Blank Insolvency Irs PDF Template

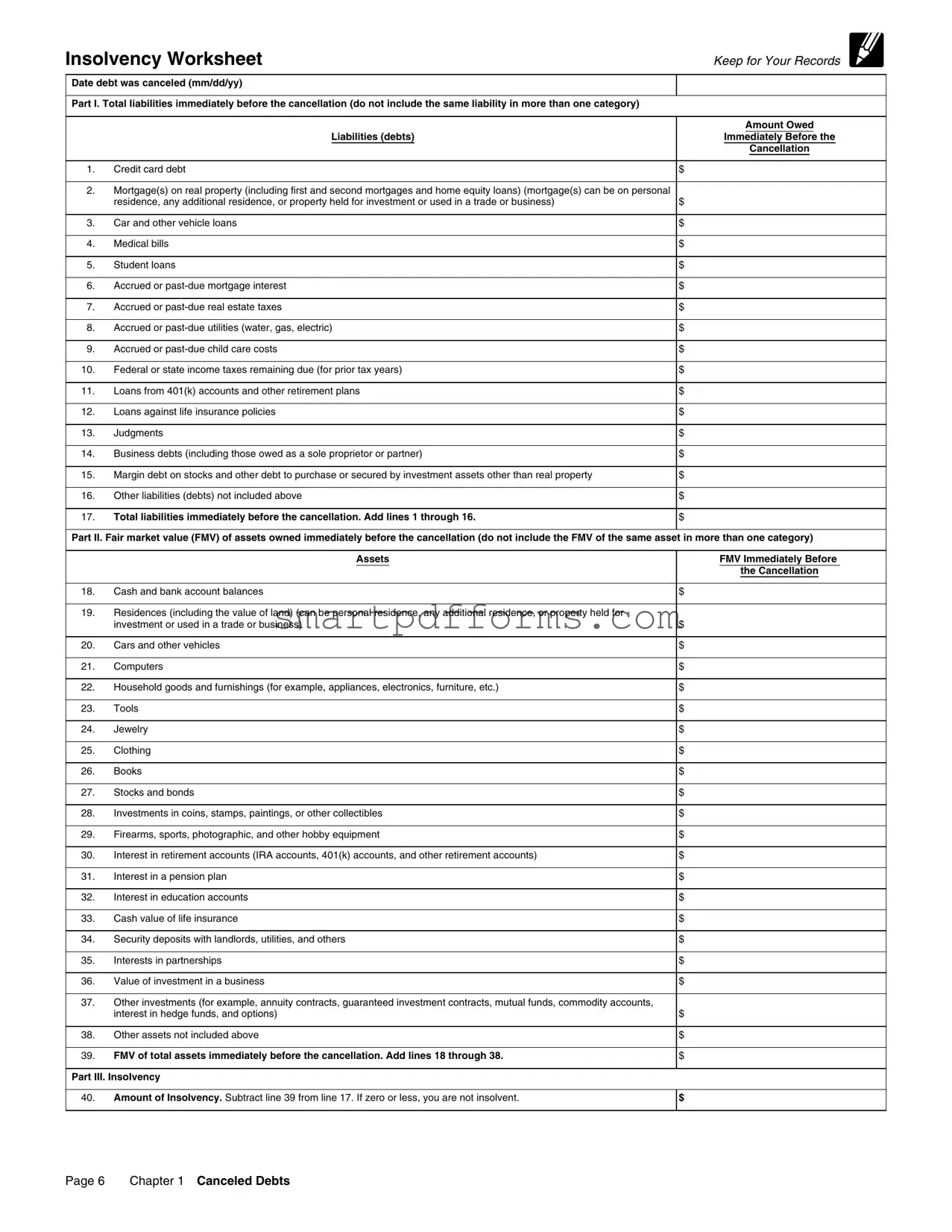

When debt is canceled, it can provide relief to individuals facing financial distress. However, this cancellation may come with tax implications that are often complex and misunderstood. The Insolvency IRS Form, namely the Insolvency Worksheet, serves as a critical tool for those navigating the cancellation of debt and its impact on their taxes. This form allows individuals to determine whether they were insolvent immediately before their debt was canceled. Insolvency, in this context, means that an individual's total liabilities exceeded their total assets. The worksheet details various categories of liabilities and assets, ranging from credit card debt and mortgages to the fair market value of personal and real property. By meticulously calculating the amounts owed and the value of their assets, individuals can derive their insolvency amount. This figure is crucial for tax reporting purposes, as insolvency can exclude canceled debt from taxable income under certain conditions. The form's comprehensive approach to categorizing and evaluating one's financial standing before the cancellation of debt offers a structured way to assess insolvency and its implications for tax obligations.

Preview - Insolvency Irs Form

Insolvency Worksheet

Keep for Your Records

Date debt was canceled (mm/dd/yy)

Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category)

|

Amount Owed |

Liabilities (debts) |

Immediately Before the |

|

Cancellation |

|

|

1. Credit card debt |

$ |

2.Mortgage(s) on real property (including first and second mortgages and home equity loans) (mortgage(s) can be on personal

|

residence, any additional residence, or property held for investment or used in a trade or business) |

$ |

|

|

|

3. |

Car and other vehicle loans |

$ |

|

|

|

4. |

Medical bills |

$ |

|

|

|

5. |

Student loans |

$ |

|

|

|

6. |

Accrued or |

$ |

|

|

|

7. |

Accrued or |

$ |

|

|

|

8. |

Accrued or |

$ |

|

|

|

9. |

Accrued or |

$ |

|

|

|

10. |

Federal or state income taxes remaining due (for prior tax years) |

$ |

|

|

|

11. |

Loans from 401(k) accounts and other retirement plans |

$ |

|

|

|

12. |

Loans against life insurance policies |

$ |

|

|

|

