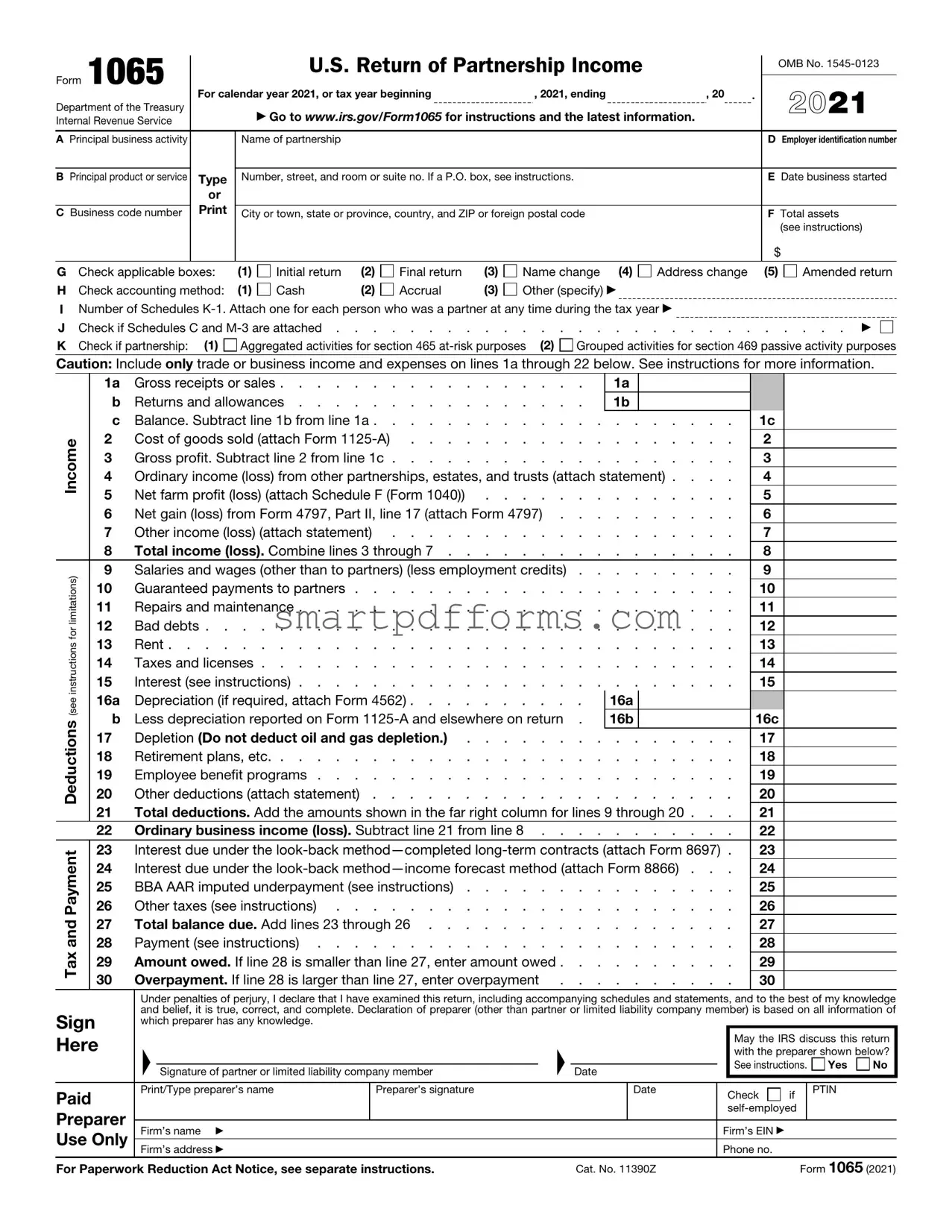

Blank IRS 1065 PDF Template

Navigating the complexities of tax obligations can be a daunting endeavor for partnerships and entities classified as "pass-through" businesses. At the heart of these responsibilities is the IRS 1065 form, a crucial document that serves essentially as an annual report of income, gains, losses, deductions, credits, and other vital financial information. It's designed to ensure transparency and compliance with the Internal Revenue Service by detailing the operations' financial health over the past year. More than just a formality, completing the IRS 1065 correctly plays a pivotal role in determining how profits and losses are distributed among partners, affecting individual tax liabilities. This process, while intricate, underscores the importance of maintaining meticulous financial records and understanding the tax implications of various business activities. As with most tax forms, the 1065 comes with its own set of challenges and nuances, such as different schedules and attachments required depending on the specifics of the business's operations, making it imperative for partners to grasp its components thoroughly or seek expert guidance to navigate its complexities.

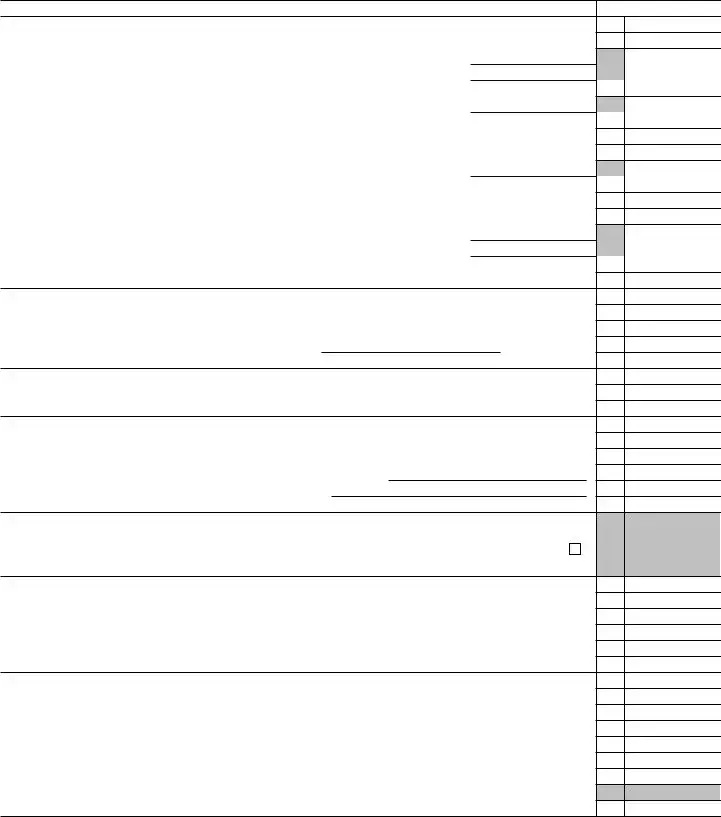

Preview - IRS 1065 Form

Form 1065 |

|

|

U.S. Return of Partnership Income |

|

|

|

OMB No. |

|||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Department of the Treasury |

