Blank IRS 1310 PDF Template

Dealing with the Internal Revenue Service (IRS) can often feel like navigating a complex maze, especially when one encounters forms like the IRS 1310. This form serves a very specific purpose: it's used to claim a federal tax refund on behalf of someone who has passed away. At first glance, the thought of dealing with taxes after a loved one has passed might seem overwhelming, but the IRS 1310 form is designed to help ease this part of the process. Whether you're the legal representative, surviving spouse, or another qualifying family member, understanding how to properly complete and submit this form is crucial. It plays a pivotal role in ensuring that any refunds due are directed to the rightful party, offering a small but significant piece of closure during a difficult time. From identifying who can file it to understanding the required supporting documentation, mastering the IRS 1310 form is an essential step for those navigating the aftermath of a loved one's departure with financial matters left to settle.

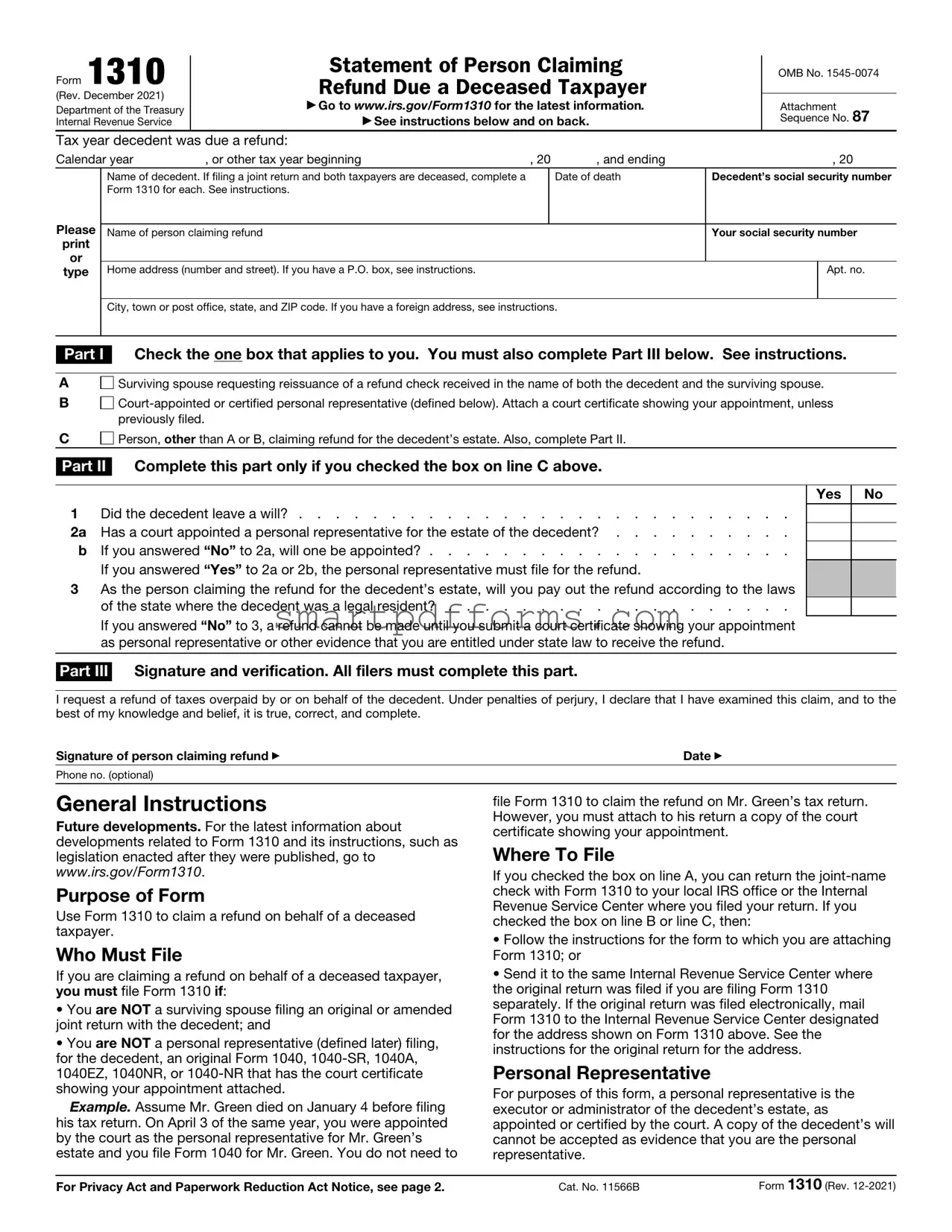

Preview - IRS 1310 Form

Form 1310

(Rev. December 2021)

Department of the Treasury

Internal Revenue Service

Statement of Person Claiming Refund Due a Deceased Taxpayer

▶Go to www.irs.gov/Form1310 for the latest information.

