Blank IRS 1040-V PDF Template

When it comes to paying taxes, accuracy and timely submission play crucial roles in staying compliant and avoiding potential penalties. Among the variety of forms provided by the Internal Revenue Service (IRS) to assist taxpayers in meeting their obligations, the IRS 1040-V form stands out as a key component for those who decide to make their payments through mail. This payment voucher, while simple in its format, serves as an essential tool in ensuring that your payment is correctly applied to your account, thereby avoiding misapplication or delays in processing. Designed for use alongside your tax return, the form is not just about making a payment; it's about providing clarity and security in the transaction between you and the IRS. By furnishing specific details such as your name, social security number, and the amount you're paying, the IRS 1040-V form streamlines the process, making it easier for the IRS to process your payment accurately and promptly.

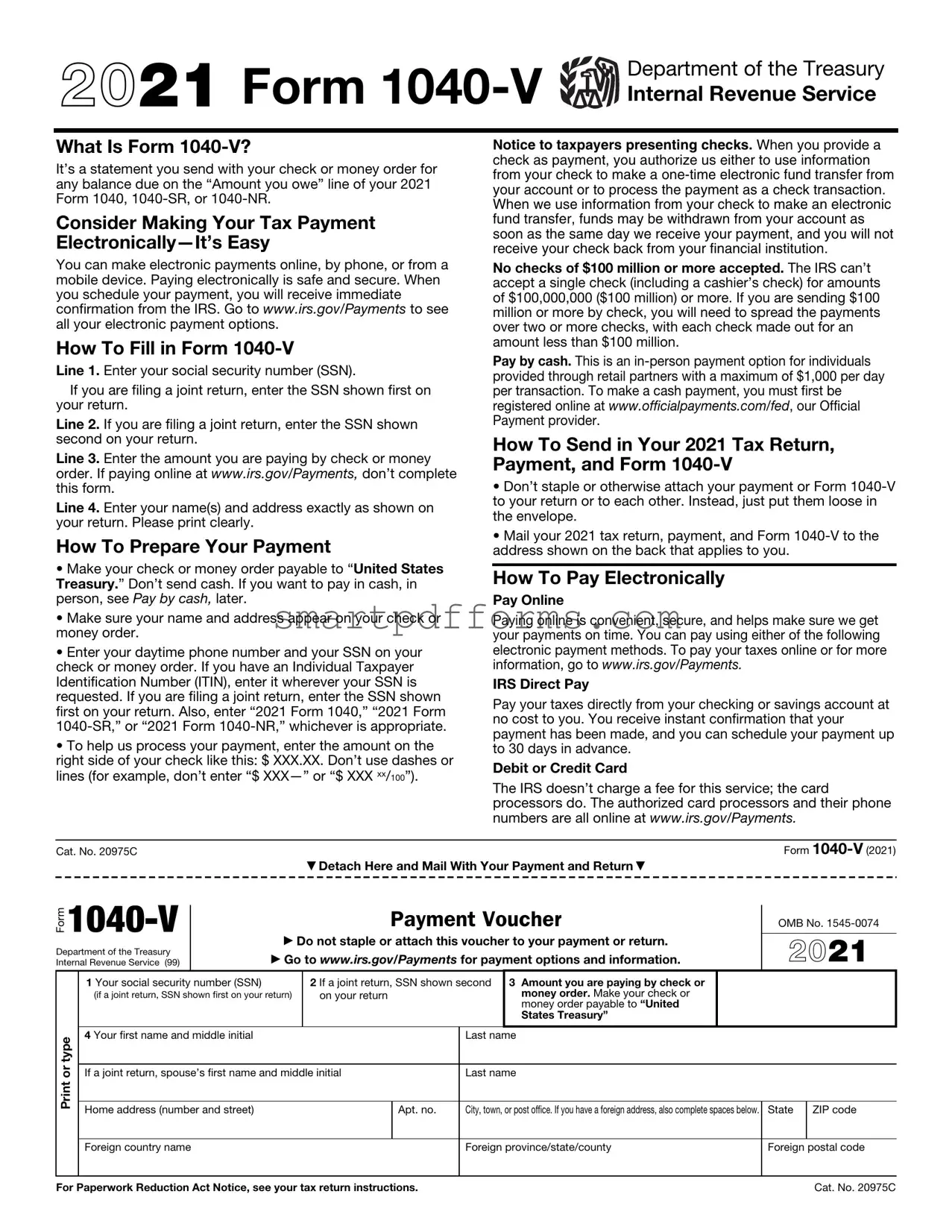

Preview - IRS 1040-V Form

2021 Form

Department of the Treasury

Internal Revenue Service

What Is Form

It’s a statement you send with your check or money order for any balance due on the “Amount you owe” line of your 2021 Form 1040,

Consider Making Your Tax Payment

You can make electronic payments online, by phone, or from a mobile device. Paying electronically is safe and secure. When you schedule your payment, you will receive immediate confirmation from the IRS. Go to www.irs.gov/Payments to see all your electronic payment options.

How To Fill in Form

Line 1. Enter your social security number (SSN).

If you are filing a joint return, enter the SSN shown first on your return.

Line 2. If you are filing a joint return, enter the SSN shown second on your return.

Line 3. Enter the amount you are paying by check or money order. If paying online at www.irs.gov/Payments, don’t complete this form.

Line 4. Enter your name(s) and address exactly as shown on your return. Please print clearly.

How To Prepare Your Payment

•Make your check or money order payable to “United States Treasury.” Don’t send cash. If you want to pay in cash, in person, see Pay by cash, later.

•Make sure your name and address appear on your check or money order.

•Enter your daytime phone number and your SSN on your check or money order. If you have an Individual Taxpayer Identification Number (ITIN), enter it wherever your SSN is requested. If you are filing a joint return, enter the SSN shown first on your return. Also, enter “2021 Form 1040,” “2021 Form