For calendar year 2021, or tax year beginning |

|

, 2021, ending |

, 20 |

. |

|

2021 |

|||||

|

|

▶ Go to www.irs.gov/Form1065 for instructions and the latest information. |

|

|

||||||||

Internal Revenue Service |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||

A Principal business activity |

|

Name of partnership |

|

|

|

|

|

|

D Employer identification number |

|||

|

|

|

|

|

|

|||||||

B Principal product or service |

Type |

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

E Date business started |

|||||||

|

|

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

C Business code number |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

F Total assets |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

G |

Check applicable boxes: |

(1) |

Initial return |

(2) |

Final return |

(3) |

Name change (4) |

Address change |

(5) |

Amended return |

||

H |

Check accounting method: |

(1) |

Cash |

(2) |

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

INumber of Schedules

J |

Check if Schedules C and |

. . . . . . . . . . . . . . . . ▶ |

|

K |

Check if partnership: (1) |

Aggregated activities for section 465 |

Grouped activities for section 469 passive activity purposes |

Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information.

|

|

1a |

Gross receipts or sales |

. |

1a |

|

|

|

|

|

|

|

|

|

||||

|

|

b |

Returns and allowances |

. |

1b |

|

|

|

|

|

|

|

|

|

||||

|

|

c |

Balance. Subtract line 1b from line 1a |

. . . . . . . . . |

|

1c |

|

|

|

|

||||||||

Income |

|

2 |

Cost of goods sold (attach Form |

. . . . . . . . . |

|

2 |

|

|

|

|

||||||||

|

3 |

Gross profit. Subtract line 2 from line 1c |

. . . . . . . . . |

|

3 |

|

|

|

|

|||||||||

|

4 |

Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) . . . . |

|

4 |

|

|

|

|

||||||||||

|

5 |

Net farm profit (loss) (attach Schedule F (Form 1040)) |

. . . . . . . . . |

|

5 |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

6 |

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) . |

. . . . . . . . . |

|

6 |

|

|

|

|

||||||||

|

|

7 |

Other income (loss) (attach statement) |

. . . . . . . . . |

|

7 |

|

|

|

|

||||||||

|

|

8 |

Total income (loss). Combine lines 3 through 7 |

. . . . . . . . . |

|

8 |

|

|

|

|

||||||||

limitations) |

|

9 |

Salaries and wages (other than to partners) (less employment credits) |

. . . . . . . . . |

|

9 |

|

|

|

|

||||||||

|

10 |

Guaranteed payments to partners |

. . . . . . . . . |

|

10 |

|

|

|

|

|||||||||

|

11 |

Repairs and maintenance |

. . . . . . . . . |

|

11 |

|

|

|

|

|||||||||

|

12 |

Bad debts |

. . . . . . . . . |

|

12 |

|

|

|

|

|||||||||

for |

|

|

|

|

|

|

||||||||||||

|

13 |

Rent |

. . . . . . . . . |

|

13 |

|

|

|

|

|||||||||

instructions |

|

|

|

|

|

|

||||||||||||

|

14 |

Taxes and licenses |

. . . . . . . . . |

|

14 |

|

|

|

|

|||||||||

|

15 |

Interest (see instructions) |

. . . . . . . . . |

|

15 |

|

|

|

|

|||||||||

|

16a |

Depreciation (if required, attach Form 4562) |

. |

16a |

|

|

|

|

|

|

|

|

|

|||||

(see |

|

|

|

|

|

|

|

|

|

|

||||||||

|

b |

Less depreciation reported on Form |

. |

16b |

|

|

|

|

16c |

|

|

|

|

|||||

Deductions |

|

|

|

|

|

|

|

|

|

|||||||||

|

17 |

Depletion (Do not deduct oil and gas depletion.) |

. . . . . . . . . |

|

17 |

|

|

|

|

|||||||||

|

18 |

Retirement plans, etc |

. . . . . . . . . |

|

18 |

|

|

|

|

|||||||||

|

19 |

Employee benefit programs |

. . . . . . . . . |

|

19 |

|

|

|

|

|||||||||

|

20 |

Other deductions (attach statement) |

. . . . . . . . . |

|

20 |

|

|

|

|

|||||||||

|

|

21 |

Total deductions. Add the amounts shown in the far right column for lines 9 through 20 . . . |

|

21 |

|

|

|

|

|||||||||

|

|

22 |

Ordinary business income (loss). Subtract line 21 from line 8 . . |

. . . . . . . . . |

|

22 |

|

|

|

|

||||||||

Payment |

|

23 |

Interest due under the |

|

23 |

|

|

|

|

|||||||||

|

24 |

Interest due under the |

|

24 |

|

|

|

|

||||||||||

|

25 |

BBA AAR imputed underpayment (see instructions) |

. . . . . . . . . |

|

25 |

|

|

|

|

|||||||||

|

26 |

Other taxes (see instructions) |

. . . . . . . . . |

|

26 |

|

|

|

|

|||||||||

and |

|

27 |

Total balance due. Add lines 23 through 26 |

. . . . . . . . . |

|

27 |

|

|

|

|

||||||||

|

28 |

Payment (see instructions) |

. . . . . . . . . |

|

28 |

|

|

|

|

|||||||||

Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

29 |

Amount owed. If line 28 is smaller than line 27, enter amount owed . |

. . . . . . . . . |

|

29 |

|

|

|

|

|||||||||

|

30 |

Overpayment. If line 28 is larger than line 27, enter overpayment . |

. . . . . . . . . |

|

30 |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge |

|||||||||||||||

Sign |

|

and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of |

||||||||||||||||

|

which preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

May the IRS discuss this return |

|||||||

Here |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

with the preparer shown below? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions. Yes |

