Blank Insurance Quote PDF Template

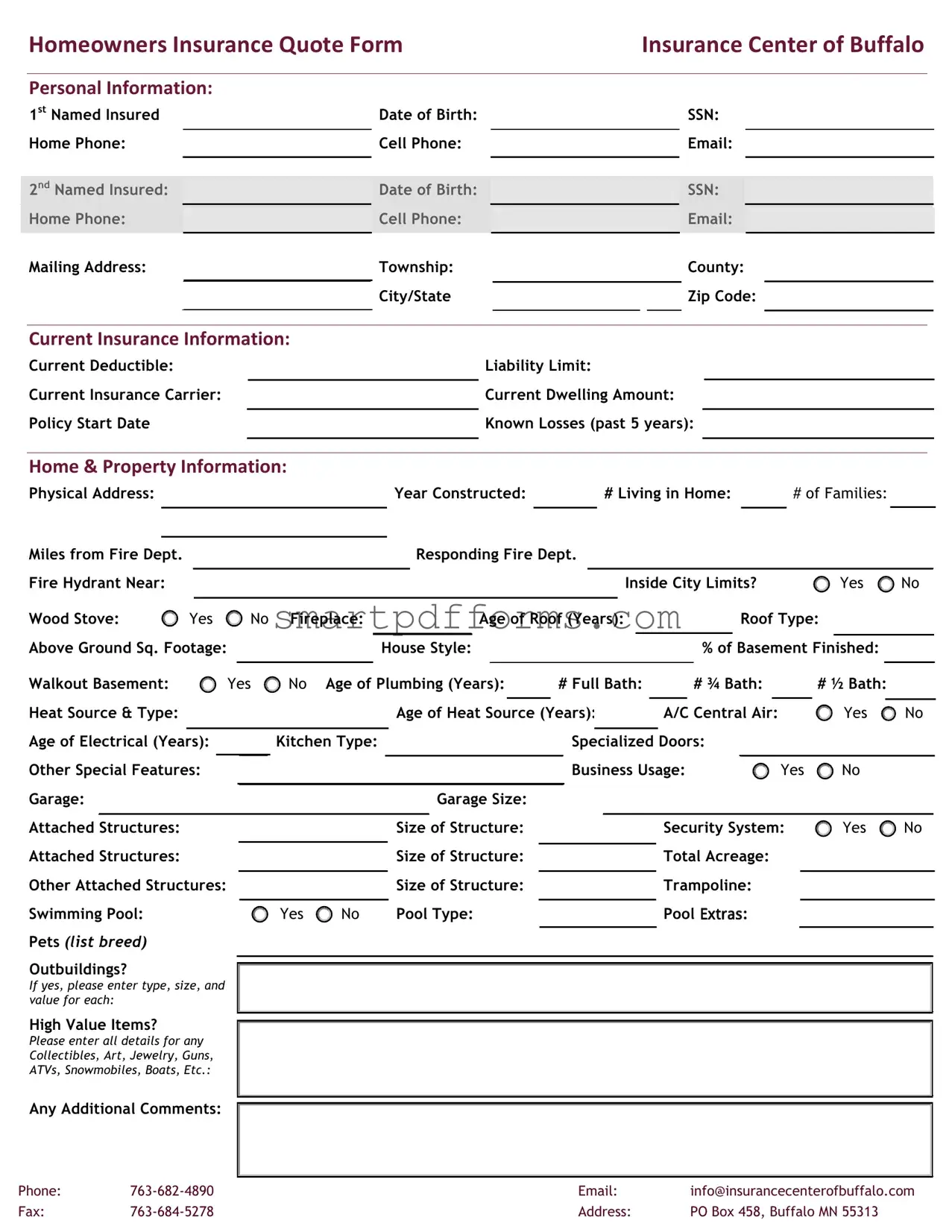

Finding the right insurance coverage can feel like navigating through a maze, full of twists, turns, and unexpected surprises. At the heart of this journey is the Insurance Quote Form, a crucial first step to obtaining the protection you need for your home and possessions. This comprehensive document, as exemplified by the Insurance Center of Buffalo's Homeowners Insurance Quote Form, gathers essential personal details—ranging from contact information and Social Security numbers of the insured parties to current insurance specifics. It also delves into the specifics of the property in question, covering everything from its physical address and construction year to distinctive features like the presence of a wood stove or swimming pool. Additionally, it inquires about any business usage on the premises, safety features such as security systems, and even details on high-value items that require additional coverage. With sections dedicated to current insurance details and a deep dive into both the home and property information, the form is designed not just to capture data but to build a comprehensive profile of the applicant's insurance needs. This enables insurers to tailor their quotes accurately, ensuring that homeowners receive coverage that is both adequate and appropriate for their unique circumstances.

Preview - Insurance Quote Form

|

|

Homeowners Insurance Quote Form |

|

Insurance Center of Buffalo |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Information: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Named Insured |

|

|

Date of Birth: |

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone: |

|

|

Cell Phone: |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Named Insured: |

|

|

|

Date of Birth: |

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone: |

|

|

|

Cell Phone: |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

Township: |

|

|

|

|

County: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State |

|

|

|

|

Zip Code: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Insurance Information:

Current Deductible: |

|

Liability Limit: |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Insurance Carrier: |

|

|

Current Dwelling Amount: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Policy Start Date |

|

|

Known Losses (past 5 years): |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home & Property Information:

Physical Address:  Year Constructed:

Year Constructed:  # Living in Home:

# Living in Home:  # OF FAMILIES:

# OF FAMILIES:

Miles from Fire Dept. |

|

|

|

|

|

|

|

Responding Fire Dept. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fire Hydrant Near: |

|

|

|

|

|

|

