Blank IRS 1099-R PDF Template

Navigating the intricacies of tax documentation can feel overwhelming, especially when it involves forms like the IRS 1099-R, which are crucial for individuals receiving distributions from pensions, annuities, retirement plans, IRAs, or insurance contracts. This form serves a pivotal role in ensuring that taxpayers accurately report their retirement income on their tax returns, providing the IRS with detailed information about the type and amount of distribution received during the tax year. Whether you're drawing from your retirement savings, receiving benefits as a beneficiary, or simply managing your investments, understanding the 1099-R form is essential. It not only helps in complying with federal tax laws but also in planning for tax liabilities associated with retirement income. With potential implications for income tax calculations and the necessity to report correctly to avoid penalties, getting acquainted with the 1099-R form is of paramount importance for anyone dealing with retirement distributions.

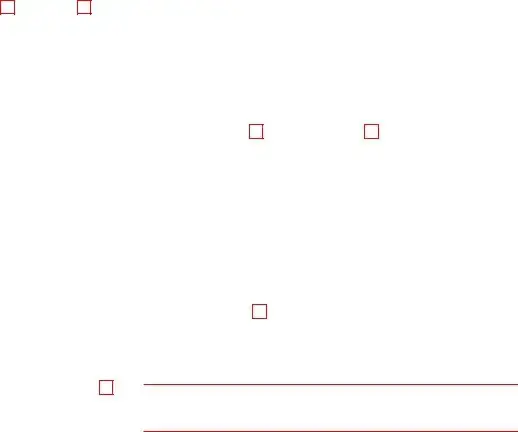

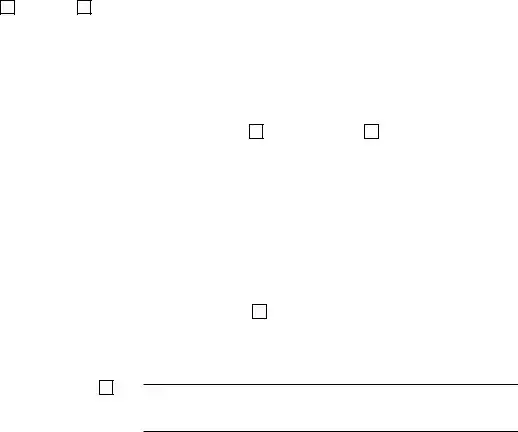

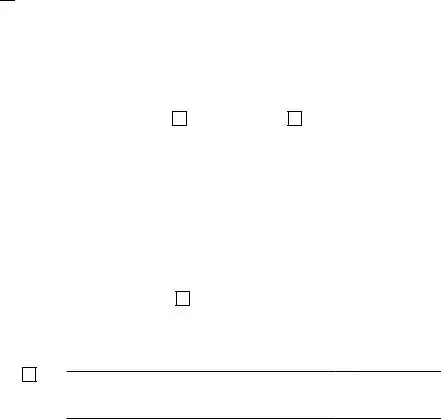

Preview - IRS 1099-R Form

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

|

|

9898 |

|

|

VOID |

|

CORRECTED |

|

|

|

|

|

|

|

|

|

Distributions From |

|||||

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

OMB No. |

|

||||||||||||||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|

|

Pensions, Annuities, |

||||||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

2022 |

|

|

|

Retirement or |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

2a Taxable amount |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

IRAs, Insurance |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

Form |

|

|

|

Contracts, etc. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

2b Taxable amount |

|

|

Total |

|

|

Copy A |

|||||||

|

|

|

|

|

|

|

|

|

|

not determined |

|

|

distribution |

|

|

For |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

|

|

|

|

RECIPIENT’S TIN |

|

|

3 Capital gain (included in |

4 Federal income tax |

|

|

Internal Revenue |

||||||||||

|

|

|

|

|

|

|

|

|

|

box 2a) |

|

|

|

|

withheld |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service Center |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

