Blank Illinois Rut 25 X PDF Template

When navigating the complexities of vehicle usage tax within the state of Illinois, the Illinois Department of Revenue RUT-25-X form emerges as a pivotal document for individuals seeking to amend previously filed vehicle use tax transactions. Designed for a range of corrections – from simple computational errors to updates on vehicle details like make, model, or VIN – this form ensures that taxpayers can rectify their records with accuracy and compliance. By accommodating modifications in financial information, the RUT-25-X form also permits taxpayers to adjust their tax obligations in light of corrected purchase prices or after accounting for trade-ins and rebates. Additionally, it's structured to support various exceptions and exemptions, catering to specific cases such as out-of-state purchases, farm implements, or situations wherein a vehicle is returned and a deal is canceled. In essence, it's a comprehensive tool tailored to uphold the integrity of vehicle use tax submissions, while also extending a pathway for taxpayers to align their records with legislative expectations. Embedded within the procedural steps are guidelines on payment adjustments, ensuring that individuals can reconcile any overpayments or underpayments efficiently. This undertaking embodies the nuanced balance between regulatory adherence and taxpayer facilitation, underscoring the importance of precision and transparency in managing one’s tax responsibilities in Illinois.

Preview - Illinois Rut 25 X Form

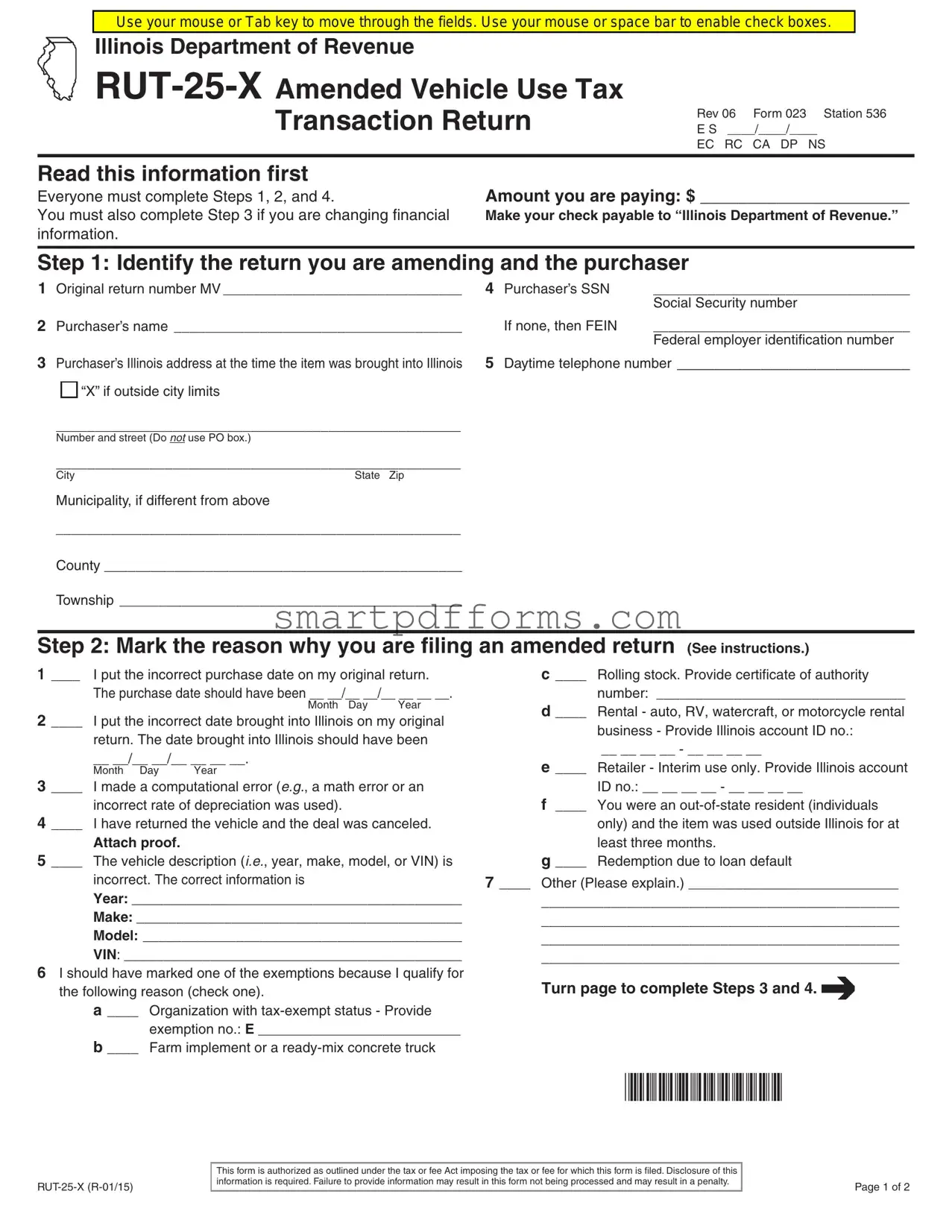

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Rev 06 Form 023 Station 536 E S ____/____/____

EC RC CA DP NS

Read this information first

Everyone must complete Steps 1, 2, and 4. |

Amount you are paying: $ ______________________ |

You must also complete Step 3 if you are changing financial |

Make your check payable to “Illinois Department of Revenue.” |

information. |

|

Step 1: Identify the return you are amending and the purchaser

1 Original return number MV _______________________________ |

4 |

Purchaser’s SSN |

_________________________________ |

|

|

|

|

|

Social Security number |

2 |

Purchaser’s name _____________________________________ |

|

If none, then FEIN |

__________________________________ |

|

|

|

|

Federal employer identification number |

3 |

Purchaser’s Illinois address at the time the item was brought into Illinois |

5 |

Daytime telephone number _________________________ |

|

“X” if outside city limits

____________________________________________________

Number and street (Do not use PO box.)

____________________________________________________

City |

