Blank Independent PDF Template

The Independent Review form plays a critical role in the assurance of compliance with Federal Anti-Money Laundering (AML) Regulations by Money Services Businesses (MSBs). It is designed to be utilized by an external reviewer, who is knowledgeable about AML requirements applicable to MSBs, ensuring that the review is not conducted by the MSB's Compliance Officer, their subordinates, or any representative from MoneyGram. This form serves as a comprehensive template to guide the independent review process, covering various aspects of an MSB’s AML compliance program. Such aspects include the establishment of a compliance officer, adoption of written policies and procedures aligned with the Bank Secrecy Act, employee training on AML compliance, risk assessment based on the services offered and the business location, and procedures for customer identification and transaction processing. The MSB is required to retain the completed form and any supporting documents for a minimum of five years, emphasizing the importance of thorough documentation and record-keeping in demonstrating compliance with AML obligations. Additionally, the form requires MSBs to also address the frequency and methodology of employee training in AML matters, underscoring the critical role of continuous education in maintaining an effective compliance program.

Preview - Independent Form

Section 4 : Independent Review

MoneyGram

INDEPENDENT REVIEW

When you established your Compliance Program and with MoneyGram's approval, you indicated how often you would have an Independent Review of your AML Compliance Program.

In the event that you do not have your own Independent Review form, the following pages of this section

contains an Independent Review template that you should have the reviewer use as a guide and complete

accordingly.

As a reminder:

•An Independent Review of your MSB is required by Federal AML Regulations.

•The Independent Review will be conducted by a person or persons who are knowledgeable about the AML requirements that apply to MSBs.

•The Agent's Independent Review cannot be conducted by your designated Compliance Officer, anyone that reports to your Compliance Officer, or any MoneyGram representative.

What do I do with the completed Independent Review Form?

Once the Independent Review Form has been completed and signed by the reviewer, please keep/file/store it with your Compliance related documents for at least 5 years.

Please make extra copies of the blank Independent Review Form and

do not use your last blank one.

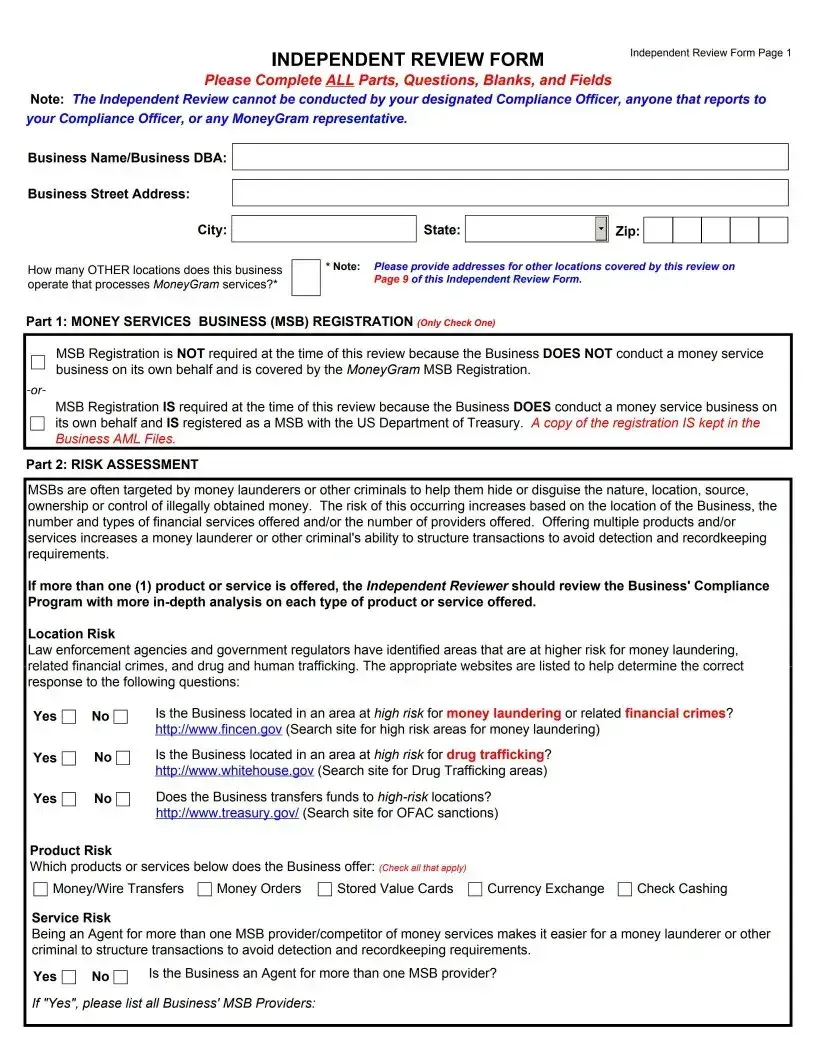

INDEPENDENT REVIEW FORM

Independent Review Form Page 1

Please Complete ALL Parts, Questions, Blanks, and Fields

Note: The Independent Review cannot be conducted by your designated Compliance Officer, anyone that reports to your Compliance Officer, or any MoneyGram representative.

How many OTHER locations does this business |

Note: Please provide addresses for other locations covered by this review on |

operate that processes MoneyGram services?* |

Page 9 of this Independent Review Form. |

|

Part 1: MONEY SERVICES BUSINESS (MSB) REGISTRATION (Only Check One)

MSB Registration is NOT required at the time of this review because the Business DOES NOT conduct a money service business on its own behalf and is covered by the MoneyGram MSB Registration.

MSB Registration IS required at the time of this review because the Business DOES conduct a money service business on

Оits own behalf and IS registered as a MSB with the US Department of Treasury. A copy of the registration IS kept in the Business AML Files.

