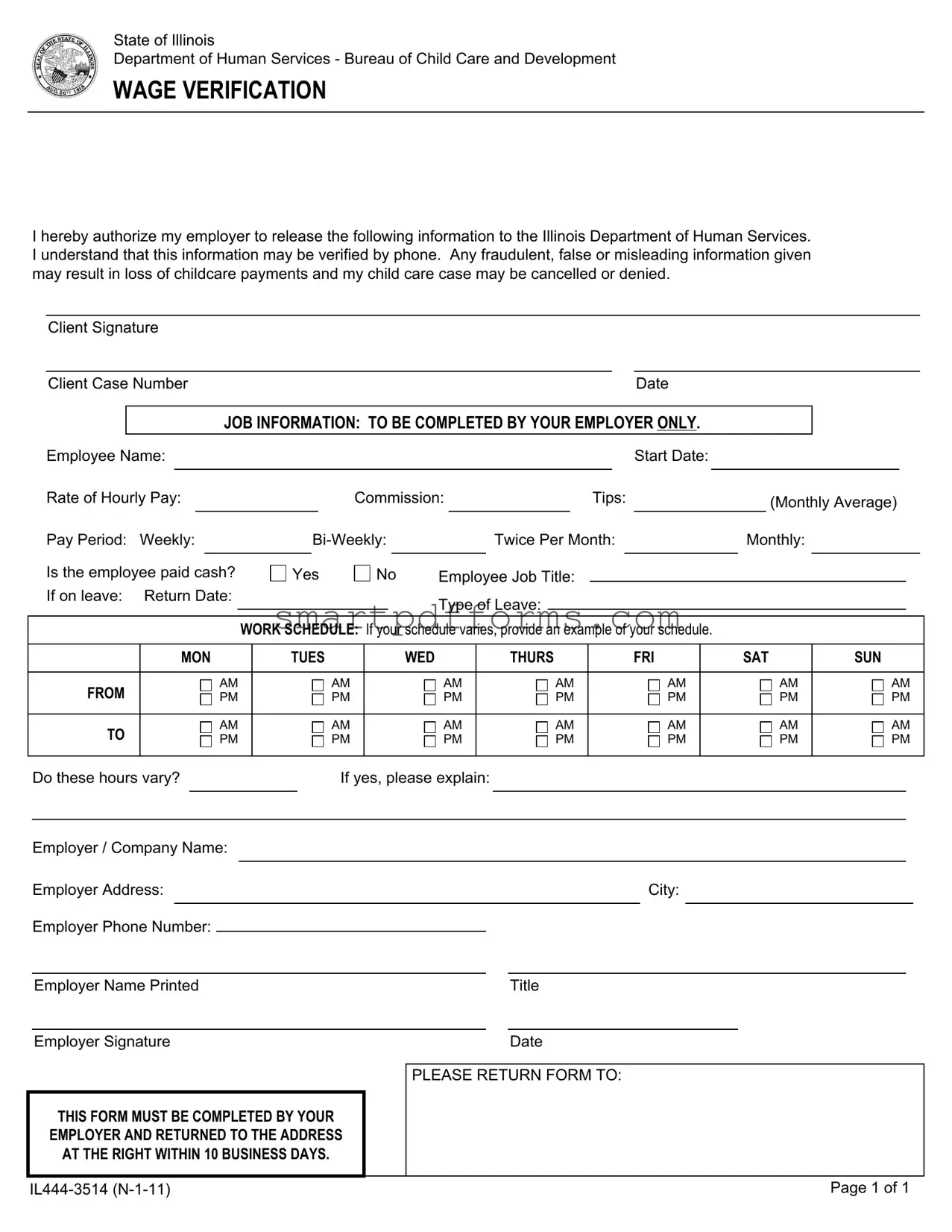

Blank Illinois Wage Verification PDF Template

In the heart of Illinois' efforts to support working families, the Illinois Wage Verification form emerges as a critical document designed to facilitate the process of verifying employment and income information for individuals applying for childcare assistance through the Department of Human Services' Bureau of Child Care and Development. This form requires applicants to authorize their employers to disclose specific job-related information, underpinning the state's commitment to ensuring that childcare assistance is appropriately allocated based on accurate financial data. Employers are tasked with providing detailed information regarding the employee's position, salary, pay frequency, and working hours, along with any cash payments. The importance of this document is underscored by the warning that any fraudulent or misleading information may result in the termination of childcare payments or denial of the childcare case. The meticulous design of the form reflects an effort to capture a comprehensive snapshot of an applicant's employment situation, offering an example schedule for those with varying work hours and emphasizing the urgent 10-business-day deadline for submission, further highlighting the state's dedication to the welfare of its youngest residents and the support of working families.