13. |

Judgments |

$ |

|

|

|

14. |

Business debts (including those owed as a sole proprietor or partner) |

$ |

|

|

|

15. |

Margin debt on stocks and other debt to purchase or secured by investment assets other than real property |

$ |

|

|

|

16. |

Other liabilities (debts) not included above |

$ |

|

|

|

17. |

Total liabilities immediately before the cancellation. Add lines 1 through 16. |

$ |

Part II. Fair market value (FMV) of assets owned immediately before the cancellation (do not include the FMV of the same asset in more than one category)

|

Assets |

FMV Immediately Before |

|

|

the Cancellation |

|

|

|

18. |

Cash and bank account balances |

$ |

19.Residences (including the value of land) (can be personal residence, any additional residence, or property held for

|

investment or used in a trade or business) |

$ |

|

|

|

20. |

Cars and other vehicles |

$ |

|

|

|

21. |

Computers |

$ |

|

|

|

22. |

Household goods and furnishings (for example, appliances, electronics, furniture, etc.) |

$ |

|

|

|

23. |

Tools |

$ |

|

|

|

24. |

Jewelry |

$ |

|

|

|

25. |

Clothing |

$ |

|

|

|

26. |

Books |

$ |

|

|

|

27. |

Stocks and bonds |

$ |

|

|

|

28. |

Investments in coins, stamps, paintings, or other collectibles |

$ |

|

|

|

29. |

Firearms, sports, photographic, and other hobby equipment |

$ |

|

|

|

30. |

Interest in retirement accounts (IRA accounts, 401(k) accounts, and other retirement accounts) |

$ |

|

|

|

31. |

Interest in a pension plan |

$ |

|

|

|

32. |

Interest in education accounts |

$ |

|

|

|

33. |

Cash value of life insurance |

$ |

|

|

|

34. |

Security deposits with landlords, utilities, and others |

$ |

|

|

|

35. |

Interests in partnerships |

$ |

|

|

|

36. |

Value of investment in a business |

$ |

37.Other investments (for example, annuity contracts, guaranteed investment contracts, mutual funds, commodity accounts,

|

interest in hedge funds, and options) |

$ |

|

|

|

38. |

Other assets not included above |

$ |

|

|

|

39. |

FMV of total assets immediately before the cancellation. Add lines 18 through 38. |

$ |

Part III. Insolvency

40.Amount of Insolvency. Subtract line 39 from line 17. If zero or less, you are not insolvent.