▶See instructions below and on back.

OMB No.

Attachment Sequence No. 87

Tax year decedent was due a refund:

Calendar year |

, or other tax year beginning |

, 20 |

, and ending |

, 20 |

Please

or

type

Name of decedent. If filing a joint return and both taxpayers are deceased, complete a |

Date of death |

Decedent’s social security number |

|

Form 1310 for each. See instructions. |

|

|

|

|

|

|

|

Name of person claiming refund |

|

Your social security number |

|

|

|

|

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

Apt. no. |

|

|

|

|

City, town or post office, state, and ZIP code. If you have a foreign address, see instructions.

Part I Check the one box that applies to you. You must also complete Part III below. See instructions.

A |

Surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse. |

B

C Person, other than A or B, claiming refund for the decedent’s estate. Also, complete Part II.

Person, other than A or B, claiming refund for the decedent’s estate. Also, complete Part II.

Part II Complete this part only if you checked the box on line C above.

1 |

Did the decedent leave a will? |

2a |

Has a court appointed a personal representative for the estate of the decedent? |

b |

If you answered “No” to 2a, will one be appointed? |

|

If you answered “Yes” to 2a or 2b, the personal representative must file for the refund. |

3As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the laws

of the state where the decedent was a legal resident? . . . . . . . . . . . . . . . . . . .

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment as personal representative or other evidence that you are entitled under state law to receive the refund.

Yes

No

Part III Signature and verification. All filers must complete this part.

I request a refund of taxes overpaid by or on behalf of the decedent. Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature of person claiming refund ▶ |

Date ▶ |

Phone no. (optional)

General Instructions

Future developments. For the latest information about developments related to Form 1310 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form1310.

Purpose of Form

Use Form 1310 to claim a refund on behalf of a deceased taxpayer.

Who Must File

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if:

•You are NOT a surviving spouse filing an original or amended joint return with the decedent; and

•You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040,

Example. Assume Mr. Green died on January 4 before filing his tax return. On April 3 of the same year, you were appointed by the court as the personal representative for Mr. Green’s estate and you file Form 1040 for Mr. Green. You do not need to

file Form 1310 to claim the refund on Mr. Green’s tax return. However, you must attach to his return a copy of the court certificate showing your appointment.

Where To File

If you checked the box on line A, you can return the

•Follow the instructions for the form to which you are attaching Form 1310; or

•Send it to the same Internal Revenue Service Center where the original return was filed if you are filing Form 1310 separately. If the original return was filed electronically, mail Form 1310 to the Internal Revenue Service Center designated for the address shown on Form 1310 above. See the instructions for the original return for the address.

Personal Representative

For purposes of this form, a personal representative is the executor or administrator of the decedent’s estate, as appointed or certified by the court. A copy of the decedent’s will cannot be accepted as evidence that you are the personal representative.

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 11566B |

Form 1310 (Rev. |

Form 1310 (Rev. |

Page 2 |

Additional Information

For more details, see Death of a Taxpayer in the instructions for your return, or get Pub. 559, Survivors, Executors, and Administrators.

Specific Instructions

Name of Decedent

If you are filing a joint return for spouses who are both deceased and you are required to file Form 1310 (see Who Must File, earlier), you must do the following.

•Complete a separate Form 1310 for each spouse.

•Attach both of these completed Forms 1310 to the return.

Note: If a refund is due, following these steps will assist in the timely release of the refund.

P.O. Box

Enter your box number only if your post office does not deliver mail to your home.