File with Form 1096. |

RECIPIENT’S name |

|

|

|

|

|

5 Employee contributions/ |

6 Net unrealized |

|

|

For Privacy Act |

||||||||||||

|

|

|

|

|

|

|

|

|

Designated Roth |

|

appreciation in |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

contributions or |

|

employer’s securities |

|

|

and Paperwork |

||||||||

|

|

|

|

|

|

|

|

|

insurance premiums |

|

|

|

|

|

|

|

Reduction Act |

|||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

Notice, see the |

Street address (including apt. no.) |

|

|

7 Distribution |

|

IRA/ |

8 Other |

|

|

|

2022 General |

||||||||||||

|

|

|

|

|

|

|

|

|

code(s) |

|

|

|

SEP/ |

|

|

|

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIMPLE |

$ |

|

|

|

|

|

|

Certain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

||

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

9b Total employee contributions |

|

|||||||||||||||||||

|

Returns. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

distribution |

% |

$ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

10 Amount allocable to IRR |

|

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

15 State/Payer’s state no. |

|

16 State distribution |

|||||||||||||

within 5 years |

|

|

|

Roth contrib. |

|

|

requirement |

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

||

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

|

|

13 Date of |

17 Local tax withheld |

|

18 Name of locality |

|

|

19 Local distribution |

||||||||||||

|

|

|

|

|

|

|

payment |

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Form |

Cat. No. 14436Q |

|

|

|

|

www.irs.gov/Form1099R |

|

|

|

|

Department of the Treasury - Internal Revenue Service |

|||||||||||

Do Not Cut |

or Separate Forms on |

This Page |

— |

Do Not |

Cut |

or Separate Forms |

on This Page |

|||||||||||||||

|

|

|

VOID |

CORRECTED |

|

|

|

|

Distributions From |

||||

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

OMB No. |

|

|||||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

Pensions, Annuities, |

||||||

|

|

|

|

|

|

$ |

|

|

2022 |

|

|

Retirement or |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

2a Taxable amount |

|

|

|||||

|

|

|

|

|

|

|

|

|

IRAs, Insurance |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

Form |

|

|

Contracts, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

2b Taxable amount |

|

Total |

|

Copy 1 |

|||

|

|

|

|

|

|

not determined |

|

distribution |

|

For |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

|

|

RECIPIENT’S TIN |

|

3 Capital gain (included in |

4 Federal income tax |

|

||||||

|

|

|

|

State, City, |

|||||||||

|

|

|

|

|

|

box 2a) |

|

withheld |

|

||||

|

|

|

|

|

|

|

|

or Local |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

Tax Department |

|

|

|

|

|

|

|

|

|

|

|

|

||

RECIPIENT’S name |

|

|

|

|

|

5 Employee contributions/ |

6 Net unrealized |

|

|

||||

|

|

|

|

|

|

Designated Roth |

|

appreciation in |

|

|

|||

|

|

|

|

|

|

contributions or |

|

employer’s securities |

|

|

|||

|

|

|

|

|

|

insurance premiums |

|

|

|

|

|

||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

Street address (including apt. no.) |

|

|

|

7 Distribution |

|

IRA/ |

8 Other |

|

|

|

|||

|

|

|

|

|

|

code(s) |

|

SEP/ |

|

|

|

|

|

|

|

|

|

|

|

|

SIMPLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

9b Total employee contributions |

|

||||||||||

|

|

|

|

|

|

distribution |

% |

$ |

|

|

|

|

|

10 Amount allocable to IRR |

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

15 State/Payer’s state no. |

16 State distribution |

||||||

within 5 years |

|

|

Roth contrib. |

|

requirement |

$ |

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

13 Date of |

17 Local tax withheld |

|

18 Name of locality |

|

19 Local distribution |

|||||

|

|

|

|

|

payment |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

|

|

www.irs.gov/Form1099R |

|

|

|

Department of the Treasury - Internal Revenue Service |

||||||

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

OMB No. |

|

|

Distributions From |

|||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

Pensions, Annuities, |

||||||

|

|

|

|

|

$ |

|

|

2022 |

|

|

Retirement or |

||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

2a Taxable amount |

|

|

||||||

|

|

|

|

|

|

|

|

IRAs, Insurance |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

$ |

|

|

Form |

|

|

Contracts, etc. |

||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

2b Taxable amount |

|

Total |

|

Copy B |

||||

|

|

|

|

|

not determined |

|

distribution |

|

Report this |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

PAYER’S TIN |

|

RECIPIENT’S TIN |

|

3 Capital gain (included in |

4 Federal income tax |

|

|||||||

|

|

|

income on your |

||||||||||

|

|

|

|

|

box 2a) |

|

withheld |

|

|||||

|

|

|

|

|

|

|

federal tax |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

$ |

|

|

$ |

|

|

|

return. If this |

|

|

|

|

|

|

|

|

|

|

|

form shows |

|||

RECIPIENT’S name |

|

|

|

|

5 Employee contributions/ |

6 Net unrealized |

|

federal income |

|||||

|

|

|

|

|

Designated Roth |

|

appreciation in |

|

tax withheld in |

||||

|

|

|

|

|

contributions or |

|

employer’s securities |

|

box 4, attach |

||||

|

|

|

|

|

insurance premiums |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

this copy to |

||||

|

|

|

|

|

$ |

|

|

$ |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

your return. |

|||

Street address (including apt. no.) |

|

7 Distribution |

|

IRA/ |

8 Other |

|

|

|

|||||

|

|

|

|

|

