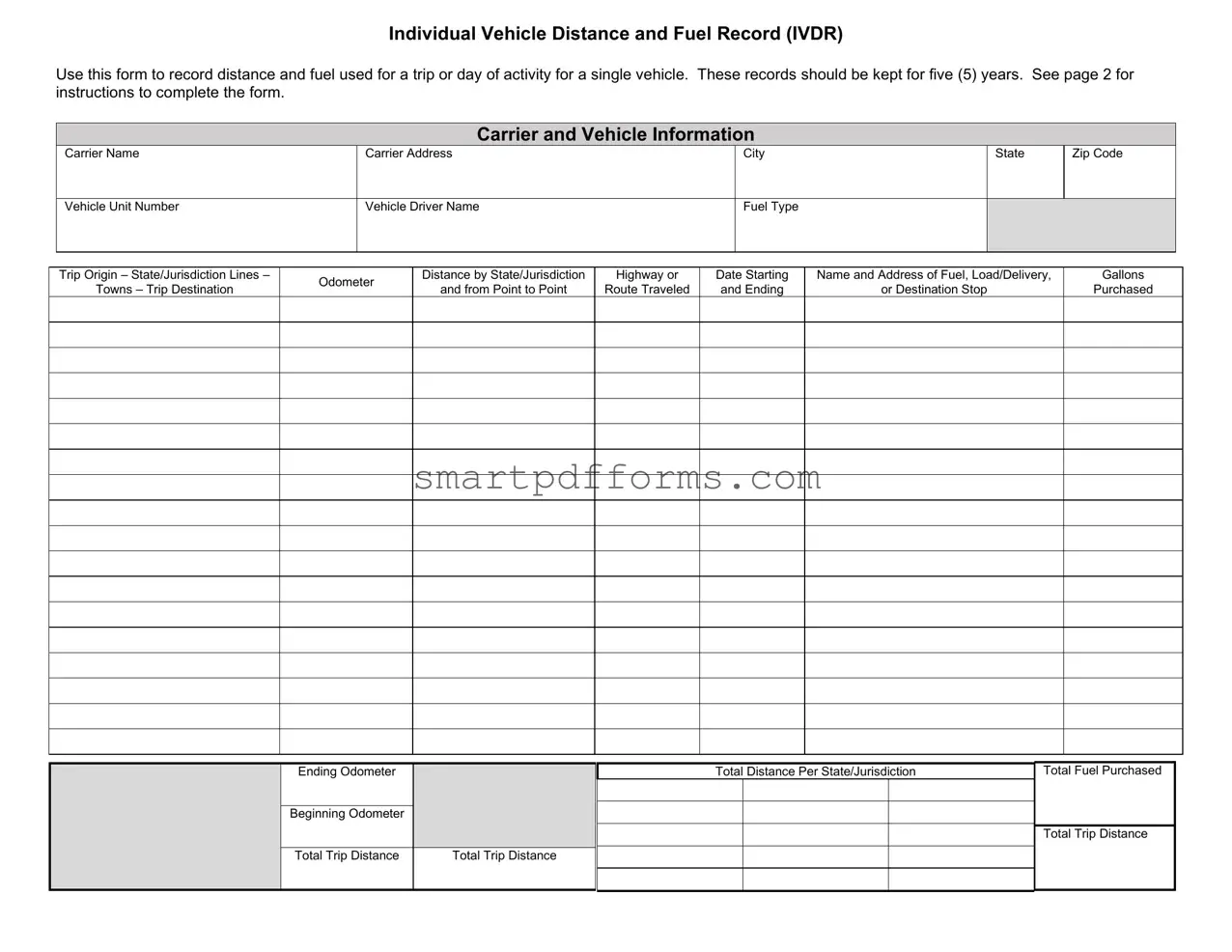

Blank Individual Vehicle Distance Fuel Report PDF Template

In the day-to-day operations of a commercial vehicle, accurately recording distances and fuel consumption is not just a best practice—it's an essential part of managing expenses and complying with regulatory requirements. The Individual Vehicle Distance and Fuel Record, commonly referred to as the IVDR form, serves as a reliable tool for this purpose. It meticulously captures critical details such as distances traveled, fuel used during a trip or day's activity, and specifics related to the vehicle and carrier information. With instructions clearly outlined to ensure the legibility and accuracy of the entered data, the IVDR form becomes an indispensable asset for both drivers and fleet managers alike. This form, requiring to be kept for five years, systematically delineates information from the vehicle unit number and driver’s name to the type of fuel used, trip origin, the route taken, and odometer readings, among other vital data points. The breakdown of instructions for completing the form includes entries for carrier name, address, trip destinations, gallons of fuel purchased, and detailed mileage calculations—culminating in a comprehensive trip summary. This thorough record-keeping facilitates not only internal fleet management but also adherence to regulatory audits, making the IVDR form an essential document for the transportation industry.

