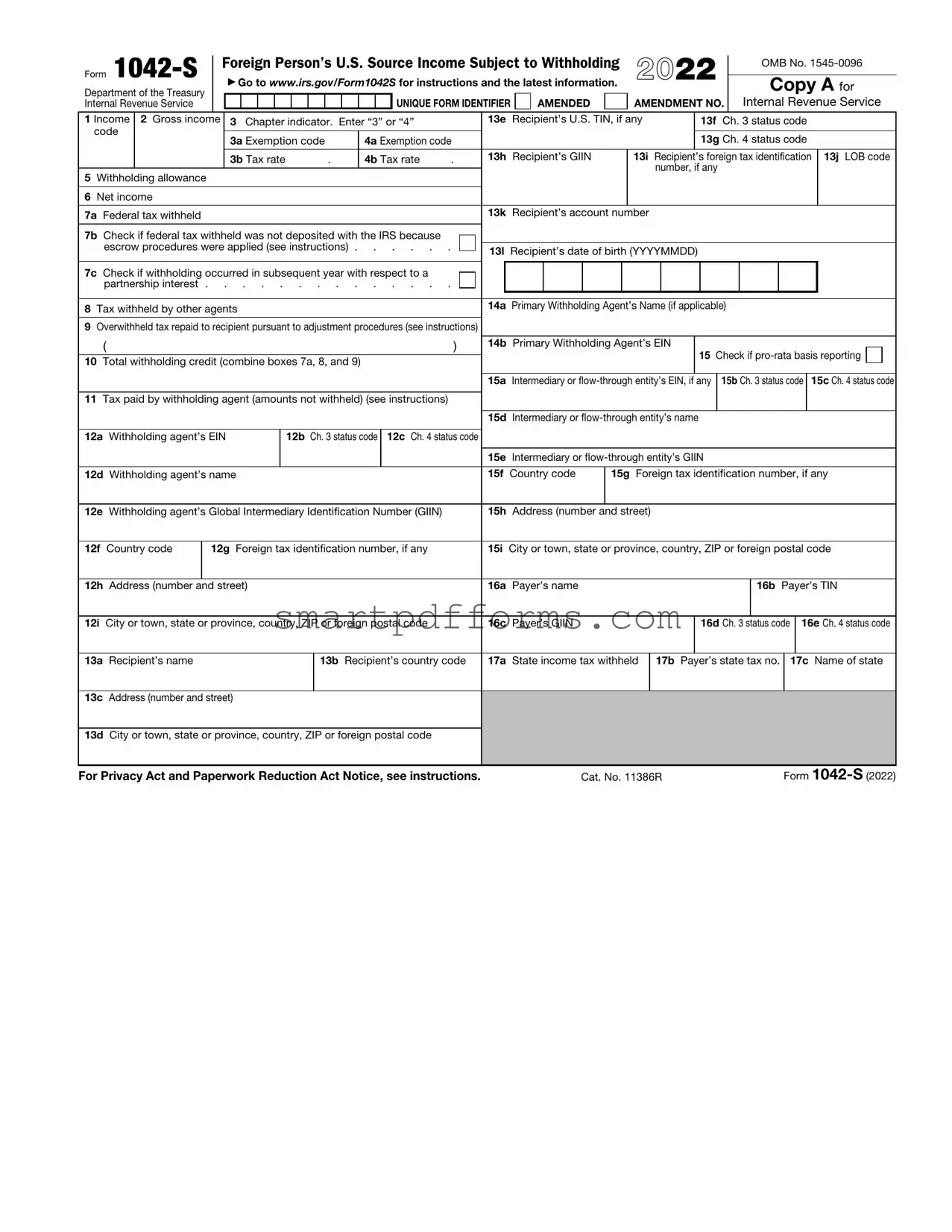

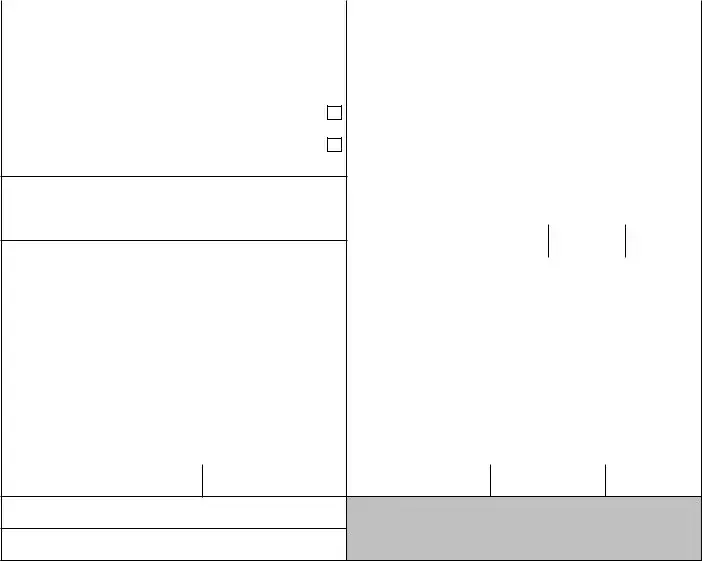

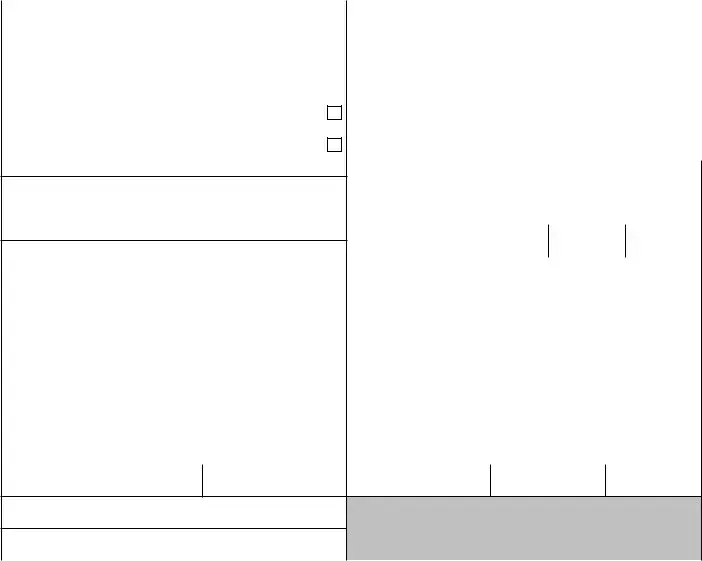

Blank IRS 1042-S PDF Template

Navigating the complex waters of U.S. tax regulations can be daunting, especially when it comes to understanding the myriad forms required by the Internal Revenue Service (IRS). Among these is the IRS 1042-S form, a crucial document for foreign individuals and entities receiving U.S. source income that's subject to withholding. This form serves multiple purposes: it reports income, whether it's from dividends, interests, rents, royalties, or compensation for independent personal services, and the amount of tax withheld on that income. Not only does it play a pivotal role in ensuring compliance with tax laws, but it also aids in reconciling tax liabilities and refund claims for income that might be taxed in both the United States and the recipient's home country. Given its importance, understanding the 1042-S form is essential for anyone involved in international financial transactions with the U.S., aiming to simplify what can otherwise be a complex filing process.

