Blank Illinois Llc 45 5 PDF Template

When starting or expanding a business in Illinois, one crucial step for limited liability companies (LLCs) outside of the state is completing the LLC-45.5 form, a document that serves as an application for these entities to be admitted to transact business within Illinois. Issued by the Secretary of State's Department of Business Services, this form requires detailed information about the company, including its official name, any assumed name under which it will operate if its official name is not available in Illinois, jurisdiction of organization, date of organization, and the duration for which it is organized. This form, which carries a $150 filing fee, also necessitates the disclosure of the LLC's principal place of business, the name and address of a registered agent in Illinois, and the specific activities the company intends to pursue in the state. Moreover, it requires information about whether the LLC will be manager-managed or member-managed and details regarding the managers or members with managing authority. An authenticated Certificate of Good Standing from the entity’s original state of formation must accompany this application, underscoring the company's legitimacy and compliance with its home state's regulations. This process affirms the Illinois Secretary of State as the agent for service of process, a critical legal designation that facilitates the LLC's capacity to conduct business in Illinois reliably and within the state’s regulatory framework.

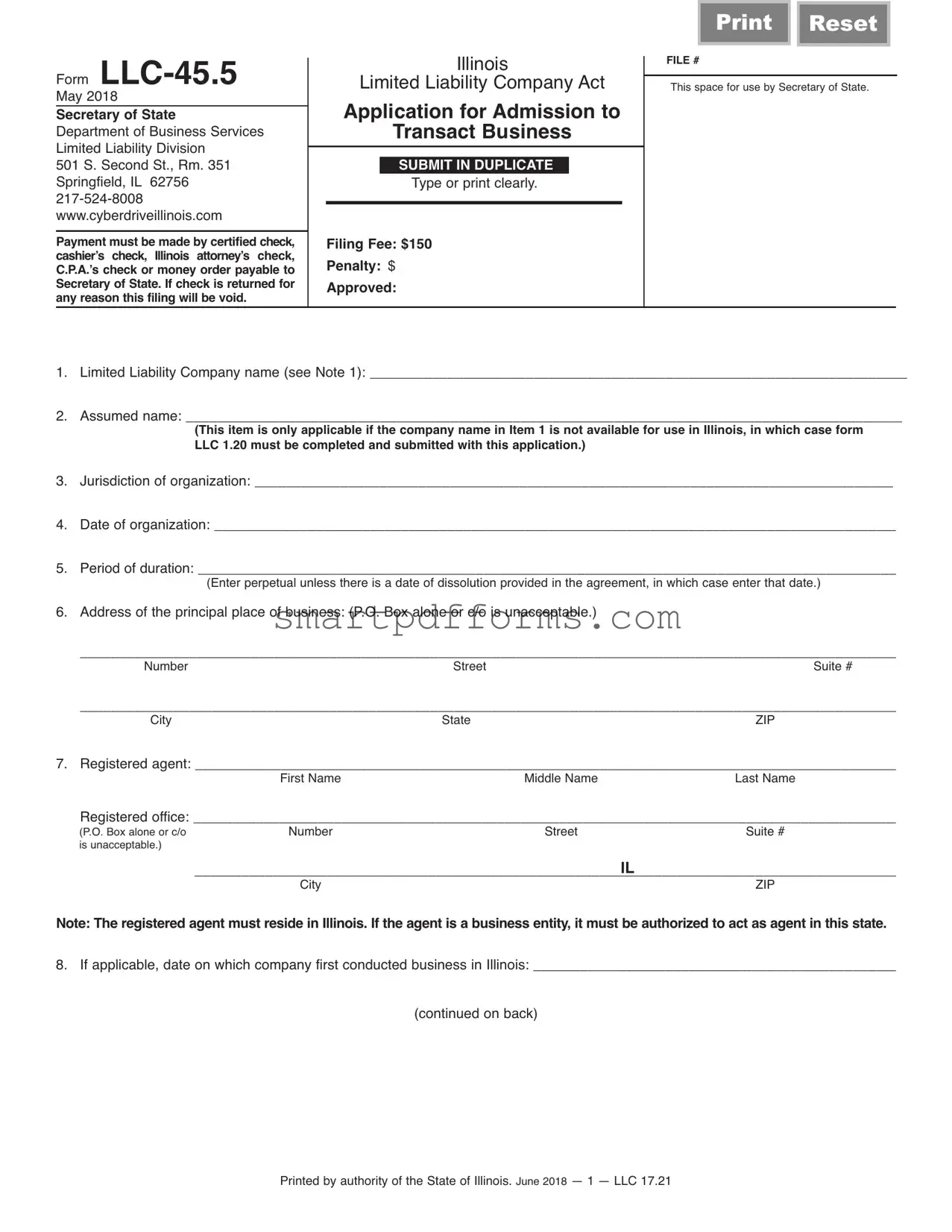

Preview - Illinois Llc 45 5 Form

Form

May 2018

Secretary of State

Department of Business Services Limited Liability Division

501 S. Second St., Rm. 351 Springfield, IL 62756

Payment must be made by certified check, cashier’s check, Illinois attorney’s check, C.P.A.’s check or money order payable to Secretary of State. If check is returned for any reason this filing will be void.

Illinois

Limited Liability Company Act

Application for Admission to

Transact Business

Type or print clearly.

Filing Fee: $150

Penalty: $

Approved:

Print Reset

FILE #

This space for use by Secretary of State.

1.Limited Liability Company name (see Note 1): _____________________________________________________________________

2.Assumed name: ____________________________________________________________________________________________

(This item is only applicable if the company name in Item 1 is not available for use in Illinois, in which case form LLC 1.20 must be completed and submitted with this application.)

3.Jurisdiction of organization: __________________________________________________________________________________

4.Date of organization: ________________________________________________________________________________________

5.Period of duration: __________________________________________________________________________________________

(Enter perpetual unless there is a date of dissolution provided in the agreement, in which case enter that date.)

