Blank In-Kind Donation Receipt PDF Template

Charitable organizations often rely on the generosity of donors not just for monetary gifts, but also for donations in the form of goods and services. These contributions, known as in-kind donations, play a crucial role in helping nonprofits fulfill their mission. Recognizing the value of these donations, as well as ensuring transparency and accountability, requires a systematic approach to documentation. This is where the In-Kind Donation Receipt form becomes indispensable. It serves not just as a record of the donor's generosity, but also as an essential document for tax reporting purposes for both the donor and the recipient organization. The form typically details the nature of the donation, its estimated value, and the date of contribution, among other vital information. It stands as a testament to the act of giving, providing a tangible acknowledgment of the donor’s support while ensuring that the nonprofit organization adheres to regulatory requirements and upholds best practices in nonprofit management and accounting.

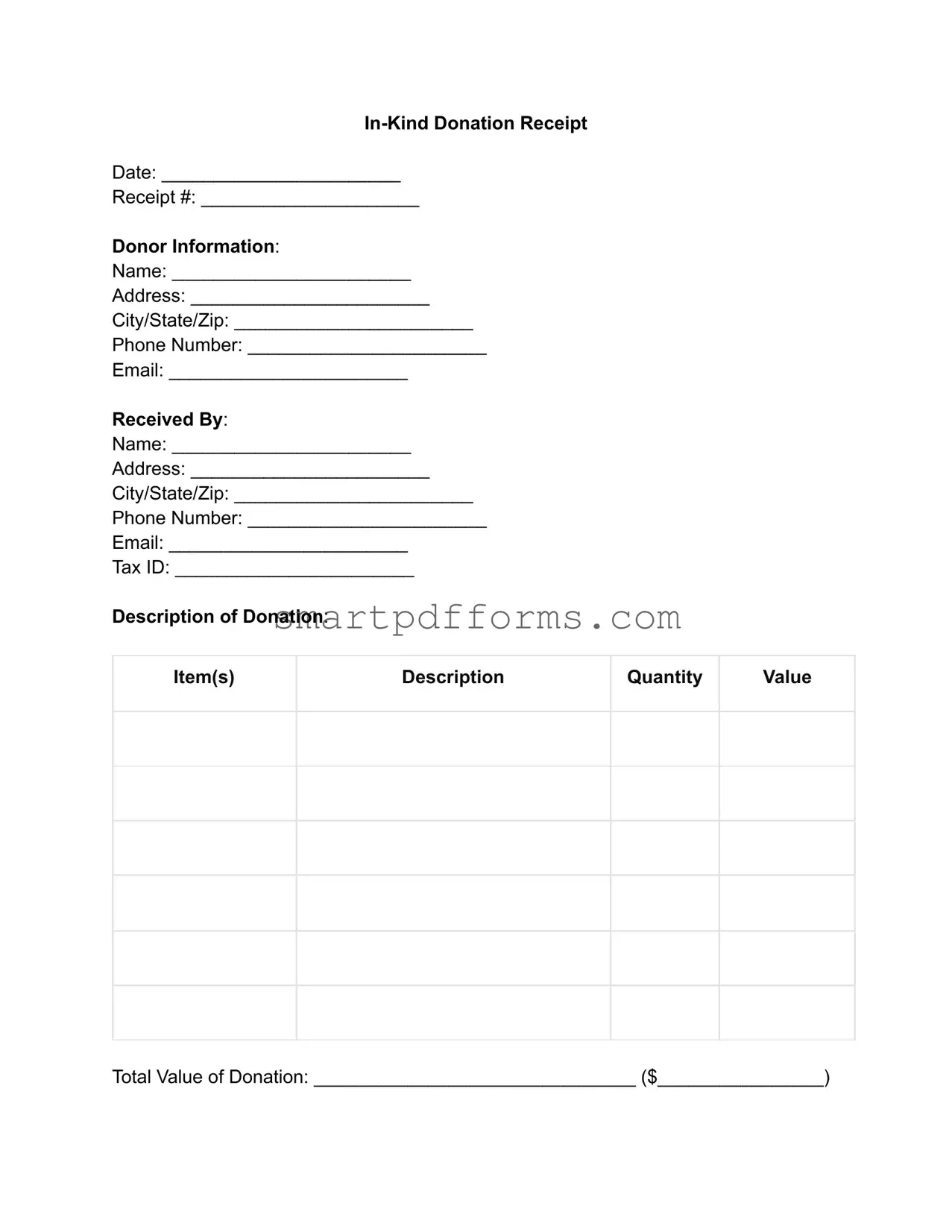

Preview - In-Kind Donation Receipt Form

Date: _______________________

Receipt #: _____________________

Donor Information:

Name: _______________________

Address: _______________________

City/State/Zip: _______________________

Phone Number: _______________________

Email: _______________________

Received By:

Name: _______________________

Address: _______________________

City/State/Zip: _______________________

Phone Number: _______________________

Email: _______________________

Tax ID: _______________________

Description of Donation:

Item(s)

Description

Quantity

Value

Total Value of Donation: _______________________________ ($________________)

Acknowledgement:

_______________________ gratefully acknowledges receipt of the

listed above. No goods or services were provided in exchange for this donation. The donation is tax deductible to the extent allowed by law.

Thank you for your generosity!

Authorized Signature: ___________________________

Print Name: ___________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | An In-Kind Donation Receipt is a document used by organizations to acknowledge the receipt of a contribution that is not cash, but goods or services. |

| Importance | It provides a record for both the donor and the receiving organization for tax and bookkeeping purposes. |

| Contents | Typically includes the donor's name, description of the donation, date of the donation, and the organization's information. |

| Valuation | The receipt does not usually assign a value to the donation; it is the donor's responsibility to determine its fair market value for tax purposes. |

| IRS Guidelines | According to the IRS, organizations should provide a written acknowledgment for any in-kind donation valued over $250. |

| State-Specific Requirements | Some states may have specific laws governing in-kind donations and the necessary documentation, affecting how the receipt should be formatted and what information is required. |

| Benefit to Donor | Allows the donor to potentially claim a tax deduction for the fair market value of the donated goods or services. |

| Benefit to Recipient | Enables organizations to receive goods or services that can support their operations or mission without financial expenditure. |

Instructions on Utilizing In-Kind Donation Receipt

Filling out an In-Kind Donation Receipt is an important step in documenting non-monetary contributions to an organization. These can range from goods to services that have tangible value but aren't cash-based. This receipt not only aids the organization in keeping precise records but also helps donors in claiming tax deductions where applicable. By following a clear and simple process, donors can ensure their generosity is accurately captured and recognized.

The steps needed to fill out the In-Kind Donation Receipt form are as follows:

- Donor Information: Start by providing detailed information about yourself or your organization. This includes the name, address, email, and phone number. This ensures the charity can reach out to you for any follow-up or to express gratitude.

- Description of Donation: Itemize the donated goods or services with as much detail as possible. If you are donating goods, include a list of items with their quantity and condition. For services, describe the nature of the service and the time committed.

- Value of Donation: Enter the fair market value of the donated goods or services. It's important to be honest and realistic about this valuation, as it will be used for tax reporting purposes. If you're unsure, consider consulting with a valuation expert, especially for high-value items or specialized services.

- Date of Donation: Clearly write the date when the donation was made. This date is crucial for both parties' records, especially for accounting and tax purposes.

- Recipient Organization Details: Include the name and contact information of the recipient organization. This ensures the receipt can be properly filed and attributed to the right entity.

- Signature: The form should be signed by a representative of the recipient organization. This acts as an acknowledgement of the donation and provides the donor with the necessary documentation for their records.

Once completed, the In-Kind Donation Receipt should be kept by both the donor and the recipient organization for record-keeping. It serves as a proof of donation and may be required by tax authorities in the event of a deduction claim. Remember, the value of in-kind contributions can make a significant difference to organizations, providing them with essential goods and services without impacting their cash flow. Your careful documentation ensures this generosity is recognized and encourages a continued partnership between donors and charitable organizations.

Obtain Answers on In-Kind Donation Receipt

-

What is an In-Kind Donation Receipt?