State Zip |

Municipality, if different from above |

|

____________________________________________________

County ______________________________________________

Township ____________________________________________

Step 2: Mark the reason why you are filing an amended return (See instructions.)

1 ____ |

I put the incorrect purchase date on my original return. |

c ____ |

Rolling stock. Provide certificate of authority |

|||

|

The purchase date should have been __ __/__ __/__ __ __ __. |

|

number: ________________________________ |

|||

2 ____ |

|

Month Day |

Year |

d ____ |

Rental - auto, RV, watercraft, or motorcycle rental |

|

I put the incorrect date brought into Illinois on my original |

||||||

|

business - Provide Illinois account ID no.: |

|||||

|

return. The date brought into Illinois should have been |

|

||||

|

|

__ __ __ __ - __ __ __ __ |

||||

|

__ __/__ __/__ __ __ __. |

|

|

|||

|

|

e ____ |

Retailer - Interim use only. Provide Illinois account |

|||

3 ____ |

Month Day |

Year |

|

|||

I made a computational error (e.g., a math error or an |

|

ID no.: __ __ __ __ - __ __ __ __ |

||||

|

incorrect rate of depreciation was used). |

|

f ____ |

You were an |

||

4 ____ |

I have returned the vehicle and the deal was canceled. |

|

only) and the item was used outside Illinois for at |

|||

|

Attach proof. |

|

|

|

least three months. |

|

5 ____ |

The vehicle description (i.e., year, make, model, or VIN) is |

g ____ |

Redemption due to loan default |

|||

|

incorrect. The correct information is |

|

7 ____ Other (Please explain.) ___________________________ |

|||

|

Year: __________________________________________ |

______________________________________________ |

||||

|

Make: _________________________________________ |

______________________________________________ |

||||

|

Model: _________________________________________ |

______________________________________________ |

||||

|

VIN: ___________________________________________ |

______________________________________________ |

||||

6 I should have marked one of the exemptions because I qualify for |

Turn page to complete Steps 3 and 4. |

|||||

the following reason (check one). |

|

|||||

a ____ Organization with

exemption no.: E __________________________

b ____ Farm implement or a

*502361110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Page 1 of 2

Step 3: Correct your financial information

Complete this step only if you are changing financial information. Otherwise, go to Step 4 and sign your return. Remember the following:

•round to the nearest whole dollar.