Preview - IRS 1042-S Form

|

|

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2022 |

|

OMB No. |

|||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy A for |

|||||||||

Form |

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

|

|||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

AMENDED |

|

|

AMENDMENT NO. |

|

Internal Revenue Service |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f Ch. 3 status code |

||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

13i Recipient’s foreign tax identification |

13j LOB code |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|

|

|

|

||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11386R |

Form |

Form |

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2022 |

|

|

OMB No. |

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

Copy B |

||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

AMENDED |

|

|

AMENDMENT NO. |

|

|

for Recipient |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

|

13i Recipient’s foreign tax identification |

13j LOB code |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

(keep for your records) |

Form |

U.S. Income Tax Filing Requirements

Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with U.S. income, including income that is effectively connected with the conduct of a trade or business in the United States, must file a U.S. income tax return. However, no return is required to be filed by a nonresident alien individual, nonresident alien fiduciary, or foreign corporation if such person was not engaged in a trade or business in the United States at any time during the tax year and if the tax liability of such person was fully satisfied by the withholding of U.S. tax at the source. Corporations file Form

En règle générale, tout étranger

àIRS.gov et dans toutes les ambassades et tous les consulats des

Explanation of Codes

Box 1. Income Code.

Code |

Types of Income |

01Interest paid by U.S.

02Interest paid on real property mortgages

03Interest paid to controlling foreign corporations

04Interest paid by foreign corporations

05Interest on

|

22 |

Interest paid on deposit with a foreign branch of a domestic |

|

Interest |

30 |

corporation or partnership |

|

Original issue discount (OID) |

|||

|

29 |

Deposit interest |

|

|

31 |

||

|

33 |

Substitute |

|

|

51 |

Interest paid on certain actively traded or publicly offered |

|

|

|

securities1 |

|

|

54 |

Substitute |

|

|

|

or publicly offered securities1 |

|

Dividend |

06 |

Dividends paid by U.S. |

|

07 |

Dividends qualifying for direct dividend rate |

||

|

|||

|

08 |

Dividends paid by foreign corporations |

Por regla general, todo extranjero no residente, todo organismo fideicomisario extranjero no residente y toda sociedad anónima extranjera que reciba ingresos en los Estados Unidos, incluyendo ingresos relacionados con la conducción de un negocio o comercio dentro de los Estados Unidos, deberá presentar una declaración estadounidense de impuestos sobre el ingreso. Sin embargo, no se requiere declaración alguna a un individuo extranjero, una sociedad anónima extranjera u organismo fideicomisario extranjero no residente, si tal persona no ha efectuado comercio o negocio en los Estados Unidos durante el año fiscal y si la responsabilidad con los impuestos de tal persona ha sido satisfecha plenamente mediante retención del impuesto de los Estados Unidos en la fuente. Las sociedades anónimas envían el Formulario

Im allgemeinen muss jede ausländische Einzelperson, jeder ausländische Bevollmächtigte und jede ausländische Gesellschaft mit Einkommen in den Vereinigten Staaten, einschliesslich des Einkommens, welches direkt mit der Ausübung von Handel oder Gewerbe innerhalb der Staaten verbunden ist, eine Einkommensteuererklärung der Vereinigten Staaten abgeben. Eine Erklärung, muss jedoch nicht von Ausländern, ausländischen Bevollmächtigten oder ausländischen Gesellschaften in den Vereinigten Staaten eingereicht werden, falls eine solche Person während des Steuerjahres kein Gewerbe oder Handel in den Vereinigten Staaten ausgeübt hat und die Steuerschuld durch Einbehaltung der Steuern der Vereinigten Staaten durch die Einkommensquelle abgegolten ist. Gesellschaften reichen den Vordruck

|

34 |

Substitute |

|

40 |

Other dividend equivalents under IRC section 871(m) |

Dividend |

52 |

Dividends paid on certain actively traded or publicly offered |

|

securities1 |

|

|

|

|

|

53 |

Substitute |

|

|

publicly offered securities1 |

|

56 |

Dividend equivalents under IRC section 871(m) as a result of |

|

|

applying the combined transaction rules |

|

|

|

|

09 |

Capital gains |

|

10 |

Industrial royalties |

|

11 |

Motion picture or television copyright royalties |

|

12 |

Other royalties (for example, copyright, software, |

|

|

broadcasting, endorsement payments) |

Other |

13 |

Royalties paid on certain publicly offered securities1 |

14 |

Real property income and natural resources royalties |

|

|

15 |

Pensions, annuities, alimony, and/or insurance premiums |

|

16 |

Scholarship or fellowship grants |

|

17 |

Compensation for independent personal services2 |

|

18 |

Compensation for dependent personal services2 |

|

19 |

Compensation for teaching2 |

See back of Copy C for additional codes

1This code should only be used if the income paid is described in Regulations section

2If compensation that otherwise would be covered under Income Codes 17 through 20 is directly attributable to the recipient’s occupation as an artist or athlete, use Income Code 42 or 43 instead.