Preview - Illinois Wage Verification Form

State of Illinois

Department of Human Services - Bureau of Child Care and Development

WAGE VERIFICATION

I hereby authorize my employer to release the following information to the Illinois Department of Human Services. I understand that this information may be verified by phone. Any fraudulent, false or misleading information given may result in loss of childcare payments and my child care case may be cancelled or denied.

Client Signature

Client Case NumberDate

JOB INFORMATION: TO BE COMPLETED BY YOUR EMPLOYER ONLY.

Employee Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start Date: |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate of Hourly Pay: |

|

|

|

|

|

Commission: |

|

|

|

|

Tips: |

|

|

(Monthly Average) |

|

||||||||||||||||

Pay Period: |

Weekly: |

|

|

|

|

|

Twice Per Month: |

Monthly: |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Is the employee paid cash? |

|

Yes |

|

No |

Employee Job Title: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

If on leave: |

Return Date: |

|

|

|

|

|

|

|

|

Type of Leave: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

WORK SCHEDULE: If your schedule varies, provide an example of your schedule. |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

MON |

|

TUES |

|

|

|

|

WED |

|

THURS |

|

|

FRI |

|

SAT |

SUN |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

FROM |

|

|

|

AM |

|

|

|

|

AM |

|

AM |

|

|

AM |

|

|

|

AM |

|

|

AM |

AM |

|

||||||||

|

|

|

PM |

|

|

|

|

PM |

|

PM |

|

|

PM |

|

|

|

PM |

|

|

PM |

PM |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

TO |

|

|

|

AM |

|

|

|

|

AM |

|

AM |

|

|

AM |

|

|

|

AM |

|

|

AM |

AM |

|

||||||||

|

|

|

PM |

|

|

|

|

PM |

|

PM |

|

|

PM |

|

|

|

PM |

|

|

PM |

PM |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do these hours vary? |

If yes, please explain: |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer / Company Name: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Address: |

|

|

|

|

|

City: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Employer Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||

Employer Name Printed |

|

|

|

|

Title |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

Employer Signature |

|

|

|

|

Date |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

PLEASE RETURN FORM TO: |

|

|

||||||

THIS FORM MUST BE COMPLETED BY YOUR

EMPLOYER AND RETURNED TO THE ADDRESS

AT THE RIGHT WITHIN 10 BUSINESS DAYS.

Page 1 of 1 |

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Illinois Wage Verification |

| Issuing Department | Illinois Department of Human Services - Bureau of Child Care and Development |

| Purpose | To authorize an employer to release an employee's wage information to the Illinois Department of Human Services. |

| Method of Verification | Information may be verified by phone. |

| Consequences of False Information | Providing fraudulent, false, or misleading information may result in the loss of childcare payments, and the child care case may be denied or canceled. |

| Information Required from Employer | Employee name, start date, rate of hourly pay, commissions, tips, pay period, job title, and work schedule. |

| Submission Deadline | The form must be completed by the employer and returned to the specified address within 10 business days. |

| Governing Law | This form is governed by the regulations and laws of the State of Illinois. |

Instructions on Utilizing Illinois Wage Verification

Once you've determined the need to fill out the Illinois Wage Verification form for childcare payments through the Illinois Department of Human Services, it's crucial to accurately complete this form to ensure there are no delays or issues with your case. This form requires both the employee who is receiving childcare payments and their employer to provide specific details about employment and wages. Here’s a step-by-step guide to help you complete the form correctly.

- Gather all necessary information before starting the form, including your client case number, employment details, and schedule.

- At the top section of the form sign your name under "Client Signature," then enter your Client Case Number and the Date.

- Hand the form to your employer to fill out the "JOB INFORMATION" and "WORK SCHEDULE" sections.

- In the "JOB INFORMATION" section, your employer will need to fill in:

- Your Employee Name.

- Your Start Date.

- Your Rate of Hourly Pay, Commission, and Tips (if applicable).

- The Pay Period — marking whether it's weekly, bi-weekly, twice per month, or monthly.

- Whether you are paid in cash.

- Your Job Title.

- If you are on leave, the Return Date and Type of Leave.

- For the "WORK SCHEDULE" section, your employer must provide a sample schedule by marking the hours worked from Monday to Sunday. If your hours vary, they should also provide an explanation.