Foreign Address

If your address is outside the United States or its possessions or territories, enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

Line A

Check the box on line A only if you received a refund check in your name and your deceased spouse’s name. You can return the

Line B

Check the box on line B only if you are the decedent’s court- appointed or certified personal representative claiming a refund for the decedent on Form 1040X

Line C

Check the box on line C if you are not a surviving spouse requesting reissuance of a refund check received in your name and your deceased spouse’s name and if there is not a court- appointed or certified personal representative. You must also complete Part II. If you check the box on line C, you must have proof of death.

The proof of death is a copy of either of the following.

•The death certificate.

•The formal notification from the appropriate government office (for example, Department of Defense) informing the next of kin of the decedent’s death.

Do not attach the death certificate or other proof of death to Form 1310. Instead, keep it for your records and provide it if requested.

Example. Your father died on August 25. You are his sole survivor. Your father did not have a will and the court did not appoint a personal representative for his estate. Your father is entitled to a $300 refund. To get the refund, you must complete and attach Form 1310 to your father’s final return. You should check the box on Form 1310, line C; answer all the questions in Part II; and sign your name in Part III. You must also keep a copy of the death certificate or other proof of death for your records.

Lines

If you checked the box on line C, you must complete lines 1 through 3.

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. This information will be used to determine your eligibility pursuant to Internal Revenue Code section 6012 to claim the refund due the decedent. Code section 6109 requires you to provide your social security number and that of the decedent. You are not required to claim the refund due the decedent, but if you do so, you must provide the information requested on this form. Failure to provide this information may delay or prevent processing of your claim. Providing false or fraudulent information may subject you to penalties. Routine uses of this information include providing it to the Department of Justice for use in civil and criminal litigation, to the Social Security Administration for the administration of Social Security programs, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You do not have to provide your phone number.

You are not required to provide the information requested on a form unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 1310 | Form 1310 is used by individuals to claim a federal tax refund on behalf of a deceased taxpayer. |

| Who Files Form 1310 | The form can be filed by a surviving spouse or a court-appointed or certified personal representative. |

| Filing Requirement | If no person is court-appointed, the individual who claims to be entitled to the refund must file Form 1310. |

| Documentation for Filing | Court certificate or a statement must accompany Form 1310 if filed by a representative other than the spouse. |

| IRS Processing Time | The IRS typically processes Form 1310 within 6-8 weeks of receipt. |

| State-Specific Requirements | While Form 1310 is federal, some states require a separate state-specific form or documentation to claim a refund due to a deceased taxpayer. |

Instructions on Utilizing IRS 1310

When facing the task of claiming a refund on behalf of a deceased taxpayer, the IRS Form 1310 becomes a necessary step. This form is required for individuals who are not surviving spouses or the court-appointed or certified personal representatives of the deceased taxpayer's estate. Filling out this form correctly ensures that the IRS can process the refund claim without unnecessary delays. The following steps are designed to guide you through the completion of IRS Form 1310, making the process as straightforward as possible.

- Begin by gathering all necessary documentation, including the deceased taxpayer's final tax return, death certificate, and your personal identification information.

- Enter the full name of the deceased taxpayer in the designated area at the top of the form.

- Provide the deceased taxpayer's social security number in the space provided.

- Fill in the date of the taxpayer's death as recorded on the death certificate.

- Indicate your relationship to the deceased individual by checking the appropriate box in Section A. If you are not the surviving spouse or the personal representative, you will need to complete Section B.

- In Section B, if applicable, declare that you are entitled to the refund due to the deceased taxpayer, and specify your relationship to them.

- Detail how you are related to the deceased and confirm that no other individual is entitled to claim the refund. If another person is entitled, explain the circumstances.

- Provide your name, social security number, and contact information, including your address and telephone number, in the designated areas.

- Sign and date the form at the bottom to certify that the information provided is accurate to the best of your knowledge.

- Attach any required documentation, such as a copy of the death certificate, to the IRS Form 1310.

- Review the completed form and attached documents to ensure all information is correct and complete.

- Send the completed form and any attachments to the IRS, using the address provided in the instructions for the deceased taxpayer's final tax return.

Successfully submitting IRS Form 1310 is a vital step in managing the affairs of a deceased loved one's estate. By carefully following these instructions, you can help ensure that the process moves forward efficiently, allowing you to focus on other aspects of settling the estate.

Obtain Answers on IRS 1310

-

What is the IRS 1310 form used for?