•attach a copy of the bill of sale to this return.

•use 6.25 percent as your tax rate for Line 6 unless the address listed in Step 1 is one of the following locations:

Cook County |

7.25 percent (7.50 percent in Bensenville, Elmhurst, Hinsdale, Oak Brook, Roselle, and Woodridge) |

DuPage County |

7.25 percent (7.0 percent outside of DuPage Water Commission territory and in West Chicago) |

Will County |

7.0 percent (7.25 percent in Naperville or Woodridge) |

Kane, Lake, and McHenry Counties |

7.0 percent |

Madison and St. Clair Counties |

6.5 percent (6.25 percent outside the Metro East Mass Transit District) |

|

|

|

Column A |

|

Column B |

|

|

Most recent figures filed |

|

Figures as they should |

|

|

|

|

|

|

have been filed |

1 |

Purchase price - before |

1 |

____________ |

1 |

____________ |

2 |

2 |

____________ |

2 |

____________ |

|

3 |

Net purchase price. Subtract Line 2 from Line 1. |

3 |

____________ |

3 |

____________ |

4 |

Depreciation for |

4 |

____________ |

4 |

____________ |

5 |

Taxable amount. Subtract Line 4 from Line 3. |

5 |

____________ |

5 |

____________ |

6 |

Tax. Multiply Line 5 by the tax rate ________. (See the rates listed above.) |

6 |

____________ |

6 |

____________ |

7Credit for tax previously paid to another state or to a retailer. (See instructions.)

|

Enter the state or the name of the retailer ____________________. |

7 |

____________ |

7 |

____________ |

8 |

Tax due. Subtract Line 7 from Line 6. |

8 |

____________ |

8 |

____________ |

9 |

Total amount paid. |

|

|

9 |

____________ |

|

Compare Line 8, Column B, and Line 9. |

|

|

|

|

•If Line 9 is greater than Line 8, Column B, enter the difference on Line 10.

•If Line 9 is less than Line 8, Column B, enter the difference on Line 11.

10 Overpayment — This is the amount you have overpaid. Go to Step 4 and sign this return. |

10 ____________ |

11Underpayment — This is the amount you have underpaid. Pay this amount.

Go to Step 4 and sign this return. |

11 ____________ |

Make your check payable to “Illinois Department of Revenue.”

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

__________________________________________________________________________________ _____________________________________________________________________________________

Purchaser’s signatureDateCo-owner’s signatureDate

__________________________________________________________________________________ _____________________________________________________________________________________

Purchaser’s Current mailing address |

City |

State |

ZIP |

Mail to: ILLINOIS DEPARTMENT OF REVENUE PO BOX 19034

SPRINGFIELD IL

Enter the amount you are paying on the line provided in the “Read this information first” section on the front of this return.

*502362110*

Page 2 of 2

Reset

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Illinois RUT-25-X Amended Vehicle Use Tax Transaction Return |

| Revision Date | Revision 06 Form 023 |

| Governing Body | Illinois Department of Revenue |

| Primary Purpose | To amend previously filed vehicle use tax transaction returns |

| Key Steps for Completion | Steps 1, 2, 4 are mandatory for everyone. Step 3 is required for changes in financial information. |

| Payment Instruction | Make checks payable to “Illinois Department of Revenue.” |

| Amendment Reasons | Incorrect purchase date, date brought into Illinois, computational errors, deal cancellation, wrong vehicle description, and other specified exemptions. |

| Tax Rate Information | Standard tax rate is 6.25%, with variations depending on the county or municipality. |

| Document Requirements | Along with the amended return, a copy of the bill of sale is required. |

| Governing Laws | This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of information is mandatory. |