|||||||||

|

|

|

|

|

code(s) |

|

SEP/ |

|

|

|

|

|

|

|

|

|

|

|

|

SIMPLE |

|

|

|

|

This information is |

||

|

|

|

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

% |

|||

|

|

|

|

|

|

|

|

|

|

being furnished to |

|||

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

9b Total employee contributions |

|||||||||||

the IRS. |

|||||||||||||

|

|

|

|

|

distribution |

|

$ |

|

|

|

|||

|

|

|

|

|

% |

|

|

|

|

||||

10 Amount allocable to IRR |

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

15 State/Payer’s state no. |

16 State distribution |

||||||

within 5 years |

|

Roth contrib. |

|

requirement |

$ |

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

|

13 Date of |

17 Local tax withheld |

|

18 Name of locality |

|

19 Local distribution |

|||||

|

|

|

|

payment |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

Form |

|

www.irs.gov/Form1099R |

|

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Instructions for Recipient

Generally, distributions from retirement plans (IRAs, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance contracts, etc., are reported to recipients on Form

IRAs. For distributions from a traditional individual retirement arrangement (IRA), simplified employee pension (SEP), or savings incentive match plan for employees (SIMPLE), generally the payer isn’t required to compute the taxable amount. See the instructions for your tax return to determine the taxable amount. If you’re at least age 72, you must take minimum distributions from your IRA (other than a Roth IRA). If you don’t, you’re subject to a 50% excise tax on the amount that should’ve been distributed. See Pub.

Roth IRAs. For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution.

Loans treated as distributions. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a distribution and include all or part of the amount borrowed in your income. There are exceptions to this rule. If your loan is taxable, code L will be shown in box 7. See Pub. 575.

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the payer has reported your complete TIN to the IRS.

Account number. May show an account, policy, or other unique number the payer assigned to distinguish your account.

Box 1. Shows the total amount distributed this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA, a recharacterized IRA contribution; or you may have received it

as periodic payments, nonperiodic payments, or a total distribution. Report the amount on Form 1040,

If a life insurance, annuity, qualified

7.If a charge or payment was made against the cash value of an annuity contract or the cash surrender value of a life insurance contract for the purchase of qualified

Box 2a. This part of the distribution is generally taxable. If there is no entry in this box, the payer may not have all the facts needed to figure the taxable amount. In that case, the first box in box 2b should be checked. You may want to get one of the free publications from the IRS to help you figure the taxable amount. See Additional information on the back of Copy 2. For an IRA distribution, see IRAs and Roth IRAs, earlier. For a direct rollover, other than from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to a designated Roth account in the same plan or to a Roth IRA, zero should be shown and you must enter zero

(Continued on the back of Copy C)

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

|

OMB No. |

|

|

Distributions From |

||||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

Pensions, Annuities, |

|||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Retirement or |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

2a Taxable amount |

|

2022 |

|

||||||

|

|

|

|

|

|

|

|

|

|

IRAs, Insurance |

|||||

|

|

|

|

|

|

$ |

|

|

|

Form |

|

|

|

Contracts, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

2b Taxable amount |

|

|

Total |

|

|

Copy C |

|||

|

|

|

|

|

|

not determined |

|

|

distribution |

|

|

For Recipient’s |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

|

|

RECIPIENT’S TIN |

|

3 Capital gain (included in |

|

4 Federal income tax |

|

|

||||||

|

|

|

|

|

|

Records |

|||||||||

|

|

|

|

|

|

box 2a) |

|

|

withheld |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

|

|

5 Employee contributions/ |

|

6 Net unrealized |

|

|

|

|||||

|

|

|

|

|

|

Designated Roth |

|

|

appreciation in |

|

|

|

|||

|

|

|

|

|

|

contributions or |

|

|

employer’s securities |

|

|

|

|||

|

|

|

|

|

|

insurance premiums |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

7 Distribution |

|

IRA/ |

|

8 Other |

|

|

|

|

|||||

|

|

|

|

|

|

code(s) |

|

SEP/ |

|

|

|

|

|

|

This information is |

|

|

|

|

|

|

|

SIMPLE |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

% |

|

being furnished to |

||

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

|

9b Total employee contributions |

|

the IRS. |

||||||||||

|

|

|

|

|

|

distribution |

% |

$ |

|

|

|

|

|

||

10 Amount allocable to IRR |

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

|

15 State/Payer’s state no. |

|

16 State distribution |

||||||

within 5 years |

|

|

Roth contrib. |

|

requirement |

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

13 Date of |

17 Local tax withheld |

|

|

18 Name of locality |

|

|

19 Local distribution |

||||||

|

|

|

|

|

payment |

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Form |

(keep for your records) |

www.irs.gov/Form1099R |

|

|

Department of the Treasury - Internal Revenue Service |

||||||||||

Instructions for Recipient (continued)

a Roth IRA, you must include on the “Taxable amount” line of your tax return the amount shown in this box plus the amount in box 6, if any.