•To help us process your payment, enter the amount on the right side of your check like this: $ XXX.XX. Don’t use dashes or lines (for example, don’t enter “$

Notice to taxpayers presenting checks. When you provide a check as payment, you authorize us either to use information from your check to make a

No checks of $100 million or more accepted. The IRS can’t accept a single check (including a cashier’s check) for amounts of $100,000,000 ($100 million) or more. If you are sending $100 million or more by check, you will need to spread the payments over two or more checks, with each check made out for an amount less than $100 million.

Pay by cash. This is an

How To Send in Your 2021 Tax Return, Payment, and Form

•Don’t staple or otherwise attach your payment or Form

•Mail your 2021 tax return, payment, and Form

How To Pay Electronically

Pay Online

Paying online is convenient, secure, and helps make sure we get your payments on time. You can pay using either of the following electronic payment methods. To pay your taxes online or for more information, go to www.irs.gov/Payments.

IRS Direct Pay

Pay your taxes directly from your checking or savings account at no cost to you. You receive instant confirmation that your payment has been made, and you can schedule your payment up to 30 days in advance.

Debit or Credit Card

The IRS doesn’t charge a fee for this service; the card processors do. The authorized card processors and their phone numbers are all online at www.irs.gov/Payments.

Cat. No. 20975C

Form

Department of the Treasury Internal Revenue Service (99)

▼ Detach Here and Mail With Your Payment and Return ▼

Payment Voucher

▶ Do not staple or attach this voucher to your payment or return.

▶Go to www.irs.gov/Payments for payment options and information.

Form

OMB No.

2021

|

1 Your social security number (SSN) |

2 If a joint return, SSN shown second |

3 Amount you are paying by check or |

|

||

|

(if a joint return, SSN shown first on your return) |

on your return |

|

money order. Make your check or |

|

|

|

|

|

|

|

money order payable to “United |

|

|

|

|

|

|

States Treasury” |

|

|

|

|

|

|

|

|

or type |

4 Your first name and middle initial |

|

|

Last name |

||

If a joint return, spouse’s first name and middle initial |

Last name |

|||||

Home address (number and street) |

|

Apt. no. |

City, town, or post office. If you have a foreign address, also complete spaces below. |