- The form requires your employer to fill in their Name, Title, Phone Number, and the Company's Address.

- The bottom part of the form must be signed and dated by your employer.

- Finally, the completed form must be returned to Illinois Action For Children at the address provided on the form within 10 business days.

Ensure that all information provided on the form is accurate and legible to avoid any potential delays. Both the employee seeking childcare payments and the employer play vital roles in the completion of this form. It's a collaborative effort that facilitates the continued support from the Illinois Department of Human Services.

Obtain Answers on Illinois Wage Verification

What is the Illinois Wage Verification form used for?

The Illinois Wage Verification form is a document designed to provide the Illinois Department of Human Services with accurate information about an individual's employment and income details. This form plays a crucial role in determining eligibility for childcare payments. By completing and submitting this form, an applicant authorizes their employer to disclose pertinent wage information to the state department, facilitating the assessment of their childcare subsidy application.Who needs to complete the Illinois Wage Verification form?

The Illinois Wage Verification form must be completed by the employer of the individual applying for childcare assistance. The initial authorization to release employment and wage information is provided by the applicant, who must sign and date the form. Subsequently, detailed job information, including start date, rate of pay, and schedule, must be filled out exclusively by the employer.How does an individual authorize their employer to release information?

Authorization is given directly on the Illinois Wage Verification form. The individual seeking childcare assistance must sign and provide their client case number on the form, thereby giving their employer official permission to release their employment and wage details to the Illinois Department of Human Services. This signed authorization is necessary for the verification process to proceed.What job information is required on the form?

The form requests several pieces of job-related information including the employee's name, start date of employment, hourly rate of pay, commission, and average monthly tips if applicable. It also asks for the pay period frequency, whether the employee is paid in cash, their job title, any leave details (including type and expected return date), and a typical work schedule.What should be done if an employee has a varying work schedule?

In cases where an employee's work schedule changes regularly, the employer is prompted to provide an example schedule covering a typical week. Additionally, the employer must explain how the schedule varies to give the Illinois Department of Human Services a clear understanding of the employee's working hours, which is critical for accurately determining childcare assistance eligibility.Is it possible to verify the information over the phone?

Yes, the information provided on the Illinois Wage Verification form may be verified by phone. This means that the Illinois Department of Human Services may contact the employer directly to confirm the accuracy of the submitted details or to clarify any information.What are the consequences of submitting false information?

Submitting fraudulent, false, or misleading information on the Illinois Wage Verification form can lead to severe consequences, including the loss of childcare payments. Additionally, the childcare case associated with the fraudulent application may be cancelled or denied, underscoring the importance of providing accurate and honest information.Where should the completed form be returned?

The completed Illinois Wage Verification form must be returned to Illinois Action For Children at the specified address: 1340 South Darren Avenue, 3rd Floor, Chicago, IL 60608. It is essential that the form is completed by the employer and returned within 10 business days to ensure timely processing of the childcare assistance application.

Common mistakes

When filling out the Illinois Wage Verification form, individuals sometimes encounter errors that can affect the processing of their child care benefits. Understanding and avoiding these common mistakes can streamline the process and ensure accurate verification.

- Not verifying the completeness of the employee section: The form requires specific job information that only your employer can complete. Making sure all the required fields are filled out by your employer is crucial. Otherwise, incomplete information may delay the verification process.

- Omitting the work schedule: A detailed work schedule is necessary for the Department of Human Services to understand your child care needs. Forgetting to provide a comprehensive schedule or not explaining variations in your hours can cause complications.

- Incorrectly marking pay period frequencies: Accurately indicating whether you are paid weekly, bi-weekly, twice per month, or monthly is essential. Mistakes here can lead to incorrect assumptions about your income, affecting your eligibility.

- Failing to disclose cash payments: If you're paid in cash, it's imperative to mark 'Yes' appropriately. Not disclosing this information can lead to discrepancies during the verification process and potentially impact the outcome of your case.

- Overlooking the type of leave: If applicable, specifying the type of leave (e.g., maternity, medical, etc.) and the expected return date is vital. Without this, the form may appear incomplete or inaccurate to the reviewer.

- Delay in submission: The form must be returned to the specified address within 10 business days. Late submissions can result in delays in the processing of child care payments or even denial of the case.

Ensuring accuracy and completeness when filling out the Illinois Wage Verification form is key to the timely processing of child care benefits. Avoiding these common mistakes can significantly improve the efficiency and outcome of your verification process.