Form |

|

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2022 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

Copy C for Recipient |

||||||||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

|

AMENDED |

|

|

AMENDMENT NO. |

|

Attach to any Federal tax return you file |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

|

13i Recipient’s foreign tax identification |

13j LOB code |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

Form

Explanation of Codes (continued)

|

20 |

Compensation during studying and training2 |

|

|

23 |

Other income |

|

|

24 |

Qualified investment entity (QIE) distributions of capital |

|

|

|

gains |

|

|

25 |

Trust distributions subject to IRC section 1445 |

|

|

26 |

Unsevered growing crops and timber distributions by a trust |

|

|

|

subject to IRC section 1445 |

|

|

27 |

Publicly traded partnership distributions subject to IRC |

|

|

|

section 1446 |

|

|

28 |

Gambling winnings3 |

|

|

32 |

Notional principal contract income4 |

|

Other |

35 |

Substitute |

|

36 |

Capital gains distributions |

||

|

|||

|

37 |

Return of capital |

|

|

38 |

Eligible deferred compensation items subject to IRC section |

|

|

|

877A(d)(1) |

|

|

39 |

Distributions from a nongrantor trust subject to IRC section |

|

|

|

877A(f)(1) |

41Guarantee of indebtedness

42Earnings as an artist or

43Earnings as an artist or

44Specified federal procurement payments

50Income previously reported under escrow procedure6

55Taxable death benefits on life insurance contracts

57Amount realized under IRC section 1446(f)

Boxes 3a and 4a. Exemption Code (applies if the tax rate entered in box 3b or 4b is 00.00).

CodeAuthority for Exemption Chapter 3

01Effectively connected income

02Exempt under IRC7

03Income is not from U.S. sources

04Exempt under tax treaty

05Portfolio interest exempt under IRC

06QI that assumes primary withholding responsibility

07WFP or WFT

08U.S. branch treated as U.S. Person

09Territory FI treated as U.S. Person

10QI represents that income is exempt

11QSL that assumes primary withholding responsibility

12Payee subjected to chapter 4 withholding

22QDD that assumes primary withholding responsibility

23Exempt under section 897(l)

24Exempt under section 892

Chapter 4

13Grandfathered payment

14Effectively connected income

15Payee not subject to chapter 4 withholding

16Excluded nonfinancial payment

17Foreign Entity that assumes primary withholding responsibility

18U.S.

19Exempt from withholding under IGA8

20Dormant account9

21

Boxes 12b, 12c, 13f, 13g, 15b, 15c, 16d, and 16e. Withholding Agent, Recipient, Intermediary, and Payer Chapter 3 and Chapter 4 Status Codes.

Type of Recipient, Withholding Agent, Payer, or Intermediary Code

Chapter 3 Status Codes

03Territory

04Territory

05U.S.

06U.S.

07U.S.

08Partnership other than Withholding Foreign Partnership or Publicly Traded Partnership

09Withholding Foreign Partnership

See back of Copy D for additional codes

2If compensation that otherwise would be covered under Income Codes 17 through 20 is directly attributable to the recipient’s occupation as an artist or athlete, use Income Code 42 or 43 instead.

3Subject to 30% withholding rate unless the recipient is from one of the treaty countries listed under Gambling winnings (Income Code 28) in Pub. 515.

4Use appropriate Interest Income Code for embedded interest in a notional principal contract.