An In-Kind Donation Receipt is a document provided by an organization to a donor, acknowledging the receipt of a donation that is not made in cash but in goods or services. This form of acknowledgment is vital for both the donor and the receiving organization, as it serves as a record of the contribution for tax and accounting purposes.

-

Why is it important to obtain an In-Kind Donation Receipt?

Obtaining an In-Kind Donation Receipt is important for several reasons. For donors, it provides proof of the donation that can be used when filing taxes, potentially allowing for deductions based on the value of the donated goods or services. For organizations, it helps in maintaining accurate records of received donations, ensuring compliance with financial reporting requirements and supporting the organization's tax-exempt status.

-

What information is typically included on an In-Kind Donation Receipt?

The receipt usually includes information such as the name and address of the donor, a description of the donated goods or services, the date of the donation, and the name and signature of a representative from the receiving organization. It may also include the estimated value of the donation, although determining and recording this value often falls to the donor.

-

How can a donor determine the value of the donated goods or services?

Determining the value of donated goods or services is the responsibility of the donor. It is recommended to assess the fair market value, which is the price at which the goods or services would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts. Donors might need to consult with a tax professional or use available guides from tax authorities to make accurate estimations.

-

Can a donor claim a tax deduction for every type of in-kind donation?

Not all in-kind donations are eligible for tax deductions. The eligibility for tax deductions can depend on several factors, including the type of donated goods or services, the donor's tax status, and how the receiving organization uses the donation. Donors are advised to consult with tax professionals or refer to IRS guidelines to understand what donations qualify for tax deductions.

-

What should an organization do upon receiving an in-kind donation?

Upon receiving an in-kind donation, an organization should promptly issue an In-Kind Donation Receipt to the donor. The organization should also record the donation in its accounting records, including a description of the donated items or services and their estimated value, ensuring that its financial statements accurately reflect all received contributions.

-

What happens if a donor does not receive an In-Kind Donation Receipt?

If a donor does not receive an In-Kind Donation Receipt, they should contact the organization to request one. Without this receipt, it may be challenging to claim a tax deduction for the donation. Organizations are generally keen to assist in these matters, recognizing the importance of accurately documenting donations for both parties.

-

Is there a deadline for issuing an In-Kind Donation Receipt?

While there is no strict federal deadline for issuing an In-Kind Donation Receipt, it is best practice for organizations to issue the receipt as soon as possible after the donation is made. For tax purposes, donors must obtain the receipt before filing their tax return for the year in which the donation was made. Therefore, timely issuance is beneficial and appreciated by donors.

Common mistakes

When it comes to supporting charitable organizations, in-kind donations can be as valuable as monetary gifts. However, when documenting these contributions through an In-Kind Donation Receipt form, several common missteps can be avoided to ensure the transaction is recorded properly. Let's dive into some of these errors:

Not providing a detailed description of the donated item(s) or service(s) - Donors often list items in very general terms, which can create confusion and inaccuracies in the charity's records.

Omitting the date of the donation - This piece of information is essential for both the donor’s and the organization's records, especially for tax purposes.

Forgetting to include the donor's full name and contact information - This oversight can lead to challenges in acknowledging the donation properly and issuing a thank you note or an official acknowledgment letter.

Failing to determine or document the fair market value of the donated goods or services - While it's ultimately the donor's responsibility to estimate this value for tax purposes, providing guidance or documentation can be very helpful.

Leaving out necessary signatures - Both the donor and a representative of the charity should sign the form to validate the donation. Missing signatures can lead to questions about the authenticity of the donation.

Ignoring specific IRS requirements for documentation - Depending on the amount or value of the donation, additional documentation may be required to comply with IRS rules.

Not retaining a copy of the completed form - Both the donor and the recipient organization should keep a copy of the filled-out form for their records, yet this crucial step is often overlooked.

By steering clear of these common mistakes, donors and charitable organizations can ensure their generosity is captured accurately and effectively, making the process rewarding for everyone involved.