If this is a total distribution from a qualified plan and you were born before January 2, 1936 (or you’re the beneficiary of someone born before January 2, 1936), you may be eligible for the

If you’re an eligible retired public safety officer who elected to exclude from income distributions from your eligible plan used to pay certain insurance premiums, the amount shown in box 2a hasn’t been reduced by the exclusion amount. See the instructions for your tax return for more information.

Box 2b. If the first box is checked, the payer was unable to determine the taxable amount and box 2a should be blank, except for an IRA. It’s your responsibility to determine the taxable amount. If the second box is checked, the distribution was a total distribution that closed out your account.

Box 3. If you received a

Box 4. Shows federal income tax withheld. Include this amount on your income tax return as tax withheld, and if box 4 shows an amount (other than zero), attach Copy B to your return. Generally, if you receive payments that aren’t eligible rollover distributions, you can change your withholding or elect not to have income tax withheld by giving the payer Form

Box 5. Generally, this shows the employee’s investment in the contract

Box 6. If you received a

Form 4972. If you roll over the distribution to a designated Roth account in the same plan or to a Roth IRA, see the instructions for box 2a. For a direct rollover to a designated Roth account in the same plan or to a Roth IRA, the NUA is included in box 2a. If you didn’t receive a

Note: If code B is in box 7 and an amount is reported in box 11, see the Instructions for Form 5329.

(Continued on the back of Copy 2)

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

|

OMB No. |

|

Distributions From |

|||||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

Pensions, Annuities, |

|||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Retirement or |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

2a Taxable amount |

|

2022 |

|

||||||

|

|

|

|

|

|

|

|

|

|

IRAs, Insurance |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Form |

|

|

|

Contracts, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

2b Taxable amount |

|

|

Total |

|

|

Copy 2 |

|||

|

|

|

|

|

|

not determined |

|

|

distribution |

|

|

File this copy |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

|

|

RECIPIENT’S TIN |

|

3 Capital gain (included in |

|

4 Federal income tax |

|

|

||||||

|

|

|

|

|

|

with your state, |

|||||||||

|

|

|

|

|

|

box 2a) |

|

|

withheld |

|

|

||||

|

|

|

|

|

|

|

|

|

|

city, or local |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

income tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

return, when |

|||

RECIPIENT’S name |

|

|

|

|

|

5 Employee contributions/ |

|

6 Net unrealized |

|

|

required. |

||||

|

|

|

|

|

|

Designated Roth |

|

|

appreciation in |

|

|

|

|||

|

|

|

|

|

|

contributions or |

|

|

employer’s securities |

|

|

|

|||

|

|

|

|

|

|

insurance premiums |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

7 Distribution |

|

IRA/ |

|

8 Other |

|

|

|

|

|||

|

|

|

|

|

|

code(s) |

|

SEP/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIMPLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

||

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

|

9b Total employee contributions |

|

|||||||||||

|

|

|

|

|

|

distribution |

% |

$ |

|

|

|

|

|

||

10 Amount allocable to IRR |

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

|

15 State/Payer’s state no. |

16 State distribution |

|||||||

within 5 years |

|

|

Roth contrib. |

|

requirement |

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

|

13 Date of |

17 Local tax withheld |

|

|

18 Name of locality |

|

|

19 Local distribution |

|||||

|

|

|

|

|

payment |

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Form |

|

|

www.irs.gov/Form1099R |

|

|

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Instructions for Recipient (continued)

If the IRA/SEP/SIMPLE box is checked, you’ve received a traditional IRA, SEP, or SIMPLE distribution.

Box 8. If you received an annuity contract as part of a distribution, the value of the contract is shown. It isn’t taxable when you receive it and shouldn’t be included in boxes 1 and 2a. When you receive periodic payments from the annuity contract, they’re taxable at that time. If the distribution is made to more than one person, the percentage of the annuity contract distributed to you is also shown. You’ll need this information if you use the

were made for qualified

Box 9a. If a total distribution was made to more than one person, the percentage you received is shown.

Box 9b. For a life annuity from a qualified plan or from a section 403(b) plan (with

Box 10. If an amount is reported in this box, see the Instructions for Form 5329 and Pub. 575.

Box 11. The first year you made a contribution to the designated Roth account reported on this form is shown in this box.

Box 12. If checked, the payer is reporting on this Form 1099 to satisfy its Internal Revenue Code chapter 4 account reporting requirement under FATCA. You may also have a filing requirement. See the Instructions for Form 8938.

Box 13. Shows the date of payment for reportable death benefits under section 6050Y.

Boxes

Additional information. You may want to see:

Form

Pub. 525, Taxable and Nontaxable Income Pub. 560, Retirement Plans for Small Business Pub. 571,

Pub. 575, Pension and Annuity Income Pub.