Part 2: RISK ASSESSMENT

MSBs are often targeted by money launderers or other criminals to help them hide or disguise the nature, location, source, ownership or control of illegally obtained money. The risk of this occurring increases based on the location of the Business, the number and types of financial services offered and/or the number of providers offered. Offering multiple products and/or services increases a money launderer or other criminal's ability to structure transactions to avoid detection and recordkeeping requirements.

If more than one (1) product or service is offered, the Independent Reviewer should review the Business' Compliance Program with more

Location Risk

Law enforcement agencies and government regulators have identified areas that are at higher risk for money laundering, related financial crimes, and drug and human trafficking. The appropriate websites are listed to help determine the correct response to the following questions:

Yes |

NoD |

Is the Business located in an area at high risk for money laundering or related financial crimes? |

|

|

htto://www.fincen.aov (Search site for hiqh risk areas for monev launderinq) |

Yes |

NoD |

Is the Business located in an area at high risk for drug trafficking? |

|

|

htto://www.whitehouse.qov (Search site for Druq Traffickinq areas) |

Yes |

NoD |

Does the Business transfers funds to |

|

|

htto://www.treasurv.qov/ (Search site for OFAC sanctions) |

Product Risk

Which products or services below does the Business offer: (Check all that apply)

ОMoney/Wire Transfers Q Money Orders Q Stored Value Cards Q Currency Exchange Q Check Cashing

Service Risk

Being an Agent for more than one MSB provider/competitor of money services makes it easier for a money launderer or other criminal to structure transactions to avoid detection and recordkeeping requirements.

Yes О No О Is the Business an Agent for more than one MSB provider?

If "Yes", please list all Business' MSB Providers:

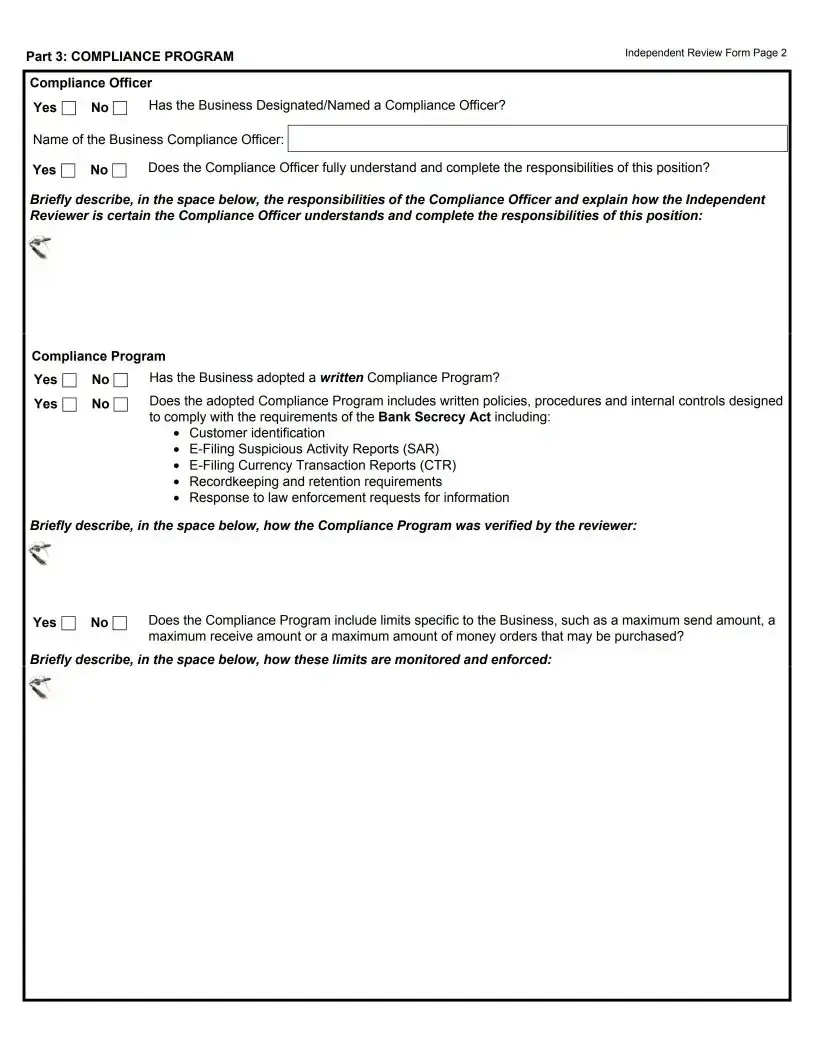

Part 3: COMPLIANCE PROGRAM |

Independent Review Form Page 2 |

Compliance Officer

Yes |

No О Has the Business Designated/Named a Compliance Officer? |

Name of the Business Compliance Officer:

Yes П No О Does the Compliance Officer fully understand and complete the responsibilities of this position?

Briefly describe, in the space below, the responsibilities of the Compliance Officer and explain how the Independent Reviewer is certain the Compliance Officer understands and complete the responsibilities of this position:

Compliance Program

Yes О No П |

Has the Business adopted a written Compliance Program? |

||

Yes |

No |

Does the adopted Compliance Program includes written policies, procedures and internal controls designed |

|

|

|

to comply with the requirements of the Bank Secrecy Act including: |

|

|

|

• |

Customer identification |

|

|

• |

|

|

|

• |

|

|

|

• Recordkeeping and retention requirements |

|

|

|

• |

Response to law enforcement requests for information |

Briefly describe, in the space below, how the Compliance Program was verified by the reviewer:

Yes |

No О Does the Compliance Program include limits specific to the Business, such as a maximum send amount, a |

|

maximum receive amount or a maximum amount of money orders that may be purchased? |

Briefly describe, in the space below, how these limits are monitored and enforced:

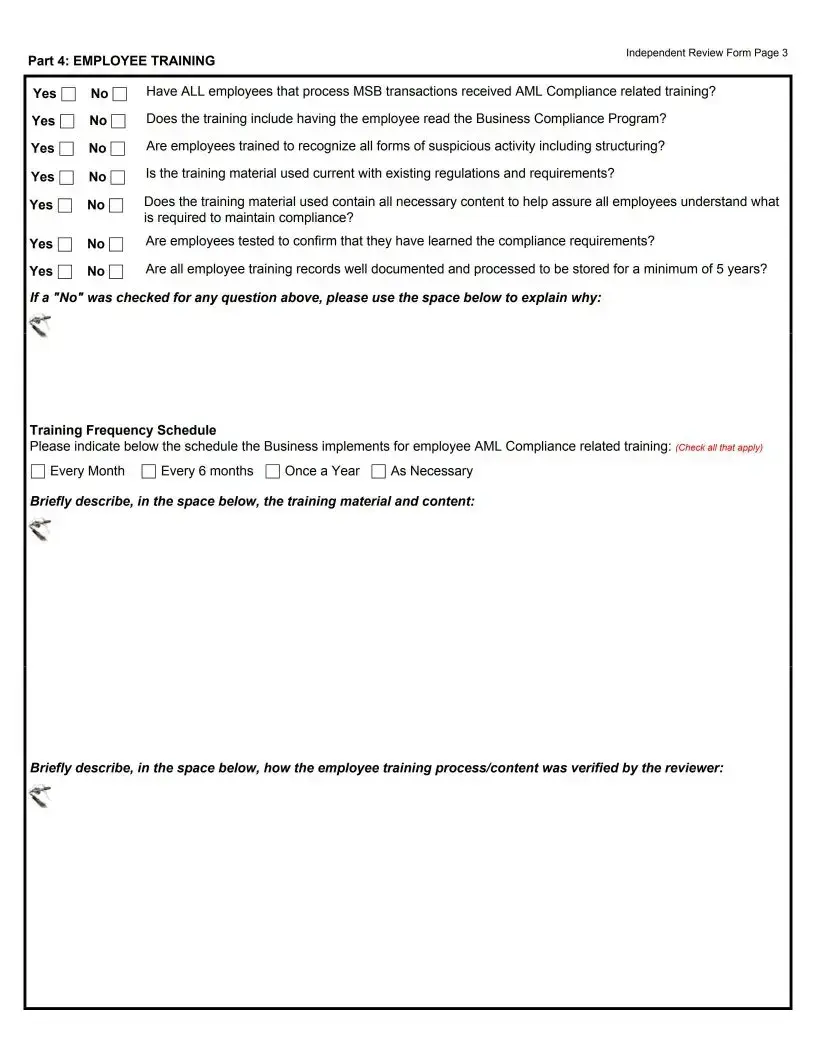

Part 4: |

|

Independent Review Form Page 3 |

EMPLOYEE TRAINING |

||

Yes |

NoD |

Have ALL employees that process MSB transactions received AML Compliance related training? |

Yes |

NoD |

Does the training include having the employee read the Business Compliance Program? |

Yes |

No |

Are employees trained to recognize all forms of suspicious activity including structuring? |

Yes |

No |

Is the training material used current with existing regulations and requirements? |

Yes |

No |

Does the training material used contain all necessary content to help assure all employees understand what |

|

|

is required to maintain compliance? |

Yes |

No |

Are employees tested to confirm that they have learned the compliance requirements? |

Yes |

No |

Are all employee training records well documented and processed to be stored for a minimum of 5 years? |

If a "No" was checked for any question above, please use the space below to explain why:

Training Frequency Schedule

Please indicate below the schedule the Business implements for employee AML Compliance related training: (Check all that apply)

Every Month |

Every 6 months |

Once a Year О As Necessary |

Briefly describe, in the space below, the training material and content:

Briefly describe, in the space below, how the employee training process/content was verified by the reviewer:

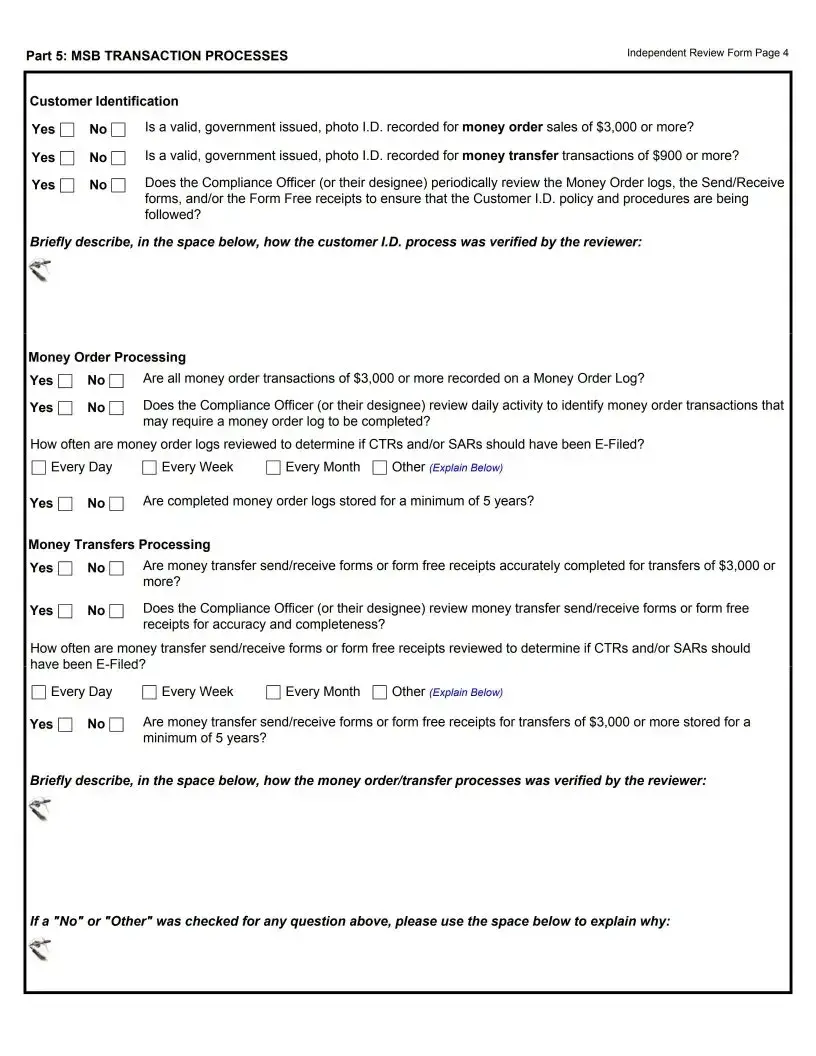

Part 5: MSB TRANSACTION PROCESSES |

Independent Review Form Page 4 |

Customer Identification

Yes |

NoD |

Is a valid, government issued, photo I.D. recorded for money order sales of $3,000 or more? |

Yes |

No О |

Is a valid, government issued, photo I.D. recorded for money transfer transactions of $900 or more? |

Yes |

No |

Does the Compliance Officer (or their designee) periodically review the Money Order logs, the Send/Receive |

|

|

forms, and/or the Form Free receipts to ensure that the Customer I.D. policy and procedures are being |

|

|

followed? |

Briefly describe, in the space below, how the customer I.D. process was verified by the reviewer:

Money Order Processing

Yes |

No О Are all money order transactions of $3,000 or more recorded on a Money Order Log? |

|

Yes |

No |

Does the Compliance Officer (or their designee) review daily activity to identify money order transactions that |

|

|

may require a money order log to be completed? |

How often are money order logs reviewed to determine if CTRs and/or SARs should have been

Ц Every Day |

Q Every Week |

Q Every Month Q Other (Explain Below) |

|

Yes |

No О |

Are completed money order logs stored for a minimum of 5 years? |

|

Money Transfers Processing |

|

||

Yes |

No |

Are money transfer send/receive forms or form free receipts accurately completed for transfers of $3,000 or |

|

|

|

more? |

|

Yes |

No О |

Does the Compliance Officer (or their designee) review money transfer send/receive forms or form free |

|

|

|

receipts for accuracy and completeness? |

|

How often are money transfer send/receive forms or form free receipts reviewed to determine if CTRs and/or SARs should have been

О Every Day |

Every Week |

Q Every Month Ц Other (Explain Below) |

|

Yes |

No П |

Are money transfer send/receive forms or form free receipts for transfers of $3,000 or more stored for a |

|

|

|

minimum of 5 years? |

|

Briefly describe, in the space below, how the money order/transfer processes was verified by the reviewer:

V

If a "No" or "Other" was checked for any question above, please use the space below to explain why:

V

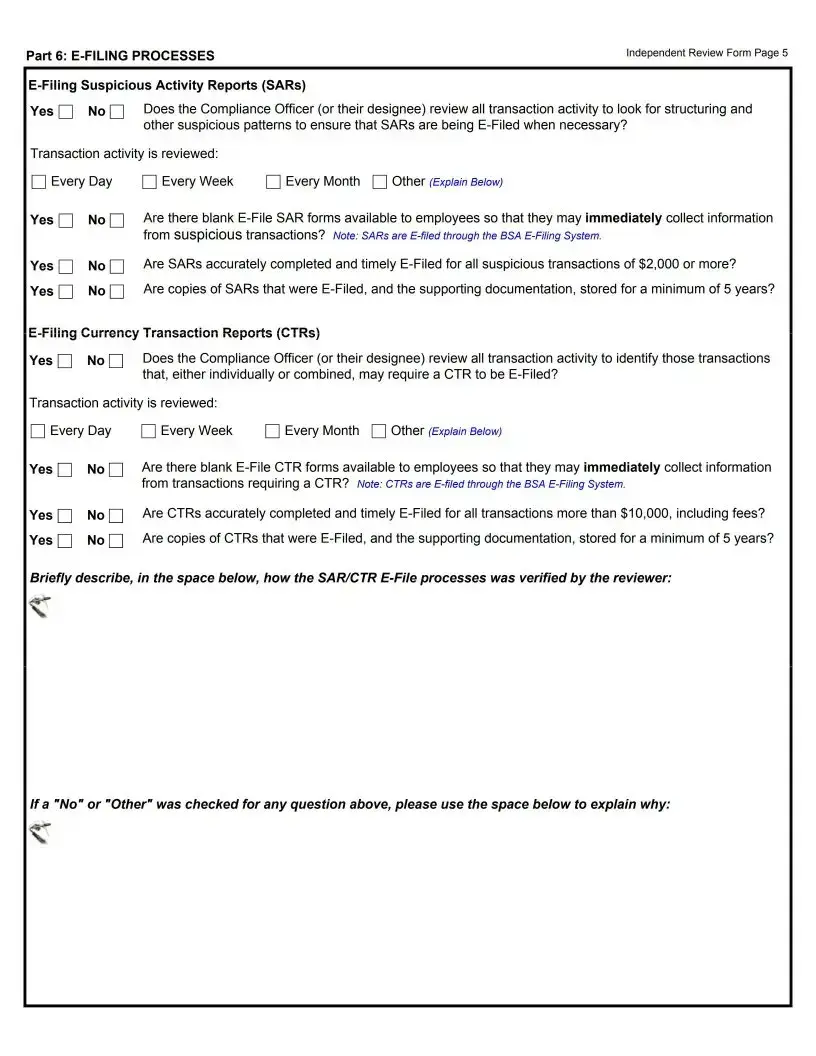

Part 6: |

Independent Review Form Page 5 |

Yes |

No |

Does the Compliance Officer (or their designee) review all transaction activity to look for structuring and |

|

|

other suspicious patterns to ensure that SARs are being |

Transaction activity is reviewed:

Ц Every Day |

Q Every Week |

Q Every Month Q Other (Explain Below) |

|

Yes |

No О |

Are there blank |

|

|

|

from suspicious transactions? Note: SARs are |

|

Yes |

No О |

Are SARs accurately completed and timely |

|

Yes |

No |

Are copies of SARs that were |

|

Yes |

No О |

Does the Compliance Officer (or their designee) review all transaction activity to identify those transactions |

|

|

|

that, either individually or combined, may require a CTR to be |

|

Transaction activity is reviewed:

О Every Day |

Every Week |

Q Every Month Q Other (Explain Below) |

|

Yes П No О |

Are there blank |

||

|

|

from transactions requiring a CTR? Note: CTRs are |

|

Yes |

No О |

Are CTRs accurately completed and timely |

|

Yes |

No О |

Are copies of CTRs that were |

|

Briefly describe, in the space below, how the SAR/CTR

If a "No" or "Other" was checked for any question above, please use the space below to explain why:

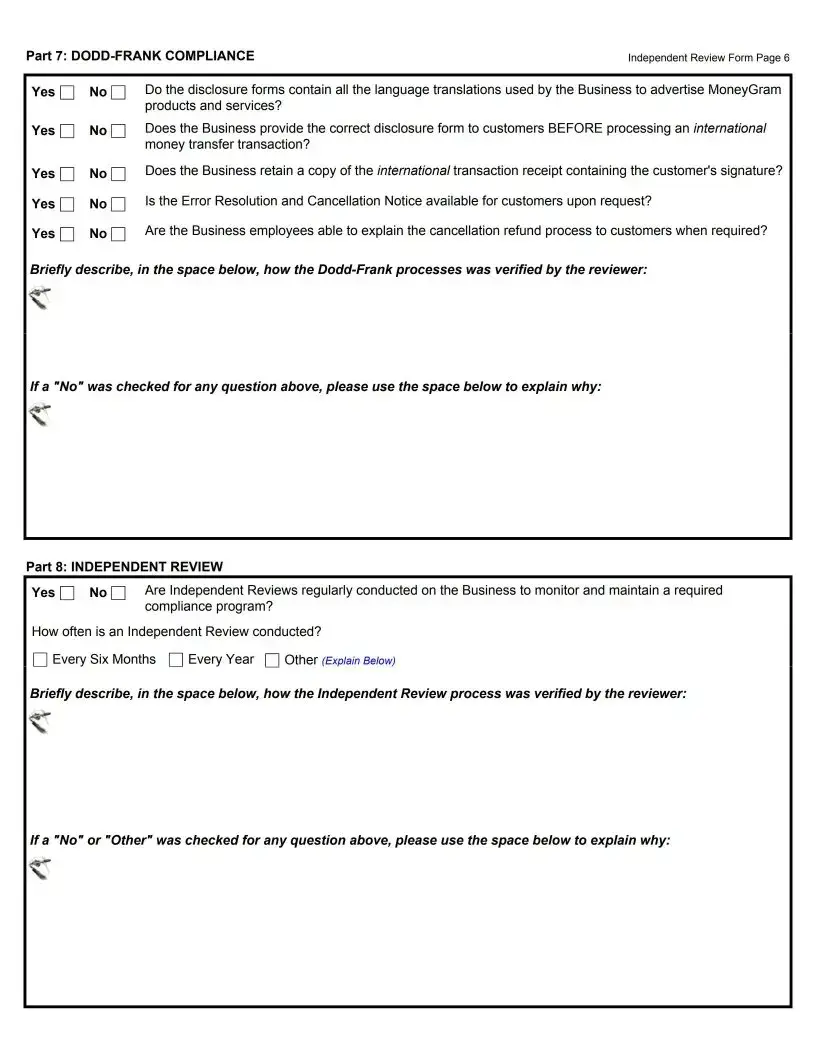

Part 7: |

Independent Review Form Page 6 |

||

Yes |

No |

Do the disclosure forms contain all the language translations used by the Business to advertise MoneyGram |

|

|

|

products and services? |

|

Yes |

No |

Does the Business provide the correct disclosure form to customers BEFORE processing an international |

|

|

|

money transfer transaction? |

|

Yes |

No |

Does the Business retain a copy of the international transaction receipt containing the customer's signature? |

|

Yes |

No |

Is the Error Resolution and Cancellation Notice available for customers upon request? |

|

Yes |

No |

Are the Business employees able to explain the cancellation refund process to customers when required? |

|

Briefly describe, in the space below, how the

If a "No" was checked for any question above, please use the space below to explain why:

V

Part 8: INDEPENDENT REVIEW___________________________________________________________________

Yes |

No |

Are Independent Reviews regularly conducted on the Business to monitor and maintain a required |

|

|

compliance program? |

How often is an Independent Review conducted?

Every Six Months Every Year Other (Explain Below)

Briefly describe, in the space below, how the Independent Review process was verified by the reviewer:

c

If a "No" or "Other" was checked for any question above, please use the space below to explain why:

Part 9: BUSINESS DATA and RECORDS ANALYSIS |

Independent Review Form Page 7 |

It is critical that the Business being reviewed is meeting reporting and recordkeeping requirements. It is recommended that the reviewer conducts an analysis or test on a sample of random completed transactions from the past. Guidelines for this analysis

are detailed below.

Yes |

No О Will a business data and records analysis be conducted on the Business? (if not, please explain why below.) |

Briefly describe, in the space below, the results of the business data and records analysis:

Business Data and Records Analysis Guidelines

1.Money transfers of $900 and above must include the customer's:

•Name

•Current residential address

•Phone number

•Type of ID provided, the ID number and the ID issuer

2.Money transfers of $3,000 and above must include the customer's:

•Name

•Current residential address

•Phone number

•Type of ID provided, the ID number and the ID issuer

•Social Security number (SSN) or Tax ID Number (TIN), if the customer is a citizen or authorized resident in the U.S. A SSN or TIN is unnecessary if the customer lives and works outside of the U.S. and presents a passport or other applicable photo ID issued by a foreign government.