|

|

|

|

|

|

Inside City Limits? |

YES |

NO |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Wood Stove: |

YES |

NO Fireplace: |

|

|

|

Age of Roof (Years): |

|

|

|

Roof Type: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Above Ground Sq. Footage: |

|

|

House Style: |

|

|

% of Basement Finished: |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walkout Basement: |

YES |

NO Age of Plumbing (Years): |

# Full Bath: |

# ¾ Bath: |

|

# ½ Bath: |

|

||

Heat Source & Type: |

|

|

|

Age of Heat Source (Years): |

A/C Central Air: |

|

YES |

NO |

|

Age of Electrical (Years): |

|

Kitchen Type: |

|

Specialized Doors: |

|

|

|

||

Other Special Features: |

|

|

|

|

Business Usage: |

YES |

NO |

|

|

Garage: |

|

|

|

Garage Size: |

|

|

|

|

|

Attached Structures: |

|

|

|

Size of Structure: |

|

Security System: |

YES |

NO |

|

Attached Structures: |

|

|

|

Size of Structure: |

|

Total Acreage: |

|

|

|

Other Attached Structures: |

|

|

|

Size of Structure: |

|

Trampoline: |

|

|

|

Swimming Pool: |

|

YES |

NO |

Pool Type: |

|

Pool ([WUDV: |

|

|

|

Pets (LIST BREED) |

|

|

|

|

|

|

|

|

|

Outbuildings? |

|

|

|

|

|

|

|

|

|

If yes, please enter type, size, and value for each:

High Value Items?

Please enter all details for any

Collectibles, Art, Jewelry, Guns,

ATVs, Snowmobiles, Boats, Etc.:

Any Additional Comments:

PHONE: |

EMAIL: |

INFO@INSURANCECENTEROFBUFFALO.COM |

|

FAX: |

ADDRESS: |

PO BOX 458, BUFFALO MN 55313 |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The form is designed to collect information for a Homeowners Insurance Quote. |

| Administered By | Insurance Center of Buffalo. |

| Personal Information Required | Includes name, date of birth, social security number, contact numbers, and email for the 1st and 2nd insured individuals. |

| Mailing Address Details | Collects detailed information including township, county, city, state, and ZIP code. |

| Current Insurance Information | Includes current deductible, liability limit, carrier, dwelling amount, policy start date, and any known losses in the past 5 years. |

| Home & Property Information | Covers various aspects such as physical address, year constructed, number living in home, proximity to fire department, and fire hydrant presence. |

| Additional Property Details | Details on home features like wood stove, fireplace, age and type of roof, square footage, and whether there's a basement. |

| Security Features | Asks about the existence of a security system, and if there are attached structures, total acreage, and additional features like pools and trampolines. |

| Contact Information | Includes phone number, email, and fax for the Insurance Center of Buffalo. |