The IRS 1310 form is utilized by individuals to claim a federal tax refund on behalf of someone who has passed away. This form is necessary when a refund is due to the deceased taxpayer, and the person filing is not the surviving spouse or the administrator or executor directly appointed by the court. Essentially, it enables a claimant to receive the refund that the deceased was entitled to but did not live to receive.

-

Who needs to file the IRS 1310 form?

This form must be filed by anyone who is claiming a refund on behalf of a deceased taxpayer and does not automatically qualify to receive the refund as a surviving spouse or a court-appointed executor or administrator of the deceased’s estate. It's particularly aimed at individuals such as other family members or legal representatives who have taken on the responsibility of managing the deceased individual's final affairs and believe they are entitled to receive the tax refund.

-

What information do I need to fill out the IRS 1310 form?

- The deceased taxpayer’s name, social security number, and date of death.

- The name and social security number of the person claiming the refund.

- The relationship of the claimant to the deceased.

- Information about whether a refund was requested on the original tax return filed on behalf of the deceased.

- Details regarding whether the claimant has been appointed as the executor or administrator of the deceased's estate by the court.

This form requires thorough details about both the deceased and the claimant to ensure proper processing and distribution of funds.

-

What are the steps to file IRS 1310?

To file IRS 1310, the claimant should first gather the necessary documentation and information about the deceased and their relationship to them. After filling out the form with required details, attach it to the final tax return of the deceased, if it is being filed simultaneously, or to the claim for refund if the refund is being claimed after the tax return has already been filed. The completed form, along with any other required tax documents, should then be mailed to the appropriate IRS address, typically found in the form's instructions or the IRS website depending on the specific circumstances.

-

How long does it take to receive the refund after filing IRS 1310?

The time it takes to receive a refund after filing Form 1310 can vary based on several factors, including the time of year the form is filed, whether the return and form are filed electronically or by mail, and the current workload of the IRS. Generally, refunds are processed more quickly for electronic filings compared to paper filings. Typically, it can take up to six to eight weeks for a paper return and Form 1310 to be processed. However, claimants should be prepared for the possibility of longer processing times, especially during peak tax filing seasons or due to operational delays within the IRS.

Common mistakes

-

One common mistake made when filling out the IRS 1310 form is incorrectly identifying the claimant. Individuals often confuse their role, either by misidentifying themselves as the executor or beneficiary. It's crucial to accurately determine and communicate your relationship to the deceased, as this dictates your eligibility to file a refund claim.

-

Another frequent error is failure to attach the required documentation. The IRS mandates the submission of certain documents alongside Form 1310, such as a copy of the death certificate and, in cases where a formal executor or administrator hasn't been appointed, proof of entitlement to the deceased's property. This oversight can delay processing significantly.

-

Submitting the form with incomplete information is also a commonly observed mistake. All fields must be fully completed to ensure the IRS has all the necessary details to process the refund claim. Missing information, such as the deceased's social security number or the exact amount of the refund requested, can halt the process until the missing data is provided.

-

Incorrectly completed Sections of the form often lead to processing delays or outright rejection of the claim. Specifically, individuals sometimes mistakenly complete sections of the form that do not pertain to their particular situation. Each section of Form 1310 is designed for different circumstances, and understanding which sections apply to your situation is crucial for a successful submission.

Documents used along the form

When managing a deceased person's final affairs, the IRS Form 1310 is typically submitted by a surviving family member or the executor of the estate to claim a refund on behalf of the deceased taxpayer. However, this form is just one piece of the puzzle. Several other forms and documents often accompany it, each serving a unique purpose in the process of settling tax matters for someone who has passed away.

- IRS Form 1040: This is the standard Individual Income Tax Return form. If the deceased was due a refund for overpaid taxes in their final year of life, the IRS Form 1040 needs to be filed along with Form 1310.

- IRS Form 1041: This form is the U.S. Income Tax Return for Estates and Trusts. For individuals managing an estate, this form is crucial for reporting any income the estate generates before it is distributed to the beneficiaries.

- IRS Form 56: Notice Concerning Fiduciary Relationship is filed to notify the IRS of the creation or termination of a fiduciary relationship. It designates someone to act on behalf of the deceased in matters of estate.

- Death Certificate: A copy of the death certificate is often required to accompany Form 1310. It serves as official proof of death for the IRS and other financial institutions.