Instructions on Utilizing Illinois Rut 25 X

Filing an amended Vehicle Use Tax Transaction Return with the Illinois Department of Revenue using Form RUT-25-X is a process that corrects previously submitted information or adjusts financial details concerning the taxed transaction of a vehicle. The necessity for this amendment could arise from several errors or oversights in the original submission, such as incorrect purchase dates, computational errors, or changes in exemption status. Accurate completion and prompt submission of this amended form ensure compliance with state tax regulations, preventing potential penalties and facilitating the proper tax calculation.

- Begin by using either your mouse or the Tab key to navigate through the fields on the form. To check a checkbox, use your mouse or the space bar.

- In Step 1, specify the original return number and the purchaser’s Social Security number or Federal employer identification number, alongside the purchaser’s name and Illinois address at the time of the purchase. Also, provide a daytime telephone number.

- For Step 2, indicate the reason(s) for filing an amended return by marking the appropriate box(es) and provide any required information, such as correct purchase dates, vehicle description changes, or the correct reason for exemption if applicable.

- Only proceed to Step 3 if there are changes to your financial information. This involves stating the most recent financial details filed and the corrected figures, including the purchase price, trade-in or discount, net purchase price, depreciation for out-of-state use, taxable amount, tax calculated at the appropriate rate, and any credit for tax previously paid to another state or to a retailer.

- Calculate any overpayment or underpayment and enter this in the designated area. If you have underpaid, prepare to remit the outstanding amount with your check made payable to the “Illinois Department of Revenue.”

- In Step 4, sign and date the form, asserting under penalty of perjury that the information provided is accurate. Co-owners, if applicable, should also sign and date. Include the current mailing address.

- Review the entire form to ensure all necessary corrections are made and all relevant sections are completed based on your amendment reason.

- Finally, mail the completed form along with any payment due to the provided Illinois Department of Revenue address.

By following these detailed instructions, individuals can confidently amend their Vehicle Use Tax Transaction Return, ensuring their tax responsibilities are accurately met.

Obtain Answers on Illinois Rut 25 X

-

What is the Illinois RUT-25-X form used for?

The Illinois RUT-25-X form is an amended vehicle use tax transaction return. It's used when you need to make corrections to a previously filed RUT-25 form. These corrections could involve changes to the purchase date, the date the item was brought into Illinois, computational errors, vehicle returns or cancellations, incorrect vehicle descriptions, or to correct exemption claims.

-

Who needs to complete the Illinois RUT-25-X form?

Anyone who has previously filed a vehicle use tax transaction return (RUT-25 form) and needs to correct information on that original return must complete the RUT-25-X form. This includes corrections to financial details, vehicle information, or other pertinent data initially reported incorrectly.

-

What steps must be completed on the RUT-25-X form?

- Step 1: Identifying the return being amended and the purchaser.

- Step 2: Marking the reason for filing an amended return.

- Step 3: Correcting financial information (if applicable).

- Step 4: Signing the form to declare the accuracy and completeness of the information provided.

-

How do I calculate the tax rate on the amended return?

Tax is calculated at a rate of 6.25% unless the address listed in Step 1 is in specific locations where the tax rate might be higher, such as Cook County, DuPage County, Will County, Kane, Lake, McHenry Counties, Madison, and St. Clair Counties. The form provides specific rates for these locations.

-

What should I attach to the RUT-25-X form?

When filing an amended return, it's important to attach a copy of the bill of sale to the RUT-25-X form. Additionally, if the amendment involves a refunded or canceled deal, proof of the vehicle return or cancellation should also be attached.

-

Where do I mail the completed RUT-25-X form?

The completed form, along with any payment due and attached documentation, should be mailed to the Illinois Department of Revenue at PO BOX 19034, Springfield, IL 62794-9034. Ensure that the form is signed and that the correct amount of payment is included with the form.