Instructions on Utilizing Insurance Quote

Completing an insurance quote form is the first step in the process of securing coverage for your home. This form gathers essential details about you, your property, and any specific needs you might have. By providing accurate and comprehensive information, you enable the insurance provider to offer the best possible policy options suited to your circumstances. After submitting the form, a representative will review your information and contact you to discuss your options, ensuring you have the necessary coverage for your peace of mind.

Steps for Filling Out the Homeowners Insurance Quote Form:

- Enter the first named insured's Personal Information, including:

- Date of Birth

- Social Security Number (SSN)

- Home Phone

- Cell Phone

- Fill in the second named insured's information, following the same format as the first named insured.

- Provide the Mailing Address, including:

- Township

- County

- City/State

- Zip Code

- Under Current Insurance Information, denote:

- Current Deductible

- Liability Limit

- Current Insurance Carrier

- Current Dwelling Amount

- Policy Start Date

- Known Losses in the past 5 years

- For Home & Property Information, specify:

- Physical Address

- Year Constructed

- Number Living in Home

- Number of Families

- Miles from Fire Department

- Responding Fire Department

- Proximity to Fire Hydrant

- Whether inside city limits

- Presence of Wood Stove or Fireplace

- Age and Type of Roof

- Square Footage Above Ground

- House Style

- Percentage of Basement Finished

- Walkout Basement

- Age of Plumbing, Type, and Number of Bathrooms

- Heating Source and Type

- Age of Heating Source

- A/C Central Air

- Age of Electrical Systems

- Kitchen Type

- Specialized Doors and Other Special Features

- Business Usage

Garage Size and Attached Structures

- Security System

- Additional Attached Structures

- Total Acreage

- Presence of Trampoline or Swimming Pool

- Pool Type and Extras

- Pets, including breed

- Outbuildings

- High Value Items

- Include Any Additional Comments that might be relevant for your insurance quote.

- Submit the form using the provided PHONE, EMAIL or FAX contact information, or send it to the ADDRESS listed at the end of the form.

After the insurance company receives your completed form, they will process the information to create a quote tailored to your needs. The process may involve additional questions or requests for clarification, so it’s essential to provide contact information where you can easily be reached. This dialogue ensures that the insurance coverage you receive is as accurate and comprehensive as possible.

Obtain Answers on Insurance Quote

What information do I need to provide to get a homeowners insurance quote?

To get a homeowners insurance quote, you need to provide specific personal information for both the first and second named insured, if applicable. This includes date of birth, Social Security Number (SSN), home phone, cell phone, and email addresses. For your property, information required includes the mailing address, township, county, city/state zip code, and details about your current insurance like deductible and liability limit. Home and property details such as the physical address, year constructed, number of individuals living in the home, proximity to a fire department, and features like wood stoves, fireplaces, and security systems among others will also be required.

What details about my property's construction and features are important for obtaining an insurance quote?

For an accurate homeowners insurance quote, details about your property’s construction and distinctive features are crucial. This includes the year your home was built, the materials used in construction (especially the roof type and age), square footage, style of the house, percentage of the basement finished if any, and whether you have a walkout basement. Asset-specific characteristics such as the presence of a wood stove or fireplace, and the age of key systems like plumbing, heating, and electrical are also important. Additionally, the presence of safety features or risks like swimming pools, trampolines, and the type of heat source can significantly impact your quote.

How does the proximity to emergency services like fire departments impact my insurance quote?

