941-X is used by employers to amend withholding reports.

Dos and Don'ts

When completing the IL-941 X form, accuracy and clarity are paramount. It is designed to amend Illinois Withholding Income Tax Returns, so meticulous attention to detail ensures the correct processing of your amendments. Here are 10 tips, dividing into what you should and shouldn't do, to assist you in accurately filling out the form.

Do:

- Utilize your mouse or Tab key to navigate through the fields efficiently.

- Activate check boxes using your mouse or space bar for a smoother experience.

- Electronically file the form on MyTax Illinois or use an IDOR (Illinois Department of Revenue) approved Tax-Prep software program for faster processing.

- Ensure to attach a completed Schedule P and, if required, a Schedule WC for comprehensive submission.

- Accurately report your Federal Employer Identification Number (FEIN) and other business information to avoid any processing delays.

- Choose the correct quarter you are amending to maintain the relevance of your submitted data.

- Enter the total number of Forms W-2 and Forms 1099 reporting Illinois withholding only if you are filing for the 4th quarter or a final return.

- Report the total dollar amount subject to Illinois withholding tax for the reporting period in question for an accurate amendment.

- Correctly enter the amount of Illinois Income Tax actually withheld from employees or others to ensure your account is adjusted accurately.

- Sign the form under the penalties of perjury to attest to the accuracy and completeness of the information provided.

Don't:

- Forget to use MyTax Illinois or an IDOR approved Tax-Prep software program, as it might delay the processing of your amendment.

- Omit any required support like Schedule P and Schedule WC, which are crucial for processing your amendment.

- Include additional correspondence with the form as it is not necessary and will not be processed.

- Leave fields blank that apply to your amendment; ensure all relevant sections are completed.

- Misreport your FEIN or other business information as it can lead to processing errors and potential delays.

- Select the wrong quarter for amendment as it will result in incorrect processing of your form.

- Complete Lines A1 and A2 unless you are filing for the 4th quarter or a final return to avoid confusion.

- Underestimate the importance of accurately reporting amounts subject to withholding and amounts withheld.

- Estimate the dollar amount of withholding payments made to the IDOR; ensure accuracy for proper credit.

- Forget to sign the form as an unsigned form may not be processed, potentially leading to penalties.

Misconceptions

There are several misconceptions about the Illinois IL-941-X form, which is crucial for correcting filed information on withholding taxes. Understanding these misconceptions is essential for employers and tax professionals to ensure compliance and accuracy in tax filings.

Misconception 1: The IL-941-X Form is Optional for Corrections

Many believe that filing the IL-941-X form is optional and that minor errors can be corrected in the next tax period. However, it is mandatory to amend inaccuracies in previously filed IL-941 forms. This ensures that both the Illinois Department of Revenue and the employer have accurate tax records.

Misconception 2: The IL-941-X Can Be Filed at Any Time

Some think that there's no deadline for submitting the IL-941-X form. In reality, to avoid penalties and interest, it's important to file the amendment as soon as an error is discovered. Timely correction demonstrates good faith and can mitigate potential penalties.

Misconception 3: Corrections Don't Require Supporting Documentation

A common misunderstanding is that errors can be corrected simply by indicating changes on the IL-941-X form without further explanation or documentation. The truth is, changes often require accompanying documentation, like a completed Schedule P or WC, to substantiate the amendment.

Misconception 4: Any Type of Amendment Can Be Made with IL-941-X

There is a misconception that the IL-941-X form can be used to make any type of amendment to withholding information. Actually, the form is specifically designed for correcting the amount of total payments, withheld taxes, and employee counts. It's not for adjusting other types of tax information or filings.

Misconception 5: Electronic Filing Is Not Preferred for the IL-941-X

Some believe that paper filing is preferable or the only way to submit an IL-941-X form. Contrary to this belief, Illinois encourages electronically filing the amendment through MyTax Illinois or using approved tax-prep software, making the process more efficient and reducing the risk of errors.

Correcting misunderstandings about the IL-941-X form ensures that employers fulfill their tax obligations accurately and efficiently. Familiarity with the form's purpose, requirements, and filing methods is key to managing Illinois withholding taxes effectively.

Key takeaways

Filling out and using the IL-941 X form, a critical document for amending Illinois Withholding Income Tax Returns, requires attention to detail and an understanding of the procedure to ensure accuracy and compliance. Here are key takeaways to help guide you through the process:

- Electronic Filing Preferred: The Illinois Department of Revenue encourages taxpayers to file the IL-941 X form electronically through MyTax Illinois or using an IDOR-approved Tax-Prep software program. This speeds up processing and reduces errors.

- Mailing Option: If electronic filing is not possible, the form along with required support documents can be mailed to the specific address provided by the IDOR.

- Required Attachments: Ensure to attach a completed Schedule P and, if required, a Schedule WC. Do not include additional correspondence unless instructed.

- Business Information Updates: Check the appropriate boxes if there have been changes to your business name or address to keep records current.

- Quarterly Amendment: Clearly indicate the quarter for which you are amending the return. Mistakes here can lead to processing delays or incorrect assessments.

- Final Returns for Closed Businesses: If your business has permanently ceased operations or no longer pays Illinois wages, check the indicated box and consider this your final return.

- Detailed Reporting: Provide detailed reporting of the total dollar amount subject to withholding for the amendment period and the exact amount of Illinois Income Tax withheld.

- Previous Overpayments: If there were any credits or refunds from previous filings (original or amended), these should be accurately reported on the form.

- Payments and Credits: Report any withholding payments made for the period in question, including those via IL-501 payments, and add any credits from Schedule WC that you're applying.

- Balance Calculation: Carefully calculate the remaining balance due or identify any overpayment, as this will determine if you owe additional taxes or are due for a refund.

- Signature and Verification: Signing the IL-941 X form under penalty of perjury means affirming that, to the best of your knowledge, the information provided is accurate and complete. Paid preparers should also provide their information if applicable.

By keeping these key points in mind, you can navigate the amendment process more effectively and help ensure your business remains compliant with Illinois tax laws. Always remember to review the instructions provided by the IDOR thoroughly for any form you are required to submit.

Popular PDF Forms

Hud1 - Facilitates understanding and agreement on the distribution of costs and adjustments before finalizing a property sale.

Buyers Order Template - Addresses the buyer’s acknowledgment of potential additional costs for items such as inspecting, cleaning, and adjusting vehicles.