- Legal Will or Estate Documents: These documents may not be directly submitted to the IRS but are essential for the executor or surviving family members. They outline the deceased's wishes regarding the distribution of assets and designation of the executor.

- IRS Form 8855: Election to Treat a Qualified Revocable Trust as part of an Estate. This is relevant for estates that include a revocable trust, allowing it to be treated as part of the estate for tax purposes.

Together, these forms and documents create a comprehensive approach to handling a deceased person's tax and estate affairs. They ensure that the process honors the wishes of the deceased, complies with legal requirements, and provides for the smooth transition of assets to beneficiaries. Navigating this process can be complex, but understanding the role each document plays helps in managing these crucial responsibilities effectively.

Similar forms

The IRS 1310 form is specifically designed for individuals claiming a refund on behalf of a deceased taxpayer. Several other documents share similarities with the IRS 1310 in terms of their functions, purposes, or the information they require. Below is a list of 10 such documents:

- W-9 Form - Similar to the IRS 1310, the W-9 is used to provide taxpayer identification information, albeit for living individuals or entities for reasons such as employment or financial transactions.

- 1040 Form - The similarity with the IRS 1310 lies in the context of filing tax returns. While the 1040 is for individuals, the 1310 is specifically for claiming refunds on behalf of deceased taxpayers.

- 8802 Form - This form is used to request a U.S. Residency Certification. Like the IRS 1310, it involves the submission of taxpayer information to the IRS for a specific purpose, emphasizing the taxpayer's status.

- 4868 Form - Similar to the IRS 1310 in that it is also filed with the IRS to alter the tax filing status. Specifically, the 4868 is an application for an automatic extension of time to file U.S. individual income tax returns.

- 8822 Form - This form is used to notify the IRS of a change in address, similar to the IRS 1310's role in notifying the IRS about the taxpayer's death and the claimant's right to receive the refund.

- SS-4 Form - Used to apply for an Employer Identification Number (EIN), the SS-4 requires informational input about the entity or individual, akin to the IRS 1310 needing details about the deceased and claimant.

- 2848 Form - Power of Attorney and Declaration of Representative form, like IRS 1310, involves representation on someone's behalf for tax-related matters, although the 2848 deals with a broader range of tax issues beyond refunds.

- 4506-T Form - This form is for requesting tax transcripts, sharing the similarity of requiring detailed taxpayer information similar to IRS 1310, though the purposes of the information differ.

- 709 Form - Used for reporting gift taxes, the 709 form, similar to the IRS 1310, involves individual taxpayer situations and necessitates detailed financial and personal information for tax purposes.

- 941 Form - This form is for employers to report federal tax returns. Similarities with the IRS 1310 include the need for careful handling of sensitive financial information, albeit for a business rather than an individual context.

Each of these forms serves a specific purpose within the handling of tax and financial information, requiring accurate and complete data submission akin to the IRS 1310 form. While their applications might differ, the underlying principle of providing structured information to the IRS unites them.

Dos and Don'ts

When dealing with the IRS 1310 form, which is essential for claiming a refund on behalf of a deceased taxpayer, it's crucial to pay attention to detail and follow specific guidelines. Below, find a comprehensive list of dos and don'ts to assist in the process.

Do:

- Ensure you're eligible to file the Form 1310. Generally, this means you are the executor of the deceased's estate or, if there's no formal executor, a person responsible for the estate.

- Provide all required information accurately, including the deceased's name, social security number, the tax year, and the details of the person claiming the refund.

- Attach a copy of the death certificate if you're not the deceased's surviving spouse requesting a refund that's made out to both you and the deceased or if you're not a court-appointed or certified personal representative.

- Remember to sign and date the form. An unsigned form can lead to unnecessary delays or rejection of the claim.

- File the form in a timely manner, preferably with the final income tax return for the deceased, to expedite the refund process.

Don't:

- File Form 1310 if you're not required to. For instance, if you are the deceased's surviving spouse filing a joint return, or if you're already a court-appointed representative and the refund is being issued to you.

- Omit any pertinent information. Missing details can lead to processing delays or the refund being denied.

- Guess information. If unsure about any detail, it's better to verify first to avoid errors that could complicate the refund process.