No |

||||

|

|

|

▲ Signature of partner or limited liability company member |

▲ |

Date |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

|

Print/Type preparer’s name |

Preparer’s signature |

|

|

|

Date |

|

Check |

if |

|

PTIN |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Firm’s name ▶ |

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

|

|||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s address ▶ |

|

|

|

|

|

|

Phone no. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

For Paperwork Reduction Act Notice, see separate instructions. |

|

Cat. No. 11390Z |

|

|

|

|

|

Form 1065 (2021) |

||||||||||

Form 1065 (2021) |

|

|

|

|

|

|

|

Page 2 |

|||

Schedule B |

Other Information |

|

|

|

|

|

|

|

|

|

|

1 What type of entity is filing this return? Check the applicable box: |

|

|

Yes |

No |

|||||||

a |

Domestic general partnership |

b |

Domestic limited partnership |

|

|

|

|

|

|||

c |

Domestic limited liability company |

d |

Domestic limited liability partnership |

|

|

|

|

||||

e |

Foreign partnership |

f |

Other ▶ |

|

|

|

|

|

|||

2 At the end of the tax year: |

|

|

|

|

|

|

|

|

|

||

a Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax- |

|

|

|

||||||||

|

exempt organization, or any foreign government own, directly or indirectly, an interest of 50% or more in the profit, |

|

|

|

|||||||

|

loss, or capital of the partnership? For rules of constructive ownership, see instructions. If “Yes,” attach Schedule |

|

|

|

|||||||

|

|

|

|

||||||||

b Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of |

|

|

|||||||||

|

|

|

|||||||||

|

the partnership? For rules of constructive ownership, see instructions. If “Yes,” attach Schedule |

|

|

|

|||||||

|

on Partners Owning 50% or More of the Partnership |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

3 At the end of the tax year, did the partnership: |

|

|

|

|

|

|

|

|

|

||

a Own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of |

|

|

|

||||||||

|

stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership, see instructions. |

|

|

|

|||||||

|

If “Yes,” complete (i) through (iv) below |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) Name of Corporation |

|

|

(ii) Employer Identification |

|

(iii) Country of |

(iv) Percentage |

|||

|

|

|

|

|

Number (if any) |

|

Incorporation |

Owned in Voting Stock |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

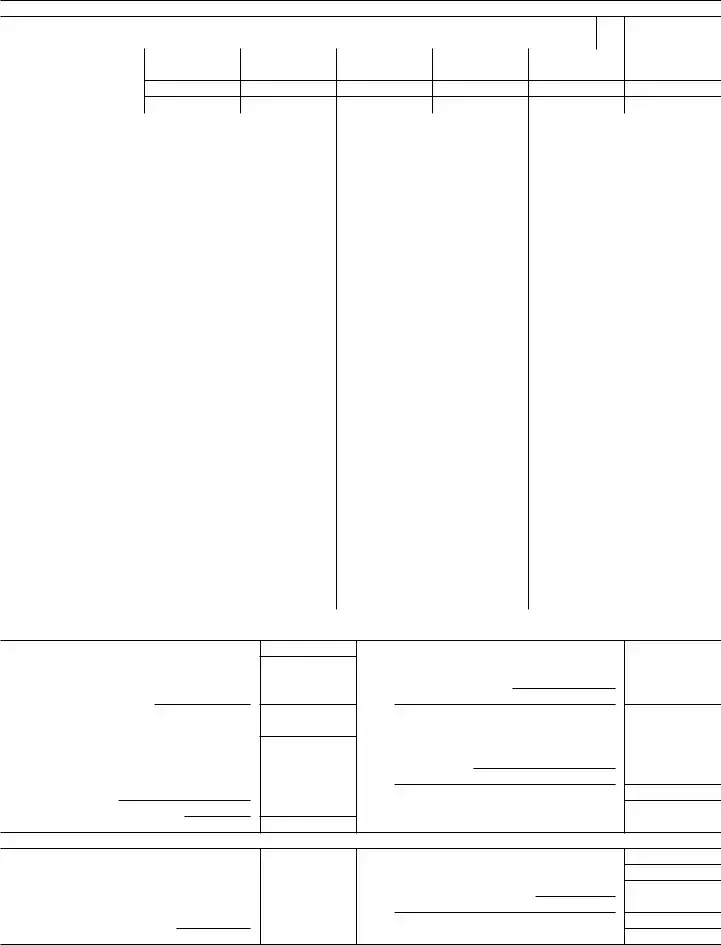

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below . .

(i)Name of Entity

(ii)Employer Identification

Number (if any)

(iii)Type of Entity

(iv)Country of Organization

(v)Maximum Percentage Owned in Profit, Loss, or Capital

4 Does the partnership satisfy all four of the following conditions? |

Yes No |

aThe partnership’s total receipts for the tax year were less than $250,000.

bThe partnership’s total assets at the end of the tax year were less than $1 million.

cSchedules

d The partnership is not filing and is not required to file Schedule

If “Yes,” the partnership is not required to complete Schedules L,

5 Is this partnership a publicly traded partnership, as defined in section 469(k)(2)? . . . . . . . . . . .

6During the tax year, did the partnership have any debt that was canceled, was forgiven, or had the terms modified

so as to reduce the principal amount of the debt? . . . . . . . . . . . . . . . . . . . . .

7Has this partnership filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

information on any reportable transaction? . . . . . . . . . . . . . . . . . . . . . . . .

8At any time during calendar year 2021, did the partnership have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? See instructions for exceptions and filing requirements for FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). If “Yes,” enter the name of the foreign country ▶

9At any time during the tax year, did the partnership receive a distribution from, or was it the grantor of, or transferor to, a foreign trust? If “Yes,” the partnership may have to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. See instructions . . . . . . . . .

10a Is the partnership making, or had it previously made (and not revoked), a section 754 election? . . . . . .

See instructions for details regarding a section 754 election.

bDid the partnership make for this tax year an optional basis adjustment under section 743(b) or 734(b)? If “Yes,”

attach a statement showing the computation and allocation of the basis adjustment. See instructions . . . .