Preview - Individual Vehicle Distance Fuel Report Form

Individual Vehicle Distance and Fuel Record (IVDR)

Use this form to record distance and fuel used for a trip or day of activity for a single vehicle. These records should be kept for five (5) years. See page 2 for instructions to complete the form.

Carrier Name

Carrier and Vehicle Information

Carrier Address |

City |

State |

Zip Code |

|

|

|

|

Vehicle Unit Number

Vehicle Driver Name

Fuel Type

Trip Origin – State/Jurisdiction Lines –

Towns – Trip Destination

Odometer

Distance by State/Jurisdiction

and from Point to Point

Highway or

Route Traveled

Date Starting

and Ending

Name and Address of Fuel, Load/Delivery,

or Destination Stop

Gallons

Purchased

Ending Odometer

Beginning Odometer

Total Trip Distance |

Total Trip Distance |

Total Distance Per State/Jurisdiction

Total Fuel Purchased

Total Trip Distance

Instructions for Completing the Individual Vehicle Distance and Fuel Record

Please print all information entered on the IVDR. In case of an audit, it is very important for the information on this form to be legible.

1.Enter the Carrier’s name.

2.Enter the Carrier’s street address, city, state, and zip code.

Note: If you are leased on with a carrier based in Canada, enter the province name in the state field and the carrier’s postal code in the zip code field.

3.Enter the vehicle unit number also referred to as the truck number. This is not the same as a Vehicle Identification Number (VIN).

4.Enter the driver’s name who is completing the trip recorded on this form.

5.Enter the fuel type used in the vehicle, i.e., diesel, propane, gas, etc.

6.In the Trip Origin – State/Jurisdiction Lines – Towns – Trip Destination column, enter the following:

a.Trip Origin – the city and state/jurisdiction where the trip begins

b.State/Jurisdiction Lines – each state or jurisdiction line crossed

c.Towns where you load or unload

d.Trip Destination – the city and state/jurisdiction where the trip ends

7.In the Odometer column, enter the odometer reading which corresponds to each of the locations entered in #6 above.

8.In the Distance by State/Jurisdiction and from Point to Point column, enter the mileage between each of the locations entered in #6 above.

9.In the Highway or Route Traveled column, enter the road, highway or interstate traveled between each of the locations entered in #6 above.

10.In the Date Starting and Ending column, enter the date the trip began, the date you were in each location between the origin and destination locations, and the date the trip ended.

11.In the Name and Address of Fuel/Load and Delivery, or Destination column, enter the street address, city, state/jurisdiction, and zip or postal code for each location entered in #6 above.

12.In the Gallons Purchased column, enter the total number of gallons of fuel purchased at each fuel stop.

13.In the bottom section of the form, enter the Ending Odometer reading and the Beginning Odometer reading. The Total Trip Distance is the difference between these two readings.

14.The second field named Total Trip Distance is the total of all miles entered in the Odometer column. The number in this field should equal the total trip distance determined in #13 above.

15.In the Total Distance by State/Jurisdiction section, add the miles listed for each state or jurisdiction in #8 above and enter the total for each state.

16.In the Total Fuel Purchased field, enter the total number of gallons purchased during the trip. This is determined by adding the number of gallons purchased at each stop and listed in #12 above.

17.In the last Total Trip Distance field, add all miles for each state/jurisdiction (listed in #15) and enter the total. This total should match #13 and #14 above.

USE THIS FILLED OUT FORM AS A GUIDE - RESPONSES WILL VARY

Carrier and Vehicle Information

Carrier Name |

Carrier Address |

City |

State |

Zip Code |

|

|

IRP Trucking Co. |

7064 Crowner Dr |

|

|

Dimondale |

MI |

|

|

48821 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Unit Number |

Vehicle Driver Name |

|

|

Fuel Type |

|

|

|

|

|

|

|

|

|||

|

101 |

John Smith |

|

|

Diesel |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Trip Origin – State/Jurisdiction Lines – |