Pub. 721, U.S. Civil Service Retirement Benefits Pub. 939, General Rule for Pensions and Annuities Pub. 969, HSAs and Other

|

|

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, |

1 Gross distribution |

|

|

OMB No. |

|

|

Distributions From |

||||||||

country, ZIP or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

Pensions, Annuities, |

|||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Retirement or |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

2a Taxable amount |

|

2022 |

|

||||||

|

|

|

|

|

|

|

|

|

|

IRAs, Insurance |

|||||

|

|

|

|

|

|

$ |

|

|

|

Form |

|

|

|

Contracts, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

2b Taxable amount |

|

|

Total |

|

|

Copy D |

|||

|

|

|

|

|

|

not determined |

|

|

distribution |

|

|

For Payer |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

|

|

RECIPIENT’S TIN |

|

3 Capital gain (included in |

|

4 Federal income tax |

|

|

||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

box 2a) |

|

|

withheld |

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

|

|

|

5 Employee contributions/ |

|

6 Net unrealized |

|

|

For Privacy Act |

||||

|

|

|

|

|

|

Designated Roth |

|

|

appreciation in |

|

|

||||

|

|

|

|

|

|

contributions or |

|

|

employer’s securities |

|

|

and Paperwork |

|||

|

|

|

|

|

|

insurance premiums |

|

|

|

|

|

|

Reduction Act |

||

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Notice, see the |

|||

Street address (including apt. no.) |

|

|

|

7 Distribution |

|

IRA/ |

|

8 Other |

|

|

|

2022 General |

|||

|

|

|

|

|

|

code(s) |

|

SEP/ |

|

|

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

SIMPLE |

$ |

|

|

|

|

Certain |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|||

City or town, state or province, country, and ZIP or foreign postal code |

9a Your percentage of total |

|

9b Total employee contributions |

|

|||||||||||

|

|

Returns. |

|||||||||||||

|

|

|

|

|

|

distribution |

% |

$ |

|

|

|

|

|

||

10 Amount allocable to IRR |

11 1st year of desig. |

|

12 FATCA filing |

14 State tax withheld |

|

|

15 State/Payer’s state no. |

|

16 State distribution |

||||||

within 5 years |

|

|

Roth contrib. |

|

requirement |

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

|

13 Date of |

17 Local tax withheld |

|

|

18 Name of locality |

|

|

19 Local distribution |

|||||

|

|

|

|

|

payment |

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Form |

|

|

www.irs.gov/Form1099R |

|

|

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1099-R form is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. |

| Issuer | It is issued by the plan provider or institution that distributed the funds. |

| Recipient | The form must be sent to both the IRS and the individual who received the distributions. |

| Deadline for Issuance | Providers must issue the 1099-R form by January 31 to report distributions made in the previous calendar year. |

| Mandatory Fields | Includes distributions amount, taxable amount, and the federal income tax withheld, among other financial details. |

| State-Specific Variants | Some states require a separate state tax reporting using a variation of the 1099-R form, governed by each state's tax laws. |

| Potential Penalties | Failure to file a 1099-R form can result in penalties from the IRS, including fines based on how late the form is filed. |

| Filing Methods | The form can be filed electronically through the IRS FIRE system or mailed in paper form if the issuer meets certain criteria. |

Instructions on Utilizing IRS 1099-R

After receiving or making a distribution from a retirement plan, it's crucial to correctly complete the IRS 1099-R form. This document ensures that the distribution is accurately reported to the IRS. Paying attention to detail and following each step carefully will prevent any delays or issues with tax filings. Preparing to fill out the form involves gathering pertinent information such as the amount distributed, the account numbers, and personal identification details. Below are the steps to properly complete the IRS 1099-R form.

- Locate the payer's name and address in the top left section of the form. Ensure this information is accurate to guarantee the form reaches the IRS without issues.

- Fill in the payer's federal identification number and the recipient's identification number in the designated boxes. The payer’s federal identification number is usually an EIN (Employer Identification Number), while the recipient's identification number is their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Enter the recipient's name and address in the space provided. This information should match what is on file with the IRS to avoid mismatches and potential processing delays.

- In the box labeled "1.", input the total amount of distributions before any deductions. This figure represents the gross distribution.

- Box "2a." requires the taxable amount of the distribution, if known. If the taxable amount is not determined, leave this box blank.

- In box "2b.", check the appropriate box if the taxpayer is not able to determine the taxable amount or if it is a total distribution.

- Report the federal income tax withheld in box "4." This is the amount of money withheld from the distribution for federal taxes.

- Boxes "5." through "9." and "12." through "17." may require additional information pertaining to the distribution such as contributions, insurance premiums, and state tax information. Fill these boxes as applicable based on the specifics of the distribution.

- Ensure that every applicable box has been filled out correctly. Review the entire form for accuracy.

- Once the form is complete, sign and date it in the designated area, if required. Not all forms will need to be signed by the payer.