•Date of birth (DOB)

•Specific occupation

•Signature

3.Multiple money order cash purchases made by the same person in one business day must be aggregated, or added together, and treated as a single purchase, even if purchased at different times during the day. If the same consumer purchases $3,000 or more in money orders, using cash, in the same day, the following consumer transaction information must be recorded on a Money Order Log BEFORE completing the transaction(s):

•Name

•Current residential address

•Phone number

•Type of ID provided, the ID number and the ID issuer

•Social Security number (SSN) or Tax ID Number (TIN), if the customer is a citizen or authorized resident in the U.S.

ASSN or TIN is unnecessary if the customer lives and works outside of the U.S. and presents a passport or other applicable photo ID issued by a foreign government.

•Date of birth (DOB)

•Specific occupation

•Signature

4.Aggregated transaction activity should be reviewed to determine if SARs or CTRs were required to be

Independent Review Form Page 8

Acknowledgement of Independent Review Completion

I certify an independent review of the compliance program belonging to the Business listed below has been completed.

Business Name/Business DBA:

Among other things, this review focused on the requirements of the USA PATRIOT Act and the Bank Secrecy Act.

The results of this review show that the Business'

ОAcceptable О Acceptable: Requires Enhancements Detailed Below О Unacceptable: Detailed Below

Please describe, in the space below, the enhancements needed or reasons for an "unacceptable" rating:

Additional Location Address (If Required)

Independent Review Form Page 9

If additional locations blanks are needed, please copy this page and add accordingly.

Form Data

| Fact Name | Details |

|---|---|

| Requirement for Independent Review | An Independent Review is mandatory under Federal AML Regulations and must be conducted by individuals knowledgeable about AML requirements applicable to MSBs, excluding the designated Compliance Officer, their subordinates, or any MoneyGram representative. |

| Retention Period for Independent Review Forms | The completed Independent Review Form must be stored with compliance-related documents for a minimum of five years, ensuring the availability of extra blank forms. |

| Compliance Officer and Program Verification | The Independent Review must confirm the designation of a Compliance Officer, their understanding and execution of their responsibilities, and the adoption of a comprehensive written Compliance Program by the Business. |

| Employee Training and Processes | All employees processing MSB transactions must receive AML Compliance training, including understanding the Compliance Program and recognizing suspicious activities, with documented records kept for at least five years. |

Instructions on Utilizing Independent

Completing the Independent Review Form is a critical task for ensuring that your Anti-Money Laundering (AML) Compliance Program adheres to federal regulations. This meticulous process requires attention to detail and an understanding of AML requirements specific to Money Services Businesses (MSBs). The following steps are designed to guide you through completing the form accurately. After the form is fully completed and signed by an independent reviewer—someone with knowledge in AML requirements but not directly involved in your compliance program—it should be filed and stored along with other compliance documents for at least five years. Remember, this independent review is essential for identifying any areas of improvement in your AML Compliance Program and for ensuring compliance with relevant laws.

- Enter the official Business Name/Business DBA (Doing Business As) in the designated space provided.

- Fill out the Business Street Address, including City, State, and Zip code.

- If your business operates other locations that process MoneyGram services, specify the total number and provide their addresses on Page 9 of the Independent Review Form.

- In Part 1: MONEY SERVICES BUSINESS (MSB) REGISTRATION, check the appropriate box to indicate whether MSB Registration is required or not at the time of the review, based on your business activities.

- In Part 2: RISK ASSESSMENT, determine and check whether the business location is at high risk for money laundering or related financial crimes, drug trafficking, or if it transfers funds to high-risk locations. Check all products and services offered by the business and answer whether it’s an agent for more than one MSB provider.

- Under Part 3: COMPLIANCE PROGRAM, provide the name of your Compliance Officer and answer whether they comprehend and fulfill their responsibilities, adhering to detailed expectations outlined. Confirm if your business has adopted a written Compliance Program that includes specific written policies, procedures, and internal controls to comply with the Bank Secrecy Act.

- In Part 4: EMPLOYEE TRAINING, address whether all employees processing MSB transactions have received AML Compliance training, detailing the training material, content, and frequency schedule.

- For Part 5: MSB TRANSACTION PROCESSES, verify and document the procedures for Customer Identification, Money Order Processing, and Money Transfers Processing, ensuring all actions are in compliance and highlight how these processes were independently verified.

- If any question in the form is marked "No" or "Other," provide a detailed explanation in the space provided below the relevant section.

Remember, the Independent Review Form plays a pivotal role in assessing the robustness of your AML Compliance Program. It is not only a regulatory requirement but also a critical internal check to ensure your business operations align with federal AML standards. After completing the form, review it thoroughly to ensure all information is accurate and comprehensive before filing it with your compliance documents.

Obtain Answers on Independent

When it comes to maintaining compliance with Anti-Money Laundering (AML) regulations, the Independent Review Form plays a vital role for Money Services Businesses (MSBs). To help demystify this important document, here are answers to some commonly asked questions:

- What is the purpose of the Independent Review Form?

- Why is it important to have an Independent Review conducted?

- Who is qualified to conduct the Independent Review?

- What happens after the Independent Review Form is completed?

- Is it necessary to make multiple copies of the Independent Review Form?

- What should be done if an MSB doesn’t have its own Independent Review form?

The Independent Review Form is designed to assist MSBs in conducting a thorough examination of their AML Compliance Program. This form guides the reviewer through a detailed assessment of the business's compliance measures, including its risk assessment procedures, the effectiveness of its compliance program, employee training practices, and specific transaction processes related to AML regulations.