$

Page 6 |

Chapter 1 Canceled Debts |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | The Insolvency IRS Form is used to determine if a taxpayer was insolvent immediately before their debt was canceled. Insolvency occurs when total liabilities exceed the fair market value of total assets. |

| Components of Insolvency | The form includes three parts: Total liabilities immediately before the cancellation, Fair Market Value (FMV) of assets owned immediately before the cancellation, and calculation of insolvency amount by subtracting the total FMV of assets from total liabilities. |

| Type of Debts and Assets Included | It covers various types of debts such as credit card debt, mortgage loans, vehicle loans, medical bills, student loans, business debts, and more. Assets include cash, residences, vehicles, household goods, investments, and retirement accounts, among others. |

| Governing Law | This form is governed by federal law under the United States Internal Revenue Code (IRC) related to the treatment of canceled debts, specifically addressing the issue of insolvency and how it affects gross income reporting. |

Instructions on Utilizing Insolvency Irs

When a debt is canceled, especially if it's significant, it's important to understand the financial implications. The IRS provides a way to potentially reduce your tax liability through the concept of insolvency. Filling out the Insolvency Worksheet is a crucial step in this process. This document requires you to take a detailed look at your financial situation just before your debt was forgiven. By comparing your liabilities to your assets, you can determine if you were insolvent and by how much. This amount could affect your taxable income. Let's walk through how to fill out the Insolvency Worksheet step by step.

- Gather all financial documents related to debts and assets. This includes bank statements, mortgage documents, loan statements, and any other documents that show what you owed and owned.

- In the "Date debt was canceled" field, enter the date your debt was forgiven. This date is crucial for assessing your financial situation at the specific time of cancellation.

- Under Part I, start with your liabilities. For each line from 1 to 16, enter the amount owed for:

- Credit card debt

- Mortgages on real property

- Car and other vehicle loans

- Medical bills, and so on, ending with "Other liabilities."

- Add up the amounts from lines 1 through 16 and write the total in the space provided for line 17 ("Total liabilities immediately before the cancellation").

- Moving on to Part II, focus on your assets immediately before the debt cancellation. Begin with the cash and bank account balances, and continue down the list from lines 18 to 38, which include personal residences, vehicles, household goods, and more. Don't duplicate any asset in more than one category.

- Add up the amounts from lines 18 through 38 to find the total FMV of your assets. Enter this total in the space provided for line 39.

- To determine your insolvency amount, subtract line 39 from line 17 and enter the result in line 40. This is the crucial number indicating your degree of insolvency immediately before the debt cancellation. If the result is zero or a negative number, you were not insolvent.

After completing the worksheet, keep a copy for your records. This document does not need to be submitted with your tax return but should be retained as proof of your calculations and financial status if the IRS requires verification. If you've determined that you were insolvent, consulting a tax advisor or the IRS for guidance on how to report this on your tax return may be beneficial. Remember, the goal is to accurately reflect your financial situation to ensure you're only paying the taxes you truly owe.

Obtain Answers on Insolvency Irs

What is an Insolvency IRS Form?

The Insolvency IRS Form, not a formal IRS form but rather a worksheet, helps individuals determine if they were insolvent immediately before having a debt canceled. Insolvency occurs when your total liabilities (what you owe) exceed your total assets (what you own). This worksheet is useful for preparing for tax obligations related to canceled debts.

How do you calculate insolvency using the worksheet?

To calculate insolvency, list your liabilities and the fair market value (FMV) of your assets immediately before the cancellation of your debt. Subtract the total FMV of your assets from the total amount of your liabilities. If the result is zero or a negative number, you were insolvent.

What types of debts and assets should be included on the Insolvency Worksheet?