5Income Code 43 should only be used if Letter 4492, Venue Notification, has been issued by the Internal Revenue Service (otherwise, use Income Code 42 for earnings as an artist or athlete). If Income Code 42 or 43 is used, Recipient Code 22 (artist or athlete) should be used instead of Recipient Code 16 (individual), 15 (corporation), or 08 (partnership other than withholding foreign partnership).

6Use only to report gross income the tax for which is being deposited in the current year because such tax was previously escrowed for chapters 3 and 4 and the withholding agent previously reported the gross income in a prior year and checked the box to report the tax as not deposited under the escrow procedure. See the instructions to this form for further explanation.

7This code should only be used if no other specific chapter 3 exemption code applies.

8Use only to report a U.S. reportable account or nonconsenting U.S. account that is receiving a payment subject to chapter 3 withholding.

9Use only if applying the escrow procedure for dormant accounts under Regulations section

Form |

|

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2022 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

Copy D for Recipient |

||||||||||||||||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

|

AMENDED |

|

|

AMENDMENT NO. |

|

|

Attach to any state tax return you file |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e |

Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

|||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h |

Recipient’s GIIN |

|

13i Recipient’s foreign tax identification |

13j LOB code |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k |

Recipient’s account number |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a |

Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

Form

Explanation of Codes (continued)

10Trust other than Withholding Foreign Trust

11Withholding Foreign Trust

12Qualified Intermediary

13Qualified Securities

14Qualified Securities

15Corporation

16Individual

17Estate

18Private Foundation

19International Organization

20Tax Exempt Organization (Section 501(c) entities)

21Unknown Recipient

22Artist or Athlete

23Pension

24Foreign Central Bank of Issue

25Nonqualified Intermediary

26Hybrid entity making Treaty Claim

35Qualified Derivatives Dealer

36Foreign

37Foreign

38Publicly Traded Partnership

Pooled Reporting Codes10

27Withholding Rate

28Withholding Rate

29PAI Withholding Rate

30PAI Withholding Rate

31Agency Withholding Rate

32Agency Withholding Rate

Chapter 4 Status Codes

01U.S. Withholding

02U.S. Withholding

03Territory

04Territory

05Participating

06Participating

07Registered

08Registered

09Registered

10Certified

11Certified

12Certified

13Certified

14Certified

15Nonparticipating FFI

16

17U.S.

18U.S.

19Passive NFFE identifying Substantial U.S. Owners

20Passive NFFE with no Substantial U.S. Owners

21Publicly Traded NFFE or Affiliate of Publicly Traded NFFE

22Active NFFE

23Individual

24Section 501(c) Entities

25Excepted Territory NFFE

26Excepted

27Exempt Beneficial Owner

28Entity Wholly Owned by Exempt Beneficial Owners

29Unknown Recipient

30Recalcitrant Account Holder

31Nonreporting IGA FFI

32Direct reporting NFFE

33U.S. reportable account

34Nonconsenting U.S. account

35Sponsored direct reporting NFFE

36Excepted

37Undocumented Preexisting Obligation

38U.S.

39Account Holder of Excluded Financial Account11

40Passive NFFE reported by FFI12

41NFFE subject to 1472 withholding

50U.S. Withholding

Pooled Reporting Codes

42Recalcitrant

43Recalcitrant

44Recalcitrant

45Recalcitrant

46Recalcitrant

47Nonparticipating FFI Pool

48U.S. Payees Pool

49

Box 13j. LOB Code (enter the code that best describes the applicable limitation on benefits (LOB) category that qualifies the taxpayer for the requested treaty benefits).

LOB Code |

LOB Treaty Category |

02Government – contracting state/political subdivision/local authority

03Tax exempt pension trust/Pension fund

04Tax exempt/Charitable organization

05Publicly traded corporation

06Subsidiary of publicly traded corporation

07Company that meets the ownership and base erosion test

08Company that meets the derivative benefits test

09Company with an item of income that meets the active trade or business test

10Discretionary determination

11Other

12No LOB article in treaty

10Codes 27 through 32 should only be used by a QI, QSL, WP, or WT. A QI acting as a QDD may use only code 27 or 28.