Common mistakes

Filling out the Illinois RUT-25-X form incorrectly can lead to delays and potential penalties. Here are seven common mistakes to avoid:

Not using the mouse or Tab key properly to navigate through the fields can lead to skipped sections or improperly filled fields.

Failing to enable check boxes by using the mouse or space bar might result in incomplete information regarding exemptions or reasons for amending the return.

Omitting the original return number or providing incorrect information here can cause delays as the Department of Revenue may not be able to locate the original filing.

Incorrect financial data entry, especially not rounding to the nearest whole dollar or using the wrong tax rate, affects the calculation of the tax due or refund owed.

Forgetting to attach a copy of the bill of sale when changing financial information can result in processing delays.

Not checking the appropriate reason for filing an amended return or failing to fill out the date corrections accurately leads to unclear amendment reasons.

Skipping the signature step, which is crucial, as an unsigned form may be considered invalid and not processed.

By paying close attention to these details, individuals can ensure a smoother amendment process with the Illinois Department of Revenue.

Documents used along the form

When dealing with vehicle transactions in Illinois, particularly amendments that require the use of the RUT-25-X form, various other documents often play a crucial role. These documents help to establish the details of the transaction, justification for amendments, and compliance with state tax laws.

- Original RUT-25 Vehicle Use Tax Transaction Return: This is the initial form filed for reporting the vehicle use tax. It provides a baseline for any amendments made with the RUT-25-X form.

- Bill of Sale: This document serves as proof of purchase, detailing the transaction between the buyer and seller. It is essential for verifying the purchase price and date.

- Proof of Previous Tax Payments: Documents showing that tax was paid in another state or to a retailer, which may allow for a tax credit on the RUT-25-X form.

- Certificate of Title: The title proves ownership of the vehicle and may be required to verify any changes to the vehicle information being amended, such as the VIN, make, or model.

- Loan Cancellation Document: If the vehicle deal was canceled due to a return or repossession, documentation supporting the cancellation is necessary.

- Exemption Certificates: If claiming an exemption, such as for farm implements or organizations with tax-exempt status, relevant certificates or identification numbers must be provided.

- Lease Agreement: For leased vehicles, the lease agreement may be required to substantiate claims about the terms of use or any errors in reporting initial tax obligations.

- Insurance Documents: These could be necessary to provide proof of a vehicle's status, especially if it was totaled or significantly damaged after the initial tax was paid.

- Department of Transportation (DOT) Certificate for Rolling Stock: Specific to rolling stock vehicles, this certificate or its number validates the claim for exemption based on the vehicle's use.

- Proof of Residency: If claiming an exemption based on out-of-state residency, documents proving residency status at the time of purchase or use may be required.

Together, these documents play a vital role in ensuring compliance with Illinois's vehicle use tax laws and in facilitating the accurate amendment of previously filed returns. Whether you're correct a mistake on the original filing or update the Department of Revenue on changes to the vehicle's status, having the right documentation in order is essential. Proper understanding and preparation of these forms and documents can help streamline the amendment process, ensuring a smoother resolution to any tax-related issues.

Similar forms

The Illinois RUT-25 form, titled "Vehicle Use Tax Transaction Return", shares similarities with the RUT-25-X in its purpose of calculating and reporting vehicle use tax. Both forms necessitate information about the vehicle's purchase such as the purchase price, trade-in values, and applicable tax rates based on the vehicle’s storage location. However, the RUT-25 form is used for initial tax payment submissions, while RUT-25-X is specifically designed for amending previously filed RUT-25 forms.

The Illinois RUT-50 form, known as "Private Party Vehicle Use Tax Transaction Return", is akin to the RUT-25-X in that it also deals with the taxation of vehicles. Similar data about the vehicle purchase need to be provided (e.g., purchase price and discounts). The primary distinction lies in the use context; RUT-50 is for vehicles purchased from a private party rather than a dealership, indicating that the criteria for tax liabilities and exemptions have unique considerations.