The distance between your home and the nearest fire department, as well as the availability of a fire hydrant nearby, can significantly affect your insurance quote. Insurance companies evaluate these factors as part of their assessment of the property's risk level. Homes closer to emergency services typically pose a lower risk of severe fire damage, potentially leading to lower insurance premiums. Conversely, properties located farther from fire services might see higher premiums due to the increased risk of damage before help can arrive.

Why do insurance companies need to know if I have a wood stove or fireplace?

Insurance companies ask about wood stoves and fireplaces because these features can increase the likelihood of a fire in your home. They represent potential hazards that could lead to costly claims. As such, having these features in your home could impact your insurance premiums. The insurance company may also require certain safety measures or standards to be met with the installation and use of these heating sources to mitigate risk.

Can my pets affect my homeowners insurance quote?

Yes, owning pets, especially certain breeds of dogs, can influence your homeowners insurance quote. Some insurance companies view certain dog breeds as a higher liability risk due to the potential for bites or other injuries. It's important to disclose the breed of any dogs you own as this information could impact your coverage options and premiums. Additionally, having pets might necessitate additional liability coverage to protect against potential claims from bites or other incidents.

What should I do if I have high-value items in my home?

If you possess high-value items, such as collectibles, art, jewelry, firearms, or expensive sports equipment, it's critical to inform your insurance company. Standard homeowners insurance policies typically have limited coverage for high-value items, which might not be sufficient to cover their full value in case of loss or damage. You might need to purchase additional coverage or a separate policy to ensure those valuables are adequately protected. Providing details about these items during the quote process helps ensure you get the most accurate quote and adequate coverage.

Common mistakes

Not providing complete personal information for all insured parties can lead to delays. This includes accurate dates of birth, social security numbers, and both home and cell phone numbers for the primary and secondary insured individuals, alongside their email addresses. Ensuring full transparency and accuracy in this section is crucial for the insurance company to offer the most accurate quote.

Inaccurately reporting current insurance coverage details can lead to misquote. This encompasses not only the current deductible and liability limit but also the correct dwelling amount, the carrier's name, and the policy’s start date. It is equally important to disclose any known losses over the past five years, as this information significantly impacts premium calculations.

Overlooking the Home & Property Information section can result in an incomplete risk assessment. Key details such as the physical address, year constructed, number of residents, and proximity to fire departments are essential. Additionally, specifying the presence of a wood stove or fireplace, specifics about the roof, square footage, and the age of major systems like plumbing, heating, and electrical, are critical for determining the right level of coverage.

Omitting information about special features or risks associated with the property. This includes not mentioning if there's a trampoline or swimming pool, as these significantly affect the risk profile and, consequently, the insurance premium. It’s vital to disclose the presence of any business conducted on the premises, security systems, and any high-value items such as collectibles, art, or jewelry which may require additional coverage.

Failure to provide detailed information about attached or detached structures, specialized doors, and other unique home features can impact the accuracy of the insurance quote. Size and value of outbuildings, garages, and any additional structures on the property need to be accurately conveyed, as these factors contribute to the overall valuation and insurance needs of the home.

Documents used along the form

When managing insurance-related matters, particularly when applying for homeowners insurance, it's crucial to have all the necessary documents prepared along with the insurance quote form. These documents serve various purposes, from verifying personal information to providing detailed information about the property in question. This list encompasses some commonly used forms and documents alongside the Insurance Quote Form, each playing a unique role in the insurance application and evaluation process.

- Proof of Identity: Official identification, such as a driver's license or passport, is required to verify the personal information provided in the insurance application.

- Proof of Residence: A utility bill or lease agreement helps in confirming the address of the residence the insurance is being applied for.

- Property Deed or Title: This document proves the ownership of the property in question and can include details about the property's boundaries and rights of way.

- Recent Home Inspection Report: Often requested to assess the condition of the home, including the electrical, plumbing, and HVAC systems, to identify any potential risks or necessary repairs.

- Receipts for Home Improvements: Documentation of recent renovations or improvements can affect the value of the property and might help in obtaining a more favorable insurance quote.

- Previous Insurance Policy: Presenting a current or recently expired insurance policy helps the new insurer understand your coverage history and any claims made.