Documents used along the form

In-kind donations are a vital resource for many organizations, offering goods and services that directly support their operations and mission without the exchange of money. To properly account for and acknowledge these generous contributions, an array of documents is usually involved alongside the In-Kind Donation Receipt form. These forms and documents ensure both the donor and recipient organizations maintain accurate records, comply with tax regulations, and cultivate a transparent, appreciative relationship. Here is a list of documents that are often used in conjunction with the In-Kind Donation Receipt form.

- Donation Acknowledgement Letter - This letter serves as a formal thank you to the donor, acknowledging the receipt of the in-kind donation. It provides details about the donation and its estimated value for the donor’s tax records.

- Gift Agreement Form - This document outlines the terms and conditions of the donation, including how the items will be used and any restrictions placed on their use by the donor.

- IRS Form 8283 - For donations valued over $500, donors need to complete this form for non-cash gifts when filing their taxes to claim a deduction. It requires a description of the donated property and its condition.

- Donor Intent Letter - This letter clarifies the donor’s intentions regarding the use of the donation, which can include stipulations or conditions they want the organization to follow.

- Property Release Form - When donated items are physical goods, this form officially transfers ownership from the donor to the recipient organization, releasing the donor from liability associated with the items.

- Valuation Documentation - Documents or appraisals that substantiate the estimated value of the donated goods or services, which are necessary for the donor’s tax records and the recipient organization’s financial accounting.

Together, these documents form a comprehensive framework that supports the in-kind donation process. They not only ensure legal compliance and financial accountability but also help in building stronger relationships between donors and recipient organizations through clear communication and mutual appreciation. Proper handling and filing of these documents are crucial for the integrity of the donation process and the continued support of the organization’s efforts.

Similar forms

Charitable Donation Receipt: Similar to an In-Kind Donation Receipt, this document acknowledges monetary contributions to nonprofit organizations. Both provide proof for the donor's tax deductions.

Goods Donation Receipt: This receipt is for when physical items are donated to organizations, much like the In-Kind Donation Receipt. It specifies the items donated and serves as a record for tax purposes.

Services Donation Receipt: It documents the provision of services to a nonprofit, similar to in-kind services. Both acknowledge non-monetary contributions and help in claiming tax deductions.

Gift Receipt: Issued to acknowledge a gift item, closely parallels the In-Kind Donation Receipt in that it provides a record of something given without direct compensation.

Acknowledgement Letter for Donation: While it's more of a formal thank-you letter, it shares the purpose of confirming the receipt of a donation, just like the In-Kind Donation Receipt.

Volunteer Time Sheet: This document tracks volunteer hours contributed to an organization. It's similar in that it records non-monetary contributions, akin to how a donation of services might be documented.

Tax Deduction Record: A personal record kept by donors of any donations made throughout the year for tax purposes. It often includes information similar to what is found on In-Kind Donation Receipts.

Auction Item Donation Form: Used when items are donated for auction, this form includes details like the In-Kind Donation Receipt, ensuring the donation is recorded and acknowledged for tax benefit purposes.

Corporate Sponsorship Agreement: This document outlines the terms of sponsorship contributions to organizations, sometimes including in-kind support, paralleling the In-Kind Donation Receipt's role in acknowledging contributions.

Nonprofit Contribution Statement: Provided by nonprofits to donors, it details all contributions made, including in-kind, over the fiscal year, serving a similar purpose by aiding in tax preparation.

Dos and Don'ts

Filling out an In-Kind Donation Receipt form accurately is essential for ensuring that both the donor and the recipient organization can accurately track and report donations. The following guidelines outline the do's and don'ts to help streamline this process and ensure legal compliance.

Do's:

- Clearly describe the donated items or services, including details such as condition, quantity, and any other pertinent information to accurately value the donation.

- Include the date of the donation to establish when the transaction occurred. This is important for both accounting purposes and for the donor's tax preparations.

- Provide the donor's full name and contact information. This ensures that the donation can be properly acknowledged and allows for clear communication between the donor and the organization.

- Ensure that the form includes the organization’s name and charitable status information. This verifies the donation is going to a legitimate entity and can be tax-deductible.

- Sign and date the receipt. An authorized representative of the organization should sign the receipt to validate it.

- Encourage donors to keep a copy of the completed form for their records. This serves as evidence of their contribution for tax purposes.