6.Address of the principal place of business: (P.O. Box alone or c/o is unacceptable.)

_________________________________________________________________________________________________________ |

||

Number |

Street |

Suite # |

_________________________________________________________________________________________________________ |

||

City |

State |

ZIP |

7. Registered agent: ___________________________________________________________________________________________ |

||

First Name |

Middle Name |

Last Name |

Registered office: ___________________________________________________________________________________________ |

||||

(P.O. Box alone or c/o |

Number |

Street |

|

Suite # |

is unacceptable.) |

|

|

IL |

|

|

City |

|

ZIP |

|

|

|

|

||

Note: The registered agent must reside in Illinois. If the agent is a business entity, it must be authorized to act as agent in this state.

8.If applicable, date on which company first conducted business in Illinois: _______________________________________________

(continued on back)

Printed by authority of the State of Illinois. June 2018 — 1 — LLC 17.21

9.Purpose(s) for which the company is organized and proposes to conduct business in Illinois (see Note 2):

10.The Limited Liability Company: (check one)

n is managed by the manager(s) or n has management vested in the member(s):

11.List names and business addresses of all managers and any member with the authority of manager:

12.The Illinois Secretary of State is hereby appointed the agent of the Limited Liability Company for service of process under circumstances set forth in subsection (b) of Section

13.This application is accompanied by a Certificate of Good Standing or Existence, duly authenticated within the last 60 days, by the officer of the state or country wherein the LLC is formed.

14.The undersigned affirms, under penalties of perjury, having authority to sign hereto, that this application for admission to transact business is to the best of my knowledge and belief, true, correct and complete.

Dated: ____________________________________________Month, Day, Year

_________________________________________________Signature

_________________________________________________Name and Title (type or print)

_________________________________________________If applicant is signing for a company or other entity,

state name of company or entity.

Note 1: The name must contain the term Limited Liability Company, LLC or L.L.C. The name cannot contain any of the following terms: “Corporation,” “Corp.” “Incorporated,” “Inc.,” “Ltd.,” “Co.,” “Limited Partnership” or “LP.” However, a limited liability company that will provide services licensed by the Illinois Department of Financial and Professional Regulation must instead contain the term Professional Limited Liability Company, PLLC or P.L.L.C. in the name.

Note 2: A professional limited liability company must state the specific professional service or related professional services to be rendered by the professional limited liability company.