The Illinois ST-556 form, titled “Sales Tax Transaction Return”, resembles the RUT-25-X through its function of documenting sales and use tax for transactions, particularly those involving motor vehicles sold by dealers. Both require detailed information regarding the sale transaction. Where RUT-25-X amends vehicle use tax details, ST-556 is typically filed by dealers to report and remit the sales tax collected from the buyer at the point of sale.

The Illinois RUT-75, or "Aircraft Use Tax Transaction Return", is analogous to the RUT-25-X in its role of reporting use tax, yet it focuses on aircraft acquisitions rather than vehicles. Crafted for specific tax obligations associated with aircraft ownership, it mirrors the RUT-25-X in necessitating comprehensive transaction details, proving that different types of property are subject to similar tax reporting disciplines.

The Form IL-1040-X, “Amended Individual Income Tax Return”, shares the principle of amending originally filed returns with the RUT-25-X. Designed for corrections to an individual's income tax return, it parallels the RUT-25-X in allowing taxpayers to rectify errors, update financial information, and potentially adjust their tax obligations accordingly. Although IL-1040-X concentrates on personal income, the fundamental purpose of facilitating amendments underlines its similarity to RUT-25-X.

Dos and Don'ts

When filling out the Illinois RUT-25-X form, which is an Amended Vehicle Use Tax Transaction Return, it's important to approach the document with attention and care. Below are lists of five things you should and shouldn't do to ensure a smooth process and avoid common pitfalls.

Do:

- Double-check all entered information for accuracy, including original return numbers, dates, and the corrected financial information.

- Use a calculator to confirm your math, especially when recalculating the tax due to ensure the figures are correct.

- Mark the correct reason for filing an amended return by reviewing the options in Step 2 carefully and selecting the one that truly represents your reason.

- Attach all required documents, such as a copy of the bill of sale if you're changing financial information in Step 3, along with any other documentation to support your amendments.

- Ensure to sign and date the form in Step 4 to validate the return. An unsigned form is considered incomplete and could delay processing.

Don't:

- Use pencil to fill out the form; all entries should be made in blue or black ink to ensure they are permanent and legible.

- Guess or estimate dates and figures. If you're unsure, take the time to verify the correct information before entering it on the form.

- Leave fields blank if they apply to you. If a step requires completion based on your corrections, make sure to fill in all relevant information.

- Ignore the specific tax rates applicable based on the address listed in Step 1. These rates vary by location and are crucial for calculating the correct tax due.

- Forget to include contact information, such as a daytime telephone number, where you can be reached should any questions arise regarding your amended return.

Misconceptions

When it comes to the Illinois Department of Revenue RUT-25-X Amended Vehicle Use Tax Transaction Return, there are several misconceptions that can complicate the process for taxpayers. It's crucial to clear these up to ensure smooth filing and compliance with state laws. Here, we tackle eight common misunderstandings:

- Electronic Filing is Required: Many assume that the Illinois RUT-25-X form must be filed electronically. However, this particular form is designed for manual completion and mailing to the Illinois Department of Revenue, PO BOX 19034, Springfield, IL 62794-9034. While electronic options are increasingly common for tax filings, this form currently requires hard copy submission.

- Only Vehicle Sales are Taxable: A common misconception is that the RUT-25-X form is solely for vehicles sold in Illinois. In reality, this form is used for amending taxes on various vehicle use transactions, including leases, transfers, and even some non-sale transactions where use tax is applicable.

- Personal Checks are Not Accepted: Unlike some transactions that may require certified funds, payments for the amount due on the RUT-25-X form can indeed be made with a personal check. Checks should be made payable to “Illinois Department of Revenue.”

- Amendments Only for Recent Transactions: There's a false impression that amendments using the RUT-25-X can only be made for recent vehicle transactions. While it’s beneficial to file amendments promptly, corrections to previously filed RUT-25 forms can be submitted as needed, without a strict time limit, to correct errors or adjustments in financial information, vehicle description, or tax status.