11This code should only be used if income is paid to an account that is excluded from the definition of financial account under Regulations section

12This code should only be used when the withholding agent has received a certification on the FFI withholding statement of a participating FFI or registered deemed- compliant FFI that maintains the account that the FFI has reported the account held by the passive NFFE as a U.S. account (or U.S. reportable account) under its FATCA requirements. The withholding agent must report the name and GIIN of such FFI in boxes 15d and 15e.

13This code should only be used by a withholding agent that is reporting a payment (or portion of a payment) made to a QI with respect to the QI’s recalcitrant account holders.

Form |

|

Foreign Person’s U.S. Source Income Subject to Withholding |

2022 |

|

|

OMB No. |

|||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

▶ Go to www.irs.gov/Form1042S for instructions and the latest information. |

|

|

|

Copy E |

||||||||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

UNIQUE FORM IDENTIFIER |

|

AMENDED |

|

|

AMENDMENT NO. |

|

|

for Withholding Agent |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 Income |

2 Gross income |

|

3 Chapter indicator. Enter “3” or “4” |

|

|

13e Recipient’s U.S. TIN, if any |

|

|

|

13f |

Ch. 3 status code |

||||||||||||||||||||||||

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a Exemption code |

|

|

4a Exemption code |

|

|

|

|

|

|

|

|

|

|

|

|

|

13g Ch. 4 status code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

3b Tax rate |

. |

|

4b Tax rate |

. |

|

13h Recipient’s GIIN |

|

13i Recipient’s foreign tax identification |

13j LOB code |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number, if any |

|

|

|

|

|

|

|||

5 Withholding allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

7a Federal tax withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

13k Recipient’s account number |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7b Check if federal tax withheld was not deposited with the IRS because |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

escrow procedures were applied (see instructions) |

|

|

13l Recipient’s date of birth (YYYYMMDD) |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7c Check if withholding occurred in subsequent year with respect to a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

partnership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8 Tax withheld by other agents |

|

|

|

|

|

|

|

14a Primary Withholding Agent’s Name (if applicable) |

|||||||||||||||||||||||||||

9Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( |

) |

|

14b Primary Withholding Agent’s EIN |

15 Check if |

|

|

|

|

|

||||

10 Total withholding credit (combine boxes 7a, 8, and 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15a Intermediary or |

|||

11Tax paid by withholding agent (amounts not withheld) (see instructions)

|

|

|

|

|

|

|

15d Intermediary or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

Withholding agent’s EIN |

|

12b Ch. 3 status code |

12c Ch. 4 status code |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

Intermediary or |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

12d Withholding agent’s name |

15f Country code |

15g Foreign tax identification number, if any |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

12e |

Withholding agent’s Global Intermediary Identification Number (GIIN) |

15h |

Address (number and street) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12f |

Country code |

12g |

Foreign tax identification number, if any |

15i |

City or town, state or province, country, ZIP or foreign postal code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

12h |

Address (number and street) |

16a |

Payer’s name |

|

|

|

16b Payer’s TIN |

|||||||

|

|

|

|

|

|

|

|

|

||||||

12i City or town, state or province, country, ZIP or foreign postal code |

16c |

Payer’s GIIN |

|

|

16d Ch. 3 status code |

|

16e Ch. 4 status code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

13a |

Recipient’s name |

|

|

13b Recipient’s country code |

17a |

State income tax withheld |

17b Payer’s state tax no. |

17c Name of state |

||||||

13c Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Form |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 1042-S | This form is used to report income paid to a foreign person that is subject to income tax withholding by the U.S. |

| Income Types Reported | Form 1042-S reports types of income like dividends, royalties, scholarships, and other types of compensation. |

| Recipients | It is issued to non-resident aliens, foreign businesses, and other foreign entities that receive certain types of income from U.S. sources. |