Form 1065 (2021)

Form 1065 (2021) |

|

|

Page 3 |

Schedule B |

Other Information (continued) |

|

|

c Is the partnership required to adjust the basis of partnership assets under section 743(b) or 734(b) because of a |

|

Yes No |

|

substantial |

|

||

734(d))? If “Yes,” attach a statement showing the computation and allocation of the basis adjustment. See instructions |

|

||

11Check this box if, during the current or prior tax year, the partnership distributed any property received in a like- kind exchange or contributed such property to another entity (other than disregarded entities wholly owned by the

partnership throughout the tax year) . . . . . . . . . . . . . . . . . . . . . . . . ▶

12At any time during the tax year, did the partnership distribute to any partner a

undivided interest in partnership property? . . . . . . . . . . . . . . . . . . . . . . . .

13If the partnership is required to file Form 8858, Information Return of U.S. Persons With Respect To Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), enter the number of Forms 8858 attached. See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

14Does the partnership have any foreign partners? If “Yes,” enter the number of Forms 8805, Foreign Partner’s

Information Statement of Section 1446 Withholding Tax, filed for this partnership . . . ▶

15Enter the number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, attached

|

to this return . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

16a |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions |

b |

If “Yes,” did you or will you file required Form(s) 1099? |

17Enter the number of Forms 5471, Information Return of U.S. Persons With Respect To Certain Foreign

Corporations, attached to this return |

. . |

. |

. |

▶ |

||

|

|

|

|

|

|

|

18 Enter the number of partners that are foreign governments under section 892 |

. . |

. |

. |

▶ |

|

|

19During the partnership’s tax year, did the partnership make any payments that would require it to file Forms 1042 and

20Was the partnership a specified domestic entity required to file Form 8938 for the tax year? See the Instructions for Form 8938

21Is the partnership a section 721(c) partnership, as defined in Regulations section

22During the tax year, did the partnership pay or accrue any interest or royalty for which one or more partners are

not allowed a deduction under section 267A? See instructions . . . . . . . . . . . . . . . . .

If “Yes,” enter the total amount of the disallowed deductions . . . . . . . . . ▶ $

23Did the partnership have an election under section 163(j) for any real property trade or business or any farming

business in effect during the tax year? See instructions . . . . . . . . . . . . . . . . . . . .

24 Does the partnership satisfy one or more of the following? See instructions . . . . . . . . . . . . .

aThe partnership owns a

bThe partnership’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the partnership has business interest.

cThe partnership is a tax shelter (see instructions) and the partnership has business interest expense. If “Yes” to any, complete and attach Form 8990.

25 Is the partnership attaching Form 8996 to certify as a Qualified Opportunity Fund? . . . . . . . . . .

If “Yes,” enter the amount from Form 8996, line 15 . . . . . . . . . . . . ▶ $

26Enter the number of foreign partners subject to section 864(c)(8) as a result of transferring all or a portion of an interest in the partnership or of receiving a distribution from the partnership . . . . . ▶

Complete Schedule

27At any time during the tax year, were there any transfers between the partnership and its partners subject to the

disclosure requirements of Regulations section

28Since December 22, 2017, did a foreign corporation directly or indirectly acquire substantially all of the properties constituting a trade or business of your partnership, and was the ownership percentage (by vote or value) for purposes of section 7874 greater than 50% (for example, the partners held more than 50% of the stock of the foreign corporation)? If “Yes,” list the ownership percentage by vote and by value. See instructions.

Percentage: |

By Vote |

By Value |

29Is the partnership electing out of the centralized partnership audit regime under section 6221(b)? See instructions. If “Yes,” the partnership must complete Schedule

If “No,” complete Designation of Partnership Representative below.

Designation of Partnership Representative (see instructions)

Enter below the information for the partnership representative (PR) for the tax year covered by this return.

Name of PR ▶

U.S. address of PR

▲

U.S. phone number of

PR

▲

If the PR is an entity, name of the designated individual for the PR ▶

U.S. address of |

▲ |

designated individual |

U.S. phone number of designated individual

▲

Form 1065 (2021)

|

Form 1065 (2021) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Partners’ Distributive Share Items |

|

|

|

|

|||||||||

|

Schedule K |

|

|

|

|

|||||||||||

|

|

1 |

Ordinary business income (loss) (page 1, line 22) |

|||||||||||||

|

|

2 |

Net rental real estate income (loss) (attach Form 8825) |

|||||||||||||

|

|

3a |

Other gross rental income (loss) . . |

. . . . . . . . . . . |

3a |

|

||||||||||

|

|

b |

Expenses from other rental activities (attach statement) |

3b |

|

|||||||||||

|

|

c |

Other net rental income (loss). Subtract line 3b from line 3a |

|||||||||||||

|

(Loss) |

4 |

Guaranteed payments: a Services |

|

4a |

|

|

|

b Capital |

4b |

|

|||||

|

|

c Total. Add lines 4a and 4b |

||||||||||||||

|

|

|

||||||||||||||

|

|

5 |

Interest income |

|||||||||||||

|

Income |

6 |

Dividends and dividend equivalents: |

a Ordinary dividends |

||||||||||||

|

|

b Qualified dividends |

6b |

|

|

|

|

|

|

c Dividend equivalents |

6c |

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

7 |

Royalties |

|||||||||||||

|

|

8 |

Net |

|||||||||||||

|

|

9a |

Net |

|||||||||||||

|

|

b |

Collectibles (28%) gain (loss) . . . |

. . . . . . . . . . . |

9b |

|

||||||||||

|

|

c |

Unrecaptured section 1250 gain (attach statement) |

9c |

|

|||||||||||

|

|

10 |

Net section 1231 gain (loss) (attach Form 4797) |

|||||||||||||

|

|

11 |

Other income (loss) (see instructions) |

Type ▶ |

|

|

|

|

||||||||

|

Deductions |

12 |

Section 179 deduction (attach Form 4562) |

|||||||||||||

|

d |

Other deductions (see instructions) |

Type ▶ |

|

|

|

|

|||||||||

|

|

13a |

Contributions |

|||||||||||||

|

|

b |

Investment interest expense |

|||||||||||||

|

|

c |

Section 59(e)(2) expenditures: |

(1) |

Type ▶ |

|

|

|

(2) Amount ▶ |

|||||||

- |

14a |

Net earnings (loss) from |

||||||||||||||

Self- Employ ment |

c |

Gross nonfarm income |

||||||||||||||

|

|

b |

Gross farming or fishing income |

|||||||||||||

|

|

15a |

|

|

|

|

||||||||||

|

Credits |

b |

||||||||||||||

|

c |

Qualified rehabilitation expenditures (rental real estate) (attach Form 3468, if applicable) . . |