|||

|

||||||

|

|

|||||

|

Foreign country name |

|

|

Foreign province/state/county |

||

|

|

|

||||

|

|

|

|

|

|

|

State |

ZIP code |

|

|

Foreign postal code

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 20975C |

Form |

Page 2 |

IF you live in . . . |

THEN use this address to send in your payment . . . |

|

|

Alabama, Florida, Georgia, Louisiana, Mississippi, North |

Internal Revenue Service |

Carolina, South Carolina, Tennessee, Texas |

P.O. Box 1214 |

|

Charlotte, NC |

|

|

Arkansas, Connecticut, Delaware, District of Columbia, Illinois, |

Internal Revenue Service |

Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, |

P.O. Box 931000 |

Minnesota, Missouri, New Hampshire, New Jersey, New York, |

Louisville, KY |

Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, |

|

Wisconsin |

|

|

|

Alaska, Arizona, California, Colorado, Hawaii, Idaho, Kansas, |

Internal Revenue Service |

Michigan, Montana, Nebraska, Nevada, New Mexico, North |

P.O. Box 802501 |

Dakota, Ohio, Oregon, Pennsylvania, South Dakota, Utah, |

Cincinnati, OH |

Washington, Wyoming |

|

|

|

A foreign country, American Samoa, or Puerto Rico (or are |

Internal Revenue Service |

excluding income under Internal Revenue Code 933), or use an APO |

P.O. Box 1303 |

or FPO address, or file Form 2555 or 4563, or are a |

Charlotte, NC |

or nonpermanent resident of Guam or the U.S. Virgin Islands |

|

|

|

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 1040-V | This form is used as a payment voucher to accompany your check or money order for any balance due on your federal income tax return when you file on paper. |

| Not Required for Electronic Payments | When you pay your taxes electronically, using options such as Direct Pay, EFTPS, or credit card, the IRS does not require Form 1040-V. |

| Where to Send | The mailing address for Form 1040-V varies depending on the state you live in and whether you are including a payment. The IRS provides a list of addresses on their official website. |

| Making Payments | Payments made with Form 1040-V should be made by check or money order, payable to the "United States Treasury" and must include the taxpayer's Social Security number, the tax year, and the type of form filed to ensure proper posting. |

Instructions on Utilizing IRS 1040-V

When you're making a payment on your taxes, the IRS 1040-V payment voucher aids in ensuring your payment is processed accurately. This document accompanies your check or money order for any taxes owed when you file your annual return. It's a relatively straightforward form, but accuracy is critical to avoid any processing delays or errors in accrediting your payment. Below are the step-by-step instructions for completing the IRS 1040-V form properly.

- Fill in your Social Security Number (SSN): This should be the SSN of the person listed first on the tax return. If filing jointly, use the SSN shown first on your tax return.

- Enter your name and address: Type or print your legal name, address, city, state, and ZIP code. These should match the information on your tax return.

- Enter the amount you are paying: Clearly write the amount of your payment in the space provided. Ensure this matches the amount owed that you're submitting with your tax return.

- Include your phone number: Write your daytime telephone number in case the IRS needs to contact you regarding your payment.

After filling out the IRS 1040-V form, attach your check or money order made payable to the "United States Treasury." Make sure your Social Security Number, the tax year, and form number (1040-V) are written on the front of your check or money order. Do not staple or attach your payment to the form. Instead, simply place them together in the envelope with your tax return or in a separate envelope if you’ve already sent your tax return. Then, mail it to the IRS at the address provided for your location. By following these instructions, you can help ensure your payment is processed smoothly and accurately, avoiding possible delays.

Obtain Answers on IRS 1040-V

-

What is the IRS 1040-V form?

The IRS 1040-V form is a payment voucher that you send with your check or money order when you're mailing a payment to the IRS. It's used for individuals who are submitting a payment for any taxes owed on their Form 1040, Form 1040-SR, or Form 1040-NR income tax returns. Think of it as a helpful note to the IRS, ensuring your payment is correctly processed and applied to your account.

-

Why should I use the 1040-V payment voucher?