- Submit the form to the IRS and provide the necessary copies to the recipient of the distribution for their records and tax reporting purposes.

After the form is filed, it's essential to keep a copy for your records. Should the IRS require further information or if there are any discrepancies, having easy access to your filed forms will streamline any clarification or resolution process. Ensure all deadlines are met to avoid any penalties or interest.

Obtain Answers on IRS 1099-R

The IRS 1099-R form is an important document for many taxpayers, particularly those who have received distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts. Understanding this form is crucial for accurate tax reporting. Below are some frequently asked questions about the 1099-R form to aid in comprehension and ensure compliance with tax obligations.

- What is the IRS 1099-R form?

The IRS 1099-R form is a document that reports distributions of $10 or more from pensions, annuities, retirement plans, IRAs, or insurance contracts. It is used by the IRS to track distributions that may be subject to taxation.

- Who should receive a 1099-R form?

Individuals who have received distributions from any of the above-mentioned sources within a tax year should receive a 1099-R form. This includes retirees, beneficiaries of deceased individuals' plans, or any person who has taken a loan from their retirement plan that is treated as a distribution.

- What should I do if I receive a 1099-R form?

Upon receiving a 1099-R form, you should:

- Review the form for accuracy, particularly the distribution amount and tax withheld.

- Retain a copy for your records.

- Report the information on your income tax return, as it may affect your taxable income and tax liability.

- Is every distribution from a retirement plan reportable on the 1099-R form?

Yes, all distributions from retirement plans, including normal distributions, rollovers, and loans treated as distributions, must be reported on a 1099-R form. However, direct rollovers and trustee-to-trustee transfers, where funds are transferred between qualified plans without the individual having access to the money, are reported differently and may not be taxable.

- How does the 1099-R form affect my tax return?

The 1099-R form impacts your tax return by potentially increasing your taxable income. The taxable amount of the distribution is included in your income unless it is a qualified Roth distribution or another type of exempt distribution. Taxes withheld from the distribution are also reported on the form and can be credited against the total tax liability on your return. It is important to accurately report these amounts to prevent underpayment or overpayment of taxes.

Common mistakes

Filling out IRS Form 1099-R, which reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., can sometimes feel like navigating a maze. A misstep isn't just a simple oversight; it could lead to inquiries from the IRS or even penalties. Let’s break down 10 common mistakes to avoid when tackling this form.

Misunderstanding the Type of Distribution: It's key to correctly identify the nature of the distribution. Is it a direct rollover, a normal distribution, or something else? This affects the tax treatment of the distribution.

Entering Incorrect Personal Information: Something as simple as transposing numbers in a Social Security Number or misspelling a name can cause significant delays and confusion.

Not Using the Correct Codes in Box 7: Box 7 requires specific codes that describe the type of distribution received. Using the wrong code can lead to the IRS misinterpreting the nature of your distribution.

Failing to Report a Distribution: If you received a distribution, it must be reported. Even if it is a non-taxable rollover, it needs to be documented on the form.

Miscalculating the Taxable Amount: Not all distributions are fully taxable. Ensuring the taxable amount is accurately calculated can prevent over or underpaying taxes.

Overlooking State Tax Information: Some states have tax implications for distributions that are different from federal taxes. Ignoring this section can lead to unwelcome surprises at the state level.

Incorrectly Reporting a Roth IRA Conversion: Converting a traditional IRA to a Roth IRA has specific reporting requirements that, if missed, can lead to tax complications.

Omitting the Payer’s and Recipient’s TIN: Both the Taxpayer Identification Number (TIN) for the payer and the recipient are crucial. Inaccuracies here can cause processing delays or incorrect tax amounts being attributed.

Confusing Total Distribution With Taxable Amount: The total distribution amount and the taxable amount can be different. It’s important not to confuse the two, as this affects your tax liability.

Not Filing Electronically When Required: If you are required to file electronically due to the number of forms you are submitting and fail to do so, you could face penalties.

Avoiding these common mistakes can pave the way for a smoother experience with the IRS. It’s always a good idea to double-check your form for accuracy before submission. If you’re uncertain about how to fill out the form or how a specific distribution should be reported, seeking advice from a tax professional can be a valuable investment.

Documents used along the form

The IRS 1099-R form is crucial for reporting distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. However, handling retirement funds and related transactions requires more than just the 1099-R form. Here is a list of other forms and documents often used in conjunction with the 1099-R form, each serving its unique purpose in the broader context of financial management and tax reporting.

- Form 1040: The individual income tax return form where taxpayers report their annual income to the IRS, including any distributions reported on the 1099-R form.

- Form 5498: This form reports contributions to IRAs, including Roth, SEP, and SIMPLE IRAs. It is important for verifying the contributions reported and for certain tax situations.