- Overlook attaching the necessary documentation. Except in specific instances, attaching a death certificate or court documents proving your authority could be crucial.

- Mail the form to the wrong address. Ensure you're sending it to the correct IRS office to prevent any delays in processing your claim.

Misconceptions

When it comes to filing taxes, especially under circumstances involving a deceased taxpayer, the IRS Form 1310 becomes relevant. However, there are several misconceptions about this form that often lead to confusion. Below, we aim to clarify these misunderstandings, assisting individuals in navigating this process with greater ease.

- Only family members can file Form 1310. This is not accurate. In reality, anyone who is responsible for settling the deceased's estate can file this form, whether they are a family member or not. This might include legal representatives or executors of the estate.

- Form 1310 is required for all tax filings for a deceased person. This statement is not entirely true. Form 1310 is specific to situations where a refund is due to the deceased taxpayer. If there's no refund or the deceased's spouse is filing a joint return, this form may not be necessary.

- The process of filing Form 1310 is long and complicated. While dealing with the IRS can sometimes be challenging, Form 1310 is relatively straightforward. It is designed to be simple so that individuals can claim a refund due to the deceased without getting overwhelmed.

- You need a lawyer to file Form 1310. It's a common belief that legal assistance is needed to correctly file Form 1310. However, many individuals successfully complete and submit this form without a lawyer's help. Instructions provided by the IRS are usually enough to guide one through the process.

- Form 1310 can only be filed by mail. As of the latest updates, this isn't always the case. While mailing is the traditional method, options for electronic submissions of certain forms and under specific circumstances are evolving. It's advisable to check the current IRS guidelines or consult a professional for the most accurate information.

Understanding these points about IRS Form 1310 can substantially ease the filing process and alleviate some of the stresses associated with the tax obligations of a deceased loved one's estate. When in doubt, refer directly to the IRS's official communications or seek advice from a tax professional.

Key takeaways

When it comes to managing the final affairs of someone who has passed away, the IRS form 1310 becomes crucial if you're claiming a refund on behalf of the deceased. This form allows you to notify the IRS of the death and request the refund that the deceased was entitled to. Understanding this form is key to ensure that the process is as smooth as possible. Here are key takeaways about filling out and using the IRS 1310 form:

- Filing Requirements: Form 1310 is required unless you're the surviving spouse filing a joint return or a court-appointed or certified personal representative filing an original return for the deceased.

- Information Needed: To complete Form 1310, you'll need the deceased’s full name, Social Security Number, date of death, and the amount of the refund being claimed.

- Claiming Status: If you're not the surviving spouse or a court-appointed representative, you'll need to explain your relationship to the deceased and why you're claiming the refund.

- Documentation: Attaching a copy of the death certificate can expedite the process, though it's not mandatory unless you are a court-appointed representative.

- Where to File: The completed Form 1310 should be sent to the IRS office that serves your area, or where the tax return is required to be filed. If you're filing it with a tax return, attach it to the front of the return.

- Timing: Submit Form 1310 as soon as you are ready to claim the refund. There are no specific deadlines, but your claim should be timely to avoid potential complications or delays.

- Direct Deposit: Refunds can be directly deposited into a bank account. Ensure the IRS has correct and current banking information to prevent delays.

- State Taxes: Remember, Form 1310 is for federal tax refunds. You may need to complete a separate process for state tax refunds.

- Amended Returns: If filing an amended return for the deceased, attach Form 1310 to claim any additional refund owed.

- Legal Assistance: If you're unsure about filling out Form 1310 or dealing with the deceased's final tax matters, consider seeking help from a tax professional or an attorney.

Handling someone's final affairs can be challenging, but taking care of forms like the IRS 1310 is a necessary step in the process. Ensure you have all the required information and documents to make the submission process as smooth as possible. Remember, the IRS is there to help if you have questions or need clarification on how to properly fill out and submit the form.

Popular PDF Forms

Uscg Career Intentions Worksheet - Members use this form to communicate whether they intend to extend their enlistment, reenlist, separate, or transition to the reserves.

Fw001 - In addition to personal and financial information, the FW-001 form asks for details about any legal representation you may have.

State Farm Disbursement Request Form - The inclusion of a legal disclaimer serves as a deterrent against fraudulent claims, ensuring integrity in the payment process.