Using the Form 1040-V helps the IRS process your payment more efficiently and ensures your payment is credited to your account promptly. Without this voucher, your payment might be delayed or misapplied, leading to possible interest and penalties. It's a simple step that can save a lot of hassle.

-

How do I fill out the 1040-V form?

Filling out the form is straightforward. You'll need to include your name, address, Social Security number, the amount you're paying, and the tax year for the payment. Make sure the information matches what's on your tax return. It's essential to write this information clearly to avoid any delays in processing your payment.

-

Where do I send my 1040-V payment voucher and payment?

The mailing address for your 1040-V payment voucher varies depending on where you live and whether you're including a payment with your tax return. The IRS provides a list of addresses in the instructions for Form 1040-V. It's important to send it to the correct address to ensure your payment is processed correctly.

-

Can I make my payment electronically?

Absolutely! The IRS encourages individuals to make their payments electronically. This is faster, secure, and more efficient than mailing a check or money order. You can use the IRS Direct Pay service, Electronic Federal Tax Payment System (EFTPS), or a credit or debit card. If you pay electronically, you don't need to send in a Form 1040-V.

-

What should I do if I can't afford to pay my tax bill in full?

If you're unable to pay your tax bill in full, the IRS offers options to help. You might qualify for an installment agreement, allowing you to make monthly payments. There's also the possibility of an offer in compromise, which could settle your tax bill for less than the amount owed. It's important to contact the IRS to discuss your situation instead of waiting. The longer you wait, the more interest and penalties you may incur.

-

Do I still need to file my tax return by the deadline if I'm using Form 1040-V?

Yes, you should still file your tax return by the deadline, even if you're submitting a payment with Form 1040-V. The voucher does not extend the filing deadline. Filing your tax return on time helps avoid late filing penalties, which are separate from any penalties for paying late.

-

Can I use a single 1040-V form for multiple tax years?

No, each Form 1040-V is specific to a single tax year. If you need to make payments for multiple tax years, you must use a separate 1040-V form for each year. This ensures that your payments are accurately applied to the correct tax year's balance.

-

What happens if I forget to include my 1040-V form with my payment?

If you forget to include the Form 1040-V with your payment, don't worry too much. The IRS can usually process your payment without it, though it might take a bit longer. To avoid any confusion or delays, include a note with your payment that lists your full name, Social Security number, address, phone number, and the tax period for the payment if you're sending it without the 1040-V form.

Common mistakes

When filling out the IRS 1040-V form, which is used to send payments along with tax returns, individuals often encounter a range of common errors. These mistakes can cause delays in processing payments and can even affect the status of one’s tax account. Paying attention to detail and understanding the form's requirements can help avoid these pitfalls.

Not verifying the Social Security Number (SSN): The SSN must match the number on your Social Security card exactly. Incorrect or missing numbers are one of the most common errors.

Incorrect tax year noted: Each payment must correspond to the correct tax year. If the tax year on the 1040-V form is not the year for which the payment is being made, it leads to misapplied funds.

Failing to sign the form: While the 1040-V itself does not require a signature, forgetting to sign the associated tax return can invalidate both documents.

Incorrect payment amount: It's essential to double-check that the amount written on the 1040-V form matches the amount of the check or money order precisely.

Using the wrong form for the payment type: The 1040-V is specifically for payments alongside tax returns. Utilizing another form by mistake can misdirect the payment.

Mailing to the incorrect address: There are multiple IRS addresses depending on where you live and whether you are including a payment. Sending the 1040-V to the wrong address can delay processing.

Steering clear of these errors when completing the IRS 1040-V form helps ensure that your payment is processed accurately and without unnecessary delay.

Documents used along the form

When filing taxes in the United States, the IRS form 1040-V is often accompanied by a variety of other forms and documents. This voucher is a statement of the tax you are paying by check or money order. However, preparing your tax return typically requires more than just this payment voucher. Here are several forms and documents commonly used alongside the IRS 1040-V to ensure a complete and correct tax filing process.

- Form 1040: The primary document for individual federal income tax returns. It details your income, adjustments, deductions, and credits to calculate the tax owed or refund due.