Don'ts:

- Leave sections of the form blank. Incomplete forms can lead to misunderstandings or disputes over the value and nature of the donated goods or services.

- Overestimate the value of the donated items or services. This can lead to legal issues, including audits or penalties for both the donor and the organization.

- Forget to provide a copy of the receipt to the donor. Donors need this document to claim tax deductions.

- Delay issuing the receipt. Prompt acknowledgment of the donation reinforces trust and encourages future contributions.

- Use vague language to describe the donation. Specificity is key to ensuring transparency and accountability.

- Overlook privacy considerations. Handle the donor's personal information with care to protect their privacy and comply with data protection laws.

Misconceptions

When it comes to supporting nonprofits and charities, many people generously offer in-kind donations. However, there are several misunderstandings about the documentation process for these contributions, specifically concerning the In-Kind Donation Receipt form. Let’s clarify some common misconceptions to ensure donors and recipients alike can navigate this process confidently.

Only monetary gifts require a receipt. This is a common misconception. In reality, the IRS requires documentation for any donation, including goods and services, valued over $250. The In-Kind Donation Receipt form serves as this documentation, making it just as necessary for non-cash gifts.

Donors determine the value of their in-kind donation. While donors can estimate the value of their contribution, it is ultimately the responsibility of the recipient organization to provide a good faith estimate of the value on the receipt. This ensures donors have the documentation needed for tax purposes while adhering to IRS guidelines.

The form is complicated and time-consuming to complete. Many people hesitate to complete an In-Kind Donation Receipt form, believing it to be a lengthy and complex process. However, the form itself is straightforward, requiring essential information about the donated items, donor details, and the receiving organization. This document can usually be completed quickly and easily.

A receipt is not necessary for tax deductions. This misunderstanding can lead to complications when donors file their taxes. According to IRS regulations, taxpayers must have written acknowledgment of any in-kind donation to claim it on their taxes. Without an In-Kind Donation Receipt, donors may be unable to legally claim their donation as a tax deduction.

Understanding these aspects of the In-Kind Donation Receipt can enhance the donation process for both donors and nonprofit organizations, making it easier for generous contributions to make their way to those in need.

Key takeaways

Filling out and using an In-Kind Donation Receipt form is crucial for both donors and nonprofit organizations. These forms not only help in maintaining clear records of contributions but also ensure compliance with tax regulations. Here are five key takeaways to understand when navigating the use of an In-Kind Donation Receipt form:

- Ensure Accuracy: It's vital to accurately describe the donated items or services. This description should be detailed enough to allow someone unfamiliar with the donation to understand its value. Avoid being too vague; specifics can make a difference in how the donations are recorded and used.

- Assign a Fair Market Value: Donors are responsible for determining the fair market value of their donation. This is the price the item would sell for in its current condition in the open market. It's different from the cost to replace the item new. Organizations can provide guidance but cannot assign the value for donors.

- Understand the Tax Implications: For donors, in-kind donations can be tax-deductible, depending on their tax situation. However, the organization receiving the donation must be a registered 501(c)(3) nonprofit. Donors should consult with a tax professional to understand how to properly report these donations on their tax returns.

- Keep Comprehensive Records: Both the donating party and the recipient should retain a copy of the completed In-Kind Donation Receipt. This documentation is critical for financial records, tax reporting, and internal audits. It serves as proof of the donation and may be required by tax authorities.

- Legal Requirements and Thresholds: For donations above a certain value, additional IRS forms may be needed. For example, for in-kind donations over $500, donors must fill out IRS Form 8283 and attach it to their tax return. If the donation's value exceeds $5,000, an independent appraisal is usually required.

Being thorough and honest in filling out an In-Kind Donation Receipt form ensures that the generosity of donors is accurately captured and benefits both the donor and the recipient organization fully. It's a crucial step in the process of giving that upholds integrity and accountability.

Popular PDF Forms

Lic 215 - Requiring the listing of both personal and financial references, the Lic 215 form demonstrates the multifaceted approach to evaluating a potential licensee's capabilities.

How to Pay a Nanny Legally - A formal arrangement detailing the operational hours, holiday closures, and payment obligations for childcare services.