Form Data

| Fact | Description |

|---|---|

| Purpose and Use | This form is an Application for Admission to Transact Business for limited liability companies desiring to operate in Illinois. |

| Filing Fee | The required filing fee for this application is $150. |

| Payment Methods | Payments must be made via certified check, cashier’s check, Illinois attorney's check, C.P.A.’s check, or money order payable to Secretary of State. |

| Governing Law | The application is governed under the Illinois Limited Liability Company Act. |

Instructions on Utilizing Illinois Llc 45 5

Filling out the Illinois LLC-45.5 form is crucial for limited liability companies (LLCs) seeking to transact business within the state. This process, while necessary, can be navigated with careful attention to detail. The steps listed below will guide you through completing the form correctly. It's important to fill out each section accurately and to double-check that all information is current and matches your official records. After you've completed the form, you will submit it along with the necessary payment to the Secretary of State. Ensuring that all parts of the form are filled out correctly will help avoid any delays in the processing of your application.

- Company Name: Enter the full legal name of your limited liability company as registered in your home state. Ensure that it includes "Limited Liability Company," "LLC," or "L.L.C."

- Assumed Name: If the company name from Item 1 is unavailable in Illinois, you must provide an assumed name and attach the completed Form LLC-1.20.

- Jurisdiction of Organization: Specify the state or country where your LLC was originally formed.

- Date of Organization: Enter the date your LLC was officially formed, as per your original state or country of organization.

- Period of Duration: Indicate "perpetual" unless the LLC has a specific end date, in which case, provide that date.

- Principal Place of Business: Provide the street address, city, state, and ZIP code of your LLC's primary business location. P.O. Boxes or c/o addresses are not acceptable.

- Registered Agent: Write the name of the individual or business entity in Illinois authorized to receive legal papers on behalf of your LLC.

- Registered Office: Provide the address in Illinois where the registered agent can be found. P.O. Boxes or c/o addresses are not allowed.

- Business in Illinois: If applicable, state the date on which your LLC first began doing business in Illinois.

- Purpose of Business: Describe the specific purpose(s) for which your LLC intends to conduct business in Illinois.

- Management: Indicate whether your LLC is managed by managers or if management is vested in its members by checking the appropriate box.

- Managers/Members with Authority: List the names and business addresses of all managers or members with managing authority.

- Agent for Service of Process: Acknowledge that the Illinois Secretary of State is appointed the agent for service of process under specific circumstances.

- Certificate of Good Standing: Confirm that this application includes a Certificate of Good Standing or Existence from the jurisdiction of organization, authenticated within the last 60 days.

- Signature: The form must be signed by an individual with the authority to do so, affirming under penalties of perjury that the information provided is true, correct, and complete. Include the date, signer’s name, title, and, if applicable, the name of the company or entity the signer represents.

Obtain Answers on Illinois Llc 45 5

- What is the Form LLC-45.5 and who needs to use it?

Form LLC-45.5 is an application required by the State of Illinois for any limited liability company (LLC) that wishes to be authorized to do business in Illinois. This form applies to LLCs that were originally formed in another jurisdiction but now seek to operate legally within Illinois.

- What is the filing fee for Form LLC-45.5?

The filing fee is $150. Accepted forms of payment include certified check, cashier’s check, checks by an Illinois attorney or C.P.A., or a money order made payable to the Secretary of State. If a check is returned for any reason, the filing will be deemed void.

- What information is required to complete Form LLC-45.5?

The form requires the limited liability company name, any assumed name under which it will operate, the jurisdiction of its original organization, the date of organization, the period of its duration, address of its principal place of business, information about the registered agent in Illinois, purpose for which the company is organized in Illinois, management structure, and names and addresses of managers or members with managerial authority.

- Who can serve as a registered agent for the purposes of this form?

A registered agent must reside in Illinois. If the agent is a business entity rather than an individual, the entity must be authorized to act as an agent within the state.

- What if the company name is not available in Illinois?

If the LLC's name is already in use or not permissible in Illinois, the LLC must adopt an assumed name for use within the state. This requires the completion and submission of Form LLC-1.20 alongside Form LLC-45.5.

- Is there a penalty for late filing?

The form itself does not specify a penalty for late filing, but it’s crucial to file as soon as possible to avoid any potential legal or operational issues for conducting business in Illinois without proper authorization.

- What does 'period of duration' mean on the form?