Odometer |

|

Distance by State/Jurisdiction |

Highway or |

Date Starting |

Name and Address of Fuel, Load/Delivery, |

|

Gallons |

|

||||||

|

|

Towns – Trip Destination |

|

and from Point to Point |

Route Traveled |

and Ending |

or Destination Stop |

|

|

|

|

Purchased |

|

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Start – Dimondale, MI |

45,678 |

|

|

|

|

7/1/20 |

7064 Crowner Dr., Dimondale, MI - |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Home |

|

|

|

|

|

|

|

|

Ohio State Line |

45798 |

120 MI |

96, 23 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Toledo, OH |

45810 |

12 OH |

|

|

|

Fuel - Speedway, Toledo, OH |

|

|

100 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canton, OH |

45969 |

159 OH |

80/90, 77 |

|

|

Rest Stop |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky State Line |

46314 |

345 OH |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisville, KY |

46334 |

20 KY |

70, 71 |

|

|

Delivery - 1234 Louie Road, |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Louisville, KY |

|

|

|

|

|

|

|

|

Ohio State Line |

46354 |

20 KY |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cincinnati, OH |

46454 |

100 OH |

71 |

|

|

Delivery – 345 Blue Rd., Canton, |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

OH |

|

|

|

|

|

|

|

|

Michigan State Line |

46654 |

200 OH |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

End - Dimondale, MI |

46776 |

122 MI |

75, 96 |

7/2/20 |

7064 Crowner Dr., |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Dimondale, MI - Home |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Ending Odometer |

|

|

|

|

Total Distance Per State/Jurisdiction |

|

|

Total Fuel Purchased |

|

|||||

|

|

|

46776 |

|

|

|

MI |

|

242 |

|

|

|

|

100 Gal |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

OH |

|

816 |

|

|

|

|

|

|||

|

|

|

Beginning Odometer |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

45,678 |

|

|

|

KY |

|

40 |

|

|

|

|

Total Trip Distance |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1098 |

|

|

|

|

|

|

Total Trip Distance |

|

Total Trip Distance |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

1098 |

1098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Used to record distance and fuel for a single vehicle per trip or day. |

| Retention Period | These records should be kept for five (5) years. |

| Primary Components | Carrier and Vehicle Information, Trip Details, Fuel Details, Odometer Readings, Total Distance, and Fuel Purchase Records. |

| Completion Instructions | Print all information to ensure legibility for audits. |

| Information Required | Includes carrier name, address, vehicle unit number, driver name, fuel type, trip origin and destination, odometer readings, and fuel purchases. |

| Distance Calculations | Total Trip Distance calculated from beginning and ending odometer readings and distances by state/jurisdiction. |

| Fuel Purchases | Record the total gallons of fuel purchased at each stop. |

| Audit Relevance | Accurate and legible records are crucial for audit purposes. |

| Example Fill-out | Provided to guide the recording of trip from Dimondale, MI, through various states, detailing fuel purchases and stops. |

Instructions on Utilizing Individual Vehicle Distance Fuel Report

Filling out the Individual Vehicle Distance and Fuel Report form is a straightforward process that requires attention to detail. This document is essential for tracking the distance traveled and fuel consumed by a vehicle over a trip or during a day of activity. The information provided will not only help in managing expenses but also in complying with regulatory requirements. Maintained records should be kept for a period of five years, making them available for auditing purposes. Here’s how to complete the form properly:

- Enter the Carrier’s name. This is the name of the company or individual that owns the vehicle.

- Provide the Carrier’s complete address. Include the street address, city, state, and ZIP code. If the carrier is based in Canada, use the province name for the state and the postal code for the ZIP code.

- List the vehicle unit number. This is often referred to as the truck number and differs from the Vehicle Identification Number (VIN).

- Write the driver’s name. This should be the name of the driver undertaking the recorded trip.

- Specify the fuel type used. Indicate whether it’s diesel, propane, gas, etc.

- Detail the trip’s logistics. In the specified column, enter the trip origin, list each state or jurisdiction crossed, note towns for loading or unloading, and mark the trip destination – including cities and states/jurisdictions.

- Record odometer readings. Correspond these with each location mentioned in the above step.

- Enter distances traveled. In the designated column, note the mileage between the recorded locations.

- List highways or routes. Specify which roads, highways, or interstates were traveled between the locations.

- Mark dates of travel. Include the start date, dates you were in each location, and the end date of the trip.

- Specify fuel/load and delivery destinations. Provide the street address, city, state/jurisdiction, and ZIP or postal code for locations associated with fueling, loading, or unloading.