| Filing Deadline | The form must be filed with the IRS by March 15 following the calendar year in which the income was paid. |

| Electronic Filing | Entities that are required to file 250 or more forms must file them electronically. |

| Withholding Rates | The withholding rates may vary depending on the type of income, the tax treaty between the U.S. and the recipient's country, and the recipient's U.S. tax status. |

| Requirement for Social Security Number (SSN) or ITIN | Recipients of income reported on Form 1042-S may need to provide a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) if they are claiming a reduced rate of withholding under a tax treaty. |

| Amendments | If errors are discovered after filing, an amended Form 1042-S must be submitted to correct the information. |

| State-specific Forms | The 1042-S is a federal form, and its requirements do not change from state to state; however, recipients should be aware of any state-specific tax obligations that may apply to their situation. |

Instructions on Utilizing IRS 1042-S

After submitting the IRS 1042-S form, a few important steps follow. The completion of this form is essential for reporting amounts paid to non-U.S. persons, including income such as salaries, dividends, or scholarships. This process ensures compliance with U.S. tax laws for payments made to foreign entities and individuals. Once completed and submitted, it's crucial to keep a copy for your records, monitor for any correspondence from the IRS in case they have questions or require additional information, and prepare for any potential tax obligations this reporting may highlight. The steps outlined below will guide you through the process of filling out the form accurately.

- Identify the recipient of the income. Determine if the recipient is an individual, a corporation, or another entity. This will affect how you proceed with the form.

- Locate the appropriate IRS 1042-S form for the tax year you are reporting. Make sure to use the most current version, as rules and form layouts can change.

- Gather all necessary information, including the recipient’s taxpayer identification number (TIN), country of residence, the total amount of income paid during the year, and any tax withheld.

- Begin by filling out the recipient's details in the sections provided. This includes their name, address, country of citizenship, and TIN.

- Enter the specifics of the income paid to the recipient in the next section. This part of the form requires you to classify the type of income and report the total amount paid.

- If tax was withheld from the payments, detail these amounts in the withholding tax section. Be precise, as this information is crucial for accurate tax reporting.

- Review the form thoroughly. Ensure all information is accurately reported and that no sections have been missed. Errors or omissions can lead to delays or questions from the IRS.

- Sign and date the form. This verifies that the information provided is accurate and truthful to the best of your knowledge.

- File the form with the IRS by the required deadline. Deadlines can vary, so it’s important to verify the specific due date for the tax year you are reporting.

- Keep a copy of the form for your records. It’s important to have a record of what was submitted for future reference or in case the IRS requests additional information.

Completing the IRS 1042-S form is a crucial step in ensuring tax compliance for payments made to non-U.S. individuals and entities. By following the steps outlined above, you can fill out the form correctly and efficiently, helping to avoid potential complications down the line. Remember, staying informed about tax obligations and maintaining accurate records is key to navigating the complexities of tax reporting for international transactions.

Obtain Answers on IRS 1042-S

If you've stumbled upon a need to understand or fill out a 1042-S form, you're likely dealing with specific types of payments from the U.S. to foreign persons. Here's a more digestible breakdown to navigate this form:

- What exactly is a 1042-S form?

The 1042-S form is used by the IRS to report amounts paid to foreign persons by a U.S. based institution or business. This includes incomes such as dividends, royalties, scholarships, and other types of income paid to non-resident aliens or foreign entities. Essentially, it's a way for the U.S. government to keep track of taxable income going to non-U.S. individuals or entities.

- Who needs to file the 1042-S form?

This form should be filed by the American institution or business that made the payment to the foreign individual or entity. If you're a non-resident alien receiving any of the income types described above from a U.S. source, expect to receive a 1042-S form reporting those payments.

- Is there a difference between a 1042-S and a W-2 or 1099 form?

Yes, there's a significant difference. While the W-2 and 1099 forms are used to report income for U.S. citizens and resident aliens, the 1042-S form is exclusively for reporting income paid to non-resident aliens and foreign entities. These forms have different purposes and are processed differently by the IRS.