- Form is Only for Dealerships: The belief that only auto dealerships can file the RUT-25-X form is incorrect. Individuals who have engaged in a vehicle transaction requiring a use tax amendment, such as a private sale or an out-of-state purchase brought into Illinois, are also required to use this form for any necessary corrections.

- All Sections Must be Completed: While the form instructions emphasize that everyone must complete Steps 1, 2, and 4, not every section applies to all filers. For example, Step 3 is only necessary if there are changes to the financial information previously reported. Properly understanding which sections apply can save time and reduce errors.

- Incorrect Assumption of Tax Rate: Users often mistakenly apply a flat 6.25 percent tax rate to their transactions. The correct tax rate can vary based on the location details provided in Step 1 of the form, with different counties having slightly different rates.

- Farm Implement Exemption Misunderstanding: Another frequent error is the misinterpretation of exemptions, such as assuming all farm implements are automatically exempt. The exemption selection in the form requires proper identification and qualification, such as providing an exemption number for organizations with tax-exempt status or specifically qualifying farm implements or ready-mix concrete trucks.

Correcting these misconceptions ensures that taxpayers can confidently navigate the process of amending their vehicle use tax transactions, thereby fulfilling their tax obligations accurately and efficiently. Always refer to the most current version of the instructions and consult with the Illinois Department of Revenue or a tax professional if in doubt.

Key takeaways

Filling out the Illinois RUT-25-X form correctly is essential for anyone who needs to amend a vehicle use tax transaction. Here are key takeaways to guide you through the process:

- Identify the original return: You must provide the number of the original tax return you are amending. This ensures your amendment is matched correctly to your initial filing.

- Provide purchaser information accurately: The form requires detailed information about the purchaser, including Social Security Number (SSN) or Federal Employer Identification Number (FEIN), name, and Illinois address at the time of the original transaction.

- Understand the reasons for filing: Be clear on why you are filing an amended return. The form lists several common reasons, including errors in the purchase date, computational errors, or incorrect vehicle information. Knowing the reason will help you complete the form correctly.

- Exemptions matter: If you qualify for an exemption you did not claim on your original return, such as tax-exempt status or specific vehicle exemptions (e.g., farm implement), you can indicate this on the RUT-25-X.

- Tax rates vary by location: The applicable tax rate might differ depending on your locality. Pay attention to the rates listed for different counties and use the correct rate when recalculating your tax obligation.

- Financial information requires attention: When amending financial information, ensure you subtract discounts or trade-in values, account for depreciation, and correctly calculate the taxable amount. Mistakes here can lead to either underpaying or overpaying your tax.

- Documentation is crucial: Attach a copy of the bill of sale to your return. This acts as proof of the purchase price and any deductions such as trade-ins or discounts.

- Overpayment or underpayment: After recalculating, you might find that you've either overpaid or underpaid your taxes. Indicate the correct amount on the form, whether it's an additional payment due to the Illinois Department of Revenue or a refund you're expecting.

- Signature is a declaration: By signing the form, you are stating under penalty of perjury that the information provided is true, correct, and complete. Ensure all provided information is accurate before signing.

- Mailing instructions: Finally, make sure you send your completed form to the correct address: ILLINOIS DEPARTMENT OF REVENUE, PO BOX 19034, SPRINGFIELD, IL 62794-9034. This ensures that your amended return will be processed without delays.

Completing the RUT-25-X form correctly plays a critical role in ensuring you comply with Illinois tax laws while avoiding potential fines or penalties. Pay close attention to each step, and double-check your information to ensure accuracy.

Popular PDF Forms

Inspection Contingency Example - Binds the seller to address and rectify specific concerns identified in a home inspection report to the buyer's satisfaction.

Lic38 - The LIC38 form includes a requirement for applicants to specify if they are authorizing another person to file electrical applications under the business name.

How to Get a New Birth Certificate California - Efficiently translate your birth certificate, ensuring no detail from name to place of issue is lost in translation.