Documents used along the form

When managing childcare arrangements and support in Illinois, particularly in interactions with the Department of Human Services, a range of forms and documents are typically processed alongside the Illinois Wage Verification form. This collection of documents ensures accuracy, comprehensiveness, and compliance with state guidelines, facilitating smoother transactions and verifications. Understanding the purpose of each document will provide clarity and assist in navigating the requirements efficiently.

- Employment Verification Letter: Confirms an individual's current employment status, job title, and income details. Often used as proof for various applications where employment verification is necessary.

- Childcare Application Form: Required for applying to various childcare programs, detailing personal and child information, along with specific childcare needs.

- Child Support Documentation: Provides evidence of child support payments or agreements, essential for determining the need for additional childcare financial assistance.

- Income Tax Returns: Serve as proof of annual income and financial status, necessary for verifying eligibility for certain income-based programs.

- Pay Stubs: Supplement the Wage Verification form by providing detailed pay information over a period, showing consistency in earnings.

- Self-Employment Ledger: Documents income for individuals who are self-employed, providing a record of earnings and business expenses.

- Bank Statements: Offer a comprehensive look at an individual's financial situation, including income deposits and expenses, over a specified period.

- Proof of Residency: Validates Illinois residency, often a requirement in state-specific programs to ensure services are provided to residents only.

- Identification Documents: Includes state ID, driver’s license, or passport to verify identity as part of the application process.

- Proof of Child's Age: Necessary for age-based childcare program eligibility, including birth certificates or medical records.

Gathering these documents in conjunction with the Illinois Wage Verification form can streamline the process of applying for childcare assistance, making it essential to understand and prepare the required paperwork in advance. Each document plays a critical role in creating a complete and accurate profile of the applicant's employment, financial status, and childcare needs, helping the Department of Human Services make informed decisions regarding childcare support.

Similar forms

Documents similar to the Illinois Wage Verification form share the common purpose of collecting and verifying employment details, income information, or both, mainly for official verification purposes. These documents are widely used across various sectors, both public and private, to ensure accurate record-keeping and compliance with regulations or to facilitate benefits and services. Here are ten other documents that are similar to the Illinois Wage Verification form:

- Employment Verification Letter: Similar in function, this document is typically requested by lenders or landlords to verify an individual's employment status and salary for loan or lease approval processes. It includes details such as the employee's position, salary, and duration of employment.

- Income Verification Letter from Employer: This letter serves a similar purpose by confirming the income an employee receives. It is often used for financial services, such as securing loans, or when applying for various welfare benefits.

- Pay Stubs: While not a form, pay stubs serve as a direct source of wage verification, detailing an employee's earnings, taxes withheld, and other deductions. They are frequently used to substantiate income claims on numerous applications.

- Tax Return Forms: Documents like the Form 1040 for individuals in the U.S. provide comprehensive details on an individual's income from all sources, tax deductions, and credits claimed, serving a similar purpose of income verification for various applications.

- Unemployment Verification Form: This is used to verify an individual's unemployment status and benefits received, similar to how wage verification forms confirm employment and income details.

- Worker's Compensation Verification Form: Documents that verify an employee's receipt of workers' compensation benefits due to workplace injury or illness share similarities in verifying income received outside of traditional wages.

- Public Assistance Verification Form: States and local governments use these forms to verify income and employment details for individuals applying for public assistance programs, paralleling the wage verification process for benefit eligibility.

- Social Security Benefits Verification Letter: Issued by the Social Security Administration, this letter verifies the amount of social security benefits an individual receives, similar to verifying income through wage documentation.

- Rental Application Employment Verification: Part of the rental application process, this form or section requires details about employment and income to ensure the potential tenant has the means to afford rent, mirroring the wage verification's role in confirming financial stability.

- Bank Loan Application Employment Verification: Similar to rental applications, many bank loan applications require proof of employment and income to assess a borrower's ability to repay the loan, necessitating a process akin to wage verification.

These documents, while varying in specific use and scope, all fundamentally serve to verify an individual's employment status, wage or salary information, or both. They play crucial roles in facilitating access to services, benefits, and financial products, ensuring eligibility and compliance with respective requirements.

Dos and Don'ts

When filling out the Illinois Wage Verification form, it is important to pay attention to both what you should and shouldn't do to ensure accuracy and compliance. Here are some crucial pointers to consider:

Things you should do:

Ensure all information provided on the form is accurate and truthful. This includes correct details about pay rates, work schedules, and any cash payments.