- Claim History Report: A detailed record of any insurance claims made on the property in the past. Insurers use this information to gauge potential future risks.

- Mortgage Statement: For properties with a mortgage, a recent statement may be required to show the lender's details and the remaining balance, as it might influence the policy's terms.

Having these documents ready when applying for homeowners insurance not only streamlines the application process but also assists in obtaining a more accurate and comprehensive insurance quote. Each document provides vital information, ensuring that the insurance provider has a detailed understanding of both the applicant and the property. It's a thorough approach that benefits all parties involved in the transaction.

Similar forms

The Auto Insurance Quote Form is similar because it also gathers personal information such as name, date of birth, and contact details, alongside vehicle-specific data comparable to the home and property information on a homeowners insurance quote form. This form assesses risk and determines premium costs based on individual and property characteristics.

A Rental Application Form shares similarities as it collects personal details of the applicant, including contact information and social security number. Additionally, it may inquire about current living situation and history, which parallels the insurance quote's request for current insurance information and home details.

The Loan Application Form resembles the insurance quote form in structure by requiring personal financial information, current dwelling or asset information, and detailed questions about the applicant's financial status. This form evaluates financial risk and repayment capability in a manner akin to how an insurance quote assesses risk and insurance costs.

Health Insurance Enrollment Forms are alike in their collection of personal information, including contact details and social security numbers, and they similarly assess risk factors—though focused on health rather than property or vehicular risks. These forms also feature questions about current insurance coverage and specific conditions that may affect policy terms and pricing.

A Home Inspection Report shares a parallel by detailing specific aspects of a home's condition, like the age of the roof, plumbing, and electrical systems, as well as the presence of safety features or potential risks. While not a form filled out by a homeowner, it provides comprehensive data on a property's condition that could influence insurance coverage and premiums, akin to the details requested in an insurance quote form.

Dos and Don'ts

When completing your Homeowners Insurance Quote Form, it’s crucial to approach the process with attention to detail and honesty. Below are guidelines to help ensure you provide accurate and complete information, distinguishing between what you should and shouldn't do.

Things You Should Do:- Review and double-check all personal details such as dates of birth, social security numbers, phone numbers, and email addresses for accuracy.

- Be honest about your home’s characteristics and condition, including the age of the roof, plumbing, electrical systems, and any specialized features like security systems or fireplaces.

- Disclose all relevant information about your property, including the presence of a swimming pool, trampoline, wood stove, or any business usage, as these can impact your policy.

- Include information about all additional structures on your property, detailing their size and value.

- List any high-value items such as collectibles, art, jewelry, or recreational vehicles, as they may require additional coverage.

- Be upfront about any known losses or claims in the past five years to avoid discrepancies or issues in the future.

- Use the ‘Any Additional Comments’ section to clarify or provide further information about your property or situation not covered elsewhere on the form.

- Do not leave sections incomplete; if a question does not apply, mark it as ‘N/A’ instead of skipping it.

- Avoid guessing or estimating critical information, especially regarding the construction and features of your home. Always verify the details if unsure.

- Never provide false information or omit significant details about your property and its usage, as this can lead to denied claims or policy cancellation.

- Refrain from using unclear or ambiguous language when describing features of your home or personal property.

- Avoid rushing through the form; take your time to ensure all information is accurate and complete.

- Do not ignore instructions for how to complete certain fields or sections, which could result in erroneous submissions.

- Never omit details about pets and their breeds, especially if they could be considered high-risk, since this information can significantly impact your liability coverage.

Filling out your insurance quote form with attention to these dos and don'ts can make a substantial difference in the accuracy of your quote and the extent of coverage you receive. Always remember, the key to a seamless insurance process lies in transparency and thoroughness.

Misconceptions

There are several misconceptions about the process of completing an Insurance Quote form that can lead to confusion and potentially inadequate coverage. By addressing these misunderstandings, individuals can ensure they fully comprehend the form and the implications of the information they provide.