||||||||||||||

|

|

|||||||||||||||

|

|

d |

Other rental real estate credits (see instructions) |

Type ▶ |

|

|

||||||||||

|

|

e |

Other rental credits (see instructions) |

Type ▶ |

|

|

|

|

||||||||

|

International Transactions |

f |

Other credits (see instructions) |

Type ▶ |

|

|

|

|

||||||||

|

16 |

Attach Schedule |

||||||||||||||

|

|

|||||||||||||||

|

|

|

this box to indicate that you are reporting items of international tax relevance |

|||||||||||||

Alternative MinimumTax Items(AMT) |

17a |

|||||||||||||||

b |

Adjusted gain or loss |

|||||||||||||||

c |

Depletion (other than oil and gas) |

|||||||||||||||

|

|

|||||||||||||||

|

|

d |

Oil, gas, and geothermal |

|||||||||||||

|

|

e |

Oil, gas, and geothermal |

|||||||||||||

|

|

f |

Other AMT items (attach statement) |

|||||||||||||

|

Information |

18a |

||||||||||||||

|

b |

Other |

||||||||||||||

|

|

|||||||||||||||

|

|

c |

Nondeductible expenses |

|||||||||||||

|

|

19a |

Distributions of cash and marketable securities |

|||||||||||||

|

|

b |

Distributions of other property |

|||||||||||||

|

Other |

20a |

Investment income |

|||||||||||||

|

b |

Investment expenses |

||||||||||||||

|

|

|||||||||||||||

|

|

c |

Other items and amounts (attach statement) |

|

|

|

|

|||||||||

|

|

21 |

Total foreign taxes paid or accrued |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4

Total amount

1

2

3c

4c

5

6a

7

8

9a

10

11

12

13a

13b

13c(2)

13d

14a

14b

14c

15a

15b

15c

15d

15e

15f

17a

17b

17c

17d

17e

17f

18a

18b

18c

19a

19b

20a

20b

21

Form 1065 (2021)

Form 1065 (2021) |

Page 5 |

Analysis of Net Income (Loss)

1Net income (loss). Combine Schedule K, lines 1 through 11. From the result, subtract the sum of

|

Schedule K, lines 12 through 13d, and 21 |

. |

. . |

1 |

|

||||

2 |

Analysis by |

(i) Corporate |

(ii) Individual |

(iii) Individual |

(iv) Partnership |

(v) |

Exempt |

|

(vi) |

|

partner type: |

|

(active) |

(passive) |

|

Organization |

Nominee/Other |

||

aGeneral partners

bLimited partners

Schedule L |

|

Balance Sheets per Books |

Beginning of tax year |

|

End of tax year |

||||

|

|

|

Assets |

|

(a) |

(b) |

(c) |

|

(d) |

1 |

Cash |

|

|

|

|

|

|

||

2a |

Trade notes and accounts receivable |

|

|

|

|

|

|

||

b |

Less allowance for bad debts |

|

|

|

|

|

|

||

3 |

Inventories |

|

|

|

|

|

|

||

4 |

U.S. government obligations |

|

|

|

|

|

|

||

5 |

|

|

|

|

|

|

|||

6 |

Other current assets (attach statement) |

|

|

|

|

|

|

||

7a |

Loans to partners (or persons related to partners) . |

|

|

|

|

|

|

||

b |

Mortgage and real estate loans |

|

|

|

|

|

|

||

8 |

Other investments (attach statement) |

|

|

|

|

|

|

||

9a |

Buildings and other depreciable assets |

|

|

|

|

|

|

||

b |

Less accumulated depreciation |

|

|

|

|

|

|

||

10a |

Depletable assets |

|

|

|

|

|

|

||

b |

Less accumulated depletion |

|

|

|

|

|

|

||

11 |

Land (net of any amortization) |

|

|

|

|

|

|

||

12a |

Intangible assets (amortizable only) |

|

|

|

|

|

|

||

b |

Less accumulated amortization |

|

|

|

|

|

|

||

13 |

Other assets (attach statement) |

|

|

|

|

|

|

||

14 |

Total assets |

|

|

|

|

|

|

||

|

|

|

Liabilities and Capital |

|

|

|

|

|

|

15 |

Accounts payable |

|

|

|

|

|

|

||

16 |

Mortgages, notes, bonds payable in less than 1 year |

|

|

|

|

|

|

||

17 |

Other current liabilities (attach statement) . . . . |

|

|

|

|

|

|

||

18 |

All nonrecourse loans |

|

|

|

|

|

|

||

19a |

Loans from partners (or persons related to partners) . |

|

|

|

|

|

|

||

b |

Mortgages, notes, bonds payable in 1 year or more . |

|

|

|

|

|

|

||

20 |

Other liabilities (attach statement) |

|

|

|

|

|

|

||

21 |

Partners’ capital accounts |

|

|

|

|

|

|||

22 |

Total liabilities and capital |

|

|

|

|

|

|

||

Schedule |

Reconciliation of Income (Loss) per Books With Income (Loss) per Return |

|

|

||||||

Note: The partnership may be required to file Schedule

1Net income (loss) per books . . . .

2Income included on Schedule K, lines 1, 2, 3c, 5, 6a, 7, 8, 9a, 10, and 11, not recorded on books this year (itemize):

3Guaranteed payments (other than health

insurance) . . . . . . . . . .

4Expenses recorded on books this year not included on Schedule K, lines 1 through 13d, and 21 (itemize):

aDepreciation $

bTravel and entertainment $

5Add lines 1 through 4 . . . . . .