- Schedule A: Used to itemize deductions like medical expenses, taxes paid, and charitable donations if you choose not to take the standard deduction.

- Schedule B: Necessary for reporting interest and ordinary dividend income over certain amounts; it helps detail the sources of income listed on your 1040.

- Schedule C: Employed by those who operate a business or practice a profession as a sole proprietor. This form reports income or loss from a business.

- Schedule D: Utilized for reporting capital gains or losses from the sale or exchange of capital assets not reported on another form or schedule.

- Schedule E: Used for reporting income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 8863: For those claiming education credits, such as the American Opportunity Credit or Lifetime Learning Credit, detailing the amount of credit claimed.

- Form 8889: Required for those who have a Health Savings Account (HSA), detailing contributions, distributions, and the tax treatment of HSAs.

- W-2 Forms: These documents are provided by employers and show your earnings and the taxes withheld from your paycheck.

Collecting and accurately filling out these forms ensures that you can account for various aspects of your income, deductions, and credits on your tax return. Each document plays a crucial role in the calculation of your taxable income and the amount of tax you owe or the refund you are entitled to. It's important to consult these documents carefully and, if necessary, seek guidance to understand their specifics fully.

Similar forms

IRS 1040 Form: This document, the primary income tax return form for individuals in the United States, is similar to the 1040-V because it is used in conjunction with it. The 1040-V is a payment voucher used when mailing your payment to the IRS, while the 1040 form details your income, deductions, and credits.

IRS 1040-ES Form: The Estimated Tax for Individuals form is another document related to personal financial responsibilities to the IRS, like the 1040-V. It’s used by individuals to estimate their taxes for the year and make quarterly payments. Both forms involve planning for and making tax payments, although their specific purposes differ.

IRS Schedule C: This form is used by sole proprietors to report profits or losses from a business they operate. Similarity with the 1040-V comes into play as any calculated tax owed through Schedule C may be paid using the 1040-V voucher if mailing a payment to the IRS.

IRS Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return resembles the 1040-V in its auxiliary role to the main tax filing process. While the 4868 form is used to request more time for filing taxes, the 1040-V form is used to accompany a payment when filing is already completed but payment is being made separately or at a later date.

IRS Form 8809: Application for Extension of Time to File Information Returns shares its connectivity with the 1040-V through the theme of managing deadlines and obligations with the IRS, albeit for different types of submissions. The 1040-V is specific to tax payments, while the 8809 pertains to informational returns.

IRS Form W-2: Wage and Tax Statement, while primarily a form for employers to report employee wages and taxes withheld, links to the individual's responsibility akin to the 1040-V. The information from the W-2 is used by the individual to complete their 1040 form, and any ensuing tax owed could be paid via the 1040-V voucher.

IRS Form W-4: Employee’s Withholding Certificate directly impacts the amount of tax withheld from an employee's paycheck, which in turn affects the potential need for a 1040-V. If too little tax is withheld, the employee might need to make a payment using Form 1040-V to cover the underpayment.

IRS Form 1099: Various versions of the 1099 form are used to report income other than wages, such as freelancing or gig economy work. Individuals receiving this form may need to use a 1040-V if they owe taxes based on the additional income reported on their 1099 forms, linking the use of these two forms in the tax preparation and payment process.

Dos and Don'ts

Filing your taxes requires careful attention to detail, particularly when submitting your payment with the IRS Form 1040-V. This payment voucher is an integral part of ensuring your payment is processed correctly. To assist you in this process, here are several do's and don'ts that you should keep in mind:

Do's:

- Ensure that your name, address, and social security number on the 1040-V match those on your tax return.

- Double-check the amount you're paying. It should match the amount you owe on your tax return.

- Make your check or money order payable to the "United States Treasury." Be sure to write your social security number, the tax year, and the form number (1040-V) on your payment.

- Send your payment along with the 1040-V form to the address specified for your area, which is listed in the form's instructions.

- Consider using electronic payments if possible. It's faster, more secure, and provides immediate confirmation for your records.

Don'ts:

- Don't forget to include your payment voucher (1040-V) when mailing your payment. This voucher is crucial for processing your payment correctly.