An Independent Review is not just a regulatory requirement; it's a critical component of an MSB's compliance strategy. By having an external and knowledgeable reviewer evaluate the effectiveness of its AML Compliance Program, an MSB can identify and rectify potential weaknesses in its policies or procedures, thereby minimizing the risk of non-compliance with federal AML regulations.

The review must be carried out by someone with a solid understanding of AML requirements as they pertain to MSBs. Importantly, the reviewer cannot be the MSB's designated Compliance Officer, anyone who directly reports to the Compliance Officer, or any representative from MoneyGram. This ensures that the review is objective and free from potential conflicts of interest.

Once the review is finalized and the form is completed, it's essential for the MSB to securely store the document with its other compliance-related files for at least five years. This retention period is vital for demonstrating compliance readiness and can be crucial during audits or investigations by regulatory bodies.

Yes, it's advisable to keep extra copies of the blank Independent Review Form on hand. This preparation ensures that the MSB is always ready to initiate an Independent Review without delay, maintaining continuous oversight of its AML Compliance Program's efficacy.

In cases where an MSB does not have a bespoke form ready, it is encouraged to use the template provided in the Independent Review section as a guide. This standard form contains all the necessary fields and questions to conduct a comprehensive review of the MSB’s AML Compliance Program.

Understanding and completing the Independent Review process is essential for MSBs to ensure they are compliant with Federal AML regulations, protecting both their business and their customers from the risks associated with money laundering and other related crimes.

Common mistakes

When completing the Independent Review form, people often encounter issues that can affect the accuracy and compliance of the document. Here are five common mistakes to be aware of:

- Not having an eligible reviewer. The Independent Review must be conducted by someone knowledgeable about AML requirements for MSBs and cannot be your Compliance Officer, anyone reporting to the Compliance Officer, or any MoneyGram representative.

- Filling out the form incompletely. All parts, questions, blanks, and fields should be carefully completed to ensure a thorough review.

- Incorrectly assessing risk areas. Failure to correctly identify and assess the business's risk for money laundering, drug trafficking, or conducting business in high-risk locations could compromise the entire AML Compliance Program.

- Overlooking the details of the Compliance Program. Ensuring the Compliance Program includes written policies, procedures, and internal controls is crucial, as is accurately documenting the responsibilities of the Compliance Officer.

- Insufficient employee training documentation. It's essential that all employees processing MSB transactions receive AML Compliance related training, and records of this training must be well documented and stored for a minimum of 5 years.

Addressing these potential pitfalls can significantly enhance the effectiveness and compliance of your Independent Review, benefiting your business’s standing with regulators.

Documents used along the form

When managing compliance and regulatory requirements, especially pertaining to Anti-Money Laundering (AML) obligations, businesses often use several key documents alongside the Independent Review Form. These documents are essential for ensuring that all operations are up to industry standards and comply with legal regulations. They also serve as a reinforcement of a company's commitment to preventing any misuse of its services for illicit activities.

- AML Compliance Program Policy: This document outlines the business’s procedures and policies to detect, prevent, and report money laundering and terrorist financing. It includes details on customer due diligence, ongoing monitoring, and the roles and responsibilities of the Compliance Officer and other staff.

- Risk Assessment Report: A critical document that identifies and evaluates the risks of money laundering and terrorist financing specific to the business. It considers factors such as customer types, products and services offered, and geographical locations of operations.

- Employee Training Records: These records show that employees have received training on AML compliance, including recognizing and dealing with suspicious activities and transactions. This ensures that all staff are informed about compliance policies and procedures.

- Suspicious Activity Reporting (SAR) Procedures: Outlines the process for reporting suspicious activities to appropriate authorities. It includes identification of what constitutes suspicious behavior, how to document and report it, and employee responsibilities in the SAR process.

- Customer Identification Program (CIP): Describes the methods used by the business to verify the identity of its customers. This document is crucial for ensuring that the business knows with whom it is dealing, thereby reducing the risk of money laundering.

- Transaction Records: Detailed and accurate records of transactions processed by the business. These are crucial for audits and investigations by regulatory bodies and must be kept for a period as specified by law, usually five years.

Together, these documents form a comprehensive framework that supports the Independent Review Form in achieving a more thorough and effective compliance program. In essence, the synergy between these documents provides a robust defense against potential legal vulnerabilities and enhances the integrity of the business’s operations concerning AML regulations.

Similar forms

The Independent form shares similarities with an Internal Audit Report, as both aim to assess and verify compliance with regulatory requirements and internal policies. The key objective is to identify areas for improvement to ensure adherence with established protocols. In both documents, detailed examinations are conducted by parties with the requisite knowledge, but who are not directly involved in the operations under review, to maintain objectivity.

It also resembles a Risk Assessment Document, particularly in parts where it assesses the potential risk associated with the location of the business, the types of services offered, and whether these services are offered to high-risk areas. Both documents require a systematic evaluation of factors that could potentially compromise the integrity or security of operations.

Similar to a Compliance Training Manual, the Independent form includes a section that evaluates whether employees have received adequate training related to AML compliance. This involves assessing the comprehensiveness and currency of the training material, as well as verifying that employee understanding is tested and documented, aspects that are critical in both documents for fostering a culture of compliance.

This form can be likened to a Customer Identification Program (CIP) Checklist, especially in its focus on verifying that proper identification processes are in place for transactions exceeding certain thresholds. Like CIP checklists, the form requires verification of procedures for recording and reviewing customer IDs to prevent illicit activities.

It parallels a Regulatory Compliance Certification form, where businesses affirm their adherence to specific legal and regulatory standards. Both require businesses to document and certify that they have met prescribed compliance obligations, including but not limited to MSB registration, risk assessments, and implementation of a compliance program.

Similarly, it matches the structure of a Money Services Business (MSB) Registration Form in the segment where it asks about the MSB registration status. Both documents necessitate the disclosure of compliance with U.S. Department of the Treasury regulations, serving as a formal declaration of operating status within the regulatory framework.