Schedule

6Income recorded on books this year not included on Schedule K, lines 1 through 11 (itemize):

a

7Deductions included on Schedule K, lines 1 through 13d, and 21, not charged against book income this year (itemize):

aDepreciation $

8 Add lines 6 and 7 . . . . . . . .

9Income (loss) (Analysis of Net Income (Loss), line 1). Subtract line 8 from line 5

1 |

Balance at beginning of year . . . |

6 |

Distributions: a Cash |

|

2 |

Capital contributed: a Cash . . . |

|

|

b Property |

|

b Property . . |

7 |

Other decreases (itemize): |

|

3 |

Net income (loss) (see instructions) . |

|

|

|

4 |

Other increases (itemize): |

8 |

Add lines 6 and 7 |

|

5 |

Add lines 1 through 4 |

|

9 |

Balance at end of year. Subtract line 8 from line 5 |

Form 1065 (2021)

Form Data

| Fact Number | Description |

|---|---|

| 1 | The IRS 1065 form is used by partnerships to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. |

| 2 | It is required for domestic partnerships and foreign partnerships generating income in the United States. |

| 3 | Partnerships don't pay income tax. Instead, the form helps pass through any profits or losses to partners who then report it on their own tax returns. |

| 4 | Along with Form 1065, partnerships might need to submit Schedule K-1 for each partner. Schedule K-1 outlines each partner's share of the business's profits, losses, deductions, and credits. |

| 5 | The form requires detailed information about the partnership's income, including sales, cost of goods sold, and various types of deductions. |

| 6 | It also necessitates reporting on the partnership's balance sheet, liabilities, and capital accounts. |

| 7 | The filing deadline for Form 1065 is the 15th day of the 3rd month after the end of the partnership's tax year. For partnerships operating on a calendar year, this date is March 15th. |

| 8 | If a partnership fails to file Form 1065 by the deadline, it may face penalties. The penalty is based on the period of the delay and the number of partners in the partnership. |

| 9 | State-specific requirements for partnerships may vary. Partnerships should consult the tax authority in their state to determine if additional forms are necessary. |

Instructions on Utilizing IRS 1065

After completing IRS Form 1065, partnerships provide the IRS with a snapshot of the business's annual financial status. This process is crucial for the accurate assessment of taxes that may be due from the partnership itself or passed through to the individual partners. The steps to fill out this form are straightforward but require careful attention to detail to ensure all the necessary information is accurately reported.

- Gather necessary documents, including the partnership's Employer Identification Number (EIN), financial statements, and records of any expenses or deductions.

- Go to the IRS website and download the latest version of Form 1065.

- Enter the basic information about the partnership, including its name, address, EIN, and the tax year for which you are filing.

- Complete the Income section by reporting the partnership's total income, including gross receipts or sales, less cost of goods sold, plus any other income.

- Fill in the Deductions section with all allowable expenses, such as salaries and wages, rent, taxes, and interest.

- Calculate the partnership's total income or loss for the year by subtracting total deductions from total income.

- Complete Schedule B, answering additional questions about the partnership, its partners, and its activities.

- Fill out Schedule K to report the partnership's income, deductions, credits, etc., which will be shared among the partners.

- Distribute Schedule K-1 forms to each partner to report their share of the partnership's income, deductions, and credits.

- Review the form for accuracy, sign it, and date it. An authorized partner or representative must sign the form.

- Submit the completed Form 1065 to the IRS by the deadline, typically March 15th for calendar year partnerships, along with any required attachments.

Completing IRS Form 1065 with precision is essential for compliance and to minimize any potential tax liabilities. It's recommended to seek the advice of a tax professional if there are uncertainties or complex issues. Upon submission, partners should retain copies for their records and be prepared for any additional information that the IRS may request.

Obtain Answers on IRS 1065

-

What is the IRS 1065 form?

The IRS 1065 form, also known as the U.S. Return of Partnership Income, is a document that must be filed by partnerships in the United States. It's used to report the income, gains, losses, deductions, credits, and other financial information of a partnership for the tax year. This form helps the IRS assess the partnership’s tax obligations and ensures that partners are accurately reporting their share of the partnership's financial activities on their individual tax returns.

-

Who needs to file the IRS 1065 form?

Generally, the IRS 1065 form must be filed by any domestic partnership engaged in trade or business in the United States. This includes Limited Partnerships (LPs), Limited Liability Partnerships (LLPs), and certain Limited Liability Companies (LLCs) that elect to be treated as partnerships for tax purposes. Additionally, foreign partnerships with income in the United States or those involved in a trade or business within the country are also required to file this form.

-

When is the IRS 1065 form due?

The deadline for filing the IRS 1065 form is generally the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, the due date is March 15th of the following year. If the due date falls on a weekend or legal holiday, the deadline is shifted to the next business day. Partnerships may request a six-month extension to file using Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

-

What information is required on the IRS 1065 form?

The IRS 1065 form requires detailed information about the partnership's financial activities. This includes the partnership's income, expenses, and deductions; the allocation of income, losses, and credits to partners; a balance sheet for the beginning and end of the year if the partnership meets certain criteria; and information about the partners and their capital accounts. Schedules K and K-1, attached to the 1065, are particularly important as they report each partner's share of the partnership's income, deductions, and credits.

-

How is the information on IRS 1065 form used?

The information reported on the IRS 1065 form is used by the IRS to ensure that the partnership and its partners are complying with the U.S. tax code. The form details the partnership's total income and how it is divided among partners. Each partner then reports their share of income, deductions, and credits on their individual tax returns. This process allows the IRS to cross-reference information between the partnership's and individual partners' filings, ensuring accurate tax reporting and compliance.

-

Are there penalties for failing to file the IRS 1065 form?

Yes, partnerships that fail to file the IRS 1065 form on time or file an incomplete or incorrect form may face penalties. The penalty is generally based on the duration of the delay and the number of partners in the partnership, increasing with each month the form is late. Additionally, discrepancies between the income, deductions, and credits reported by the partnership and those reported by individual partners can lead to audits and further penalties for both the partnership and individual partners.

-

Can the IRS 1065 form be filed electronically?

Yes, the IRS strongly encourages partnerships to file the 1065 form electronically. Filing electronically is faster, safer, and provides confirmation that the IRS has received the form. Electronic filing can also facilitate quicker processing of the information and reduce the likelihood of errors. Partnerships can use various IRS-authorized e-filing services to submit their 1065 form and related schedules electronically.