On the Insolvency Worksheet, you should include a broad range of liabilities and assets. For debts, this includes credit card debt, mortgages, vehicle loans, medical bills, student loans, and more. For assets, include cash, bank accounts, personal and investment properties, vehicles, household goods, and various investments among others.

Who needs to use the Insolvency Worksheet?

Individuals who have had debt canceled during the tax year and want to determine if they were insolvent immediately before the debt cancellation should use the Insolvency Worksheet. This worksheet can help ascertain whether the canceled debt must be included as income on their tax return.

Is canceled debt always taxable?

Canceled debt is generally considered taxable income by the IRS. However, if you were insolvent immediately before the cancellation, you might not have to include the canceled amount in your income, or you might qualify to exclude part of it.

How do you report insolvency to the IRS?

If you were insolvent and qualify to exclude canceled debt from your income, you must file the IRS Form 982, 'Reduction of Tax Attributes Due to Discharge of Indebtedness', along with your tax return. You don't need to submit the Insolvency Worksheet, but it's crucial to keep it for your records in case the IRS requests documentation.

Can insolvency exclude any type of canceled debt from being taxed?

The insolvency exclusion can apply to most types of canceled debt, including credit card debt, car loans, and mortgages. However, certain debts like federal student loans forgiven under a public service program or as a result of death or disability may have different tax implications.

What happens if I make a mistake on my Insolvency Worksheet?

If you discover a mistake on your Insolvency Worksheet that affects your tax return, you should amend your return using Form 1040-X, Amended U.S. Individual Income Tax Return, and adjust your income, credits, or deductions based on the corrected worksheet. Keeping accurate records and consulting with a tax advisor if uncertain about the process is important.

Common mistakes

Filling out the Insolvency IRS form requires careful attention to detail. Many individuals inadvertently make errors during this process, leading to potential consequences with the IRS. It is crucial to avoid these common mistakes to ensure the form is completed accurately and effectively.

Not accurately listing all liabilities and assets: It's essential to include every liability and asset. Omitting items can lead to an incorrect insolvency calculation.

Double-counting certain debts or assets: Some may mistakenly include the same liability or asset in multiple categories, skewing the total figures.

Misunderstanding the fair market value (FMV) of assets: Often, individuals either underestimate or overestimate the FMV of their assets, affecting the accuracy of their financial situation portrayal.

Forgetting to add accrued interest on debts: Many forget to include accrued or past-due interest on mortgages, taxes, and other liabilities, which can significantly impact the total liability amount.

Overlooking smaller assets: Items such as jewelry, tools, or electronics, though seemingly minor, can add up and must be included to accurately represent one's asset base.

Failing to list all debts: Every debt, regardless of its size, should be included. Overlooking even minor debts like past-due utilities or childcare costs can result in inaccuracies.

Not keeping adequate records: Without proper documentation, claiming insolvency can be challenging. Individuals should keep detailed records of all liabilities and assets.

Incorrectly calculating retirement accounts or life insurance: Misunderstanding how to accurately report these can lead to significant discrepancies in the total assets.

Not consulting with a professional: Given the complexities of the IRS form and the potential for significant financial implications, seeking professional advice is often advisable.

To avoid these pitfalls, individuals are encouraged to:

Meticulously review each section of the form, ensuring no item is overlooked.

Consult current market analyses or professional appraisals to determine accurate FMVs for their assets.

Maintain organized and comprehensive records of all financial transactions, debts, and asset acquisitions.

Seek guidance from financial advisers or tax professionals experienced in handling insolvency matters with the IRS.

By being vigilant and thorough in filling out the Insolvency IRS form, individuals can accurately represent their financial situation and navigate the complexities of declaring insolvency with confidence.

Documents used along the form

When dealing with the complex process of addressing insolvency for tax purposes, it's important to understand that the IRS Insolvency form is just a starting point. To accurately complete this process, several other forms and documents are often required. These documents help paint a full picture of an individual's financial situation, ensuring that the insolvency claim is substantiated with comprehensive evidence.

- Form 1040 (U.S. Individual Income Tax Return): This form is the standard federal income tax form used to report an individual's gross income. It's often needed alongside the Insolvency Worksheet to assess the taxable income implications of debt cancellation.