Personal Information is Optional: Many believe that providing personal information such as Social Security Numbers (SSN) or date of birth is optional. However, these details are crucial for the insurer to accurately assess risk and prevent fraud, making them typically mandatory.

Only Basic Home and Property Information is Needed: It's a common misconception that only surface details about the home and property are required. Insurers, however, need comprehensive details like the age of the roof, heating type, or special features to accurately determine the insurance premium and coverage scope.

Current Insurance Information is Irrelevant: Some applicants think their current insurance details don't impact the new quote. However, current coverage levels, deductible, and any known losses are critical for providing an accurate quote and identifying potential gaps or overlaps in coverage.

Listing of Pets and High-Value Items is Unnecessary: Many fail to recognize the importance of declaring pets, especially certain breeds, and high-value items. This information is vital for comprehensive coverage and ensures valuable personal property is adequately protected.

Information About Attached and Detached Structures is Optional: Another common misunderstanding is that details about attached or detached structures aren't essential unless they're living spaces. Insurers need to know about all structures to accurately assess risk and coverage needs.

Business Use of the Home Doesn't Need to Be Disclosed: Some homeowners believe that if they're running a small or home-based business, it doesn't impact their Homeowners Insurance. However, disclosing business activities is essential, as it can significantly affect coverage terms and premium calculations.

The Quote Form is the Final Offer: A prevalent misconception is that the information provided in the quote form will result in a final, non-negotiable offer. In reality, the quote is a preliminary estimate, and further discussions or adjustments can be made based on additional details or negotiations.

Security Features Don't Influence the Quote Much: Many underestimate the impact of security systems and features on their insurance quote. The presence of security systems, fire alarms, and other safety features can lower risk and therefore potentially reduce premiums.

A Swimming Pool or Trampoline Doesn't Need to Be Declared: Some homeowners mistakenly believe recreational features like swimming pools or trampolines don't need to be declared. These features significantly increase liability risk, making it crucial to disclose them for proper coverage.

Understanding these misconceptions can guide individuals through the process of completing an insurance quote form with more accuracy and confidence, ensuring they obtain adequate coverage tailored to their specific needs.

Key takeaways

Filling out an Insurance Quote form accurately and thoroughly is essential for getting the best homeowners insurance coverage that meets your needs. Here are key takeaways to ensure you're fully prepared.

- Prioritize accuracy in providing your Personal Information, including dates of birth, social security numbers, and contact details, to ensure your quote is as precise as possible.

- When detailing Current Insurance Information, be clear about your policy's deductible, liability limits, current insurance carrier, and dwelling amount to allow for accurate comparisons and potentially uncover cost-saving opportunities.

- Disclose any Known Losses in the past 5 years openly to avoid discrepancies or potential claim denials in the future.

- The section on Home & Property Information is crucial for assessing the risk and determining the premium. Provide comprehensive information about your home’s location, construction year, size, and unique features like fireplaces or wood stoves.

- Accurately disclosing the age and condition of your home's systems (roof, plumbing, heating, electrical) is vital for assessing insurance needs and potential risks.

- Understanding the importance of your home's security features, such as alarms and whether there are attachment structures, can influence your quote and potentially lower your insurance costs.

- Be clear about any business usage of the home, as this might require additional coverage or special policies.

- Inform the insurance company about any high-value items you possess. This includes collectibles, art, jewelry, and more, ensuring they're adequately covered under your policy.

- Finally, double-check all the information entered on the form before submitting it to the insurance company to ensure there are no errors or omissions.

Remember, the goal of filling out the Homeowners Insurance Quote form is to secure coverage that's tailored to your specific situation. Taking the time to provide detailed and accurate information can lead to more competitive rates and better protection for your home and belongings.

Popular PDF Forms

Truck Wash Receipt - A concise directive for drivers to ensure the Washout Receipt includes everything from the type of service received to the trailer number for verifying service completion.

Da Form 5513 Example - Serves as a historical record of key issuance and return, useful for review and investigation purposes.

Form 10-583 - Offers a clearly defined pathway for veterans to communicate their healthcare needs and expense challenges to the VA.