‘Period of duration’ refers to the length of time the LLC intends to operate. By default, this is perpetual, meaning there is no planned end date. If there is a specific end date for the LLC's operations, that date should be provided instead.

- What does noting the purpose of the LLC entail?

The purpose section requires the LLC to specify the nature of business or activities it intends to conduct in Illinois. For professional limited liability companies, this must include the specific professional service(s) they will provide.

- What is the significance of the Illinois Secretary of State being appointed as an agent?

This designation allows the Illinois Secretary of State to accept legal papers on behalf of the LLC under specific circumstances, ensuring that the LLC can be properly served with legal documents.

- How recent must the Certificate of Good Standing be?

The Certificate of Good Standing or Existence, which verifies the LLC’s legal status in its home jurisdiction, must be authenticated within the last 60 days prior to the submission of Form LLC-45.5.

Common mistakes

When filling out the Illinois LLC 45.5 form, individuals often make mistakes that can delay or impact the registration process. Below are ten common errors:

- Not including the required term in the company name. The name must have "Limited Liability Company," "LLC," or "L.L.C." Professional services companies need to use "Professional Limited Liability Company," "PLLC," or "P.L.L.C."

- Choosing a company name already in use or too similar to an existing name in Illinois without providing an assumed name in conjunction with the completed form LLC 1.20.

- Failing to provide the correct jurisdiction of organization, which refers to the state or country where the LLC was initially formed.

- Providing an inaccurate date of organization or not specifying if the company has a different duration by omitting the date of dissolution if one is set within the agreement.

- Listing a principal place of business that is unacceptable, such as a P.O. Box alone or a "c/o" address, instead of a specific street address.

- Incorrectly identifying the registered agent or registered office, or not adhering to the requirements that the agent must reside in Illinois or, if a business entity, must be authorized to act as agent within the state.

- Forgetting to specify the date the company first conducted business in Illinois if applicable, which can be important for compliance and tax purposes.

- Omitting details about the company's purpose(s) for which it is organized and proposes to conduct business in Illinois, especially specific services if it’s a professional limited liability company.

- Not clearly indicating whether the LLC is managed by managers or members, and failing to list the names and business addresses of all managers or members with management authority.

- Error in signing the document: The signer forgets to sign, prints the wrong name or title, or incorrectly states the capacity in which they are signing for the company or other entity.

Attention to detail and carefully reviewing the form before submission can prevent these common mistakes, ensuring a smoother process for entity registration with the Illinois Secretary of State.

Documents used along the form

For businesses considering or beginning operations in Illinois as a limited liability company (LLC), filing the Form LLC-45.5, also known as the Application for Admission to Transact Business, is an essential step. This form is just one of several documents that may be required throughout the establishment and maintenance phases of an LLC in Illinois. Understanding these associated documents can provide clarity and guidance for business owners navigating through legal and procedural requirements.

- Articles of Organization (Form LLC-5.5): This foundational document officially creates the LLC within the state. It includes vital information such as the business name, purpose, principal place of business, duration, and information about the registered agent.

- Operating Agreement: Though not filed with the state, this internal document outlines the governance and financial arrangements of the LLC, including the distribution of profits and losses, member responsibilities, and procedures for adding or removing members.

- Annual Report (Form LLC-50.1): Required yearly to maintain an LLC in good standing. It updates the state on the LLC’s essential information, such as the address, registered agent, and managerial details.

- Assumed Name Registration (Form LLC-1.20): If an LLC operates under a name different from its legal name, this form is required to register the alternate name, also known as a "Doing Business As" (DBA) name.

- Statement of Change of Registered Agent or Office (Form LLC-1.36/1.37): This is necessary if the LLC decides to change its registered agent or the office address of the registered agent.

- Application for Reinstatement: Utilized if an LLC has been administratively dissolved or revoked but wishes to resume business operations, this form helps restore the company's good standing within the state.

- Certificate of Good Standing: Though not a form, this certificate is often required by banks, lenders, and other parties to verify that the LLC is compliant with state regulations and permitted to conduct business.

- Articles of Amendment (Form LLC-5.25): If any of the original information filed with the Articles of Organization changes, such as the company name or purpose, this form must be submitted to update state records.