- Form 982 (Reduction of Tax Attributes Due to Discharge of Indebtedness): This form helps individuals report the exclusion of forgiven debt from gross income under certain conditions, such as insolvency. It's directly related to the IRS Insolvency Worksheet's outcomes.

- Statement of Financial Affairs: Often a required part of bankruptcy filings, this document provides a comprehensive overview of the debtor's financial transactions and balances. It might be used to corroborate the information on the Insolvency Worksheet.

- Bank Statements: Recent bank statements are crucial for verifying cash and bank account balances noted in the Insolvency Worksheet, serving as proof of the financial situation immediately before the debt cancellation.

- Property Appraisals: To confirm the fair market value of assets listed in the worksheet, especially for real estate and personal property, appraisals provide necessary, accurate valuations.

- Loan Statements and Mortgage Documents: These documents substantiate the amounts listed as liabilities in the worksheet, particularly for mortgages, vehicle loans, and other significant debts.

- Pay Stubs and Employment Records: These can help verify income levels and financial commitments, providing context to the insolvency calculation, especially when assessing an individual's ability to pay back debts.

- Credit Report: A current credit report can offer a comprehensive view of an individual's debt landscape, including debts that may not be regularly invoiced or have been overlooked.

Navigating the insolvency process with the IRS requires a deep dive into one's financial situation, with multiple documents and forms coming into play. Understanding and correctly deploying these documents can significantly impact the outcome of an insolvency claim, often leading to a more favorable tax position. Thus, attention to detail and the ability to gather comprehensive financial information are critical steps in this intricate process.

Similar forms

The 1040 Form, used for individual income tax returns, shares similarities with the Insolvency IRS form in the way it requires a comprehensive disclosure of an individual's financial status, including income, deductions, and credits. However, while the 1040 form focuses on assessing tax liability based on income, the Insolvency form specifically evaluates the financial condition of an individual to determine solvency or insolvency by comparing total liabilities to the fair market value of total assets.

The Schedule C (Form 1040), related to profit or loss from a business, is similar to the Insolvency IRS form given its need for detailed financial information. Schedule C requires taxpayers to list all business-related income and expenses, very much like the Insolvency form demands a thorough listing of liabilities and assets, some of which may include business debts or investments in a business.

The Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) is another document bearing resemblance to the Insolvency IRS form. It is used by the IRS to collect financial information from individuals to work out payment plans or settlements. Both forms require detailed listings of personal assets, liabilities, and income sources to evaluate an individual’s financial capacity.

Form 982 (Reduction of Tax Attributes Due to Discharge of Indebtedness) is directly related to the Insolvency IRS form as it is used to report the exclusion of forgiven debt from taxable income due to insolvency. This form acts in conjunction with the Insolvency form by using the insolvency calculation to determine how much of the discharged debt may be excluded from income on the taxpayer's tax return.

Dos and Don'ts

When dealing with the Insolvency IRS form, it’s crucial to navigate the process with care. Here are some dos and don'ts that can help individuals prepare their documentation accurately and efficiently.

Do:

- Review all sections carefully: Before filling out the form, make sure to read through each part to understand the types of information required.

- Gather documentation: Compile all relevant financial documents, such as bills, bank statements, and loan statements, to ensure the information you report is accurate.

- List all liabilities and assets: Do not overlook any debts or assets. Including everything ensures the IRS gets a complete picture of your financial situation.

- Check for accuracy: Before submission, double-check your figures for each liability and asset to prevent errors that could affect your insolvency calculation.

Don't:

- Repeat entries: Ensure that you are not listing the same liability or asset in more than one category. Each should only be included once.

- Estimate figures: Use actual amounts rather than estimates. Accuracy is key to correctly determining your insolvency status.

- Forget to sign and date the form: An unsigned or undated form is considered incomplete and can lead to processing delays.

- Ignore IRS guidelines: The IRS provides specific instructions for filling out the form. Ignoring these can result in incorrect filling and potential issues.