- Form W-4P: A withholding certificate for pension or annuity payments. Individuals use this form to determine the amount of federal income tax to withhold from their retirement distributions.

- Form 5329: Used to report additional taxes on qualified plans, including IRAs and other tax-favored accounts. It plays a crucial role in addressing issues related to early withdrawals or insufficient required minimum distributions.

- Schedule A (Form 1040): For itemizing deductions on the tax return, including medical and dental expenses, which may be relevant for individuals with significant healthcare expenses post-retirement.

- Form W-2: Though primarily for reporting wages, salaries, and tips to employees, it's relevant for persons who've worked part of the year before retirement.

- Form 8606: Necessary for reporting nondeductible contributions to IRAs, which helps in determining the taxable portion of a distribution.

- Form 8960: Used for calculating the Net Investment Income Tax applicable to individuals, estates, and trusts with investment income above certain threshold amounts.

- Form RRB-1099: Issued by the Railroad Retirement Board, reporting the benefits paid, resembling the 1099-R but specific to railroad retirement payments.

Understanding the interplay between these forms and the 1099-R is fundamental to accurate tax reporting and financial planning. By considering the broader financial picture these documents present together, individuals are better equipped to manage their retirement distributions, plan for their tax liabilities, and ensure compliance with the vast landscape of tax regulations.

Similar forms

IRS Form W-2: Both IRS Form 1099-R and IRS Form W-2 report income to the IRS. However, while the Form 1099-R is dedicated to reporting distributions from pensions, annuities, retirement plans, etc., the Form W-2 is used for wages and salaries paid to employees. Despite their differences in the type of income they report, both play crucial roles in an individual's tax filing process.

IRS Form 1099-MISC: Similar to Form 1099-R, the 1099-MISC is used to report payments made in the course of a trade or business to a person who's not an employee. This can include rents, prizes, awards, and other fixed determinable income. While 1099-MISC covers a broader range of transactions, both forms serve the purpose of reporting income outside of traditional wages.

IRS Form 1099-INT: Form 1099-INT and 1099-R share the purpose of reporting specific types of income. The 1099-INT form is used to report interest income from banks and other financial institutions. Although they cater to different sources of income, interest vs. retirement distributions, both are necessary for accurately documenting income on tax returns.

IRS Form 1099-DIV: This form is similar to the 1099-R in that it reports income not earned through wages, salaries, or tips. Specifically, the 1099-DIV form is used to report dividends and distributions from investments. Both of these documents are crucial for individuals to claim their income correctly and to ensure proper taxation.

IRS Form 5498: Whereas the 1099-R reports distributions from retirement plans, the Form 5498 reports contributions to such accounts. It includes information on IRA contributions, rollovers, and the fair market value of the account. Both forms are essential for monitoring retirement savings and for tax documentation purposes, showcasing two sides of retirement account transactions.

IRS Form 1099-B: The 1099-B form relates to Form 1099-R in its use for reporting transactions not related to employment. Form 1099-B is used for reporting the sale and exchange of securities. The form tracks the cost basis of sold securities, which is crucial for calculating capital gains or losses. Both forms are integral in providing a complete financial picture for tax reporting.

IRS Form 1099-G: Form 1099-G and 1099-R are similar as both report income that may not be directly from employment but is nonetheless crucial for tax filings. The 1099-G form specifically reports government payments like unemployment compensation, state or local income tax refunds, and other grants. It's essential for taxpayers who receive these types of income to report them just as they would with distributions from retirement plans using the 1099-R.

Dos and Don'ts

Filling out the IRS 1099-R form, which reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., can be daunting. However, being meticulous and informed can help you navigate this task smoothly. Here is a compilation of dos and don'ts that will guide you in accurately completing the IRS 1099-R form.

Do:- Double-check the taxpayer identification numbers (TINs). Ensuring the TINs, including your Social Security Number, are accurate is crucial for both the payee and the payer.

- Report the correct distribution code in Box 7. This code identifies the type of distribution received and can significantly impact the tax implications of the distribution.

- Understand the taxable amount. Not all distributions are fully taxable. It's important to know the portion of the distribution that is taxable and report it correctly.

- Include federal and state tax withheld, if applicable, in the designated boxes. These amounts can often be credited against your total tax liability when filing your annual tax returns.

- Sign and date the form if you’re the payer. A form without a signature may not be considered valid.

- Leave any required fields blank. Incomplete forms may be rejected. If a particular section does not apply, it's better to enter "0" or "N/A" than to leave it empty.

- Mix different types of distributions on one form. If you have multiple types of distributions, use a separate 1099-R form for each unique distribution code.

- Ignore the deadline. Submitting your 1099-R form late can lead to penalties. Be aware of the IRS deadlines for submission to avoid any unnecessary fees or complications.