- Don't staple or attach your payment to the 1040-V form. They should be sent together but not attached to each other.

- Don't ignore the specific mailing instructions provided in the form's instructions, as using the wrong address could delay processing.

- Don't send cash. Always use a check or money order for mail payments or opt for electronic payments.

- Don't overlook the possibility of setting up an installment agreement if you find you're unable to pay the full amount owed. The IRS offers options that can help manage larger tax liabilities over time.

By following these do's and don'ts, you'll help ensure that your payment is processed efficiently and accurately, avoiding potential delays or issues. Remember, paying attention to the details when dealing with IRS forms and payments can save a significant amount of time and effort down the line.

Misconceptions

When it comes to tax filings, the IRS 1040-V form is often misunderstood. This voucher plays an important role in the tax payment process for those who choose to mail their payments. Dispelling these misunderstandings can provide clarity and ease the payment process for taxpayers. Below are four common misconceptions about the IRS 1040-V form:

- Use of the form is mandatory for all taxpayers. This is not accurate. The IRS 1040-V form is a payment voucher used by individuals who make a payment via check or money order to the IRS. Taxpayers who pay their taxes electronically do not need to submit this form. It serves to assist the IRS in processing payments more efficiently when payments are made through traditional mailing methods.

- The form is complicated to fill out. Contrary to what some believe, the IRS 1040-V is straightforward. It requires basic information such as the taxpayer's name, social security number, the amount of the payment, and the tax year for which the payment is made. This simplicity ensures that it is accessible to all taxpayers, regardless of their familiarity with tax forms.

- Submitting the form by itself is sufficient for tax payment. This is a misconception. The form must accompany a check or money order for the amount owed to the IRS. It is not a standalone payment method but rather a tool to help the IRS correctly apply payments to the right accounts. Properly attaching the form to the payment ensures accurate processing.

- Electronic payment filers must also send in the 1040-V form. This is incorrect. Taxpayers who opt for electronic payments through the IRS Direct Pay, EFTPS (Electronic Federal Tax Payment System), or by using a credit or debit card do not need to send a 1040-V form. This form is only for those paying by mail. Electronic payments are processed differently, removing the need for a physical form to accompany the payment.

Understanding these facts can help taxpayers navigate their tax payments with greater confidence and precision. The IRS 1040-V form is a tool designed to streamline the payment process for those who prefer or need to pay by mail, ensuring their payments are processed correctly and efficiently.

Key takeaways

If you're getting ready to send a payment to the Internal Revenue Service (IRS), the 1040-V form is an important slip that ensures your payment is processed correctly. Below are six key takeaways about filling out and using this form:

- Always include Form 1040-V when mailing your tax payment to the IRS. This form serves as a statement for your payment, helping the IRS correctly apply your payment to your account.

- Complete all required fields on Form 1040-V, such as your name, address, social security number, and the amount of your payment. This information is crucial to prevent processing errors.

- Use a check or money order to make your payment. Make it payable to “United States Treasury” and include your social security number, the tax form number (1040), and the tax year on your payment.

- Do not attach the payment to your tax return or the Form 1040-V. Instead, enclose them loosely in the envelope you're sending to the IRS. This helps with the processing of both your payment and your return.

- Send your payment and Form 1040-V to the address provided in the IRS instructions for the 1040-V form. The correct address depends on your state of residence and whether you're including a tax return.

- If your situation changes and you end up owing less or more before you send the Form 1040-V, recalculate your taxes. If you owe more, fill out a new 1040-V with the correct amount. If you owe less, consider adjusting your payment accordingly, but ensure to provide an explanation to the IRS.

Adhering to these guidelines will help make sure your payment is processed timely and accurately, reducing potential issues with your tax return. Remember, handling your taxes with care not only keeps you in good standing with the IRS but also prevents unnecessary stress.

Popular PDF Forms

Iris Number - Defines emergency contact information, reinforcing the safety net for participants within the waiver program.

What Happens If You Break Your Orthodontist Contract - A complete breakdown of financial obligations linked to orthodontic care, designed to prevent surprises and foster a positive patient-provider relationship.