Misconceptions

When it comes to the Insolvency IRS Form, there's a lot of confusion out there. Here's a look at some common misconceptions:

- Misconception 1: Only large debts like mortgages and student loans count towards insolvency. In reality, all types of debts, including credit card debt, car loans, and even accrued utilities, can be included in your total liabilities.

- Misconception 2: You need to be completely out of cash to be considered insolvent. However, the insolvency calculation considers the fair market value of all your assets, not just cash, against your liabilities.

- Misconception 3: The insolvency worksheet is a form that must be submitted to the IRS. Actually, the worksheet is for your records only; it helps you determine if you were insolvent at the time of debt cancellation but isn't submitted with your tax return.

- Misconception 4: If you're insolvent, you're automatically exempt from paying taxes on all canceled debts. The truth is, the amount of debt relieved through insolvency can only be excluded from income up to the amount by which you were insolvent. Not everything might be covered.

- Misconception 5: Retirement accounts don’t count as assets. In fact, interests in retirement accounts are definitely considered part of your assets when determining insolvency.

- Misconception 6: Personal belongings with little resale value aren't worth listing. Despite their low resale value, items like clothing, furniture, and household goods should be assessed at their fair market value and included as assets.

- Misconception 7: Only past-due amounts are considered as liabilities. While past-due amounts are critical, the total balance of debts such as mortgages and car loans, whether past due or not, counts towards your liabilities.

- Misconception 8: You must be bankrupt to use the Insolvency exclusion. Insolvency and bankruptcy are separate concepts. You can be insolvent without filing for bankruptcy, qualifying you for the exclusion based solely on the insolvency worksheet calculation.

- Misconception 9: Tax debts are irrelevant in the insolvency calculation. Contrary to this belief, federal or state income tax debts for prior years should be included in your liabilities.

Understanding how the Insolvency IRS Form works can help you navigate your financial situation more effectively. Remember, it's about the total picture of your assets and liabilities at the time your debt was cancelled. This can be a critical component in managing the aftermath of debt cancellation and ensuring that you're making informed decisions about your finances.

Key takeaways

Understanding how to properly fill out and utilize the Insolvency Worksheet provided by the IRS can be critical for individuals facing financial challenges, particularly in the context of canceled debt. Here are some key insights that could provide guidance during this process:

- Diligently Document Your Liabilities and Assets: It is essential to accurately record all liabilities and assets immediately before the cancellation of debt. The worksheet requires a detailed listing, splitting these elements into liabilities, such as credit card debt, mortgages, and loans, and assets, ranging from cash, properties, to personal belongings like jewelry and vehicles.

- Comprehensive Calculation is Key: The goal of the Insolvency Worksheet is to determine if an individual was insolvent immediately before their debt was canceled. This is calculated by subtracting the total fair market value (FMV) of one’s assets from their total liabilities. An accurate and honest assessment requires thoroughness to ensure all debts and assets are considered.

- Understand the Importance of Insolvency Determination: Determining insolvency is crucial because if you were insolvent immediately before the cancellation of debt, you might not be required to pay taxes on the canceled debt up to the amount by which you were insolvent. This can significantly impact your financial recovery and obligations to the IRS.

- Keep Your Records Safe: Even though the Insolvency Worksheet is not submitted to the IRS, it is vital to keep it with your records. If the IRS inquires about your insolvency claim, this worksheet will serve as important documentation to support your claim and verify the accuracy of your filed taxes.

Approaching the Insolvency Worksheet with attention to detail and an honest evaluation of your financial situation will help ensure that you accurately determine your insolvency status and adhere to tax obligations. This process, while complex, stands as an essential aspect of managing the consequences of debt cancellation.

Popular PDF Forms

Baker Act Florida Form - Streamlines the process for professionals when intervening in mental health crises that require immediate attention.

Labor Code 1776 - Clarifies the obligation to follow OSHA regulations, prioritizing safety and health on construction projects.

Employee Emergency Contact Form Template - An information collection form designed for employee safety, gathering emergency contacts to be used only under urgent circumstances.