The form is akin to a Compliance Program Review Checklist, focusing on evaluating the effectiveness and thoroughness of a business's compliance program, including policies, procedures, training, and internal controls. This section ensures that all elements designed to prevent and detect money laundering and other financial crimes are not only in place but are functional and comprehensive.

Dos and Don'ts

When filling out the Independent Review Form, following a set of best practices can ensure a more accurate and compliant review process. Below are five things you should and shouldn't do:

Things You Should Do:

- Complete all sections: Ensure every question, blank, and field is thoroughly filled out to maintain the integrity of the review.

- Use knowledgeable reviewers: The review must be conducted by individuals who are well-informed about AML requirements applicable to MSBs.

- Keep thorough records: Retain the completed form alongside compliance-related documents for a minimum of five years, as required.

- Provide detailed responses: In areas requiring explanations, provide comprehensive and clear information for a more effective assessment.

- Follow AML regulations: Ensure the review meticulously adheres to all Federal AML Regulations to confirm compliance.

Things You Shouldn't Do:

- Do not allow restricted individuals to conduct the review: Your Compliance Officer, anyone reporting to this officer, or any MoneyGram representative must not carry out the Independent Review.

- Avoid incomplete submissions: Leaving parts of the form blank can result in an incomplete assessment of your compliance program.

- Do not ignore training details: Failing to accurately report on the AML Compliance training programs for your employees can result in non-compliance issues.

- Avoid generalizations: Failing to specify the compliance program's effectiveness in various sections can lead to an inaccurate review.

- Do not forget to document updates: Any changes in the compliance program or relevant regulations should be documented and reviewed in the form.

Misconceptions

Understanding the Independent Review form for Anti-Money Laundering (AML) compliance might get tricky, and there are common misconceptions that people often come across. Here’s a breakdown of those misunderstandings:

- An Independent Review is optional.

This is incorrect. Federal AML regulations require an Independent Review of your Money Services Business (MSB). It’s not a choice but a legal obligation.

- The designated Compliance Officer can conduct the Review.

Contrary to this belief, the Independent Review cannot be conducted by your designated Compliance Officer, anyone who reports to the Compliance Officer, or any representative from MoneyGram. Independence is key.

- One-time compliance is enough.

Some might think once they’ve completed an Independent Review, they’re set for life. However, compliance is an ongoing process. Regular reviews are necessary as dictated by your compliance program and MoneyGram’s requirements.

- All areas of the evaluation are equally significant.

While every section of the Independent Review is important, areas such as the risk assessment, your compliance program's effectiveness, and transaction processes may require deeper analysis due to their critical nature in preventing money laundering.

- Small businesses are not targeted by money launderers.

This is a dangerous assumption. Regardless of size, businesses offering money services might be exploited to launder money or finance terrorism. Risk assessment forms part of the Independent Review for this reason.

- The Independent Review is solely about filling out a form.

Completing the form is just one part of it. The process involves a thorough examination of your MSB's policies, procedures, and compliance practices to ensure adherence to AML regulations.

- Keeping records of the Review is unnecessary.

It’s mandatory to file and store the completed Independent Review Form and any supporting documents with your compliance-related documents for at least 5 years. This documentation is critical for both internal reference and potential regulatory inspections.

Understanding these misconceptions helps in properly conducting an Independent Review, ensuring compliance with AML laws, and ultimately protecting your business from being misused for illicit activities.

Key takeaways

Fulfilling the requirements for an Independent Review of your Anti-Money Laundering (AML) Compliance Program is a crucial obligation. Adhering to these stipulations not only aligns with federal mandates but also fortifies your business’s defenses against money laundering activities. Here are four key takeaways regarding the completion and utilization of the Independent Review form that should guide you through this meticulous but vital process.

- Selecting an Independent Reviewer: It is imperative that the Independent Review of your Money Services Business (MSB) is executed by an individual or individuals who possess comprehensive knowledge of AML obligations pertinent to MSBs. Importantly, the reviewer must not be your designated Compliance Officer, anyone subordinate to them, or any representative from MoneyGram. This criterion ensures an unbiased evaluation of your compliance program.

- Document Retention: Once the Independent Review Form is duly filled out and signed by the reviewer, it must be securely stored alongside your compliance-related documents for a minimum of five years. This retention period is mandated to facilitate any future reviews or audits by regulatory bodies, highlighting the importance of organized and accessible record-keeping practices.

- Comprehensive Completion: Every section, question, blank space, and field in the Independent Review Form must be meticulously completed. This not only encompasses details about your business and its AML compliance measures but also evaluates the inherent risks associated with the location of your business, the variety of financial services you offer, and your relationships with other MSB providers. A thorough review helps in identifying and mitigating potential vulnerabilities within your compliance program.

- Continual Preparedness: Always keep additional copies of the blank Independent Review Form at hand and avoid using the last copy. This practice ensures that you are always prepared for subsequent reviews, reflecting a proactive approach towards maintaining compliance with AML regulations. Staying ahead with preparations underscores the commitment of your business to adhering to federal compliance mandates efficiently.

By carefully following these guidelines, your business not only adheres to federal requirements but also strengthens its framework against the misuse for money laundering or related financial crimes. The Independent Review forms a critical component of your AML Compliance Program, ensuring that your operations remain transparent, accountable, and within the bounds of legal compliance.

Popular PDF Forms

Direct Deposit Slip - A financial tool for CalPERS recipients to directly manage where their benefits are deposited.

Letter Va Statement in Support of Claim Example - This document is essential for veterans who wish to submit additional information after their initial claim has been filed, allowing for the introduction of new evidence or arguments.

How to Stop Social Security Payments After Death - Facilities are required to detail any prior conditions contributing to the client's death, emphasizing comprehensive documentation.