- Record gallons purchased. In the appropriate column, enter the total gallons of fuel purchased at each stop.

- Enter ending and beginning odometer readings. The total trip distance can be calculated by finding the difference between these two figures.

- Calculate the total trip distance again. This time, use the sum of all miles entered in the Odometer column. It should match the total determined in the previous step.

- Summarize the total distance by state/jurisdiction. Add the miles for each state or jurisdiction as listed and enter the totals.

- Enter the total fuel purchased. Add up the gallons purchased at each stop as listed and record the total.

- Acknowledge the final total trip distance. Add all miles for each state/jurisdiction as listed. Ensure this total matches the ones determined in previous relevant steps.

By following these steps, the Individual Vehicle Distance and Fuel Report form will be correctly filled out, ensuring accurate tracking of your vehicle's travel and fuel consumption. Remember to review the form for completeness and accuracy before submitting it for auditing or compliance purposes.

Obtain Answers on Individual Vehicle Distance Fuel Report

What is the Individual Vehicle Distance and Fuel Report (IVDR) used for?

The IVDR is designed to record the distance traveled and fuel used by a single vehicle for a trip or day of activity. It collects specific information about the trip including the journey's start and end points, fuel purchases, and mileage covered, making it essential for financial and regulatory purposes, such as fuel tax reporting.

How long should the IVDR be kept?

It's important to keep these records for five years. This duration ensures that you have the necessary documentation available for audits or any other reporting requirements that might arise.

What information is required on the IVDR?

- Carrier name and address

- Vehicle unit number and driver’s name

- Fuel type used

- Trip details including origin, destination, and routes taken

- Odometer readings at various points

- Fuel purchases during the trip

All the above information helps in calculating the total distance traveled and fuel consumed, offering insights for accurate fuel management and reporting.

Why is it important to print all information entered on the IVDR legibly?

In case of an audit, being able to present clear and legible records is crucial. It helps in verifying the information without discrepancies, ensuring compliance with regulations.

How do you calculate the Total Trip Distance?

The Total Trip Distance is calculated by noting the vehicle's odometer reading at the beginning and end of the trip and finding the difference between these two numbers. This provides the total distance covered directly.

How is the total fuel purchased calculated?

You calculate the total fuel purchased by adding up the gallons of fuel obtained at each stop during the trip. This total is crucial for understanding fuel efficiency and for tax reporting.

What if the carrier is based in Canada?

If the carrier you are leased on with is based in Canada, you should enter the province name in the state field and the carrier’s postal code in the zip code field. This adjustment ensures accurate documentation for international carriers.

Common mistakes

When filling out the Individual Vehicle Distance and Fuel Report form, people often make mistakes that can be avoided. These mistakes can cause inaccuracies that might lead to problems, especially during audits. Here are common mistakes to watch out for:

- Not printing clearly: All information on the form should be printed clearly. Unclear handwriting can lead to misunderstandings or incorrect data interpretation during an audit.

- Incorrect carrier or vehicle information: Ensure the carrier name, address, and vehicle unit number are accurate and match the vehicle being reported.

- Misidentifying the fuel type: Clearly specify the type of fuel used for the trip. Mixing up fuel types can lead to erroneous calculations of fuel efficiency.

- Incomplete trip details: It’s essential to include complete details about the trip origin, destination, and any stops or state lines crossed. Missed details can result in inaccurate trip distances.

- Omitting odometer readings: Failing to record the odometer readings at each point can lead to incorrect total trip distance calculations.

- Skipping distance entries: Not entering the distance by state or from point to point can distort the total distance traveled and fuel usage data.

- Leaving out fuel purchase information: Every fuel purchase must be documented, including the name and address of the fuel stop and gallons purchased. Omissions here affect the total fuel purchased calculation.

- Incorrect totals and calculations: Double-check the mathematics for the total trip distance, total fuel purchased, and distance per state. Incorrect totals can lead to discrepancies during audits.

In addition to these common mistakes, keeping the following tips in mind can help ensure the form is filled out correctly:

- Always use a pen with black or blue ink for better legibility.

- Review each section of the form upon completion to ensure no field has been left blank.

- Update the form immediately after each trip segment to avoid forgetting crucial details.

- Maintain records in an organized manner, as these need to be retained for five years.

By avoiding these mistakes, you can ensure your Individual Vehicle Distance and Fuel Record forms are accurate and compliant, simplifying your record-keeping and audit processes.