Together, these documents and forms play critical roles in the formation, operation, and compliance of an LLC in Illinois. Whether starting a new business or ensuring an existing company remains in good standing, understanding and properly managing these elements can significantly impact the success and legality of the business. Guidance from a legal professional can be invaluable in navigating these requirements.

Similar forms

The Articles of Incorporation for corporations, similar to the Illinois LLC-45.5 form, serve as the initial document for registering a new corporation with a state's Secretary of State office. Both establish the entity's legal presence within the state, outline the primary business location, and designate an agent for service of process.

The Certificate of Authority for foreign corporations, akin to the Illinois LLC-45.5, is filed when a corporation formed in one state wishes to conduct business in another state. It requires similar information about the business, such as its principal place of business and registered agent.

The "Doing Business As" (DBA) Registration, although not specific to LLCs or corporations, requires businesses to register any assumed business names. The LLC-45.5 form also touches upon assumed names, necessitating a filing if the true business name is unavailable in Illinois.

Application for Registration of a Foreign LLC parallels the LLC-45.5 form in its purpose for LLCs, facilitating a foreign LLC's authorization to operate in a non-origin state. Both applications require details such as the jurisdiction of formation and an appointed registered agent within the state.

Biennial Report or Annual Report filings, though required post-establishment, share common data points with the LLC-45.5 form such as business addresses, the names and addresses of managers or members, and changes in registered agents, keeping the state updated on the business's current information.

The Articles of Organization for LLC formation within a state bears resemblance to the Illinois LLC-45.5 for foreign LLCs seeking admission. Both documents officially outline the business's basic operational structure, including management type and principal business activities.

Certificate of Good Standing request forms, while secondary to initial filings like the LLC-45.5 form, are interconnected as ongoing proof of compliance with state regulations, required by the LLC-45.5 for foreign entities to validate their existence and standing in the state of origin.

The Change of Registered Agent/Office form, similar to sections within the LLC-45.5, involves the designation or modification of a business entity's registered agent or office location, ensuring the state has current contact information for legal and official correspondence.

Statement of Termination or Dissolution filings, although designed for discontinuing business operations, indirectly mirror the LLC-45.5 form's function by finalizing a business's legal presence in a state, contrasting with the form’s role in initiating state-level business activities.

Dos and Don'ts

When filling out the Illinois LLC-45.5 form, it's essential to follow specific guidelines to ensure the form is completed accurately and accepted by the Secretary of State. Below, find a list of things you should and shouldn't do to assist in this process:

Do:- Ensure accuracy: Type or print clearly to avoid any misunderstandings or processing delays.

- Use the correct payment method: Payment must be by certified check, cashier’s check, Illinois attorney’s check, C.P.A.’s check, or money order payable to the Secretary of State.

- Include a Certificate of Good Standing: This certificate, authenticated within the last 60 days from the jurisdiction where the LLC is formed, must accompany the application.

- Appropriately name your LLC: Make sure the name complies with state requirements, including the proper use of “Limited Liability Company,” “LLC,” or “L.L.C.” Avoid restricted terms unless specifically allowed (e.g., for professional services).

- Provide complete addresses: The addresses for the principal place of business and registered agent must be complete and cannot be a P.O. Box alone or in care of (c/o).

- Designate the management structure: Clearly indicate whether the LLC is managed by managers or member(s).

- Sign and date the form: The application must be signed by someone with the authority to do so, affirming the truthfulness and accuracy of the information under penalty of perjury.

- Forget the filing fee: Remember to include the $150 filing fee with your application.

- Use prohibited terms in the LLC name: Do not include terms like “Corporation,” “Corp.,” “Incorporated,” “Inc.,” “Ltd.,” “Co.,” “Limited Partnership,” or “LP” unless you are forming a professional limited liability company, in which case “PLLC” or “P.L.L.C.” should be used.

- Ignore the requirement for an Illinois-based registered agent: Your registered agent must have a physical address in Illinois.

- Leave sections incomplete: Ensure all applicable sections of the form are fully completed to avoid processing delays.

- Use a P.O. Box for addresses: Providing only a P.O. Box for your business or registered agent address is not acceptable.

- Delay submission after obtaining Certificate of Good Standing: Since the certificate needs to be recent (within the last 60 days), timely submission of your form is critical.