By following these guidelines, you can fill out the IRS 1099-R form accurately and avoid common pitfalls that may lead to errors or complications with the IRS. When in doubt, consulting with a tax professional can provide clarity and ensure compliance with tax laws and regulations.

Misconceptions

The IRS Form 1099-R is misunderstood quite often, leading to common misconceptions that can impact tax filing. Understanding what it is, when it’s used, and how it affects taxes is crucial for anyone receiving it. Here are eight common misconceptions about this form, clarified for a better understanding.

All retirement distributions are taxable. Not all money received from retirement plans is taxable. The form reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. However, a part of these distributions may be non-taxable, especially if already taxed contributions (such as those in a Roth IRA) are part of the distribution.

The 1099-R form is only for retirees. This form isn’t exclusive to retirees. It also applies to beneficiaries or anyone who has received distributions from retirement plans, regardless of their age or employment status. This includes individuals who have taken early distributions.

You don't need to report it if the amount is small. Regardless of how small the distribution might seem, all distributions reported on a 1099-R must be included in your tax return. There is no minimum amount that exempts you from reporting.

Loans from retirement accounts don't need to be reported. If a loan from a qualified plan is not repaid according to the plan’s terms, it might be considered a distribution and thus, reportable on Form 1099-R. This surprises many who believe loans are not taxable or reportable events.

Only the federal government uses the 1099-R form. While the IRS requires the form for federal tax purposes, many states also use this information to determine state income tax liability. Thus, it’s not solely a federal concern.

Form 1099-R reports contributions. The form does not report the money you put into a retirement plan but rather the distributions you take out. Contributions are typically reported elsewhere, such as on Form 5498 for IRAs.

All codes on the 1099-R form are the same. The form uses various codes in Box 7 to indicate the type of distribution received. These codes are essential for determining the tax implications of the distribution. Misunderstanding these codes can lead to errors in tax filing.

If taxes were withheld, there’s no extra tax due. Withholding on a distribution may not cover the total tax liability. The withholding is often a set percentage of the distribution, but depending on total income and tax rates, additional taxes may be owed.

Unraveling these misconceptions about the IRS Form 1099-R can lead to more accurate tax reporting and a better understanding of one’s financial picture regarding retirement distributions. It’s always a good idea to consult with a tax professional if there are any questions regarding specific situations or tax liabilities related to distributions.

Key takeaways

Filing and understanding the IRS 1099-R form—a document that reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts—can sometimes feel like navigating a maze. Here are eight key takeaways that can help illuminate the path, ensuring that individuals and tax professionals alike handle this vital piece of tax reporting with confidence and efficiency.

- Know when to expect it: The IRS 1099-R form is mailed out to recipients by January 31st each year. This schedule allows taxpayers enough time to receive their forms before the tax filing deadline in April.

- Identify the distribution codes: The form includes distribution codes in Box 7 that describe the type of distribution received. These codes are crucial for understanding the tax implications of each distribution and ensuring accurate reporting on your tax return.

- Not just for retirees: Though commonly associated with retirement, the IRS 1099-R form is also used for reporting distributions from profit-sharing or a 401(k) plan, annuities, and insurance contracts. This means you might receive a 1099-R even if you're not retired.

- Check for accuracy: As soon as you receive your 1099-R, verify all the information, especially your Social Security Number and the total distribution amount. Any errors should be reported immediately to the issuer for correction.

- Understand the taxable amount: Not all distributions reported on the 1099-R are fully taxable. The taxable amount of the distribution is reported in Box 2a, but if this box is blank, it's your responsibility to determine the taxable portion, possibly requiring consultation with a tax professional.

- State tax reporting: Depending on your state's tax laws, distributions reported on 1099-R may also be taxable at the state level. It's important to understand how your state taxes these distributions to avoid any surprises come tax time.

- Rollovers and direct transfers: If you've rolled over funds from one retirement account to another or completed a direct transfer, these transactions should be reported on your 1099-R. Proper reporting is key to ensuring these movements are not mistakenly taxed as distributions.

- Keep your records: Retain a copy of your 1099-R for your records, along with any related documentation for the transactions reported on the form. These records can be vital if questions or issues arise with the IRS about your tax return in the future.

Navigating the complexities of the IRS 1099-R form doesn't have to be daunting. By keeping these key points in mind, taxpayers and professionals can manage this aspect of tax reporting more effectively and avoid common pitfalls. Remember, when in doubt, consulting with a tax professional can provide valuable guidance and peace of mind.

Popular PDF Forms

Additional Insurance - Under this form, additional insured status is granted with respect to liability arising from the named insured's work performed for them.

Aarp Claims Phone Number - Dodge state intervention in your AARP Life Insurance benefits distribution by accurately designating beneficiaries on the provided form.

Navpers 1300/22 - It serves as an essential tool in the Navy's efforts to document and manage the professional growth and behavior of its members.