-

What are the schedules attached to the IRS 1065 form, and what do they represent?

The IRS 1065 form includes several schedules that partnerships must complete in addition to the main form. Key schedules include:

- Schedule K: Reports the partnership's aggregate gains, losses, income, deductions, and credits to be shared among partners.

- Schedule K-1: Allocates the individual shares of the above items to each partner for inclusion on their tax returns.

- Schedule B: Provides information on the type of business, ownership structure, and certain financial activities.

- Other schedules may be required depending on specific deductions, credits, or foreign transactions.

These schedules ensure that the partnership's and partners' tax responsibilities are fully documented and accurately reported to the IRS.

-

How can partnerships amend a previously filed IRS 1065 form?

If a partnership needs to correct or amend information previously reported on a filed IRS 1065 form, it can do so by filing an amended 1065 form and checking the "Amended Return" box. The partnership must also provide an explanation of the amendments and, if necessary, issue corrected Schedule K-1s to each partner. It's important for partnerships to amend incorrect returns to avoid penalties, ensure compliance with tax laws, and guarantee proper income reporting by partners on their individual tax returns.

Common mistakes

When filling out the IRS 1065 form, which is essential for certain partnerships to submit their financial information, people tend to make a range of mistakes. It's a complex document and errors can happen easily. Here’s a look at some of the most common errors:

Not double-checking the Partnership's Information: Basic details like the name, address, and EIN (Employer Identification Number) are sometimes filled incorrectly or left blank.

Improperly Allocating Income, Deductions, and Credits among partners: This could lead to underreported or overreported figures, impacting tax liabilities.

Failing to Report All Income: All sources of income, including foreign transactions, must be reported accurately to avoid penalties.

Mistakes in Calculating Deductions: Overlooking or double-counting deductions is a common error, which can either inflate or deflate the partnership’s income.

Omitting Necessary Schedules: The 1065 form requires various schedules and attachments, depending on specific partnership activities. Missing documentation can cause delays or audits.

Incorrectly Filing State and Local Taxes: Not all states follow federal tax rules closely, so ensuring state-specific forms align with the 1065 is crucial.

Forgetting to Sign and Date the Form: An unsigned form is not valid and will be returned, possibly causing filing delays and penalties.

Using the Wrong Tax Year: Partnerships need to pay attention to the tax year they are reporting for, especially if their fiscal year doesn't align with the calendar year.

Lack of Recordkeeping: Inadequate documentation of financial activities throughout the year can lead to errors when filling out the form.

These mistakes can generally be avoided with careful preparation and by double-checking all entries on the form. Consulting with a tax professional can also help ensure the form is filled out correctly and in compliance with IRS regulations.

Documents used along the form

When dealing with the IRS 1065 form, which is essential for reporting the income, gains, losses, deductions, and credits of a partnership, there are several other documents and forms that often need to be filled out alongside it. These additional documents help in providing a comprehensive view of the partnership's financial situation and assist in ensuring that all necessary information is accurately reported to the IRS. Understanding these accompanying documents can make the process smoother and more efficient.

- Schedule K-1 (Form 1065) - This document is used to report the share of a partnership's income, deductions, credits, etc., attributed to each partner. It's crucial for the partners to use this information to complete their own tax returns.

- Schedule M-3 (Form 1065) - Partnerships with assets of $10 million or more are required to file this form. It provides a more detailed report of the partnership's financial activities, offering a reconciliation of income and loss reported on tax returns with that reported on financial statements.

- Form 4562 - This form is used to report depreciation and amortization. If a partnership has assets that depreciate, such as buildings, vehicles, or equipment, this form should be completed to claim those expenses.

- Form 8825 - This form is specifically designed for reporting income and expenses related to real estate rentals owned by the partnership. It is similar to Schedule E (Form 1040), which is used by individual taxpayers.

- Form 8308 - In cases where there has been a sale or exchange of partnership interests, this form is necessary. It reports the sale or exchange of certain partnership interests to the IRS.

- Form 7004 - This is an application for an automatic extension of time to file certain business income tax, information, and other returns, including Form 1065. If a partnership needs more time to gather and prepare its documents, this form can be filed to request an extension.

Filling out the IRS 1065 form and its associated documents correctly is crucial for partnerships to comply with tax regulations and avoid potential penalties. Each document serves a specific purpose in ensuring that the partnership's financial activities are fully and accurately reported. By familiarizing yourself with these forms, you can ensure that the partnership fulfills its tax obligations effectively.

Similar forms

IRS 1040: Individual Income Tax Return. This form is similar to the IRS 1065 as both are essential for tax filing purposes. While the 1040 form is used by individuals, the 1065 is for partnerships, showing the division of income, deductions, gains, losses, etc., among partners.

IRS 1120: U.S. Corporation Income Tax Return. This form is akin to the 1065 in its purpose of reporting income, gains, losses, deductions, and credits to the IRS. However, the 1120 is specific to corporations, detailing their financial activities within the fiscal year.

IRS 1120-S: U.S. Income Tax Return for an S Corporation. It shares similarities with the 1065 as both are used by entities that pass income directly to owners or shareholders. The key difference is that the 1120-S is for S corporations, which have specific tax treatment compared to the partnerships using the 1065.

IRS 1041: U.S. Income Tax Return for Estates and Trusts. Like the 1065, this form reports income, but for estates and trusts instead of partnerships. It details distributions to beneficiaries and how income is distributed or accumulated within the estate or trust.

Schedule K-1 (Form 1065): Partner's Share of Income, Deductions, Credits, etc. Directly associated with the 1065, the Schedule K-1 is an essential complementary document that details each partner's share of the partnership's financial activity reported on the 1065.

IRS 990: Return of Organization Exempt from Income Tax. While targeting nonprofit organizations, this form shares the intent of reporting income, expenses, and operational data to the IRS like the 1065. The primary difference lies in the entity types and the tax-exempt status of those filing the 990.

IRS 8832: Entity Classification Election. Entities might use this form to elect their classification for federal tax purposes. Although not a direct tax return, it influences how entities, including those that file form 1065, will be taxed, whether as a corporation, partnership, or disregarded entity.