Have the form completed by your employer, as it is their responsibility to provide job-specific information. This ensures the information is verified and authentic.

Check that your employer signs and dates the form. An employer's signature verifies that the information provided is accurate and recognized by the company.

Make a copy of the completed form for your records before submitting it. This can be crucial for your reference or in case the original gets lost in transit.

Submit the form within 10 business days to the specified address: Illinois Action For Children, 1340 South Darren Avenue, 3rd Floor, Chicago, IL 60608. Timely submission is essential for the continued processing of your childcare payments.

Things you shouldn't do:

Do not leave any section incomplete, especially those sections that require input from your employer. Incomplete information can lead to unnecessary delays or denial of childcare payments.

Avoid guessing information. If you're unsure about specific details such as your average tips or commission, confirm these details with your employer before filling them in.

Do not forge signatures or falsify information. Fraudulent information can lead to severe consequences, including the cancellation or denial of your childcare case.

Do not forget to include your client case number and signature at the beginning of the form. These elements are crucial for identifying and processing your form correctly.

Avoid delaying the submission of your form. Failing to submit the form within the 10 business day deadline can interrupt or delay your childcare payment processing.

Misconceptions

Several misconceptions surround the Illinois Wage Verification form and its requirements. Clearing up these misconceptions is crucial for both employers and employees to ensure compliance and avoid any unnecessary complications. Below are five common misconceptions explained:

- Only employees can fill out the form: This is incorrect. The form explicitly states that it is to be completed by the employer. It requires information such as the employee’s name, job information, and work schedule, which the employer is in a better position to provide accurately.

- It’s optional to return the completed form: Actually, returning the completed form is not optional. The form must be returned to the address provided (Illinois Action for Children) within 10 business days. Failing to do so could result in the denial or cancellation of childcare payments.

- Any information provided will not be verified: On the contrary, the form clearly mentions that the information may be verified by phone. This means that the Illinois Department of Human Services reserves the right to confirm the details provided on the form to ensure their accuracy.

- Verbal authorization is enough to release information: This is not the case. The form requires a client's signature to authorize the employer to release the specified information to the Illinois Department of Human Services. Without this written authorization, the employer cannot legally share the employee's details.

- Cash payments need not be disclosed: Incorrect. The form asks specifically if the employee is paid in cash, requiring a yes or no answer. This question must be answered truthfully to provide a complete and accurate portrayal of the employee’s wage situation.

Understanding these key points about the Illinois Wage Verification form is essential for both employers and employees to ensure that the childcare payment process is handled smoothly and within legal boundaries.

Key takeaways

When dealing with the Illinois Wage Verification form, it's crucial to understand its importance and the need for accuracy. This form is an essential document for verifying employment details and earnings with the Illinois Department of Human Services, especially for those involved in childcare services. Below are six key takeaways that should be noted:

- Filling out the Illinois Wage Verification form accurately is essential to avoid any potential penalties, including the loss of childcare payments or the denial of childcare cases. It is imperative for clients to ensure that all provided information is truthful and complete.

- Authorization by the client, through their signature, allows their employer to release specified employment and wage information to the Illinois Department of Human Services. This step is critical for the verification process to proceed.

- The employer is responsible for completing the majority of the form, including details such as the employee's name, pay rate, job title, and work schedule. This ensures that the information comes directly from the source and is therefore more likely to be accurate.

- There's a section that accounts for employees who are paid in non-traditional ways, such as in cash, through tips, or via commission. This part highlights the importance of transparency in disclosing all forms of earnings to get a comprehensive understanding of the individual’s financial situation.

- Work schedules, including any variations in hours, must be clearly defined in the form. If the employee has an inconsistent work schedule, an example should be provided to give the Illinois Department of Human Services a clear picture of the applicant's employment circumstances.

- The form must be completed by the employer and returned to the specified address within 10 business days. This deadline emphasizes the time-sensitive nature of the verification process and underscores the importance of prompt action by the employer and the employee.

Adherence to the instructions and deadlines specified in the Illinois Wage Verification form is crucial for the smooth processing of childcare payments. Employees and employers must work together to ensure all information is accurate and submitted on time.

Popular PDF Forms

How Do I Know If My Medical Is Active - Applicants must disclose any physical, mental, emotional, or developmental disabilities for each person added.

Ets Military Acronym - Guidance on completing the form for different sections of the military and civilian service fosters inclusivity and comprehensive support.

Dhs Form 7001 - Requires detailed contact information for both the reporting entity and the bank holding the custodial account.