Documents used along the form

When managing a vehicle's travel and fuel usage, the Individual Vehicle Distance and Fuel Record (IVDR) form is a crucial document. However, it usually functions within a suite of other documents that provide a comprehensive view of a vehicle's operations. Here's a look at some of the additional forms and documents often used alongside the IVDR form.

- Vehicle Maintenance Log: This document tracks all maintenance work performed on a vehicle, ensuring it remains in good working order.

- Driver's Daily Log Book: Used by drivers to record their duty status for each 24-hour period, including off-duty, sleeping, driving, and on-duty but not driving times.

- Fuel Purchase Receipts: These receipts are critical for corroborating the fuel purchases entered in the IVDR, often required during audits.

- Vehicle Inspection Reports: Pre-trip and post-trip inspection reports are crucial for identifying and recording any issues with the vehicle that might affect its safety or operability.

- Freight Bills or Bills of Lading: These documents act as a receipt for cargo delivery, detailing the nature, quantity, and destination of the goods being transported.

- Expense Reports: Any expenses incurred during trips, such as tolls, lodging, or meals, are recorded here for reimbursement and accounting purposes.

- Time Sheets: For drivers paid by the hour, this document records the number of hours worked.

- International Fuel Tax Agreement (IFTA) Quarterly Tax Return: This form is necessary for commercial vehicles traveling across state lines, summarizing the fuel used, miles traveled, and taxes owed per jurisdiction.

- Incident/Accident Reports: In the case of an accident or incident, this form details what happened, who was involved, and any damage to the vehicle.

- Route Plans and Maps: These outline the planned route for a trip, often including alternative routes in case of road closures or heavy traffic.

These documents collectively ensure that a vehicle's use is efficiently managed and thoroughly documented, serving not only compliance needs but also assisting in operational and financial management. Keeping accurate and up-to-date records can ease the burden of regulatory audits and contribute to smoother, more cost-effective fleet operations.

Similar forms

Vehicle Maintenance Record: This form tracks the servicing history of a vehicle, similar to the Individual Vehicle Distance and Fuel Record (IVDR), which documents fuel usage and distance traveled. Both forms play crucial roles in managing vehicle operational efficiency and ensuring compliance with regulatory requirements.

Driver's Daily Log Book: Used by drivers to record their hours of service, this document is akin to the IVDR as both are mandated for regulatory compliance and auditing purposes. They ensure that drivers and vehicles operate within the legal limits for safety and efficiency.

Expense Report Form: Like the IVDR, an expense report form details costs incurred during business travel, consolidating information such as fuel purchases, similar to how the IVDR tracks fuel gallons purchased along a trip. Both serve as financial accountability tools for businesses.

Truck Load Sheet: This document records the details of cargo being transported, paralleling the IVDR's role in logging the specifics of a journey's load/delivery stops. Each form contributes to the operational transparency and logistics efficiency of transportation activities.

Fuel Tax Report: Required for calculating taxes due on fuel purchases, this report shares similarities with the IVDR by needing accurate fuel purchase records across different jurisdictions. Both are essential for compliance with state and federal tax regulations.

Distance Summary Sheet: It tallies the total distance traveled by a vehicle over a certain period, akin to the IVDR which compiles trip distances, including odometer readings and miles traveled per state/jurisdiction. These summaries support operational analysis and planning.

International Fuel Tax Agreement (IFTA) Quarterly Tax Return: This form, like the IVDR, aggregates distance traveled and fuel purchased across member jurisdictions for tax reporting purposes. They are instrumental in facilitating the equitable distribution of fuel taxes among states and provinces.

Vehicle Inspection Report: Although focusing on vehicle condition rather than travel specifics, this report is similar to the IVDR in its necessity for compliance, safety, and audit purposes. Regular inspections complement the detailed travel and fuel consumption logs for overall fleet management.

Trip Planner Sheet: Used to outline the route and anticipated stops for a journey, this planning tool mirrors the IVDR's role in recording actual travel details, including routes taken and stops made. Both are vital for efficient logistics and strategic planning.

Dos and Don'ts

Filling out the Individual Vehicle Distance and Fuel Report accurately is crucial for compliance and accuracy in record-keeping. Understanding what to do, and what not to do, can ensure the process is completed correctly. Follow these guidelines:

- Do ensure that you print clearly and legibly. This is vital for audit purposes.

- Do accurately enter the Carrier's name, address, and other carrier and vehicle information as requested on the form.

- Do fill in the vehicle unit number carefully, remembering that it is different from the Vehicle Identification Number (VIN).

- Do record the driver's name who completed the trip. This is crucial for accountability.