IRS 8865: Return of U.S. Persons With Respect to Certain Foreign Partnerships. This form parallels the domestic intentions of the 1065, requiring U.S. persons who control or have significant stakes in foreign partnerships to report financial details, much like how domestic partnerships report theirs on the 1065.

IRS 5471: Information Return of U.S. Persons With Respect To Certain Foreign Corporations. Similar to the 1065 in terms of reporting financial activity, the 5471 applies to U.S. citizens or residents who are officers, directors, or shareholders in certain foreign corporations, detailing their foreign assets and reporting income.

IRS 1099-MISC: Miscellaneous Income. Although not a tax return, it relates closely to the reporting process on the 1065. It documents various types of income payments, such as rents or royalties, which are common income types reported by partnerships on their 1065 forms.

Dos and Don'ts

Filling out IRS Form 1065, also known as the U.S. Return of Partnership Income, is a critical task for partners in a business. It's where you report your partnership's financial details for the tax year. To guide you in this process, here are some do's and don'ts that will help ensure you complete the form accurately and comply with tax obligations.

Things You Should Do

- Double-check your information: Before submission, verify all details, including Social Security numbers, Employer Identification Numbers (EINs), and addresses, are correct. Errors in these areas can lead to processing delays or audits.

- Gather all necessary documents: Compile financial statements, expense reports, and any other relevant documentation before starting. This ensures the accuracy of the information you report.

- Calculate deductions carefully: Partnerships can claim various deductions that can significantly lower taxable income. Dedicate time to accurately calculate and justify these amounts.

- Use IRS instructions: The IRS provides detailed instructions for Form 1065. Refer to these guidelines to understand each part of the form and the information required.

Things You Shouldn't Do

- Don’t estimate numbers: Ensure all financial figures are precise. Estimations can lead to inaccuracies in taxable income or deductions, potentially triggering an audit.

- Don’t leave sections blank: If a section does not apply to your partnership, mark it as “0” or “N/A.” Blank sections may cause confusion or imply that you overlooked parts of the form.

- Don’t forget to sign the form: An unsigned form is considered incomplete by the IRS and will not be processed. Make sure that the designated partner signs the form.

- Don’t ignore filing deadlines: Late filings can result in penalties and interest charges. Be aware of the deadline (typically March 15 for partnerships) and plan accordingly to avoid late submission.

Properly completing IRS Form 1065 is essential for any partnership. By following these guidelines, you can navigate the filing process more smoothly and help ensure your partnership remains in good standing with the IRS.

Misconceptions

Only large partnerships need to file Form 1065: This is a common misconception. The IRS requires every partnership, regardless of its size, to file Form 1065. This form is used to report the partnership's income, gains, losses, deductions, credits, etc., to the IRS.

Form 1065 is for tax payment: In reality, Form 1065 does not involve directly paying taxes. Instead, it's an informational return where a partnership reports its financial activities. The partners then use this information to complete their own individual tax returns.

Partnerships must pay income taxes on profits: It's often misunderstood that partnerships themselves pay income taxes. However, partnerships are "pass-through" entities. This means the profits or losses pass through to the individual partners, who then report this income on their personal tax returns.

Personal expenses can be deducted on Form 1065: Some may think that personal expenses of the partners can be deducted on Form 1065. The truth is, only expenses that are directly related to the partnership's business operations can be deducted. Personal expenses of the partners are not deductible through the partnership.

All partnerships are required to file Form 1065 electronically: While the IRS encourages electronic filing, not all partnerships are mandated to file Form 1065 electronically. Small partnerships with fewer than 100 partners have the option to file paper returns, although electronic filing is preferred for its convenience and speed.

Form 1065 includes a section for calculating the partnership's tax liability: This is not accurate. Form 1065 is an informational form that does not directly calculate tax liability. Instead, it includes schedules and information that partners use to report their share of the partnership's income or loss on their individual tax returns.

Amending Form 1065 is not allowed: If a partnership discovers an error or omission after filing Form 1065, it is actually possible to amend the return. Filing an amended return allows partnerships to correct the information previously reported to the IRS and ensure accurate reporting of income, deductions, and credits.

Key takeaways

Filling out and using the IRS 1065 form, known as the U.S. Return of Partnership Income, is a crucial task for partnerships in the United States. This form not only helps in reporting the income, deductions, gains, and losses from the operations of a partnership, but it also plays a significant role in ensuring compliance with tax laws. Understanding the key takeaways about this form can simplify the process and ensure accuracy.

- Determine if You Need to File: Not all business arrangements require the filing of Form 1065. Generally, any entity operating as a partnership must file this form. This includes limited partnerships, general partnerships, and limited liability companies (LLCs) that are classified as partnerships for tax purposes. Identifying your entity's classification is the first step in complying with tax obligations.

- Gather Necessary Information: Before filling out Form 1065, partners should compile all necessary financial records. This includes income statements, balance sheets, and documents pertaining to deductions and credits. Accurate and thorough record-keeping simplifies the filing process and helps avoid mistakes that could lead to audits or penalties.

- Understand the Importance of Schedules: Form 1065 comes with various schedules that require detailed information about the partnership's financial activities. Key schedules include Schedule K-1, which reports each partner's share of the partnership's income, deductions, and credits. It's important for both the partnership and the individual partners, as it outlines how each partner should report items on their personal tax returns.

- Pay Attention to Deadlines: Like all tax forms, the IRS Form 1065 has a strict deadline. The form is usually due on the 15th day of the 3rd month after the end of the partnership's tax year. For partnerships operating on a calendar year, the deadline is March 15. Filing late can result in penalties, so it's crucial to submit the form on time or file for an extension if necessary.

Correctly filling out and timely submitting Form 1065 is essential for partnerships to accurately report their financial activities and maintain compliance with tax laws. Partnerships should seek assistance from tax professionals if they have questions or need help navigating complex tax rules and filing requirements.

Popular PDF Forms

Incident Report Construction - Assists in the evaluation of safety measures on construction sites by documenting incidents and the effectiveness of current protocols.

Near Miss Accident Examples - A ladder used in the stockroom was found to be unstable and missing a foot, risking a fall.

89809 Labcorp - Key to unlocking secure access to your LabCorp test results online, necessitating a straightforward identity verification.