- Omit the signature and date: Failing to sign or date the form can result in its rejection.

Misconceptions

When businesses in Illinois consider the process of becoming officially recognized to operate in the state, using the Form LLC-45.5 is often surrounded by misunderstandings. Here are five common misconceptions about this form and clarifications to help demystify the process:

- Payment must be made with a specific type of check: It's often thought that any form of payment can be used to submit Form LLC-45.5, when, in reality, the form explicitly requires payment to be made by certified check, cashier’s check, Illinois attorney’s check, C.P.A.’s check, or money order payable to the Secretary of State. This detail is crucial for ensuring the application is processed without delays.

- The form only relates to new businesses: Another common misunderstanding is that Form LLC-45.5 is solely for new businesses establishing themselves as limited liability companies (LLCs) in Illinois for the first time. In fact, this form is used for any LLC that needs to report its admission to transact business in Illinois, including those originally established in another jurisdiction seeking to operate in Illinois.

- Any business address can be used: The assumption here is misleading. The form specifies that the principal place of business cannot be a P.O. Box alone or in care of another address. A valid street address must be provided to satisfy this requirement, emphasizing the need for a concrete location as the primary business address.

- Registered agents don’t need to be Illinois residents: This is incorrect. The form clearly states that if an individual is acting as the registered agent, they must reside in Illinois. If a business entity is serving as the registered agent, it must be specifically authorized to perform this role within the state. This detail ensures there's always a reliable point of contact within the state for legal and official matters.

- All LLCs can choose their management structure: It's often misunderstood that all LLCs filing this application can freely choose between being member-managed or manager-managed. While the form does allow a company to identify its management structure, certain types of companies, especially professional limited liability companies (PLLCs), may have restrictions or expectations related to their structure based on the professional services they provide.

Understanding these aspects of the Form LLC-45.5 can navigate the filing process more smoothly and ensure compliance with the Illinois Limited Liability Company Act. Businesses are encouraged to review the form carefully and consult with legal professionals if they have specific questions or needs.

Key takeaways

When it comes to filling out the Illinois LLC-45.5 form, crucial details can guide you through a smooth filing process, ensuring compliance and establishing your business presence in Illinois effectively. Here are six key takeaways to keep in mind:

- Accepted Payments: The form specifies acceptable payment methods, which include certified check, cashier’s check, Illinois attorney’s check, C.P.A.’s check, or money order payable to the Secretary of State. This detail is crucial for ensuring your payment is processed without delays.

- Filing Fee and Penalty: A non-negotiable filing fee of $150 is required with this application. Being aware of the cost upfront helps in financial planning for your business expenses.

- Company Name Requirements: The name of your limited liability company must include either "Limited Liability Company," "LLC," or "L.L.C." It cannot include designations reserved for other types of entities, such as “Corporation” or “Incorporated,” unless it is a professional limited liability company, which then must include "Professional Limited Liability Company," "PLLC," or "P.L.L.C."

- Designation of Registered Agent: The form requires the designation of a registered agent with a physical address in Illinois (P.O. Boxes are not acceptable). This agent will act on behalf of the company for legal and state communication. Ensuring you have a reliable agent in place is essential for maintaining good standing in the state.

- Need for a Certificate of Good Standing: Along with the completed form, you must submit a Certificate of Good Standing (or a similar document) from the state or country where your LLC was originally formed. This document must be authenticated within the last 60 days before your application, signifying that your business complies with regulatory requirements in its home state.

- Perjury Statement: By signing the application, you affirm, under penalties of perjury, that the information provided is complete, true, and correct to the best of your knowledge. This emphasizes the importance of accuracy and honesty in the filing process.

Understanding these key elements can significantly enhance your readiness and confidence in navigating the registration of your LLC in Illinois, setting a solid foundation for your business operations within the state.

Popular PDF Forms

Hsmv 82101 - No fee required if applying for a duplicate title within 180 days of the last issuance that was lost in mail, courtesy of the HSMV 82101 form.

Miss Punch Application - Assists in maintaining accurate payroll records by documenting instances when employees need to correct missed punches, after supervisor approval.

How to Write a Construction Bid - Enables a methodical approach to construction budgeting, ensuring resources are allocated wisely.