- Do specify the type of fuel used in the vehicle, as this is essential for calculating the efficiency and costs associated with the trip.

- Do meticulously record the trip details, including origin, destination, and all towns, states, or jurisdictions in between.

- Do not guess odometer readings or fuel purchases. Always use actual figures to ensure the accuracy of the report.

- Do enter the total trip distance correctly, ensuring it matches the sum of distances recorded in the Odometer column and the Total Distance by State/Jurisdiction.

- Do not overlook the importance of recording the date for each segment of the trip. This information is critical for compliance and historical data.

- Do not leave any fields blank. If a section does not apply, clearly mark it as "N/A" (not applicable) to indicate it was not overlooked.

By adhering to these guidelines, anyone filling out the Individual Vehicle Distance and Fuel Report can ensure they provide complete and accurate information, thereby avoiding potential issues during audits and helping maintain precise records for compliance and planning purposes.

Misconceptions

When it comes to filling out the Individual Vehicle Distance and Fuel Record (IVDR), there are several misconceptions that can lead to inaccuracies or confusion. Understanding these misconceptions can help ensure that the process is carried out more smoothly and effectively.

Misconception 1: The form is only for long trips. Some may think the IVDR is designed only for long-haul journeys. However, it is intended for recording any trip or day of activity, regardless of the distance covered. This includes short trips within a single jurisdiction or state.

Misconception 2: Vehicle Identification Number (VIN) is required. Unlike what some might believe, the form requests the vehicle unit number, not the Vehicle Identification Number (VIN). These two are not interchangeable; the unit number is specific to the carrier's internal fleet identification system.

Misconception 3: Only diesel fuel types need to be recorded. Another common error is the assumption that the form is only for vehicles that use diesel fuel. In contrast, any type of fuel, such as gas, propane, or diesel, should be documented in the IVDR, which asks for the fuel type used during the trip.

Misconception 4: Details of every stop are not necessary. It's also mistakenly believed that not all stops need to be detailed, particularly short or seemingly insignificant ones. In reality, the form requires information on every fuel, load/delivery, or destination stop, including the name and address for each location entered.

Misconception 5: Only the final odometer reading matters. Some may think that recording just the final odometer reading of the trip suffices. However, both the beginning and ending odometer readings are crucial for accurately determining the total trip distance.

Misconception 6: Recording every state crossed is optional. A common oversight is the failure to document each state or jurisdiction the vehicle enters. The IVDR requires listing every state/jurisdiction crossed, along with the miles traveled within each, to accurately calculate total distance per state/jurisdiction.

Misconception 7: The form doesn't need to be legible if all information is provided. Even if all the information is filled in, some might not prioritize legibility. However, the instructions emphasize the importance of printing all information clearly, as legible records are essential in case of an audit.

By clarifying these misconceptions, carriers and drivers can better understand the requirements of the IVDR form, ensuring that their records are accurate, comprehensive, and in compliance with record-keeping standards.

Key takeaways

Filling out the Individual Vehicle Distance and Fuel Record (IVDR) form correctly is crucial for accurate record-keeping and compliance with regulatory requirements. Below are key takeaways to ensure the form is completed properly:

- Accurate Details: It's essential to input all information clearly and accurately, especially since these records must be retained for five years. Incorrect or illegible entries can lead to complications, especially during audits.

- Comprehensive Tracking: Every segment of the trip, including the start and end points, states or jurisdictions crossed, and specific towns for loading or unloading, must be meticulously recorded. This ensures that the distance and fuel usage are accurately captured for each leg of the journey.

- Meticulous Fuel Recording: Recording the exact amount of fuel purchased at each stop is critical. This information helps in monitoring fuel efficiency and is crucial for financial and environmental considerations.

- Consistency in Calculations: The form requires calculations of total trip distance, total distance per state/jurisdiction, and total fuel purchased. Ensuring consistency in these calculations is vital for accurate reporting. Discrepancies in these figures can lead to misunderstandings or misrepresentations of vehicle performance and operational costs.

By paying attention to these details, carriers and drivers can ensure their IVDR forms are filled out comprehensively and accurately, thus maintaining compliance and optimizing operational efficiency.

Popular PDF Forms

How Much Does It Cost to Join Amway - The terms and conditions delve into the contractual relationship between Amway and the IBO, indicating rights, responsibilities, and the structure of the business opportunity.

Transmittal Form Meaning - Offers a streamlined method for managing the return of loaned prints or documents, ensuring accountability.