- What types of income are reported on the 1042-S form?

- Dividends and interest from U.S. sources

- Royalties

- Compensation for services performed in the U.S.

- Scholarships and fellowship grants

- Other types of income that qualify under the IRS rules for non-resident aliens or foreign entities

- Can the information on a 1042-S form affect tax returns?

Absolutely. For non-resident aliens and foreign entities, the information reported on the 1042-S can significantly impact how they file their U.S. tax returns and calculate their tax obligations. It's used to claim benefits under tax treaties or to report income for which taxes were already withheld.

- What if I don't receive a 1042-S form but should have?

If you're expecting a 1042-S form and haven't received it, it's wise to contact the payer or institution that should've issued it. There are deadlines for issuing these forms, typically by March 15th following the year in which the income was paid. Acting swiftly can prevent filing delays or complications with the IRS.

- How does the 1042-S form interact with tax treaties?

Many foreign persons and entities are subject to reduced rates of taxation or exemptions based on tax treaties between their country and the U.S. The 1042-S form is instrumental in applying these treaty benefits correctly, reporting income, and documenting that the proper amount of tax was withheld in accordance with the treaty.

- Where can I find more information or get help with the 1042-S form?

For more detailed guidance or assistance, visiting the IRS website is a great starting point. It offers comprehensive information, instructions, and resources regarding the 1042-S form. Additionally, consulting with a tax professional skilled in international tax matters can prove invaluable, especially for those unfamiliar with the complexities of U.S. tax law as it applies to foreign nationals and entities.

Navigating the intricacies of international tax obligations can be challenging, but understanding the essentials of the 1042-S form is a good step forward. Whether you're a payer or a recipient, staying informed and seeking professional advice when necessary can help ensure compliance with U.S. tax laws and potentially avoid penalties.

Common mistakes

Incorrect or Missing Taxpayer Identification Numbers (TINs): One of the most critical yet frequently overlooked details is the taxpayer identification number. This number is essential for the IRS to process the form correctly. When it's incorrect or missing, it can lead to processing delays or even penalties. It's important to double-check this information for accuracy before submitting the form.

-

Errors in the Tax Rate or Exemption Code: For entries related to withholdings, it's common to see mistakes in the tax rate or exemption code used. This part of the form directly affects the calculated tax obligation, so inaccuracies can lead to either overpayment or underpayment of taxes. Understanding the criteria for different tax rates and exemption codes is crucial.

-

Failing to Properly Report the Type of Income: The IRS 1042-S form is used to report various types of income, from salaries and wages to scholarships and fellowships. Incorrectly categorizing the income can be a significant error. Paying careful attention to income types ensures that the form is filled out correctly and complies with IRS requirements.

-

Not Including All Necessary Information: Completeness is key when filling out any tax form. The IRS 1042-S form requires detailed information, including the recipient's full name, country of citizenship, and whether the benefits of a tax treaty are being claimed. Leaving out any required data may result in the rejection of the form or unnecessary delays in processing.

-

Misunderstanding Who Needs to File: One fundamental mistake is not recognizing whether you're actually required to file the form. The IRS 1042-S is specifically for reporting payments to foreign persons. Domestic transactions do not require this form. Ensuring that you need to file before starting is essential, as filling out unnecessary forms wastes time and resources.

To avoid these common errors:

- Always verify the accuracy of all identification numbers and personal information.

- Ensure you understand the specific tax rates and exemption codes that apply to the type of income you're reporting.

- Review the IRS instructions for the 1042-S form closely to make sure every necessary piece of information is included and correctly listed.

- Ask for help if you're unsure. Consulting a tax professional or using IRS resources can prevent many of these common mistakes.

Remember, investing the time to accurately complete the IRS 1042-S form can save you from potential headaches down the line. Accuracy, completeness, and understanding the form's requirements are your best tools for smooth sailing through tax season.

Documents used along the form